Market Overview

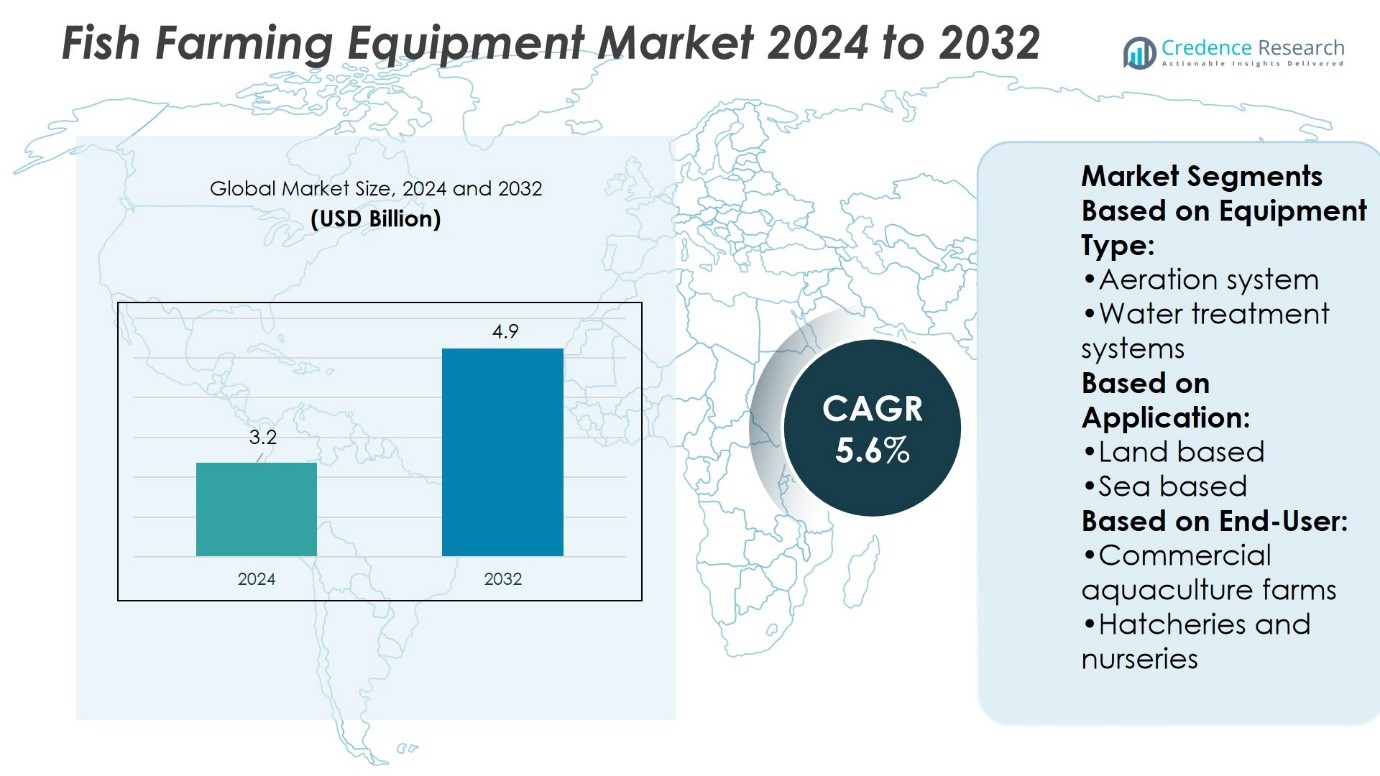

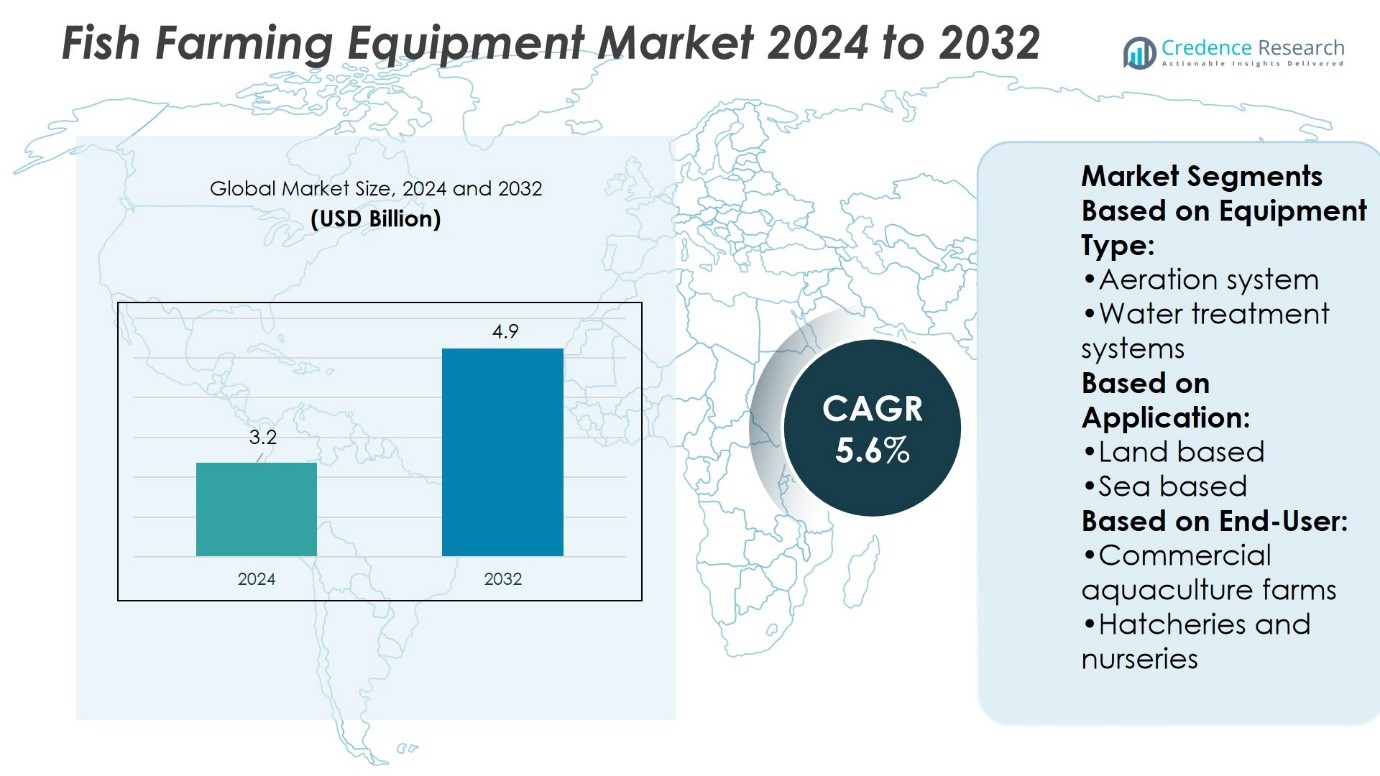

Fish Farming Equipment Market size was valued at USD 3.2 billion in 2024 and is anticipated to reach USD 4.9 billion by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fish Farming Equipment Market Size 2024 |

USD 3.2 Billion |

| Fish Farming Equipment Market, CAGR |

5.6% |

| Fish Farming Equipment Market Size 2032 |

USD 4.9 Billion |

The Fish Farming Equipment Market grows with rising global demand for seafood, supported by population growth and urbanization. Advanced equipment enables efficient feeding, aeration, and water treatment, improving yields while reducing environmental risks. It benefits from technological progress in automation, IoT-based monitoring, and data-driven farm management. Sustainability also drives adoption, as farms invest in eco-friendly solutions that ensure compliance with strict environmental regulations. Offshore farming technologies expand opportunities, with durable cages and oxygenation systems supporting large-scale operations. Strong government support, coupled with consumer preference for traceable and sustainable seafood, positions the market for steady long-term growth.

The Fish Farming Equipment Market shows strong geographical diversity, with Asia-Pacific holding the largest share, driven by China, India, and Southeast Asia’s aquaculture expansion. Europe follows with advanced salmon farming in Norway and Scotland, supported by sustainable practices and strict regulations. North America grows through adoption of recirculating aquaculture systems, while Latin America strengthens production in Chile and Brazil. The Middle East & Africa remain emerging markets. Key players include AKVA, Innovasea, Grundfos Holding A/S, ABB, and Blue Ridge Aquaculture.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Fish Farming Equipment Market size was valued at USD 3.2 billion in 2024 and is projected to reach USD 4.9 billion by 2032, growing at a CAGR of 5.6%.

