Market Overview

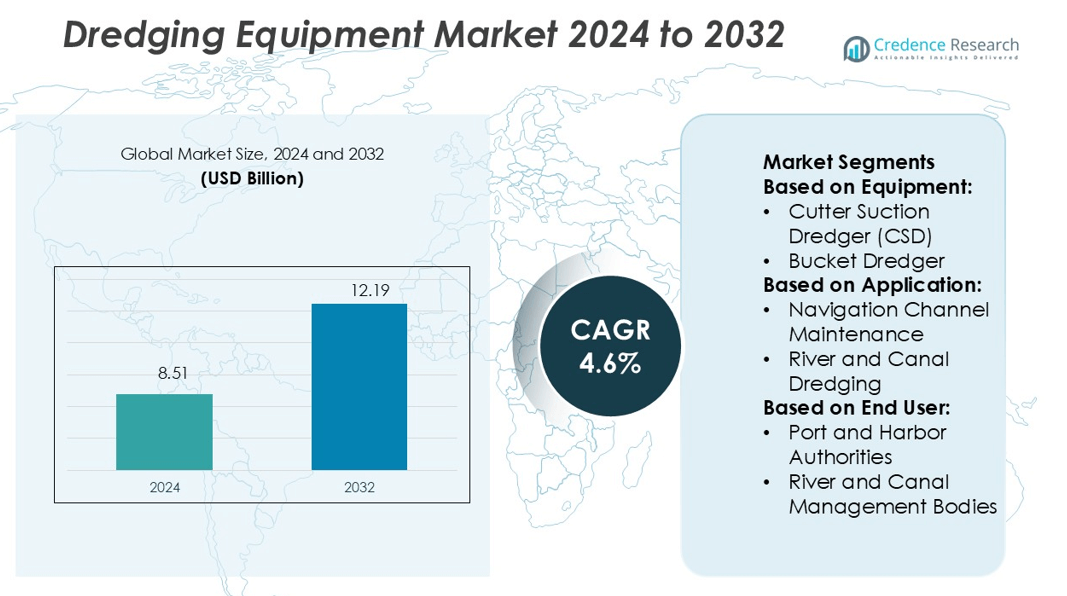

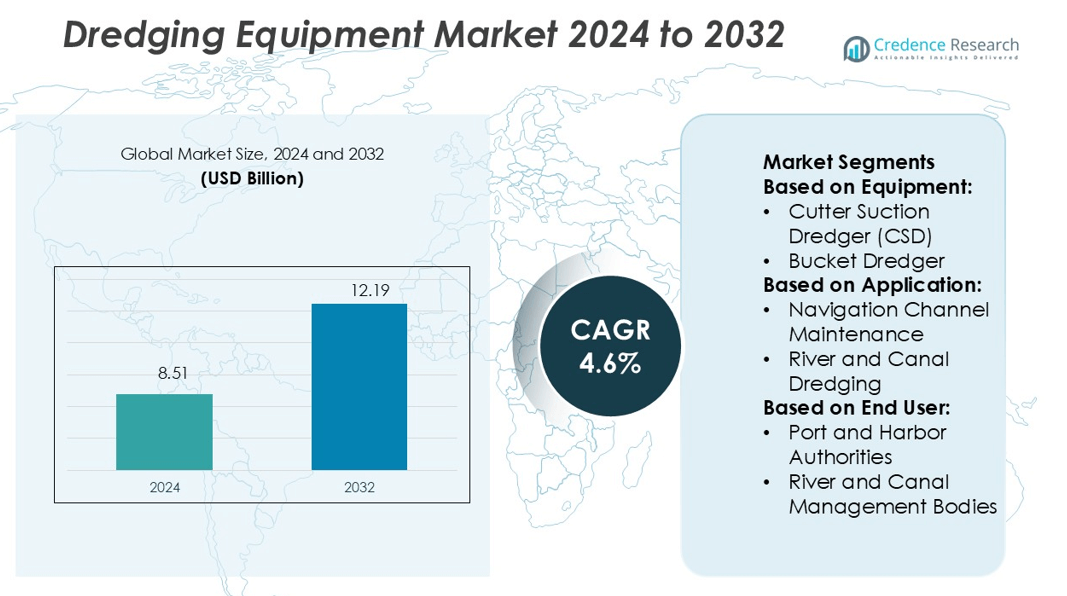

Dredging Equipment Market size was valued USD 8.51 billion in 2024 and is anticipated to reach USD 12.19 billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dredging Equipment Market Size 2024 |

USD 8.51 billion |

| Dredging Equipment Market, CAGR |

4.6% |

| Dredging Equipment Market Size 2032 |

USD 12.19 billion |

The dredging equipment market is shaped by leading companies such as Hitachi Construction Machinery, Liebherr, Sany, Doosan, Caterpillar, Terex, Komatsu, Volvo, Deere & Co., and CNH Industrial. These manufacturers focus on innovation, automation, and energy-efficient solutions to strengthen their global market position. Advanced dredging technologies, strategic collaborations, and robust service networks enhance their competitive edge. Asia Pacific leads the global dredging equipment market with a 32.4% share, driven by extensive port modernization, large-scale reclamation projects, and offshore energy investments. The region’s strong manufacturing base and government-led infrastructure initiatives further consolidate its dominant position in the global market.

