Market Overview:

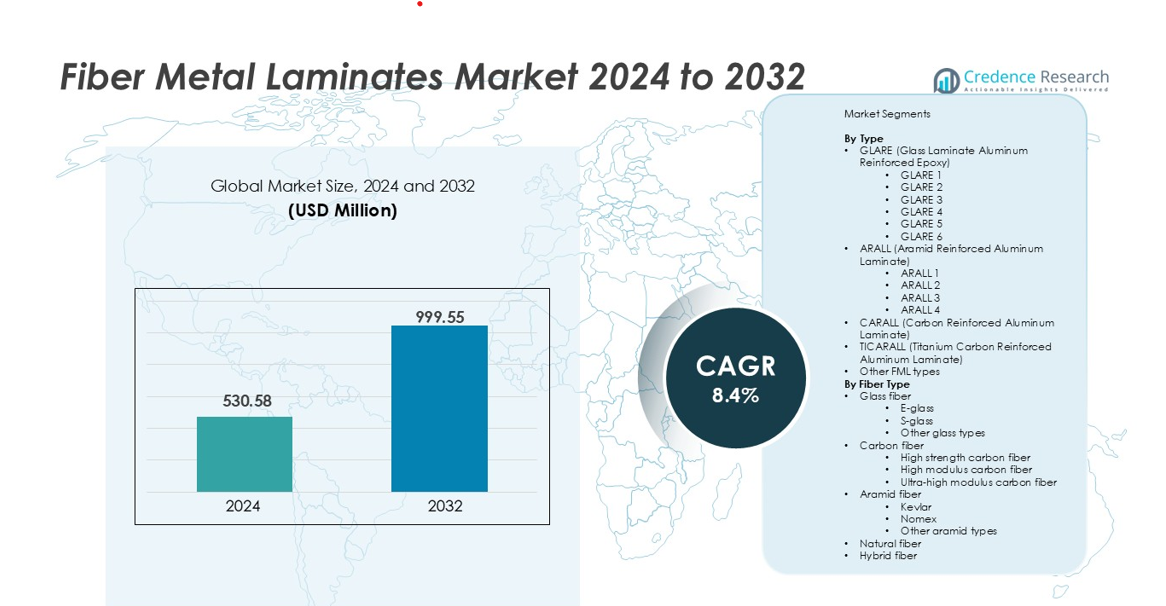

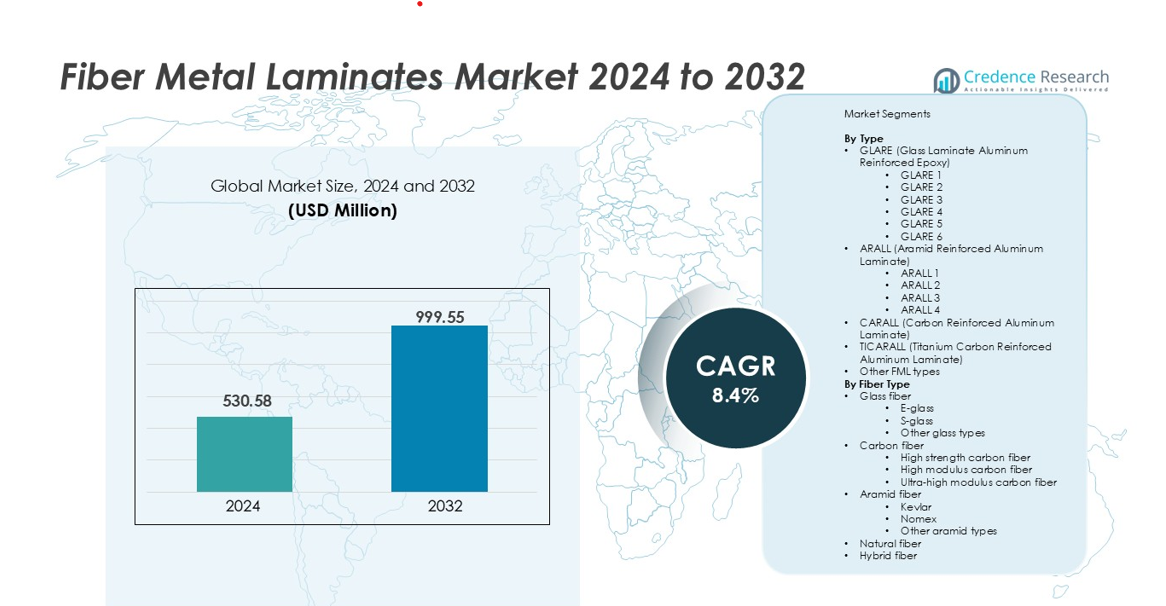

Fiber metal laminates market size was valued at USD 530.58 million in 2024 and is anticipated to reach USD 999.55 million by 2032, at a CAGR of 8.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fiber Metal Laminates Market Size 2024 |

USD 530.58 million |

| Fiber Metal Laminates Market, CAGR |

8.4% |

| Fiber Metal Laminates Market Size 2032 |

USD 999.55 million |

The global fiber metal laminates market is dominated by key players such as Airbus Group, Boeing Company, Hexcel Corporation, Toray Industries, Teijin Limited, 3M Company, Cytec Solvay Group, Koninklijke Ten Cate BV, Mitsubishi Chemical Corporation, Gurit Holding AG, and SGL Carbon SE. These companies maintain leadership through continuous R&D, strategic partnerships, and advanced composite manufacturing capabilities, focusing on lightweight, high-strength, and durable FML solutions for aerospace, defense, automotive, and renewable energy applications. Regionally, North America leads with approximately 35% market share, driven by a strong aerospace and defense sector, followed by Europe at 28%, with established aviation, automotive, and wind energy industries. Asia Pacific holds around 25% share, fueled by rapid industrialization, expanding aerospace and automotive sectors, and growing renewable energy investments. Collectively, these players and regions define the competitive and high-growth landscape of the FML market.

Market Insights

- The global fiber metal laminates market was valued at USD 530.58 million in 2024 and is projected to reach USD 999.55 million by 2032, growing at a CAGR of 8.4%.

- Increasing demand for lightweight and fuel-efficient structures in aerospace and automotive sectors is driving adoption of GLARE, CARALL, and ARALL laminates, particularly GLARE 3, which holds the dominant segment share.

- Key trends include the integration of hybrid fiber composites, advanced manufacturing processes like autoclave and vacuum bag molding, and expansion into renewable energy applications such as wind turbine blades and nacelle components.

