Market Overview

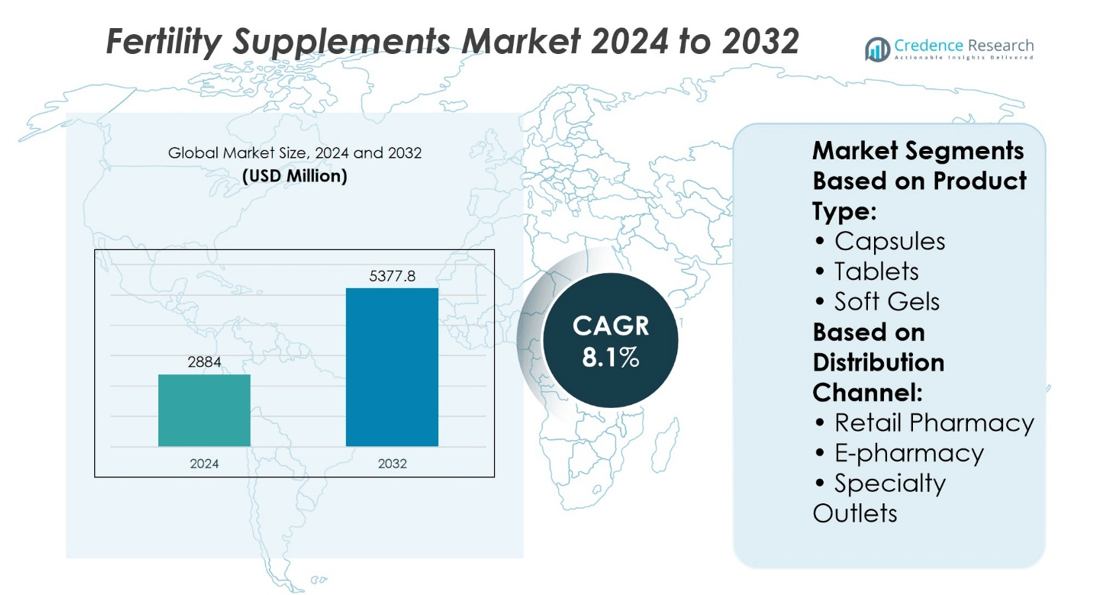

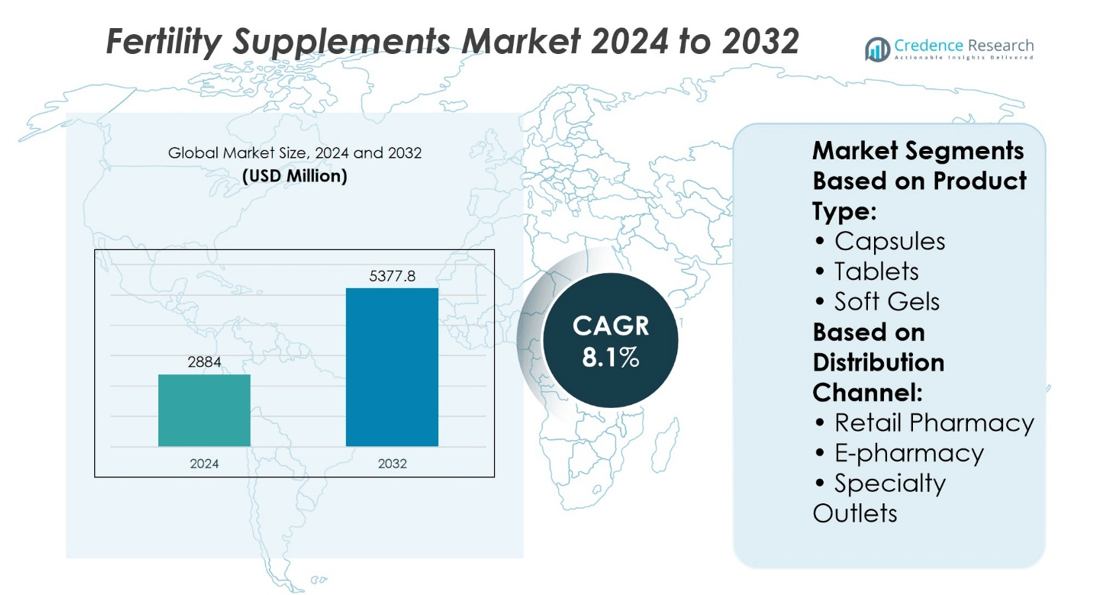

Fertility Supplements Market size was valued at USD 2884 million in 2024 and is anticipated to reach USD 5377.8 million by 2032, at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fertility Supplements Market Size 2024 |

