Market Overview

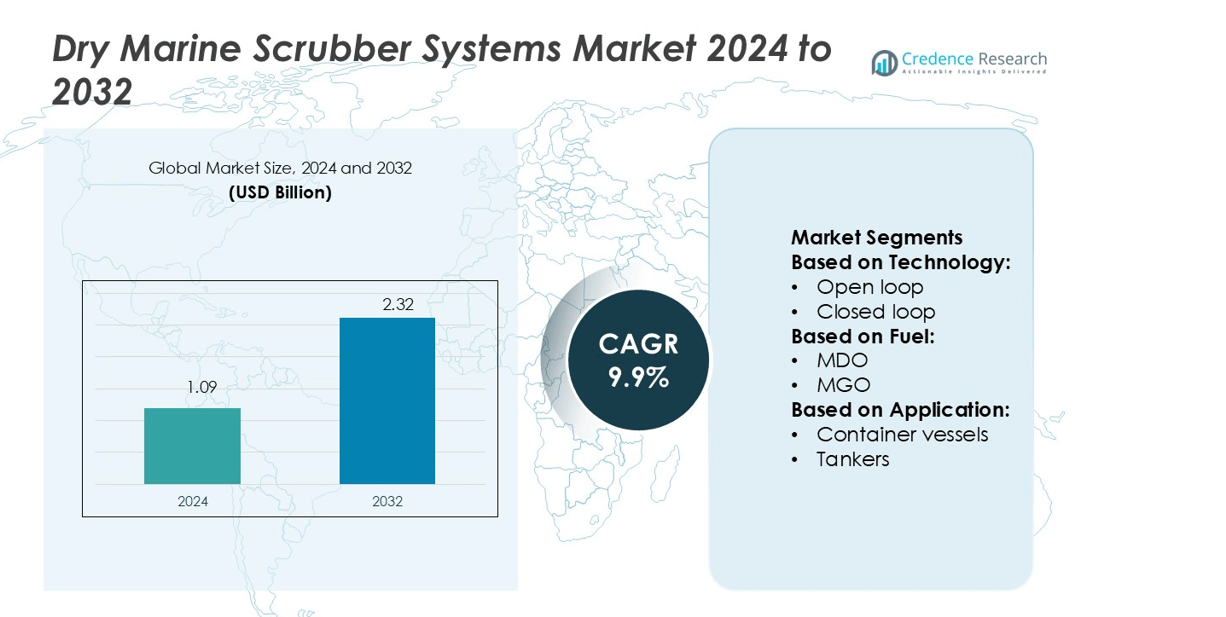

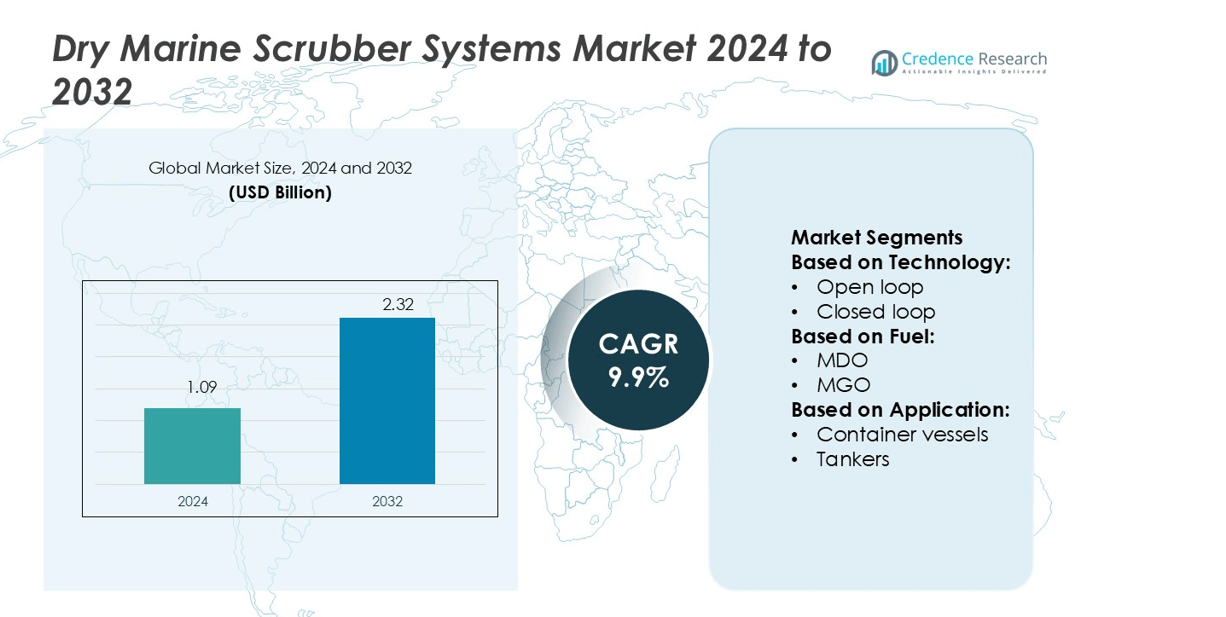

Dry Marine Scrubber Systems Market size was valued USD 1.09 billion in 2024 and is anticipated to reach USD 2.32 billion by 2032, at a CAGR of 9.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dry Marine Scrubber Systems Market Size 2024 |

