Market Overview

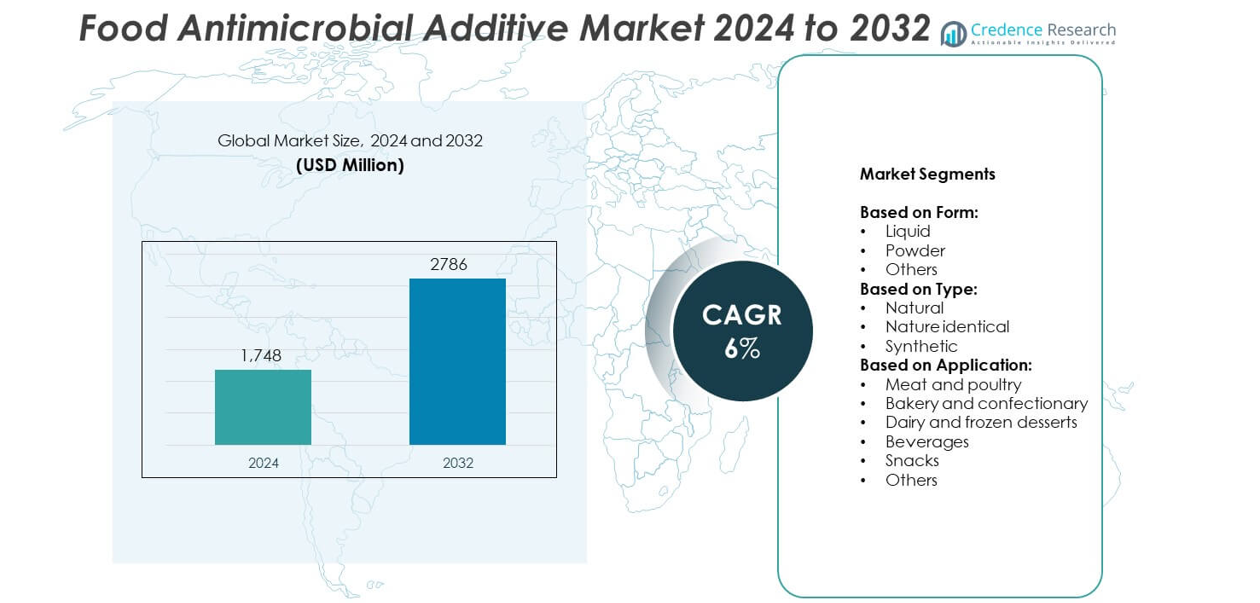

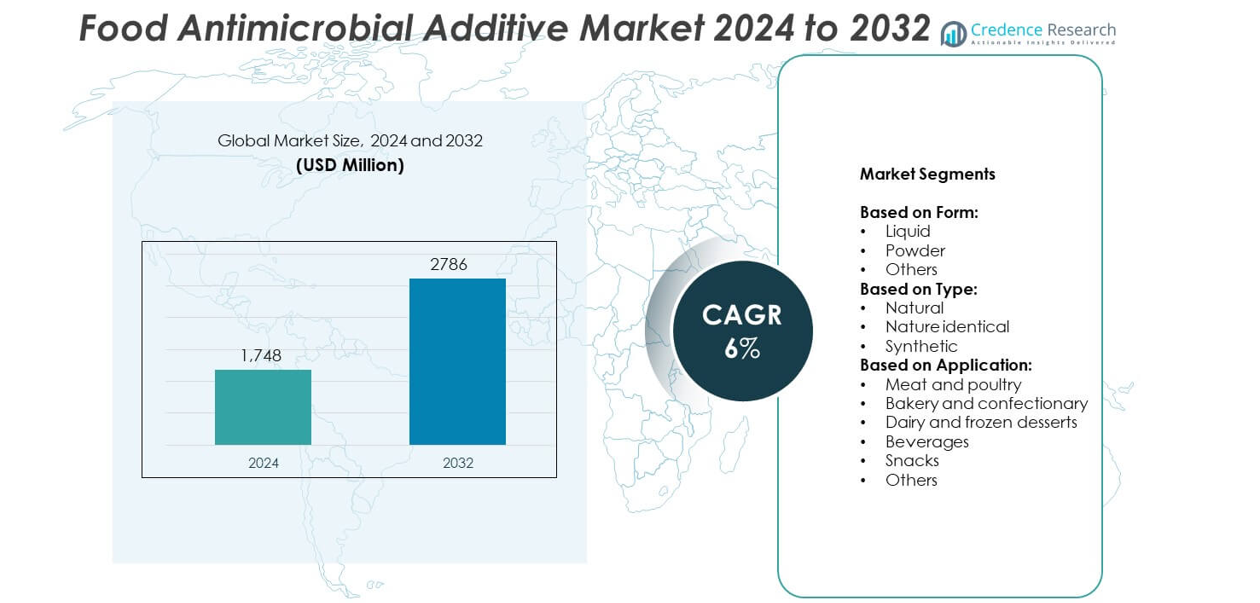

The Food Antimicrobial Additive Market size was valued at USD 1748 million in 2024 and is expected to reach USD 2786 million by 2032. The market is projected to grow at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Antimicrobial Additive Market Size 2024 |

USD 1748 million |

| Food Antimicrobial Additive Market, CAGR |

6% |

| Food Antimicrobial Additive Market Size 2032 |

USD 2786 million |

Food Antimicrobial Additive market grows with rising demand for clean-label and natural preservation solutions. Strict food safety regulations and increasing packaged food consumption drive adoption across industries. Manufacturers focus on developing natural, multifunctional additives to meet consumer preferences and regulatory requirements. Integration with active packaging technologies and innovations like microencapsulation improve product stability and shelf life. Growing health awareness and expansion of convenience food markets further support demand, encouraging continuous research and collaboration to create safer and more sustainable food solutions.

North America leads with 35% share, driven by strong regulations and demand for safe packaged foods. Europe follows with 28%, emphasizing natural and sustainable additives under strict EFSA standards. Asia-Pacific holds 22% and shows fastest growth due to expanding food processing and urbanization. Latin America and Middle East & Africa account for 9% and 6% respectively, supported by rising exports and modern retail growth. Key players include Mitsubishi Chemical, Jungbunzlauer, Celanese, and Kerry Group, focusing on innovation and regional expansion.

Market Insights

- Food Antimicrobial Additive market was valued at USD 1748 million in 2024 and is projected to reach USD 2786 million by 2032, growing at a CAGR of 6%.

- Rising demand for clean-label and natural additives drives adoption across food and beverage industries.

- Trends include integration of antimicrobials with active packaging systems and development of multifunctional solutions.

- Leading players such as Mitsubishi Chemical, Jungbunzlauer, Celanese, Novonesis, and Kerry Group focus on innovation, partnerships, and sustainable product development.

- High cost of natural ingredients and diverse regional regulatory requirements create challenges for manufacturers and delay new product launches.

