Market Overview

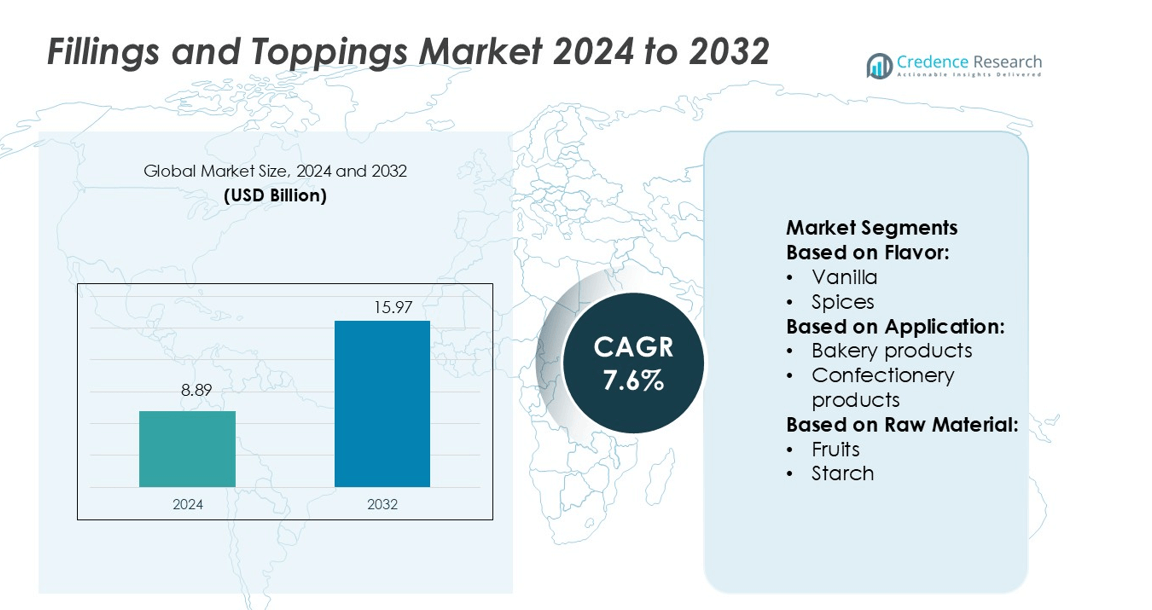

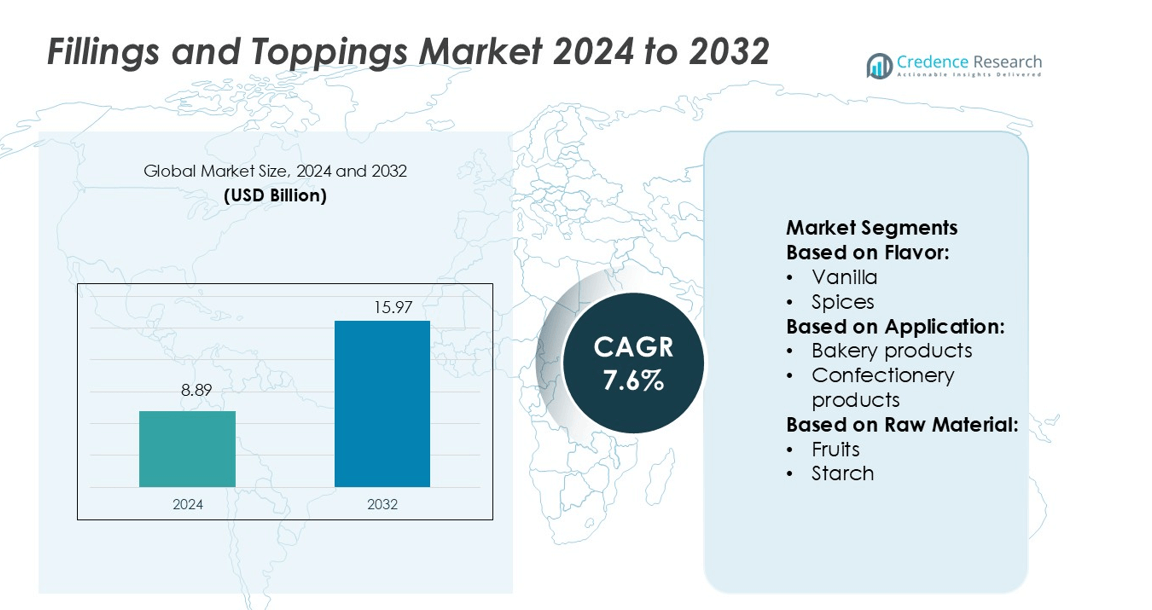

Fillings and Toppings Market size was valued USD 8.89 billion in 2024 and is anticipated to reach USD 15.97 billion by 2032, at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fillings and Toppings Market Size 2024 |

USD 8.89 billion |

| Fillings and Toppings Market, CAGR |

7.6% |

| Fillings and Toppings Market Size 2032 |

USD 15.97 billion |

The fillings and toppings market is shaped by key players including Cargill, Frutarom, Dawn Foods, Ingredion, Barry Callebaut, Bakkavor Group, Fleischmann’s Ingredients, ADM, Ikor Group, and CSM Bakery Ingredients. These companies focus on flavor innovation, clean-label reformulations, and advanced processing technologies to meet evolving consumer demand. Strategic partnerships with QSR chains and confectionery brands strengthen their market presence globally. Asia Pacific leads the global market with a 33% share in 2024, driven by rapid urbanization, rising disposable income, and increasing consumption of bakery and confectionery products. Strong distribution networks and flavor diversification further enhance the region’s dominance.

Market Insights

- The fillings and toppings market was valued at USD 8.89 billion in 2024 and is projected to reach USD 15.97 billion by 2032, growing at a CAGR of 7.6%.

- Rising demand for premium bakery and confectionery products and growing clean-label adoption are driving strong market growth.

- Flavor innovation, plant-based ingredients, and functional formulations are shaping new trends, supported by expanding QSR and café chains.

- Key players including Cargill, Frutarom, Dawn Foods, Ingredion, Barry Callebaut, and ADM are strengthening competitiveness through technology investments and strategic partnerships.

