Market Overview

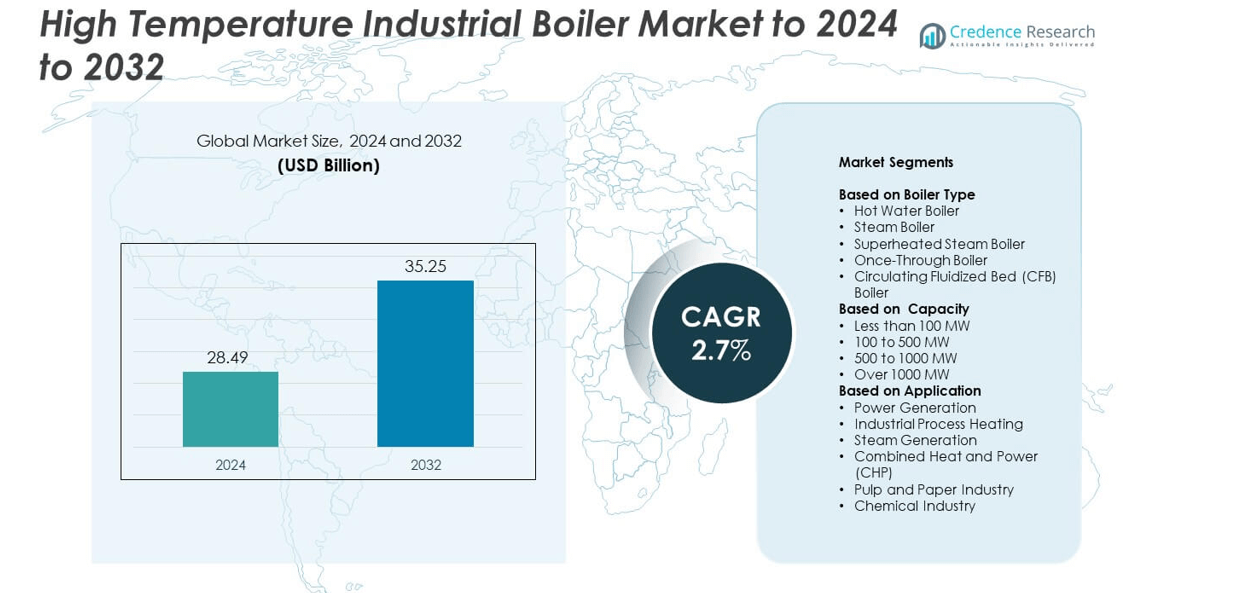

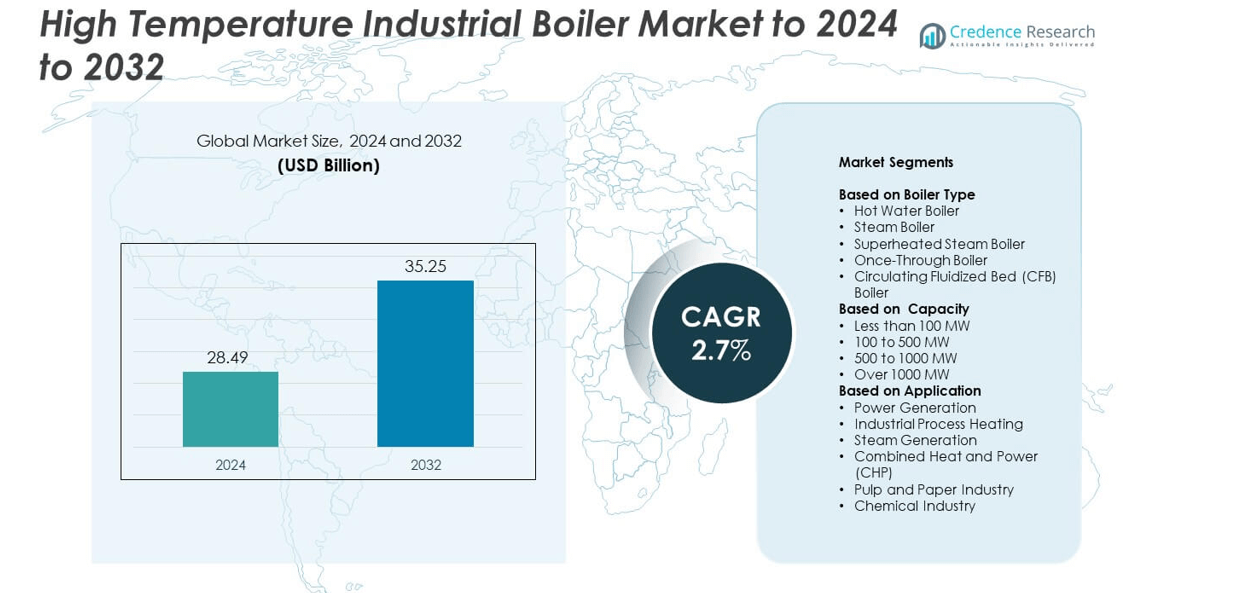

High Temperature Industrial Boiler Market size was valued USD 28.49 billion in 2024 and is anticipated to reach USD 35.25 billion by 2032, at a CAGR of 2.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Temperature Industrial Boiler Market Size 2024 |

USD 28.49 billion |

| High Temperature Industrial Boiler Market, CAGR |

2.7% |

| High Temperature Industrial Boiler Market Size 2032 |

USD 35.25 billion |

The High Temperature Industrial Boiler Market is shaped by leading players such as Babcock & Wilcox, Mitsubishi Heavy Industries, GE Power, Alfa Laval, Thermax, Doosan Heavy Industries Construction, Viessmann, and CleaverBrooks. These companies emphasize efficiency, emission control, and digital integration to meet industrial and environmental standards. Asia-Pacific led the global market with a 37% share in 2024, driven by strong industrialization and growing power generation projects in China and India. North America followed with a 29% share, supported by modernization of thermal plants and adoption of low-emission technologies. Europe accounted for 25%, propelled by strict energy efficiency regulations and renewable integration.

Market Insights

- The High Temperature Industrial Boiler Market was valued at USD 28.49 billion in 2024 and is projected to reach USD 35.25 billion by 2032, growing at a CAGR of 2.7%.

- Rising industrial power demand, energy efficiency initiatives, and modernization of thermal plants are key drivers accelerating market growth across manufacturing and energy sectors.

- Advancements in automation, hybrid fuel integration, and waste heat recovery systems are emerging as major trends enhancing boiler efficiency and sustainability.

- The market remains moderately consolidated, with leading players focusing on R&D, low-emission technologies, and regional expansion to strengthen their presence.

- Asia-Pacific led with 37% share in 2024, followed by North America at 29% and Europe at 25%, while the steam boiler segment dominated with 41% share, driven by widespread use in power generation and heavy industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Boiler Type