- North America leads with 35% share, followed by Europe with 28%, Asia-Pacific with 22%, Latin America with 9%, and Middle East & Africa with 6%.

- Future growth will be driven by expansion in emerging economies, advancements in controlled-release technologies, and increased investment in sustainable, eco-friendly antimicrobial solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Clean-Label and Natural Solutions

Food Antimicrobial Additive market benefits from growing consumer preference for clean-label products. Manufacturers are adopting natural antimicrobials such as plant extracts and essential oils to meet demand. It helps brands position their products as safe and healthy. Food companies focus on transparency in labeling to build consumer trust. The trend encourages suppliers to invest in natural and bio-based antimicrobial research. Rising awareness of chemical residue impact further strengthens the use of natural additives. This shift is reshaping innovation strategies across the food and beverage sector.

- For instance, In a yoghurt study using nisin nanoparticles (nisin NPs), complete eradication of methicillin-resistant Staphylococcus aureus (MRSA) was observed at a concentration of 0.25 mg/mL after 24 hours

Stringent Food Safety Regulations and Compliance Requirements

Governments implement strict regulations to ensure food safety and prevent contamination. Food Antimicrobial Additive market grows as companies comply with HACCP and FSMA standards. It supports consistent quality across processed foods and beverages. Regulators emphasize microbial control to reduce outbreaks of foodborne illnesses. This creates strong demand for reliable and proven antimicrobial solutions. Companies focus on validated, regulatory-approved additives to maintain compliance. Strict safety norms drive adoption across meat, dairy, and ready-to-eat food producers.

- For instance, In a study on mozzarella cheese, researchers tested both a natamycin-coated hydroxyethylcellulose film and a direct natamycin spray at a concentration of 1 mg/dm². The study found that while both methods significantly reduced fungal growth, the direct spray was more effective. Specifically, the direct spray treatment reduced the fungal population by 5.28 Log CFU/g compared to the control group, whereas the natamycin incorporated into the film only achieved a 4.15 Log CFU/g reduction.