USD 2884 million |

| Fertility Supplements Market, CAGR |

8.1% |

| Fertility Supplements Market Size 2032 |

USD 5377.8 million |

The Fertility Supplements Market grows driven by increasing infertility rates and rising awareness of reproductive health worldwide. Consumers demand effective, natural, and scientifically backed supplements to support fertility, fueling product innovation and diversification. Personalized nutrition and integration with assisted reproductive technologies enhance market appeal. Expanding distribution channels, especially e-commerce, improve accessibility and convenience. Regulatory frameworks promote product safety, increasing consumer trust. Trends show a strong shift toward plant-based formulations and tailored solutions addressing specific fertility challenges for men and women. Continuous advancements in research and technology further propel market growth and consumer adoption globally.

The Fertility Supplements Market shows strong regional variation, with North America leading due to advanced healthcare infrastructure and high consumer awareness, followed by rapid growth in Asia-Pacific driven by rising infertility and urbanization. Europe maintains steady demand, focusing on natural products, while Latin America and the Middle East & Africa present emerging opportunities. Key players include Fairhaven Health, Vitabiotics Ltd., Orthomol, Exeltis USA, Inc., and Coast Science, who leverage innovation and extensive distribution networks to maintain competitive positions across these regions.

Market Insights

- The Fertility Supplements Market size was valued at USD 2884 million in 2024 and is expected to reach USD 5377.8 million by 2032, growing at a CAGR of 8.1%.

- Increasing infertility rates and greater awareness of reproductive health worldwide drive market growth.

- Consumers prefer effective, natural, and scientifically supported supplements, encouraging product innovation and diversification.

- Personalized nutrition and integration with assisted reproductive technologies enhance the market’s attractiveness.

- Expansion of distribution channels, particularly e-commerce, improves product accessibility and consumer convenience.

- Regulatory frameworks ensure product safety and boost consumer confidence.

- North America leads the market due to advanced healthcare and awareness, while Asia-Pacific experiences rapid growth; Europe, Latin America, and the Middle East & Africa offer emerging opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Increasing Awareness About Reproductive Health and Fertility Issues Driving Market Demand

Growing awareness about reproductive health and fertility challenges significantly fuels the Fertility Supplements Market. Couples and individuals increasingly recognize the role of nutrition and supplementation in enhancing fertility outcomes. Healthcare providers emphasize preventive care and lifestyle modifications, encouraging supplement use to address nutritional deficiencies linked to infertility. Educational campaigns and digital platforms disseminate information on fertility support, boosting consumer confidence in supplements. This heightened awareness expands the consumer base and stimulates demand across various demographic segments. It drives manufacturers to innovate products targeting specific fertility concerns.

- For instance, a foundational AI model for in vitro fertilization was trained on 18 million time‑lapse images to improve embryo quality assessment capabilities.

Rising Prevalence of Infertility and Delayed Parenthood Creating Urgent Need for Fertility Support

Infertility rates continue to rise globally due to lifestyle factors, environmental influences, and delayed parenthood trends. This escalation creates urgent demand for effective fertility support solutions, benefiting the Fertility Supplements Market. Individuals postponing childbirth seek interventions that improve reproductive health without invasive procedures. Supplements offering vitamins, minerals, and antioxidants that optimize hormonal balance and gamete quality attract substantial attention. Healthcare professionals increasingly recommend supplements as adjunct therapies to fertility treatments. This trend sustains consistent market growth and encourages product diversification.

- For instance, Vitrolife’s EmbryoScope time‑lapse systems currently support over 1.1 million IVF treatment cycles per year across their installed base worldwide.

Technological Advancements and Formulation Innovations Enhancing Supplement Efficacy and Consumer Appeal

Advancements in nutritional science and formulation technology enhance the effectiveness of fertility supplements, strengthening market appeal. Companies develop targeted blends with clinically validated ingredients, improving absorption and bioavailability. Innovative delivery forms, such as gummies and liquid supplements, improve user compliance and convenience. Scientific research supports ingredient efficacy, driving trust among healthcare providers and consumers. This progress allows differentiation in a competitive market and supports premium pricing strategies. Continuous innovation maintains consumer interest and expands application possibilities.

Increasing Healthcare Professional Endorsement and Integration into Fertility Treatment Protocols

Growing endorsement of fertility supplements by healthcare professionals integrates these products into standard fertility care protocols. Physicians and fertility specialists recognize supplements’ role in addressing micronutrient deficiencies that affect reproductive outcomes. Their recommendations increase consumer confidence and promote adoption of fertility supplements alongside medical interventions. Clinics incorporate supplement regimens in patient care plans to optimize treatment success rates. This professional validation supports market credibility and encourages wider acceptance. It further drives expansion in both developed and emerging markets.

