Market Overview

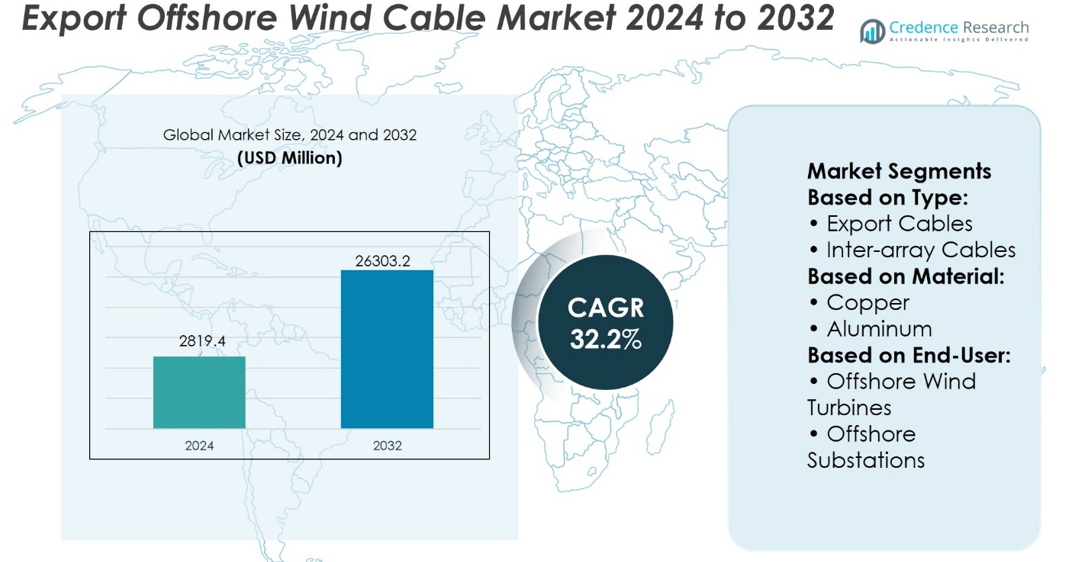

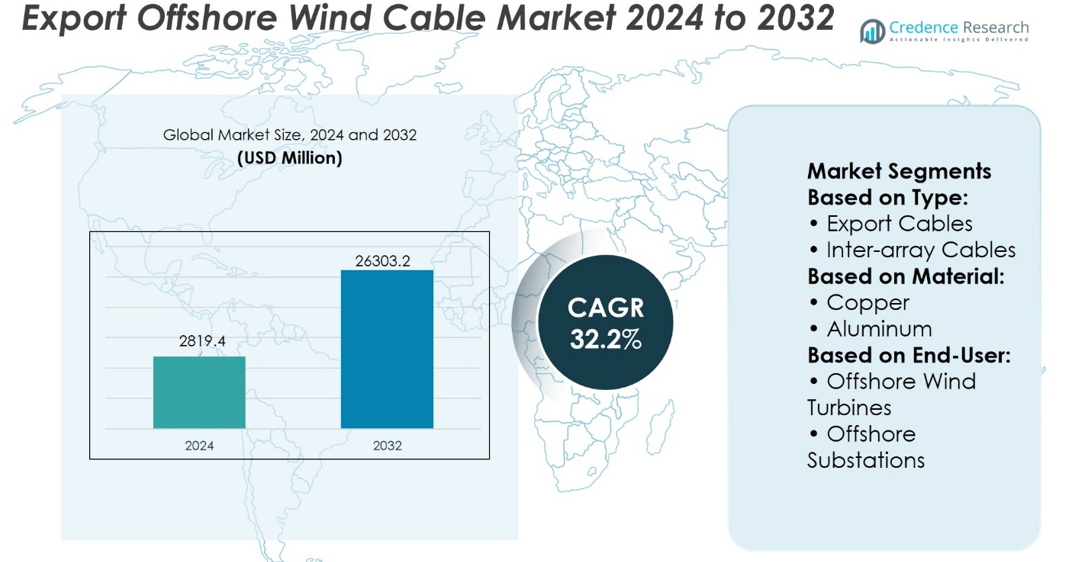

Export Offshore Wind Cable Market size was valued at USD 2819.4 million in 2024 and is anticipated to reach USD 26303.2 million by 2032, at a CAGR of 32.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Export Offshore Wind Cable Market Size 2024 |

