Market Overview:

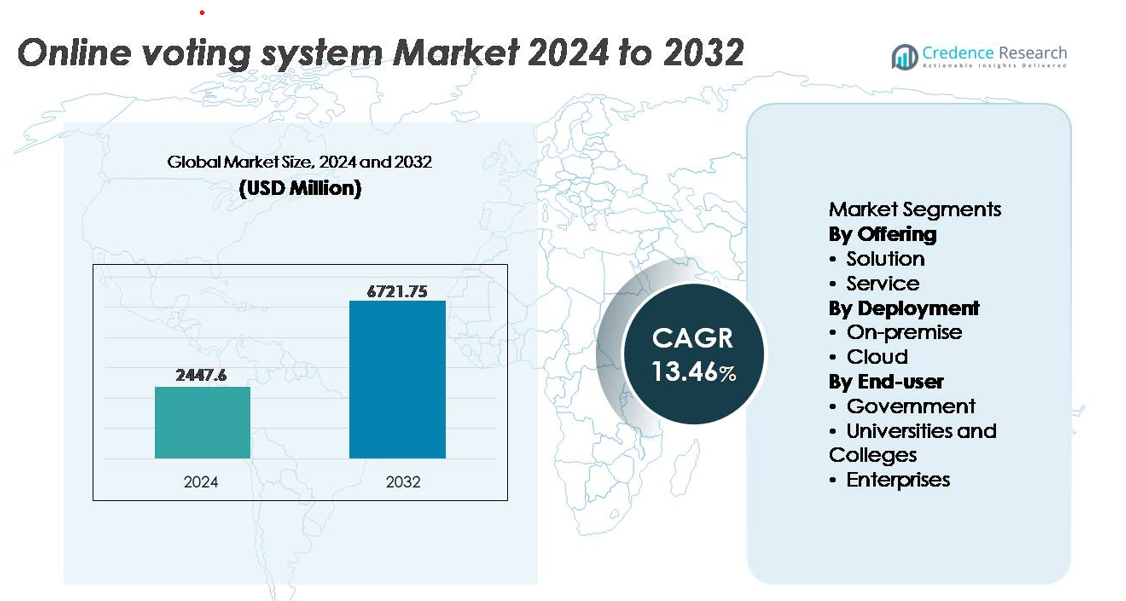

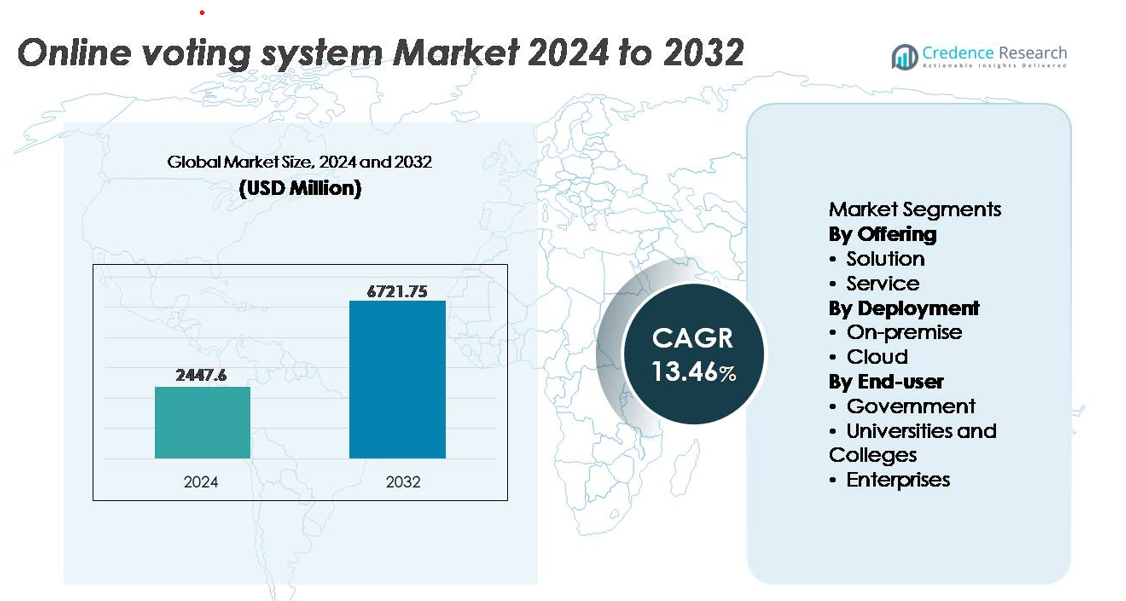

The global online voting system market was valued at USD 2,447.6 million in 2024 and is projected to reach USD 6,721.75 million by 2032, expanding at a CAGR of 13.46% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Online Voting System Market Size 2024 |

USD 2,447.6 million |

| Online Voting System Market, CAGR |

13.46% |

| Online Voting System Market Size 2032 |

USD 6,721.75 million |

The online voting system market is led by a diverse set of technology providers and platform specialists, including Democracy Live Inc, Smartmatic, POLYAS, Avante International Technology Inc., Votem Corp, BallotReady, benel Solutions, Insightrix Research Inc., ElectionBuddy Inc., and public-sector stakeholders such as the Australian Electoral Commission. These players compete by offering secure authentication, encrypted ballot processing, cloud deployment, and blockchain-based audit trails. North America remains the leading region with a 35% market share, driven by strong digital governance adoption, election modernization initiatives, and advanced cybersecurity readiness. Europe follows, supported by regulated digital identity frameworks and government-funded e-democracy programs.

Market Insights:

- The global online voting system market was valued at USD 2,447.6 million in 2024 and is projected to reach USD 6,721.75 million by 2032, registering a CAGR of 13.46% during the forecast period.

- Growth is driven by rising digital governance initiatives, demand for transparent electoral processes, and increasing adoption of cloud-based voting platforms across public institutions and private organizations.

- Key trends include blockchain-enabled verification, biometric authentication, and AI-driven fraud detection, improving security, scalability, and voter accessibility.

- The competitive landscape features technology providers and election software vendors focused on encryption, compliance, and remote participation, with solution-based offerings holding the dominant segment share.