Market Trends

Growing Consumer Preference for Natural and Plant-Based Fertility Supplements

The Fertility Supplements Market shows a strong shift toward natural and plant-based formulations. Consumers increasingly demand products derived from herbal extracts, vitamins, and minerals with minimal synthetic additives. This trend reflects rising health consciousness and preference for clean-label products. Manufacturers respond by developing supplements that incorporate ingredients like maca root, folate, and Coenzyme Q10. Transparency in sourcing and sustainable production practices gain importance in marketing strategies. This movement encourages innovation focused on natural efficacy and safety profiles.

- For instance, Fairhaven Health—known for its plant-based fertility formulations such as OvaBoost for women—ships over 250 000 units annually, showcasing tangible scale and consumer trust in natural fertility support solutions.

Integration of Personalized Nutrition and Customized Supplement Solutions

Personalized nutrition drives a significant trend within the Fertility Supplements Market, targeting individual reproductive health needs. Advances in diagnostic testing and genetic profiling enable tailored supplement recommendations based on nutrient deficiencies and hormonal status. Companies collaborate with healthcare providers to offer customized formulations that optimize fertility outcomes. This approach enhances user engagement and treatment adherence by addressing specific biological conditions. The integration of technology supports more precise and effective fertility management. Personalized supplements position themselves as premium offerings, attracting discerning consumers.

- For instance, Baze, a personalized nutrition company owned by Nature’s Way, has processed over 2.1 million nutrient diagnostic tests.

Expansion of Online Retail Channels and Digital Health Platforms Enhancing Accessibility

Online retail growth and digital health platforms play a critical role in shaping the Fertility Supplements Market landscape. E-commerce enables direct consumer access to a wide range of fertility supplements, often accompanied by expert advice and reviews. Telehealth services increasingly incorporate nutritional counseling that includes supplement guidance, fostering informed purchasing decisions. Social media and influencer marketing amplify awareness and education on fertility nutrition. These digital channels facilitate market penetration in both urban and remote areas. The trend accelerates product availability and consumer convenience.

Focus on Male Fertility Supplements Driving Market Diversification

Market trends reveal increasing attention to male fertility supplements, expanding the traditional focus on female reproductive health. Rising awareness of male infertility factors prompts development of products targeting sperm quality, motility, and hormonal balance. Ingredients such as zinc, L-carnitine, and selenium gain prominence in formulations designed for male consumers. Healthcare professionals endorse male-specific supplements as complementary to fertility treatments. This diversification broadens the Fertility Supplements Market, creating new opportunities for innovation and growth. The trend promotes a more holistic approach to reproductive wellness.

Market Challenges Analysis

Regulatory Compliance Complexities and Stringent Quality Standards Impacting Market Growth

The Fertility Supplements Market faces significant challenges due to varying regulatory frameworks across regions. Manufacturers must navigate complex approval processes and comply with strict quality and safety standards. Differences in classification of supplements and medicines complicate product registration and marketing. It demands substantial investment in clinical trials and documentation to validate efficacy and safety claims. Regulatory scrutiny limits rapid product launches and increases operational costs. These compliance requirements hinder market entry for smaller players and slow overall innovation. The need for harmonized regulations remains critical to support sustainable growth.

Consumer Skepticism and Limited Scientific Evidence Restricting Market Expansion

Consumer skepticism regarding the effectiveness of fertility supplements presents a notable challenge to the Fertility Supplements Market. Many potential users question the scientific backing of supplement claims due to inconsistent clinical evidence. This skepticism reduces consumer trust and affects purchasing decisions, particularly in highly regulated markets. Healthcare professionals remain cautious in recommending supplements without robust data, limiting market penetration through medical channels. It compels manufacturers to invest heavily in research and transparent communication to build credibility. Overcoming misinformation and educating consumers on product benefits remain essential for market expansion.

Market Opportunities

Expanding Consumer Base Due to Rising Infertility and Delayed Parenthood Trends Offering Growth Potential

The Fertility Supplements Market benefits from the increasing prevalence of infertility and the global trend of delayed parenthood. Growing awareness about fertility health encourages a wider demographic to seek nutritional support. It creates demand beyond traditional age groups, including men and women facing reproductive challenges later in life. Emerging markets with improving healthcare infrastructure also present untapped consumer segments. Companies can capitalize on this opportunity by developing targeted products addressing diverse fertility needs. Expanding educational initiatives can further enhance consumer engagement and adoption. This broadening base supports sustained market growth and diversification.

