Market Overview

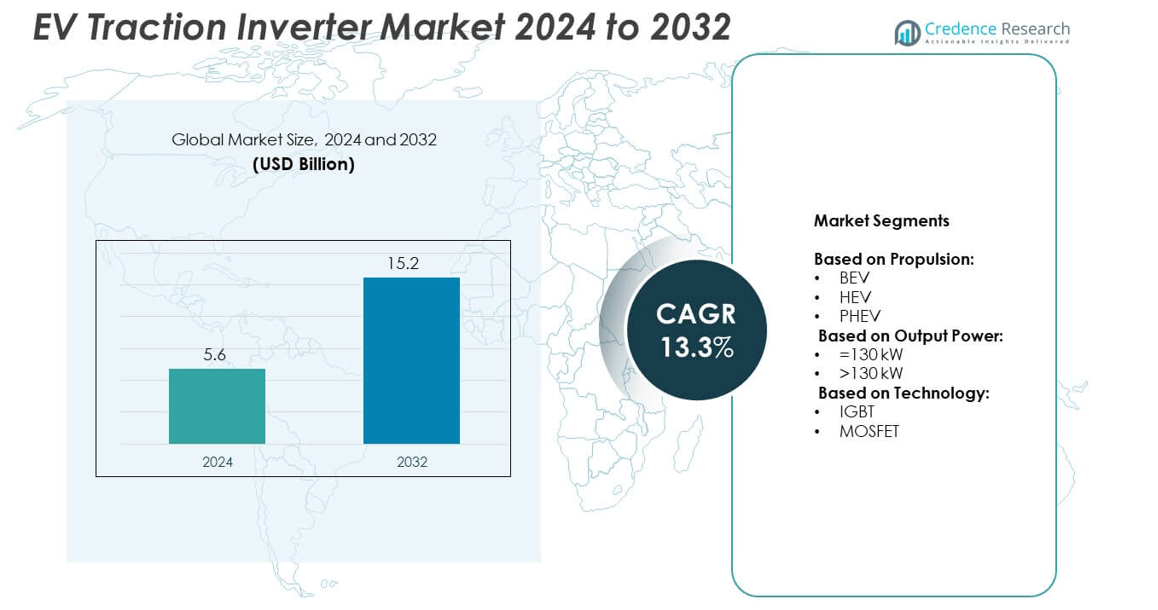

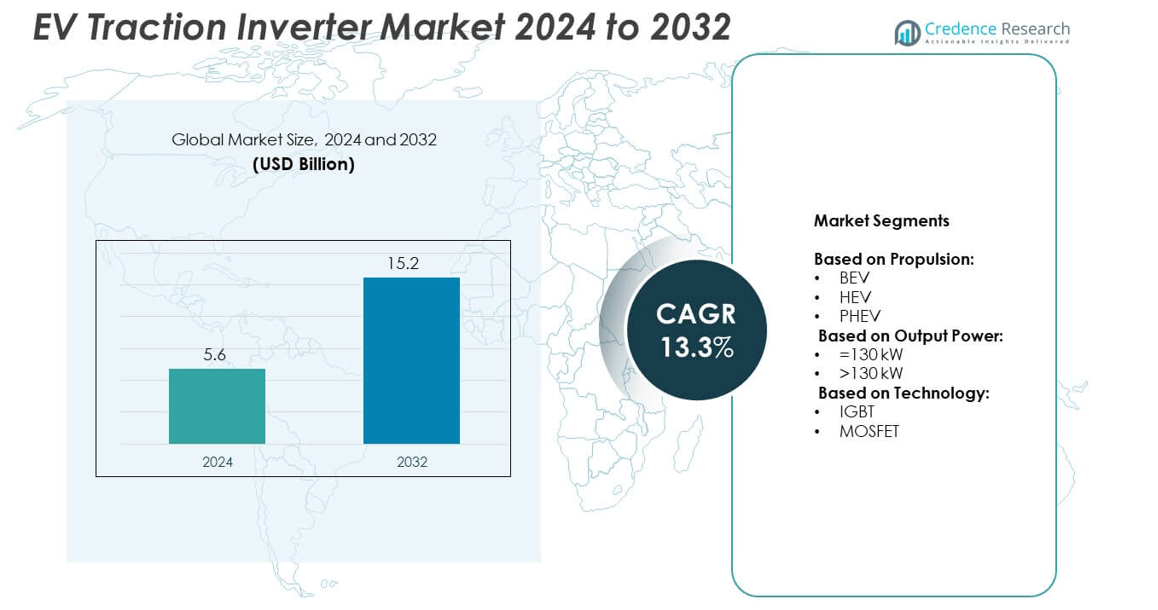

EV Traction Inverter Market size was valued at USD 5.6 billion in 2024 and is anticipated to reach USD 15.2 billion by 2032, at a CAGR of 13.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| EV Traction Inverter Market Size 2024 |

USD 5.6 billion |

| EV Traction Inverter Market, CAGR |

13.3% |

| EV Traction Inverter Market Size 2032 |

USD 15.2 billion |

The EV Traction Inverter market grows with rising electric vehicle adoption and demand for energy-efficient propulsion systems. It benefits from government incentives, urban mobility initiatives, and fleet electrification programs. Advanced inverter technologies, including IGBT and MOSFET modules, enhance vehicle performance and range. Increasing production of BEVs and PHEVs drives inverter integration across multiple segments. Continuous innovation in compact, high-output, and modular designs supports scalability. Collaborations between automakers and semiconductor manufacturers strengthen product development. Expanding charging infrastructure further boosts market growth.

North America, Europe, and Asia-Pacific dominate the EV Traction Inverter market, driven by strong EV adoption and supportive government policies. ZF Friedrichshafen AG, Hitachi Astemo Ltd, Valeo SA, and Toyota Industries Corporation lead technological innovation and product deployment across these regions. North America focuses on high-performance and commercial EV applications, while Europe emphasizes regulatory compliance and efficiency. Asia-Pacific benefits from large-scale manufacturing and urban mobility solutions. Regional expansion, infrastructure development, and strategic partnerships strengthen market presence globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The EV Traction Inverter market was valued at USD 5.6 billion in 2024 and is projected to reach USD 15.2 billion by 2032, growing at a CAGR of 13.3%.