- Asia Pacific leads with a 33% regional share, followed by North America at 31% and Europe at 28%, while the bakery segment holds the largest market share within applications, supported by strong consumer demand for indulgent and innovative flavors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Flavor

Fruits flavor dominates the fillings and toppings market with a 33% share in 2024. This segment benefits from rising consumer demand for natural and clean-label ingredients. Fruit-based flavors enhance taste profiles in bakery, confectionery, and dairy applications, supporting product innovation and premium offerings. Growing preference for tropical and exotic fruits in ready-to-eat desserts and beverages further drives adoption. Chocolate and vanilla flavors follow due to their consistent popularity in cakes, pastries, and frozen products. Seasonal and regional flavor variations also help brands cater to evolving consumer tastes and preferences.

- For instance, Ingredion offers the NOVATION® 2700 functional native starch, a viscosifying agent derived from waxy maize that produces high-viscosity suspensions suitable for food processes with low to moderate temperature and shear.

By Application

Bakery products hold the largest share of 39% in the fillings and toppings market. Increasing demand for cakes, pastries, and muffins in both retail and food service channels supports segment growth. Product innovation, including gluten-free and reduced-sugar bakery goods, boosts the need for functional toppings and fillings. Confectionery and dairy products follow closely due to growing consumption of indulgent and ready-to-eat desserts. Frozen product applications are also expanding with the rising popularity of frozen cakes and ice creams. Strong distribution networks further enhance market penetration across regions.

