| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fiber Reinforced Polymers (FRP) Panels & Sheets Market Size 2024 |

USD 1,709.43 million |

| Fiber Reinforced Polymers (FRP) Panels & Sheets Market, CAGR |

6.47% |

| Fiber Reinforced Polymers (FRP) Panels & Sheets Market Size 2032 |

USD 2,925.64 million |

Market Overview

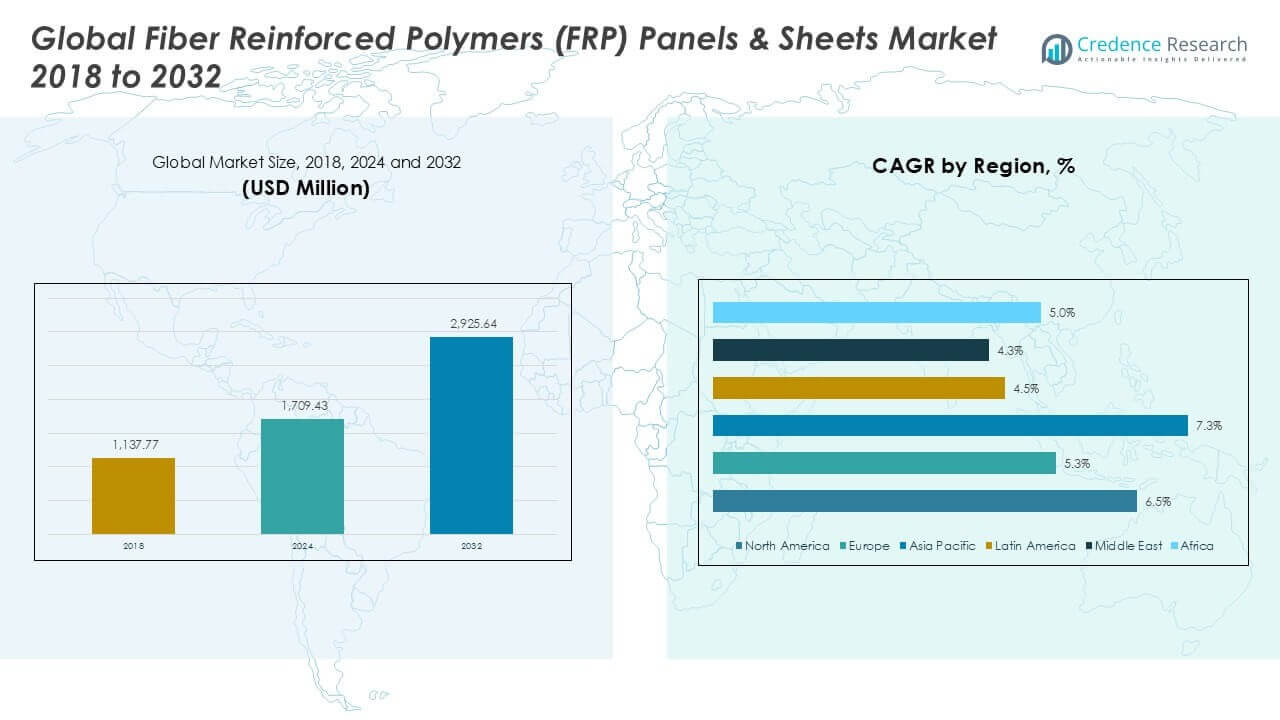

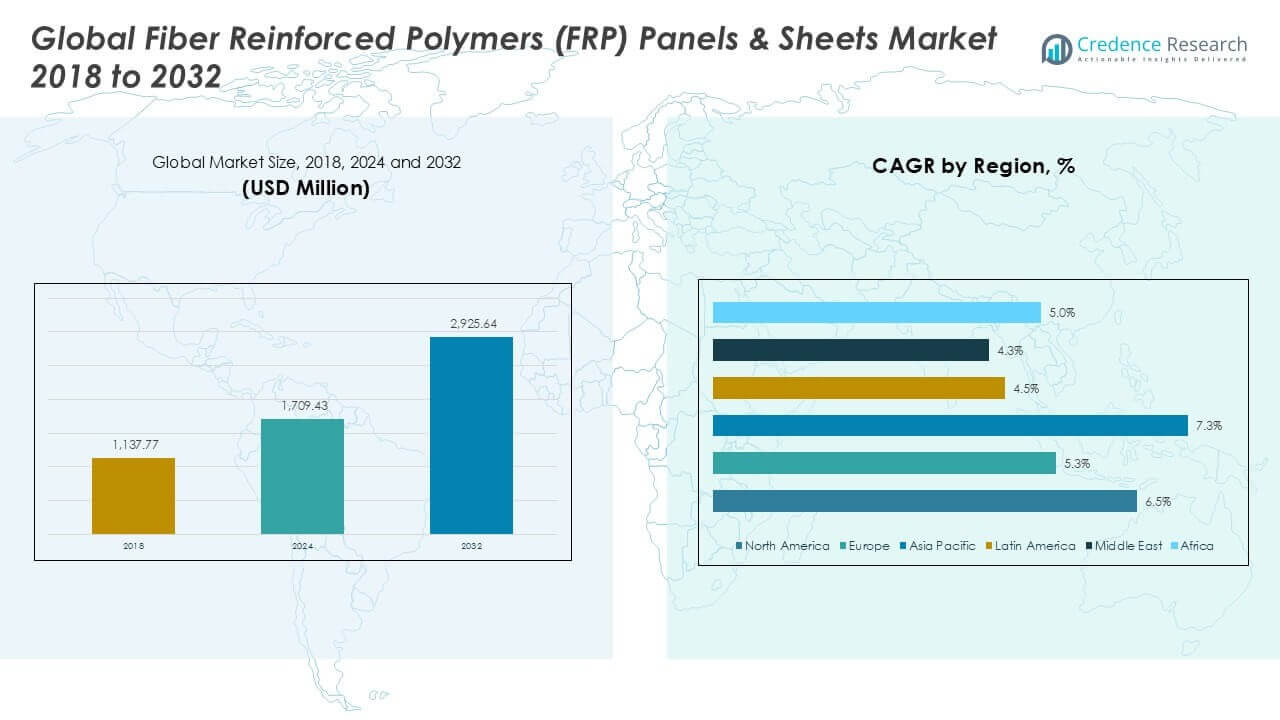

The Fiber Reinforced Polymers (FRP) Panels & Sheets Market size was valued at USD 1,137.77 million in 2018 to USD 1,709.43 million in 2024 and is anticipated to reach USD 2,925.64 million by 2032, at a CAGR of 6.47% during the forecast period.

The Fiber Reinforced Polymers (FRP) Panels & Sheets Market is driven by the rising demand for lightweight, durable, and corrosion-resistant materials across construction, automotive, and aerospace industries. Increasing infrastructure development, particularly in emerging economies, fuels the adoption of FRP panels and sheets as a reliable alternative to traditional materials like steel and aluminum. The market benefits from the growing emphasis on energy-efficient and sustainable building practices, which favor composites for their thermal insulation and low maintenance requirements. Technological advancements in resin formulations and manufacturing processes enhance product performance and design flexibility, further accelerating market penetration. In addition, stringent regulatory standards promoting the use of non-corrosive materials in industrial applications support consistent growth. Key trends include the integration of FRP in modular construction, increased use in marine and transportation sectors, and the development of bio-based composites to meet sustainability goals, positioning FRP panels and sheets as a vital component in modern engineering solutions.

The Fiber Reinforced Polymers (FRP) Panels & Sheets Market demonstrates strong geographical presence across Asia Pacific, North America, and Europe, with Asia Pacific leading due to rapid industrialization, infrastructure expansion, and manufacturing growth in countries like China, India, and Japan. North America follows closely, driven by demand in transportation, aerospace, and construction sectors across the United States and Canada. Europe shows consistent growth supported by sustainability regulations and advanced composite adoption in countries such as Germany and the UK. Key players in this market include Strongwell Corporation, known for its broad product range and engineering expertise; Crane Composites, Inc., a leading provider of fiberglass-reinforced plastic solutions across various industrial applications; and Redwood Plastics and Rubber, which specializes in custom-engineered composite materials. These companies are investing in product innovation, capacity expansion, and regional partnerships to strengthen their global footprint and respond to evolving industrial demands.