- North America leads with 35% regional share, followed by Europe at 28% and Asia-Pacific at 22%, supported by digital identity frameworks, cybersecurity development, and expanding smart governance programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Offering:

The solution segment holds the dominant market share, driven by increasing demand for secure, scalable, and integrated online voting platforms across government and institutional applications. Organizations prioritize complete software suites with real-time vote tracking, end-to-end encryption, biometric authentication, and blockchain-enabled audit trails to reduce fraud and improve transparency. The service segment is gaining traction as support, customization, integration, and election management services become crucial for first-time adopters transitioning from paper-based systems. However, solutions remain the growth anchor, as standardized, cloud-compatible voting platforms reduce cost and implementation complexity for large-scale deployments.

- For instance,”Smartmatic’s digital election infrastructure has processed more than 5 billion electronically cast votes in the Philippines across five election cycles from 2010 to 2022, demonstrating system scalability and throughput under national-level deployments. Its technology has also been deployed in numerous other countries on five continents.”

By Deployment:

The cloud deployment segment leads the market, capturing the largest share due to rising adoption of remote voting, decentralized authentication, and flexible subscription-based models that reduce infrastructure ownership costs. Cloud platforms enable high voter turnout by supporting device-agnostic access and real-time dashboarding for administrators spanning multiple locations. The on-premise segment retains relevance among government bodies and defense-linked institutions requiring controlled data residency, strict compliance, and restricted network environments. Nonetheless, the long-term shift favors cloud ecosystems as cybersecurity modernization, AI-driven voter validation, and cross-border digital governance initiatives expand globally.

- For instance, Votem’s cloud-based CastIron Platform has processed millions of digital ballots primarily for corporate, union, and private organizations, as well as some small-scale government or military pilot programs.

