Market Overview

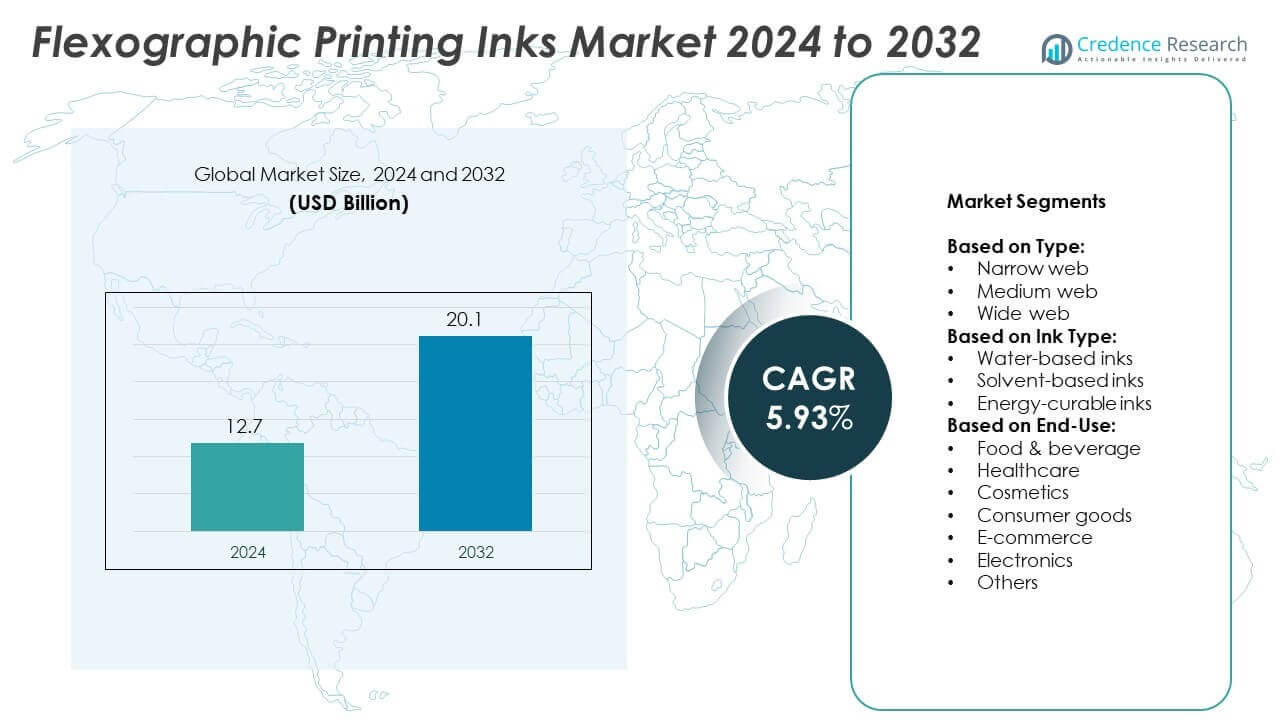

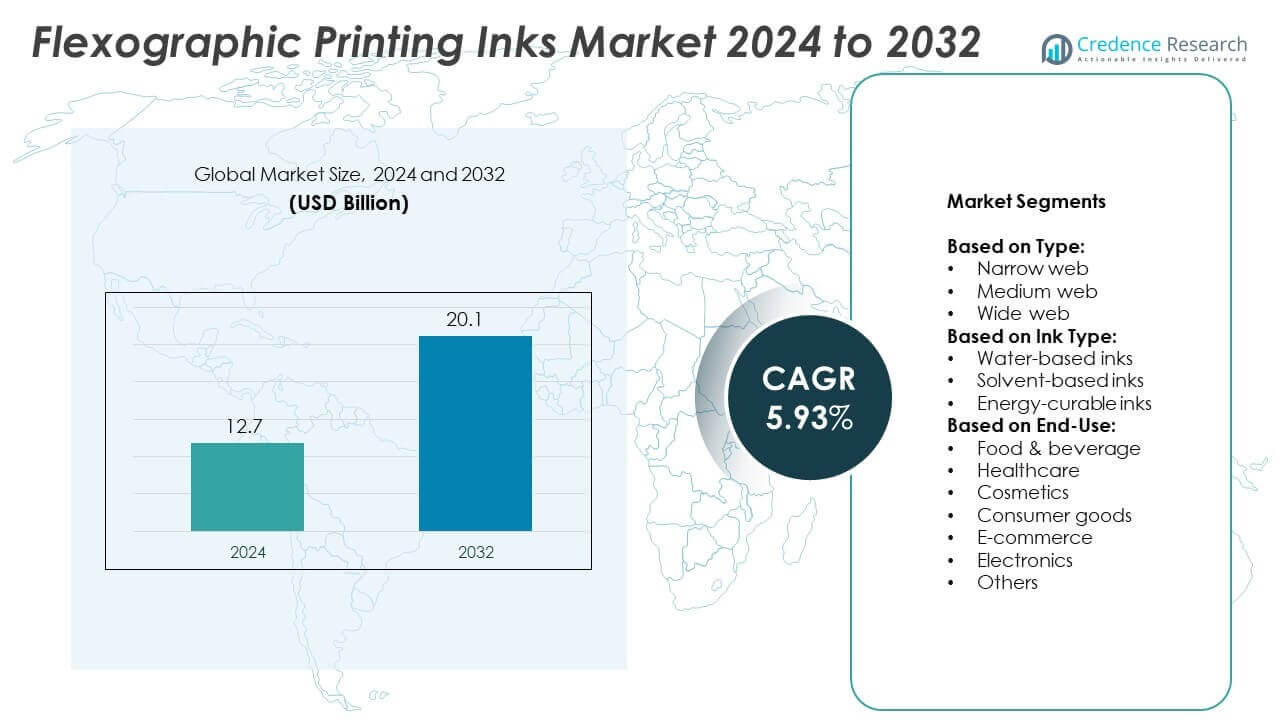

Flexographic Printing Inks Market size was valued at USD 12.7 billion in 2024 and is anticipated to reach USD 20.1 billion by 2032, at a CAGR of 5.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flexographic Printing Inks Market Size 2024 |

USD 12.7 Billion |

| Flexographic Printing Inks Market, CAGR |

5.93% |

| Flexographic Printing Inks Market Size 2032 |

USD 20.1 Billion |

The Flexographic Printing Inks market grows with rising demand for sustainable, high-speed, and cost-effective packaging solutions. Regulatory pressure drives adoption of water-based and UV-curable inks across food, beverage, and consumer goods sectors. E-commerce expansion fuels usage in corrugated packaging and shipping labels. Advancements in press technology and hybrid workflows push ink innovation for improved adhesion, drying, and print quality. Brands seek consistent color output and eco-friendly materials, reinforcing the shift toward low-VOC and recyclable ink systems across global markets.

Asia Pacific leads the Flexographic Printing Inks market due to rapid industrialization, packaging demand, and local ink production growth. North America and Europe follow with strong focus on sustainable ink systems and regulatory compliance. Latin America and the Middle East & Africa show steady expansion driven by packaging modernization. Key players driving regional presence include Flint Group, Komori Corporation, Amcor PLC, and Heidelberger Druckmaschinen AG, each leveraging localized strategies to support high-volume packaging and eco-compliant ink solutions.

Market Insights