- Rising global demand for seafood driven by population growth and urbanization boosts equipment adoption.

- Technological advancements in automation, IoT-based monitoring, and data-driven management shape market trends.

- Competition intensifies as companies focus on sustainable solutions, smart feeding systems, and advanced aeration technologies.

- High operational costs and strict environmental regulations act as key restraints for smaller farms.

- Asia-Pacific leads with China, India, and Southeast Asia, while Europe and North America follow with advanced systems.

- Latin America grows with Chile and Brazil, and Middle East & Africa show emerging opportunities for adoption.

Market Drivers

Rising Global Demand for Aquaculture Products Driving Equipment Needs

The Fish Farming Equipment Market grows due to strong demand for seafood driven by population growth and urbanization. Consumers seek affordable protein sources, and aquaculture meets this rising need. It supports consistent supply where wild fishing is limited or unsustainable. Advanced equipment ensures efficiency in fish breeding, feeding, and monitoring. Adoption of automated systems improves yield quality and reduces manual labor dependence. These drivers make modern fish farming technology a critical element in global food security.

- For instance, Blue Ridge Aquaculture, operating from a 100,000 ft² recirculating aquaculture system facility, produces around 5 million pounds of tilapia per year, and ships 10,000 to 20,000 pounds of live tilapia daily to markets such as New York, Toronto, and Washington, D.C.

Technological Advancements in Automated and Smart Farming Solutions

The Fish Farming Equipment Market benefits from rapid innovation in automation and smart monitoring tools. Producers use sensors, AI-based feeders, and IoT platforms to control water quality and feeding schedules. It allows farmers to track fish growth, prevent disease outbreaks, and cut operational costs. Energy-efficient aerators and oxygen supply systems improve productivity in high-density environments. Smart cages and feeding robots raise production consistency across large-scale operations. These advancements help meet rising demand while improving sustainability.

- For instance, Grundfos, a major supplier for the aquaculture industry, produces more than 16 million pump units annually, including circulator (UP), submersible (SP), and centrifugal (CR) types, which are key to its aquaculture offerings.

Government Support and Regulatory Push Toward Sustainable Aquaculture

The Fish Farming Equipment Market expands with strong policy support for sustainable food production. Governments promote aquaculture with subsidies, grants, and regulations that encourage adoption of advanced farming systems. It ensures environmental protection through better waste management and water-use practices. Equipment makers align products with global sustainability goals to attract large-scale adoption. Strict compliance rules encourage farmers to invest in filtration, recycling, and biosecurity tools. These measures create a favorable landscape for modern equipment providers.

Expansion of Commercial Farming and Global Seafood Trade

The Fish Farming Equipment Market thrives with rising seafood exports and expansion of commercial farms. International demand for salmon, tilapia, and shrimp drives investment in large-scale aquaculture facilities. It pushes the adoption of automated cages, water circulation systems, and climate-resilient equipment. Global retailers prefer consistent, traceable supply chains, encouraging farms to adopt advanced monitoring tools. Growth in e-commerce food distribution strengthens reliance on high-capacity farming systems. This expansion ensures the sector remains a key contributor to global trade.

Market Trends

Integration of Digital Technologies and Smart Monitoring Systems

The Fish Farming Equipment Market experiences strong adoption of digital and automated solutions. Farmers deploy IoT devices, AI-powered feeders, and real-time monitoring tools to optimize production. It helps maintain water quality, track fish health, and improve feeding efficiency. Advanced sensors reduce waste and cut operational costs while boosting output. The use of cloud-based platforms allows remote farm management and predictive analytics. These trends mark a shift toward precision aquaculture.

- For instance,The company also offers the fully automated SEP-Art AutoMag for processing SEP-Art cysts; for instance, it can process a 5-ton hatching tank (10 kg of EG SEP-Art cysts at 2 g/L) in under an hour, producing a clean nauplii suspension ready for larval feeding.

