Market Overview

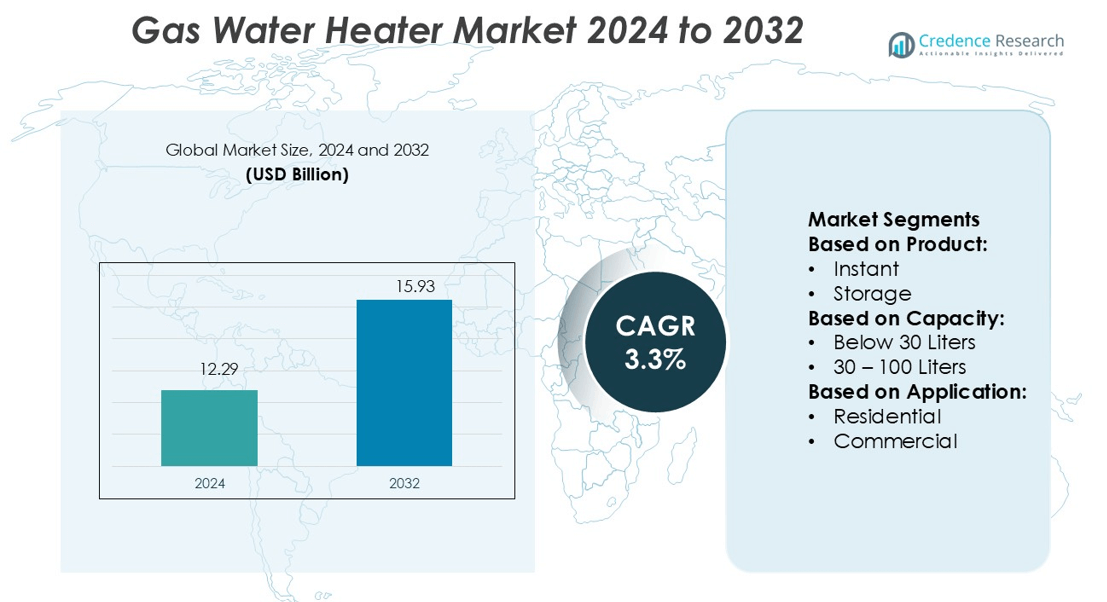

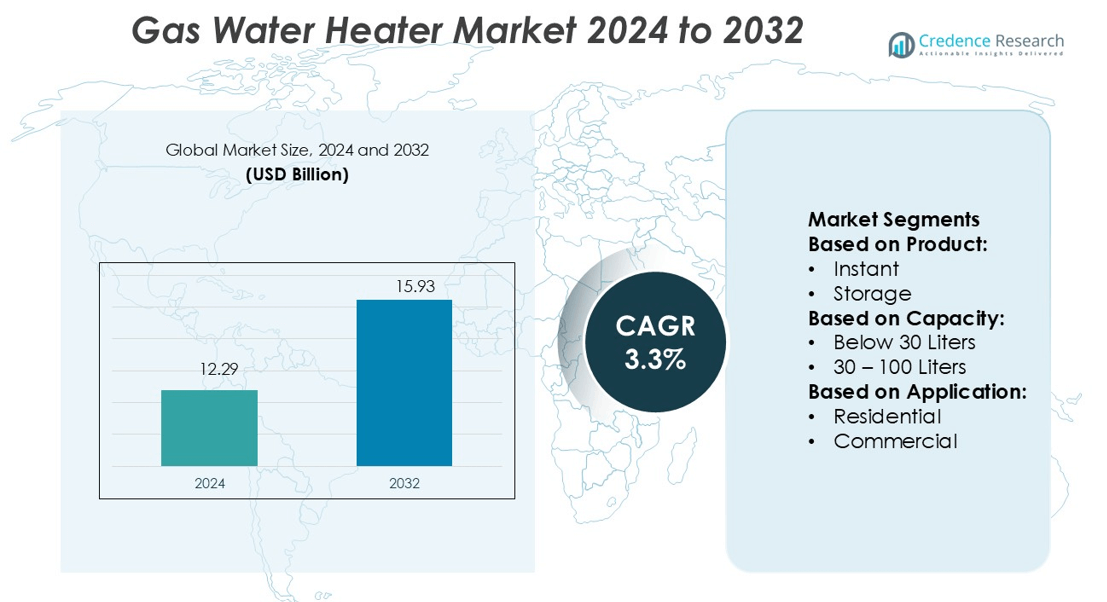

Gas Water Heater Market size was valued USD 12.29 billion in 2024 and is anticipated to reach USD 15.93 billion by 2032, at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Water Heater Market Size 2024 |