- The Flexographic Printing Inks market was valued at USD 12.7 billion in 2024 and is projected to reach USD 20.1 billion by 2032, growing at a CAGR of 5.93%.

- Rising demand for sustainable, food-safe, and fast-drying ink systems drives steady market expansion.

- Water-based and UV-curable inks are gaining traction as brands shift to low-VOC and recyclable solutions.

- Leading players focus on innovation, hybrid-press compatibility, and regional production to improve supply and performance.

- Raw material cost fluctuations and strict regulatory requirements challenge profit margins and operational planning.

- Asia Pacific shows the highest growth due to increasing flexible packaging output and rising local ink manufacturing.

- Europe and North America push sustainable ink adoption, while Latin America and Middle East & Africa show moderate, infrastructure-driven growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Packaged Food and Beverages Supports Volume Growth

The expanding packaged food and beverage industry drives steady demand for flexographic printing inks. This sector depends on high-speed, cost-efficient printing for labels, flexible films, and cartons. Growth in e-commerce and ready-to-eat products increases the need for visually appealing and durable packaging. Manufacturers prefer flexographic printing due to its ability to support a wide range of substrates and short lead times. The Flexographic Printing Inks market benefits from these trends by supplying inks compatible with food-safe materials and high-speed presses. Water-based and low-VOC inks also gain popularity due to regulatory needs and consumer health concerns. This shift enhances adoption across food packaging operations globally.

