Market Overview

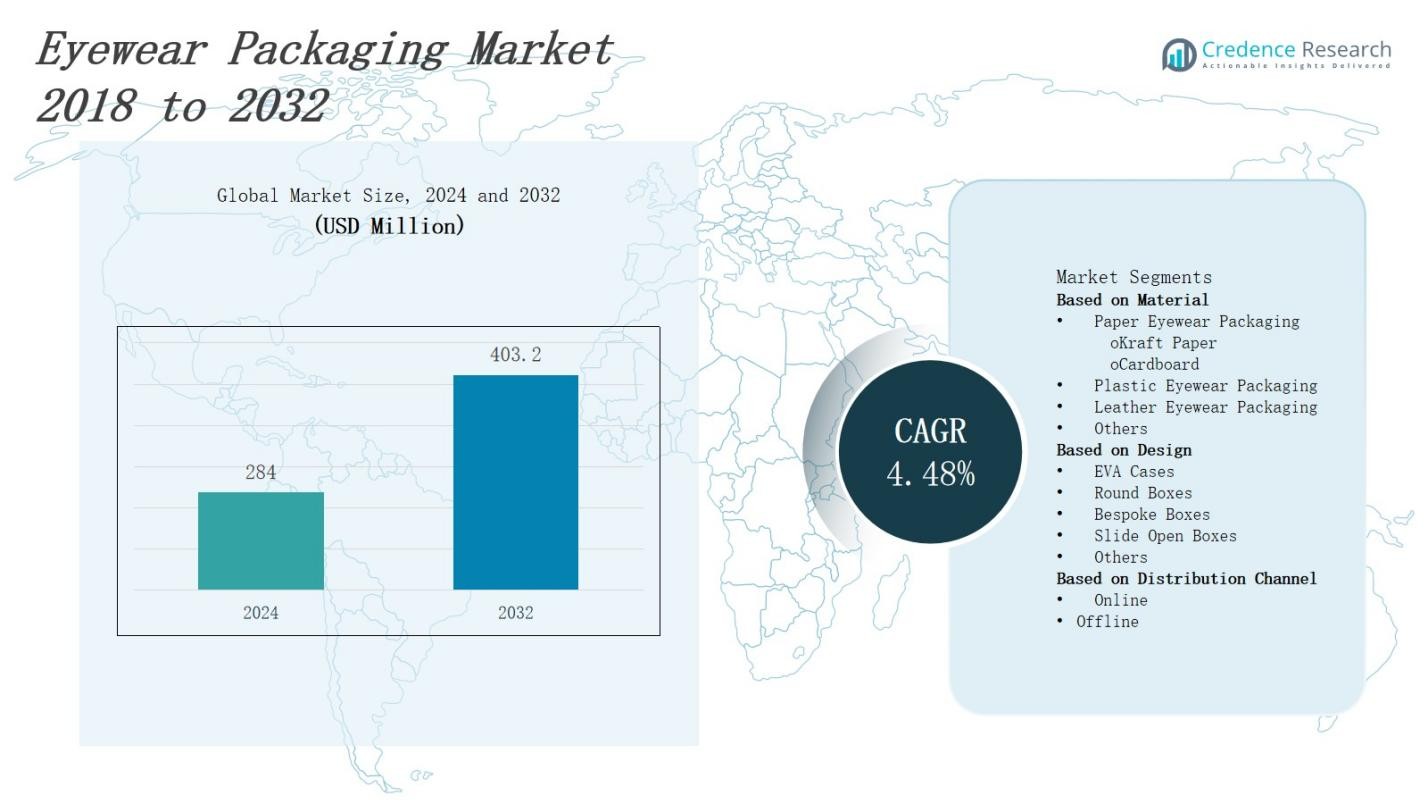

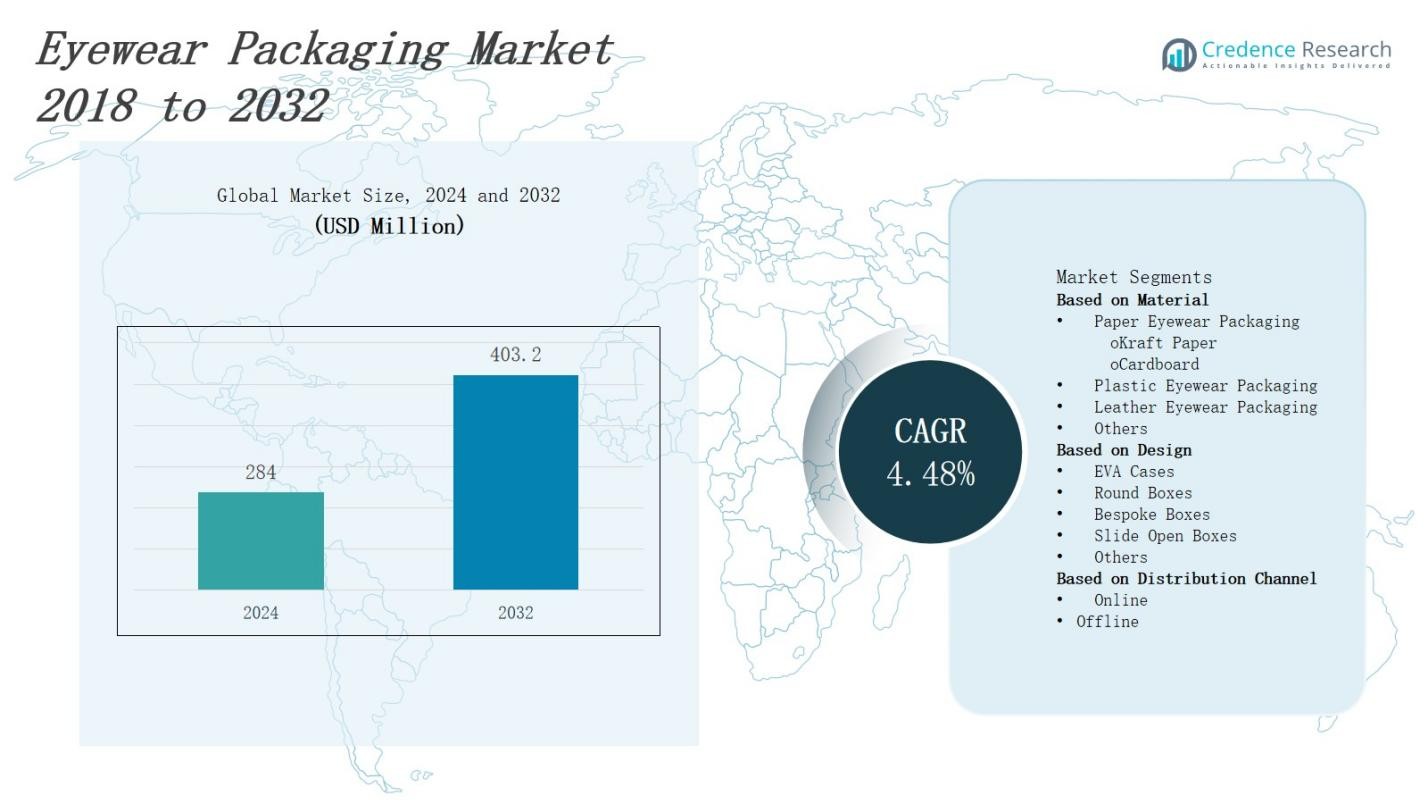

The eyewear packaging market is projected to grow from USD 284 million in 2024 to USD 403.2 million by 2032, at a compound annual growth rate of 4.48%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Eyewear Packaging Market Size 2024 |

USD 284 Million |

| Eyewear Packaging Market, CAGR |

4.48% |

| Eyewear Packaging Market Size 2032 |

USD 403.2 Million |

Rising global eyewear consumption and expanding e‑commerce channels drive the eyewear packaging market, as brands demand durable, lightweight solutions that protect frames during transit and enhance shelf appeal. Sustainability initiatives encourage manufacturers to adopt bio‑based polymers and recycled materials, reducing environmental impact and complying with regulations. Technological advances in UV‑resistant coatings, anti‑scratch films and precision die‑cutting enable custom designs that improve functionality and branding. Companies integrate smart features such as QR codes for authentication and traceability, boosting consumer engagement. Strategic collaborations between packaging specialists and eyewear producers accelerate innovation, optimize production efficiency and address evolving market preferences and greater differentiation.

