Market Overview

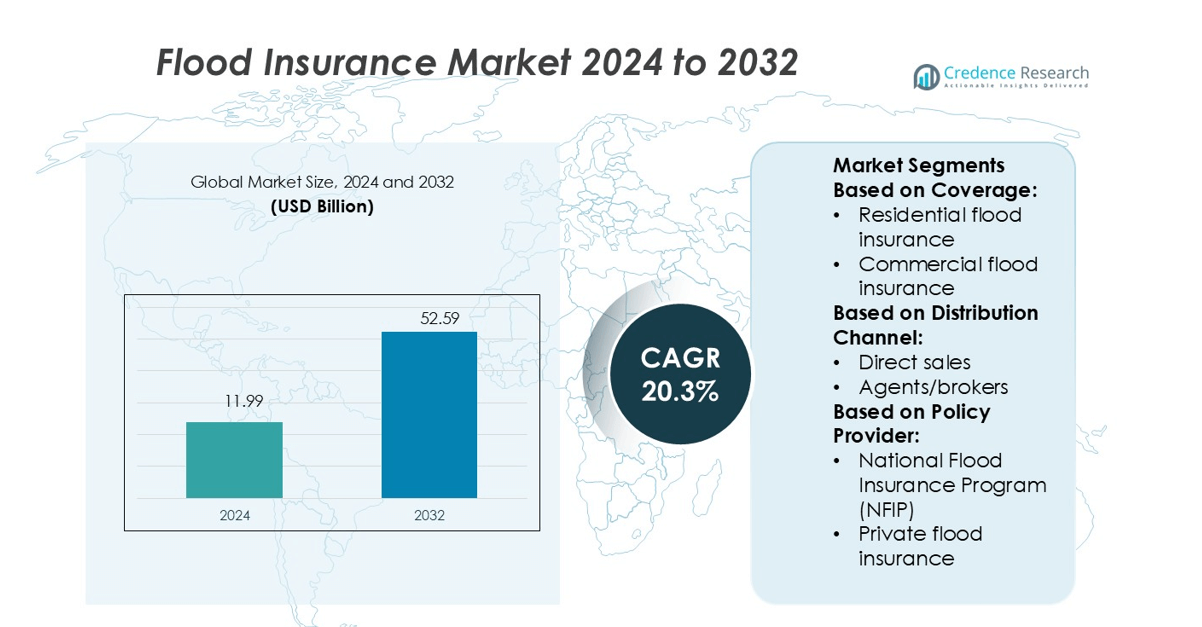

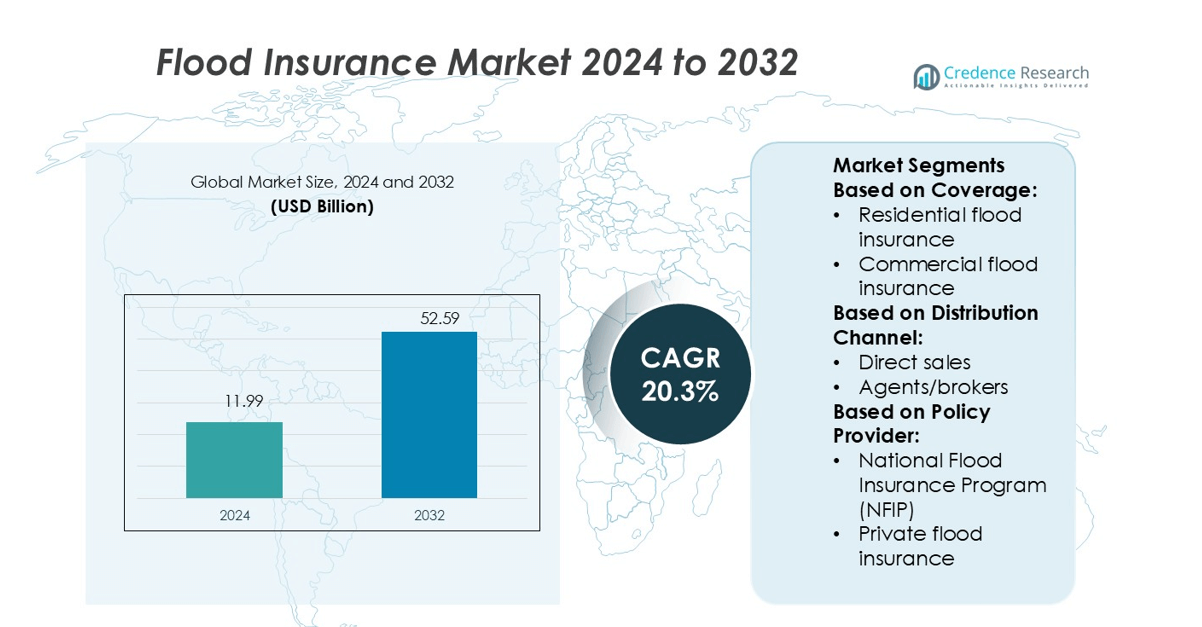

Flood Insurance Market size was valued USD 11.99 billion in 2024 and is anticipated to reach USD 52.59 billion by 2032, at a CAGR of 20.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flood Insurance Market Size 2024 |

