Market Overview

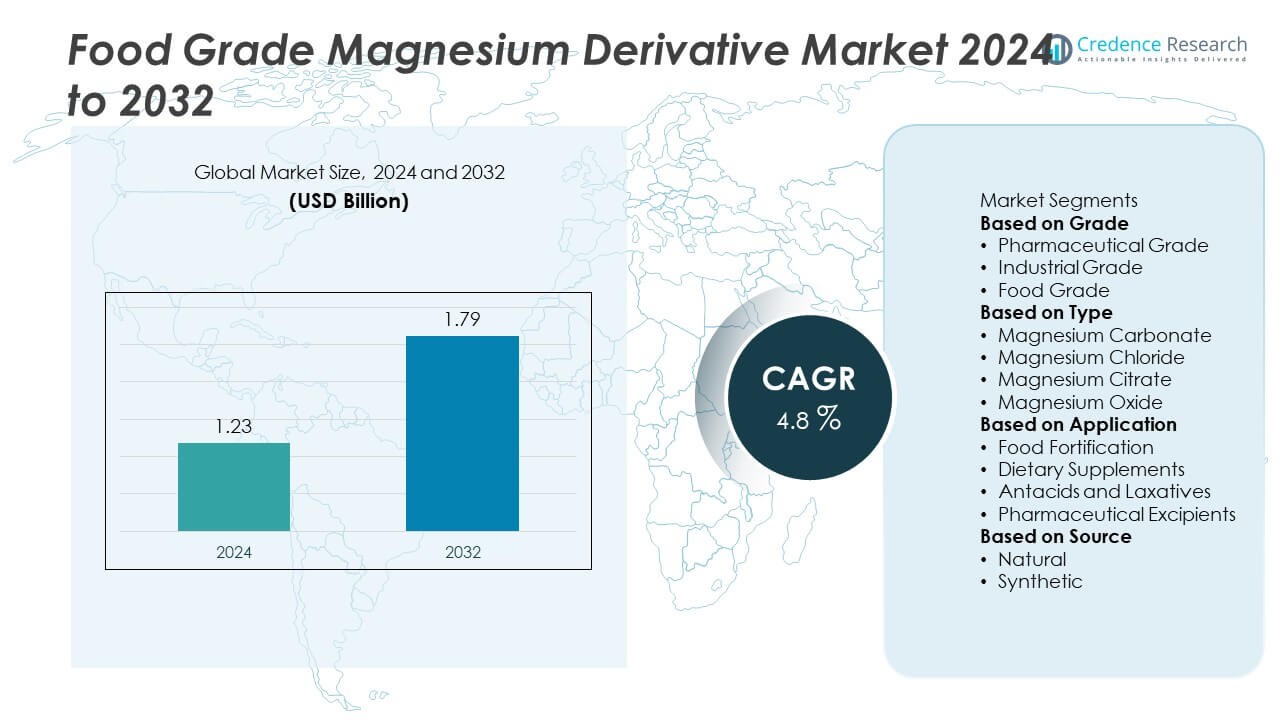

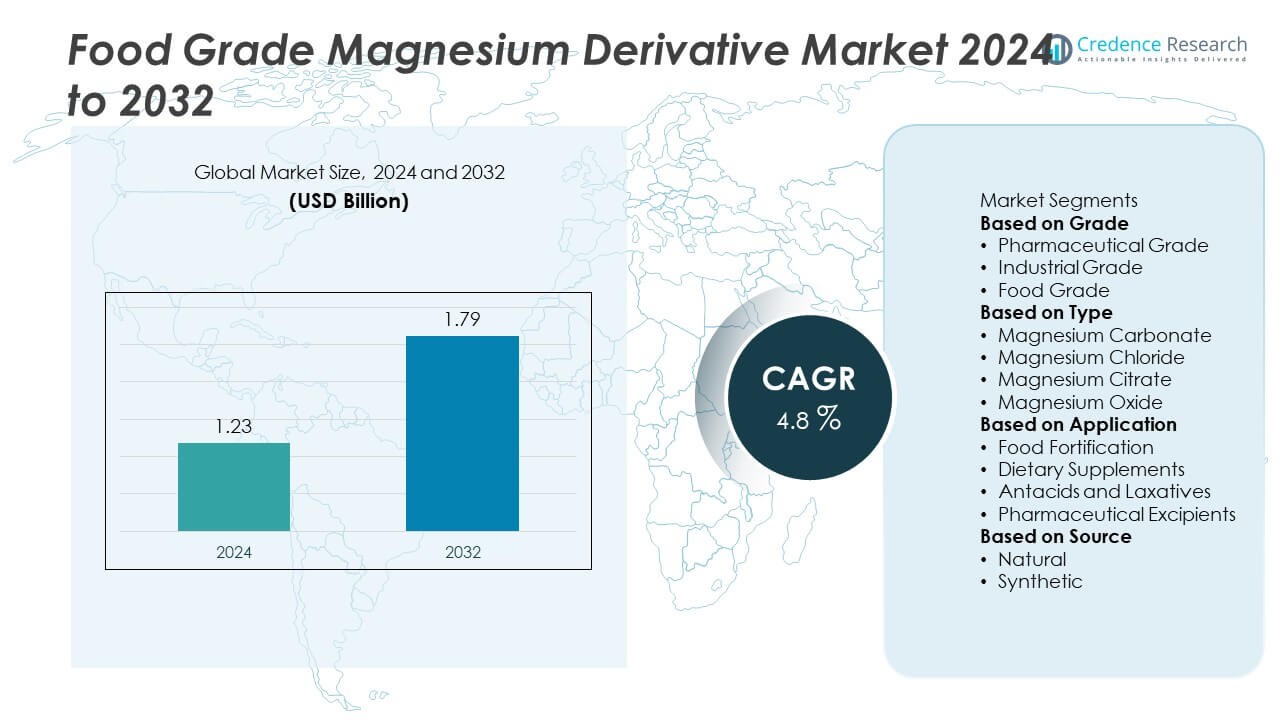

The Food Grade Magnesium Derivative market was valued at USD 1.23 billion in 2024 and is expected to reach USD 1.79 billion by 2032, growing at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Grade Magnesium Derivative Market Size 2024 |

USD 1.23 Billion |

| Food Grade Magnesium Derivative Market, CAGR |

4.8% |

| Food Grade Magnesium Derivative Market Size 2032 |

USD 1.79 Billion |

The Food Grade Magnesium Derivative market is led by key players such as Dead Sea Magnesium, Showa Denko, BASF, Martin Marietta Materials, Solikamsk Magnesium Works, Magnesita, Salton Energy, Ube Industries, SCM Chemicals, and Lianyungang Dahua Magnesium Industry Co., Ltd. These companies focus on product quality, capacity expansion, and strategic partnerships to maintain competitiveness. North America dominated the market with 35% share in 2024, driven by strong demand for dietary supplements and fortified foods. Europe held 28% share, supported by stringent nutritional regulations, while Asia-Pacific captured 25% share as the fastest-growing region, fueled by rising health awareness and government-led fortification initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food Grade Magnesium Derivative market was valued at USD 1.23 billion in 2024 and is projected to reach USD 1.79 billion by 2032, growing at a CAGR of 4.8% during 2025–2032.

- Rising demand for dietary supplements and functional food fortification drives market growth, supported by government-led nutrition programs and consumer awareness about magnesium deficiency.

- Key trends include increasing adoption of highly bioavailable magnesium forms like citrate and glycinate, along with a shift toward clean-label and naturally sourced products to meet consumer preferences.

- The market is moderately consolidated with leading players such as Dead Sea Magnesium, BASF, Showa Denko, and Martin Marietta Materials focusing on product innovation, regional expansion, and sustainable production methods.

- North America led with 35% share in 2024, followed by Europe at 28% and Asia-Pacific at 25%, while dietary supplements held the largest application share, accounting for over 50% of overall demand.

Market Segmentation Analysis:

By Grade