North America holds 32% share, led by Honeywell International Inc., which supplies protective and branded cases. Europe commands 28% share, where GIORGIO FEDON & FIGLI SpA dominates luxury packaging. Asia Pacific accounts for 24% share, with Packman Packaging Private Limited offering cost‑effective mailer solutions. Latin America (10%) features Umiya Plast for regional formats, while Middle East & Africa (6%) relies on Well Packaging Limited for durable case designs. The eyewear packaging market demands collaboration between global leaders and local innovators to meet varied regulatory and consumer requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market will grow from USD 284 million in 2024 to USD 403.2 million by 2032 at a 4.48% CAGR.

- Rising eyewear demand and online sales force brands to adopt durable, lightweight cases that protect products and reduce shipping costs.

- Sustainability mandates push use of bio‑based polymers and recycled content to meet regulatory and consumer expectations.

- UV‑resistant coatings, anti‑scratch films and precision die‑cutting deliver better protection and stronger brand presentation.

- QR codes and NFC tags enable product authentication, traceability and direct consumer engagement.

- Volatile raw material prices and supply chain bottlenecks increase production costs and pressure margins.

- North America holds 32% share, Europe 28%, Asia Pacific 24%, Latin America 10% and Middle East & Africa 6%, which demands region‑specific packaging strategies.

Market Drivers

Rising Demand for Protection

The eyewear packaging market benefits from heightened consumer focus on frame durability and damage prevention. Brands require robust solutions that shield lenses and frames during transport. Packaging specialists supply rigid cases and impact‑resistant materials that preserve product integrity. It drives manufacturers to refine material blends and enhance cushioning performance. Innovative case closures guarantee secure sealing and ease of use. Partnerships with logistics firms ensure package reliability throughout the supply chain.

Expansion of E‑Commerce Channels

Rapid growth in online eyewear sales drives demand for secure packaging solutions. The eyewear packaging market adapts by adopting lightweight, tamper‑evident designs that reduce shipping costs. Packaging developers integrate protective inserts to improve efficiency. It encourages automation in case production to meet volume requirements. Retailers expect unboxing experiences that reinforce brand value. Collaboration with courier services optimizes pack dimensions for pallets. Sustainable mailer innovations minimize waste and uphold eco commitments.

- For instance, Hala Optical introduced 100% biodegradable and compostable packaging bags for their premium eyewear frames, aligning with environmental responsibility while serving clients like COSTCO.

Emphasis on Sustainability Standards

Stricter environmental policies compel material innovation in the eyewear packaging market. Brands request recyclable plastics and compostable fibers to meet regulatory targets. It promotes adoption of bio‑based polymers and recycled content that satisfy eco labels. Packaging engineers adopt water‑based inks and solvent‑free adhesives to reduce chemical footprint. Manufacturers invest in life cycle analysis to prove compliance. Certification programs boost consumer trust. Cross‑sector alliances drive circular economy practices and reuse initiatives.

- For instance, Zenni Optical’s EcoBloomz frames incorporate upcycled plastic from water bottles and bio-based acetate made from renewable resources like wood pulp and castor bean oil.

Integration of Smart Technologies

Innovation in digital authentication enhances the eyewear packaging market. Brands deploy QR codes and NFC tags to verify product authenticity and track shipments. It enables real time data exchange between manufacturer and consumer. Packaging vendors embed sensors that monitor temperature and humidity to ensure product safety. Software platforms analyze scan data to detect tampering attempts. Strategic investments in IoT infrastructure strengthen supply chain visibility. Collaborative R&D efforts refine sensor miniaturization.