Growth of Packaged and Convenience Food Consumption

Urbanization and changing lifestyles increase demand for packaged food products. Food Antimicrobial Additive market plays a key role in extending shelf life. It reduces spoilage risk during transportation and storage. Growth of retail chains and e-commerce amplifies the need for longer-lasting products. Consumers expect freshness even in long supply chains. Producers invest in advanced antimicrobial technologies to maintain quality. Rising middle-class populations in emerging economies further fuel demand.

Advancements in Preservation Technologies and Innovation

Technological progress improves efficiency of antimicrobial additives in food applications. Food Antimicrobial Additive market benefits from microencapsulation and controlled-release systems. It enhances stability and maintains sensory qualities of food products. Continuous innovation drives development of multi-functional additives that offer both preservation and nutritional benefits. Collaboration between ingredient suppliers and research institutes accelerates product development. Companies adopt digital tools for predictive modeling to optimize antimicrobial usage. Such advancements create new opportunities for tailored solutions across applications.

Market Trends

Shift Toward Natural and Plant-Based Antimicrobials

Food Antimicrobial Additive market is witnessing a strong move toward natural solutions. Consumers prefer plant-derived options such as rosemary, thyme, and citrus extracts. It aligns with the clean-label movement and rising health awareness. Manufacturers develop products with minimal synthetic chemicals to improve market acceptance. Regulatory approvals for natural additives encourage wider adoption. This trend is driving innovation in sourcing and processing of botanical antimicrobials. Brands use this shift to differentiate their offerings in competitive markets.

- For instance, In one study on E. coli, carvacrol and thymol at 200 mg/L (200 ppm) caused a reduction of approximately 6 log CFU/mL, but this occurred within 6 hours.

Integration of Antimicrobials with Active Packaging Solutions

Packaging innovations are transforming the role of antimicrobials in food safety. Food Antimicrobial Additive market benefits from growth in active packaging systems. It enables controlled release of antimicrobial agents, extending product shelf life. Integration reduces the need for high additive concentrations within the food matrix. Technology adoption improves convenience for consumers and efficiency for producers. Companies invest in smart packaging to enhance safety monitoring. This approach supports sustainability by minimizing food waste.

- For instance, Plain yoghurt treated with natamycin 10 ppm had shelf life up to 40 days before yeast/mold growth.

Rising Focus on Multifunctional and Clean-Label Formulations

Producers demand solutions that deliver more than microbial control. Food Antimicrobial Additive market sees growth in additives that also improve texture and flavor stability. It helps reduce the need for multiple ingredients in formulations. Consumers prefer products with shorter ingredient lists and simple labeling. This drives suppliers to create multifunctional blends with synergistic effects. Demand is rising in bakery, dairy, and beverage segments. The focus is on combining preservation with value-added benefits.

Adoption of Digital and Predictive Technologies in Production

Data-driven approaches are improving antimicrobial efficiency and cost control. Food Antimicrobial Additive market benefits from predictive modeling and AI tools. It enables optimization of dosage and better risk management. Real-time monitoring helps producers prevent microbial outbreaks. Automation supports consistent quality across production batches. Technology adoption also reduces wastage and improves regulatory compliance. These advancements make antimicrobial usage more targeted and sustainable.

Market Challenges Analysis

High Cost of Natural Ingredients and Production Complexities

Food Antimicrobial Additive market faces cost pressures due to expensive natural ingredients. It impacts pricing strategies for manufacturers and limits adoption in price-sensitive regions. Extraction and stabilization of natural compounds require advanced technology, increasing production expenses. Small and mid-sized food producers struggle to maintain profitability when ingredient costs rise. Limited availability of certain botanical sources creates supply chain risks. Fluctuations in raw material prices add further uncertainty for producers. These challenges slow down large-scale penetration of premium antimicrobial solutions.

Regulatory Hurdles and Variability Across Regions

Complex and diverse regulatory requirements create barriers for market growth. Food Antimicrobial Additive market must comply with strict approvals before commercialization. It increases time-to-market and raises compliance costs for companies. Different regions follow separate safety standards, complicating global product launches. Reformulation is often required to meet local guidelines, affecting production efficiency. Delays in regulatory clearance can restrict innovation pipelines. These challenges demand continuous monitoring and adaptation by ingredient suppliers.