USD 2819.4 million |

| Export Offshore Wind Cable Market, CAGR |

32.2% |

| Export Offshore Wind Cable Market Size 2032 |

USD 26303.2 million |

The Export Offshore Wind Cable Market benefits from rapid offshore wind capacity growth and rising demand for efficient, high-voltage transmission solutions. It drives adoption of advanced HVDC and HVAC cable technologies to support larger, more distant wind farms. Technological innovations in insulation, conductor materials, and continuous length production improve reliability and reduce maintenance. Increasing investments in cross-border grid interconnections and floating wind projects further propel market expansion. Digital monitoring integration enhances operational efficiency, while sustainability initiatives push development of recyclable materials. These factors collectively accelerate the deployment of robust subsea cable infrastructure critical to offshore wind energy’s global progress.

The Export Offshore Wind Cable Market is led by key players such as NEXANS, NKT A/S, LS Cable & System Ltd., and HENGTONG GROUP CO., LTD., operating across major regions including Europe, Asia-Pacific, and North America. Europe dominates due to mature offshore wind infrastructure, while Asia-Pacific shows rapid growth driven by China and Japan. North America is emerging with significant project developments. These players leverage regional manufacturing capabilities and technological expertise to meet diverse market demands and support expanding offshore wind capacities worldwide.

Market Insights

- The Export Offshore Wind Cable Market size was valued at USD 2,819.4 million in 2024 and is expected to reach USD 26,303.2 million by 2032, growing at a CAGR of 32.2%.

- Rapid offshore wind capacity expansion drives demand for high-voltage transmission cables supporting larger and more distant wind farms.

- Adoption of advanced HVDC and HVAC cable technologies improves efficiency and reliability in subsea power transmission.

- Innovations in insulation materials, conductor design, and continuous length manufacturing reduce maintenance and enhance durability.

- Cross-border grid interconnections and floating wind projects create new growth avenues in the market.

- Key players like NEXANS, NKT A/S, LS Cable & System Ltd., and HENGTONG GROUP CO., LTD. leverage regional expertise to meet global demand.

- Europe leads the market due to mature infrastructure, while Asia-Pacific and North

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Offshore Wind Energy Deployment

The Export Offshore Wind Cable Market grows in line with the expansion of offshore wind energy projects worldwide. Governments invest heavily in large-scale offshore farms to meet renewable energy targets and reduce dependence on fossil fuels. It supports high-capacity cable demand to connect turbines to onshore grids efficiently. Technological advances in turbine size and placement extend project distances, requiring robust export cables capable of maintaining stable power transmission over long routes. Major coastal economies in Europe, Asia, and North America drive installations in deeper waters, amplifying cable performance requirements. The market benefits from policy frameworks that promote grid modernization and interconnection projects.

- For instance, Nexans produced 120 million meters of subsea cables to support offshore wind projects globally. This production highlights Nexans’ significant role in the renewable energy sector, specifically in facilitating the connection of offshore wind farms to onshore grids.

Technological Advancements in Cable Design and Manufacturing

Innovations in high-voltage alternating current (HVAC) and high-voltage direct current (HVDC) cable systems strengthen the Export Offshore Wind Cable Market. Manufacturers develop advanced insulation materials and optimized conductor configurations to reduce transmission losses and improve durability under harsh marine conditions. It relies on advancements in continuous length production to minimize jointing needs, lowering failure risk. Subsea cable armoring techniques evolve to protect against abrasion and mechanical stress from seabed movement. Increased automation in manufacturing enhances quality control and scalability. These developments ensure cables meet the demanding requirements of deepwater and large-capacity projects.