Focus on Sustainability and Eco-Friendly Aquaculture Practices

The Fish Farming Equipment Market reflects growing demand for sustainable farming solutions. Equipment designs now emphasize reduced energy consumption and eco-friendly waste management systems. It supports cleaner production environments and compliance with environmental regulations. Biosecure cages, water recycling units, and low-impact aerators gain preference among producers. Such solutions limit disease spread and preserve natural ecosystems. Sustainability remains a leading trend shaping future equipment adoption.

- For instance, FREA’s flagship RAS facility—FREA A/S, operational since 2014—produces over 2,000 tonnes of rainbow trout per year across two 4,000 m² buildings, using no direct discharge to natural water bodies and relying on natural seepage for water return.

Rising Popularity of Offshore and High-Capacity Farming Systems

The Fish Farming Equipment Market evolves with wider use of offshore farming technologies. Farmers expand operations into deeper waters to meet global seafood demand. It requires durable cages, automated feeding units, and advanced oxygenation systems. Offshore platforms handle larger stock volumes while reducing coastal environmental strain. Equipment manufacturers focus on robust materials that withstand extreme marine conditions. This trend supports large-scale commercial aquaculture expansion.

Increased Investment in Research, Innovation, and Customization

The Fish Farming Equipment Market advances through research and product innovation. Companies design tailored equipment for species-specific requirements and diverse farming environments. It enables greater efficiency in breeding, feeding, and harvesting cycles. Modular equipment systems allow scalability for small and large farms alike. Ongoing R&D delivers smart aerators, automated cleaning devices, and hybrid cage systems. This innovation-driven trend strengthens market competitiveness and adoption worldwide.

Market Challenges Analysis

High Operational Costs and Limited Access to Advanced Technology

The Fish Farming Equipment Market faces major hurdles due to the high cost of advanced systems. Farmers in developing regions often struggle to afford automated cages, oxygen systems, and smart monitoring devices. It creates a gap between large-scale operators and small or medium farms. Maintenance and replacement expenses further add to operational burdens. Limited access to financing restricts adoption of innovative equipment in many regions. This challenge slows the pace of modernization across global aquaculture.

Environmental Concerns and Strict Regulatory Compliance Requirements

The Fish Farming Equipment Market encounters difficulties linked to environmental risks and regulatory frameworks. Poorly managed equipment can contribute to water pollution, disease outbreaks, and ecosystem damage. It forces producers to invest heavily in waste management and biosecurity tools. Regulatory bodies enforce strict compliance standards that require costly upgrades. Farmers often face delays in expansion plans due to environmental approvals. These pressures create operational complexity and financial strain for aquaculture businesses.

Market Opportunities

Expansion of Sustainable Aquaculture and Eco-Friendly Equipment Solutions

The Fish Farming Equipment Market presents strong opportunities through sustainability-focused innovations. Global demand for eco-friendly equipment drives adoption of energy-efficient aerators, biosecure cages, and waste recycling systems. It enables farms to align with environmental standards while improving operational performance. Manufacturers that deliver low-impact solutions gain a competitive advantage in regions with strict regulations. The trend also opens new prospects for companies offering modular, scalable systems adaptable to diverse environments. This growing emphasis on sustainable aquaculture strengthens long-term opportunities for equipment providers.

Rising Global Seafood Demand and Advancement of Smart Farming Technologies

The Fish Farming Equipment Market benefits from rising seafood consumption and global trade expansion. Growing preference for protein-rich diets accelerates investment in commercial aquaculture facilities. It fuels demand for smart cages, AI-driven feeding systems, and automated monitoring platforms. Companies investing in digital solutions gain access to high-growth markets across Asia-Pacific and Europe. The integration of predictive analytics and IoT tools creates new revenue streams for technology-driven suppliers. This opportunity supports broader market penetration and global adoption of advanced fish farming equipment.

Market Segmentation Analysis:

By Equipment Type

The Fish Farming Equipment Market covers a wide range of equipment that supports efficient aquaculture operations. Aeration systems remain essential for maintaining dissolved oxygen levels and preventing fish mortality in intensive farming. Water treatment systems ensure high-quality environments by controlling waste, bacteria, and pollutants. Feeding systems gain traction due to their role in reducing manual labor and improving feed conversion ratios. Fish handling equipment helps maintain fish health during transfer, vaccination, or sorting activities. Monitoring and control systems, supported by IoT and sensor technologies, enable real-time supervision of water quality and stock growth. Harvesting and grading systems streamline large-scale operations, while other equipment such as pumps and lighting solutions provide critical support for optimized farm conditions.

