Market Overview:

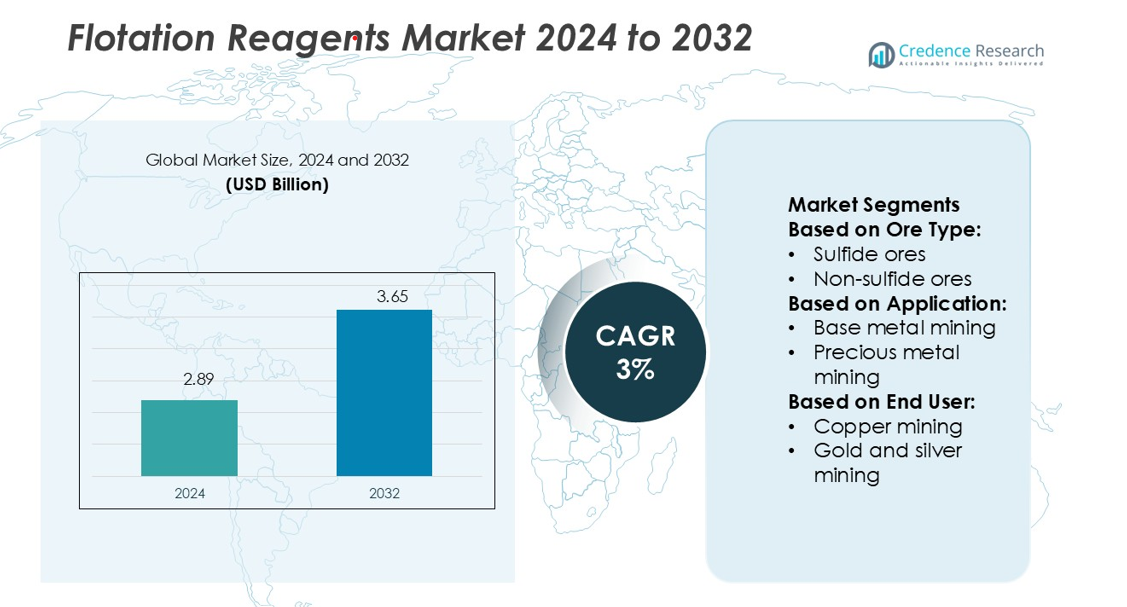

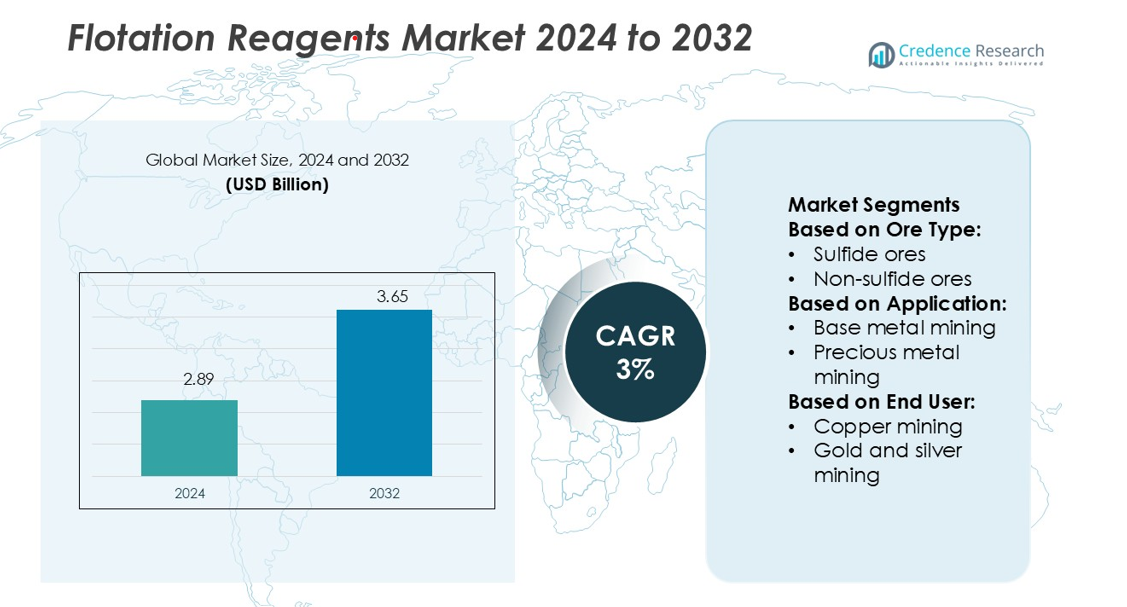

Flotation Reagents Market size was valued USD 2.89 billion in 2024 and is anticipated to reach USD 3.65 billion by 2032, at a CAGR of 3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flotation Reagents Market Size 2024 |

USD 2.89 billion |

| Flotation Reagents Market, CAGR |

3% |

| Flotation Reagents Market Size 2032 |

USD 3.65 billion |

The Flotation Reagents Market is led by major players such as Clariant, Kemira, Chevron Phillips Chemical, Arkema, Dow, Cytec Industries, Beijing Hengju, BASF SE, Huntsman, and Cheminova. These companies maintain a strong competitive edge through advanced reagent formulations, sustainability-focused innovations, and global distribution networks. Strategic partnerships with mining operators strengthen their market positions and enable tailored solutions for complex ore processing. North America emerges as the leading region in the market, holding a 36% share, supported by advanced mining operations, strong regulatory frameworks, and high adoption of eco-friendly flotation reagents. The region’s well-established infrastructure and focus on process optimization further reinforce its leadership position in the global market.

Market Insights

- The Flotation Reagents Market size reached USD 2.89 billion in 2024 and is projected to reach USD 3.65 billion by 2032, growing at a CAGR of 3%.

- Rising demand from the mining sector and the shift toward eco-friendly chemical solutions are driving steady market expansion.

- Sustainability-focused innovations and strategic partnerships are shaping market trends, with top players investing in advanced formulations and global distribution.

- High production costs, strict regulatory standards, and fluctuating raw material prices act as key restraints for market growth.

- North America holds a 36% regional share, leading the market with advanced mining infrastructure and strong environmental regulations, while the collectors segment dominates product demand with widespread use in mineral processing applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Ore Type

Sulfide ores hold the dominant share in the flotation reagents market. These ores include copper, lead, zinc, and nickel-bearing minerals, which respond well to reagent-based flotation. The high recovery efficiency and lower processing cost drive demand for collectors and frothers in sulfide ore processing. Non-sulfide ores like phosphate, potash, and rare earth minerals follow, supported by rising investments in specialty chemicals to enhance separation efficiency in complex ore bodies.

- For instance, Clariant Mining Solutions trialled its HOSTAFLOT™ NP107 collector in a copper-molybdenum sulfide mine in Chile, it enabled operation at a rougher flotation pH of 9.5 instead of 11 while maintaining the same metallurgical recovery performance.

By Application

Base metal mining accounts for the largest share of flotation reagent consumption. This segment benefits from extensive use of collectors and modifiers in copper, lead, and zinc ore processing. Growth in infrastructure and renewable energy projects increases the need for base metals, driving reagent adoption. Precious metal mining ranks second, supported by growing gold extraction, while industrial minerals mining expands steadily due to rising demand in construction and fertilizers.

- For instance, Kemira’s article states that the new reagent enables producers to increase recoveries and that there were indications of potential recovery increases of as much as 1–2%.

By End User

Copper mining represents the leading end-use segment, contributing the largest market share. High global demand for copper in power, electronics, and transportation industries fuels extensive flotation reagent use. Gold and silver mining follows, supported by rising investment in precious metals. Nickel and platinum group metals mining grows with EV and clean energy demand. Zinc mining and other segments, including iron ore and coal, contribute steadily through increasing beneficiation activities worldwide.

Key Growth Drivers

Rising Demand for Base and Precious Metals

The growing demand for copper, gold, zinc, and other base metals is a major market driver. Expanding infrastructure, electrification, and renewable energy projects are increasing mineral production. This creates strong demand for flotation reagents to enhance ore recovery and processing efficiency. Countries like Chile, Australia, and China are ramping up mining operations to meet global supply needs. The surge in exploration and production activities accelerates the adoption of advanced collectors, frothers, and modifiers, supporting sustained market growth over the forecast period.

- For instance, Orfom® CO100 collector is listed on Chevron Phillips Chemical’s website as a specific product for mining applications. The product is described for use in “mixed sulfide flotation operations.

Technological Advancements in Mineral Processing

Innovations in flotation chemistry and processing techniques are improving operational efficiency. Modern reagents offer higher selectivity, enabling better separation of complex ores. Mining companies are integrating advanced chemical formulations to increase yield and reduce reagent consumption. These improvements lower operating costs and enhance environmental compliance. Adoption of digital control and automated flotation systems further boosts process accuracy. The push for sustainable and cost-effective solutions strengthens market expansion across both sulfide and non-sulfide ore applications globally.

- For instance, Arkema’s CustoFloat® 390 collector for sedimentary phosphate flotation eliminates the need for pH adjustment and fuel-oil addition. The product is designed to provide improved selectivity and higher overall recovery for operations.

Expanding Industrial Mineral Applications

Growing demand for industrial minerals such as phosphate, potash, and rare earth elements is creating new opportunities. Flotation reagents play a key role in improving recovery rates and product purity in these sectors. Fertilizer production, electronics manufacturing, and clean energy technologies rely heavily on these minerals. Increased investments in mining projects for critical raw materials drive reagent consumption. The shift toward diversifying mineral supply chains further strengthens the need for advanced flotation solutions, supporting stable market growth worldwide.

Key Trends & Opportunities

Adoption of Environmentally Friendly Reagents

Sustainability trends are encouraging the use of biodegradable and non-toxic flotation chemicals. Regulatory pressure on mining companies to reduce environmental impact accelerates this shift. Green reagents minimize harmful tailings and improve water recycling in flotation circuits. Leading manufacturers are developing bio-based collectors and eco-friendly frothers to meet these evolving standards. This transition not only aligns with global sustainability goals but also provides a competitive advantage to suppliers offering low-toxicity solutions.

- For instance, Dow markets its DOWFROTH™ 200 frother as a poly-glycol-ether-based reagent used in mining applications, particularly for platinum group metals and fine particle flotation.

Integration of Digital and Automated Flotation Systems

Mining companies are investing in digital process control and AI-driven flotation technologies. These systems improve reagent dosage accuracy, reduce wastage, and enhance recovery efficiency. Real-time monitoring and data analytics help optimize chemical usage and streamline processing operations. Automation reduces operational costs and improves plant productivity, creating new opportunities for reagent suppliers to offer tailored solutions compatible with advanced control platforms. This trend is particularly strong in large-scale mining operations.

- For instance, Cytec’s “Flotation Matrix 100™” methodology uses just 18 multivariate batch tests to characterise complex base-metal ores and optimise reagent blends.

Growing Investments in Critical Mineral Projects

Rising demand for critical minerals like lithium, rare earths, and potash is opening new growth avenues. Governments are supporting mining and processing expansions to secure supply chains. These projects require efficient flotation systems to ensure high recovery rates. Advanced reagents designed for complex mineralogy are in demand. This creates strong opportunities for manufacturers to supply high-performance chemicals to emerging mining markets across Asia Pacific, Africa, and Latin America.

Key Challenges

Stringent Environmental and Regulatory Compliance

Environmental regulations governing chemical use in mining are becoming more rigorous. Flotation reagents, especially xanthates and other sulfur-based collectors, face tighter restrictions due to toxicity concerns. Compliance increases operational costs and limits product usage in some regions. Companies must invest in developing greener alternatives and updating processing systems to meet new standards. These regulatory pressures may slow market expansion and require significant R&D investments.

Volatile Raw Material Prices and Supply Chain Risks

Fluctuating costs of raw materials used in reagent production can disrupt market stability. Price swings in specialty chemicals and transportation affect profit margins for manufacturers and mining operators. Global supply chain disruptions, driven by geopolitical tensions and logistical constraints, further impact reagent availability. Such volatility increases procurement challenges for large mining projects. These risks make cost control and supply security critical factors for both producers and end users.

Regional Analysis

North America

North America holds a 28% market share in the flotation reagents market. The region benefits from a strong base metal mining industry, especially for copper, gold, and zinc. The U.S. and Canada have well-established processing facilities and advanced reagent technologies. Mining modernization and investments in sustainable solutions drive steady reagent demand. Digital and automated flotation systems are widely adopted to enhance recovery and reduce waste. Environmental regulations encourage the use of eco-friendly reagents, further shaping market dynamics. Rising exploration activities for lithium and other critical minerals also support market growth in this region.

Europe

Europe accounts for a 17% market share, supported by its well-regulated mining and processing sector. The region focuses on sustainable mineral extraction and strict compliance with environmental standards. Countries such as Sweden, Finland, and Germany are key contributors, with advanced copper and zinc mining operations. High adoption of biodegradable flotation reagents aligns with the region’s green transition goals. Strategic investments in rare earth and lithium mining projects are increasing due to energy transition demands. Europe’s strong regulatory framework and R&D capabilities foster innovation in reagent formulation and processing technologies.

Asia Pacific

Asia Pacific leads the flotation reagents market with a 39% market share, driven by rapid industrialization and expanding mining operations. China, Australia, and India dominate production of copper, gold, and industrial minerals. High consumption of base metals for manufacturing and infrastructure fuels reagent demand. Countries are investing heavily in critical mineral projects to strengthen supply chains. The region also sees growing adoption of automated flotation systems in large mines. Favorable government policies and cost-effective reagent production make Asia Pacific a global leader in mining chemical consumption.

Latin America

Latin America holds a 10% market share, supported by abundant mineral reserves and expanding mining projects. Chile, Peru, and Brazil are major copper and precious metal producers. The region’s mining industry is adopting modern flotation technologies to boost yield and improve operational efficiency. International investments in exploration and processing facilities are increasing, driving reagent demand. Regulatory reforms and infrastructure improvements support market expansion. However, operational challenges and environmental pressures require sustainable reagent solutions. Latin America’s growing role in global metal supply strengthens its position in the market.

Middle East & Africa

The Middle East & Africa region represents a 6% market share, with rising demand from emerging mining operations. South Africa dominates production in the region, supported by strong reserves of platinum group metals, gold, and base metals. Countries like Saudi Arabia are investing in critical mineral exploration to diversify their economies. The adoption of advanced flotation reagents is increasing to improve processing efficiency. Growing foreign investment, coupled with infrastructure development, is enhancing mining capacity. However, limited local manufacturing and supply chain gaps remain key challenges, creating opportunities for international reagent suppliers.

Market Segmentations:

By Ore Type:

- Sulfide ores

- Non-sulfide ores

By Application:

- Base metal mining

- Precious metal mining

By End User:

- Copper mining

- Gold and silver mining

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Flotation Reagents Market is shaped by key players including Clariant, Kemira, Chevron Phillips Chemical, Arkema, Dow, Cytec Industries, Beijing Hengju, BASF SE, Huntsman, and Cheminova. The Flotation Reagents Market is defined by continuous innovation, advanced processing technologies, and strong global distribution networks. Companies focus on improving reagent selectivity, reducing operational costs, and enhancing mineral recovery efficiency. Strategic partnerships with mining operators and investments in R&D drive differentiation and market expansion. Manufacturers are also adopting sustainable and eco-friendly formulations to meet tightening environmental regulations. Many players emphasize tailored reagent solutions to address complex ore types and regional mining challenges. The competition remains intense, with firms prioritizing performance, quality, and technical support to secure long-term contracts and strengthen their global presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Clariant

- Kemira

- Chevron Phillips Chemical

- Arkema

- Dow

- Cytec Industries

- Beijing Hengju

- BASF SE

- Huntsman

- Cheminova

Recent Developments

- In April 2025, Quadra, a leading North American ingredient and chemical distributor, announced its acquisition of Bell Chem, a Florida-based supplier known for serving diverse industries, including water treatment. This strategic move enhances Quadra’s reach and capabilities in the water treatment and froth flotation chemicals market, areas critical to both environmental management and mineral processing.

- In September 2024, FUJIFILM Irvine Scientific broadened its life-sciences line by integrating laboratory chemicals and diagnostics from FUJIFILM Wako Chemicals to provide end-to-end solutions.

- In December 2023, Roche entered into a definitive agreement with select parts of the LumiraDx group related to LumiraDx’s innovative Point of Care technology. This further expanded the diagnostic horizon of the company, leading to increased production of various biochemical reagents. Therefore, this strategy generated noteworthy sales for the company.

- In April 2023, Abbott Laboratories finalized its acquisition of Cardiovascular Systems, Inc. (CSI), a medical device company renowned for its innovative atherectomy system utilized in the treatment of peripheral and coronary artery disease. This acquisition encompassed a range of diagnostics and reagents tailored for the identification and management of these diseases, effectively broadening the product portfolio and boosting sales

Report Coverage

The research report offers an in-depth analysis based on Ore Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand from the mining industry.

- Sustainable and eco-friendly reagents will gain strong adoption worldwide.

- Digital process control will enhance flotation efficiency and productivity.

- Advanced chemical formulations will improve ore recovery and selectivity.

- Regional mining expansion will create new business opportunities for suppliers.

- Companies will focus on lowering operational costs through optimized reagent use.

- Stricter environmental regulations will accelerate the shift toward green solutions.

- Strategic partnerships will strengthen global distribution networks.

- Automation and AI integration will improve real-time process monitoring.

- Continuous R&D investments will drive product innovation and market competitiveness.