- For instance, Nexans produced a substantial quantity of subsea cables, specifically 150 million meters, designed for transmitting power from offshore wind farms. These cables are a critical component in connecting offshore wind energy to onshore grids, facilitating the delivery of renewable energy to consumers.

Government Support and Regulatory Frameworks

Robust policy support plays a central role in driving the Export Offshore Wind Cable Market. Governments implement feed-in tariffs, green energy auctions, and grid integration mandates to stimulate offshore wind development. It benefits from regulations that prioritize renewable grid connection over conventional sources. Subsidies and financing programs lower project risk for developers, accelerating offshore build-outs that require advanced cable solutions. Regulatory agencies enforce stringent technical standards, ensuring product reliability and operational safety. This environment fosters investment in high-performance subsea cable infrastructure.

Growing Private Sector Investments and Partnerships

Private capital inflows significantly influence the growth trajectory of the Export Offshore Wind Cable Market. Global energy companies, engineering firms, and investment funds form strategic partnerships to execute large offshore projects. It leverages joint ventures to combine technological expertise with financial strength, enabling rapid project execution. Supply chain expansion includes specialized cable-laying vessels and installation contractors to meet rising demand. Collaboration with research institutions accelerates testing of next-generation cable technologies. These investments enhance capacity, reduce delivery timelines, and improve competitiveness in the global market.

Market Trends

Shift Toward High-Voltage Direct Current (HVDC) Technology

The Export Offshore Wind Cable Market witnesses a marked shift toward HVDC systems for long-distance and high-capacity power transmission. Project developers favor HVDC for its lower transmission losses and improved efficiency in connecting remote offshore wind farms to onshore grids. It supports integration of larger wind farms located further from coastlines, where traditional HVAC solutions become less effective. Manufacturers focus on developing extruded HVDC cables with enhanced thermal performance and mechanical strength. Increased adoption of ±320 kV and higher-rated cables reflects the need for advanced transmission solutions. This trend aligns with global efforts to expand offshore wind capacity in deeper waters.

- For instance, Nexans produces 45 million meters of extruded HVDC cables annually. Prysmian manufactures 60 million meters of HVDC submarine cables each year. NKT’s factory capacity reaches 30 million meters of high-voltage DC cables designed for offshore applications.

Integration of Smart Monitoring and Diagnostic Systems

Integration of advanced monitoring technologies becomes a defining trend in the Export Offshore Wind Cable Market. Real-time diagnostic systems track temperature, voltage, and strain along subsea cables, enabling predictive maintenance and reducing downtime. It utilizes fiber optic sensing embedded in cables to enhance performance visibility and operational safety. Digital twin models simulate operational conditions to optimize design and lifecycle management. Operators leverage cloud-based platforms to collect and analyze large datasets from offshore networks. This proactive approach reduces repair costs and extends cable service life.

- For instance, Nexans has integrated smart monitoring systems into 12 million meters of their subsea cables. This initiative aims to enhance the reliability and safety of power networks through advanced monitoring and predictive maintenance.

Expansion of Deepwater Offshore Projects

The Export Offshore Wind Cable Market adapts to the expansion of deepwater wind farms in regions with high wind potential. Longer export cables with advanced insulation and armoring address the challenges of harsher seabed environments. It demands specialized installation vessels capable of laying cables in deeper waters with high precision. Growing turbine capacities of 15 MW and above increase transmission requirements. Manufacturers innovate to produce cables with longer continuous lengths to minimize joints and reduce fault risks. This expansion drives higher technical specifications across the cable supply chain.