- For instance, Siegwerk is a global manufacturer of printing inks and coatings, with a strong focus on inks for food and beverage packaging, including low-migration and water-based systems. In its 2021 financial reporting, the company noted that it had a strong year, with overall sales increasing slightly to approximately €1.185 billion ($1.38 billion), driven by the packaging segment

Rapid Expansion of Flexible Packaging across Industries Boosts Ink Consumption

Flexible packaging adoption across food, cosmetics, household products, and pharmaceuticals stimulates demand for specialized flexographic inks. These inks must perform on films such as polyethylene, polypropylene, and polyester. The market benefits from innovation in ink chemistry, including faster drying and improved adhesion on non-absorbent surfaces. Printing speed and cost-efficiency make flexography the preferred method for large-volume packaging jobs. The Flexographic Printing Inks market addresses this demand by offering solvent-based, water-based, and UV-curable variants tailored for modern presses. The trend toward lightweight, compact packaging designs supports long-term consumption growth. Global brands invest in eye-catching print quality, pushing suppliers to offer stable and vivid ink systems.

- For instance, Flint Group is a global manufacturer of printing inks, coatings, and consumables for flexible packaging, serving food, cosmetics, and healthcare applications. The company develops specialized low-migration ink systems for flexographic presses to ensure safety and compliance for sensitive applications. For 2023, Flint Group reported revenues of €1.5 billion.

Regulatory Push for Low-VOC and Sustainable Inks Accelerates Reformulation Efforts

Global environmental regulations targeting solvent emissions accelerate the shift toward sustainable ink formulations. Governments impose stricter limits on volatile organic compounds (VOCs), affecting traditional ink systems. In response, ink producers develop water-based and UV-curable products that meet safety and environmental standards. It leads to increased R&D investment and partnerships between converters and chemical suppliers. The Flexographic Printing Inks market responds by expanding portfolios with compliant, high-performance alternatives. Demand for compostable and recyclable packaging also pushes development of inks that do not interfere with waste recovery. These regulations reshape product offerings and drive innovation at scale.

Technological Advancements in Printing Presses Increase Compatibility Demands

High-performance flexographic presses with automation, faster throughput, and tighter registration capabilities require equally advanced ink systems. The rise of hybrid and CI presses necessitates inks with excellent flow, quick curing, and color consistency. Brands demand sharper graphics and finer details, increasing pressure on ink suppliers to ensure compatibility with new anilox configurations and plate materials. The Flexographic Printing Inks market evolves with these needs by offering high-pigment, shear-stable formulations. Integration of IoT and press monitoring systems further requires inks that maintain performance consistency under varying machine conditions. These shifts raise the bar for performance benchmarks across commercial packaging operations.

Market Trends

Shift Toward Water-Based and UV-Curable Inks Reflects Environmental and Performance Priorities

Converters shift from solvent-based systems to water-based and UV-curable inks for regulatory and quality reasons. Water-based inks offer low emissions and easy cleanup, aligning with sustainability targets. UV-curable inks provide high durability, fast curing, and minimal substrate distortion. The shift supports food-safe applications and minimizes worker exposure to harmful solvents. The Flexographic Printing Inks market incorporates these trends by expanding eco-compliant ink options across substrates. Printers seek inks that meet both regulatory benchmarks and production efficiency goals. This trend reshapes product portfolios and technology adoption across value chains.

- For instance, hubergroup Print Solutions, a global printing ink and coatings specialist, develops a wide range of ink systems for flexographic printing, including for new-generation Central Impression (CI) flexo presses. The company’s ink systems are engineered for high-speed automation, ensuring stable and high-quality performance. In 2021, the company’s Indian subsidiary, Hubergroup India Private Limited (HIPL), saw a significant 29% increase in revenue, while the overall group faced a challenging global business environment due to market fluctuations and supply chain issues.

