Market Overview

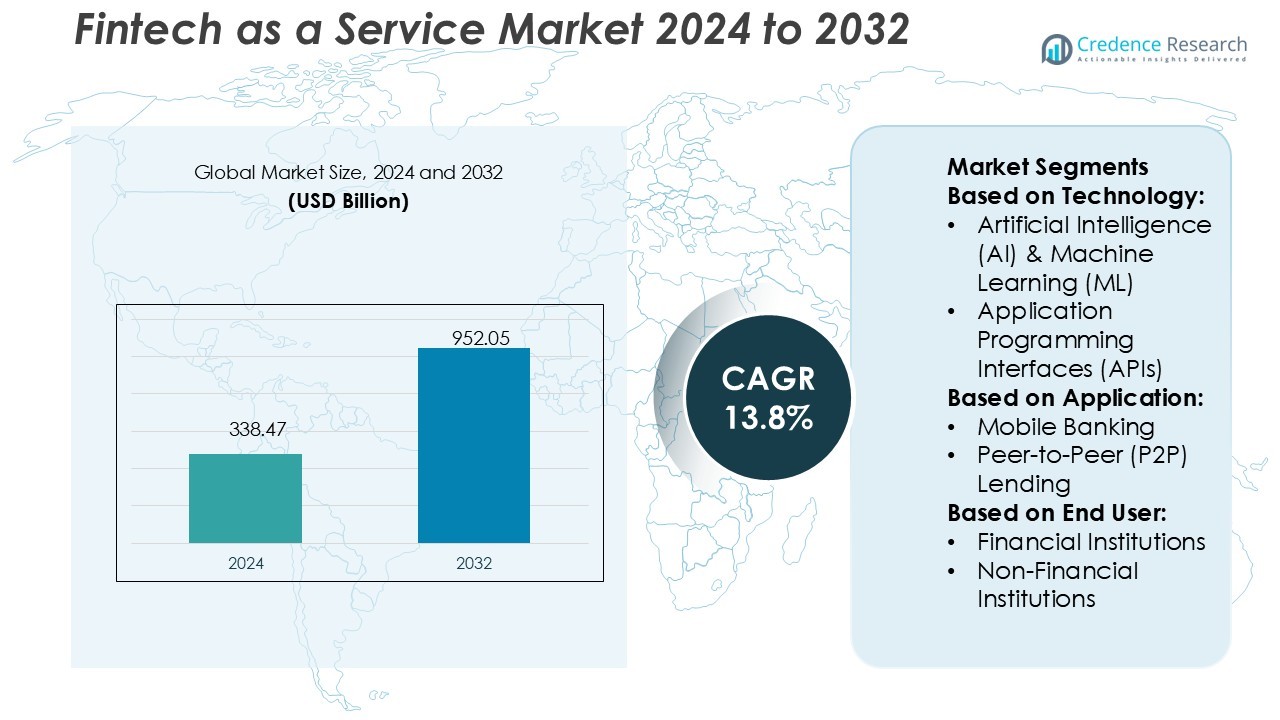

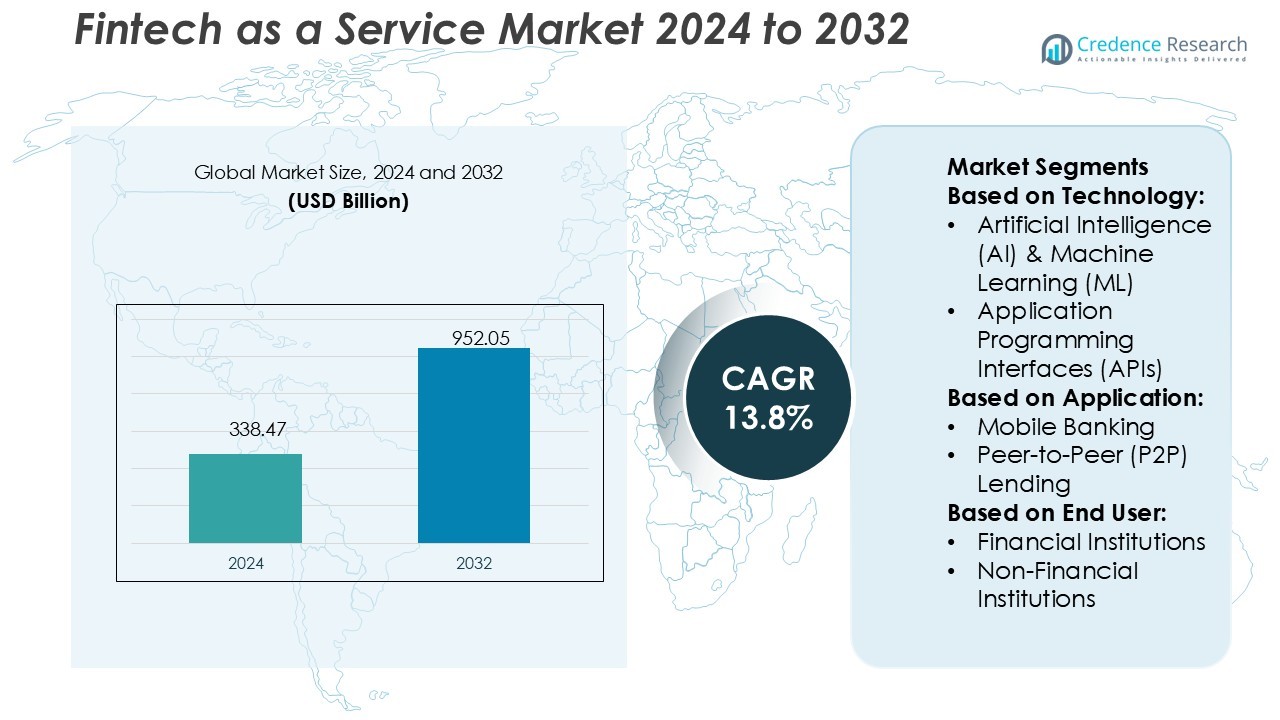

Fintech as a Service Market size was valued USD 338.47 billion in 2024 and is anticipated to reach USD 952.05 billion by 2032, at a CAGR of 13.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fintech as a Service Market Size 2024 |

USD 338.47 Billion |

| Fintech as a Service Market, CAGR |

13.8% |

| Fintech as a Service Market Size 2032 |

USD 952.05 Billion |

The Fintech as a Service market is driven by top players such as Dwolla, Fiserv, Mastercard, Finastra, Block, PayPal, FIS, Adyen, OpenPayd, and Envestnet, each leveraging advanced technologies to strengthen their global presence. These companies focus on expanding digital payment ecosystems, cloud-based platforms, and API-driven solutions to meet the evolving needs of financial and non-financial institutions. North America emerges as the leading region, holding 38% of the total market share, supported by strong digital infrastructure, regulatory frameworks, and high adoption of mobile banking and embedded finance solutions, ensuring sustained regional dominance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fintech as a Service Market size was USD 338.47 billion in 2024 and will reach USD 952.05 billion by 2032, growing at a CAGR of 13.8%.

- The market is driven by increasing demand for digital payment ecosystems, cloud-based platforms, and API-driven solutions that enhance scalability, compliance, and customer experience.

- Key trends include the rapid integration of AI, blockchain, and embedded finance models, enabling financial and non-financial institutions to deliver secure, seamless, and personalized financial services.

- Competitive analysis highlights top players such as Dwolla, Fiserv, Mastercard, Finastra, Block, PayPal, FIS, Adyen, OpenPayd, and Envestnet focusing on innovation, partnerships, and expansion into new markets.

- North America leads the market with 38% share, driven by strong infrastructure and mobile banking adoption, while mobile banking itself dominates applications with 42% share, reinforcing the region’s position as the primary hub for fintech-as-a-service growth.