Market Trends

Customization and Personalization Strategies

Consumers prefer unique designs that reflect personal style. The eyewear packaging market shifts toward bespoke cases and limited editions. It encourages manufacturers to provide on‑demand printing. Brands use custom embossing and color matching to enhance perceived value and differentiation. Packaging specialists partner with design teams to develop personalization platforms. Growth in social media trends drives demand for shareable unboxing experiences. Market research highlights preference for tailor‑made solutions that improve brand loyalty.

Minimalist and Premium Aesthetic Adoption

Consumer demand accentuates clean, elegant packaging that conveys luxury. The eyewear packaging market adopts sleek materials and discreet branding to amplify premium positioning. It drives suppliers to select high‑quality textured papers and matte finishes. Brands streamline structural design to remove excess elements and focus on core functionality. Packaging engineers apply subtle embossing and soft‑touch coatings to convey sophistication. Market data indicate growth in demand for premium unboxing. Partnerships with luxury labels reinforce trend momentum.

- For instance, CONES & RODS by Blackink uses sustainable, minimalist packaging that emphasizes ethical production and sleek designs. Their eyewear frames are made from 100% titanium and metal, and packaging highlights environmental responsibility alongside luxury.

Advancement in Digital Printing Technologies

Digital printing capability expands design flexibility and shortens lead times. The eyewear packaging market uses variable data printing to tailor graphics for individual products. It allows rapid prototype development and reduces waste from unused stock. Brands deploy high‑resolution imagery and foil stamping to enhance visual impact. Suppliers integrate eco‑friendly UV‑curable inks that meet stringent safety standards. Consumer surveys reveal rising acceptance of digitally crafted packaging. Manufacturer investment in printing upgrades drives competitive advantage.

- For instance, Formlabs leverages selective laser sintering (SLS) 3D printing to manufacture eyewear frames with complex geometries and built-in hinges, enabling rapid prototyping and reduced assembly steps without compromising strength or quality.

Lightweight and Modular Packaging Solutions

Demand for efficient logistics propels development of compact, lightweight cases. The eyewear packaging market leverages modular insert systems to fit diverse frame styles. It reduces material usage and shipping expenses without sacrificing protection. Brands adopt foldable designs that simplify storage at retail and consumer locations. Packaging engineers test new composite blends that deliver high strength at low weight. Industry reports forecast increased adoption of modular platforms. Collaboration between material scientists and packagers accelerates innovation pace.

Market Challenges Analysis

Rising Raw Material Cost Pressures and Supply Chain Disruptions

Manufacturers face mounting challenges in securing consistent supplies of premium plastics, metals and sustainable fibers. It amplifies production costs and compresses profit margins. The eyewear packaging market contends with frequent price fluctuations for oil‑based resins and aluminum components. Suppliers struggle to lock in long‑term contracts at stable rates. Brands demand supply chain transparency, yet logistical bottlenecks prolong lead times. Packaging producers must balance cost control with quality standards. Collaboration across procurement, production and logistics teams remains critical to mitigate risk.

Complex Regulatory and Sustainability Mandates

Regulators impose strict guidelines on recyclable content, chemical additives and waste disposal. It forces rapid adaptation of material formulations and production processes. The eyewear packaging market must satisfy diverse regional requirements, from EU Extended Producer Responsibility schemes to North American recycling targets. Documentation and testing protocols consume time and resources. Brands risk non‑compliance penalties if they overlook evolving standards. Packaging engineers must validate eco‑friendly adhesives and inks. Strategic investment in compliance management tools helps firms stay ahead of regulatory shifts.

Market Opportunities

Expansion into Emerging Markets

The eyewear packaging market benefits from rising income and an increase in eyewear penetration in Asia‑Pacific and Latin America. It encourages packaging makers to tailor designs that resonate with local tastes. Brands that enter new regions demand cost‑effective, robust cases that preserve frames in harsh climates. Packaging developers can establish regional production hubs to reduce transit costs and lead times. Collaboration with local distributors secures shelf placement and brand visibility. Certifications that meet regional standards strengthen market acceptance. Strategic market entry can unlock new revenue streams.