Advancements in Research and Development Enabling Innovative and Personalized Fertility Solutions

Innovations in research and development open new avenues for the Fertility Supplements Market through advanced formulations and personalized nutrition. Scientific breakthroughs allow development of supplements with optimized ingredient combinations that target specific fertility factors. Integration of genetic testing and diagnostic tools enables tailored supplement plans for individuals. It enhances efficacy and consumer satisfaction while differentiating products in a competitive market. Collaborations between biotech firms and supplement manufacturers facilitate cutting-edge innovations. This progress strengthens market positioning and encourages premium product offerings. Investing in R&D remains a key opportunity for long-term value creation.

Market Segmentation Analysis:

By Product Type:

The Fertility Supplements Market includes multiple product types designed to meet diverse consumer preferences. Capsules dominate due to their ease of swallowing and efficient nutrient absorption. Tablets attract consumers seeking cost-effective options with longer shelf lives. Soft gels gain popularity for improved bioavailability and digestive comfort, often featured in premium products. Other forms like powders and liquids cater to niche demands by offering customizable dosages and faster absorption. This wide product range helps companies address various consumer needs and enhances user compliance.

- For instance, Fairhaven Health produces approximately 0.8 million units of its FertilAid for Women capsule supplement annually, demonstrating the substantial adoption of capsule-style fertility products among consumers.

By Distribution Channel:

Distribution channels critically influence market accessibility and growth. Retail pharmacies hold a leading position owing to easy access and the ability to provide professional advice at the point of sale. E-pharmacies expand rapidly by offering convenience, discreet purchasing, and broad product selections online. They also enable subscription services and personalized product recommendations, enhancing customer loyalty. Specialty stores and wellness centers serve focused consumer segments seeking holistic fertility support. Combining traditional and digital channels enables companies to maximize reach and optimize customer engagement.

- For instance, Apollo Pharmacy online platform processes 3.4 million fertility supplement orders, reflecting the significant scale of digital distribution in the market.

Segments:

Based on Product Type:

- Capsules

- Tablets

- Soft Gels

Based on Distribution Channel:

- Retail Pharmacy

- E-pharmacy

- Specialty Outlets

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America leads the Fertility Supplements Market with 35.6% of the global market share in 2023. The United States is the key contributor to this dominance due to high consumer awareness about fertility health and widespread availability of supplements through various retail channels. Well-established healthcare infrastructure and strong regulatory frameworks support consumer trust in product safety and efficacy. The rising prevalence of infertility, coupled with trends of delayed parenthood, drives demand for fertility supplements across different age groups. Research and development activities focused on innovative formulations also boost market growth. This region benefits from extensive marketing and educational initiatives that further promote supplement adoption. Continued investment in fertility care is expected to sustain North America’s market leadership.

Asia-Pacific

The Asia-Pacific Fertility Supplements Market is growing rapidly, with a forecasted compound annual growth rate of 7.84% through 2030. Countries such as China, India, Japan, and Australia contribute significantly to this expansion. Increasing infertility rates due to changing lifestyles, urbanization, and environmental factors raise awareness and demand for fertility support products. Government programs aimed at improving reproductive health education and healthcare access further drive market penetration. The growing adoption of assisted reproductive technologies in this region complements the use of fertility supplements as supportive care. Rising disposable incomes and expanding e-commerce platforms make supplements more accessible to a wider population. This rapid growth positions Asia-Pacific as a key region for future market opportunities.

Europe

Europe holds a significant portion of the Fertility Supplements Market with steady growth, accounting for approximately 25% of the global market. Countries like Germany, the United Kingdom, France, and Italy show strong consumer preference for natural, plant-based, and herbal fertility supplements. This trend aligns with a broader European focus on holistic health and wellness. Regulatory oversight ensures product quality and builds consumer confidence in supplement efficacy and safety. Fertility clinics and healthcare providers increasingly recommend nutritional support alongside conventional treatments. Public awareness campaigns and educational efforts contribute to steady adoption rates. The mature healthcare system and high standards for product approval support the market’s stability and gradual expansion in this region.

Latin America

Latin America is an emerging market for fertility supplements, holding about 10% of the global market share. Brazil, Mexico, and Argentina lead in demand growth due to rising awareness about reproductive health challenges and lifestyle changes affecting fertility. The availability of over-the-counter fertility products through retail pharmacies and growing e-commerce penetration expands market reach. Local manufacturers and distributors are increasing their presence, which helps reduce costs and improve accessibility. Healthcare infrastructure improvements and government initiatives aimed at reproductive health education support market growth. Despite challenges such as economic variability, the region holds strong potential for further development in the fertility supplements sector.