USD 1.09 billion |

| Dry Marine Scrubber Systems Market, CAGR |

9.9% |

| Dry Marine Scrubber Systems Market Size 2032 |

USD 2.32 billion |

The Dry Marine Scrubber Systems Market is driven by key players such as Ecospray Technologies, Damen Shipyards Group, KwangSung, CR Ocean Engineering, ALFA LAVAL, Hyundai Heavy Industries, Fuji Electric, ANDRITZ, Clean Marine, and DuPont. These companies focus on technological innovation, retrofitting solutions, and integration in newbuild vessels to strengthen their global presence. Advanced engineering capabilities, energy-efficient designs, and strong service networks help them maintain a competitive edge. North America leads the global market with a 34.7% share, supported by strict emission regulations, advanced port infrastructure, and a strong fleet modernization strategy. The region’s leadership is further reinforced by high investments in sustainable shipping technologies and growing adoption of hybrid scrubber systems, driving consistent market expansion.

Market Insights

- The Dry Marine Scrubber Systems Market was valued at USD 1.09 billion in 2024 and is expected to reach USD 2.32 billion by 2032, growing at a CAGR of 9.9%.

- Rising emission control regulations and sulfur cap compliance requirements are driving strong demand across commercial shipping fleets worldwide.

- Ongoing technological advancements and hybrid system integration are shaping market trends, supported by innovations in energy efficiency and material durability.

- The market is highly competitive, with key players focusing on retrofitting solutions, system miniaturization, and expanding global service networks to strengthen their positions.

- North America leads with a 34.7% regional share, followed by Europe and Asia Pacific, while the hybrid segment dominates due to its operational flexibility and strong adoption among fleet operators.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Wet technology dominates the Dry Marine Scrubber Systems Market with a 64.2% share. Open loop systems lead within this category due to lower capital cost and simpler operation. They discharge wash water directly into the sea, making them suitable for vessels operating in international waters. Closed loop systems follow, offering compliance in stricter emission control areas through recirculation and minimal discharge. Hybrid systems combine both, supporting flexible operation. Dry scrubbers hold a smaller share but are gaining traction where zero discharge is required. The demand for open loop systems is strongly driven by cost efficiency and IMO SOx compliance.

- For instance, Ecospray Technologies has delivered hybrid scrubber systems with engine power ratings of up to 70 MW, enabling operation under both open and closed-loop modes to meet MARPOL Annex VI regulations.

By Fuel

MDO (Marine Diesel Oil) holds the largest market share of 46.5% in the fuel segment. MDO remains widely used in commercial shipping fleets because of its cost-effectiveness and compatibility with most existing scrubber systems. MGO (Marine Gas Oil) follows closely, supported by its cleaner combustion properties and reduced sulfur content. Hybrid fuel options are increasing, enabling dual-fuel flexibility for vessels operating across regulatory zones. Others include LNG blends and alternative low-sulfur fuels. The dominance of MDO is driven by its global availability, lower price compared to alternatives, and the existing fleet’s reliance on diesel engines.

- For instance, Damen Shipyards Group integrated MDO-based exhaust gas cleaning systems on its ASD Tug 2813 series, enabling operation with engines rated at 2,525 kW each, meeting IMO Tier III NOx and SOx emission standards while maintaining high propulsion efficiency.

By Application

Container vessels account for the dominant share of 37.4% in the application segment. These ships operate on fixed, long-distance routes and require reliable scrubber systems to meet emission norms without switching fuels. Tankers and bulk carriers follow due to their heavy fuel consumption and large engine capacities. RO-RO vessels and other commercial vessels are adopting scrubbers gradually, especially in emission control zones. The dominance of container vessels is driven by strict regulatory compliance, fuel cost optimization, and the ability to retrofit scrubbers on large fleets efficiently. This segment remains central to market expansion.

Key Growth Drivers

Stringent Sulfur Emission Regulations

Global maritime regulations under MARPOL Annex VI are driving rapid scrubber adoption. These rules cap sulfur emissions at 0.5%, pushing shipowners to install scrubbers to comply while using high-sulfur fuel oil. This approach reduces operating costs compared to low-sulfur fuels. Shipping companies favor dry marine scrubber systems for their lower water use and simpler maintenance. Growing enforcement of these regulations in Europe, Asia, and North America is boosting installations across bulk carriers, container vessels, and tankers.