USD 11.99 billion |

| Flood Insurance Market, CAGR |

20.3% |

| Flood Insurance Market Size 2032 |

USD 52.59 billion |

The Flood Insurance Market is shaped by major players including Tokio Marine Holdings, Inc., AXA SA, Zurich Insurance Group AG, The Travelers Companies, Inc., Allianz SE, Chubb Limited, USAA Insurance Agency, Swiss Re Group, Allstate Corporation, and Nationwide Mutual Insurance Company. These companies focus on expanding product portfolios, improving underwriting accuracy, and leveraging advanced risk modeling tools to enhance coverage offerings. Strategic partnerships and digital distribution platforms strengthen their market positions. North America leads the global market with a 36% share, supported by strong regulatory frameworks, high insurance penetration, and frequent flood-related events driving sustained demand for coverage solutions.

Market Insights

- The Flood Insurance Market size was valued at USD 11.99 billion in 2024 and is expected to reach USD 52.59 billion by 2032, registering a CAGR of 20.3%.

- Rising climate risks and frequent flooding events are driving demand for comprehensive insurance coverage across residential and commercial segments.

- Growing adoption of digital platforms and parametric insurance models is improving claim speed, pricing accuracy, and customer accessibility.

- North America leads the market with a 36% share, followed by Europe at 29% and Asia Pacific at 24%, reflecting strong regulatory frameworks and increasing policy uptake.

- The market features strong competition among major insurers focusing on product diversification, advanced risk modeling, and regional expansion, while high premium costs and low awareness in emerging economies remain key restraints.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Coverage

Residential flood insurance holds a dominant 67.8% share of the market. This segment leads due to rising climate risks, increased homeownership, and growing awareness of financial protection for households. Many governments offer incentives and subsidies for residential coverage, which further boosts adoption. Rapid urbanization in flood-prone zones and mandatory insurance requirements in high-risk areas also support strong demand. Insurers are introducing flexible coverage options and digital claim services, enhancing policy appeal. Commercial flood insurance grows steadily, but its uptake remains lower because many businesses rely on broader property insurance.

- For instance, Chubb embeds insurance in partner platforms via Chubb Studio. According to the company’s website, its API ecosystem issues over 10 million digital quotes per day, handles over 15 million monthly claims digitally, and supports over 2 million API calls per month.

By Distribution Channel

Agents and brokers account for 59.3% of the market. Their dominance stems from the need for personalized policy guidance and claims support in complex flood risk scenarios. Customers often prefer expert intermediaries to navigate coverage options and pricing structures. This channel’s strength is supported by established trust networks, especially in high-risk regions. Direct sales are expanding through online platforms and insurer portals, driven by ease of access and faster policy issuance. However, brokers retain a strong position due to their advisory role in policy customization and compliance.

- For instance, Allstate uses generative AI to draft claims-related emails, which are reviewed by agents before being sent. A separate cognitive agent, Amelia, handles over 250,000 monthly conversations with customers, resolving about 75% of inquiries on the first contact.

By Policy Provider

The National Flood Insurance Program (NFIP) dominates with 71.4% market share. Its leadership is driven by government-backed affordability, standardized coverage, and regulatory mandates in high-risk flood zones. NFIP’s accessibility and widespread network make it the preferred choice for residential policyholders. Private flood insurance is gaining traction as insurers offer broader coverage limits, faster claim settlements, and innovative pricing models using advanced risk mapping. This segment is attracting commercial clients and high-value property owners who seek tailored protection beyond NFIP’s standard structure. Both segments benefit from increasing climate resilience initiatives.

Key Growth Drivers

Rising Climate Risks and Severe Weather Events

The increasing frequency of floods due to extreme weather is driving the demand for flood insurance. Many regions are experiencing intense rainfall, storms, and rising sea levels. These events lead to higher property damage risks, making insurance coverage essential. Governments and insurers are encouraging homeowners and businesses to adopt flood protection measures. This risk awareness boosts policy purchases, expanding the market. Additionally, regulatory frameworks and disaster relief programs are reinforcing the need for financial protection against natural catastrophes.