Customization and Color Consistency Demands Drive Ink Formulation Enhancements

Brand owners demand consistent color reproduction across global facilities, pushing for standardized ink systems. Inks with higher pigment load, better viscosity control, and extended shelf life gain preference. Custom color-matching services become integral to supplier offerings, especially for brand-critical packaging. The Flexographic Printing Inks market responds by investing in color management software and advanced dispersion technologies. Precision in ink delivery helps minimize waste and reprints, improving operational cost savings. This trend strengthens demand for high-quality inks with stable rheology and color fidelity on various substrates.

- For instance, INX International is a global manufacturer of high-performance printing inks and coatings and is a subsidiary of the Japanese company Sakata INX. For the fiscal year ending December 31, 2024, Sakata INX reported consolidated net sales of 245.570 billion Japanese Yen ($1.56 billion USD). As of the first half of 2025, Sakata INX continued its strong financial performance, reporting a 4.4% increase in net sales compared to the same period in 2024

Digital Integration into Flexographic Lines Encourages Hybrid Workflow Adoption

The rise of digital-flexo hybrid printing systems encourages development of inks compatible with variable data workflows. Printers integrate digital modules into flexo presses to meet short-run and personalization needs. These hybrid systems require flexographic inks that align with digital overprint compatibility and fast changeover. The Flexographic Printing Inks market evolves by enabling workflows that combine flexo’s speed with digital’s versatility. Ink suppliers develop systems that maintain adhesion, clarity, and registration even when switching between print modes. This trend supports customized packaging for regional, promotional, and seasonal campaigns.

Growing Use of Sustainable Packaging Fuels Development of Compostable Ink Systems

Brands adopt biodegradable and compostable packaging materials, creating demand for inks that do not hinder recyclability. Conventional inks often interfere with recycling processes or introduce toxic residues during breakdown. Ink producers develop compostable and deinkable systems to match the lifecycle of eco-packaging. The Flexographic Printing Inks market adapts by launching solutions certified for food safety and environmental impact. Formulators remove heavy metals, mineral oils, and halogenated compounds from standard recipes. This trend influences long-term ink development strategies across FMCG and healthcare sectors.

Market Challenges Analysis

Volatile Raw Material Prices and Supply Chain Disruptions Weaken Margin Stability

Frequent fluctuations in crude oil prices and petrochemical derivatives directly impact ink resin and solvent costs. Disruptions in global supply chains, including pigment shortages and transport delays, increase procurement risks. Small and mid-sized ink manufacturers face challenges in securing raw materials at stable prices. The Flexographic Printing Inks market deals with these uncertainties by exploring alternative sourcing and localizing supply chains where possible. Sudden cost hikes disrupt budgeting and limit pricing flexibility with converters. These issues put pressure on profitability and delay innovation investments across the industry.

Strict Regulatory Compliance and Waste Management Raise Operational Complexity

Environmental regulations limit the use of VOCs, heavy metals, and certain pigments in ink formulations. Compliance with evolving standards such as REACH and FDA food-contact norms requires constant product reformulation. It complicates inventory planning, increases testing costs, and prolongs approval timelines for new products. The Flexographic Printing Inks market must ensure compatibility with recycling guidelines and maintain performance on compostable substrates. Waste disposal and effluent management also demand dedicated infrastructure and training. These compliance efforts increase overhead for manufacturers and slow speed-to-market for innovative ink systems.

Market Opportunities

Emergence of Bio-Based Inks Unlocks New Revenue Streams for Sustainable Packaging

The growing shift toward green packaging opens space for bio-based ink development. Inks derived from soy, algae, and other renewable sources appeal to eco-conscious brands. These inks offer biodegradability and low toxicity, making them suitable for food and pharmaceutical packaging. The Flexographic Printing Inks market explores this potential by investing in bio-based formulations with stable print properties. Government policies supporting sustainable materials increase commercial viability for such innovations. Ink producers can capture long-term contracts by aligning with circular economy goals. This creates space for brand differentiation and regulatory compliance in one solution.

Rising Penetration in Emerging Markets Creates Demand for Cost-Effective Solutions

Fast-growing economies in Asia, Latin America, and Africa expand packaging production capacity across food, retail, and logistics sectors. These regions seek scalable and cost-effective printing technologies that flexographic processes can offer. It supports high-volume output with lower setup costs compared to alternatives like gravure. The Flexographic Printing Inks market finds opportunity in providing localized solutions with water-based and solvent-based systems. Training services, technical support, and regional production hubs increase product adoption across diverse end-use industries. This expansion allows suppliers to tap into previously underpenetrated segments with tailored, price-sensitive products.