Market Insights

- The Fiber Reinforced Polymers (FRP) Panels & Sheets Market was valued at USD 1,709.43 million in 2024 and is projected to reach USD 2,925.64 million by 2032, growing at a CAGR of 6.47% during the forecast period.

- Strong demand for lightweight, high-strength, and corrosion-resistant materials across construction, automotive, and aerospace sectors is driving market expansion globally.

- Emerging trends include increased adoption of FRP panels in green buildings, modular construction, and renewable energy infrastructure such as wind turbines and solar panel mounts.

- Asia Pacific leads the global market due to rapid industrialization and infrastructure growth, with China, India, and Japan as major contributors. North America and Europe follow, supported by demand in transportation and sustainable building solutions.

- Key players such as STRONGWELL CORPORATION, CRANE COMPOSITES, INC., and Redwood Plastics and Rubber focus on innovation, product customization, and regional partnerships to enhance competitiveness.

- High raw material costs and limited recycling options for thermoset FRP products remain key restraints affecting market scalability and environmental compliance.

- The market continues to diversify across end-user sectors, with opportunities rising in marine, utility, and public infrastructure projects where FRP’s long service life and low maintenance benefits are increasingly valued.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Lightweight and High-Strength Materials in Industrial Applications

The Fiber Reinforced Polymers (FRP) Panels & Sheets Market is gaining traction due to increasing demand for materials that offer high strength-to-weight ratios across sectors such as construction, transportation, and aerospace. Industries seek alternatives to traditional metals to reduce overall weight while maintaining structural integrity. FRP panels and sheets meet this requirement with their superior tensile strength and reduced density. It helps manufacturers improve fuel efficiency, optimize load capacity, and simplify installation. The market benefits from growing awareness of operational cost reduction through material innovation. Adoption is especially high in transport infrastructure, automotive frames, and aircraft interiors, where weight plays a critical performance role.

- For instance, the adoption of FRP materials in the construction industry has surged due to their lightweight nature, durability, and resistance to corrosion.

Accelerated Infrastructure Modernization and Urbanization in Developing Regions

Rapid urban growth and ongoing infrastructure upgrades in emerging economies are fueling the expansion of the Fiber Reinforced Polymers (FRP) Panels & Sheets Market. Governments and private developers increasingly adopt FRP materials for bridges, walkways, tunnels, and utility enclosures due to their corrosion resistance and extended service life. It supports lower maintenance requirements in environments exposed to moisture, chemicals, and extreme temperatures. High demand from water treatment plants, industrial facilities, and marine projects highlights the shift toward long-lasting composites. The market responds well to the need for cost-effective materials that withstand harsh environmental conditions. Investments in smart cities and public infrastructure further amplify growth opportunities.

Strict Regulatory Pressure for Corrosion-Resistant and Eco-Friendly Materials

Global regulatory frameworks focused on safety, durability, and sustainability continue to shape the Fiber Reinforced Polymers (FRP) Panels & Sheets Market. Industries face mandates to use materials with lower lifecycle emissions and greater structural reliability, particularly in corrosive environments. It drives preference for FRP panels, which offer chemical resistance, UV stability, and minimal degradation over time. Environmental compliance in sectors like oil and gas, wastewater management, and transportation supports market growth. Governments encourage the use of non-metallic materials through codes and certifications, reinforcing the position of FRP. Manufacturers respond with advanced product lines that meet evolving compliance standards without compromising performance.

- For instance, the construction sector accounted for 45% of the total FRP panel market, with major investments directed toward incorporating these materials in infrastructure projects.