- The market is highly competitive with leading players such as Airbus, Boeing, Hexcel, Toray Industries, Teijin Limited, and 3M Company focusing on R&D, strategic partnerships, and high-performance FML solutions. Cost and technical complexity remain key restraints.

- Regionally, North America leads with 35% share, Europe holds 28%, Asia Pacific captures 25%, Middle East & Africa 7%, and Latin America 5%, reflecting strong aerospace, defense, automotive, and renewable energy demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Fiber Metal Laminates market, segmented by type, is dominated by GLARE (Glass Laminate Aluminum Reinforced Epoxy), which holds the largest market share due to its superior fatigue resistance, lightweight properties, and corrosion resistance. GLARE 3, in particular, is widely adopted in aerospace applications for fuselage and wing structures, driving segment growth. ARALL and CARALL also contribute significantly, with ARALL preferred for impact resistance in automotive applications, while CARALL finds usage in high-strength structural components. Growing demand for fuel-efficient aircraft and lightweight transportation solutions acts as a key driver for this segment.

- For instance, For the Airbus A380, approximately 485 square meters of GLARE (Glass Laminate Aluminium Reinforced Epoxy) panels were utilized in the upper fuselage, contributing to a direct structural weight reduction of around 800 kilograms compared to conventional aluminum alloys.

By Fiber Type

Glass fiber-based laminates lead the fiber type segment, with E-glass maintaining the dominant market share owing to its cost-effectiveness, high strength-to-weight ratio, and versatility across aerospace, automotive, and wind energy sectors. Carbon fiber, particularly high modulus carbon fiber, is gaining traction in high-performance applications such as structural components in aerospace and automotive due to its exceptional stiffness and strength. Aramid fibers, including Kevlar, are preferred in crash-resistant applications. Rising adoption of hybrid fiber composites to meet diverse performance requirements is further driving growth in this segment.

