Market Overview

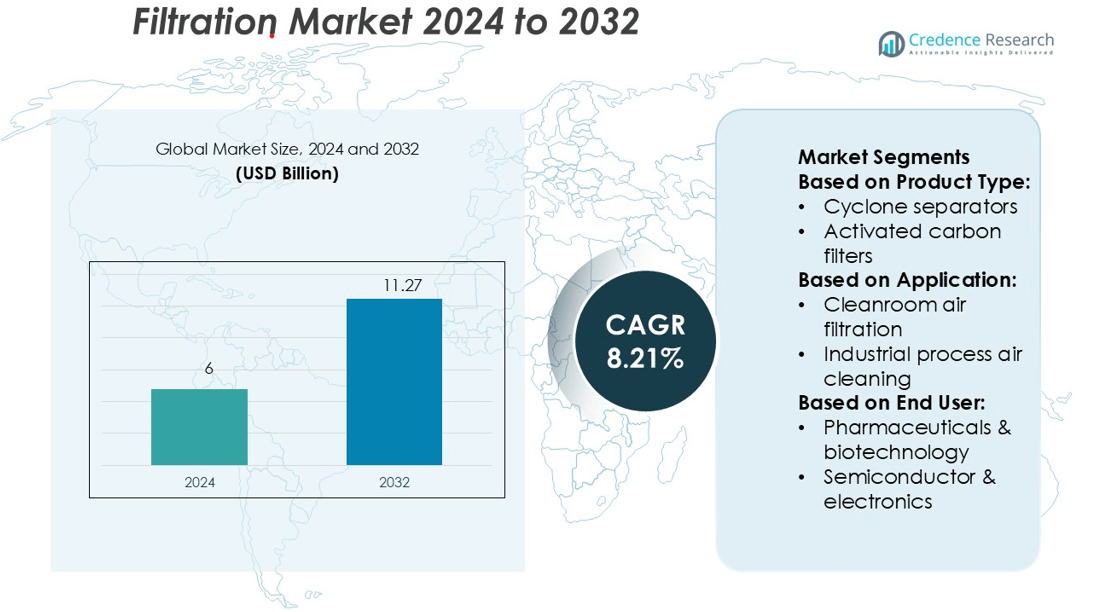

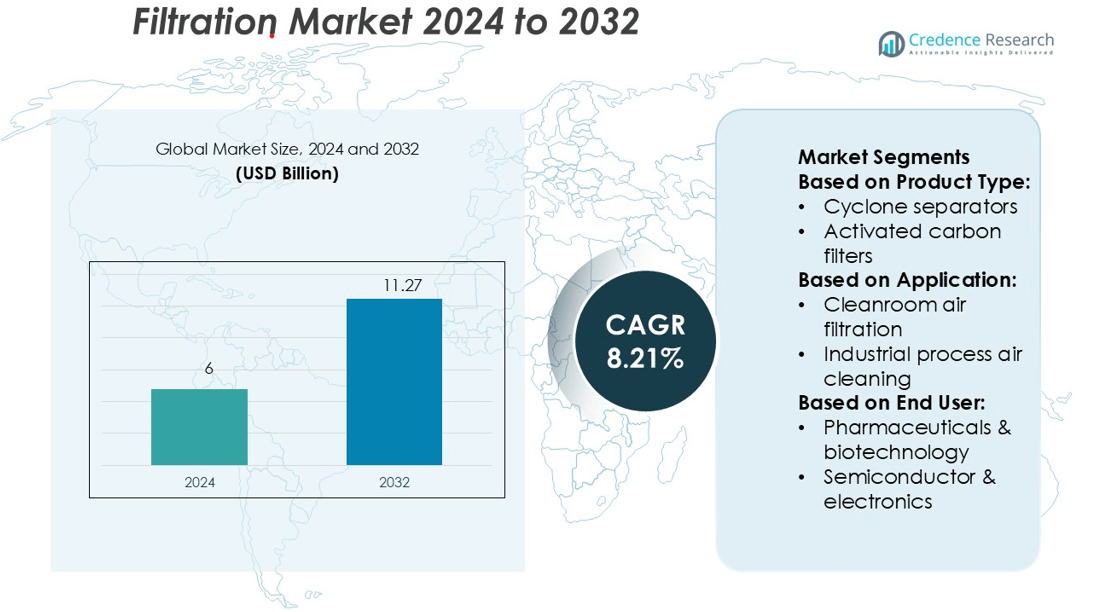

Filtration Market size was valued USD 6 billion in 2024 and is anticipated to reach USD 11.27 billion by 2032, at a CAGR of 8.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Filtration Market Size 2024 |

USD 6 billion |

| Filtration Market, CAGR |

8.21% |

| Filtration Market Size 2032 |

USD 11.27 billion |

The filtration market is driven by strong competition among top players such as Fives Group, Camfil, Lydall Gutsche, Donaldson, AAF, Filtration Group Corporation, BWF, Freudenberg, Absolent, and Cummins Filtration. These companies focus on expanding product portfolios, enhancing technological capabilities, and entering high-growth regions through strategic partnerships and acquisitions. Their investments in smart filtration systems, energy-efficient technologies, and sustainable filter media strengthen their market position. Asia Pacific leads the global filtration market with a 33.5% share, supported by rapid industrialization, expanding cleanroom infrastructure, and rising environmental regulations. This strong regional dominance attracts continued investment from major filtration manufacturers.