Market Insights

- The dredging equipment market was valued at USD 8.51 billion in 2024 and is expected to reach USD 12.19 billion by 2032, growing at a CAGR of 4.6%.

- Growing port modernization, offshore energy expansion, and coastal protection projects are driving strong equipment demand.

- Rising automation, AI integration, and sustainable dredging technologies are shaping key market trends and enhancing operational efficiency.

- Asia Pacific leads the market with a 32.4% share, followed by North America at 27.3% and Europe at 24.8%, supported by extensive reclamation and port infrastructure programs.

- Cutter suction dredgers dominate the equipment segment with the largest market share, supported by increasing usage in large-scale infrastructure and energy projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Equipment

Cutter Suction Dredger (CSD) dominates the equipment segment with a 42.7% market share. CSDs offer continuous dredging operations and high output efficiency, making them ideal for large-scale projects. Their ability to handle compact and cohesive materials boosts their adoption in port deepening and reclamation work. Mechanical dredgers, bucket dredgers, backhoe dredgers, and grab dredgers serve niche applications such as maintenance dredging and small-scale operations. Growing investments in port infrastructure and shipping routes further strengthen CSD demand, supported by advancements in automation, pump efficiency, and modular design.

- For instance, Liebherr uses its HS 8100.1 duty cycle crawler crane with a rope diameter of 34 mm, rope speed up to 96 m/min, and line pull of 275 kN on the first layer.

By Application

Port and Harbor Deepening holds the largest share of 38.5% in the application segment. Rising global seaborne trade and expanding container traffic increase the need for deeper ports and navigation channels. Dredging supports the accommodation of larger vessels and efficient cargo handling. Land reclamation and coastal protection also witness rising demand due to urbanization and climate resilience initiatives. Capital dredging remains crucial for infrastructure expansion in emerging economies. The growing focus on offshore trade hubs and logistics development continues to drive sustained investments in dredging projects.

- For instance, Bobcat T7X all-electric compact track loader is powered by a 72.6-kilowatt-hour lithium-ion battery, providing up to six hours of continuous operation on a single charge. The actual run time can vary depending on the application and usage.

By End User

Port and Harbor Authorities lead the end-user segment with a 36.2% market share. These authorities are key operators of dredging projects for maintaining navigable waterways and expanding berthing capacity. Government and municipal bodies follow closely, focusing on coastal defense and flood protection. River and canal management entities prioritize maintenance dredging to ensure smooth inland navigation. The oil and gas sector leverages dredging for offshore platform support and subsea pipeline installation. The increasing collaboration between port operators and dredging contractors accelerates long-term infrastructure development across global trade corridors.

Key Growth Drivers

Expansion of Global Trade and Port Infrastructure

Growing international trade volumes and port expansions are driving dredging equipment demand. Many countries are investing in port modernization to handle larger vessels and increase cargo throughput. For instance, major Asian ports have deepened channels to accommodate Panamax and post-Panamax ships. This expansion supports trade competitiveness and enhances global connectivity. Rising port infrastructure projects in China, India, and the Middle East strengthen the need for advanced cutter suction and mechanical dredgers. As trade flows grow, governments and private operators are prioritizing deeper, wider, and more efficient shipping routes.

- For instance, Abbott’s HeartMate 3 heart pump, in the MOMENTUM 3 trial involving more than 1,000 patients, showed that the five-year survival rate was 58.4%, compared to 43.7% in the control arm with HeartMate II.

Coastal Protection and Land Reclamation Projects

Rising sea levels and coastal erosion are increasing coastal protection and land reclamation activities worldwide. Governments are investing in dredging projects to safeguard infrastructure, expand land use, and enhance flood resilience. Countries such as the Netherlands, Singapore, and the UAE are leading large-scale reclamation programs. Advanced dredgers enable precise material removal and placement, improving operational efficiency. This trend boosts demand for high-capacity equipment capable of handling complex environmental conditions. Coastal protection initiatives are also tied to climate adaptation strategies, reinforcing long-term dredging needs.