- Rising adoption of electric vehicles and government incentives drive consistent demand for traction inverters.

- Technological trends focus on silicon carbide and gallium nitride semiconductors, improving efficiency and power density.

- Leading players such as ZF Friedrichshafen AG, Hitachi Astemo Ltd, Valeo SA, and Toyota Industries Corporation invest heavily in R&D and strategic partnerships.

- High production costs and complex integration with vehicle systems limit adoption in cost-sensitive segments.

- North America, Europe, and Asia-Pacific dominate regional demand due to strong EV adoption, infrastructure development, and manufacturing capabilities.

- Increasing urban mobility projects, fleet electrification, and expansion of high-performance EV segments create long-term growth opportunities.

Market Drivers

Rising Adoption of Electric Vehicles and Government Incentives Driving Market Growth

The increasing adoption of electric vehicles significantly supports the EV Traction Inverter market. Governments worldwide promote EV sales through subsidies, tax exemptions, and low-emission mandates. It encourages automakers to integrate advanced inverters into new vehicle models. Rising awareness of environmental sustainability accelerates demand for clean transportation solutions. Fleet operators adopt electric mobility to reduce operational costs and meet regulatory targets. Consumer preference for efficient, low-maintenance vehicles further fuels inverter integration. Continuous policy support strengthens the overall market momentum.

- For instance, BYD sold a record 240,220 New Energy Vehicles in China during May 2023. This sales growth, driven by factors including government incentives and strong consumer demand, highlights the expanding market for inverter-equipped EV platforms like BYD’s e-Platform 3.0.