Market Insights

- The filtration market was valued at USD 6 billion in 2024 and is projected to reach USD 11.27 billion by 2032, growing at a CAGR of 8.21%.

- Rising demand for clean air, strict emission standards, and rapid industrial growth are driving market expansion across pharmaceutical, semiconductor, and manufacturing sectors.

- Growing adoption of smart filtration systems, nanofiber membranes, and energy-efficient technologies is shaping new market trends.

- Intense competition among major players is boosting investments in R&D, sustainable materials, and strategic regional expansion, strengthening global market positions.

- Asia Pacific leads with a 33.5% share, driven by industrialization and cleanroom growth, while HEPA filters hold the dominant product segment share due to their high efficiency and regulatory compliance advantages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

HEPA filters held the largest market share of 31.2% in 2024. These filters offer high particle retention efficiency, making them vital for cleanrooms, healthcare, and electronics manufacturing. Their ability to capture 99.97% of particles sized 0.3 microns strengthens their adoption in high-purity environments. HEPA filters are widely used in pharmaceutical production and semiconductor fabrication to maintain contamination-free spaces. Their compliance with strict regulatory standards further drives demand. Baghouse filters follow closely due to their suitability for heavy dust environments such as cement and power plants.

- For instance, Fives Group’s TGT® baghouse filters employ long filter bags of up to 8 m length with can velocities of 0.4–0.5 m/s, enabling stable low-pressure operation and extended bag life.

By Application

Cleanroom air filtration accounted for the largest market share of 29.8% in 2024. High demand from pharmaceutical, biotechnology, and semiconductor industries drives this segment. Strict environmental control requirements make advanced filtration systems essential to ensure product quality and regulatory compliance. Cleanrooms require HEPA and ULPA filters to control airborne particulate levels effectively. Increasing investment in biologics manufacturing and semiconductor fabs supports steady growth. HVAC system filtration and industrial process air cleaning also show strong expansion, driven by the push for energy-efficient buildings and pollution control.

- For instance, Camfil’s Megalam™ panel filters are available in pack depths of 53 mm, 70 mm or 100 mm, and deliver efficiencies from 95% at 0.3 µm up to 99.99995% at MPPS, meeting ULPA-level performance.

By End User

Pharmaceuticals and biotechnology dominated the market with a 27.4% share in 2024. High air purity standards in drug manufacturing and biologics production fuel the need for efficient filtration systems. HEPA and ULPA filters are widely integrated to maintain ISO Class cleanroom conditions. Rapid expansion of vaccine production facilities and biologics research boosts adoption. Stringent GMP compliance and quality assurance frameworks further reinforce the segment’s strength. The semiconductor and electronics sector also shows significant growth, supported by investments in chip fabrication and display panel manufacturing.Top of Form

Key Growth Drivers

Rising Demand for Clean Air and Regulatory Compliance

Stringent environmental regulations and workplace safety standards are driving demand for advanced filtration systems. Industries such as pharmaceuticals, food processing, and electronics rely on clean air to meet product quality and compliance standards. Governments are enforcing stricter emission norms to reduce airborne contaminants in industrial zones. This push encourages companies to adopt high-efficiency solutions like HEPA and activated carbon filters. Urban air pollution and indoor air quality concerns also fuel adoption in commercial buildings and HVAC systems, strengthening market growth worldwide.

- For instance, Lydall Gutsche’s microvel® PL filter elements were selected in a project for the Tušimice power plant, supplying 25,000 filter bags to handle a flue gas volume of 5.64 million m³/hour across four 200 MW units, ensuring particulate capture compliant with < 0.01% outlet emissions (i.e. greater than 99.99% efficiency).

Rapid Expansion of Pharmaceutical and Semiconductor Industries

The growing need for contamination-free manufacturing drives large-scale filtration system deployment in pharmaceutical and semiconductor facilities. Cleanroom air filtration ensures compliance with Good Manufacturing Practices (GMP) and ISO cleanroom standards. Global expansion of biologics production and chip fabrication plants accelerates demand for HEPA and ULPA filters. Rising investment in high-purity environments, especially in Asia Pacific and North America, supports industry growth. The increasing complexity of advanced manufacturing processes further boosts the need for efficient particulate control technologies.