Market Segmentation Analysis:

By Technology

Cloud Computing leads the technology segment with a 37% share due to its scalability, flexibility, and cost efficiency. Financial service providers increasingly rely on cloud platforms for digital payments, customer data management, and real-time analytics. The integration of APIs enhances interoperability between cloud-based applications, creating seamless ecosystems for banking and fintech operations. Blockchain and AI & ML follow, driven by demand for secure transactions and predictive financial insights. Adoption is also reinforced by regulatory push for transparent, scalable infrastructures, positioning cloud solutions as the core enabler of fintech service expansion.

- For instance, Mastercard’s network handles roughly 125 billion transactions annually, routing transaction data through its API ecosystem to ensure latency under 100 milliseconds in many cases, as cited in its public statements.

By Application

Mobile Banking dominates the application segment with a 42% market share, fueled by rising smartphone penetration and consumer demand for contactless transactions. Banks and fintech firms enhance user experience with instant payments, biometric authentication, and personalized financial services. Peer-to-peer lending is gaining momentum, supported by digital-first platforms that expand credit access to underserved demographics. Regulatory compliance and risk management remain vital as institutions adopt advanced fintech solutions to address cybersecurity threats and evolving financial regulations. The shift toward digital-first banking ensures mobile banking retains its leadership across global markets.

- For instance, Block employs over 4,000 engineers across its brands. While Cash App alone serves more than 57 million monthly active users in the U.S. and the Square ecosystem supports approximately 4 million merchants.

By End User

Financial Institutions account for 65% of the end-user segment, making them the dominant category. Traditional banks, credit unions, and insurance companies invest heavily in fintech-as-a-service to modernize operations, lower costs, and deliver customer-centric solutions. Demand is particularly strong for digital payment processing, compliance management, and advanced data analytics. Non-financial institutions, including retail and e-commerce firms, adopt fintech platforms to streamline payment gateways and expand consumer financing options. The competitive need for efficiency, secure transactions, and improved customer engagement ensures financial institutions maintain a commanding position in driving market growth.

Key Growth Drivers

Rising Demand for Digital Payments

The growing shift toward cashless transactions is a primary driver for the Fintech as a Service market. Consumers and businesses increasingly prefer digital wallets, contactless payments, and real-time fund transfers for convenience and efficiency. This trend is strengthened by government initiatives promoting financial inclusion and cashless economies. Financial institutions and fintech providers leverage advanced payment gateways and APIs to meet this demand. As e-commerce and cross-border trade expand, digital payments remain a central force accelerating adoption of fintech-as-a-service solutions across industries and regions.

- For instance, PayPal’s fraud detection engine saw a 5× throughput improvement, scaling from 200,000 to 1,000,000 transactions per second, by integrating Aerospike into its core stack.

Adoption of Cloud-Based Platforms

The rapid migration to cloud computing fuels market growth by enabling scalable and cost-efficient financial services. Cloud platforms offer robust infrastructure for payment processing, fraud detection, and customer analytics. Financial institutions adopt cloud services to reduce operational costs while improving agility and speed of deployment. Integration with APIs and blockchain strengthens data security and compliance. Cloud-based models also support innovation in customer experience by enabling real-time updates and personalized services. This adoption trend ensures cloud solutions remain at the forefront of fintech-as-a-service expansion globally.

- For instance, FIS reduced legacy tech workload share from 48 % to 9 %, shifting the majority of processing onto its new public and hybrid cloud platform, with its Investment Data Platform (IDP) processing billions of data records daily via Snowflake infrastructure.

Regulatory Push for Compliance Solutions

Increasing regulatory complexity drives demand for fintech-as-a-service offerings focused on compliance and risk management. Financial institutions must meet strict requirements on data security, anti-money laundering, and consumer protection. Fintech providers address these needs with automated monitoring tools, AI-driven fraud detection, and secure reporting systems. Governments worldwide encourage technology adoption to improve transparency and reduce financial crime. By integrating compliance into digital platforms, fintech solutions enable institutions to navigate regulatory landscapes effectively. This driver strengthens trust, ensuring market adoption across both financial and non-financial industries.