- For instance, Avebe is collaborating with TNO and Wageningen to explore 3D-printing of plant-based meat analogues using potato-derived paste. The prototype 3D printer is designed for scalable throughput and easier cleaning/maintenance, making factory deployment feasible.

By Raw Material

Fruits remain the leading raw material in the fillings and toppings market with a 31% share. The shift toward natural ingredients and reduced artificial additives supports this dominance. Fruit-based raw materials align with clean-label trends and offer versatility across multiple applications. Starch and hydrocolloids follow as they provide stability and texture enhancement in processed food products. Sweeteners and cocoa continue to drive demand in premium confectionery and dairy segments. Sustainable sourcing of fruit ingredients and advanced processing methods also strengthen this segment’s growth outlook.

Key Growth Drivers

Rising Demand for Premium Bakery and Confectionery Products

The growing preference for premium bakery and confectionery products is a major market driver. Consumers are increasingly drawn to indulgent and visually appealing desserts, cakes, and pastries. This shift drives demand for fillings and toppings with improved flavors, textures, and natural ingredients. Food service chains, bakeries, and confectionery manufacturers are expanding their portfolios with innovative flavors. The rising influence of Western-style bakery products in developing economies also supports market expansion. This trend is reinforced by increased disposable income and changing lifestyle patterns worldwide.

- For instance, Herbstreith & Fox demonstrates that in vegan gummy confectionery systems, they can replace up to 5 g of starch per 100 g formula by using 1.1 g of H&F pectin without loss of texture, while achieving reduced stickiness and faster setting time.

Growing Adoption of Clean Label and Natural Ingredients

Consumers are increasingly aware of ingredients and prefer clean-label products. Food brands are responding by using natural sweeteners, fruit-based fillings, and preservative-free toppings. This shift aligns with health-conscious lifestyles and transparent labeling regulations. Manufacturers are investing in product reformulation to remove artificial additives and enhance nutritional profiles. This clean-label movement is particularly strong in North America and Europe. It encourages innovation in organic, vegan, and allergen-free filling and topping options, driving product differentiation and market growth across multiple food categories.

- For instance, Cargill holds a patent for a glucose syrup replacement composition comprising at least 80 wt % maltodextrin (DE 15-20) and up to 20 wt % sorbitol/glycerol for use in bakery, confectionery, and ice cream systems.

Expanding Foodservice and Quick-Service Restaurant Sector

The rapid expansion of the foodservice sector, including QSR chains, cafes, and dessert shops, fuels demand for fillings and toppings. These establishments use toppings to enhance flavor, visual appeal, and customization. Ready-to-use and shelf-stable solutions support operational efficiency and consistency. Growing consumer preference for on-the-go desserts, waffles, pancakes, and frozen treats strengthens market prospects. Global chains and local brands are partnering with ingredient suppliers to develop unique product offerings. This increased demand from the foodservice industry plays a critical role in accelerating market growth.

Key Trends & Opportunities

Product Innovation and Flavor Diversification

Manufacturers are focusing on product innovation and introducing exotic flavors, textures, and formats. The rise of seasonal and limited-edition offerings enhances brand appeal and drives repeat purchases. Plant-based fillings and sugar-reduced toppings are gaining popularity among health-conscious consumers. Premiumization trends are also pushing demand for artisanal and gourmet flavors. Product customization for QSR chains and bakery segments creates opportunities for market expansion. These innovations improve shelf life, flavor stability, and consumer experience, strengthening brand competitiveness in both developed and emerging markets.

- For instance, AB Mauri (ABF’s bakery division) has reduced its water-intensity ratio by 25 % (water consumed per tonne of product) across its global yeast and bakery sites.

Integration of Functional Ingredients

The use of functional ingredients in fillings and toppings is an emerging trend. Producers are incorporating probiotics, plant proteins, and fiber-rich formulations to meet wellness trends. Functional toppings cater to demand for immunity-boosting, low-sugar, and nutrient-dense options. This shift allows brands to tap into the health and wellness segment without compromising taste. Clean label and fortified products are increasingly positioned as premium offerings. This trend creates opportunities for companies to target niche health-conscious consumers and expand their product portfolios effectively.