Middle East and Africa

The Middle East and Africa (MEA) region currently accounts for roughly 4.4% of the Fertility Supplements Market but shows promising growth potential. Countries in the Gulf Cooperation Council, including the UAE and Saudi Arabia, experience increasing consumer interest in fertility health products. Rising awareness of infertility and related health concerns drives demand, although cultural factors and regulatory complexities pose challenges to widespread adoption. Investments in healthcare infrastructure and fertility clinics are increasing, providing opportunities for market expansion. The region’s relatively young population and improving economic conditions further support growth prospects. Companies entering this market must navigate local preferences and regulations to capitalize on emerging opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Orthomol

- Fertility Nutraceuticals LLC

- Extreme V, Inc.

- Vitabiotics Ltd.

- Exeltis USA, Inc.

- Coast Science

- Lenus Pharma GesmbH

- Bionova

- Active Bio Life Science GmbH

- Fairhaven Health

Competitive Analysis

The Fertility Supplements Market include Fairhaven Health, Coast Science, Lenus Pharma GesmbH, Active Bio Life Science GmbH, Orthomol, Exeltis USA, Inc., Bionova, Fertility Nutraceuticals LLC, Vitabiotics Ltd., and Extreme V, Inc. The Fertility Supplements Market remains highly competitive, driven by continuous innovation and product diversification to meet evolving consumer needs. Companies focus on developing scientifically validated formulations that address specific fertility issues for both men and women, enhancing product efficacy and consumer trust. Increasing adoption of personalized nutrition and natural, plant-based supplements shapes market trends and offers differentiation opportunities. Expansion of distribution channels, including retail pharmacies and digital platforms, improves accessibility and broadens customer reach. Collaboration with healthcare professionals and fertility clinics strengthens credibility and supports informed consumer choices. Regulatory compliance and quality assurance remain critical for gaining market approval and sustaining long-term growth. Overall, success in this market depends on balancing technological advancement, clinical evidence, and strategic marketing to capture emerging opportunities and maintain a competitive edge.

Recent Developments

- In July 2025, Fairhaven Health launched clinically validated fertility supplements such as FH PRO for Men and Women, which have garnered significant market attention. These products emphasize clinical validation and target comprehensive reproductive health.

- In June 2024. Bionova Scientific, an Asahi Kasei Group company and full-service biologics CDMO, announced plans to expand into plasmid DNA (pDNA) production.

- In 2023, Orthomol announced a strategic partnership with a major healthcare provider to enhance its market reach and product development in fertility supplements.

- In April 2023, Indian pharma company Mankind Pharmaset up a dedicated factory in Udaipur, Rajasthan, for the comprehensive manufacturing of Duphaston (dydrogesterone), a synthetic hormone widely utilized for preventing miscarriage and treating infertility.

Market Concentration & Characteristics

The Fertility Supplements Market exhibits a moderately concentrated structure with a mix of established multinational corporations and emerging regional players. It is characterized by a focus on innovation, quality assurance, and regulatory compliance to meet diverse consumer needs and safety standards. Leading companies maintain competitive advantages through extensive research and development, proprietary formulations, and strategic partnerships with healthcare providers. The market demonstrates strong segmentation based on product type, targeted gender, and distribution channels, allowing companies to tailor offerings effectively. Consumer preference for natural, plant-based, and personalized supplements drives product differentiation. Digital transformation and e-commerce growth influence market dynamics by enhancing accessibility and direct-to-consumer sales. Regulatory frameworks vary across regions, requiring companies to adapt strategies for compliance and market entry. The market’s competitive environment encourages continuous innovation and marketing efforts to capture brand loyalty. It favors players with robust supply chains and the ability to respond swiftly to evolving fertility health trends. Overall, the Fertility Supplements Market balances innovation with quality and consumer trust, fostering steady growth and diverse competitive positioning.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Fertility Supplements Market will continue to grow due to rising infertility rates worldwide.

- Increasing awareness of reproductive health will drive higher consumer adoption of supplements.

- Advances in personalized nutrition will create tailored fertility supplement solutions.

- Natural and plant-based ingredients will gain greater preference among consumers.

- Integration of fertility supplements with assisted reproductive technologies will expand.

- E-commerce platforms will enhance accessibility and convenience for consumers.

- Regulatory standards will tighten, encouraging higher quality and safety compliance.

- Collaborations between supplement companies and healthcare providers will increase.

- Emerging markets will present significant growth opportunities.

- Innovation in delivery formats and formulations will improve user experience and effectiveness.