- For instance, Imetrik is a telematics service provider for usage-based insurance (UBI). The company, a global player in the industry, has over 800,000 connected vehicles, offering services to both insurers and vehicle finance companies.

Government Incentives and Policy Support

Governments play a critical role in expanding the flood insurance market through incentives and mandates. Subsidized premiums, tax benefits, and public-private partnerships make insurance more accessible. Programs like the National Flood Insurance Program (NFIP) in the U.S. increase market coverage. Authorities are also enforcing floodplain management regulations, encouraging insurance uptake. This structured approach not only mitigates disaster impact but also improves financial resilience. Such initiatives are increasing market penetration among both residential and commercial property owners.

- For instance, Agero processes approximately 12 million service events annually through its Swoop dispatch and accident management network for its clients, which include insurance carriers and auto manufacturers.

Rising Property Development in High-Risk Zones

Rapid urbanization and infrastructure growth in flood-prone regions are fueling insurance demand. More residential and commercial properties are being built in coastal and riverine areas. These developments increase exposure to flood risks, prompting property owners to seek coverage. Builders and developers are also integrating flood insurance requirements into project planning. This rising exposure drives insurers to offer customized products, enhancing market growth. As property values rise in these regions, insurance coverage becomes more critical for financial security.

Key Trends & Opportunities

Adoption of Advanced Risk Assessment Technologies

Insurers are adopting geospatial mapping, AI, and predictive models to assess flood risk more accurately. These technologies support better pricing strategies and risk selection. Real-time flood monitoring tools also enable quicker response and claim management. Improved risk prediction encourages insurers to design tailored products. These innovations strengthen underwriting capabilities, expanding business opportunities. The growing use of technology enhances transparency and builds customer trust.

- For instance, Semtech announced that the HL7900 module had been certified by major US carriers AT&T, T-Mobile, and Verizon, as well as the Japanese carrier KDDI.

Expansion of Private Flood Insurance Providers

Private insurers are entering the market with flexible and affordable plans. Unlike traditional government-backed schemes, private players offer faster claim settlements and customizable coverage. Their presence increases competition, driving product innovation. Advanced modeling tools allow these providers to assess risk more effectively. This diversification creates growth opportunities, particularly in underserved markets. The trend is strengthening consumer confidence in flood protection solutions.

- For instance, Vodafone Automotive supports insurers by deploying telematics devices that offer services such as real-time crash alerts and behavior scoring. Italian insurer Quixa, over 30,000 policyholders per year have chosen to have a connected device installed.

Integration of Parametric Insurance Models

Parametric flood insurance is gaining attention for its simplified claims process. Instead of traditional loss assessments, payouts are triggered by specific flood parameters. This approach reduces delays and improves customer satisfaction. It also lowers administrative costs for insurers, making products more attractive. Parametric models open new opportunities for covering high-risk areas often excluded by standard policies. Their adoption is likely to accelerate market expansion.

Key Challenges

High Premium Costs and Limited Affordability

Flood insurance premiums remain high in many regions, limiting coverage uptake. Many homeowners in flood-prone zones cannot afford comprehensive protection. This cost barrier affects both residential and small business segments. Insurers face difficulty balancing risk pricing with customer affordability. Without subsidies or incentives, policy penetration remains low. High costs also restrict the expansion of private insurance offerings.

Lack of Awareness and Risk Perception

Many property owners underestimate their flood risk, especially in moderate-risk areas. This low awareness reduces insurance adoption rates. Inadequate education and outreach campaigns further widen the protection gap. Misconceptions about government disaster aid also discourage policy purchases. This challenge slows market growth despite increasing climate risks. Effective communication and public engagement are essential to improve awareness and boost coverage.

Regional Analysis

North America

North America holds a 36% share of the global flood insurance market, making it the largest regional contributor. Strong regulatory frameworks, including the National Flood Insurance Program (NFIP) in the U.S., support wide policy coverage. High exposure to hurricanes and coastal flooding drives demand among homeowners and businesses. The region has a mature insurance ecosystem, with both public and private providers offering flexible solutions. Advanced flood mapping and risk modeling further support efficient underwriting. Frequent severe weather events continue to sustain high policy adoption rates, reinforcing the region’s leading market position.

Europe

Europe accounts for a 29% share of the global flood insurance market. The region’s expanding flood coverage is driven by climate adaptation policies and increased urban development in flood-prone areas. Countries like the UK, Germany, and the Netherlands lead in insurance adoption due to well-structured public-private insurance models. Frequent river and coastal flooding events push governments to enforce mandatory coverage in vulnerable zones. Insurers are also investing in predictive analytics to price risks accurately. Strong policy frameworks and climate adaptation strategies continue to support sustained market growth across Europe.