- For instance, Zentis markets All-in-One Plant-Based Compounds that customers simply mix with water. These compounds ship in containers sized between 200 kg and 1,000 kg, enabling bulk processing scale.

E-commerce and Direct-to-Consumer Expansion

The growing popularity of e-commerce platforms supports direct access to fillings and toppings for both individual consumers and small businesses. Online retail enables ingredient brands to showcase product diversity and promote specialty toppings. Subscription models and bulk purchase options increase accessibility and convenience. Digital channels allow faster product launches, targeted marketing, and greater consumer engagement. This direct-to-consumer approach provides companies with valuable consumer insights, helping them develop tailored offerings. E-commerce expansion enhances market penetration and strengthens brand visibility globally.

Key Challenges

Fluctuating Raw Material Prices

Volatile prices of raw materials such as sugar, cocoa, and dairy products create significant cost pressures for manufacturers. Global supply chain disruptions and climate change impacts on crop yields further complicate sourcing. Price instability affects profit margins and makes it challenging to maintain consistent pricing strategies. Smaller producers face greater difficulty absorbing these cost variations compared to large multinationals. As a result, companies must focus on strategic sourcing, hedging, and operational efficiency to mitigate the effects of raw material price fluctuations.

Stringent Regulatory Standards and Labeling Requirements

Regulatory frameworks related to food safety, labeling, and ingredient transparency pose compliance challenges. Governments across major markets are enforcing stricter standards on sugar content, preservatives, and allergen declarations. Meeting these standards requires investment in reformulation, testing, and certification processes. Non-compliance risks legal penalties and damages brand reputation. Additionally, regulations vary across regions, increasing complexity for global manufacturers. Companies must maintain robust quality assurance and regulatory monitoring systems to ensure compliance while preserving product quality and market competitiveness.

Regional Analysis

North America

North America holds a 31% share of the global fillings and toppings market in 2024. The strong market position is supported by a mature bakery and confectionery industry, with high per capita dessert consumption. The U.S. leads the region with widespread use of flavored fillings and clean-label toppings in bakery, ice cream, and beverages. Quick-service restaurants and café chains drive innovation and flavor diversification. Consumers’ preference for low-sugar, plant-based, and functional ingredients accelerates product reformulation. Strategic investments in advanced processing technologies strengthen domestic production capacity and export potential, reinforcing the region’s leadership position.

Europe

Europe accounts for 28% of the global market share in 2024, driven by robust demand from the bakery and patisserie sectors. Germany, France, and the U.K. lead in artisanal and premium product innovation. Clean-label and organic toppings are gaining traction due to strict labeling laws and strong consumer awareness. Seasonal products, such as fruit-based and chocolate fillings, remain highly popular. Strong retail infrastructure and established foodservice networks enhance market penetration. European manufacturers emphasize sustainable sourcing and ingredient transparency, supporting long-term growth and maintaining the region’s competitive edge in premium product segments.

Asia Pacific

Asia Pacific leads the global fillings and toppings market with a 33% share in 2024. The region’s growth is fueled by rapid urbanization, rising disposable income, and growing demand for western-style bakery products. China, Japan, and India are key contributors, with expanding bakery chains and QSR outlets. Flavor innovation, especially fruit-based and dairy toppings, appeals to diverse consumer preferences. The rise of e-commerce and modern retail formats further boosts accessibility. Regional manufacturers invest in large-scale production facilities and R&D to meet growing local demand and strengthen exports, solidifying Asia Pacific’s dominant market position.