- For instance, the Sparus™ Pump with Constant Flow Technology (CFT) supports fully programmable flow from 75 to 530 L/min. It self-adjusts pump speed to maintain this set flow, even as conditions change, ensuring energy efficiency.

By Application

The Fish Farming Equipment Market divides into land-based and sea-based farming operations. Land-based farms, including recirculating aquaculture systems, grow due to their controlled environments and lower ecological impact. It ensures consistent production closer to consumer markets and reduces disease risks. Sea-based aquaculture dominates in regions with strong seafood export demand, particularly for species like salmon, tuna, and shrimp. Offshore farms adopt durable cages, oxygenation systems, and automated feeding platforms to withstand open-water conditions. Both land and sea-based segments contribute to meeting global protein needs.

- For instance, the Simor scaler handles fish ranging from 113 g (4 oz) up to 10 kg (16 lb), even accommodating flounder up to 12 in (30 cm) wide. Its performance reaches up to 125 fish per minute, depending on size, and operates on water pressure of around 241 kPa (35 psi) with various power supply options from 208 to 550 V.

By End User

The Fish Farming Equipment Market serves diverse end users ranging from large-scale farms to research bodies. Commercial aquaculture farms hold the largest share, investing in automated cages, aerators, and advanced feeding platforms to maximize output. Hatcheries and nurseries focus on specialized equipment that supports breeding, early growth, and disease control. It plays a key role in ensuring strong survival rates for juvenile fish. The ornamental fish and aquarium trade segment expands demand for smaller-scale monitoring devices and water treatment systems that maintain quality for niche species. Research and educational institutions adopt advanced monitoring and control systems to support studies in fish biology, genetics, and sustainable aquaculture practices. This diversity of end users creates a broad base of opportunity across the global market.

Segments:

Based on Equipment Type:

- Aeration system

- Water treatment systems

Based on Application:

Based on End-User:

- Commercial aquaculture farms

- Hatcheries and nurseries

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America represents close to 20 % of the Fish Farming Equipment Market. The U.S. dominates this share, supported by strong seafood demand and heavy investment in aquaculture technology. Land-based recirculating aquaculture systems (RAS) continue to gain popularity, with automated feeders, advanced water treatment systems, and oxygen control solutions widely deployed. Canada also contributes significantly, particularly in salmon farming, where durable offshore cages and monitoring platforms maintain consistency in production. It benefits from advanced supply chains, strong consumer preference for traceable seafood, and government funding for sustainable farming initiatives. North America emphasizes efficiency and sustainability, which drives adoption of smart monitoring devices, automated fish handling equipment, and high-capacity aeration systems. Growth potential remains steady, supported by expanding commercial farms and investments in innovation.

Europe

Europe holds around 25 % of the global market share, with Norway, Scotland, and the Netherlands leading adoption of advanced equipment. Salmon production remains the backbone of the region, relying heavily on oxygenation systems, feeding robots, and biosecure cages designed for offshore operations. It benefits from strict environmental policies, which push farmers to use eco-friendly water treatment and energy-efficient systems. Recirculating aquaculture systems are expanding in Western and Northern Europe, providing land-based production that reduces ecological impact. Technology suppliers cater to regulatory needs by offering solutions that improve sustainability while maintaining high output. Europe’s strong focus on innovation makes it a hub for smart aquaculture solutions, including IoT-based monitoring, automated grading systems, and hybrid cage technology. This region continues to demonstrate leadership in balancing efficiency with environmental responsibility.

Asia-Pacific

Asia-Pacific dominates the Fish Farming Equipment Market with nearly 40 % share. China leads production with large-scale carp, tilapia, and shrimp farming supported by government-backed aquaculture expansion programs. It invests heavily in aeration systems, automated feeders, and monitoring technologies to maintain efficiency across massive inland and coastal farms. India, Vietnam, and Indonesia contribute significantly with shrimp and freshwater species production, boosting regional equipment demand. The region benefits from high seafood consumption, both domestically and through strong export markets. Offshore aquaculture continues to expand, with durable cages and automated water treatment systems used in open-water farming. It stands out as the fastest-growing market due to sheer production scale, increasing consumer demand, and rising adoption of smart technologies. Asia-Pacific remains central to global seafood supply, ensuring long-term reliance on advanced farming equipment.

