Market Overview

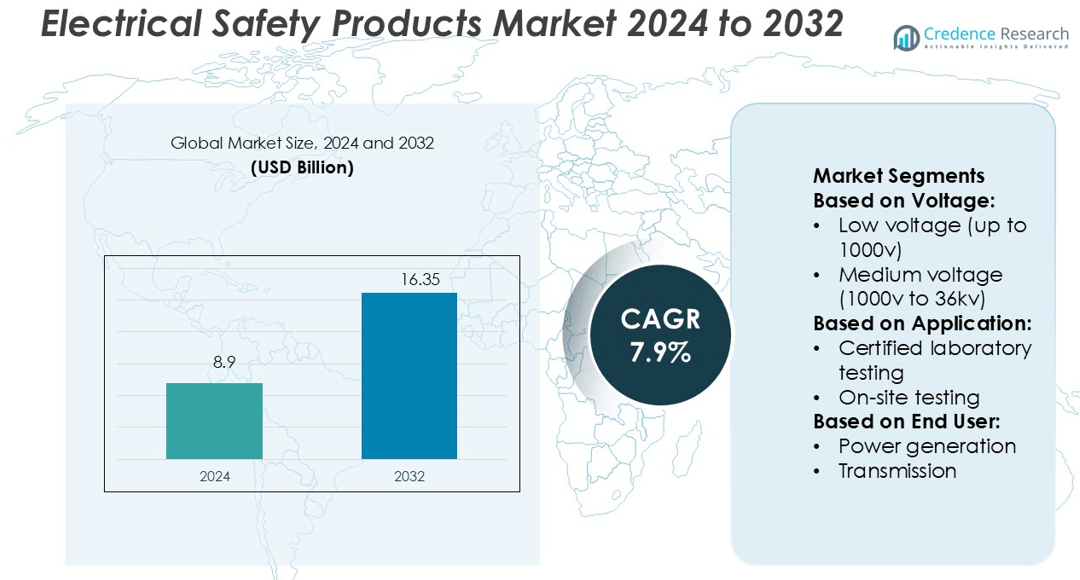

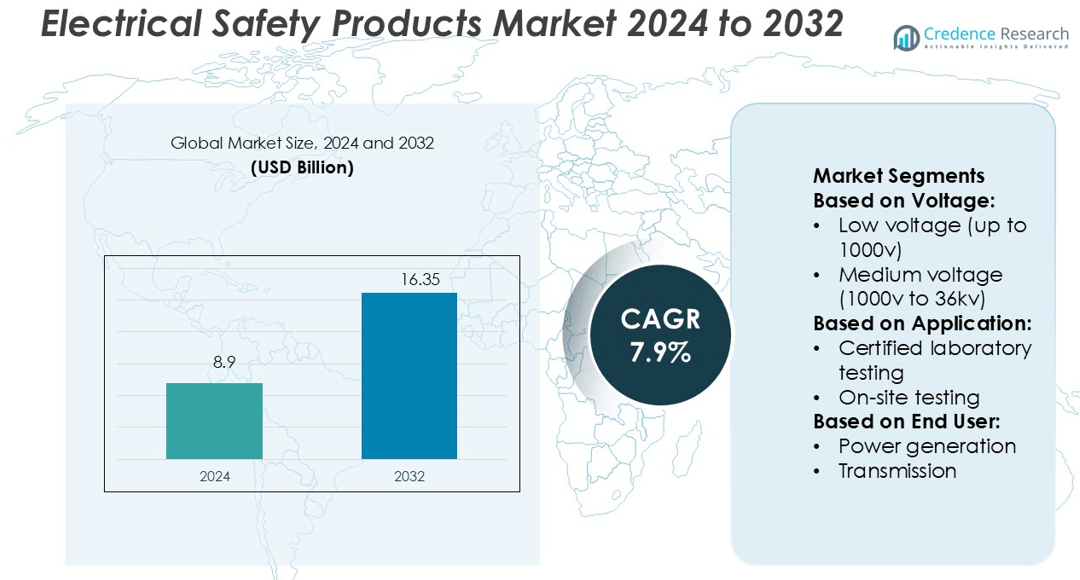

Electrical Safety Products Market size was valued USD 8.9 billion in 2024 and is anticipated to reach USD 16.35 billion by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrical Safety Products Market Size 2024 |

USD 8.9 billion |

| Electrical Safety Products Market, CAGR |

7.9% |

| Electrical Safety Products Market Size 2032 |

USD 16.35 billion |

The Electrical Safety Products Market is driven by prominent players such as Hubbell, MSA Safety, DuPont de Nemours, Ansell, Honeywell International, Leviton Manufacturing, Milliken & Company, 3M Company, Cementex Products, and Brady. These companies focus on advanced PPE development, regulatory compliance, and technology integration to strengthen their market position. Product innovation, sustainable materials, and smart safety solutions remain core strategies to address rising safety demands across industries. North America leads the global market with a 34.6% share, supported by strict safety regulations, mature infrastructure, and early adoption of advanced protective technologies. This strong regulatory and operational environment enables consistent market growth.