- For instance, DuPont’s Kevlar is widely used in aerospace applications, such as interior panels, cargo hold linings, and landing gear doors, for its high strength and low weight. However, the Airbus A350 uses a variety of composite materials, including carbon-fiber-reinforced polymers for its fuselage and Victrex PEEK for some door components.

By Metal Type

Aluminum-based FMLs dominate the metal type segment, with 2024 aluminum alloy capturing the largest share due to its favorable combination of strength, corrosion resistance, and formability. Titanium alloys, particularly Ti-6Al-4V, are increasingly applied in aerospace and defense for critical structural components where high temperature and fatigue resistance are essential. Steel and magnesium-based laminates remain niche but serve specialized applications requiring high load-bearing capacity. Key drivers for this segment include the rising emphasis on lightweight structures, fuel efficiency, and the need for high-performance materials in aerospace and automotive industries.

Key Growth Drivers

Increasing Demand for Lightweight and Fuel-Efficient Structures

The growing emphasis on reducing the weight of aerospace and automotive vehicles is driving the demand for fiber metal laminates. GLARE, CARALL, and ARALL composites offer high strength-to-weight ratios, making them ideal for aircraft fuselage, wings, and automotive structural components. Lightweight designs improve fuel efficiency, reduce greenhouse gas emissions, and support sustainability initiatives. Manufacturers are increasingly adopting aluminum and titanium-based FMLs in combination with carbon and glass fibers to achieve optimized performance. Regulatory pressure for lower emissions in aviation and automotive industries further fuels adoption. Additionally, wind energy applications benefit from lightweight turbine blades and nacelle components, boosting demand. This driver is particularly strong in commercial aviation and electric vehicles, where efficiency gains translate directly to operational cost savings and environmental compliance.

- For instance, Airbus implemented GLARE panels in the upper fuselage skins and other structural components of the A380. The use of this fiber metal laminate contributed to the aircraft’s weight reduction, but not by a total structural weight of 15%.

Superior Mechanical Performance and Durability

Fiber metal laminates are increasingly preferred due to their exceptional fatigue resistance, impact strength, and corrosion resistance compared to conventional metals. GLARE and ARALL laminates provide reliable long-term performance in harsh environments, supporting aerospace, defense, and marine applications. CARALL composites deliver high stiffness and load-bearing capacity for critical structural components. These materials reduce maintenance requirements and extend product lifecycle, lowering operational costs for end-users. The rising adoption of high-modulus carbon fibers and hybrid fiber-metal laminates enables the development of structures capable of withstanding extreme mechanical and thermal stresses. Consequently, industries focused on mission-critical applications are actively integrating FMLs to ensure safety, durability, and performance.

- For instance, Fokker Aerostructures developed and produced GLARE 4B laminates for the upper fuselage panels of the Airbus A380, where it is known for its superior fatigue and damage tolerance, significantly extending the lifespan compared to equivalent aluminum structures.

Expansion of Aerospace, Defense, and Advanced Automotive Applications

The rapid growth of aerospace, defense, and advanced automotive sectors is fueling the FML market. Airlines and defense organizations are increasingly incorporating FMLs in fuselage, wing, and empennage structures to enhance performance while meeting strict weight and safety regulations. Electric vehicle manufacturers are exploring ARALL and CARALL laminates to improve crash resistance and structural efficiency. The rise of space exploration initiatives and unmanned aerial systems further creates high-value applications for titanium and carbon fiber-reinforced laminates. Additionally, the marine sector utilizes FMLs in hull and deck structures for enhanced corrosion resistance and durability. Overall, expansion in these end-use industries drives continuous adoption of advanced fiber metal laminates.