- For instance, Donaldson’s LifeTec™ sterile filter elements for process gases and compressed air support filtration down to 0.03 micron pore size for high-purity air systems in drug fill lines and wafer fabrication tools.

Technological Advancements in Filtration Systems

Continuous innovation in filtration technologies improves efficiency, energy savings, and maintenance cycles. Smart filters equipped with sensors and IoT features allow real-time monitoring of air quality and filter performance. Nanofiber membranes, advanced coatings, and self-cleaning capabilities reduce operational costs and downtime. These technologies also enhance filtration accuracy and enable compliance with evolving regulatory standards. Industrial players are increasingly integrating automated systems to improve air handling efficiency, aligning with sustainability goals and supporting long-term market expansion across multiple end-use industries.

Key Trends & Opportunities

Adoption of Smart and IoT-Enabled Filtration Solutions

The market is witnessing rapid adoption of smart filtration systems that use sensors and digital monitoring. These solutions provide real-time data on filter performance, pressure drops, and air quality levels. Predictive maintenance capabilities reduce energy consumption and extend filter life. Facilities in manufacturing, healthcare, and commercial sectors are adopting such solutions to improve operational control. This trend opens strong opportunities for companies developing connected filtration products. The integration of AI and automation further enhances efficiency and aligns with Industry 4.0 goals.

- For instance, AAF’s Sensor360® platform uses battery-powered sensors installed upstream and downstream of filters to continuously measure particulate levels (PM1, PM2.5, PM10) and differential pressure.

Growing Focus on Energy-Efficient and Sustainable Filtration

Sustainability goals are pushing industries to adopt energy-efficient filtration systems. New materials like nanofibers and hybrid composites reduce pressure loss while maintaining high efficiency. Companies are investing in eco-friendly manufacturing methods and recyclable filter media to meet green building certifications and emission targets. Energy-efficient systems help reduce operational costs and carbon emissions. This trend is gaining traction in HVAC, cleanroom, and industrial applications. Manufacturers focusing on sustainable innovation are well-positioned to capture emerging opportunities in regulated markets.

- For instance, Filtration Group’s EnduroPleat® MERV-8 filters use a dual-component synthetic media that provides high dust holding capacity with low initial pressure drop. The frame and media are constructed to sustain longer service life while reducing energy burden.

Rising Investments in High-Tech Manufacturing Facilities

The rapid development of semiconductor fabs, biopharma plants, and precision manufacturing facilities creates strong demand for high-performance filtration systems. These environments require ultra-clean air to protect sensitive processes and ensure yield efficiency. Government incentives for local manufacturing and reshoring initiatives in the U.S., Europe, and Asia Pacific support this trend. Investments in next-generation fabs and life sciences clusters offer opportunities for filtration technology providers to expand product portfolios and secure long-term contracts with leading industry players.

Key Challenges

High Capital and Maintenance Costs

Advanced filtration systems require significant upfront investment and ongoing operational expenses. High-efficiency solutions such as HEPA and ULPA filters involve complex installation, energy use, and periodic replacements. This increases the total cost of ownership for industrial users, particularly in small and mid-sized enterprises. High maintenance costs may limit adoption in cost-sensitive sectors. Companies must balance efficiency and affordability to meet market expectations while maintaining compliance with environmental and cleanroom standards.

Complex Compliance and Standardization Issues

Filtration systems must meet multiple regional and international standards, including ISO, EPA, and ASHRAE guidelines. Frequent regulatory updates create operational challenges for manufacturers and end-users. Non-uniform standards across countries further complicate product certification and global expansion. Companies must continuously invest in product testing, documentation, and compliance strategies to stay competitive. This regulatory complexity increases lead times and costs, slowing market penetration for new entrants and limiting flexibility in product design.

Regional Analysis

North America

North America held a 31.2% share of the filtration market in 2024. The region benefits from strict air quality regulations set by agencies such as the EPA and OSHA, driving strong demand across industries. High adoption of HEPA and activated carbon filters in pharmaceuticals, automotive, and semiconductor manufacturing boosts growth. Major investments in cleanroom infrastructure and sustainable HVAC systems strengthen market penetration. The U.S. dominates the regional market with advanced technological capabilities and strong industrial presence. Continuous upgrades in industrial facilities and rising focus on emission control sustain long-term market expansion.

Europe

Europe accounted for a 27.6% share of the global filtration market in 2024. Strong regulatory frameworks under the EU’s Clean Air Policy and REACH drive the adoption of advanced filtration solutions. Germany, France, and the UK lead due to their well-established pharmaceutical, electronics, and automotive industries. Rapid investments in energy-efficient HVAC and emission control systems support market growth. The region emphasizes sustainable filtration materials and smart monitoring technologies. Strict indoor air quality standards in commercial and healthcare buildings further enhance demand, positioning Europe as a key hub for innovative filtration technologies.