Market Insights

- The Electrical Safety Products Market was valued at USD 8.9 billion in 2024 and is projected to reach USD 16.35 billion by 2032, growing at a CAGR of 7.9%.

- Rising workplace safety regulations and increasing investment in energy infrastructure are driving strong demand for advanced PPE solutions.

- Growing adoption of smart safety technologies, sustainable materials, and connected devices is shaping market trends globally.

- The market is highly competitive, with leading companies focusing on innovation, strategic partnerships, and regulatory compliance to strengthen their positions.

- North America leads with a 34.6% market share, supported by strict safety norms, followed by Europe with 27.3% and Asia-Pacific with 25.8%; the low-voltage segment dominates with a 49.2% share due to its widespread application in industrial and commercial settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Voltage

Low voltage (up to 1000 V) dominates the Electrical Safety Products Market with a 49.2% share. This segment leads due to widespread use in residential, commercial, and light industrial environments. Demand for gloves, insulated tools, and protective gear is increasing as workplace safety regulations tighten. Rapid electrification of infrastructure and growth in smart buildings further support this segment. Medium and high-voltage categories are growing steadily, driven by utility upgrades and grid modernization projects, but low-voltage applications remain the most widely adopted due to cost-effectiveness and ease of integration.

- For instance, UL Solutions opened its North America Advanced Battery Laboratory, UL Solutions confirm that the facility is a large-scale testing and engineering laboratory, with the size being cited as nearly 90,000-square-feet.

By Application

Arc flash clothing laundering and repair leads the application segment with a 36.4% share. The dominance stems from strict NFPA 70E and OSHA standards, which require regular maintenance and testing of arc-rated clothing. Certified laboratory testing and on-site testing are also expanding due to utility compliance programs. Organizations increasingly invest in maintaining PPE integrity to avoid downtime and regulatory penalties. Training services, both on-site and online, are gaining momentum as part of broader safety management strategies, though they hold a smaller market share compared to laundering and testing services.

- For instance, SGS expanded its Suwanee, Georgia lab, enabling tests of battery modules up to 100 V and current levels up to 1200 A, adding capacity for thermal, abuse, reliability, and fire propagation testing.

By End User

The power generation segment holds the largest share at 33.8% in the end-user category. Continuous investment in renewable and conventional energy plants drives strong demand for PPE, arc flash suits, and testing services. Transmission and distribution utilities follow, supported by large-scale grid modernization and electrification projects. Electrical and telecom segments are also growing as industries adopt advanced protective equipment to meet evolving safety standards. The increasing focus on operational continuity and workforce protection in high-risk environments reinforces power generation’s dominant position in the market.

Key Growth Drivers

Rising Emphasis on Workplace Safety Standards

Governments and industry bodies are enforcing strict workplace safety regulations to reduce electrical hazards. Standards such as OSHA, IEC, and NFPA 70E mandate the use of certified personal protective equipment and regular safety inspections. Industries including power generation, telecom, and manufacturing are investing in arc-rated clothing, gloves, and insulated tools. Companies are expanding their safety programs to lower incident rates and comply with insurance requirements. This regulatory pressure is a key growth catalyst for electrical safety products across developed and emerging economies.

- For instance, DEKRA inaugurated its Battery Test Center at Lausitzring (Brandenburg) after ~15 months of construction, employing up to 40 specialists to run mechanical, performance, environmental, and abuse tests under one roof.

Expansion of Power Infrastructure and Electrification

Rapid electrification projects and grid modernization programs are creating strong demand for protective equipment. Countries are investing in high-voltage transmission lines, renewable power generation, and smart grid deployments. This expansion increases the need for safety gear to protect workers handling live lines and complex electrical systems. Utilities and EPC companies are adopting advanced safety technologies to enhance reliability and meet compliance mandates. Growing energy infrastructure investments, especially in Asia-Pacific and the Middle East, significantly strengthen market growth.