Market Segmentation Analysis:

By Type:

Narrow web flexographic printing dominates short-run applications such as labels, tags, and sleeves. Its precision and speed make it suitable for retail and healthcare packaging. Medium web presses find strong use in mid-volume flexible packaging, especially for snacks and personal care products. Wide web flexography leads high-volume applications such as large-format flexible films and folding cartons. It supports large-scale food and beverage operations by reducing per-unit print costs. The Flexographic Printing Inks market aligns ink development with each press type to ensure adhesion, drying, and color fidelity. Tailored formulations improve compatibility and performance across varied web widths.

- For instance, Toyo Ink, a global manufacturer of printing inks and coatings, provides color management solutions, including its Lioatlas™ system and EcoMatch software, to help customers achieve consistent color reproduction. The company works with various multinational brands and printing converters to ensure stable flexographic print quality across global facilities. In 2019, the company highlighted its color management system’s effectiveness by citing more than 300 case studies.

By Ink Type:

Water-based inks hold the largest share due to compliance with environmental regulations and suitability for porous substrates like paper and corrugated board. Solvent-based inks continue to support high-speed film printing in flexible packaging where quick drying and durability are essential. Energy-curable inks, including UV and EB curable variants, gain traction for their low VOC emissions, sharp resolution, and resistance properties. It allows high-quality printing on non-absorbent materials and supports food packaging under controlled migration guidelines. The Flexographic Printing Inks market adapts to evolving regulatory and technical demands through hybrid ink systems. These inks balance performance, drying speed, and compliance requirements.

- For instance, DIC Corporation, a global manufacturer of printing inks and coatings, provides a wide range of flexographic ink solutions for food and beverage packaging converters in the Asia-Pacific region, focusing on safe and compliant printing. The company has a strong presence across Asia-Pacific, with operations in over 12 countries.

By End-Use:

Food and beverage remains the largest end-use segment due to the high need for safe, compliant, and durable inks on flexible packaging, cartons, and labels. Healthcare packaging uses specialized inks with low migration and sterilization resistance. Cosmetics and personal care brands demand visually rich, high-opacity printing on compact packaging. Consumer goods and e-commerce applications require durable, low-cost inks compatible with varied substrates and high-speed lines. Electronics packaging needs precise ink performance under static-sensitive or protective conditions. The Flexographic Printing Inks market supports each sector with targeted formulations that meet print performance and safety standards. This segmentation highlights diverse demand across regulated and dynamic industries.

Segments:

Based on Type:

- Narrow web

- Medium web

- Wide web

Based on Ink Type:

- Water-based inks

- Solvent-based inks

- Energy-curable inks

Based on End-Use:

- Food & beverage

- Healthcare

- Cosmetics

- Consumer goods

- E-commerce

- Electronics

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 29.4% share of the global Flexographic Printing Inks market. Strong demand from the food, beverage, and personal care packaging sectors continues to fuel regional growth. Regulatory pressure to reduce VOC emissions pushes adoption of water-based and UV-curable inks across the United States and Canada. Major packaging converters focus on sustainable packaging formats, supporting rapid replacement of solvent-based inks. E-commerce growth, especially in the U.S., increases use of flexographic printing for corrugated boxes and shipping labels. The region benefits from technological advancements, including smart packaging and real-time quality monitoring. Leading manufacturers operate domestic production hubs, reducing lead times and ensuring supply consistency.

Europe

Europe accounts for 26.1% of the global market, supported by strict environmental regulations and advanced packaging infrastructure. The EU’s Green Deal and circular economy policies accelerate the transition toward low-emission inks. Germany, France, and Italy lead in production and innovation, with high adoption of UV-curable and bio-based flexographic inks. The region emphasizes high-definition graphics, pushing suppliers to deliver pigment-rich, fast-curing inks for premium packaging. Food safety compliance further drives demand for low-migration and recyclable ink systems. Retailers and FMCG companies prioritize sustainable branding, enhancing the role of flexographic printing in carton and flexible film applications. Investments in R&D and ink testing laboratories support continuous product upgrades.