Latin America

Latin America accounts for about 10 % of the global market, led by Chile and Brazil. Chile maintains a stronghold in salmon production, investing in high-capacity cages, oxygenation systems, and biosecure water management tools to serve export markets. Brazil focuses on tilapia and shrimp farming, adopting aeration equipment, automated feeders, and monitoring systems to improve efficiency. The region benefits from expanding consumer demand and increased international trade in seafood products. Farmers also seek sustainable practices, driving demand for equipment that reduces disease risk and improves water quality. It presents growing opportunities for suppliers offering affordable, durable, and scalable solutions tailored for diverse farming conditions. Latin America’s emphasis on aquaculture exports makes equipment adoption a priority for competitiveness in global markets.

Middle East & Africa

The Middle East & Africa represent nearly 5 % of the Fish Farming Equipment Market. This region is still in the early stages of aquaculture expansion, but strong government backing highlights long-term potential. Gulf nations, particularly Saudi Arabia and the UAE, invest in aquaculture to enhance food security and reduce reliance on imports. Africa shows rising adoption of fish farming in countries like Egypt and Nigeria, where tilapia farming is expanding rapidly. Equipment demand focuses on aerators, pumps, and basic monitoring tools, although more advanced systems are slowly being introduced. It benefits from support by international agencies that provide financing, training, and technical assistance to local farmers. With growing population demand for affordable protein, this region is expected to adopt more reliable and scalable equipment solutions over time.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Fish Farming Equipment Market include Blue Ridge Aquaculture, Innovasea, Grundfos Holding A/S, CPI Equipment, INVE Aquaculture, Asakua, ABB, Frea Aquaculture Solutions, eWater Aquaculture Equipment Technology, and AKVA. The Fish Farming Equipment Market remains highly competitive, driven by continuous innovation and strong demand for sustainable solutions. Companies focus on automation, smart monitoring, and water treatment technologies to improve efficiency and reduce operational costs. Advanced feeding systems, aeration units, and biosecure cages support large-scale production while maintaining environmental compliance. Land-based recirculating aquaculture systems gain traction as farmers seek reliable and eco-friendly operations. Offshore farming also expands with durable cages and automated control systems designed for extreme marine conditions. The market’s competitiveness is shaped by a balance of cost efficiency, technological advancement, and sustainability, ensuring steady global adoption.

Recent Developments

- In June 2025, Mexico launches global center for applied aquaculture innovation, the Center for Applied Aquaculture Innovation, offering state-of-the-art facilities including laboratories, hatchery, technology, and open-ocean projects.

- In April 2025, Innovasea hired RAS expert Miguel Martin to enhance its team and capabilities in designing large-scale recirculating aquaculture systems for worldwide markets.

- In February 2025, ABB won a significant contract to supply automation and control systems for a new, 25,000-ton land-based salmon plant in Nordland, Norway. The contract includes control rooms, instrumentation, frequency converters, and lighting systems, all intended to monitor water quality and fish welfare.

- In March 2024, Hexicon’s Joint Venture, Freja Offshore, started a collaboration with Fish Farms. Freja Offshore has applied to build the offshore wind farm Mareld, 40 kilometres off the coast west of Lysekil in Sweden.

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for sustainable aquaculture practices worldwide.

- Adoption of smart monitoring and IoT systems will increase across large and small farms.

- Land-based recirculating aquaculture systems will see strong growth for controlled production.

- Offshore farming equipment will advance with durable cages and automated feeding tools.

- Energy-efficient aerators and eco-friendly water treatment systems will gain higher adoption.

- Investments in digital technologies will support predictive analytics and real-time farm control.

- Hatchery and nursery equipment will evolve to improve survival rates of juvenile fish.

- Growing seafood trade will drive demand for scalable and export-ready farming solutions.

- Research institutions will adopt advanced systems to support sustainable aquaculture innovation.

- Global competition will intensify with companies focusing on reliability and environmental compliance.