- For instance, DuPont introduced Nomex® Essential Arc HiCal, giving a single-layer ATPV of 12 cal/cm² at 6.5 oz/yd² weight. The standard Nomex® Essential Arc fiber blend fabric supports ATPV > 8 cal/cm² and EBT > 18 cal/cm².

Technological Advancements in Protective Equipment

Product innovation is improving comfort, durability, and performance of electrical safety gear. Manufacturers are introducing lightweight arc flash suits, improved insulating gloves, and real-time monitoring devices. Advanced fabrics offer higher thermal resistance while allowing greater mobility. Integration of smart sensors and RFID technology enables condition tracking and predictive maintenance of equipment. These innovations enhance worker protection and operational efficiency. As industries shift toward smarter safety systems, demand for technologically advanced electrical safety products continues to accelerate globally.

Key Trends & Opportunities

Growing Adoption of Smart PPE Solutions

Industries are adopting smart personal protective equipment that integrates sensors and digital tracking. These devices monitor temperature, voltage exposure, and real-time location to enhance worker safety. Connected solutions support predictive maintenance and compliance documentation, reducing manual oversight. Companies are leveraging IoT platforms to automate safety reporting and training. This trend is opening opportunities for manufacturers offering integrated safety systems that combine physical protection with digital intelligence.

- For instance, Honeywell’s Salisbury brand offers the Electriguard® line of dielectric overboots, which are tested and certified at voltages up to 20,000 V AC to protect workers from potential electrical hazards.

Shift Toward Sustainable and High-Performance Materials

Manufacturers are focusing on eco-friendly and high-performance materials to meet sustainability goals. Arc flash suits and gloves are increasingly made with recyclable fabrics and improved thermal resistance. These innovations lower environmental impact while maintaining or improving protection standards. Industries are also seeking longer product lifecycles and reduced maintenance costs. The move toward greener manufacturing creates opportunities for product differentiation and aligns with global ESG commitments.

- For instance, TÜV SÜD’s Auburn Hills lab supports battery cells up to 1,200 V / 1,000 A and includes five indoor abuse/safety bunkers built with steel-reinforced concrete.

Rising Investment in Training and Compliance Programs

Companies are investing more in structured training and compliance programs to reduce electrical accidents. On-site and online safety training platforms are gaining traction in utilities, telecom, and industrial facilities. These programs ensure proper use of PPE and adherence to safety procedures. Governments and insurers are encouraging training initiatives to minimize workplace risks and claims. This growing focus on skill development creates new service-based revenue opportunities for safety solution providers.

Key Challenges

High Product and Maintenance Costs

Electrical safety products, particularly arc flash suits and smart PPE, involve high initial costs. Regular maintenance, laundering, and testing further add to operational expenses. Many small and medium-sized enterprises delay adoption due to budget constraints. This cost barrier limits penetration in price-sensitive markets. Manufacturers face the challenge of balancing quality and affordability while maintaining compliance with international standards.

Limited Awareness and Skilled Workforce Gaps

Many industries, especially in developing regions, lack adequate awareness of electrical safety practices. Insufficient training and skill gaps among workers increase the risk of accidents. Employers often underestimate the importance of proper PPE usage and compliance. This lack of preparedness slows the adoption of advanced safety products. Addressing workforce education and expanding training programs remain critical to overcoming this challenge.

Regional Analysis

North America

North America leads the Electrical Safety Products Market with a 34.6% share in 2024. The region benefits from strict OSHA and NFPA 70E regulations that mandate advanced protective equipment across industries. High electrification levels in power generation, manufacturing, and construction sectors sustain strong product demand. Major utilities and industrial operators invest in arc flash suits, insulated tools, and smart PPE solutions. The U.S. drives growth with rapid grid modernization projects, while Canada supports adoption through robust safety training programs and government-backed compliance incentives. Strong awareness and established safety infrastructure keep North America at the forefront of the global market.

Europe

Europe holds a 27.3% market share, supported by stringent EU safety directives and EN standards. Countries such as Germany, France, and the U.K. are early adopters of high-performance PPE and smart safety technologies. The region is witnessing growing investments in renewable energy, smart grid development, and electrical infrastructure upgrades. These projects increase the need for arc-rated clothing, gloves, and live-line protection gear. Strong emphasis on sustainability drives manufacturers to use eco-friendly and durable materials. Strategic focus on workplace safety compliance and high labor safety awareness continue to strengthen Europe’s position in the global market.