Key Trends & Opportunities

Integration of AI and Machine Learning

Artificial Intelligence and Machine Learning are reshaping fintech services by enabling predictive analytics, automated decision-making, and enhanced fraud prevention. These technologies provide actionable insights into customer behavior, risk profiles, and financial patterns. Financial institutions use AI-driven chatbots for customer support and ML algorithms for credit scoring. Their integration also improves operational efficiency by streamlining back-office functions. As adoption rises, AI and ML create opportunities for providers to deliver advanced, customer-centric fintech services while enhancing security and reducing operational risks.

- For instance, Adyen routes every transaction through real-time ML inference models, using its “Uplift” system which has been shown to boost authorization rates (i.e. transaction success) by up to 6 units over legacy routing; its off-policy evaluation framework processed a dataset at billion-transaction scale to simulate alternative routing strategies and project millions of incremental approved transactions over six months.

Expansion of Embedded Finance

Embedded finance emerges as a significant opportunity, enabling financial services to be integrated into non-financial platforms. Retailers, e-commerce providers, and technology firms increasingly adopt embedded solutions for payments, lending, and insurance. This model creates seamless customer journeys by removing the need for separate financial service access. The expansion supports new revenue streams for both fintech firms and non-financial enterprises. As consumer expectations grow for convenience and integrated solutions, embedded finance becomes a core trend shaping the fintech-as-a-service landscape.

- For instance, OpenPayd processes an annualized transaction volume exceeding €130 billion via its API infrastructure, supporting over 5 million connected accounts and guaranteeing 99.99% platform uptime, which demonstrates its capacity to embed finance at scale.

Key Challenges

Data Security and Privacy Risks

The reliance on cloud platforms, APIs, and digital payments raises concerns around cybersecurity and data privacy. Financial institutions face growing threats from hacking, data breaches, and identity theft. Meeting strict data protection regulations across multiple jurisdictions adds complexity. A single security lapse can damage customer trust and lead to financial penalties. Providers must continually invest in encryption, threat monitoring, and compliance frameworks. Despite advancements, addressing data security risks remains one of the most critical challenges in the fintech-as-a-service market.

High Integration and Implementation Costs

Although fintech-as-a-service reduces long-term operational costs, initial integration and deployment require significant investment. Financial institutions face expenses related to system upgrades, staff training, and compliance adaptation. Legacy infrastructure often complicates seamless adoption of modern fintech platforms. Small and mid-sized firms may find it difficult to justify these costs, slowing adoption in some segments. Vendors must provide flexible pricing models and support to address these concerns. Managing integration challenges is vital to ensure widespread adoption and market growth.

Regional Analysis

North America

North America leads the Fintech as a Service market with 38% share, supported by strong digital infrastructure and high fintech adoption. The U.S. dominates with extensive use of mobile banking, digital wallets, and cloud-based financial platforms. Regulatory frameworks such as the Consumer Financial Protection Bureau promote innovation while ensuring security and compliance. Key players including PayPal, Mastercard, and Fiserv drive market growth through continuous investments in APIs and AI-based solutions. Canada contributes with rising adoption of digital lending and embedded finance platforms, further consolidating the region’s leadership in fintech-as-a-service solutions.

Europe

Europe holds 28% of the market share, driven by supportive regulations like PSD2 that encourage open banking and API integration. The UK, Germany, and France lead adoption with strong demand for digital banking, peer-to-peer lending, and risk management solutions. The rise of neobanks and fintech startups accelerates growth by offering mobile-first services and seamless payment experiences. Major players such as Adyen and Finastra strengthen Europe’s ecosystem by providing innovative cloud-based and compliance-driven solutions. Ongoing digital transformation across financial institutions and growing investment in embedded finance support Europe’s significant presence in the global market.

Asia Pacific

Asia Pacific captures 22% share of the Fintech as a Service market, recording the fastest growth due to rapid digitization and expanding mobile payment adoption. China and India dominate with large unbanked populations now accessing digital wallets and peer-to-peer lending platforms. Government initiatives promoting cashless economies and financial inclusion further drive adoption. Key companies expand their presence in Southeast Asia to meet growing demand for mobile-first services. The integration of AI, blockchain, and cloud technologies across financial and non-financial sectors positions Asia Pacific as a crucial growth engine for fintech-as-a-service globally.

