Market Overview:

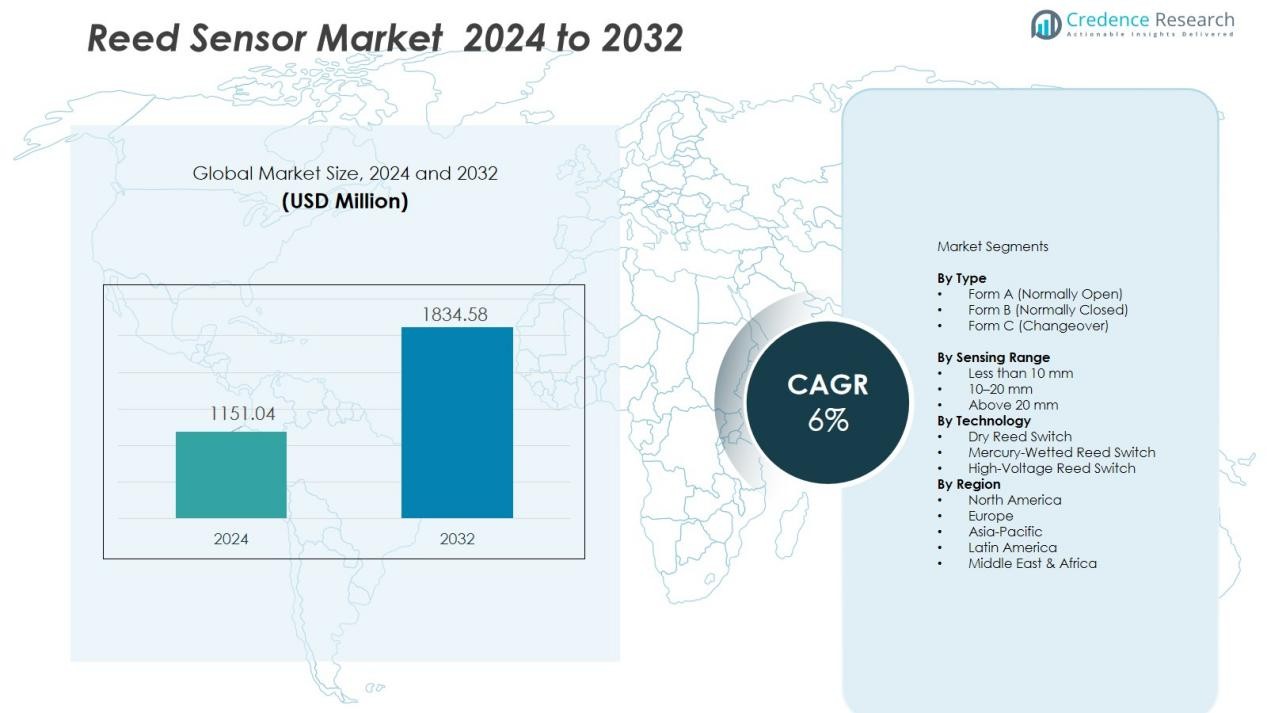

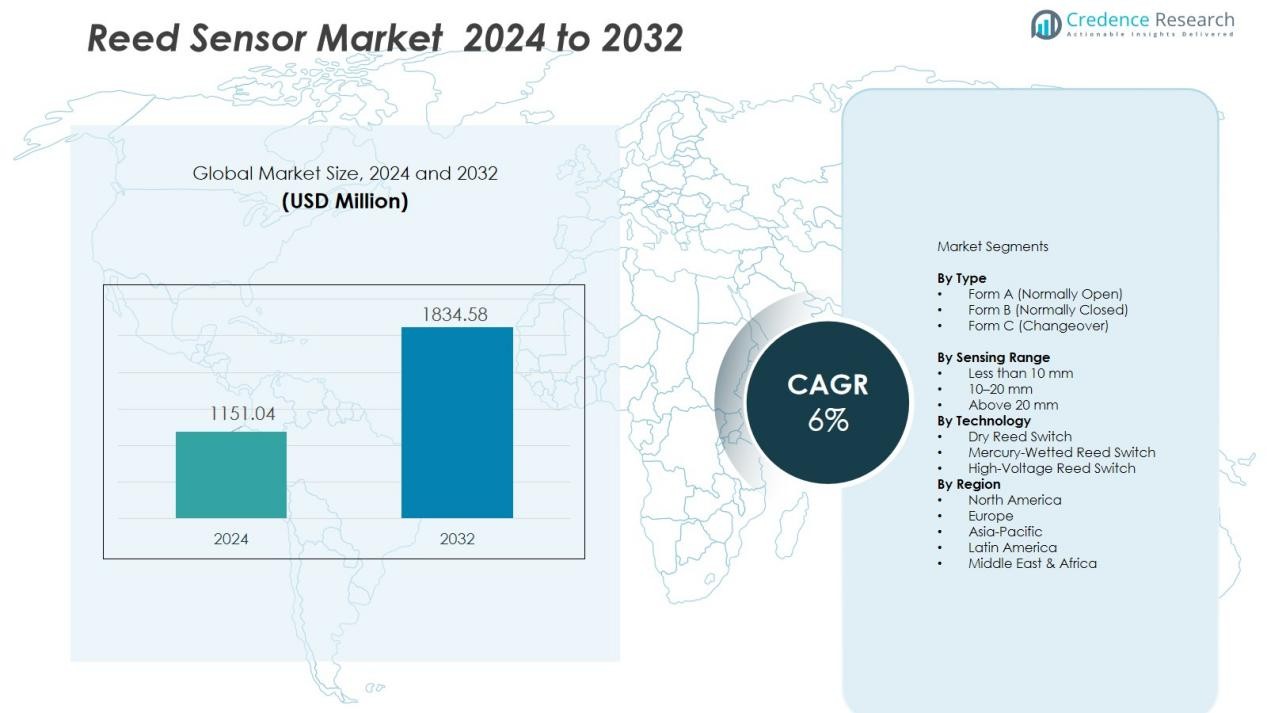

The Reed Sensor Market size was valued at USD 1151.04 million in 2024 and is anticipated to reach USD 1834.58 million by 2032, at a CAGR of 6 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Reed Sensor Market Size 2024 |

USD 1151.04 Million |

| Reed Sensor Market, CAGR |

6% |

| Reed Sensor Market Size 2032 |

USD 1834.58 Million |

Market drivers include strong penetration of reed sensors in automotive applications such as ABS systems, power windows, braking systems, and advanced driver assistance systems (ADAS). Their growing usage in smart meters, security systems, proximity detection, and medical instruments also accelerates demand. Key benefits such as low power consumption, airtight sealing, mechanical wear resistance, and compatibility with wireless systems make reed sensors an attractive replacement for mechanical switches and Hall-effect sensors in targeted applications. Expanding industrial automation and increasing deployment of IoT-enabled devices continue to enhance market potential.

Regionally, Asia-Pacific leads the market due to rapid manufacturing growth, strong automotive production, and rising adoption of smart consumer devices in China, Japan, South Korea, and India. North America shows strong demand driven by technology upgrades in aerospace, defense, and healthcare sectors. Europe maintains steady growth supported by stringent safety regulations, industrial automation investments, and high automotive innovation across Germany, France, and the UK. Emerging markets in Latin America and the Middle East offer growing opportunities with increasing electronics manufacturing and industrial modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Reed Sensor Market was valued at USD 1,151.04 million in 2024 and is projected to reach USD 1,834.58 million by 2032, growing at a CAGR of 6% during the forecast period.