Technological Advancements in Power Electronics Enhancing Vehicle Performance

Technological innovations in power electronics enhance the efficiency of EV traction inverters. Companies develop high-performance IGBT and MOSFET modules to reduce energy loss and improve power density. It allows longer driving ranges and better acceleration in electric vehicles. Advanced cooling systems maintain inverter reliability under high load conditions. The integration of silicon carbide and gallium nitride semiconductors improves thermal stability and performance. Automakers adopt these innovations to differentiate products and meet growing consumer expectations. Efficient inverters contribute to overall energy savings in EV operations.

- For instance, Bosch’s fourth-generation inverter utilizes advanced SiC technology to offer up to 99% efficiency, achieving a power density of more than 50 kVA per liter (over 100% higher than the previous generation). These improvements can boost a vehicle’s range by up to 6%, depending on the use case

Expansion of Charging Infrastructure and Urban Mobility Solutions Supporting Market Demand

The growth of public and private EV charging infrastructure boosts inverter deployment. It enables faster adoption of electric vehicles by reducing range anxiety. Urban mobility solutions, including electric buses and shared EV fleets, increase demand for reliable traction inverters. Operators require efficient systems to handle frequent start-stop cycles and high load conditions. Smart grid integration ensures energy-efficient operation across charging networks. Collaboration between automakers and infrastructure providers strengthens market adoption. Expanding metropolitan transit electrification projects further reinforce demand.

Rising Investment in Research and Development by Automotive Manufacturers

Automakers invest heavily in R&D to develop high-efficiency traction inverters. It supports the creation of lightweight, compact systems that improve vehicle performance. Continuous innovation addresses thermal management, noise reduction, and durability challenges. Collaboration with semiconductor companies accelerates product improvements and shortens time-to-market. New inverter designs focus on optimizing energy conversion and reliability. These investments enhance competitiveness in the rapidly growing EV sector. Advanced EV traction inverters become a key differentiator in premium and mass-market electric vehicles.

Market Trends

Integration of Silicon Carbide and Gallium Nitride Semiconductors Transforming Inverter Efficiency

The EV Traction Inverter market experiences a significant shift toward silicon carbide (SiC) and gallium nitride (GaN) semiconductor adoption. It enables higher switching frequencies and lower energy losses compared to conventional silicon-based inverters. Automakers deploy these technologies to achieve longer vehicle range and improved thermal performance. It reduces cooling requirements and supports compact inverter designs. Increased use of SiC and GaN improves overall system efficiency and reliability. Manufacturers integrate these semiconductors to meet stringent emission and performance standards. The trend drives innovation in next-generation electric vehicles.

- For instance, Studies confirm that Silicon Carbide (SiC) inverters offer higher efficiency than equivalent silicon IGBT inverters, leading to tangible gains in real-world energy output. Tests conducted on a 1 kW solar inverter showed an efficiency improvement of about 3% by replacing silicon IGBTs with SiC JFETs. The specific annual energy saving depends heavily on the operating conditions, load profile, and inverter design

Focus on Compact and Lightweight Designs to Enhance Vehicle Performance

Vehicle manufacturers prioritize compact and lightweight traction inverters to optimize EV efficiency. It reduces overall vehicle weight, contributing to higher energy efficiency and lower operational costs. Modular inverter designs allow flexible integration across various vehicle platforms. Advanced packaging techniques improve heat dissipation and reduce system size. It supports enhanced driving performance and faster acceleration in electric vehicles. Automakers adopt lightweight designs to differentiate products in a competitive market. The trend aligns with growing consumer demand for high-performance EVs.

