Market Overview

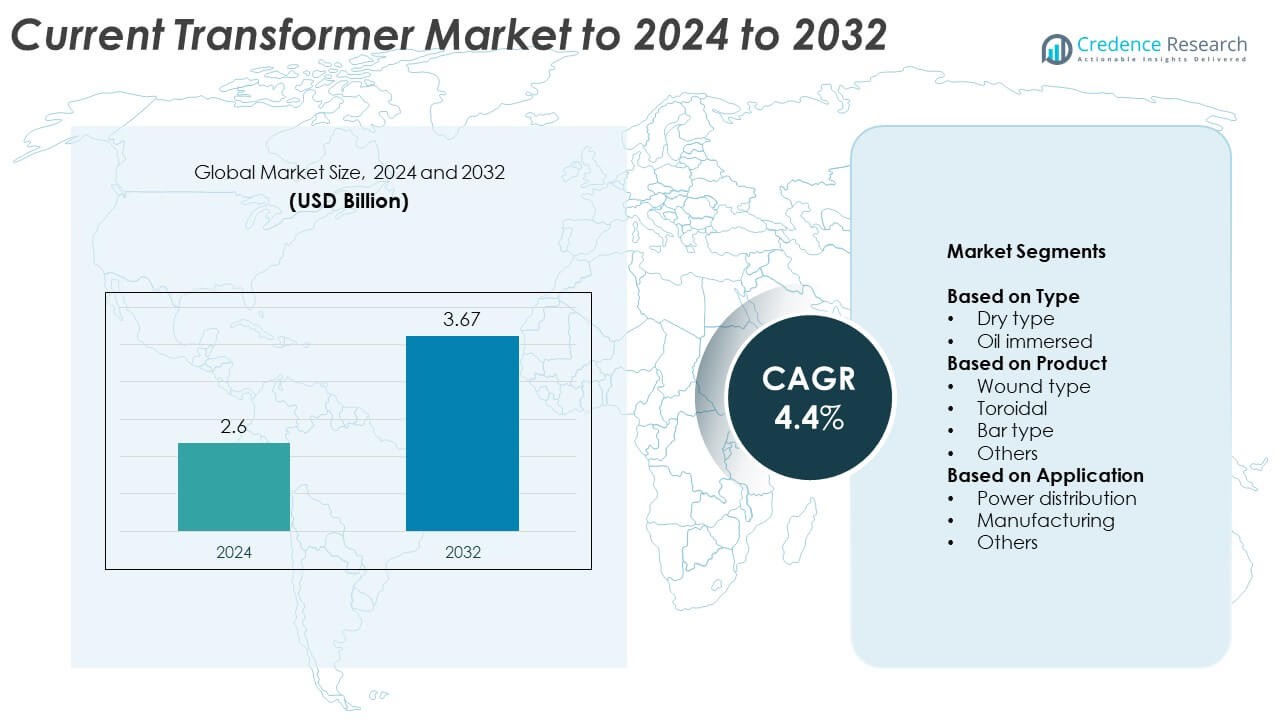

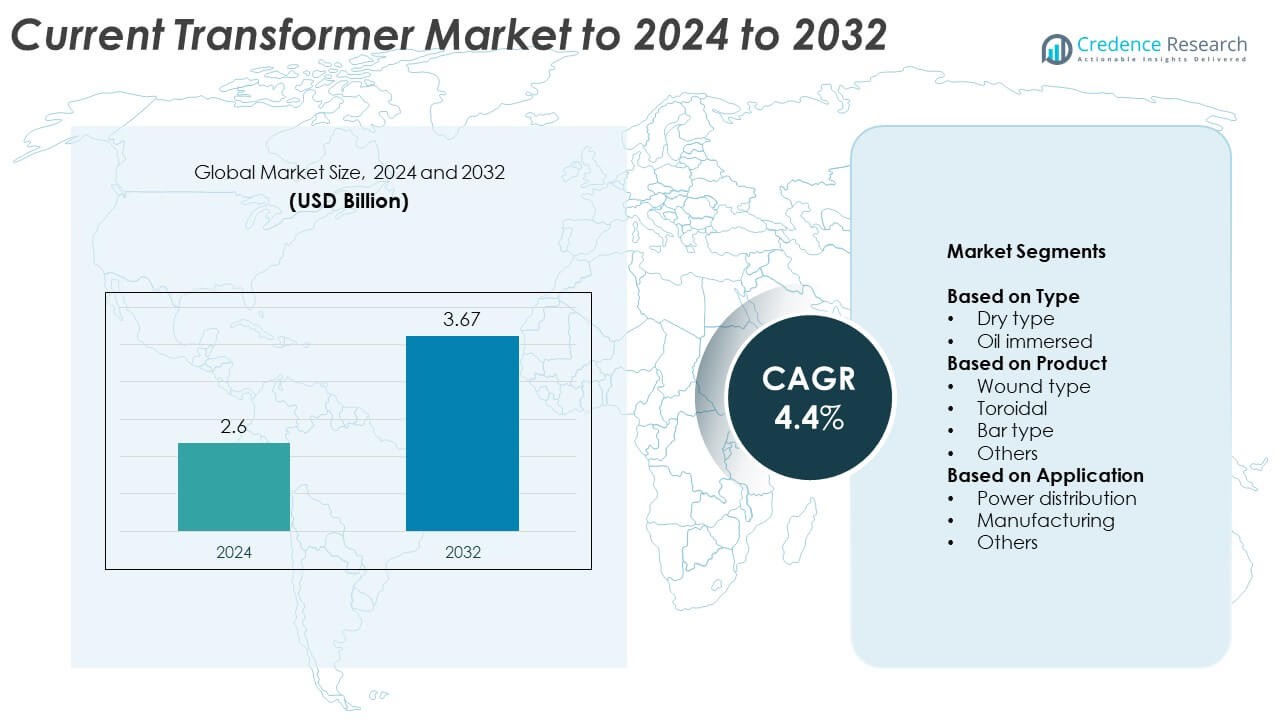

Current Transformer Market size was valued USD 2.6 Billion in 2024 and is anticipated to reach USD 3.67 Billion by 2032, at a CAGR of 4.4 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Current Transformer Market Size 2024 |

USD 2.6 Billion |

| Current Transformer Market, CAGR |

4.4 % |

| Current Transformer Market Size 2032 |

USD 3.67 Billion |

The current transformer market is led by major companies such as Siemens Energy, Eaton Corporation, GE Vernova T&D India, Hitachi Energy, and Schneider Electric. These players focus on advancing digital monitoring, improving accuracy, and supporting grid modernization efforts across industries. Strategic partnerships and R&D investments are strengthening their positions in both developed and emerging markets. Asia Pacific emerged as the leading region in 2024, capturing 34% of the global market share, driven by expanding power infrastructure and industrial automation. North America and Europe followed, supported by strong renewable integration and smart grid initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The current transformer market was valued at USD 2.6 Billion in 2024 and is projected to reach USD 3.67 Billion by 2032, growing at a CAGR of 4.4%.

- Rising demand for grid modernization, renewable integration, and industrial automation is driving market expansion globally.

- The market is witnessing trends such as IoT-enabled smart transformers, improved energy efficiency, and adoption of eco-friendly insulation materials.

- Leading companies are focusing on technological innovation, product reliability, and digital transformation to maintain competitiveness, while smaller players emphasize niche applications and cost efficiency.

- Asia Pacific leads the market with 34% share, followed by North America at 28% and Europe at 26%, while the dry-type segment holds the largest share of 58% due to safety and low maintenance benefits.

Market Segmentation Analysis:

By Type