USD 12.29 billion |

| Gas Water Heater Market, CAGR |

3.3% |

| Gas Water Heater Market Size 2032 |

USD 15.93 billion |

The Gas Water Heater Market features strong competition among Bosch Thermotechnology, Jaquar India, Heatrae Sadia, A. O. Smith, Haier Inc., Havells India Ltd, GE Appliances, Groupe Atlantic, Bradford White Corporation, and Ariston Holding N.V. These companies focus on advanced energy-efficient technologies, smart connectivity, and product durability to expand their global footprint. Strategic investments in R&D and distribution networks further strengthen their positions. Asia Pacific leads the global market with a 37% share, driven by rapid urbanization, growing residential construction, and rising demand for affordable hot water solutions. Expanding government energy efficiency programs and strong consumer adoption across India, China, and Southeast Asia further support regional dominance.

Market Insights

- The Gas Water Heater Market size was valued at USD 12.29 billion in 2024 and is projected to reach USD 15.93 billion by 2032, at a CAGR of 3.3%.

- Rising demand for energy-efficient solutions and smart connectivity features is driving product innovation and market expansion.

- Leading players such as Bosch Thermotechnology, A. O. Smith, and Haier Inc. are investing in R&D and expanding distribution to strengthen their global presence.

- High initial costs and strict emission standards may limit adoption in some developing regions, creating short-term market restraints.

- Asia Pacific holds a 37% market share, supported by rapid urbanization and strong construction activity, while the tankless gas water heater segment leads due to space-saving benefits and improved energy performance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The instant gas water heater segment holds the dominant share of 56.7% in the market. Instant systems deliver hot water on demand, reduce energy loss, and occupy less space, which makes them ideal for urban homes. Their fast heating ability supports rising consumer demand for efficiency and convenience. In contrast, storage-type heaters suit larger households or commercial settings but face slower growth. Increasing energy efficiency regulations and growing consumer awareness are strengthening the adoption of instant water heaters across residential and light commercial applications.

- For instance, Bosch Thermotechnology offers tankless water heaters designed to support a continuous hot water supply with reduced standby loss. These models can achieve high flow rates, such as 17.8 liters per minute, and operate with high energy efficiency, for example, with an energy factor of 0.82.

By Capacity

The below 30 liters capacity segment accounts for 43.2% of the market share. Compact design, faster heating cycles, and lower installation costs make this range highly suitable for apartments and small households. Rising urban housing development and the growing trend of nuclear families are driving demand for this segment. Larger capacity ranges, including 30–100 liters and above, cater to hotels, institutions, and commercial buildings but grow at a slower pace due to higher space and energy needs.

- For instance, Jaquar India has expanded its small-capacity water heater portfolio with models that combine high thermal efficiency and compact dimensions. The Elena Prime 25 L model features a 25-liter glass-lined inner tank, a 2 kW heating element, and an 0.8 MPa pressure rating designed for high-rise apartments.

By Application

The residential application segment dominates with a 64.5% share. The strong presence of middle-class households, urbanization, and expanding smart home adoption drive this segment. Consumers prioritize efficient heating, cost savings, and compact designs. The commercial, college/university, and government/military segments follow, driven by infrastructure modernization and higher hot water consumption levels. However, residential applications remain the core revenue generator, supported by strong replacement and new installation demand.

Key Growth Drivers

Rising Residential Demand and Urban Infrastructure Development

Growing urbanization and rapid housing expansion are increasing the adoption of gas water heaters in households. Compact designs, instant heating capability, and lower energy costs make these systems attractive for urban dwellings. Real estate developers are integrating energy-efficient water heating solutions into modern residential projects. Rising disposable incomes and improving living standards are further fueling replacement and new unit installations. These factors collectively strengthen the residential segment’s dominance and create sustained demand for advanced gas water heater solutions across emerging and developed economies.

- For instance, Heatrae Sadia’s Multipoint Instantaneous 9 kW model supports efficient water heating for single or dual outlets in compact homes with zero standing heat loss. The actual flow rate is dependent on the desired temperature rise but can be up to 4.5 liters per minute under typical conditions.