Key Trends & Opportunities

Integration of Hybrid Fiber Composites

The FML market is witnessing a significant trend toward hybrid fiber composites, combining carbon, glass, and aramid fibers with aluminum or titanium matrices. This integration optimizes mechanical performance, offering tailored properties such as enhanced fatigue resistance, impact strength, and thermal stability. Manufacturers are leveraging hybrid designs to meet stringent aerospace, automotive, and defense standards while maintaining lightweight structures. The opportunity lies in developing application-specific laminates that cater to emerging sectors like electric vehicles, next-generation aircraft, and high-performance wind turbine blades. Hybrid composites also enable cost-efficient production by balancing the performance benefits of advanced fibers with lower-cost materials, fostering adoption across commercial and industrial applications.

- For instance, GE Renewable Energy’s Haliade-X wind turbine has 107-meter-long blades manufactured by its subsidiary, LM Wind Power, which use composite materials. The blades can withstand tip speeds of approximately 90 m/s (324 km/h).

Adoption of Advanced Manufacturing Processes

Innovations in manufacturing techniques such as autoclave curing, vacuum bag molding, pultrusion, and filament winding are driving efficiency and quality improvements in FML production. These processes enhance fiber alignment, bonding strength, and structural consistency, enabling high-performance components at scale. Press curing and automated fabrication methods reduce production time and labor costs while ensuring precise dimensional tolerances. The trend toward advanced manufacturing creates opportunities for increased market penetration in aerospace, automotive, and marine applications, where precision and reliability are critical. As manufacturers invest in automation and process optimization, the FML market is poised for higher throughput, consistent quality, and reduced overall lifecycle costs.

- For instance, Airbus employs autoclave curing for composite fuselage panels on aircraft like the A350 XWB, achieving curing temperatures up to 180°C and pressures typically ranging between 70 and 100 psi (around 5–7 bar), which enhances laminate uniformity and reduces porosity, a standard requirement for aerospace-grade composites.

Expansion into Renewable Energy Applications

Wind energy presents a growing opportunity for fiber metal laminates, particularly in turbine blades and nacelle components. FMLs’ lightweight and high-strength characteristics improve aerodynamic efficiency, reduce material fatigue, and extend operational lifespan. The adoption of hybrid laminates combining glass and carbon fibers with aluminum alloys enhances performance under dynamic loads and harsh environmental conditions. Increasing global investments in renewable energy infrastructure and government incentives for sustainable technologies further drive market expansion. Companies focusing on this sector can develop specialized laminates that meet industry-specific regulatory and durability requirements, creating new avenues for growth and technological innovation.

Key Challenges

High Production Costs

One of the primary challenges in the FML market is the high cost of materials and manufacturing processes. Advanced fibers such as high-modulus carbon and aramid fibers, coupled with autoclave or vacuum-assisted manufacturing, result in significant production expenses. These costs limit adoption, especially in cost-sensitive automotive, marine, and consumer applications. Additionally, the need for specialized equipment, skilled labor, and stringent quality control further adds to operational expenditures. Market players must balance performance benefits with cost-effectiveness, creating pressure to innovate in both material selection and manufacturing efficiency.

Technical Complexity and Limited Awareness

The integration of fiber metal laminates into existing designs requires expertise in material science, structural engineering, and advanced fabrication techniques. Many manufacturers face challenges in process standardization, joining methods, and quality assurance, particularly for hybrid or novel laminates. Limited awareness among small and medium-sized enterprises about the benefits and applications of FMLs also hampers market penetration. Furthermore, certification requirements in aerospace, defense, and automotive sectors can prolong time-to-market, restricting widespread adoption. Addressing these technical and educational barriers is crucial for sustained growth in the market.

Regional Analysis

North America

North America leads the global fiber metal laminates market, holding approximately 35% of the total share, driven by its strong aerospace and defense sectors. High adoption of GLARE and CARALL laminates in commercial and military aircraft fuels regional demand. Advanced R&D infrastructure, combined with strategic collaborations among key manufacturers, supports continuous product innovation. Automotive applications, particularly in electric vehicles, further boost adoption of lightweight, high-strength laminates. Regulatory emphasis on fuel efficiency and emission reductions reinforces demand. The region’s technological capabilities, strong industrial base, and early adoption trends position North America as the dominant market player globally.