- Asia-Pacific leads with a 39.6% market share, driven by strong electronics manufacturing, growing automotive output, and increasing adoption in IoT-enabled consumer devices; North America holds 28.1%, supported by advanced applications in aerospace, healthcare, and defense; Europe accounts for 23.4%, benefiting from automotive innovation, industrial automation, and smart grid integration.

- Asia-Pacific is the fastest-growing region with a projected CAGR above 6.5%, supported by rising electric vehicle production, expansion of renewable energy infrastructure, and smart city development across China, Japan, and India.

- By application, the automotive segment holds the largest share at 36.2%, driven by reed sensor integration in safety systems, EV modules, and comfort features such as power windows and seatbelt alerts.

- The consumer electronics segment accounts for 24.7% of the market, supported by demand for non-contact sensing in smart meters, home automation, and portable electronic devices.

Market Drivers:

Market Drivers:

Strong Demand for Non-Contact Sensing Solutions Enhances Market Adoption

The Reed Sensor Market benefits from rising demand for non-contact switching systems across industrial, medical, and consumer electronics. Industries prefer reed sensors due to their mechanical wear resistance, moisture protection, and long operational life. It ensures reliable performance in environments that require sealed and corrosion-proof components. Their ability to operate without continuous power supply attracts manufacturers focused on low-energy designs. Increasing use in smart and compact consumer devices strengthens their market presence.