Innovation through Biodegradable and Smart Materials

The eyewear packaging market finds opportunity in sustainable and connected solutions. It prompts material scientists to test novel biodegradable polymers that satisfy regulatory and consumer expectations. Companies can integrate NFC tags and QR codes in packaging to enhance authentication and customer engagement. Seamless integration of sensors that track conditions during transit enhances product safety. Partnerships between packaging firms and technology providers accelerate adoption of smart features. Failure to innovate can leave brands vulnerable to shifting consumer preferences. Firms that lead in sustainable, connected packaging can differentiate offerings and secure premium positioning.

Market Segmentation Analysis:

By Material

The eyewear packaging market segments by material highlight diverse performance needs. Paper packaging, such as kraft paper and cardboard, offers cost efficiency and recyclability that satisfy sustainability goals. Plastic solutions provide impact resistance and design versatility for mainstream labels. Leather cases deliver premium appeal and durability for luxury offerings. Other materials such as metal or fabric address niche requirements. Leading suppliers leverage material-specific benefits to balance protection, branding, and regulatory compliance.

- For instance, Kling GmbH utilizes recycled cardboard to enhance eco-friendly packaging while maintaining structural integrity for eyewear protection.

By Design

The eyewear packaging market relies on design categories to meet usage and brand demands. EVA cases deliver lightweight protection and form-fitting support during transport. Round boxes offer elegant presentation and secure closure for boutique labels. Bespoke boxes allow full customization to reinforce brand identity at point of sale. Slide open boxes enable convenient access and safe storage. Other formats, such as magnetic flip‑top cases, help brands deliver a distinctive unboxing experience. Manufacturers align designs with function and style.

- For example, Bonito Packaging offers versatile EVA cases designed for robustness and convenient outdoor use, often including zipper closures for enhanced protection.

By Distribution Channel

The eyewear packaging market distributes products through online and offline channels to reach end users. Online platforms offer direct‑to‑consumer sales with custom orders and personalized packaging options. Offline channels such as optical stores and department outlets provide immediate availability and tactile inspection. It drives packaging suppliers to deliver consistent quality and branding across channels. Segment growth depends on partnerships with e‑commerce firms and traditional retailers to maintain market reach and customer engagement.

Segments:

Based on Material

- Paper Eyewear Packaging

- Plastic Eyewear Packaging

- Leather Eyewear Packaging

- Others

Based on Design

- EVA Cases

- Round Boxes

- Bespoke Boxes

- Slide Open Boxes

- Others

Based on Distribution Channel

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

Within North America, the eyewear packaging market commands 32% share, ahead of Europe (28%), Asia Pacific (24%), Latin America (10%), and Middle East & Africa (6%). Strong retail infrastructure and high per‑capita eyewear consumption drive demand for protective and branded packaging. Domestic brands invest in lightweight EVA cases and premium leather offerings to appeal to diverse consumer segments. It prompts packaging suppliers to expand production capacity and adopt automated assembly lines. Direct‑to‑consumer e‑commerce platforms reinforce demand for secure mailers and custom inserts. Collaborative ventures between global packaging firms and local distributors accelerate market penetration.

Europe

Europe accounts for 28% of the eyewear packaging market, following North America with 32%, Asia Pacific at 24%, Latin America 10%, and Middle East & Africa 6%. Strict environmental regulations and extended producer responsibility mandates require use of recyclable materials. Brands adopt kraft paper and recycled cardboard cases to meet compliance and consumer expectations. It encourages packaging engineers to develop solvent‑free adhesives and water‑based coatings. Luxury labels in France, Italy, and Germany favor bespoke and premium cases to differentiate offerings. Joint research programs with academic institutes advance sustainable material innovations.

Asia Pacific

Asia Pacific holds 24% share in the eyewear packaging market, behind North America (32%) and Europe (28%), and ahead of Latin America (10%) and Middle East & Africa (6%). Rapid urbanization and rising disposable incomes fuel demand for fashionable eyewear brands that require eye‑catching packaging. It drives packaging manufacturers to establish regional hubs in China and India to reduce lead times. Suppliers introduce slide‑open boxes and round cases to satisfy retailer preferences in Japan and Australia. E‑commerce growth in Southeast Asia expands need for tamper‑evident mailer solutions. Cross‑border collaborations support capacity scaling and technology exchange.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pyramex Safety Products, LLC

- Packman Packaging Private Limited

- Marber S.r.l.