By End-user:

The government segment dominates the online voting system market, accounting for the highest usage as national, state, and municipal authorities conduct public elections, referendums, and citizen consultations. Heightened pressure to increase voter participation, digitize electoral processes, and improve auditability drives demand within this segment. Universities and colleges adopt online voting to streamline student body elections and board decisions, while enterprises leverage digital ballots for shareholder resolutions and internal governance voting. However, government-led digital transformation initiatives and mandates for secure e-democracy solutions position the public sector as the anchor revenue contributor.

Key Growth Drivers:

Digital Government Transformation and E-Democracy Expansion

The rapid transition toward digital governance models is a primary driver accelerating adoption of online voting systems. National and municipal administrations are prioritizing electronic participation to improve citizen engagement, reduce the administrative burden of manual elections, and modernize legacy infrastructure. As governments launch smart city programs and public portals, digital voting complements broader e-services including document access, tax filing, and identity authentication. The integration of online voting into national digital ID frameworks enhances verification accuracy while eliminating ballot duplication and human error. Additionally, remote and postal voting limitations have intensified the need for reliable digital alternatives capable of supporting cross-border citizens, military personnel, and residents living abroad. The cost savings associated with reduced physical ballot logistics, polling station operations, and labor-intensive counting processes further incentivize public sector migration. Collectively, these elements position online voting as a strategic enabler of transparent, fast, and inclusive democratic operations.

- For instance, Estonia’s i-Voting model-supported by secure digital ID and PKI infrastructure-has enabled over 2.3 million legally binding online votes since inception, with participation spanning remote voters across more than 50 countries, demonstrating the global role of digital ballots in inclusive democracy.

Increasing Cybersecurity Capabilities Enhancing Trust and Adoption

Advancements in cybersecurity are fueling confidence in online voting, addressing concerns that previously hindered adoption. Innovations such as end-to-end encryption, multi-factor authentication, biometric identity confirmation, and cryptographic vote sealing reduce exposure to manipulation and tampering. Blockchain-based distributed ledgers add immutable audit trails, ensuring ballot transparency and preventing unauthorized alteration. Real-time threat monitoring and AI-driven anomaly detection strengthen fraud prevention by identifying bot activity, duplicate submissions, and IP-based attacks. Cybersecurity standardization frameworks adopted by governments and enterprises support compliance consistency, especially in regions enforcing stringent data sovereignty mandates. These maturing capabilities reshape stakeholder perceptions by reinforcing vote integrity, confidentiality, and traceability, thus narrowing the trust gap historically associated with online elections. The synergy of advanced threat intelligence and regulated digital security infrastructure significantly advances the feasibility of replacing or supplementing traditional ballot processes.

- For instance, Smartmatic reports safeguarding over 6.5 billion digitally cast votesthrough encrypted transmission and digitally signed ballot records cumulatively across national and municipal elections in more than 35 countries since 2000.

Rising Demand for Remote Voting and Workforce Mobility

The increase in global mobility, hybrid workforces, and geographically distributed stakeholders has created strong demand for digital voting platforms that operate beyond polling locations. Enterprises managing international shareholder decisions, academic institutions conducting student governance, and organizations executing board elections benefit from flexible platforms that support participation without physical presence. Remote access enables broader voter turnout by eliminating barriers associated with travel, health restrictions, scheduling constraints, and diaspora voting challenges. Aging populations and individuals with disabilities also gain improved accessibility through digital ballot submission and voice-assisted interfaces. As digital citizenship cultures develop and younger demographics expect mobile-first civic engagement, remote voting evolves into an expected service rather than an optional channel. These factors collectively drive long-term structural demand for online voting as institutions recognize the operational, logistical, and participation advantages of fully remote election execution.