Continuous Advancements in Composite Manufacturing Technologies

Ongoing improvements in resin systems, fiber reinforcements, and production methods support the upward momentum of the Fiber Reinforced Polymers (FRP) Panels & Sheets Market. Automation, precision molding, and pultrusion techniques have enhanced product consistency and scalability. It enables customized solutions for specific industrial needs, expanding application versatility. Faster processing times and improved surface finishes contribute to better end-user satisfaction. Material scientists introduce innovations such as flame-retardant additives and hybrid fiber blends that enhance safety and durability. These advancements reduce cost barriers and increase adoption across both small-scale and large-scale infrastructure projects.

Market Trends

Rising Adoption of FRP Sheets in Transportation and Mobility Infrastructure

The transportation sector contributes significantly to trends shaping the Fiber Reinforced Polymers (FRP) Panels & Sheets Market. Railways, automotive, and aerospace industries use FRP sheets for their corrosion resistance and impact absorption in harsh operating conditions. It enables safer, lighter, and longer-lasting transportation components. Growing emphasis on lightweight vehicle designs to meet fuel efficiency and emission reduction targets further supports FRP usage. Public transit systems and freight operations deploy FRP in bridges, walkways, and station infrastructure for longevity and safety. The versatility and structural performance of FRP materials continue to position them as key enablers of next-generation mobility systems.

- For instance, the bolstering transport industry is a primary factor driving the Fiber Reinforced Polymers (FRP) Panels & Sheets Market growth.

Growing Integration of FRP Panels in Green Building and Sustainable Design Projects

The Fiber Reinforced Polymers (FRP) Panels & Sheets Market is increasingly influenced by the global shift toward sustainability in construction and design. Architects and developers incorporate FRP panels into green buildings due to their energy efficiency, recyclability, and minimal maintenance needs. It supports long-term durability and reduces environmental impact, aligning with modern regulatory frameworks and certification standards like LEED. The lightweight nature of FRP materials allows easier transportation and installation, contributing to reduced carbon emissions during construction. Demand is rising for thermoset and thermoplastic variants that offer improved thermal insulation and reduced VOC emissions. These trends are pushing manufacturers to develop bio-based and recyclable composites that support circular economy goals.

Advancement in Aesthetic and Functional Customization Capabilities

Design flexibility has emerged as a major trend across the Fiber Reinforced Polymers (FRP) Panels & Sheets Market. Clients demand materials that meet not only structural performance standards but also modern design aesthetics. It drives innovation in surface textures, color stability, and form factors to match interior and exterior architectural themes. Builders prefer FRP sheets for their ability to replicate wood, metal, or stone finishes without sacrificing durability. Functional customization also includes features like anti-slip surfaces, fire retardancy, and UV protection. The market is responding with advanced product lines that serve both utility and visual appeal across a wide range of projects.

- For instance, digital monitoring and automated systems have optimized fuel processing, reducing emissions and improving combustion efficiency.

Expansion of Modular and Prefabricated Construction Techniques

Innovations in modular construction techniques are contributing to a broader application base within the Fiber Reinforced Polymers (FRP) Panels & Sheets Market. Builders rely on FRP panels to fabricate prefabricated walls, roofing, and partitions with consistent quality and minimal on-site assembly. It supports accelerated project timelines and reduces labor costs, especially in commercial and industrial facilities. Prefabricated schools, healthcare units, and housing developments frequently use FRP to meet building code requirements while maintaining design flexibility. Manufacturers cater to this demand with customizable sizes, textures, and finishes. The modular construction trend reinforces the value of FRP panels in fast, scalable, and cost-effective development models.

Market Challenges Analysis

High Material Costs and Limited Standardization in Manufacturing Processes

The Fiber Reinforced Polymers (FRP) Panels & Sheets Market faces significant challenges due to the high cost of raw materials and production. Resin systems and fiber reinforcements such as carbon or glass fibers contribute to elevated manufacturing expenses, which restrict widespread adoption in cost-sensitive industries. It creates pricing pressures for suppliers and limits market penetration in developing economies. Lack of standardization in composite manufacturing also affects consistency, leading to variability in performance and quality. Manufacturers often face difficulty in scaling production while maintaining uniform specifications across different applications. The absence of unified design codes and testing protocols further complicates integration in infrastructure and industrial projects.