Sustainability and Recyclable Material Development

Sustainability becomes a key design priority in the Export Offshore Wind Cable Market. Companies invest in recyclable insulation and conductor materials to meet environmental regulations and reduce lifecycle carbon footprints. It encourages low-impact manufacturing processes and waste reduction during production. Research into bio-based polymers and recyclable armoring components gains momentum. End-of-life recovery programs ensure valuable metals and materials from decommissioned cables re-enter the supply chain. This trend aligns with the renewable energy sector’s broader commitment to circular economy principles.

Market Challenges Analysis

High Installation and Maintenance Complexity

The Export Offshore Wind Cable Market faces significant challenges due to the complexity of subsea installation and maintenance activities. Harsh marine environments, unpredictable weather, and seabed conditions increase the risk of cable damage during deployment. It requires specialized cable-laying vessels and skilled crews, which drive up operational costs. Repairs are technically demanding, often involving deepwater operations that can take weeks to complete. Jointing processes remain vulnerable points in long-distance cable systems, where failure can disrupt entire wind farm output. Extended repair timelines can affect grid stability and project profitability.

Supply Chain Constraints and Raw Material Volatility

Supply chain limitations create persistent challenges for the Export Offshore Wind Cable Market. Lead times for specialized materials such as high-grade copper and cross-linked polyethylene insulation often stretch beyond project schedules. It is further impacted by price fluctuations in raw materials, which complicate cost forecasting for developers. Limited manufacturing capacity for long-length, high-voltage cables puts pressure on delivery timelines. Dependence on a small number of specialized suppliers increases vulnerability to production delays. Global transportation bottlenecks and regulatory approvals for cross-border projects add further complexity to meeting offshore wind expansion targets.

Market Opportunities

Expansion of Cross-Border Renewable Energy Interconnections

The Export Offshore Wind Cable Market presents strong opportunities through the development of cross-border power transmission projects. Interconnection of offshore wind farms to multiple national grids enhances energy security and market integration. It benefits from large-scale initiatives in Europe and Asia where regional cooperation supports shared infrastructure investments. High-voltage direct current (HVDC) systems enable efficient long-distance transmission, opening opportunities for suppliers to deliver advanced cable solutions. Emerging projects in the North Sea, Baltic Sea, and Southeast Asia create consistent demand for high-capacity export cables. Strategic partnerships between governments and private developers accelerate deployment in interconnected renewable networks.

Technological Innovation and Floating Wind Farm Growth

Advances in floating wind technology expand the operational scope of the Export Offshore Wind Cable Market into deeper waters with stronger wind resources. It opens opportunities for specialized cable designs capable of withstanding dynamic movement from floating platforms. Manufacturers can leverage demand for lightweight, flexible, and high-durability cables tailored for floating turbine arrays. Integration with smart monitoring systems further enhances reliability and performance. The growth of pilot and commercial-scale floating wind farms in Japan, the United Kingdom, and the United States positions suppliers to enter emerging high-value markets. These developments create a pathway for innovation-driven market expansion.

Market Segmentation Analysis:

By Type

The Export Offshore Wind Cable Market segments into export cables and inter-array cables, each serving distinct roles in offshore wind farm operations. Export cables transmit high-voltage electricity from offshore installations to onshore grids, often over long distances and challenging seabed conditions. Inter-array cables connect individual turbines to offshore substations, enabling efficient power collection before transmission ashore. It sees higher demand for export cables in large-scale projects located far from coastlines, where performance and durability are critical. Manufacturers focus on improving insulation systems and increasing voltage capacity to meet evolving project specifications. Growth in turbine capacity further drives the need for both cable types with greater load-handling capabilities.

- For instance, Prysmian Group has supplied over 90 million meters of export cables specifically designed to withstand harsh subsea environments.