Key Trends & Opportunities:

Blockchain Integration for Transparent and Tamper-Resistant Elections

Blockchain-based voting platforms are emerging as a transformational trend, offering immutable vote records, decentralized validation, and transparency without exposing voter identity. Smart contracts automate result tallying based on predefined rules, reducing manual intervention and error. This transparency appeals to governments facing mistrust in electoral processes and organizations requiring verifiable governance records. The technology also enables verifiable cryptographic proofs that allow voters to confirm ballot inclusion without revealing vote content. As pilot projects in municipal elections, trade associations, and shareholder voting demonstrate viability, blockchain voting presents substantial opportunities for providers capable of delivering scalable, low-latency ledger infrastructure.

- For instance, Votem’s blockchain-enabled CastIron platform has processed over 13 million verifiable digital ballots, using hash-based cryptographic proofs to secure each individual vote throughout its lifecycle.

AI and Biometrics Enhancing Voter Verification and Analytics

AI-driven facial recognition, fingerprint scanning, and voice biometrics are becoming increasingly common to validate voter identity and prevent impersonation. Machine learning algorithms monitor ballots for anomalies, detect repetitive submission patterns, and flag suspicious access behaviors in real time. Predictive analytics supports election planning by forecasting turnout and optimizing digital infrastructure loads. Natural language processing improves accessibility through multilingual and voice-command interfaces, expanding participation across diverse populations. The integration of biometrics and AI offers opportunities for vendors developing privacy-preserving verification models that balance security requirements with data protection regulations, particularly in high-compliance industries and public-sector elections.

- For instance, Smartmatic’s biometric voter authentication technology has enrolled and verified more than 23 million voters using fingerprint and facial recognition during national elections.

Key Challenges:

Cybersecurity Risks and Perception of Election Tampering

Despite advancements, public concern regarding hacking, system breaches, and manipulation remains a critical challenge. Elections represent high-value targets for cybercriminals, political interference actors, and disruptive organizations seeking influence or destabilization. The perception of vulnerability-even if technically mitigated-can damage trust and reduce voter acceptance. Additionally, sophisticated cyberattacks such as deepfake impersonation, ransomware, and coordinated bot-driven misinformation campaigns complicate verification and public communication. Reassuring stakeholders requires continuous investment in security infrastructure, incident response protocols, certification standards, and third-party auditing frameworks to validate system credibility.

Regulatory Diversity and Compliance Complexity Across Regions

Online voting systems face fragmented global regulations, with each jurisdiction enforcing different standards for identity management, data residency, privacy, and cryptographic controls. Some regions prohibit digital voting due to constitutional constraints, while others require proprietary infrastructure controlled exclusively by government operators. Cross-border compliance complicates deployment models for vendors offering standardized cloud-based platforms. Furthermore, continuous regulatory evolution demands rapid product adaptability and escalates development costs. Organizations must navigate certification, public procurement requirements, and evolving legal risk-creating barriers for both new entrants and scaling providers in the online voting ecosystem.

Regional Analysis:

North America

North America holds the largest market share of approximately 35%, supported by strong digital governance frameworks, high internet penetration, and early adoption of cloud-based election platforms by federal and local authorities. The U.S. leads with large-scale pilots in municipal and shareholder voting, while Canada advances digital democracy initiatives to enhance accessibility for remote and Indigenous communities. The region’s mature cybersecurity ecosystem encourages the integration of blockchain, biometrics, and AI-based identity validation, reducing concerns around election integrity. Enterprise-based voting for board resolutions and union ballots further accelerates commercial adoption.

Europe

Europe accounts for around 28% of the market share, driven by stringent e-governance policies, rapid digital identity adoption, and growing use of online voting for cross-border citizen participation within EU member states. Estonia’s nationwide i-Voting model remains a global benchmark, influencing digital election innovations across the bloc. GDPR compliance frameworks strengthen trust and standardization, enabling secure authentication and encrypted result reporting. Universities and government institutions increasingly adopt online voting to improve efficiency and reduce environmental impact. Expansion is supported by public funding, e-democracy initiatives, and multi-language online platforms.