- For instance, KwangSung manufactures scrubbers and claims high efficiency in SOx reduction. In a screenshot on the company’s “Customer List” webpage, a test display shows “0.02%” SOx output, which is significantly better than the required 0.5% sulfur limit.

Cost-Efficient Compliance Solutions

Dry marine scrubber systems help shipowners minimize operating costs while meeting emission limits. Unlike wet systems, dry scrubbers require no wash water treatment or discharge monitoring, lowering operational expenses. They also reduce corrosion risks, extending system life and lowering maintenance costs. This makes them attractive for long-haul commercial shipping fleets. Cost efficiency combined with regulatory compliance is a strong growth driver for these systems, especially for operators seeking quick return on investment.

- For instance, CR Ocean Engineering partners with Oberlin Filter to provide wash-water filtration systems that convert scrubber purge sludge into dry cake solids, producing filtrate with as low as 15 ppm total suspended solids and 10 NTU turbidity before discharge.

Expansion of Global Shipping and Trade

Rising international trade volumes are fueling the demand for emission control technologies. The growing number of container vessels, tankers, and bulk carriers increases the need for reliable and efficient scrubber systems. Dry scrubbers are well-suited for retrofitting and newbuilds, offering flexible installation without complex water management infrastructure. Expanding maritime routes across Asia-Pacific, Europe, and the Middle East further amplify system demand. This trade growth directly strengthens the market for dry marine scrubber solutions.

Key Trends & Opportunities

Advancements in Sorbent Technology

Manufacturers are developing advanced sorbent materials with higher sulfur removal efficiency and lower consumption rates. These innovations reduce operating costs and downtime, increasing the attractiveness of dry scrubbers. Modular sorbent systems support easy maintenance and faster turnaround times. Companies are investing in research to create recyclable sorbents that align with environmental standards. These technological upgrades offer opportunities for differentiation and long-term cost savings for operators.

- For instance, Alfa Laval’s PureSOx systems achieve sulfur removal rates greater than 98 % in real operational conditions, exceeding IMO requirements. Energy Reduction Mode, PureSOx cuts water flow to match real-time gas loading—and that adjustment can reduce energy use by up to 25 % relative to fixed-flow operation.

Growing Retrofit Opportunities

A large portion of the global fleet still operates without scrubbers, creating a strong retrofit market. Dry systems offer easier installation on existing vessels due to their compact design and no water discharge requirements. Retrofit demand is rising among bulk carrier and tanker operators seeking cost-effective emission compliance. Shipyards and service providers are expanding retrofit capabilities to meet increasing orders, creating significant opportunities for system suppliers.

- For instance, Fuji’s ZQS laser gas analyser, certified under IMO MEPC.259(68), supports retrofit by being compact (330 × 880 × 255 mm for detector unit) and requiring calibration only once per year.

Strategic Collaborations and Fleet Upgrades

Shipping companies are partnering with technology providers to integrate advanced scrubber systems into fleet upgrade programs. Collaborative projects focus on digital monitoring, automated operation, and predictive maintenance to boost operational efficiency. These partnerships support regulatory compliance while improving fuel flexibility. Such strategic alliances also help accelerate large-scale adoption across global shipping fleets.

Key Challenges

High Initial Capital Investment

Dry marine scrubber systems involve significant upfront installation costs, which can limit adoption among small and mid-sized shipping operators. Expenses cover equipment, installation, and necessary retrofitting of vessel exhaust systems. While operating costs are lower, the payback period can be long for vessels with shorter service lives. This financial barrier remains a critical challenge, especially in emerging markets with limited retrofit budgets.

Evolving Regulatory Landscape

The maritime sector faces uncertainty due to shifting emission standards and potential regional restrictions on scrubber discharge and usage. Although dry scrubbers avoid wash water discharge issues, evolving rules may still affect technology design and compliance strategies. Shipowners must adapt quickly to regulatory updates, increasing compliance complexity and costs. This dynamic regulatory environment poses a major challenge for market stability and long-term investment planning.

Regional Analysis

North America

North America holds a 34.7% share of the Dry Marine Scrubber Systems Market in 2024. The region benefits from strong regulatory enforcement by the U.S. Environmental Protection Agency (EPA) and Transport Canada, encouraging widespread adoption of compliant scrubber technologies. Major shipping companies are upgrading fleets to meet emission standards for SOx and particulate matter. The presence of advanced shipbuilding infrastructure and technology providers further boosts market growth. Ports in the U.S. and Canada are key retrofit and maintenance hubs, driving installation volumes. Ongoing investments in cleaner marine operations strengthen the region’s leadership in market share.