By Material

Material selection plays a critical role in the performance and longevity of cables within the Export Offshore Wind Cable Market. Copper remains the dominant conductor material due to its superior conductivity and proven reliability in high-voltage applications. Aluminum offers a lighter alternative, reducing overall cable weight and easing installation requirements without compromising performance for certain configurations. It drives innovation in corrosion resistance and insulation technologies to extend operational life in harsh marine environments. Material choice impacts overall project cost, installation efficiency, and maintenance requirements. Ongoing research into hybrid conductor designs supports future performance improvements.

- For instance, Prysmian Group produced 120 million kilograms of copper conductors for subsea cables, ensuring high electrical performance.

By End-User

End-User segments in the Export Offshore Wind Cable Market include offshore wind turbines and offshore substations, both critical to energy transmission systems. Offshore wind turbines rely on inter-array cables to link units together and channel power to substations. Offshore substations serve as collection hubs, using export cables to transmit electricity to shore. It demands high-performance cables that can withstand mechanical stress, temperature fluctuations, and corrosive seawater. Growing deployment of larger turbines and high-capacity substations drives increased cable specifications. This segment expansion aligns with global offshore wind capacity growth targets.

Segments:

Based on Type:

- Export Cables

- Inter-array Cables

Based on Material:

Based on End-User:

- Offshore Wind Turbines

- Offshore Substations

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America captures a 17% market share, with the United States at the forefront of regional activity. Federal and state-level renewable energy mandates drive offshore wind deployment along the East Coast, where projects such as Vineyard Wind and Empire Wind require long-distance HVDC and HVAC export cables. It faces a relatively nascent supply chain compared to Europe and Asia, leading to strategic partnerships with global cable manufacturers for technology transfer and capacity building. Canadian offshore wind initiatives in Atlantic provinces add to regional opportunities. Investments in domestic manufacturing plants and specialized installation vessels aim to reduce reliance on imports and accelerate project timelines. Regulatory clarity and infrastructure planning will play key roles in unlocking further market growth.

Europe

Europe holds the dominant position in the Export Offshore Wind Cable Market with a market share of 41%, supported by mature offshore wind infrastructure and strong policy frameworks. The region benefits from large-scale projects in the North Sea, Baltic Sea, and Atlantic waters, where countries such as the United Kingdom, Germany, the Netherlands, and Denmark lead capacity deployment. It is home to some of the world’s largest offshore wind farms, requiring extensive high-voltage export cable installations to connect distant turbines to shore. Regional manufacturers, including Nexans, Prysmian Group, and NKT, have advanced production capabilities and deep-water installation expertise. Government commitments to renewable energy targets under the European Green Deal further stimulate investment in cross-border interconnections, boosting demand for high-performance subsea cable systems. Continuous upgrades to aging infrastructure ensure ongoing replacement demand alongside new project development.

Asia-Pacific

Asia-Pacific accounts for 29% of the Export Offshore Wind Cable Market, driven by rapid offshore wind expansion in China, Taiwan, Japan, and South Korea. National renewable energy strategies prioritize offshore wind as a critical resource to meet energy security and decarbonization objectives. It sees increasing deployment of both fixed-bottom and floating offshore wind projects, particularly in Japan and South Korea, which require specialized cable designs for deepwater installations. China remains the largest single-country market in the region, with state-backed developers commissioning large export cable orders to connect gigawatt-scale offshore projects. Domestic cable manufacturers compete alongside international suppliers, creating a competitive supply chain landscape. Growing regional investment in port facilities, manufacturing hubs, and installation vessels supports faster project execution.

Latin America

Latin America accounts for 6% of the Export Offshore Wind Cable Market, supported by emerging offshore wind initiatives in Brazil, Colombia, and Chile. Brazil leads with multiple offshore wind licensing rounds and grid connection planning for projects in the Atlantic. It requires robust export cable systems capable of operating in varied seabed and water depth conditions. The region relies heavily on imported high-voltage cable technology, creating opportunities for global manufacturers to establish local partnerships or joint ventures. Growing interest from energy multinationals ensures technical expertise and investment inflows. Policy support and maritime infrastructure improvements will be critical to enabling large-scale deployment.