Asia-Pacific

Asia-Pacific represents approximately 22% of the market share and stands as the fastest-growing region due to expanding smart city programs, rapid cloud adoption, and escalating population participation in digital governance. Countries such as India, South Korea, Japan, and Australia are exploring pilot digital elections to address voter turnout challenges and support vast remote populations. The region’s thriving enterprise sector fuels demand for secure internal voting and shareholder meeting platforms. Growth is further supported by mobile-first populations, rising cybersecurity investments, and government-backed digital identity infrastructure enabling remote and secure voter authentication.

Latin America

Latin America holds close to 9% of the market share, driven by modernization of election processes and rising demand for transparency across public governance. Brazil and Mexico lead digital transformation efforts, leveraging secure e-participation platforms for referendums and policy consultations. However, uneven digital infrastructure and cybersecurity readiness create adoption variability across the region. Universities and labor organizations represent notable early adopters, utilizing online voting for internal decision-making. Increasing regulatory alignment, cloud migration, and anti-fraud digital frameworks present future growth opportunities as governments seek cost-efficient alternatives to paper-based elections.

Middle East & Africa

The Middle East & Africa account for around 6% of the market share, with adoption gaining momentum through national digital transformation agendas and investment in secure cloud-based public services. Gulf countries spearhead initiatives to enable remote participation for expatriate populations, while African nations explore digital voting to address logistical constraints in rural locations. Challenges persist due to infrastructure gaps and regulatory fragmentation, yet rising smartphone penetration and global partnerships for cybersecurity enhancement support long-term growth. Pilot implementations in corporate governance and academic institutions lay foundational adoption across the region.

Market Segmentations:

By Offering

By Deployment

By End-user

- Government

- Universities and Colleges

- Enterprises

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the online voting system market is characterized by a mix of global technology providers, specialized election software vendors, cybersecurity firms, and emerging blockchain-focused startups. Companies compete on system scalability, encryption capabilities, user authentication technologies, and compliance alignment with electoral regulations across regions. Leading providers prioritize end-to-end security, tamper-proof audit trails, and seamless integration with digital identity frameworks and cloud platforms. Strategic partnerships with governments, universities, and enterprises enable market penetration, while acquisitions and product portfolio expansion strengthen technological differentiation. The growing adoption of remote participation models fuels investment in blockchain-based verification, biometric authentication, multilingual interfaces, and AI-driven fraud detection. Open-source platforms gain traction by offering transparency and lower implementation costs, while full-service vendors differentiate through managed election administration, technical support, and real-time analytics. As regulatory environments evolve, market leaders continue shaping standards around trust, transparency, and accessibility to drive digital transformation in global voting ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In October 2025, Smartmatic S. federal prosecutors filed charges against Smartmatic (and its parent corporation) alleging a long-running bribery and money-laundering scheme tied to election-contract deals in the Philippines. The indictment stems from contracts awarded between 2015–2018. Smartmatic has denied the allegations and committed to contest them in court.

- In September 2025, Smartmatic A spokesperson from Smartmatic appeared on major media to outline the security, transparency, and accessibility benefits of online voting, advocating for increased adoption of remote-voting solutions.

- In 2025, POLYAS reports that over 4 million voters have used its online-voting system, demonstrating adoption and scale of its platform.

Report Coverage:

The research report offers an in-depth analysis based on Offering, Deployment, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Online voting adoption will accelerate as governments integrate digital citizenship and remote participation into electoral frameworks.

- Cloud-based platforms will become the preferred deployment model due to scalability, compliance flexibility, and reduced infrastructure costs.

- Blockchain will play a central role in securing audit trails and strengthening public trust in digital ballots.

- Biometric authentication and AI-powered identity verification will reduce impersonation and enhance system integrity.

- Enterprises will expand usage for corporate governance, shareholder voting, and decentralized workforce decision-making.

- Universities and academic institutions will remain early adopters for student governance and administrative elections.

- Accessibility enhancements will support voting for senior citizens, people with disabilities, and remote populations.

- Regulatory standardization will improve interoperability and encourage cross-border digital voting participation.

- Open-source voting platforms will gain traction for transparency and cost efficiency.

- Public-private technology collaborations will shape national-level digital election infrastructure and security standards.