- Aesop Technologies

- GIORGIO FEDON & FIGLI SpA

- Umiya Plast

- Processo Plast Enterprise Private Limited

- Rongyu Packing

- Well Packaging Limited

- Honeywell International Inc.

- GATTO ASTUCCI SPA

- Kling GmbH

Competitive Analysis

In the eyewear packaging market, global competitors such as Honeywell International Inc., GIORGIO FEDON & FIGLI SpA and Packman Packaging Private Limited leverage robust supply chains and diversified portfolios to secure market positions. It fosters innovation in protective case design and sustainable materials selection. Smaller specialists like Marber S.r.l. and Pyramex Safety Products, LLC differentiate through rapid customization and niche segment focus. Umiya Plast and Rongyu Packing compete on cost efficiency and modular packaging systems. Processo Plast Enterprise Private Limited and Well Packaging Limited pursue regional expansion and partnerships to strengthen distribution networks. Aesop Technologies and Kling GmbH invest in digital authentication and smart packaging solutions to offer value‑added features. Intense rivalry spurs strategic alliances and technology adoption. Brands evaluate cost, quality and sustainability credentials when they choose suppliers, which drives firms to enhance service, reduce lead times and optimize resource allocation. Leading players differentiate on design, material performance and brand collaboration opportunities.

Recent Developments

- In July 2025, Meta acquired a nearly 3% stake in EssilorLuxottica to strengthen their smart eyewear partnership, supporting integration of wearable technology with premium eyewear packaging and distribution.

- In June 2025, Kering Eyewear acquired Italian manufacturer Lenti to enhance in-house production of sun lenses, reinforcing its control over the luxury eyewear value chain, including packaging operations.

- In June 2025, Meta and Oakley announced a smart glasses collaboration, set to launch with premium packaging that combines advanced technology with lifestyle-focused design.

- In January 2025, Revo partnered with Lexus to unveil a luxury sunglasses collection, presented in exclusive packaging inspired by Lexus aesthetics to enhance the unboxing experience.

Market Concentration & Characteristics

The eyewear packaging market shows moderate concentration with a mix of global corporations and regional specialists competing across segments. It features both established players such as Honeywell International Inc. and GIORGIO FEDON & FIGLI SpA, and agile regional firms like Packman Packaging and Umiya Plast. Companies compete on design innovation, material sustainability, and customization capabilities. The market reflects strong brand alignment, with packaging tailored to luxury, mid-range, and mass-market eyewear products. Firms invest in automated production, smart packaging integration, and eco-friendly materials to meet evolving consumer and regulatory demands. Market characteristics include demand for lightweight, durable formats, rapid design adaptability, and region-specific compliance. Buyers prioritize cost, aesthetic appeal, protective function, and environmental impact. It fosters partnerships between eyewear brands and packaging manufacturers to streamline production and enhance product differentiation. Suppliers with strong R&D, responsive supply chains, and certification capabilities gain a competitive edge across both developed and emerging markets

Report Coverage

The research report offers an in-depth analysis based on Material Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Eco-friendly materials will dominate as brands shift toward recyclable and sustainable packaging alternatives globally.

- Smart packaging with QR codes and NFC tags will improve product authentication and customer interaction.

- Personalized packaging solutions will grow to enhance brand identity and customer unboxing experience across channels.

- Lightweight, compact packaging will gain preference to reduce shipping costs and improve storage efficiency.

- Automation in production processes will increase to meet higher volumes and ensure quality consistency.

- Luxury eyewear brands will demand premium packaging with sleek, minimalist designs and high-end materials.

- Regional manufacturing hubs will support faster delivery, cost control, and local market adaptability.

- Digital printing will expand packaging customization with high-resolution graphics and efficient batch production.

- Environmental regulations will drive innovation in eco-friendly adhesives, inks, and coating technologies.

- Strategic collaborations between eyewear brands and packaging firms will accelerate innovation and competitive differentiation.