The dry-type segment dominated the current transformer market in 2024 with a market share of around 58%. This dominance is driven by its superior safety, low maintenance, and suitability for indoor installations. Dry-type transformers eliminate the risk of oil leakage, making them ideal for urban and industrial applications where environmental safety is critical. They also offer better fire resistance and easier installation compared to oil-immersed types. The growing focus on sustainable and low-emission equipment across utilities and smart grid infrastructure further supports the adoption of dry-type transformers globally.

- For instance, TE Connectivity’s Crompton CTs specify 3 kV/1 min test voltage and 1.2× continuous overload at 50/60 Hz and 720 V system rating.

By Product

The toroidal segment held the largest share of about 42% in 2024. Toroidal transformers are widely used for their compact design, high accuracy, and low magnetic interference. Their efficiency in measuring alternating current and reduced energy losses make them preferred for advanced metering and protective relays. The demand for toroidal transformers is expanding due to their role in renewable energy grids and power quality monitoring systems. Additionally, their integration in modern industrial automation and substation equipment strengthens their position as the leading product category.

- For instance, the Hammond Manufacturing CT400A is a current transformer with a standard ratio of 400:5, which can achieve an accuracy of 1.2% at a 10 VA burden.

By Application

The power distribution segment accounted for the largest share of nearly 61% in 2024. This segment benefits from rising investments in grid modernization and urban electrification projects. Current transformers are essential in substations and transmission networks for accurate current measurement and fault detection. The increasing focus on smart grids, load management, and renewable energy integration further boosts adoption. Utilities favor these transformers for their reliability and precision in maintaining grid stability, driving continuous demand across developed and emerging regions.