- For instance, the cost of resin systems and fiber reinforcements, such as carbon and glass fibers, has increased due to supply chain disruptions and rising demand in aerospace and automotive industries.

Complex Recycling Processes and Environmental Concerns Related to Disposal

End-of-life disposal and recyclability present major challenges for the Fiber Reinforced Polymers (FRP) Panels & Sheets Market. Thermoset composites, which dominate the market, are difficult to recycle due to their cross-linked polymer structures. It limits the development of sustainable disposal practices and raises environmental concerns. Regulatory bodies continue to pressure manufacturers to develop closed-loop recycling solutions, but technological barriers slow progress. Incineration and landfilling remain common practices, drawing criticism from environmental groups and policymakers. The industry must invest in scalable, cost-effective recycling methods to address growing scrutiny and meet sustainability standards. Without clear pathways for material recovery, adoption in environmentally regulated sectors may face constraints.

Market Opportunities

Emerging Applications Across Renewable Energy and Marine Infrastructure

The Fiber Reinforced Polymers (FRP) Panels & Sheets Market holds strong opportunities in the renewable energy and marine sectors. Wind turbine blades, solar panel mounts, and offshore platforms require materials with high durability, corrosion resistance, and lightweight properties. It enables FRP products to meet performance demands in harsh and remote environments. Growth in offshore wind energy installations and coastal protection projects creates new demand for structural composites. Governments and private players continue to expand investment in green infrastructure, creating a favorable landscape for FRP manufacturers. The versatility and long service life of FRP panels support their use in these demanding applications.

Growing Demand for Customizable and Aesthetic Architectural Solutions

Architectural and interior design sectors are generating new opportunities for the Fiber Reinforced Polymers (FRP) Panels & Sheets Market. Designers and builders seek materials that combine structural performance with customizable finishes for façades, partitions, and decorative elements. It allows FRP panels to replace traditional wood, stone, or metal with lightweight and low-maintenance alternatives. The demand for bespoke designs in commercial buildings, airports, and public infrastructure aligns with FRP’s adaptability. Increasing use of digital fabrication and 3D modeling tools enables tailored production, enhancing product appeal. Manufacturers that offer advanced customization and design support can expand their presence in the high-value architectural segment.

Market Segmentation Analysis:

By Type:

The Fiber Reinforced Polymers (FRP) Panels & Sheets Market is segmented into glass, carbon, and others. Glass fiber dominates the market due to its cost efficiency, good mechanical strength, and widespread availability. It is commonly used in construction and transportation applications where high performance and affordability are critical. Carbon fiber, while more expensive, offers superior strength-to-weight ratio and stiffness, making it ideal for aerospace, high-performance vehicles, and advanced infrastructure. The “others” segment includes aramid and basalt fibers, which serve niche applications requiring specific properties such as high thermal resistance or impact strength.

By End- User:

The market is segmented into transportation, building & construction, and others. The building & construction segment leads due to rising use of FRP panels in cladding, roofing, wall systems, and water management structures. It supports extended service life and reduced maintenance in demanding environments. The transportation segment is expanding steadily with increased adoption in automotive, rail, and aerospace sectors focused on lightweight and fuel-efficient designs. The “others” category includes industrial equipment, marine, and utility sectors, which benefit from FRP’s corrosion resistance and structural reliability in challenging conditions.

Segments:

Based on Type:

Based on End- User:

- Transportation

- Building & Construction

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Fiber Reinforced Polymers (FRP) Panels & Sheets Market

North America Fiber Reinforced Polymers (FRP) Panels & Sheets Market grew from USD 327.05 million in 2018 to USD 483.62 million in 2024 and is projected to reach USD 831.22 million by 2032, reflecting a compound annual growth rate (CAGR) of 6.5%. North America is holding a 28.3% market share. The region benefits from strong demand in the transportation and construction sectors, particularly in the United States and Canada. Regulatory initiatives supporting energy efficiency and lightweight materials drive adoption across industrial and commercial applications. The U.S. leads in terms of consumption, with expanding investments in infrastructure modernization and defense applications. FRP adoption is also increasing in utility and wastewater treatment projects due to its corrosion resistance and low maintenance needs.