Latin America

Latin America captures a 5% share of the global fillings and toppings market in 2024. Brazil and Mexico lead regional consumption, driven by increasing popularity of confectionery and bakery products. Growing café culture and dessert chains support product adoption. Local manufacturers are introducing cost-effective and flavor-rich toppings to cater to price-sensitive consumers. The market is also seeing gradual adoption of clean-label and reduced-sugar options, aligned with rising health awareness. Investments in supply chain development and distribution networks enhance regional reach, positioning Latin America as a steadily expanding market with future growth potential.

Middle East & Africa

The Middle East & Africa holds a 3% market share in 2024, with growth driven by expanding urban retail and rising western-style dessert trends. Countries such as the UAE, Saudi Arabia, and South Africa show increasing demand for flavored fillings in bakery, confectionery, and dairy applications. International brands are expanding their presence through QSR chains and retail partnerships. Premium and halal-certified products gain strong consumer acceptance. Limited local production remains a key challenge, leading to high import reliance. However, increasing investments in food manufacturing infrastructure are expected to strengthen regional market performance over time.

Market Segmentations:

By Flavor:

By Application:

- Bakery products

- Confectionery products

By Raw Material:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the fillings and toppings market is shaped by key players including Cargill, Frutarom, Dawn Foods, Ingredion, Barry Callebaut, Bakkavor Group, Fleischmann’s Ingredients, ADM, Ikor Group, and CSM Bakery Ingredients. The fillings and toppings market is defined by strong product innovation, strategic expansion, and sustainability-focused initiatives. Companies focus on developing clean-label, natural, and functional ingredients to meet rising consumer demand for healthier products. Advanced processing technologies enhance product quality, shelf stability, and flavor retention. Manufacturers invest in R&D to create versatile solutions for bakery, confectionery, dairy, and frozen applications. Sustainable sourcing, eco-friendly packaging, and supply chain efficiency play a key role in building brand strength. Market leaders also prioritize strategic partnerships and regional expansion to strengthen global presence and increase market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cargill

- Frutarom

- Dawn Foods

- Ingredion

- Barry Callebaut

- Bakkavor Group

- Fleischmann’s Ingredients

- ADM

- Ikor Group

- CSM Bakery Ingredients

Recent Developments

- In June 2025, Puratos and AMF jointly opened a cutting-edge pilot bakery at Puratos USA headquarters in Pennsauken, NJ. This facility accelerates innovation by allowing customers to collaborate on product development, optimize recipes, test ingredients, including toppings and fillings, and train bakery teams using advanced automation and sensory research tools.

- In November 2024, Bonne Maman introduced a new line of ready-to-use pie fillings in Apple, Blueberry, and Cherry flavors. Packaged in 21-ounce glass jars, these fillings are free from high fructose corn syrup, preservatives, and artificial coloring, featuring large pieces of premium fruits for improved texture and flavor.

- In August 2024, Lassonde, a producer of fruit-based snacks and beverages, acquired Summer Garden Food Manufacturing, which specializes in specialty sauces, including sugar-free sauces that could complement toppings and fillings. This nearly doubles Lassonde’s US market presence and expands its product capabilities.

- In February 2024, Dawn Foods acquired Royal Steensma, a Dutch bakery ingredients manufacturer specializing in fruit fillings, including four manufacturing plants in the Netherlands and a facility in Thailand, significantly expanding Dawn’s global manufacturing capabilities

Report Coverage

The research report offers an in-depth analysis based on Flavor, Application, Raw Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising demand for premium desserts.

- Clean-label and natural ingredient adoption will shape future product innovation.

- Plant-based and functional toppings will gain wider consumer acceptance.

- Advanced processing technologies will improve shelf life and product quality.

- Quick-service restaurants will expand product applications across multiple categories.

- E-commerce and direct-to-consumer channels will increase global market reach.

- Sustainable sourcing and eco-friendly packaging will become standard industry practices.

- Emerging economies will contribute significantly to market expansion.

- Flavor diversification and customization will enhance product differentiation.

- Strategic partnerships and mergers will strengthen competitive positioning.