- For instance, Littelfuse developed hermetically sealed reed sensors that endure over 1 billion switching cycles in harsh industrial settings.

Expansion of Automotive Safety and Convenience Features Drives Sensor Integration

Automotive manufacturers adopt reed sensors to improve vehicle safety, comfort, and operational reliability. These sensors support features such as ABS, gear shift monitoring, brake fluid detection, power window control, and seat belt status detection. It offers high switching speed and tolerance to vibration, dust, and temperature fluctuations. Their compact size enables integration into increasingly smaller automotive modules. Growing deployment of electric vehicles further elevates sensor consumption.

- For instance, Bosch integrated Hall-effect sensors in its ABS systems for Volkswagen models, which transmit precise, digital signals to the control unit. This system allows the hydraulic modulator to adjust brake pressure at each wheel up to 15 to 20 times per second during emergency braking situations, which helps the driver maintain steering control.

Rising IoT Penetration and Smart Device Production Boosts Demand

Smart home systems, building automation, metering solutions, and consumer electronics integrate reed sensors to improve proximity detection and security functions. Manufacturers use them in wireless devices due to their low power demand and compatibility with IoT communication modules. It helps enable reliable actuation in battery-powered products. The shift toward connected appliances increases reed switch applications in lock systems, liquid level measurement, and portable electronics. Strong demand for automation upgrades supports sustained market expansion.

Increased Use in Industrial and Medical Applications Strengthens Market Growth

Industrial machinery relies on reed sensors for precise position sensing, motor control, and speed monitoring. Medical devices adopt these sensors for patient monitoring systems, implantable instruments, and diagnostic equipment due to their sealed structure and magnetic responsiveness. It improves operational safety where contamination risks must be minimized. High reliability under sterile and controlled environments encourages manufacturers to use reed switches over mechanical components. Rising production of advanced instruments reinforces the market growth momentum.

Market Trends:

Miniaturization and Enhanced Sensor Durability Shape New Design Priorities

The Reed Sensor Market experiences a growing trend toward miniaturization to support compact electronics and tighter integration in automotive, medical, and industrial systems. Manufacturers develop smaller reed switches with high magnetic sensitivity to fit space-constrained assemblies. It offers improved response precision without compromising durability or switching life. Trends indicate increasing use of advanced sealing materials to boost resistance to moisture, vibration, and extreme temperatures. The focus on durability aligns with rising deployment in harsh outdoor, industrial, and automotive environments. Integration into portable medical instruments and compact smart devices accelerates demand for miniature reed sensors. Industrial automation applications further encourage development of rugged designs.

- For instance, Standex Electronics offers ultra-miniature reed switches, such as the GR150 series, with dimensions under 5 mm in length (specifically 3.7 mm), enabling integration into space-constrained applications like hearing aids and laptops while maintaining high magnetic sensitivity.

Integration with IoT Ecosystems and Smart Automation Fuels Market Evolution

Reed sensors gain momentum in IoT-enabled systems due to their low energy requirement and compatibility with wireless modules. Manufacturers incorporate them into smart meters, building security devices, robotic systems, and remote monitoring units to improve measurement accuracy and control functions. It helps extend battery life, supporting long-term usage in residential, commercial, and industrial applications. Growing use in smart city infrastructure drives new product designs with enhanced connectivity support. Integration into energy-efficient appliances and automated lock systems reflects a broader shift toward sensor-based control. The market also witnesses rising demand for reed-based liquid level monitoring in industrial fluid management and medical diagnostics. This widespread integration reinforces reed sensor relevance in next-generation smart solutions.

- For instance, the smart metering industry leverages reed sensors (such as those manufactured by Littelfuse) in designs specifically for gas and water meters because they consume zero current in the off state, which is a critical feature for extending battery life to the typical 10-20 year operational lifespan required for these utility devices.

Market Challenges Analysis:

Competition from Alternative Sensing Technologies Restricts Market Share

The Reed Sensor Market faces pressure from Hall-effect sensors, MEMS sensors, and optical switches that offer fast response time and advanced integration capabilities. Manufacturers in automotive electronics and smart devices often prefer semiconductor-based sensors for scalable production and digital compatibility. It leads to substitution risks where lower maintenance and miniaturized electronic sensors provide added value. Reed sensors also face limitations in switching speed compared to advanced solid-state options. High sensitivity to external magnetic interference can affect measurement reliability. These factors create adoption barriers in applications requiring precision under variable electromagnetic conditions.