Asia-Pacific

Asia-Pacific accounts for 25.8% of the global Electrical Safety Products Market in 2024. Rapid electrification, urbanization, and industrial expansion drive significant demand in China, India, Japan, and South Korea. Large-scale investments in transmission and distribution networks create strong opportunities for PPE suppliers. Governments are tightening workplace safety regulations, increasing the adoption of certified equipment. The growth of telecom and renewable power sectors adds to market expansion. While awareness remains lower than in developed regions, increasing safety training initiatives and rising infrastructure spending make Asia-Pacific one of the fastest-growing regional markets globally.

Latin America

Latin America represents a 4.2% share of the global Electrical Safety Products Market in 2024. Brazil and Mexico lead regional adoption, driven by energy infrastructure modernization and industrial development. Power utilities and manufacturing industries are increasing investments in electrical safety to reduce workplace incidents. Government programs promoting occupational safety standards are gradually improving compliance. However, lower regulatory enforcement compared to developed regions slows market penetration. Growing renewable power projects and telecom network expansion are creating new opportunities for PPE suppliers. Steady regulatory improvements and rising worker safety awareness support future market growth in the region.

Middle East & Africa

The Middle East & Africa region holds an 8.1% market share, supported by expanding power generation and grid infrastructure. Countries like Saudi Arabia, UAE, and South Africa are investing heavily in transmission and renewable energy projects. These developments require strict adherence to safety protocols, boosting demand for arc flash suits and insulated tools. Although regulatory frameworks are still evolving, multinational operators are driving the adoption of international safety standards. Rising investment in energy diversification, particularly solar and wind projects, is strengthening PPE demand. Training gaps remain a challenge but offer significant growth potential.

Market Segmentations:

By Voltage:

- Low voltage (up to 1000v)

- Medium voltage (1000v to 36kv)

By Application:

- Certified laboratory testing

- On-site testing

By End User:

- Power generation

- Transmission

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electrical Safety Products Market is shaped by key players including Hubbell, MSA Safety, DuPont de Nemours, Ansell, Honeywell International, Leviton Manufacturing, Milliken & Company, 3M Company, Cementex Products, and Brady. The Electrical Safety Products Market is defined by strong innovation, regulatory compliance, and expanding global distribution networks. Companies focus on developing advanced PPE solutions that meet evolving safety standards and deliver improved comfort, durability, and protection. Product differentiation through smart technologies, such as sensor-enabled PPE and real-time monitoring tools, is gaining traction. Manufacturers are also prioritizing sustainable materials to align with global ESG goals. Strategic partnerships with utilities, industrial operators, and distributors help expand market reach. Continuous R&D investments, technological integration, and adherence to international safety standards drive competition and support long-term market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hubbell

- MSA Safety

- DuPont de Nemours

- Ansell

- Honeywell International

- Leviton Manufacturing

- Milliken & Company

- 3M Company

- Cementex Products

- Brady

Recent Developments

- In February 2025, Advantest Corporation launched the T5801 Ultra-High-Speed DRAM Test System. This state-of-the-art platform is designed to accommodate the most recent developments in high-speed memory technologies such as GDDR7, LPDDR6, and DDR6.

- In January 2025, Teradyne and Infineon Technologies announced a strategic partnership to advance power semiconductor testing. As part of the collaboration, Teradyne will acquire Infineon’s automated test equipment (ATE) technology and the associated development team based in Regensburg, Germany.

- In April 2024, Honeywell inaugurated a fully automated production line at its Clover, South Carolina plant, where electrical safety gloves will be manufactured. This development is indicative of an effort to increase production and keep up with the product growth in protection provided by the booming electrification industry.

- In January 2024, SureWerx acquired Unlimited PPE Inc., launching a brand-new Technical Services Division focusing on electrical safety, compliance, and PPE management, which draws from Unlimited PPE’s extensive expertise in arc flash and shock protection, as well as its unparalleled technical consulting throughout North America

Report Coverage

The research report offers an in-depth analysis based on Voltage, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for smart PPE with sensor-based monitoring will rise across industrial sectors.

- Regulatory compliance will continue to drive product adoption globally.

- Integration of IoT and AI will enhance real-time safety management.

- Renewable energy expansion will increase demand for high-voltage protection gear.

- Sustainability goals will push manufacturers toward eco-friendly and durable materials.

- Training and certification programs will become key to improving product utilization.

- Emerging markets will see faster adoption due to expanding power infrastructure.

- Product innovation will focus on lightweight, ergonomic, and multi-layer protection.

- Strategic partnerships will strengthen global distribution networks.

- Digital platforms will support predictive maintenance and compliance tracking.