- For instance, Henry Schein offers a Blood Control IV Catheter in a 20-gauge size with a beveled tip, available in a 1-inch or 1.16-inch length. The product is packaged 50 units per box and 4 boxes per case, supporting standardized inventory and supply chain management.

Offshore Energy Development and Infrastructure Growth

The expansion of offshore oil, gas, and renewable energy projects is a major growth driver. Dredging equipment plays a critical role in laying subsea pipelines, cables, and constructing offshore platforms. Offshore wind farms in Europe, North America, and Asia are creating sustained equipment demand. Technological advancements, such as GPS-guided dredgers, enable accurate seabed preparation and lower project timelines. Investments in offshore energy infrastructure directly translate to higher equipment utilization. This sector’s long-term growth ensures steady demand for specialized dredging solutions.

Key Trends & Opportunities

Integration of Automation and Digital Monitoring

Automation is reshaping dredging operations by improving precision and reducing operational costs. Dredgers now feature GPS positioning, remote control systems, and AI-enabled monitoring. These technologies optimize fuel use, minimize environmental impact, and enhance project efficiency. Companies are developing autonomous dredging vessels to meet complex project demands with fewer human errors. Digital solutions also support predictive maintenance, extending equipment life cycles. These innovations create opportunities for equipment manufacturers offering intelligent and connected dredging solutions.

- For instance, Terumo’s MEDISAFE WITH patch pump’s main unit dimensions are 77.9 mm x 40.1 mm x 18.9 mm, weight is 34 g. Also, its remote control measures 136.2 mm x 75.0 mm x 14.3 mm, weighs 152 g with 2 AAA batteries.

Rising Focus on Sustainable Dredging Practices

Environmental regulations are pushing the adoption of eco-friendly dredging technologies. Low-emission engines, biodegradable lubricants, and silt containment systems are becoming standard features. Ports and contractors seek sustainable solutions to reduce carbon footprints and comply with global climate goals. Manufacturers are investing in green dredging systems that meet regulatory requirements while maintaining performance. This shift is opening new opportunities for eco-innovative dredger designs and sustainable contracting models.

- For instance, BD’s primary IV administration sets for pediatric use often feature microbore tubing under 2 mm internal diameter, which minimizes priming volume and suits low-volume infusions.

Public-Private Partnerships in Infrastructure Development

Increasing public-private partnerships (PPPs) are accelerating dredging projects globally. Governments are collaborating with private companies to develop port, energy, and coastal defense infrastructure. PPP models help mobilize large-scale investments and speed up project execution. This trend supports steady demand for dredging equipment and creates opportunities for manufacturers and service providers. PPP-driven projects also encourage the adoption of advanced, high-performance dredging technologies.

Key Challenges

High Capital Costs and Maintenance Expenses

Dredging equipment involves significant upfront investment and ongoing maintenance costs. Cutter suction dredgers and mechanical dredgers require specialized components, regular servicing, and skilled operators. Smaller contractors often face financial constraints in acquiring or upgrading equipment. High operational costs can delay project execution and reduce profit margins. This limits market entry for new players and slows adoption of advanced technologies in cost-sensitive regions.

Stringent Environmental Regulations and Project Delays

Environmental compliance requirements often delay dredging projects. Strict regulations on sediment disposal, water quality, and ecosystem protection increase project complexity. Contractors must adopt costly mitigation measures and undergo lengthy approval processes. Regulatory challenges can affect project timelines and budgets. This increases operational risks for equipment users and manufacturers, particularly in ecologically sensitive coastal zones. Companies must adapt to evolving regulations while maintaining competitive efficiency.

Regional Analysis

North America

North America holds a 27.3% market share in the global dredging equipment market, supported by strong port infrastructure investments and coastal defense projects. The U.S. Army Corps of Engineers plays a major role in maintaining navigable waterways and shoreline protection. Significant dredging operations are underway in the Gulf Coast and Great Lakes to support energy transport and commercial shipping. Offshore wind energy development, particularly along the East Coast, further strengthens equipment demand. Advanced automation, environmental compliance, and high operational efficiency characterize regional projects, driving continued adoption of cutter suction and mechanical dredgers.

Europe

Europe accounts for a 24.8% market share, driven by large-scale coastal protection, port expansion, and offshore renewable projects. Countries such as the Netherlands, Belgium, and Germany lead in adopting advanced dredging technologies for land reclamation and shoreline reinforcement. The region’s strong environmental regulations push operators to use low-emission, energy-efficient dredgers. Offshore wind energy developments in the North Sea contribute to consistent dredging activity. Europe also hosts several global dredging companies, enabling access to cutting-edge equipment and technical expertise, strengthening its leadership in sustainable and technologically advanced dredging solutions.