Limitations in Scalability and Customization Delay Broader Adoption

Design constraints related to size, switching load capacity, and long-term reliability under high current environments limit reed sensor use in heavy industrial and high-power systems. Manufacturers find scaling difficult without compromising structural durability or sensitivity. It demands tailored solutions for specialized medical, automotive, and industrial equipment, increasing development time and cost. More customization increases procurement delays for high-volume production lines. Limited compatibility with advanced digital circuits restricts easy integration into evolving smart platforms. These operational constraints slow market penetration in next-generation electronics and fully automated systems.

Market Opportunities:

Rising Deployment in IoT Devices and Smart Infrastructure Creates New Growth Prospects

The Reed Sensor Market gains new opportunities through expanding use in smart city systems, connected appliances, and IoT-enabled industrial monitoring. Reed sensors support battery-powered devices due to their low energy requirement and resistance to environmental stress. It strengthens adoption in smart locks, automated meters, home security products, medical wearables, and portable diagnostic tools. The shift toward wireless control systems accelerates sensor integration into remote monitoring platforms. Growing investment in building automation and smart utility infrastructure increases demand for reliable switching components. The opportunity for compact and sealed reed designs aligns with rising growth in consumer and medical electronics.

Increasing Adoption in Electric Vehicles and Renewable Energy Applications Broadens Market Scope

Electric vehicles rely on reed sensors for battery management systems, charging units, motor position sensing, and thermal monitoring. Manufacturers recognize their ability to support high-voltage safety systems due to strong insulation and non-contact actuation. It drives wider deployment in EV charging stations and renewable power storage solutions. Wind turbines, solar inverters, and energy storage equipment require durable sensors capable of functioning under extreme environmental conditions. Reed switches meet these requirements through sealed construction and resistance to corrosion, pressure, and vibration. Growing investment in sustainable energy infrastructure opens strong long-term opportunities for advanced reed sensor integration.

Market Segmentation Analysis:

By Type

The Reed Sensor Market segments by type into form A (normally open), form B (normally closed), and form C (changeover) configurations. Form A holds a strong share due to extensive usage in automotive position sensing, consumer electronics, and security systems. It offers reliable switching with simple integration into compact modules. Form C gains traction where multi-state switching is essential, particularly in industrial automation and advanced medical devices. Form B serves specialized circuits that require safety-driven normally closed actuation. Demand for miniature reed types continues to rise across portable instruments and smart appliances.

- For instance, Standex Electronics developed a Form A reed sensor for electric vehicle position detection that integrates a stainless-steel spring mechanism, reducing activation distance to 2.3 mm with a 60% improvement in sensitivity.

By Sensing Range

Segments by sensing range include less than 10 mm, 10–20 mm, and above 20 mm. Short-range reed sensors dominate consumer electronics, wearable medical devices, and compact industrial tools, driven by their space efficiency and low power operation. It enables high accuracy in proximity detection for smart locks, portable diagnostics, and IoT-enabled appliances. Mid-range sensors gain demand in automotive modules, smart meters, and building automation due to their reliable detection distance and vibration tolerance. Long-range sensors support heavy machinery, renewable energy systems, and water level controllers where extended magnetic actuation is critical.

- For instance, Standex Electronics’ GR150 magnetic reed switch, integrated in miniaturized pill cameras, enables precise proximity detection with an operating range of -40 °C to +125 °C for non-contact activation.

By Technology

Technology segmentation includes dry reed, mercury wetted, and high-voltage reed switches. Dry reed switches lead the market due to high durability, sealed construction, and cost efficiency across automotive and industrial systems. Mercury-wetted switches deliver precise switching with lower bounce but face environmental restrictions, limiting widespread usage. It maintains selective demand in specialized test equipment and precision instruments. High-voltage reed switches expand adoption in electric vehicles, charging stations, and renewable energy systems that require safe isolation under high electrical loads.