Key Growth Drivers

Rising Demand for Grid Modernization

The global shift toward smart and digitalized power grids is a key growth driver for the current transformer market. Governments and utilities are upgrading transmission and distribution systems to enhance grid reliability and efficiency. Current transformers play a vital role in enabling real-time monitoring and fault detection in these networks. Growing urbanization and renewable energy integration further accelerate demand for high-accuracy transformers, ensuring efficient power flow and safety across utility networks.

- For instance, Siemens Energy’s digital substation concept integrates Sensformer units rated 40 MVA each and LPIT sensors. Process-bus designs minimize copper and enable real-time monitoring.

Expansion of Industrial and Manufacturing Sectors

Industrial growth, particularly in manufacturing and heavy engineering, is fueling the use of current transformers for power measurement and energy management. As industries adopt automation and high-power machinery, the need for precise current monitoring rises. These transformers help prevent equipment damage and energy losses by maintaining stable power flow. The rapid development of industrial hubs in Asia-Pacific and the Middle East strengthens the market outlook for reliable and durable transformer systems.

- For instance, Schneider Electric’s EcoStruxure Asset Advisor was implemented for a new electrical substation at BASF’s Beaumont, Texas, plant to enhance electrical asset visibility. The system remotely monitors over 60 critical assets and measures more than 100 variables, enabling more predictable performance, improving safety, and increasing operational efficiency through continuous condition monitoring.

Emphasis on Renewable Energy Integration

The accelerating integration of renewable energy sources is boosting the installation of current transformers in solar and wind power systems. These transformers support accurate current measurement and fault detection, ensuring grid stability with variable power inputs. Energy transition policies in Europe, North America, and Asia are encouraging the modernization of substations and monitoring infrastructure. This trend aligns with sustainability goals and drives new investments in transformer technology compatible with renewable networks.

Key Trends and Opportunities

Adoption of Digital and Smart Transformers

The market is witnessing a growing shift toward digital current transformers featuring IoT connectivity and data analytics. These smart devices provide real-time diagnostics and remote monitoring, improving operational efficiency and reducing downtime. Utilities are increasingly adopting these systems to enhance predictive maintenance and asset management. As digital transformation continues across the power sector, manufacturers focusing on intelligent transformer solutions are gaining a competitive edge.

- For instance, ABB highlights IEC 61869-10/-11 requirements for low-power passive current and voltage transformers used with merging units.

Growing Focus on Energy Efficiency and Safety Standards

Rising regulatory emphasis on energy efficiency and electrical safety is shaping product innovation in the market. Governments and utilities are enforcing strict standards for transformer design, testing, and operation. Manufacturers are investing in advanced insulation materials, low-loss cores, and eco-friendly production methods. This trend not only enhances performance but also supports global carbon reduction goals, positioning compliant manufacturers for long-term growth opportunities.

- For instance, Beckhoff’s SCT current transformers conform to IEC 61869, detailing accuracy-class behavior versus rated current.

Key Challenges

High Installation and Maintenance Costs

One major challenge is the high cost associated with the installation and maintenance of current transformers. Utilities and industries often face budget constraints when deploying large-scale monitoring systems. Additionally, the replacement or calibration of aging equipment adds to operational expenses. This financial burden limits adoption in small-scale and developing infrastructure projects, slowing market penetration in cost-sensitive regions.

Complexities in Calibration and Measurement Accuracy

Maintaining high measurement accuracy over time is a persistent challenge for current transformers. Environmental factors, insulation aging, and mechanical stress can affect calibration. Inaccurate readings may lead to power losses or faulty protection relay operations. Manufacturers are focusing on improving materials and design precision to overcome these issues. However, ensuring consistent performance under varying load and temperature conditions remains a significant technical barrier.

Regional Analysis

North America

North America accounted for around 28% of the current transformer market share in 2024. The region’s growth is driven by aging grid infrastructure upgrades and strong renewable integration targets in the United States and Canada. Rising investments in smart grids, digital substations, and industrial automation further enhance product adoption. Utilities prioritize reliable monitoring equipment to reduce downtime and power losses. The presence of major energy solution providers and favorable regulatory standards for safety and energy efficiency continue to support steady market expansion across North American industrial and utility applications.