- For instance, LEM’s HSTDR current sensor—used in inverter systems—measures just 29 mm × 21 mm × 12 mm and weighs 27 g, making it lightweight and compact enough to fit into tight inverter housings while supporting current ranges from ±300 A to ±1500 A

Expansion of Electric Commercial Vehicles and Urban Transit Electrification

Urban transit and commercial EV adoption influence market trends for traction inverters. It drives demand for high-capacity, durable inverters capable of frequent start-stop cycles. Electric buses, delivery trucks, and fleet vehicles require efficient inverters to maximize uptime and reduce energy consumption. Infrastructure improvements in metropolitan areas accelerate the deployment of electric fleets. It supports the integration of smart energy management systems for optimized operation. Partnerships between OEMs and public transit authorities reinforce this trend. The shift toward electrified urban mobility strengthens market growth.

Increasing Adoption of Advanced Thermal Management and Predictive Diagnostics

Advanced thermal management systems and predictive diagnostics gain prominence in EV traction inverters. It monitors inverter performance to prevent overheating and maintain efficiency under high load. Predictive maintenance reduces downtime and extends inverter lifespan. Manufacturers incorporate sensors and software to optimize energy usage and reliability. It ensures consistent vehicle performance under various driving conditions. Adoption of these technologies improves customer confidence in EV reliability. The trend drives continuous innovation and competitive differentiation across the market.

Market Challenges Analysis

High Production Costs and Complex Manufacturing Processes Limiting Market Expansion

The EV Traction Inverter market faces challenges due to high production costs of advanced semiconductors and components. It requires precise manufacturing techniques to ensure efficiency and reliability. Material expenses for silicon carbide and gallium nitride increase overall system cost. It complicates mass production and limits adoption in cost-sensitive vehicle segments. Supply chain constraints for critical raw materials further impact manufacturing timelines. Manufacturers invest in process optimization to reduce costs and improve yield. High initial investment remains a barrier for smaller automotive players.

Thermal Management and Reliability Issues Affecting Performance Consistency

Thermal management and reliability concerns pose significant challenges for traction inverters. It must operate efficiently under high temperatures and varying load conditions. Overheating and power loss can reduce vehicle range and affect system longevity. Inadequate cooling solutions may lead to frequent maintenance requirements. It requires integration of advanced cooling technologies, increasing design complexity and cost. Variability in component quality across suppliers affects consistent performance. These issues limit the scalability of high-performance inverters in diverse EV applications.

Market Opportunities

Growing Demand for High-Efficiency Electric Vehicles Creating Opportunities for Advanced Inverters

The EV Traction Inverter market presents opportunities due to increasing demand for energy-efficient electric vehicles. It enables automakers to offer longer driving ranges and improved performance. Consumers seek vehicles with lower operational costs and enhanced reliability, driving inverter adoption. Development of high-power, compact inverters allows integration into various vehicle segments. It supports the transition from traditional internal combustion engines to fully electric platforms. Collaborations between semiconductor manufacturers and automakers accelerate product innovation. Expanding EV adoption in emerging markets further strengthens growth prospects.

Expansion of Commercial and Urban Electric Mobility Solutions Driving Market Potential

Urban mobility solutions and electrification of commercial fleets create significant opportunities for traction inverters. It supports electric buses, delivery trucks, and shared mobility vehicles requiring reliable, high-capacity inverters. Smart grid integration and regenerative braking systems enhance energy efficiency in these applications. Manufacturers can leverage this demand to introduce modular and scalable inverter designs. It allows fleet operators to reduce maintenance costs and improve operational efficiency. Public-private partnerships in urban transit electrification strengthen adoption rates. Continuous infrastructure development and government support further expand market potential.

Market Segmentation Analysis:

By Propulsion:

Battery Electric Vehicles (BEVs) dominate the EV Traction Inverter market due to the need for fully electric propulsion systems. It requires high-capacity inverters to deliver maximum torque and ensure efficient energy conversion. Hybrid Electric Vehicles (HEVs) utilize inverters to manage power between the internal combustion engine and electric motor. It enables fuel efficiency and smooth transition between power sources. Plug-in Hybrid Electric Vehicles (PHEVs) integrate inverters to handle both battery and engine input, supporting extended driving range. It allows manufacturers to offer versatile mobility solutions while maintaining performance and efficiency. BEVs and PHEVs show strong growth potential with increasing consumer adoption.