Asia Pacific

Asia Pacific captured the largest share at 33.5% in 2024, making it the fastest-growing regional market. Rapid industrialization, urban expansion, and environmental concerns drive strong demand for air and emission control solutions. China, Japan, India, and South Korea lead due to their growing pharmaceutical, semiconductor, and automotive sectors. Government-backed clean air initiatives and manufacturing investments support market expansion. Increasing installation of HVAC filtration in commercial buildings and industrial process filtration systems boosts adoption. The region’s rising focus on cleanroom manufacturing and local production of advanced filters enhances its global competitiveness.

Latin America

Latin America held a 4.5% share of the global filtration market in 2024. The region is seeing steady adoption of filtration solutions in industrial and commercial applications. Brazil and Mexico drive demand through expanding automotive and food processing industries. Governments are implementing stricter emission and workplace safety regulations, supporting market development. Industrial modernization projects and investment in clean energy infrastructure increase filtration system deployment. Although cost sensitivity remains a challenge, demand for cost-effective and energy-efficient solutions is rising. Growing healthcare infrastructure also contributes to filtration adoption in hospitals and laboratories.

Middle East & Africa

The Middle East & Africa region accounted for a 3.2% share of the filtration market in 2024. The market is expanding gradually due to increasing industrialization, urban growth, and air quality concerns. GCC countries are investing in advanced filtration technologies to support clean energy and industrial diversification projects. Adoption is high in oil and gas facilities, commercial HVAC systems, and healthcare settings. South Africa and the UAE lead regional adoption with infrastructure modernization efforts. Though overall market penetration remains lower than other regions, ongoing investment in sustainable technologies supports future growth.

Market Segmentations:

By Product Type:

- Cyclone separators

- Activated carbon filters

By Application:

- Cleanroom air filtration

- Industrial process air cleaning

By End User:

- Pharmaceuticals & biotechnology

- Semiconductor & electronics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the filtration market is shaped by key players including Fives Group, Camfil, Lydall Gutsche, Donaldson, AAF, Filtration Group Corporation, BWF, Freudenberg, Absolent, and Cummins Filtration. The filtration market is highly dynamic, marked by strong technological innovation and expanding global reach. Companies are prioritizing product performance, energy efficiency, and compliance with strict environmental regulations. There is a clear shift toward smart filtration systems that offer real-time monitoring and predictive maintenance, improving operational reliability and lowering long-term costs. Many players focus on strengthening their presence in high-growth regions through strategic investments, partnerships, and capacity expansions. Sustainability remains central, with increased use of recyclable materials and eco-friendly production methods. Intense competition drives continuous advancements in filter media, automation, and system integration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fives Group

- Camfil

- Lydall Gutsche

- Donaldson

- AAF

- Filtration Group Corporation

- BWF

- Freudenberg

- Absolent

- Cummins Filtration

Recent Developments

- In July 2025, American Air Filter (AAF) introduces the BioCel VXL RC and VariCel VXL RC V-Bank Class of air filters, ushering in a new generation of high-performance air filters designed to perform better, last longer, and reduce maintenance time and total cost of ownership. Designed for use in HVAC systems in hospitals, schools, manufacturing plants, hotels, and other commercial facilities.

- In October 2024, Camfil USA announces the launch of the Absolute VG V-Bank HEPA filter an innovative solution for industries requiring high air purity, including life sciences, healthcare, and microelectronics.

- In September 2024, Donaldson Company is expanding its presence in the food and beverage markets by launching its filtration services in France, Germany and Austria. This initiative reinforces the company’s commitment to product and process integrity, with Donaldson specialists delivering their renowned innovation directly to customers’ locations.

- In August 2024, Mann+Hummel launched Mann-Filter Frecious Plus featuring nanofibers for cabin air filtration. The new filter is designed to effectively filter ultra-fine particles, as well as pollutants from both outside and inside the vehicle. It also offers proven protection against allergens, bacteria, and mol

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-efficiency filters will grow due to strict air quality regulations.

- Adoption of smart and IoT-enabled filtration systems will increase in industrial sectors.

- Cleanroom and controlled environment applications will expand in pharmaceuticals and electronics.

- Energy-efficient filtration technologies will become a key industry focus.

- Sustainable and recyclable filter media will gain strong market traction.

- Investments in semiconductor and biopharma facilities will boost advanced filtration demand.

- Rapid urbanization will drive HVAC and emission control system installations.

- Integration of nanotechnology will improve filtration performance and durability.

- Regulatory alignment across regions will support product standardization.

- Strategic partnerships and M&A activities will strengthen global market positions.