Asia Pacific

Asia Pacific dominates the market with a 32.4% share, reflecting rapid infrastructure development, port modernization, and reclamation projects. China, India, Japan, and Singapore are major contributors, investing heavily in dredging activities to support trade expansion and urban development. The Belt and Road Initiative and coastal protection programs further fuel demand for advanced dredgers. Rising offshore energy investments and industrialization are creating continuous equipment needs. The region benefits from strong manufacturing capabilities, competitive costs, and large-scale government-led projects, making it a global hub for dredging operations and equipment deployment.

Latin America

Latin America captures a 5.8% market share, driven by growing investments in port modernization and inland waterway development. Brazil, Argentina, and Chile lead in dredging activities to enhance trade connectivity and support export-oriented industries. Major river systems, such as the Amazon and Paraná, require regular dredging to maintain navigation. Government infrastructure programs and private sector participation are boosting demand for efficient cutter suction and mechanical dredgers. While the region faces budgetary and regulatory constraints, ongoing economic expansion and export growth continue to support steady equipment deployment.

Middle East & Africa

The Middle East & Africa region holds a 9.7% market share, supported by strategic infrastructure and coastal development programs. Countries like the UAE and Saudi Arabia invest in dredging to support artificial islands, port expansions, and energy transport hubs. Africa’s emerging economies are focusing on navigable waterways to boost trade and logistics. Harsh environmental conditions and water depth variations create demand for technologically advanced dredging equipment. Increasing PPP investments and tourism-related waterfront developments further drive market growth, positioning the region as an evolving opportunity for global equipment manufacturers.

Market Segmentations:

By Equipment:

- Cutter Suction Dredger (CSD)

- Bucket Dredger

By Application:

- Navigation Channel Maintenance

- River and Canal Dredging

By End User:

- Port and Harbor Authorities

- River and Canal Management Bodies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The dredging equipment market is shaped by leading companies including Hitachi Construction Machinery, Liebherr, Sany, Doosan, Caterpillar, Terex, Komatsu, Volvo, Deere & Co., and CNH Industrial. The competitive landscape of the dredging equipment market is defined by rapid technological advancement and strategic expansion. Manufacturers are focusing on enhancing dredger efficiency, durability, and environmental compliance to meet rising global demand. Innovation in automation, digital control systems, and energy-efficient engines is driving product differentiation. Companies are increasingly investing in smart dredging solutions to improve operational precision and reduce costs. Strategic alliances, joint ventures, and geographic expansion are strengthening market positions. After-sales services, remote diagnostics, and equipment customization further enhance competitiveness. This dynamic environment fosters continuous product development and positions advanced technology as a core competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, PD Ports, a UK port operator, invested in a state-of-the-art dredging vessel named Emerald Duchess. Designed and built by Dutch shipbuilder Neptune Marine, the 71-meter dredger will carry 2,500 tonnes and hold up to 2,000 cubic meters of dredged material.

- In April 2024, Royal IHC forged a strategic alliance to design and construct a state-of-the-art medium-class hopper dredge for the U.S. Army Corps of Engineers (USACE). This cutting-edge vessel is set to succeed the 57-year-old dredge McFarland and will be built at ESG’s shipyards located in Allanton and Port St. Joe, Florida.

- In March 2024, BEML Limited and Dredging Corporation of India Limited (DCIL) signed a collaboration agreement. The main aim of the agreement is the manufacturing of dredging equipment spares and aftermarket services.

- In November 2023, Komatsu Ltd. through its subsidiary, Komatsu America Corp. agreed to acquire American Battery Solutions, Inc., a battery manufacturer based in the U.S. The acquisition of American Battery Solutions, Inc. would allow Komatsu Ltd. to manufacture and develop its own battery-operated mining and construction equipment by integrating American Battery Solutions, Inc.’s battery technology with Komatsu Ltd.’s expertise

Report Coverage

The research report offers an in-depth analysis based on Equipment, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced dredging technologies will grow with expanding port infrastructure.

- Automation and digital monitoring will increase operational precision and reduce project costs.

- Sustainable dredging solutions will gain importance due to stricter environmental regulations.

- Offshore wind and energy projects will drive steady equipment demand.

- Public-private partnerships will accelerate large-scale dredging activities.

- Equipment manufacturers will expand their global distribution and service networks.

- Smart dredgers with AI and GPS integration will see faster adoption.

- Coastal protection and land reclamation projects will boost equipment utilization.

- Fleet modernization will become a key priority for major operators.

- Regional investments in trade and logistics will strengthen market growth.