- For instance, Lucid Motors integrates an 800 V+ SiC inverter, motor, differential, and transmission into a single drive unit that weighs just 74 kg. The integrated unit is designed to be highly compact and delivers over 500 kW of peak power, illustrating how BEVs use compact, high-power integration for performance optimization. The inverter alone weighs just 9 kg, contributing to the overall lightweight design.

By Output Power:

Inverters with output power equal to 130 kW cater to compact and mid-size electric vehicles. It ensures efficient energy delivery while maintaining cost-effectiveness. High-output inverters above 130 kW target premium and performance EVs requiring higher torque and acceleration. It supports heavy-duty applications like electric SUVs and commercial vehicles. The market shifts toward >130 kW inverters to meet demand for high-performance EVs in global automotive markets. Manufacturers focus on developing scalable power modules that can adapt across multiple vehicle segments. It strengthens the versatility and appeal of advanced electric vehicles.

- For instance, CRRC TEIC manufactures a range of inverters with tiered capacities for electric and hybrid vehicles. Its DM3019 inverter provides a rated output power of 80 kW and delivers a peak output of 150 kW for 30 seconds. This tiered approach allows the company to serve both standard and performance-driven applications. The DM3020 inverter, in contrast, offers a rated output power of 35 kW and a peak output of 70 kW.

By Technology:

Insulated Gate Bipolar Transistor (IGBT) technology dominates traction inverters for mainstream EVs due to its reliability and efficiency. It supports high voltage and current applications while ensuring thermal stability. Metal-Oxide-Semiconductor Field-Effect Transistor (MOSFET) technology finds adoption in high-frequency, compact designs for lightweight EVs. It provides faster switching capabilities and lower conduction losses. Technological innovation in both IGBT and MOSFET modules improves power density and energy efficiency. It allows manufacturers to optimize performance across various vehicle types. Continuous R&D strengthens competitive differentiation in the inverter market.

Segments:

Based on Propulsion:

Based on Output Power:

Based on Technology:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant share of the EV Traction Inverter market, with 35% of the global demand. Strong government incentives for electric vehicle adoption support market growth. It drives automakers to integrate high-efficiency inverters in new EV models. Leading U.S. and Canadian manufacturers focus on developing advanced IGBT and MOSFET modules. Expansion of charging infrastructure enhances consumer confidence in EV adoption. Urban centers increase demand for electric buses and fleet vehicles requiring reliable traction inverters. Collaboration between semiconductor companies and automotive OEMs strengthens innovation and accelerates market penetration.

Europe

Europe accounts for 30% of the EV Traction Inverter market, driven by stringent emission regulations and low-emission zones. It encourages manufacturers to adopt efficient inverters to comply with environmental standards. Germany, France, and the U.K. lead in electric vehicle production and adoption, supporting inverter demand. Automakers invest in lightweight and compact inverter designs to optimize vehicle efficiency. Growth in commercial EV fleets, including buses and delivery vehicles, reinforces market expansion. Continuous development of high-voltage charging infrastructure improves inverter utilization. Public-private partnerships support urban mobility electrification and drive consistent regional growth.

Asia-Pacific

Asia-Pacific represents 25% of the global EV Traction Inverter market, with China, Japan, and South Korea as major contributors. It benefits from large-scale EV adoption, government subsidies, and expanding manufacturing capacities. Chinese manufacturers dominate the mass-market EV segment and deploy inverters in mid- and high-output vehicles. Japan and South Korea focus on high-performance and compact inverters for premium EVs. Expansion of urban electric bus fleets and commercial delivery vehicles drives demand for durable traction inverters. Collaborations with semiconductor companies improve inverter efficiency and reliability. Rapid technological adoption and rising consumer awareness strengthen the regional market presence.