Europe

Europe Fiber Reinforced Polymers (FRP) Panels & Sheets Market grew from USD 224.65 million in 2018 to USD 320.04 million in 2024 and is projected to reach USD 500.94 million by 2032, reflecting a CAGR of 5.3%. Europe is holding an 18.2% market share. Germany, France, and the United Kingdom are key contributors, driven by advancements in automotive composites, sustainable construction, and aerospace manufacturing. The European Union’s environmental regulations and emphasis on material sustainability promote the use of FRP in public infrastructure and green building projects. Demand is rising for thermoplastic composites with recyclability benefits. Infrastructure renovation projects across Western and Central Europe support continued growth.

Asia Pacific Fiber Reinforced Polymers (FRP) Panels & Sheets Market

Asia Pacific Fiber Reinforced Polymers (FRP) Panels & Sheets Market grew from USD 471.72 million in 2018 to USD 736.31 million in 2024 and is projected to reach USD 1,341.04 million by 2032, reflecting a CAGR of 7.3%. Asia Pacific is holding the largest market share at 44.4%. China, India, and Japan lead demand due to rapid industrialization, infrastructure expansion, and increased production of automotive and electronic components. China dominates with large-scale applications in construction and wind energy, while India shows potential in railways and water infrastructure. Government investments in smart cities and public utilities further boost the adoption of FRP panels. The availability of low-cost raw materials and labor strengthens the regional supply chain.

Latin America Fiber Reinforced Polymers (FRP) Panels & Sheets Market

Latin America Fiber Reinforced Polymers (FRP) Panels & Sheets Market grew from USD 44.89 million in 2018 to USD 66.43 million in 2024 and is projected to reach USD 98.02 million by 2032, reflecting a CAGR of 4.5%. Latin America is holding a 3.4% market share. Brazil and Mexico are the primary markets, supported by investments in transport, oil and gas, and residential construction. Infrastructure modernization programs and corrosion issues in humid environments favor FRP use over traditional materials. Although the market is smaller, opportunities are emerging in modular construction and renewable energy sectors. Manufacturers focus on cost-effective solutions to cater to mid-sized and large infrastructure developers.

Middle East Fiber Reinforced Polymers (FRP) Panels & Sheets Market

Middle East Fiber Reinforced Polymers (FRP) Panels & Sheets Market grew from USD 32.37 million in 2018 to USD 44.52 million in 2024 and is projected to reach USD 64.49 million by 2032, reflecting a CAGR of 4.3%. The Middle East is holding a 2.2% market share. Saudi Arabia and the United Arab Emirates drive demand through large-scale construction, desalination plants, and oil infrastructure projects. Harsh environmental conditions, including high salinity and heat, make FRP an attractive choice for durability and low maintenance. Government-backed infrastructure projects and energy diversification plans provide long-term growth potential. FRP use in water management and electrical enclosures continues to gain traction across the region.

Africa Fiber Reinforced Polymers (FRP) Panels & Sheets Market

Africa Fiber Reinforced Polymers (FRP) Panels & Sheets Market grew from USD 37.09 million in 2018 to USD 58.50 million in 2024 and is projected to reach USD 89.94 million by 2032, reflecting a CAGR of 5.0%. Africa is holding a 3.1% market share. South Africa, Nigeria, and Egypt lead demand with investments in urban infrastructure, water treatment, and transport networks. The region experiences growing interest in lightweight, corrosion-resistant materials to extend the lifespan of infrastructure under challenging environmental conditions. Limited local manufacturing remains a challenge, but imports continue to meet rising demand. International partnerships and donor-funded infrastructure programs are expanding opportunities for FRP adoption across public and private projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Redwood Plastics and Rubber

- STRONGWELL CORPORATION

- Kalwall

- CRANE COMPOSITES, INC. (CRANE CO.)

- Hill & Smith Holdings PLC

- Taizhou Zhongsheng FRP Co., Ltd

- Panolam Industries International, Inc.

- KREMPEL GmbH

- POLSER Şeffaf Çatı Örtüleri San. ve Tic. A.Ş.