Asia Pacific

Asia Pacific captures a 24% market share and is witnessing rapid growth in flood insurance adoption. High population density in flood-prone zones, especially in China, India, and Japan, increases the demand for coverage. Rapid urbanization, infrastructure expansion, and rising sea levels heighten flood risks. Governments are introducing subsidies and disaster resilience programs to boost insurance penetration. Private insurers are entering the market with parametric and flexible coverage models. With frequent monsoon-related flooding and typhoon activity, the region is expected to record strong growth over the forecast period.

Latin America

Latin America holds a 7% share of the flood insurance market, with growing awareness driving gradual expansion. Countries like Brazil, Argentina, and Chile are investing in flood resilience and disaster management frameworks. Increased rainfall and river flooding are pressuring governments to promote insurance as a financial safeguard. Private insurance offerings are limited but expanding in urban areas. The market is still in its early development stage but shows high potential as risk awareness improves. Rising climate impacts and government incentives are expected to boost adoption across the region.

Middle East & Africa

The Middle East & Africa region represents a 4% share of the global flood insurance market. The region’s exposure to flash floods and extreme weather is growing due to changing climate patterns and rapid urbanization. Low insurance penetration remains a key barrier, but governments are gradually introducing disaster preparedness programs. Countries like South Africa and the UAE are leading early adoption efforts. Awareness campaigns, infrastructure development, and foreign insurer entry are supporting steady market growth. With increasing climate risk, demand for affordable and structured flood insurance solutions is expected to rise.

Market Segmentations:

By Coverage:

- Residential flood insurance

- Commercial flood insurance

By Distribution Channel:

- Direct sales

- Agents/brokers

By Policy Provider:

- National Flood Insurance Program (NFIP)

- Private flood insurance

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Flood Insurance Market features leading players such as Tokio Marine Holdings, Inc., AXA SA, Zurich Insurance Group AG, The Travelers Companies, Inc., Allianz SE, Chubb Limited, USAA Insurance Agency, Swiss Re Group, Allstate Corporation, and Nationwide Mutual Insurance Company. The Flood Insurance Market is characterized by strong innovation, strategic partnerships, and rapid digital transformation. Insurers are focusing on enhancing risk assessment through advanced modeling, AI tools, and satellite-based flood mapping. Companies are offering flexible, parametric insurance models that enable faster payouts and reduce claim processing time. The growing use of data-driven underwriting helps improve pricing accuracy and expand coverage in high-risk zones. Market players are also investing in customer-centric platforms to increase accessibility and awareness. This competitive push is driving market growth and strengthening resilience against increasing climate-related flood risks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tokio Marine Holdings, Inc.

- AXA SA

- Zurich Insurance Group AG

- The Travelers Companies, Inc.

- Allianz SE

- Chubb Limited

- USAA Insurance Agency

- Swiss Re Group

- Allstate Corporation

- Nationwide Mutual Insurance Company

Recent Developments

- In April 2024, FloodFlash, an insurtech firm based in the UK, unveiled its latest offering, parametric flood business interruption coverage, in anticipation of the 2024 hurricane season in the U.S. The Flood BI product is tailored to swiftly compensate businesses in the event of flooding, facilitating expedited recovery processes.

- In February 2024, Isleton started developing a community-centered flood insurance pilot program. Spearheaded by UC Davis researchers, this endeavor seeks to introduce an innovative approach to flood insurance within Isleton, California, in response to the escalating flood risk and climate adaptation dilemmas confronting the town.

- In May 2023, OCTO engaged into a partnership with Jooycar to transform auto insurance in Latin America. This partnership will help the company to strengthen their business and improve driving experience by providing its advanced solutions and vehicle data analysis in Latin America.

- In March 2023, Trimble Inc. launched its Mobility telematics portfolio for fleet management. It is the industry’s dwell time metrics that help fleets to make better decisions and utilize their assets efficiently

Report Coverage

The research report offers an in-depth analysis based on Coverage, Distribution Channel, Policy Provider and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Insurers will expand parametric insurance products to improve claim speed and accuracy.

- Technology adoption will increase, enhancing flood risk modeling and underwriting efficiency.

- Governments will strengthen regulations to boost insurance penetration in high-risk zones.

- Public-private partnerships will rise to make coverage more accessible and affordable.

- Climate change will increase flood frequency, driving higher policy demand.

- Digital platforms will simplify policy distribution and improve customer engagement.

- Private insurers will enter new markets, intensifying competition and innovation.

- Awareness campaigns will help close protection gaps in vulnerable communities.

- Advanced data analytics will support better pricing and risk management.

- Global investments in flood resilience programs will accelerate insurance market growth.