Food grade dominated the market in 2024, capturing over 45% share due to its extensive use in food and beverage fortification. Growing health awareness and rising demand for magnesium-enriched products support strong adoption in functional foods and nutraceuticals. Pharmaceutical grade held a significant share driven by its application in antacids, laxatives, and excipients for tablet formulations. Industrial grade remains a smaller segment, used mainly in food processing aids and additives. The dominance of food grade is reinforced by regulatory support for micronutrient fortification and consumer shift toward preventive healthcare solutions.

- For instance, a Dead Sea mineral producer—such as ICL Dead Sea—supplies high-purity magnesium chloride salt to global manufacturers, meeting strict food-grade standards.

By Type

Magnesium oxide led the market with more than 40% share in 2024, favored for its high bioavailability and cost-effectiveness in food fortification and supplements. Magnesium citrate follows closely, preferred in dietary supplements for its superior absorption rate and gastrointestinal tolerance. Magnesium carbonate is used in food applications as an anti-caking agent, while magnesium chloride sees demand in mineral-enriched beverages and pharmaceutical preparations. The high demand for magnesium oxide is driven by its multifunctional use in both food and pharmaceutical sectors, making it the most commercially significant derivative.

- For instance, the food-grade magnesium oxide produced by Resonac (formerly Showa Denko) is known for its purity, including low heavy metal content, and a uniform particle size, which are qualities that make it suitable for use in supplement applications.

By Application

Dietary supplements accounted for over 50% share of the market in 2024, reflecting the increasing consumer focus on magnesium supplementation for bone health, cardiovascular support, and stress reduction. Food fortification is another key application, boosted by government-led nutrition programs and rising processed food production. Antacids and laxatives represent steady demand from gastrointestinal care segments, while pharmaceutical excipients maintain consistent usage in tablet manufacturing. The dominance of dietary supplements is strengthened by the growing aging population and rising prevalence of magnesium deficiency, creating consistent growth opportunities for manufacturers.