Market Opportunities

Expansion in Emerging Economies and Growing Food Processing Sector

Food Antimicrobial Additive market holds strong potential in emerging regions with rising food processing activities. It supports shelf-life extension for products in markets with limited cold-chain infrastructure. Growing urban populations drive higher demand for packaged and ready-to-eat foods. Local manufacturers seek reliable solutions to meet safety standards and reduce spoilage losses. Government programs promoting fortified and safe food production create new opportunities for suppliers. Rising disposable incomes encourage consumers to prefer branded, quality-assured products. This expansion opens a path for global players to strengthen regional presence.

Innovation in Sustainable and Multifunctional Additives

Development of eco-friendly and multifunctional antimicrobial solutions presents significant growth prospects. Food Antimicrobial Additive market benefits from innovations that combine preservation with nutritional or sensory enhancements. It enables food brands to meet both safety and wellness trends. Research into biodegradable and low-residue additives aligns with sustainability goals. Suppliers are investing in precision delivery systems to optimize dosage and reduce waste. Growing collaborations between industry and academia accelerate product development. These opportunities create a competitive edge for companies focused on differentiated offerings.

Market Segmentation Analysis:

By Form:

Food Antimicrobial Additive market is segmented by form into liquid, powder, and others. Liquid form dominates due to easy blending with food products and uniform distribution. It is widely used in meat, poultry, and beverage applications where homogeneity is critical. Powder form is preferred for dry food formulations like bakery and snacks. It offers longer shelf life and stability during storage. The “others” category includes innovative delivery formats such as gels and sprays, serving niche applications. Rising demand for convenient, ready-to-use solutions supports growth across all forms

- For instance, A study by Sara et al. in the Benha Veterinary Medical Journal (2014) showed that plain yogurt treated with 10 ppm of natamycin kept yeast and mold growth under control for up to 40 days.

By Type:

The market is divided into natural, nature-identical, and synthetic additives. Natural segment is gaining popularity due to rising consumer preference for clean-label products. It helps food brands meet regulatory and health-conscious consumer requirements. Nature-identical compounds offer consistent quality and cost efficiency, supporting large-scale manufacturing. Synthetic antimicrobials remain relevant in regions with cost-sensitive markets and where regulatory approvals allow wider use. Each type plays a distinct role in meeting food safety and shelf-life targets. Growing research in bio-based solutions is expected to boost natural segment share further.

- For instance, IFF (Danisco) Nisaplin® (nisin) in gelatin films achieved a 3-log Listeria reduction in 1 hour and ~6-log in 6–8 hours versus control.

By Application:

The market is classified into meat and poultry, bakery and confectionery, dairy and frozen desserts, beverages, snacks, and others. Meat and poultry lead due to high risk of microbial contamination and strict safety standards. It ensures preservation during processing, storage, and transport. Bakery and confectionery use antimicrobials to control mold growth and extend freshness. Dairy and frozen desserts require solutions to maintain texture and prevent spoilage. Beverages adopt antimicrobial additives to improve stability and prevent yeast growth. Snacks and other processed foods utilize them to reduce wastage and meet consumer expectations for longer shelf life. Expanding demand across multiple applications continues to drive innovation in this market.

Segments:

Based on Form:

Based on Type:

- Natural

- Nature identical

- Synthetic

Based on Application:

- Meat and poultry

- Bakery and confectionary

- Dairy and frozen desserts

- Beverages

- Snacks

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Food Antimicrobial Additive market with 35% of global revenue. Strong food safety regulations such as FSMA and strict monitoring by the FDA drive consistent adoption. It supports extensive use of natural and clean-label antimicrobial solutions in processed foods. Rising demand for ready-to-eat meals and meat products boosts the need for effective preservation technologies. Manufacturers invest heavily in research and product innovation to meet evolving consumer preferences. Growth of functional foods and beverages further strengthens the role of advanced antimicrobial formulations. The presence of key market players and advanced distribution networks secures North America’s leading position.

Europe

Europe accounts for 28% of the Food Antimicrobial Additive market, driven by strict EFSA regulations on food safety and quality. It encourages producers to use approved and validated antimicrobial ingredients. Demand is growing for plant-based and bio-preservatives to support clean-label initiatives. The region emphasizes sustainability, pushing suppliers to develop eco-friendly and low-residue solutions. Consumers prefer natural preservatives in bakery, dairy, and ready-to-eat segments, leading to steady growth. Food producers in Western Europe focus on innovation to meet high safety standards and longer shelf-life requirements. Collaboration between industry and regulatory bodies ensures consistent product quality across the region.