Latin America

Latin America accounts for 7% share of the market, with Brazil and Mexico leading digital finance adoption. The region benefits from strong demand for mobile banking and peer-to-peer lending services, driven by underserved populations seeking accessible financial solutions. Fintech firms collaborate with non-financial enterprises to expand embedded finance opportunities across retail and e-commerce sectors. Regulatory frameworks continue to evolve, encouraging financial inclusion and innovation. Local fintech providers, alongside global players such as OpenPayd and PayPal, are expanding solutions tailored to regional needs, strengthening Latin America’s role as an emerging fintech-as-a-service hub.

Middle East & Africa

The Middle East & Africa represent 5% share of the market, supported by rising digital transformation initiatives and increasing smartphone penetration. The United Arab Emirates and South Africa lead adoption, with growing investment in digital wallets, online banking, and compliance management systems. Governments encourage fintech growth through regulatory sandboxes and financial inclusion policies, expanding access for underserved populations. Non-financial institutions such as retailers adopt embedded finance to improve customer engagement. Partnerships between global players like Mastercard and regional fintech firms accelerate innovation, positioning the region for steady growth within the global fintech-as-a-service landscape.

Market Segmentations:

By Technology:

- Artificial Intelligence (AI) & Machine Learning (ML)

- Application Programming Interfaces (APIs)

By Application:

- Mobile Banking

- Peer-to-Peer (P2P) Lending

By End User:

- Financial Institutions

- Non-Financial Institutions

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Fintech as a Service market is shaped by key players including Dwolla, Fiserv, Mastercard, Finastra, Block, PayPal, FIS, Adyen, OpenPayd, and Envestnet. The Fintech as a Service market features a highly competitive environment, driven by rapid digital transformation and rising demand for scalable financial solutions. Companies compete by expanding product offerings, integrating advanced technologies such as AI, blockchain, and cloud computing, and focusing on regulatory compliance to build trust. Strategic collaborations with banks, non-financial enterprises, and technology firms are reshaping customer experiences through embedded finance and omnichannel payment solutions. Investments in cybersecurity and data protection remain a critical priority, addressing rising concerns around fraud and privacy. The market also witnesses growing emphasis on sustainability, innovation, and personalized services, ensuring continuous evolution to meet the diverse needs of financial institutions and end users.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dwolla

- Fiserv

- Mastercard

- Finastra

- Block

- Paypal

- FIS

- Adyen

- OpenPayd

- Envestnet

Recent Developments

- In July 2024, Open Payment Technologies Ltd, a leading provider of fintech solutions, announced the launch of its new digital wallet app, Kuady. Kuady is expected to provide a safe and user-friendly experience to ensure efficient money management.

- In May 2024, Google Pay announced the launching of three new features in the United States, including a new online shopping rewards function, a buy now, pay later option, and autofill for card details.

- In May 2024, London-based startup Fintech Farm raised of Series B funding for its ‘Neobank in a box’ service. The service will include a bouquet of operational apps for upcoming challenger banks for debit and credit cards, buy now, pay later options, credit engines, and stock investment.

- In May 2023, Rapyd announced a strategic alliance with Belvo. This collaboration combines Rapyd’s extensive international payment infrastructure with Belvo’s extensive knowledge & expertise in open banking, resulting in a powerful synergy that opens new business opportunities globally.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with increasing adoption of digital payment platforms across industries.

- Cloud-based fintech solutions will remain central for scalability and cost efficiency.

- AI and machine learning will enhance fraud detection and customer personalization.

- Blockchain integration will improve transparency and transaction security.

- Embedded finance will grow as non-financial firms integrate payment and lending services.

- Regulatory compliance technologies will see rising demand to manage evolving policies.

- Peer-to-peer lending platforms will gain traction among underserved populations.

- Financial institutions will strengthen partnerships with fintech firms for innovation.

- Mobile banking usage will accelerate with growing smartphone penetration.

- Data security and privacy innovations will drive customer trust and adoption.