Steam boilers dominated the market with a 41% share in 2024 due to their wide use in power plants and manufacturing facilities. These boilers provide consistent thermal output and high-pressure steam essential for industrial operations. Growth is driven by rising electricity demand and the expansion of heavy industries in Asia-Pacific. Circulating Fluidized Bed (CFB) boilers are also gaining traction as they enable efficient combustion of low-grade fuels while reducing emissions, aligning with global sustainability goals.

- For instance, Sumitomo SHI FW supplied the 460 MWe supercritical CFB at Lagisza in Poland.

By Capacity

The 100 to 500 MW capacity segment accounted for 38% of the market in 2024. This range offers optimal performance for medium-scale industrial and utility applications, balancing fuel efficiency and installation cost. Increasing energy demand from metal processing, petrochemical, and cement industries drives the adoption of this capacity range. The growing focus on flexible power generation solutions in developing economies further supports demand. Larger capacity boilers above 500 MW are primarily adopted in thermal and cogeneration plants.

- For instance, Thermax won a repeat order tied to a 600 MW project in Botswana, adding another 300 MW phase.

By Application

Power generation led the market with a 44% share in 2024, supported by expanding electricity production and modernization of thermal plants. High temperature boilers in this segment enable efficient energy conversion, critical for base-load power operations. Growth is also driven by the shift toward clean coal technologies and waste heat recovery systems to reduce emissions. Industrial process heating and combined heat and power (CHP) applications are also increasing due to their ability to improve overall plant efficiency and operational cost savings.

Key Growth Drivers

Rising Industrial Power Demand

Expanding industrialization and rapid urbanization are driving the demand for reliable high-temperature energy sources. Industries such as petrochemical, pulp and paper, and steel require constant high-pressure steam for operations. The global rise in electricity consumption and industrial output encourages investments in high-capacity boiler systems. Manufacturers are focusing on enhancing fuel flexibility and efficiency to meet diverse energy needs across sectors.