Europe

Europe commands around 28% of the global FML market, supported by its established aerospace, automotive, and wind energy industries. Major aircraft manufacturers, including Airbus, drive the demand for GLARE and ARALL laminates, while automotive OEMs increasingly integrate FMLs into structural components for weight reduction and efficiency. Wind energy projects further leverage lightweight, durable laminates in turbine blades and nacelle structures. The region benefits from government regulations promoting sustainability and emission reduction, along with a robust industrial base and skilled workforce. These factors collectively sustain Europe’s strong position and steady growth in the fiber metal laminates market.

Asia Pacific

Asia Pacific accounts for approximately 25% of the global FML market and is the fastest-growing region. Expansion in aerospace, automotive, and defense industries in China, Japan, and India drives adoption of GLARE, CARALL, and ARALL composites. Increasing investments in electric vehicles and renewable energy, particularly wind turbine components, support demand for lightweight, high-performance laminates. The rise of domestic manufacturers and enhanced R&D capabilities facilitates cost-effective production and adaptation of advanced FMLs. Rapid industrialization, urbanization, and focus on energy efficiency position Asia Pacific as a high-growth market with strong potential for global FML suppliers.

Middle East & Africa

The Middle East & Africa holds roughly 7% of the global FML market. Growth is primarily driven by defense, aerospace, and energy sectors, including naval and wind energy applications. Countries like the UAE and Saudi Arabia are investing in aviation infrastructure and military modernization, boosting demand for GLARE and CARALL laminates. Strategic partnerships with international FML manufacturers facilitate technology transfer and market penetration. However, the region’s growth is constrained by limited local production capabilities and reliance on imports for high-performance composites. Infrastructure development, renewable energy initiatives, and defense investments are expected to sustain moderate growth in this market.

Latin America

Latin America represents approximately 5% of the global fiber metal laminates market, supported by aerospace, automotive, and defense sectors. Brazil and Mexico act as regional hubs for adoption, with laminates used in aircraft fuselage, vehicle structural components, and naval vessels. Growing investments in aviation manufacturing, electric vehicles, and renewable energy infrastructure contribute to regional demand. Limited local production necessitates imports, creating opportunities for global FML suppliers. Collaborative ventures and focus on cost-effective, high-performance laminates are helping penetrate the market. Rising awareness of the benefits of FMLs in weight reduction and durability continues to drive incremental growth in Latin America.

Market Segmentations:

By Type

- GLARE (Glass Laminate Aluminum Reinforced Epoxy)

- GLARE 1

- GLARE 2

- GLARE 3

- GLARE 4

- GLARE 5

- GLARE 6

- ARALL (Aramid Reinforced Aluminum Laminate)

- ARALL 1

- ARALL 2

- ARALL 3

- ARALL 4

- CARALL (Carbon Reinforced Aluminum Laminate)

- TICARALL (Titanium Carbon Reinforced Aluminum Laminate)