Shift Toward Energy-Efficient and Cost-Effective Solutions

Consumers are increasingly prioritizing energy savings and long-term cost benefits in water heating systems. Gas water heaters offer faster heating times and lower operational costs compared to electric models, driving their appeal in both residential and commercial sectors. Governments are promoting energy-efficient products through rebates and green building incentives. Manufacturers are focusing on high-efficiency burners and smart temperature control technologies. This focus on performance and sustainability is accelerating market growth and encouraging wider adoption among environmentally conscious and cost-sensitive consumers.

- For instance, A. O. Smith’s Vertex™ High Value Condensing gas heater (HV 50-gallon model) delivers a first-hour rating of 118 gallons from a 50-gallon tank while achieving a Uniform Energy Factor (UEF) of 0.90.

Expansion of Commercial and Institutional Applications

Commercial facilities such as hotels, hospitals, universities, and office buildings are rapidly adopting gas water heaters to meet high hot water demands. These systems provide faster heating and better temperature control, improving operational efficiency. Institutional infrastructure upgrades, driven by energy efficiency standards, support steady installation growth. The ability to scale capacity across large buildings strengthens their competitive position against electric alternatives. This expansion of non-residential applications is broadening the overall market base and encouraging suppliers to develop specialized high-capacity systems.

Key Trends & Opportunities

Integration of Smart and Connected Technologies

IoT-enabled water heaters are gaining traction, offering real-time monitoring, remote control, and predictive maintenance. Consumers favor devices that link with smart home systems for energy tracking and convenience. Manufacturers like Rinnai and AO Smith are investing in digital integration to enhance usability and energy management. The growing adoption of smart city infrastructure creates opportunities for connected heating systems across urban households and hospitality sectors.

- For instance, Haier’s M8 heat pump water heater uses dual-power heating—1,200 W heat pump plus auxiliary electric support—to ensure output under low ambient temperatures.

Shift Toward Eco-Friendly and Low-NOx Models

The market is witnessing a shift toward low-NOx emission gas water heaters to comply with global environmental standards. Governments and manufacturers are collaborating to reduce carbon footprints through green product lines. These models use improved burner technology that minimizes nitrogen oxide emissions while maintaining heating efficiency. The trend aligns with sustainability goals and offers growth potential in regions enforcing strict emission regulations such as Europe and North America.

- For instance, Havells unveiled a Made-in-India heat pump water heater that can produce up to 129 litres of hot water and maintain outlet temperatures up to 75 °C under ambient conditions.

Expansion in Commercial and Institutional Applications

Commercial buildings, educational institutions, and healthcare facilities are increasing their use of high-capacity gas water heaters. Continuous demand for reliable hot water supply in hotels, offices, and universities encourages bulk installations. Manufacturers offer modular systems and centralized heating solutions to meet these requirements. This diversification into large-scale applications broadens the market scope beyond residential usage and presents long-term business opportunities.

Key Challenges

Fluctuating Natural Gas Prices and Supply Constraints

Unstable natural gas prices directly impact product affordability and consumer adoption. Market growth faces risk in regions dependent on gas imports or affected by supply disruptions. Rising fuel costs can shift consumer preference toward electric or solar heaters. Manufacturers must manage cost pressures while maintaining product competitiveness through efficient designs and alternative material sourcing strategies.

High Installation and Maintenance Costs

Installation and maintenance costs remain a major barrier, especially for advanced models requiring professional setup and periodic servicing. Commercial-grade systems demand specialized installation infrastructure, raising upfront investment. In cost-sensitive markets, this limits adoption despite performance benefits. To overcome this challenge, manufacturers focus on offering compact, easy-to-install designs and extended warranty services to attract residential consumers and small-scale users.

Regional Analysis

North America

North America holds a 28.7% share of the global gas water heater market. The region benefits from advanced infrastructure, high natural gas availability, and strong adoption of energy-efficient technologies. The U.S. leads demand, supported by smart home integration and government incentives promoting low-emission heating systems. Residential applications dominate, while commercial segments like hospitality and healthcare also drive steady growth. Major manufacturers such as Rheem and A. O. Smith strengthen their positions through product innovation and distribution networks. Rising replacement of electric units with high-efficiency gas models further fuels market expansion in this region.

Europe

Europe accounts for 24.3% of the global market, driven by strict emission regulations and rapid adoption of low-NOx gas water heaters. Countries such as Germany, the UK, and France emphasize eco-friendly heating systems to align with carbon neutrality goals. The residential sector leads demand, supported by growing retrofitting activities in older buildings. Government rebates and regulatory standards accelerate replacement of outdated heating systems. Energy-efficient condensing models and compact storage heaters remain popular. Expanding commercial and institutional applications in hospitality and education sectors also contribute to steady growth across key European markets.