- For instance, BHEL has an installed base of power generating equipment exceeding 197,000 MW (197 GW) worldwide, with a significant portion of this capacity located in India

Shift Toward Energy Efficiency

Governments and industries are prioritizing energy-efficient boiler systems to reduce fuel consumption and emissions. High-temperature boilers with advanced combustion technologies help optimize energy utilization while lowering operational costs. The implementation of strict emission regulations across Europe and Asia-Pacific has accelerated the adoption of efficient boiler designs. Companies are investing in automation and smart controls to monitor performance and minimize heat loss during operations.

- For instance, Doosan Enerbility developed a rotor qualified for 630 °C service for high-efficiency turbines.

Integration of Renewable and Hybrid Systems

Growing integration of renewable energy with industrial boilers is promoting hybrid solutions. These systems combine biomass, waste heat, and conventional fuels to ensure continuous steam generation while cutting carbon emissions. Industrial users increasingly prefer hybrid boiler systems for consistent output and sustainability compliance. The transition supports industries in achieving long-term carbon neutrality targets while maintaining thermal efficiency.

Key Trends and Opportunities

Adoption of IoT and Automation Technologies

The integration of IoT and automation in boiler operations enhances real-time monitoring and predictive maintenance. Smart sensors track temperature, pressure, and fuel efficiency, reducing downtime and extending boiler lifespan. This digital transformation trend supports industries aiming to improve operational transparency and reduce maintenance expenses. IoT-based systems are particularly gaining traction in power and chemical processing sectors for process optimization.

- For instance, Emerson reports Ovation controls deployed across 1.4 million MW of generating capacity in 60+ countries.

Expansion of Waste Heat Recovery Systems

Waste heat recovery is emerging as a major opportunity to enhance boiler efficiency and sustainability. Industries are utilizing excess process heat to generate power or steam, improving overall plant performance. High-temperature boilers equipped with recovery systems help industries meet energy efficiency regulations and reduce greenhouse gas emissions. Growing investment in retrofitting existing plants with waste recovery technology is further expanding market potential.

- For instance, ANDRITZ is supplying a recovery boiler rated at 2,200 tds/d, with 8.3 MPa and 505 °C steam parameters for Nippon Paper.

Growth of Modular Boiler Designs

Compact modular boilers are gaining popularity due to their easy installation, scalability, and lower maintenance requirements. These systems cater to industries with space and cost constraints while maintaining high output. Modular boilers also offer flexibility for phased expansion in manufacturing and power generation facilities. Their ability to integrate with hybrid energy systems presents new opportunities for manufacturers focusing on sustainability and operational efficiency.

Key Challenges

High Installation and Maintenance Costs

The upfront cost of high-temperature industrial boilers remains a major restraint for small and medium-scale industries. Installation expenses, combined with periodic maintenance and fuel costs, limit adoption in cost-sensitive regions. Complex designs require skilled labor and high-quality materials, increasing operational expenditure. Manufacturers are exploring cost-effective fabrication and material innovations to address this challenge and improve long-term affordability.

Strict Environmental Regulations

Tight emission standards and environmental regulations present challenges for boiler manufacturers. Compliance requires advanced combustion systems, pollution control equipment, and frequent monitoring, increasing production costs. Regions such as Europe and North America have implemented stringent carbon and NOx emission norms that demand technology upgrades. Adapting to these evolving regulatory frameworks while maintaining profitability remains a persistent challenge for the market.

Regional Analysis

North America

North America held a 29% share of the High Temperature Industrial Boiler Market in 2024, driven by strong demand from power generation, oil and gas, and chemical industries. The United States leads due to widespread modernization of thermal plants and investment in energy-efficient systems. Government incentives promoting clean combustion technologies are accelerating adoption of low-emission boiler solutions. Canada’s expanding mining and manufacturing base also supports market growth, while retrofitting old plants with digital control systems enhances operational reliability and efficiency across industrial facilities.

Europe

Europe accounted for 25% of the market in 2024, supported by strict emission regulations and the transition toward cleaner energy systems. Countries such as Germany, the United Kingdom, and France are investing in advanced boiler technologies to reduce carbon footprints. The demand for combined heat and power (CHP) systems is increasing, especially in industrial and district heating applications. Manufacturers are focusing on high-efficiency boilers compatible with hydrogen and biomass fuels, aligning with the European Union’s decarbonization targets for 2030 and beyond.

Asia-Pacific

Asia-Pacific dominated the market with a 37% share in 2024, driven by rapid industrial expansion and growing energy demand in China, India, and Japan. Heavy industries such as steel, cement, and chemicals rely heavily on high-temperature boilers for consistent power and heat supply. Government programs promoting industrial efficiency and renewable integration are boosting technology upgrades. Local manufacturers are expanding production to meet rising domestic and export demand, while increasing investments in waste heat recovery and hybrid systems strengthen the region’s leadership in the global market.