- BRIANZA USA CORPORATION

- Captrad Ltd

- Röchling

Competitive Analysis

The competitive landscape of the Fiber Reinforced Polymers (FRP) Panels & Sheets Market is characterized by the presence of several well-established players focusing on innovation, product quality, and strategic expansion. Leading companies such as STRONGWELL CORPORATION, CRANE COMPOSITES, INC., Redwood Plastics and Rubber, Kalwall, Hill & Smith Holdings PLC, Panolam Industries International, Inc., and Röchling dominate the market through robust distribution networks and strong brand portfolios. These players emphasize the development of advanced composite technologies tailored to the needs of construction, transportation, and industrial applications. Key strategies include expanding manufacturing capacities, investing in R&D for eco-friendly and high-performance products, and entering into strategic partnerships to enhance market reach. Companies also prioritize customization to address industry-specific requirements such as UV resistance, thermal insulation, and structural strength. Regional expansion, particularly in emerging markets across Asia Pacific and Latin America, remains a core focus to tap into infrastructure growth and industrial modernization. The market is highly competitive, with differentiation driven by material innovation, cost-efficiency, and regulatory compliance. Leading players continue to build long-term relationships with end-users and project developers to secure contracts and maintain market leadership.

Recent Developments

- In May 2023, Avient Corporation expanded its production line for OnForce and Complēt long fiber reinforced thermoplastic composites in Asia Pacific. This new line will help the company meet the increasing demand related to composite materials.

- In July 2023, SABIC PP compound H1090 and Stamax 30YH611 resins were suitable for the extrusion and thermoforming of large, compound EV battery pack materials for the automotive industry.

- In March 2023, Creative Composites Group, a leading manufacturer of fiber-reinforced polymer composites, acquired Enduro Composites, a Houston-based manufacturer of FRP products. This acquisition allows companies to diversify their manufacturing lines and increase efficiency.

- In May 2022, Avient Corporation launched Bio-Based polymer solutions for medical applications, aiming to capture more market share in the composite market.

- In May 2022, Hexcel Corporation launched a new product, namely, the HexPly Nature Range. This newly launched product is made with bio-derived resin content with natural fiber reinforcements. This product addresses demands in automotive, marine, wind energy, and winter sports applications.

Market Concentration & Characteristics

The Fiber Reinforced Polymers (FRP) Panels & Sheets Market is moderately concentrated, with a mix of global players and regional manufacturers competing on product performance, customization, and distribution reach. It features strong competition in high-growth sectors such as construction, transportation, and industrial infrastructure. Leading companies differentiate through proprietary formulations, advanced manufacturing capabilities, and tailored design solutions. The market exhibits high entry barriers due to capital-intensive production, technical expertise, and strict quality standards. Demand is primarily driven by the need for lightweight, corrosion-resistant, and low-maintenance materials, which supports steady growth across developed and developing regions. Buyers often seek long-term supplier relationships, favoring firms that offer reliable supply chains, consistent quality, and technical support. Innovation, especially in resin technologies and sustainable composites, remains a key characteristic influencing market dynamics and brand positioning

Report Coverage

The research report offers an in-depth analysis based on Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness increased adoption in infrastructure and smart city projects due to demand for durable and lightweight materials.

- FRP panels will gain traction in modular and prefabricated construction systems for faster and cost-effective project execution.

- Manufacturers will invest more in sustainable and recyclable composite solutions to align with global environmental regulations.

- Demand for fire-retardant, UV-resistant, and thermally efficient panels will rise across industrial and commercial applications.

- Asia Pacific will continue to lead market growth, driven by industrial expansion and urban development in China and India.

- Aerospace and automotive sectors will increase the use of FRP panels to enhance fuel efficiency and reduce structural weight.

- Technological advancements in fiber and resin chemistry will improve product performance and expand application areas.

- Industry players will focus on regional partnerships and acquisitions to expand market reach and production capabilities.

- Customization and design flexibility will become key differentiators in architectural and decorative applications.

- Regulatory pressure on conventional materials will push end-users to adopt FRP as a long-term, low-maintenance alternative.