Europe

Europe accounts for 31.2% of the global market in 2024. Strict IMO MARPOL Annex VI implementation and EU Emission Control Areas (ECAs) drive demand for dry marine scrubbers. Leading ship operators in Germany, Norway, and the Netherlands have increased retrofitting activities to cut sulfur emissions. The region also benefits from a strong presence of scrubber manufacturers and engineering service providers. The emphasis on decarbonizing maritime transport fuels technology adoption. Strategic coastal shipping routes and busy ports support continued growth, making Europe a major contributor to the global dry marine scrubber systems market.

Asia Pacific

Asia Pacific represents 25.6% of the market share in 2024, driven by rapid maritime trade expansion and fleet modernization. China, South Korea, and Japan lead in new shipbuilding, integrating scrubber systems during vessel construction. Governments across the region are tightening emissions standards, encouraging shipowners to invest in compliance technologies. Major ports such as Shanghai, Busan, and Singapore serve as key installation and service hubs. Rising trade volumes and increasing emphasis on sustainable shipping solutions position Asia Pacific as a high-growth regional market for dry marine scrubber systems.

Latin America

Latin America holds a 5.1% market share in 2024, with gradual adoption supported by modernization of shipping fleets. Brazil and Chile are leading adopters due to rising crude oil and bulk commodity exports. Investments in port infrastructure and emission compliance programs support market expansion. The region benefits from partnerships with international equipment suppliers and service providers. Although the adoption rate is slower than in Europe or Asia, growing environmental regulation and trade activities create favorable conditions for long-term market growth across key coastal economies.

Middle East & Africa

The Middle East & Africa region accounts for 3.4% of the global market in 2024. Adoption is rising due to increasing marine traffic through major shipping lanes, including the Suez Canal and Arabian Gulf. Port authorities in the UAE and Saudi Arabia are promoting cleaner shipping practices. Energy exporters are integrating scrubbers to meet international sulfur caps while maintaining operational efficiency. The region’s strategic location and expanding commercial fleet are driving gradual but steady adoption. Ongoing investments in port modernization are expected to enhance the region’s market share over the forecast period.

Market Segmentations:

By Technology:

By Fuel:

By Application:

- Container vessels

- Tankers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Dry Marine Scrubber Systems Market is shaped by leading companies such as Ecospray Technologies, Damen Shipyards Group, KwangSung, CR Ocean Engineering, ALFA LAVAL, Hyundai Heavy Industries, Fuji Electric, ANDRITZ, Clean Marine, and DuPont. The Dry Marine Scrubber Systems Market is defined by strong technological innovation, regulatory alignment, and strategic expansion. Manufacturers focus on developing compact, energy-efficient systems that meet IMO emission standards and support global sulfur cap compliance. Companies are investing in advanced materials, automation, and integration capabilities to improve operational efficiency and reduce lifecycle costs. Retrofitting services are expanding rapidly as fleet owners upgrade existing vessels to avoid non-compliance penalties. Strategic partnerships with shipyards and service providers are strengthening market reach and enhancing aftersales support. Continuous R&D investment, combined with digital monitoring solutions, is driving product differentiation and intensifying competition among leading players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, OCEANKING and CR Ocean Engineering (CROE) entered in an agreement to offer advanced environmental solutions to the maritime industry, supporting cleaner and more sustainable shipping practices worldwide.

- In September 2024, Wärtsilä entered in an agreement with Leonhardt & Blumberg to supply carbon capture and storage ready scrubber systems for three container ships. It reduces the vessel’s operational expenses by permitting it to operate with more readily available and less costly fuel (HFO).

- In August 2024, BW LPG, announced the acquisition of 12 Very Large Gas Carriers (VLGCs) from Avance Gas. The acquisition includes four dual-fuel VLGCs and eight VLGCs, six of which are equipped with marine scrubbers to reduce emissions.

- In January 2023, Babcock & Wilcox Enterprises, Inc. acquired Hamon Research-Cottrell (HRC), enhancing its portfolio of emission control solutions. This acquisition allowed Babcock & Wilcox Enterprises to provide a wide range of advanced air quality control systems, such as wet and dry electrostatic precipitators, spray dryer absorbers, and wet flue desulfurization systems designed for oil & gas refineries

Report Coverage

The research report offers an in-depth analysis based on Technology, Fuel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of scrubber systems will grow as global emission regulations tighten.

- Shipowners will invest more in retrofitting to comply with sulfur cap standards.

- Technological advancements will make scrubbers more compact and energy efficient.

- Hybrid systems will gain momentum due to operational flexibility.

- Digital monitoring solutions will improve system performance and maintenance.

- Demand will rise in Asia Pacific as shipbuilding and trade expand.

- Strategic collaborations will strengthen supply chains and service networks.

- Material innovations will enhance scrubber durability and reduce operational costs.

- Integration of scrubbers in newbuild vessels will accelerate market penetration.

- Sustainability goals will drive long-term investments in cleaner marine technologies.