Latin America

Latin America represented an 6% share of the market in 2024, with growth centered in Brazil and Mexico. Expanding industrialization and rising investments in power generation and chemical processing are fueling demand. The region is adopting efficient and compact boiler systems to meet energy security goals and environmental regulations. Local production facilities are focusing on maintenance and retrofitting services to enhance system reliability. Supportive government initiatives and infrastructure expansion projects are creating new opportunities for manufacturers of medium-capacity boilers.

Middle East and Africa

The Middle East and Africa held a 3% market share in 2024, supported by increasing energy infrastructure projects and refinery expansions. GCC countries, including Saudi Arabia and the United Arab Emirates, are investing in high-capacity boilers for oil and gas processing and desalination plants. Africa’s industrial sector is gradually shifting toward efficient steam systems to improve power reliability. Regional growth is also driven by modernization of existing utilities and rising focus on waste heat recovery to optimize fuel consumption in energy-intensive industries.

Market Segmentations:

By Boiler Type

- Hot Water Boiler

- Steam Boiler

- Superheated Steam Boiler

- Once-Through Boiler

- Circulating Fluidized Bed (CFB) Boiler

By Capacity

- Less than 100 MW

- 100 to 500 MW

- 500 to 1000 MW

- Over 1000 MW

By Application

- Power Generation

- Industrial Process Heating

- Steam Generation

- Combined Heat and Power (CHP)

- Pulp and Paper Industry

- Chemical Industry

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Major players such as Babcock & Wilcox, Mitsubishi Heavy Industries, GE Power, Alfa Laval, Thermax, Doosan Heavy Industries Construction, Viessmann, CleaverBrooks, Harbin Boiler, Foster Wheeler, Tampella, BHEL, Dongfang Boiler, Alstom, ABB, Miura, and Zurn Industries collectively shape the competitive landscape of the High Temperature Industrial Boiler Market. The market remains moderately consolidated, with competition centered around technological innovation, efficiency improvement, and emission reduction. Companies focus on developing advanced combustion systems, waste heat recovery solutions, and digital monitoring technologies to meet evolving industrial and environmental standards. Strategic collaborations, service contracts, and modernization projects play a key role in maintaining long-term customer relationships. Many global manufacturers are expanding production facilities in Asia-Pacific to serve the growing demand from power, chemical, and process industries. Sustainability initiatives are driving investments in hybrid and biomass-compatible boiler systems, while automation and predictive maintenance tools are enhancing operational reliability. Continuous R&D and focus on low-carbon manufacturing processes remain essential for maintaining competitive differentiation in this evolving industrial heating market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Babcock & Wilcox

- Mitsubishi Heavy Industries

- GE Power

- Alfa Laval

- Thermax

- Doosan Heavy Industries Construction

- Viessmann

- CleaverBrooks

- Harbin Boiler

- Foster Wheeler

- Tampella

- BHEL

- Dongfang Boiler

- Alstom

- ABB

- Miura

- Zurn Industries

Recent Developments

- In 2023, B&W partnered with Fidelis, an energy transition company, to produce clean, zero-carbon-intensity hydrogen.

- In 2023, Alfa Laval Introduced the world’s first steam boiler systems specifically designed to run on methanol fuel.

- In 2022, BHEL signed a technology license agreement with Sumitomo SHI FW of Finland to produce CFBC boilers in India and global markets

- In 2022, Thermax, anenergy and environmental solutions provider, developed a unique multi-fuel boiler solution for industrial users wishing to transition from a traditional portfolio to a green one with the flexibility of switching inputs.

Report Coverage

The research report offers an in-depth analysis based on Boiler Type, Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-efficiency and low-emission boilers will continue rising across industrial sectors.

- Integration of digital monitoring and predictive maintenance tools will enhance operational efficiency.

- Adoption of hybrid and renewable-fueled boilers will expand with decarbonization initiatives.

- Asia-Pacific will remain the dominant manufacturing and consumption hub through 2032.

- Retrofitting of old power plants will boost the replacement demand for advanced systems.

- Modular and compact boiler designs will gain traction in space-constrained industrial sites.

- Strict emission standards will accelerate the shift toward clean combustion technologies.

- Growth in waste heat recovery systems will improve overall energy utilization.

- Collaboration between OEMs and energy companies will strengthen technology development.

- Expanding applications in chemical and process heating industries will sustain long-term market growth.