Latin America

Latin America holds 6% of the EV Traction Inverter market, supported by gradual EV adoption and government initiatives. It drives the installation of inverters in both passenger and commercial electric vehicles. Countries such as Brazil and Chile invest in charging infrastructure and fleet electrification programs. Automakers target affordable inverter solutions for cost-sensitive vehicle segments. It supports urban mobility projects and reduces operational emissions in metropolitan areas. Partnerships with local suppliers enhance distribution and technical support. The region demonstrates steady growth potential as EV penetration continues to rise.

Middle East & Africa

The Middle East & Africa represents 4% of the EV Traction Inverter market, with early-stage adoption of electric vehicles. It focuses on integrating inverters in high-performance electric cars and emerging urban mobility solutions. UAE and South Africa lead regional initiatives for EV infrastructure and incentives. High reliance on imported technology encourages collaboration with global inverter manufacturers. It supports commercial and luxury vehicle segments while addressing environmental targets. Expansion of smart city projects strengthens market demand for efficient EV components. Increasing awareness of sustainable transportation gradually improves regional market uptake.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ZF Friedrichshafen AG

- Hitachi Astemo Ltd

- Valeo SA

- Toyota Industries Corporation

- Robert Bosch GmbH

- Vitesco Technologies

- DENSO Corporation

- Continental AG

- Mitsubishi Electric Corporation

Competitive Analysis

ZF Friedrichshafen AG, Hitachi Astemo Ltd, Valeo SA, Toyota Industries Corporation, Robert Bosch GmbH, Vitesco Technologies, DENSO Corporation, Continental AG, Mitsubishi Electric Corporation. The EV Traction Inverter market remains highly competitive, driven by technological innovation and increasing EV adoption. Leading players focus on developing high-efficiency inverters with advanced thermal management systems to enhance vehicle range and reliability. It invests heavily in R&D to integrate silicon carbide and gallium nitride semiconductors for improved energy conversion. Strategic partnerships with automotive OEMs and semiconductor manufacturers strengthen product portfolios and accelerate market penetration. Companies emphasize modular and scalable inverter designs to cater to various vehicle segments, from compact EVs to high-performance SUVs and commercial fleets. Competitive differentiation also comes from reducing inverter size and weight while maintaining power output above 130 kW. Regional expansion and localized production support faster delivery and cost optimization. It faces continuous pressure to improve switching speeds, reduce conduction losses, and enhance durability under high-voltage and high-temperature conditions. Market participants also adopt innovative manufacturing processes to maintain quality and efficiency. Strong focus on after-sales support, service networks, and integration expertise further consolidates market leadership. Continuous technological advancements and strategic collaborations position these companies to capture growing global EV demand effectively.

Recent Developments

- In 2025, ZF Friedrichshafen AG – launched next-generation silicon carbide-based traction inverters for high-performance electric vehicles.

- In June 2025, ENNOVI announced new-generation busbar technologies for EV traction motor stators, designed to accommodate hairpin windings.

- In June 2024, NXP Semiconductors entered a strategic cooperation with ZF Friedrichshafen AG to devise silicon carbide traction inverters for electric vehicles. With this collaboration, NXP’s advanced high-voltage isolated gate drivers will facilitate high-performance power systems and along with it the adoption of 800-volt systems and silicon carbide power devices for electric vehicle powertrains.

Report Coverage

The research report offers an in-depth analysis based on Propulsion, Output Power, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-efficiency EV traction inverters will continue to grow globally.

- Adoption of silicon carbide and gallium nitride technologies will increase inverter performance.

- Compact and lightweight inverter designs will become standard across EV segments.

- High-output inverters above 130 kW will gain traction in premium and commercial vehicles.

- Integration with advanced thermal management systems will enhance reliability and lifespan.

- Urban electric mobility and commercial fleet electrification will drive regional adoption.

- Collaborations between semiconductor manufacturers and automakers will accelerate innovation.

- Modular and scalable inverter solutions will support multiple vehicle platforms.

- Expansion of charging infrastructure will improve inverter utilization and energy efficiency.

- Continuous R&D will strengthen competitive differentiation and support next-generation EVs.