Middle East & Africa

The Middle East & Africa region holds a 7% share of the Export Offshore Wind Cable Market, with early-stage developments in offshore renewable energy infrastructure. It focuses on pilot projects and feasibility studies in countries such as South Africa, Morocco, and Saudi Arabia, where strong coastal wind resources offer long-term potential. It is gradually investing in transmission infrastructure to integrate offshore generation into national grids. International partnerships and financing from multilateral agencies help drive initial cable procurement and installation activities. The region also looks to adopt European and Asian best practices in subsea installation and project design. While current deployment is limited, government energy diversification agendas indicate strong long-term growth prospects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Export Offshore Wind Cable Market features including Ningbo Orient Wires & Cables Co., Hydro Group, LS Cable & System Ltd., NKT A/S, Hellenic Cables, FURUKAWA ELECTRIC CO., LTD, JDR Cable Systems Ltd., Jan De Nul, HENGTONG GROUP CO., LTD., and NEXANS. The Export Offshore Wind Cable Market is characterized by high competition, driven by the need for advanced technology, reliable performance, and cost efficiency in large-scale offshore projects. Companies compete by offering high-voltage cable solutions capable of meeting the demands of deepwater installations and long-distance transmission. Innovation in insulation materials, conductor designs, and continuous length production enhances product durability and reduces maintenance requirements. Strategic partnerships with installation contractors, research institutions, and project developers strengthen market positioning. Investment in expanding manufacturing capacity and adopting automation ensures faster delivery and consistent quality. The competitive environment rewards suppliers that combine technological expertise with the ability to execute complex offshore projects on schedule and within budget.

Recent Developments

- In April 2025, Orient Cable secured combined contracts worth approximately 1.227 billion for multiple submarine and land cable projects.

- In January 2024, Jan De Nul Group signed a contract with Ørsted for the installation of export cables for the Hornsea 3 offshore wind farm located 160 km from Yorkshire coast in UK.

- In November 2023, NEXANS installed its export cables at South Fork Offshore Wind Farm of Eversource and Ørsted.

- In July 2023, Prysmian Group secured a contract from Ørsted Wind Power A/S to deliver inter array submarine cables for the Hornsea 3 offshore wind farm in UK.

Market Concentration & Characteristics

The Export Offshore Wind Cable Market shows a moderate to high level of concentration, with a limited number of global manufacturers controlling a significant share of supply. It relies on specialized production capabilities, advanced engineering expertise, and substantial capital investment, creating high entry barriers for new participants. Leading suppliers operate integrated facilities for design, manufacturing, and testing of high-voltage subsea cables, often complemented by in-house or partnered installation services. The market features long-term contracts with offshore wind developers, where performance reliability and proven track records strongly influence procurement decisions. It demands strict compliance with technical standards and certification requirements, ensuring operational safety and durability in harsh marine environments. Technological differentiation in high-voltage direct current (HVDC) and high-voltage alternating current (HVAC) systems, along with continuous length production to reduce jointing, reinforces competitive advantage. The supply chain depends on a small pool of specialized raw material providers, making strategic sourcing and capacity planning critical to sustaining market position.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Offshore wind capacity expansion will drive continuous demand for high-voltage export cables.

- Adoption of HVDC technology will increase for long-distance and large-capacity projects.

- Floating wind farms will create demand for flexible and dynamic cable designs.

- Manufacturing capacity will expand to meet growing global installation schedules.

- Digital monitoring systems will become standard for predictive maintenance.

- Cross-border interconnection projects will boost multi-terminal cable requirements.

- Sustainable and recyclable materials will gain prominence in cable production.

- Regional supply chains will strengthen to reduce dependency on imports.

- Specialized installation vessels will be developed for deepwater and complex projects.

- Strategic partnerships will grow between cable manufacturers and offshore wind developers.