Asia Pacific

Asia Pacific holds a 31.6% share, making it the largest regional contributor to the Flexographic Printing Inks market. Growth in China, India, Japan, and Southeast Asia comes from expanding middle-class populations, rapid urbanization, and increasing consumer goods demand. Flexible packaging sees high-volume production, especially in food, personal care, and household items. Ink manufacturers focus on cost-effective, solvent-based inks to meet the needs of high-speed presses. However, rising awareness of sustainability is prompting a shift toward water-based and hybrid systems. Local players invest in ink customization and inkjet-flexo hybrid compatibility to meet diverse substrate and print quality needs. Asia Pacific remains a high-growth region with large-scale packaging infrastructure upgrades underway.

Latin America

Latin America contributes 7.3% to the global market, led by Brazil, Mexico, and Argentina. The region focuses on cost-efficient packaging for food, beverages, and consumer goods. Solvent-based inks dominate due to affordability and compatibility with plastic films. However, rising export demand and compliance with international packaging standards open the market to water-based alternatives. Local converters adopt flexographic presses for improved efficiency and lower waste in packaging operations. The Flexographic Printing Inks market in Latin America continues to grow steadily with increased investment in printing equipment modernization and eco-label compliance.

Middle East & Africa

Middle East & Africa holds a 5.6% market share, driven by expanding retail and food service sectors. GCC countries invest in high-quality flexographic printing systems to meet rising FMCG and e-commerce packaging demand. South Africa and Egypt show demand for both export-grade flexible packaging and local brand development. Ink usage remains split between solvent and water-based systems, depending on cost and substrate type. Energy-curable inks are gaining interest in the region due to fast curing and durability advantages. While market size is smaller, it offers long-term potential with regulatory and packaging format advancements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Komori Corporation

- Flint Group

- Codimag

- Koenig & Bauer AG

- Gallus

- Amcor PLC

- Allstein GmbH

- Heidelberger Druckmaschinen AG

- Bobst

- Comexi

Competitive Analysis

The Flexographic Printing Inks market includes leading players such as Komori Corporation, Flint Group, Codimag, Koenig & Bauer AG, Gallus, Amcor PLC, Allstein GmbH, Heidelberger Druckmaschinen AG, Bobst, and Comexi. These companies focus on expanding their ink portfolios, improving press compatibility, and meeting rising sustainability demands. They invest in research to develop water-based, UV-curable, and bio-based inks that meet regulatory and performance standards. Innovation in color consistency, faster drying systems, and low-migration inks remains a top priority across product lines. Major firms enhance market presence through strategic partnerships with packaging converters and by setting up regional production facilities to shorten supply cycles. Competition intensifies as companies align their offerings with the growing need for recyclable and compostable packaging. Larger players leverage their global footprint and R&D capacity to lead in ink certification and technical support services. Smaller firms target niche applications by offering tailored ink solutions with shorter turnaround times. Integration of digital modules in flexographic systems increases demand for hybrid-compatible inks, prompting vendors to upgrade formulations. Continuous press technology advancement forces ink suppliers to ensure flow stability, adhesion, and durability across varying substrates. This dynamic landscape pushes players to compete on sustainability, print quality, and operational efficiency to secure long-term contracts.

Recent Developments

- In June 2025, Komori announced the first installation of its J‑throne 29 digital printing press at 1Vision’s facility in Houston, Texas.

- In January 2025, Komori Corporation acquired CPS Canadian Primoflex Systems, enhancing its access to the North American market in flexographic printing equipment.

- In November 2023, Comexi launched the Comexi F2 Origin, a flexographic printing machine emphasizing high productivity with speeds up to 400 meters per minute, operator ergonomics, and the use of solvent-free inks for environmental friendliness.

Report Coverage

The research report offers an in-depth analysis based on Type, Ink Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Bio-based inks will gain wider acceptance across food and consumer goods packaging sectors.

- Packaging converters will prefer water-based inks to meet tightening VOC emission standards.

- UV-curable inks will expand in high-speed label and pharmaceutical packaging applications.

- Flexographic printing will remain dominant in flexible and corrugated packaging markets.

- E-commerce growth will drive sustained demand for durable and cost-effective ink systems.

- Hybrid flexo-digital workflows will increase need for ink compatibility across print modes.

- Color consistency tools will become essential for global brand packaging compliance.

- Asia Pacific will lead market expansion due to rising manufacturing and packaging output.

- Local ink producers will invest in automation and sustainable formulations to stay competitive.

- Recyclable and compostable ink systems will become standard for eco-friendly packaging lines.