Europe

Europe held about 26% of the global market share in 2024, driven by its commitment to sustainable energy and modernized grid systems. Countries such as Germany, France, and the United Kingdom are investing heavily in smart grid technologies and renewable integration. The region’s emphasis on decarbonization and energy transition supports steady demand for high-accuracy current transformers. Strict regulatory frameworks related to efficiency and environmental safety further push technological advancements. Growth is also supported by the strong presence of leading manufacturers focusing on innovative and eco-friendly transformer solutions across the European energy sector.

Asia Pacific

Asia Pacific dominated the global market with a 34% share in 2024, driven by rapid industrialization and expanding power infrastructure in China, India, and Japan. Growing urban electricity demand and government-backed grid modernization programs are boosting market growth. Manufacturers benefit from large-scale renewable energy installations and industrial automation initiatives. Additionally, increasing investments in smart cities and efficient transmission networks continue to create opportunities for product deployment. Rising emphasis on energy security and continuous technological upgrades further strengthen Asia Pacific’s position as the leading regional market.

Latin America

Latin America captured nearly 7% of the current transformer market share in 2024. The region’s growth is mainly influenced by expanding power distribution networks and increasing industrialization in Brazil, Mexico, and Argentina. Government efforts to reduce power losses and improve grid reliability are encouraging the use of advanced transformer technologies. Rising renewable projects, particularly solar and wind installations, are also fueling demand. However, economic fluctuations and limited infrastructure investment present challenges to faster market adoption. Continuous modernization initiatives and supportive policies are expected to maintain moderate growth across the region.

Middle East and Africa

The Middle East and Africa region accounted for approximately 5% of the global market share in 2024. The market benefits from expanding electricity access programs, ongoing urbanization, and large-scale infrastructure projects. Gulf countries are investing heavily in grid reinforcement and smart monitoring systems to support their industrial and renewable sectors. Africa’s growing energy demand is pushing investments in transmission and distribution networks. However, the market faces constraints from limited local manufacturing and slower adoption of advanced technologies. Continued government focus on electrification and reliability improvements supports gradual market development.

Market Segmentations:

By Type

By Product

- Wound type

- Toroidal

- Bar type

- Others

By Application

- Power distribution

- Manufacturing

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The current transformer market features prominent players such as Siemens Energy, Eaton Corporation, GE Vernova T&D India, Hitachi Energy, Schneider Electric, CG Power & Industrial Solutions, ARTECHE, ABB, Hammond Manufacturing, Circutor, NISSIN ELECTRIC, Littelfuse, RECO Transformers, Amran, and Instrument Transformers. The competitive landscape is characterized by innovation-driven strategies focused on digitalization, energy efficiency, and smart grid integration. Companies are prioritizing product development that enhances measurement accuracy, safety, and remote monitoring capabilities. Strategic collaborations with utility providers and industrial automation firms are expanding global footprints. Increasing investments in research and development are fueling the adoption of IoT-enabled and eco-friendly transformer solutions. Manufacturers are also targeting renewable energy and infrastructure modernization projects to strengthen market presence. Competitive differentiation is achieved through customized solutions, compliance with regulatory standards, and after-sales services that ensure operational reliability and lifecycle optimization across power, industrial, and renewable applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens Energy

- Eaton Corporation

- GE Vernova T&D India

- Hitachi Energy

- Schneider Electric

- CG Power & Industrial Solutions

- ARTECHE

- ABB

- Hammond Manufacturing

- Circutor

- NISSIN ELECTRIC

- Littelfuse

- RECO Transformers

- Amran

- Instrument Transformers

Recent Developments

- In 2025, GE Vernova T&D India secured an order from Power Grid Corporation of India Ltd (POWERGRID) to supply over 70 extra-high-voltage (EHV) 765 kV class transformers and shunt reactors.

- In 2025, Hitachi Energy India secured a major order to supply 30 units of 765 kV 500 MVA single-phase transformers to Power Grid Corporation of India Limited to support the country’s grid expansion.

- In 2024, Siemens Energy Announced the launch of a new generation of current transformers that offer enhanced accuracy and durability for high-voltage applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising grid modernization and smart infrastructure projects.

- Demand for digital and IoT-enabled current transformers will grow across utilities.

- Renewable energy integration will continue to drive transformer installation in solar and wind systems.

- Asia Pacific will remain the dominant region with strong industrial and urban development.

- Manufacturers will focus on compact, energy-efficient, and eco-friendly transformer designs.

- Investments in smart grids and predictive maintenance will enhance product adoption.

- Technological innovation will improve accuracy, reliability, and safety in power monitoring.

- Government initiatives supporting energy efficiency will accelerate market growth.

- Expansion of manufacturing and automation sectors will sustain steady demand.

- Long-term partnerships between utilities and technology firms will shape future advancements.