Segmentations:

By Type

- Form A (Normally Open)

- Form B (Normally Closed)

- Form C (Changeover)

By Sensing Range

- Less than 10 mm

- 10–20 mm

- Above 20 mm

By Technology

- Dry Reed Switch

- Mercury-Wetted Reed Switch

- High-Voltage Reed Switch

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Leads with Expanding Electronics Manufacturing and Automotive Output

The Reed Sensor Market holds significant growth momentum in Asia-Pacific due to strong electronics production hubs and rising automotive output across China, Japan, South Korea, and India. Manufacturers benefit from robust semiconductor supply chains and increasing deployment of smart appliances, electric vehicles, and portable medical devices. It gains demand from industrial automation upgrades and expanding renewable energy installations in the region. Governments support investment in smart infrastructure, strengthening adoption of non-contact sensing devices in utility monitoring and building automation. High-volume production capabilities also reduce costs for reed-based components, encouraging wider market penetration. The pace of digital transformation further boosts demand for compact and durable reed switches in connected systems.

North America Shows Steady Expansion Driven by Advanced Technology Applications

North America maintains stable growth supported by strong adoption in aerospace, defense systems, and advanced medical technology. Reed sensors play a critical role in high-reliability applications such as avionics modules, safety controls, and portable diagnostic tools. It supports stringent regulatory requirements for secure switching systems in healthcare and industrial equipment. The region benefits from rising deployment of IoT networks and smart monitoring platforms in commercial and residential buildings. Electric vehicle development in the United States and Canada also increases demand for reed-based safety and battery control systems. Ongoing innovation in robotics and automation enhances long-term opportunities.

Europe Benefits from Automotive Innovation and Industrial Automation Adoption

Europe demonstrates consistent demand driven by innovation in automotive technology, industrial automation, and renewable energy deployment. German, French, and UK automotive manufacturers integrate reed sensors into ADAS components, EV modules, and advanced comfort systems. It strengthens usage in smart grid systems and wind energy applications due to strong sustainability policies in the region. High safety standards support adoption in medical instruments and precision industrial equipment. Expansion of smart factory initiatives encourages wider usage in monitoring, machine controls, and predictive maintenance tools. Growing demand for compact sensors in consumer electronics and building automation reinforces Europe’s competitive market landscape.

Key Player Analysis:

Competitive Analysis:

The Reed Sensor Market presents a competitive landscape shaped by strong technology capabilities and product diversification across global manufacturers. Key players focus on improving sensing precision, miniaturization, and durability to support automotive modules, smart devices, and medical instruments. Texas Instruments Inc., Infineon Technologies AG, NXP Semiconductors N.V., STMicroelectronics N.V., ON Semiconductor Corporation, Broadcom Inc., and Analog Devices, Inc. actively expand their portfolios to serve high-growth segments. It drives competition centered on integrating reed switches with advanced electronic systems that meet strict reliability standards.

Manufacturers emphasize cost efficiency, sealed construction, and compatibility with wireless platforms to gain market share. Leading companies invest in high-voltage and low-power variants to support electric vehicles, renewable energy systems, and IoT-based equipment. Reed sensor suppliers also strengthen distribution networks across Asia-Pacific to leverage strong electronics production. Product customization, miniaturized designs, and robust environmental resistance remain critical strategies for sustaining competitive advantage.

Recent Developments:

- In June 2025, Texas Instruments announced plans to invest over $60 billion in seven U.S. semiconductor fabs across Texas and Utah sites, marking the largest such investment in U.S. history and supporting over 60,000 jobs.

- In February 2025, Infineon announced the sale of its Austin Fab to SkyWater Technology to establish a strategic manufacturing partnership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Sensing Range, Technology and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Increasing adoption in smart consumer electronics will strengthen demand for compact reed switches in proximity detection and security features.

- Rising installation of building automation systems will promote the use of reed sensors in smart locks, energy meters, and HVAC monitoring units.

- Expansion of electric vehicle production will accelerate integration of reed switches in battery management, charging systems, and safety controls.

- Growth in portable medical instruments will support demand for sealed, biocompatible, and low-power sensing components.

- Industrial automation will rely more on reed sensors for position sensing, motor control, and predictive maintenance systems.

- Greater deployment of renewable energy infrastructure will drive usage in wind turbines, solar inverters, and power storage systems.

- Manufacturers will focus on miniaturized and high-accuracy reed designs to support space-constrained electronics.

- IoT penetration will encourage development of reed switches compatible with wireless modules and long-life battery operation.

- Regional production in Asia-Pacific will expand, reducing costs and boosting supply chain competitiveness.

- Product customization for harsh environments will gain priority to meet demands in aerospace, offshore, and defense applications.

Market Drivers:

Market Drivers: