Market Overview

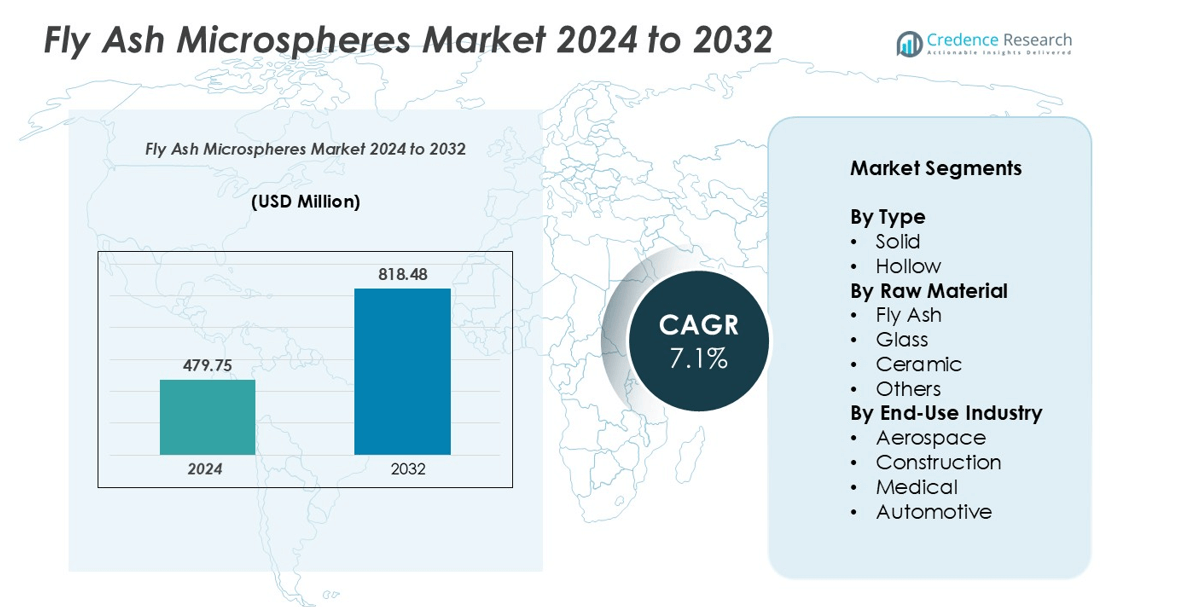

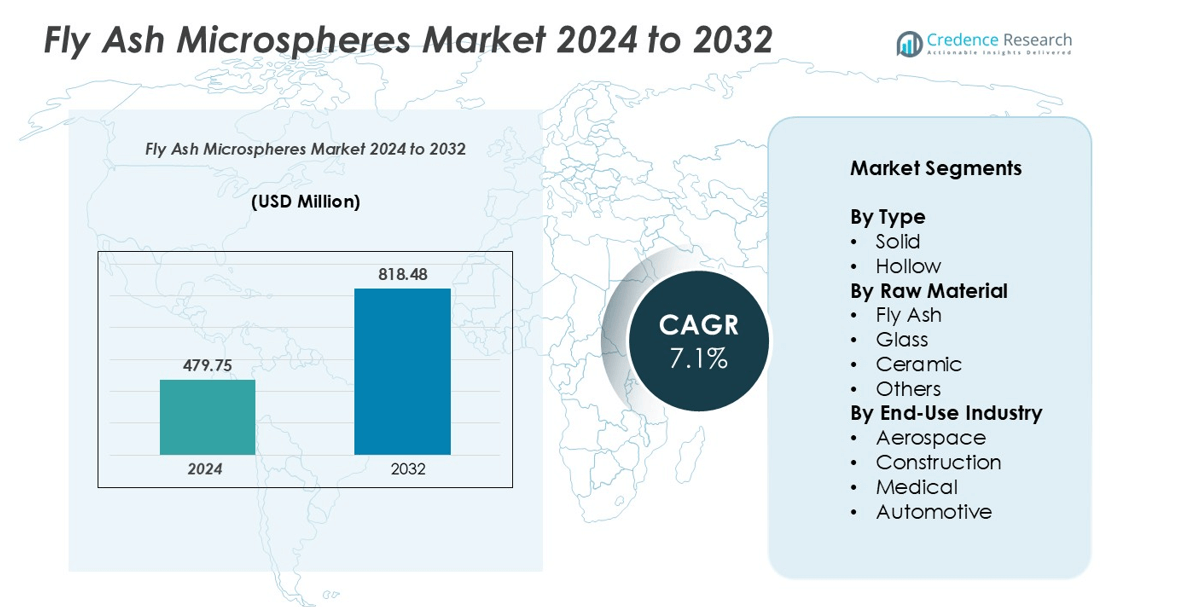

The Fly Ash Microspheres Market size was valued at USD 479.75 million in 2024 and is anticipated to reach USD 818.48 million by 2032, growing at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fly Ash Microspheres Market Size 2024 |

USD 479.75 million |

| Fly Ash Microspheres Market CAGR |

7.1% |

| Fly Ash Microspheres Market Size 2032 |

USD 818.48 million |

The Fly Ash Microspheres market is dominated by leading players such as DuPont, Lhoist Group, Omya International AG, Advanced Materials Technology, Ceno Technologies, Envirospheres, Ecosphere Technologies, HiPerNano, Luoyang Jihe Micro-Spherical Materials, SEFA Group, Stena Technoworld, and Tarmac (CRH plc). These companies drive market growth through innovation, strategic partnerships, and expansion of production capabilities, focusing on lightweight, high-strength, and eco-friendly microspheres for construction, aerospace, and automotive applications. Asia-Pacific leads the market with a 30% share, fueled by rapid urbanization and industrial growth, followed by North America at 28% due to aerospace and automotive demand, and Europe at 25%, supported by sustainable construction initiatives. These players maintain competitive advantage through R&D investments, regional manufacturing, and product diversification, positioning them strongly across the global fly ash microspheres landscape.

Market Insights

- The Fly Ash Microspheres market was valued at USD 479.75 million in 2024 and is projected to reach USD 818.48 million by 2032, growing at a CAGR of 7.1% during the forecast period.

- Market growth is driven by increasing demand in construction, aerospace, and automotive sectors for lightweight, durable, and eco-friendly materials, with hollow microspheres dominating the type segment and fly ash being the most widely used raw material.

- Key trends include technological advancements in microsphere production, adoption in medical and specialty applications, and increasing focus on sustainable and energy-efficient building materials.

- Competitive analysis highlights major players such as DuPont, Lhoist Group, Omya International AG, and Advanced Materials Technology, who leverage R&D, partnerships, and regional production to maintain market leadership.

- Regional insights show Asia-Pacific leading with 30% market share, followed by North America at 28% and Europe at 25%, driven by rapid urbanization, aerospace, automotive demand, and green construction initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The Fly Ash Microspheres market by type is segmented into solid and hollow microspheres. Among these, hollow microspheres dominate the segment, accounting for a significant market share due to their lightweight nature, high thermal insulation, and superior strength-to-weight ratio. Their increasing adoption in automotive and aerospace applications, where weight reduction is critical, drives demand. Additionally, hollow microspheres improve concrete and composite materials’ performance, enhancing durability and reducing energy consumption, which further supports market growth over the forecast period.

- For instance, 3M’s Glass Bubbles K1 have a typical density of 0.125 g/cc and an isostatic crush strength of 250 psi, making them ideal for applications requiring low density and high strength.

By Raw Material:

Based on raw materials, the market is categorized into fly ash, glass, ceramic, and others. Fly ash-based microspheres hold the largest share, owing to their cost-effectiveness, wide availability as an industrial by-product, and sustainable characteristics. The growing focus on green construction materials and eco-friendly industrial solutions is driving adoption. Fly ash microspheres provide excellent thermal resistance and chemical stability, making them ideal for use in construction, aerospace, and automotive applications, reinforcing their dominant position in the market.

- For instance, BASF’s BasoSphere™ hollow glass microspheres offer superior strength-to-density ratios and are utilized in cementing applications in the oil and gas industry, contributing to reduced CO2 emissions during well completion.

By End-Use Industry:

The end-use industry segment includes aerospace, construction, medical, and automotive sectors. Construction emerges as the dominant end-use, capturing the largest market share due to the rising use of microspheres in lightweight concrete, insulating materials, and cement composites. Drivers include increasing urbanization, infrastructure development, and the demand for energy-efficient and durable building materials. Additionally, their ability to enhance thermal insulation and reduce structural weight encourages adoption across commercial and residential projects, fueling market growth during the forecast period.

Key Growth Drivers

Expansion in Aerospace and Automotive Applications

Fly ash microspheres are gaining traction in aerospace and automotive industries due to their high strength-to-weight ratio and thermal resistance. In aerospace, microspheres are used in composites and structural components to reduce aircraft weight, improving fuel efficiency. Similarly, the automotive sector leverages them in lightweight panels, brake pads, and polymer composites, supporting emission reduction and fuel economy. Technological advancements, such as uniform microsphere size distribution and enhanced thermal stability, enable broader application across high-performance vehicles and aircraft. The growing trend toward lightweight materials in these sectors drives consistent demand and innovation in the fly ash microspheres market.

- For instance, high-grade aluminosilicate cenospheres, such as some of those offered by suppliers like Kehui Mica, can possess a crush strength ranging from 2,000 to 6,000 psi (13.8 to 41.4 MPa). This makes them suitable for demanding applications in sectors such as oil and gas, construction, and specialized composites.

Increasing Demand in Construction and Lightweight Materials

The demand for fly ash microspheres is rising sharply due to their use in lightweight concrete, insulating materials, and high-performance composites. These microspheres enhance structural strength while reducing material weight, making them ideal for modern construction and infrastructure projects. Rapid urbanization and the growing focus on sustainable, energy-efficient building materials further propel market growth. For instance, hollow fly ash microspheres are increasingly adopted in lightweight cement composites, improving thermal insulation and reducing energy consumption in buildings. Additionally, government initiatives promoting green construction and eco-friendly materials encourage widespread adoption across commercial and residential projects, solidifying this segment as a key growth driver.

- For instance, hollow microspheres can be used in controlled-release drug formulations and in medical devices like protective equipment, implants, and diagnostic devices are accurate. These applications are well-documented in scientific literature and supported by extensive research. The development of these technologies is an active field, and ongoing innovations are opening new market opportunities.

Environmental Sustainability and Utilization of Industrial By-products

The eco-friendly nature of fly ash microspheres contributes significantly to market growth. As an industrial by-product, fly ash offers a sustainable alternative to conventional raw materials, helping reduce waste and carbon footprint. Industries increasingly adopt microspheres in cement, polymers, and coatings to enhance performance while promoting environmental compliance. For instance, substituting fly ash in cement composites reduces Portland cement usage, lowering CO₂ emissions. This dual benefit of sustainability and material efficiency positions fly ash microspheres as a preferred choice for manufacturers seeking green solutions, further accelerating market adoption globally.

Key Trends & Opportunities

Technological Advancements in Microsphere Production

Innovations in manufacturing processes, such as high-temperature sintering and controlled expansion techniques, are improving microsphere quality, uniformity, and performance. Advanced production allows for precise control over density, size, and thermal stability, expanding applications in aerospace, automotive, and medical sectors. The trend toward customized microspheres tailored to specific end-use requirements creates opportunities for market players to differentiate products. Companies investing in R&D to enhance mechanical and thermal properties can capitalize on emerging opportunities, especially in high-performance composites and lightweight construction materials.

- For instance, Kehui Mica’s Aluminosilicate Microspheres Cenosphere Fly Ash exhibit a true density ranging from 0.6 to 0.9 g/cm³ and a bulk density between 0.3 and 0.5 g/cm³.

Growing Adoption in Medical and Specialty Applications

Fly ash microspheres are increasingly explored in medical devices, drug delivery, and specialty composites due to their biocompatibility and inert nature. For example, hollow microspheres can serve as carriers in controlled-release drug formulations. Additionally, the growing need for lightweight, durable materials in protective equipment, implants, and diagnostic devices opens new avenues for market expansion. Rising awareness of innovative medical materials and increasing healthcare infrastructure investments globally further support the adoption of microspheres in niche applications, representing a high-growth opportunity for manufacturers.

Expansion in Emerging Markets

Rapid urbanization, industrialization, and infrastructure development in Asia-Pacific, Latin America, and the Middle East present significant opportunities. Construction booms, automotive production growth, and aerospace sector expansion in these regions drive demand for lightweight and sustainable materials. Companies entering these markets can leverage lower production costs, abundant raw material availability, and supportive government policies to establish a strong foothold. Emerging markets also offer scope for partnerships, collaborations, and technology transfer, allowing manufacturers to expand product reach and capture new customer bases.

Key Challenges

High Production Costs and Technical Limitations

Despite their advantages, fly ash microspheres often face high manufacturing costs due to energy-intensive production and specialized equipment requirements. Additionally, maintaining uniform size, density, and thermal stability poses technical challenges. These factors can limit adoption among price-sensitive segments and small-scale manufacturers. The need for skilled labor, advanced technology, and stringent quality control further increases operational expenses. Consequently, cost management and process optimization remain critical challenges for market participants seeking sustainable growth.

Competition from Alternative Materials

Fly ash microspheres compete with other lightweight fillers, synthetic microspheres, and advanced polymer composites. Materials like glass and ceramic microspheres, as well as engineered polymers, offer similar mechanical and thermal properties in certain applications. In some cases, these alternatives provide superior consistency, corrosion resistance, or compatibility with specific composites. Intense competition pressures manufacturers to innovate, reduce costs, and demonstrate clear performance advantages to secure market share. Failure to differentiate products could hinder growth, especially in highly competitive sectors such as automotive and aerospace.

Regional Analysis

North America

North America holds a significant share of the Fly Ash Microspheres market, driven by the strong presence of aerospace and automotive industries. The U.S. and Canada lead in adopting lightweight composites and energy-efficient construction materials. Hollow microspheres are particularly in demand for aerospace components, thermal insulation, and polymer composites. Growth is further supported by government initiatives promoting sustainable construction and green building standards. Major players focus on R&D and strategic partnerships to enhance product quality and application breadth, consolidating North America’s position as a key regional market with an estimated market share of around 28%.

Europe

Europe accounts for a substantial portion of the global Fly Ash Microspheres market, primarily fueled by construction modernization, automotive lightweighting, and aerospace advancements. Countries such as Germany, France, and the U.K. lead in sustainable infrastructure development and adoption of eco-friendly materials. The market benefits from stringent environmental regulations, which drive the use of fly ash-based microspheres in cement composites and insulating materials. Continuous investment in research for high-performance and low-density microspheres supports regional growth. Europe is projected to hold a market share of approximately 25%, with increasing focus on green construction and industrial innovation.

Asia-Pacific

Asia-Pacific represents the fastest-growing Fly Ash Microspheres market, accounting for roughly 30% market share, driven by rapid urbanization, infrastructure expansion, and industrial growth. China and India are key contributors, fueled by high demand in construction, automotive, and industrial applications. The availability of raw materials like fly ash, coupled with cost advantages, encourages manufacturers to expand production. The region also witnesses growing adoption in aerospace and specialty applications, supported by government initiatives for smart cities and sustainable development. Rising investments in research and development further enhance product quality and market penetration.