Asia Pacific

Asia Pacific dominates the global market with a 34.9% share, fueled by rapid urbanization, infrastructure development, and rising middle-class populations. China, India, and Japan lead consumption, supported by increasing residential construction and commercial expansion. Affordable pricing, product availability, and rising awareness of energy efficiency strengthen adoption. Instant and below-30-liter capacity heaters remain preferred choices for compact urban households. Government initiatives to promote cleaner fuel use also support growth. Global and local manufacturers are expanding their distribution networks to meet rising demand, positioning the region as the fastest-growing market globally.

Latin America

Latin America holds a 6.8% share of the global gas water heater market. Brazil and Mexico lead demand, supported by urbanization and moderate natural gas infrastructure development. Residential users dominate consumption due to the growing middle-class population and housing expansion. Commercial adoption is rising in hospitality and educational facilities. Manufacturers focus on introducing affordable and energy-efficient models tailored to cost-sensitive consumers. However, slower regulatory implementation and uneven gas supply infrastructure limit rapid market penetration compared to developed regions.

Middle East & Africa

The Middle East & Africa region represents 5.3% of the global market share. Demand is supported by infrastructure modernization, rising residential construction, and growing hospitality projects. Gulf countries such as the UAE and Saudi Arabia drive demand through large-scale housing projects and commercial developments. Instant gas water heaters are preferred due to space-saving features and rapid heating. Limited gas pipeline networks in some African countries pose growth challenges. However, government-led infrastructure investments and expanding urban centers create promising opportunities for manufacturers in the medium to long term.

Market Segmentations:

By Product:

By Capacity:

- Below 30 Liters

- 30 – 100 Liters

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The gas water heater market features strong competition among Bosch Thermotechnology, Jaquar India, Heatrae Sadia, A. O. Smith, Haier Inc., Havells India Ltd, GE Appliances, Groupe Atlantic, Bradford White Corporation, and Ariston Holding N.V. The gas water heater market is highly competitive, driven by innovation, product diversification, and regional expansion. Manufacturers focus on integrating advanced technologies such as smart connectivity, low-NOx burners, and high-efficiency heating systems to meet evolving customer needs. Companies are expanding their portfolios with both instant and storage models, targeting residential, commercial, and institutional applications. Strategic partnerships with distributors and retailers help strengthen market reach across key growth regions. R&D investments in energy-efficient designs and eco-friendly materials align with tightening global energy standards. This competitive environment pushes companies to enhance performance, reduce emissions, and offer more value-added features.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, LG Electronics acquired Norway-based OSO Group, a specialist in premium stainless-steel water heaters. The move enhances LG’s HVAC portfolio, especially in Europe. OSO’s technology will support LG’s integrated heat pump and water heating solutions. OSO will continue to operate independently under LG’s ownership.

- In May 2025, Ariston Group and Lennox formed a joint venture to introduce Lennox-branded residential water heaters in North America by 2026. Ariston holds a stake, while Lennox owns. Product will be sold through Lennox’s dealer network and distributors. Ariston will continue offering its own brands separately.

- In April 2025, Essency, the prominent manufacturer of the award-winning Essency EXR water heater, announced a partnership with The Blumenauer Corporation as its new manufacturer’s representative for the state of Florida.

- In January 2024, AO Smith launched the Adapt Premium Condensing Gas Tankless Water Heaters equipped with X3 Scale Prevention Technology. They key features include an integrated recirculation pump, patented heat exchanger, enhanced installation flexibility and highly efficient performance

Report Coverage

The research report offers an in-depth analysis based on Product, Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient gas water heaters will increase with stricter energy regulations.

- Hybrid and condensing technologies will gain wider adoption across residential and commercial sectors.

- Smart control features and IoT integration will drive product innovation.

- Manufacturers will focus on low-emission models to meet environmental standards.

- Replacement demand will grow as old units reach the end of their lifecycle.

- Urban infrastructure development will boost installations in emerging economies.

- Government incentives for clean energy appliances will support market growth.

- Compact and tankless designs will become more popular among space-conscious consumers.

- Distribution networks will expand through online retail and dealer partnerships.

- Global players will strengthen their market positions through mergers and acquisitions.