Asia-Pacific

Asia-Pacific captures 22% of the Food Antimicrobial Additive market and is the fastest-growing region. Rapid urbanization and expansion of the food processing sector increase demand for antimicrobial solutions. It supports large-scale production of packaged foods for domestic and export markets. Rising disposable incomes lead to higher consumption of convenience food, snacks, and beverages. Government initiatives promoting food safety and modernization of manufacturing facilities accelerate adoption. Local suppliers are investing in cost-effective natural and synthetic additives to meet diverse customer needs. Strong growth potential in China, India, and Southeast Asia is expected to lift the region’s share further.

Latin America

Latin America holds 9% of the Food Antimicrobial Additive market, supported by the growth of meat and poultry exports. The region focuses on improving food safety standards to meet international trade requirements. It uses antimicrobial additives to reduce spoilage during transportation to export markets. Rising middle-class population drives higher demand for packaged and processed foods. Countries like Brazil, Mexico, and Argentina are seeing increased investment in food processing facilities. It creates opportunities for local and global suppliers to expand their presence. Adoption is expected to rise as regulatory frameworks become more robust.

Middle East and Africa

Middle East and Africa represent 6% of the Food Antimicrobial Additive market with steady growth potential. Rising population and changing dietary habits increase demand for safe, long-lasting packaged foods. It helps producers address supply chain challenges in regions with hot climates and limited refrigeration. Government initiatives to reduce foodborne diseases encourage adoption of effective antimicrobial solutions. Expansion of modern retail and foodservice sectors supports market development. Import dependence creates opportunities for international players to introduce innovative additives. Growing investment in food manufacturing infrastructure is expected to accelerate market penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The leading players in the Food Antimicrobial Additive market include Mitsubishi Chemical, Jungbunzlauer, Celanese, Novonesis, Kerry Group, Corbion, Eastman, Galactic, Dsm-firmenich, International Flavors & Fragrances, and Kalsec. These companies focus on expanding their product portfolios with natural and clean-label solutions to meet rising consumer demand. They invest heavily in research and development to create advanced formulations that maintain food safety and extend shelf life without compromising quality. Strategic collaborations with food producers and technology partners help accelerate innovation and commercialize new solutions faster. Many players emphasize sustainability by developing eco-friendly antimicrobial products and optimizing manufacturing processes to reduce environmental impact. Mergers, acquisitions, and partnerships are key strategies used to strengthen global presence and access new regional markets. Companies also focus on regulatory compliance, ensuring their additives meet international safety standards and gain faster approvals. Expansion in high-growth markets such as Asia-Pacific and Latin America is a priority, supported by investments in local production and distribution networks. Continuous innovation in microencapsulation and controlled-release technologies is helping improve efficiency and reduce dosage requirements. This competitive landscape remains dynamic, with intense focus on differentiation through quality, performance, and customer-focused solutions that address evolving industry needs

Recent Developments

- In 2025, DSM-Firmenich began construction on a new production facility in Collecchio, Italy, in the Parma province, to enhance capabilities in a range of flavors and functional blends for its Taste, Texture & Health business unit.

- In 2025, Corbion entered a partnership with BRAIN Biotech AG to develop novel bio-based antimicrobial compounds and derivatives.

- In 2023, Corbion announced the mechanical completion of its new circular lactic acid manufacturing plant in Rayong, Thailand, designed to produce lactic acid with the lowest carbon footprint in the industry

Report Coverage

The research report offers an in-depth analysis based on Form, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising demand for natural and clean-label antimicrobial solutions.

- Food producers will invest in technologies that extend shelf life without affecting taste.

- Regulatory focus on food safety will encourage wider adoption of approved additives.

- Growth in packaged and convenience food consumption will drive consistent market expansion.

- Innovation in microencapsulation and controlled-release systems will improve product performance.

- Collaboration between ingredient suppliers and research institutes will accelerate new product launches.

- Emerging economies will offer strong growth opportunities with expanding food processing sectors.

- Sustainability initiatives will boost demand for eco-friendly and low-residue antimicrobial solutions.

- Digital monitoring and predictive analytics will support precise antimicrobial usage.

- Competitive intensity will increase as players introduce multifunctional and value-added additives.