- Other FML types

By Fiber Type

- Glass fiber

- E-glass

- S-glass

- Other glass types

- Carbon fiber

- High strength carbon fiber

- High modulus carbon fiber

- Ultra-high modulus carbon fiber

- Aramid fiber

- Kevlar

- Nomex

- Other aramid types

- Natural fiber

- Hybrid fiber

By Metal Type

- Aluminum

- 2024 aluminum alloy

- 7075 aluminum alloy

- Other aluminum alloys

- Titanium

- Ti-6Al-4V

- Other titanium alloys

- Steel

- Stainless steel

- Carbon steel

- Magnesium

- Other metals

By Manufacturing Process

- Autoclave process

- Press curing

- Vacuum bag molding

- Filament winding

- Pultrusion

- Other manufacturing processes

By Application

- Aerospace

- Fuselage

- Wings

- Empennage

- Control surfaces

- Other aerospace applications

- Automotive

- Body panels

- Structural components

- Crash boxes

- Other automotive applications

- Marine

- Hull structures

- Deck structures

- Other marine applications

- Wind energy

- Turbine blades

- Nacelle components

- Other wind energy applications

- Sports & recreation

- Others

By End Use Industry

- Aerospace & defense

- Commercial aviation

- Military aviation

- Space applications

- Defense applications

- Automotive

- Passenger vehicles

- Commercial vehicles

- Electric vehicles

- Marine

- Commercial vessels

- Naval vessels

- Recreational boats

- Energy

- Wind energy

- Other energy applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global fiber metal laminates market is highly competitive, characterized by the presence of leading aerospace OEMs, specialized composite manufacturers, and advanced material suppliers. Key players such as Airbus Group, Boeing Company, Lockheed Martin, Hexcel Corporation, Toray Industries, and Teijin Limited leverage strong R&D capabilities, strategic partnerships, and proprietary technologies to maintain market leadership. Companies are increasingly investing in lightweight, high-strength, and durable FML solutions to meet the rising demand in aerospace, defense, and automotive applications. Market participants focus on continuous innovation, process optimization, and automation to enhance manufacturing efficiency and product performance. Collaborations with fiber and resin developers, coupled with global production capabilities, allow companies to deliver high-quality, customized FML materials. The competitive landscape is further shaped by emerging players exploring hybrid composites and cost-effective manufacturing techniques, intensifying innovation and driving the adoption of fiber metal laminates across multiple end-use industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Airbus Group

- Boeing Company

- 3M Company

- Hexcel Corporation

- Teijin Limited

- Toray Industries, Inc.

- Cytec Solvay Group

- Koninklijke Ten Cate BV

- Mitsubishi Chemical Corporation

- Gurit Holding AG

- SGL Carbon SE

Recent Developments

- In April 2025, Fokker Services Group (FSG), a global leader in aircraft maintenance, modifications, completions, has been selected by Airbus Corporate Jets (ACJ) to join its network of approved ACJ outfitters and completion centers. From its location in Hoogerheide, The Netherlands, FSG will provide to ACJ customers a wide range of tailored outfitting capabilities for Airbus’ ACJ320neo and ACJ330 families.

- In March 2025, Alcoa Corporation and IGNIS Equity Holdings, SL, the majority shareholder in the IGNIS Group of Companies, a vertically integrated energy company based in Spain, announced they have entered into a joint venture agreement to support the continued operation of Alcoa’s San Ciprián complex. Under the joint venture agreement, Alcoa will have 75% interest and continue as the managing operator and IGNIS EQT will have 25% interest.

- In June 2024, Bombardier and F/LIST have opened of a contemporary, 700-sq. ft. Material Lounge at Bombardier’s London Biggin Hill Service Centre located at the London Biggin Hill Airport. The new Material Lounge is the largest, most comprehensive portfolio of interior materials, fabrics and components that Bombardier has housed at one of its international service centers. It is also the first time that F/LIST, the Austria-headquartered pioneer in the production and generation of innovative luxury interiors for exclusive business and private jets and residences, has created a dedicated space showcasing its product portfolio outside of its headquarters.

Report Coverage

The research report offers an in-depth analysis based on Type, Fiber Type, Metal Type, Manufacturing Process, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for lightweight and high-strength laminates will continue to grow across aerospace, automotive, and defense sectors.

- Adoption of hybrid fiber composites combining carbon, glass, and aramid fibers will increase to meet specialized performance requirements.

- Advanced manufacturing processes, including autoclave curing, vacuum bag molding, and filament winding, will become more widespread.

- Expansion into renewable energy applications, particularly wind turbine blades and nacelle components, will drive regional market growth.

- Electric vehicle adoption will boost the use of FMLs in automotive structural and safety components.

- Aerospace OEMs will increasingly integrate FMLs in fuselage, wings, and empennage to improve fuel efficiency and reduce weight.

- Strategic partnerships between FML manufacturers and fiber/resin suppliers will enhance innovation and product quality.

- Emerging markets in Asia Pacific and Latin America will witness significant growth due to industrialization and infrastructure development.

- Companies will focus on sustainable and recyclable laminates to meet environmental regulations.

- Technological advancements in fiber and resin development will enable higher performance and durability of FML products.