Latin America

Latin America holds a moderate share of the Fly Ash Microspheres market, estimated at around 8%, with Brazil and Mexico leading regional growth. Demand is primarily driven by construction and automotive sectors seeking lightweight, energy-efficient materials. Infrastructure development projects and increased focus on sustainable building practices encourage adoption of fly ash-based microspheres. However, slower industrial modernization and limited technological adoption in some countries slightly restrict growth. Market players focus on partnerships and local manufacturing to reduce costs, expand product availability, and increase regional penetration.

Middle East & Africa

The Middle East & Africa region captures approximately 7% of the market share, driven by rising infrastructure development, urbanization, and energy-efficient building requirements. The construction sector dominates demand, with microspheres used in lightweight concrete, insulating materials, and industrial composites. The region’s adoption is supported by government investments in smart cities and sustainable urban projects. However, high production costs and reliance on imports present challenges. Market players increasingly collaborate with local distributors and construction companies to enhance accessibility, reduce logistical costs, and strengthen market presence across key Middle Eastern and African countries.

Market Segmentations:

By Type:

By Raw Material:

- Fly Ash

- Glass

- Ceramic

- Others

By End-Use Industry:

- Aerospace

- Construction

- Medical

- Automotive

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Fly Ash Microspheres market is highly competitive, characterized by the presence of both global leaders and regional players. Key companies such as DuPont, Lhoist Group, Omya International AG, and Advanced Materials Technology leverage technological expertise, strategic partnerships, and extensive distribution networks to maintain market dominance. Players focus on developing high-performance microspheres with enhanced thermal resistance, uniform particle size, and lightweight properties to meet diverse industry demands across construction, automotive, aerospace, and specialty applications. Regional manufacturers, including Luoyang Jihe Micro-Spherical Materials and HiPerNano, strengthen market presence through cost-effective production and localized supply chains. Competitive strategies include mergers and acquisitions, R&D investments, and product innovations aimed at sustainability and performance improvement. Additionally, companies increasingly emphasize eco-friendly fly ash-based microspheres to comply with environmental regulations and appeal to the growing demand for green materials, driving differentiation and shaping the competitive landscape globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Advanced Materials Technology

- Ceno Technologies

- DuPont

- Envirospheres

- Ecosphere Technologies

- HiPerNano

- Lhoist Group

- Luoyang Jihe Micro-Spherical Materials

- Omya International AG

- SEFA Group

- Stena Technoworld

- Tarmac (CRH plc)

Recent Developments

- In March 2021, Soupologie, a UK-based fresh soup company, introduced a new line inspired by sunshine. Their trio of fresh, plant-based soups is enriched with vitamin D, offering at least 50% of your daily requirement in a single serving. This vegan vitamin D3 provides a delightful way to enhance your intake.

- In January 2021, IMCD, a prominent provider of specialty ingredients, inaugurated a state-of-the-art UHT laboratory in Indonesia. This advanced facility enhances their footprint in Asia and facilitates the creation of superior ingredients for soups, dairy items, and beverages.

Report Coverage

The research report offers an in-depth analysis based on Type, Raw Material, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fly ash microspheres is expected to rise across construction, aerospace, and automotive sectors.

- Hollow microspheres will continue to dominate due to their lightweight and thermal insulation properties.

- Fly ash will remain the preferred raw material because of its cost-effectiveness and sustainability.

- Technological advancements will improve particle uniformity, strength, and thermal stability.

- Adoption in medical and specialty applications is likely to increase.

- Manufacturers will focus on eco-friendly and energy-efficient solutions to meet regulatory standards.

- Emerging markets in Asia-Pacific and Latin America will offer significant growth opportunities.

- Strategic partnerships, mergers, and acquisitions will drive competitive advantage.

- Research and development investments will enhance product performance and diversification.

- Increased awareness of sustainable materials will support long-term market expansion.