Key Growth Drivers

Rising Demand for Dietary Supplements

The growing use of magnesium derivatives in dietary supplements drives market expansion. Consumers seek magnesium-rich products to support bone health, muscle function, and stress management. Increased awareness about magnesium deficiency and its link to cardiovascular and neurological disorders fuels supplement demand. Companies are introducing new magnesium oxide and citrate formulations with improved bioavailability. E-commerce and retail distribution networks are expanding supplement accessibility, supporting higher consumption levels. The supplement sector’s dominant share continues to anchor overall market growth globally.

- For instance, driven by strong demand from pharmaceutical and nutraceutical manufacturers in Europe and North America, producers of food-grade magnesium carbonate are projected to increase production in 2025. An established Indian manufacturer, AMS Fine Chemicals, has a monthly production capacity of up to 500 metric tons of magnesium carbonate and has reported supplying nutraceutical clients in these regions.

Expansion of Functional Food Fortification

Functional food and beverage fortification is a key growth driver for the market. Food-grade magnesium derivatives, particularly magnesium oxide, are used to enrich dairy, cereals, and beverages. Rising preference for fortified food products among urban populations supports consistent growth. Government initiatives promoting micronutrient fortification strengthen adoption in developing economies. Regulatory approval for magnesium fortification across multiple regions encourages food producers to innovate. This growing use of magnesium-based additives drives demand across the food industry, solidifying its position as a core ingredient.

- For instance, Martin Marietta Materials acquired Premier Magnesia on July 25, 2025, which expanded its line of high-purity magnesia-based products used in applications like food additives, plastics, and water treatment.

Rising Pharmaceutical Applications

Pharmaceutical demand for magnesium derivatives is expanding steadily. Magnesium hydroxide and carbonate are widely used in antacids and laxatives due to their neutralizing and osmotic properties. Magnesium stearate serves as a critical excipient in tablet manufacturing, improving flow and compressibility. Growth in gastrointestinal disorder cases and aging populations boosts product demand. Pharmaceutical companies are also adopting magnesium derivatives for controlled-release drug formulations. This steady consumption from the pharma sector creates a reliable revenue stream and supports market stability.

Key Trends & Opportunities

Shift Toward Highly Bioavailable Forms

Magnesium citrate and glycinate are gaining popularity for their superior absorption and gastrointestinal tolerance. Manufacturers are focusing on developing innovative formulations with enhanced solubility and faster uptake. This trend aligns with consumer preference for premium, clinically validated supplements. Opportunities exist for companies to introduce personalized magnesium products targeting specific health needs like sleep support, stress reduction, and metabolic health. This shift toward bioavailability-focused innovation is expected to capture a growing share of the supplement market.

- For instance, market data shows that the magnesium glycinate supplement market is experiencing growth, driven by demand from personalized supplement brands for formulations related to sleep and stress management. Albion Minerals, a leading supplier of chelated minerals, provides ingredients for these products

Growth in Clean-Label and Natural Products

Demand for clean-label and plant-based formulations is reshaping the magnesium derivatives market. Consumers prefer supplements free from synthetic binders, fillers, and allergens. Manufacturers are responding by sourcing naturally derived magnesium salts and adopting eco-friendly production methods. The rise of vegan-certified and non-GMO magnesium products is creating opportunities for brand differentiation. This trend is particularly strong in North America and Europe, where clean-label positioning drives premium pricing and consumer loyalty.

- For instance, Balchem Corporation’s Human Nutrition and Health segment, which includes its Albion® Minerals line, supplies chelated magnesium for supplement manufacturers.

Key Challenges

Raw Material Price Volatility

Fluctuating magnesium ore and production costs pose challenges for manufacturers. Price spikes in raw materials can impact profit margins and limit affordability for end-users. Dependence on imports from specific countries increases supply chain vulnerability. Companies are investing in backward integration and sourcing diversification to manage price risks. Long-term supply agreements and recycling initiatives are also being explored to ensure raw material availability and price stability.

Stringent Regulatory Compliance

Compliance with food safety and pharmaceutical regulations remains a significant challenge. Manufacturers must meet strict purity, labeling, and dosage requirements across multiple markets. Frequent updates in global regulations create added compliance costs and operational complexity. Delays in product approval may hinder timely market entry. Companies are adopting advanced quality control systems and seeking third-party certifications to maintain trust and regulatory adherence.

Regional Analysis

North America

North America held 35% share of the market in 2024, driven by strong consumption of dietary supplements and fortified foods. The United States leads demand due to high consumer awareness of magnesium deficiency and widespread adoption of preventive healthcare. Government support for nutrition labeling and product fortification fuels growth across food and beverage applications. The pharmaceutical industry’s steady requirement for magnesium hydroxide and carbonate further strengthens regional demand. Robust retail and e-commerce channels enhance product accessibility, supporting consistent growth. Canada contributes with rising adoption of functional foods and expansion of clean-label supplement offerings.

Europe

Europe accounted for 28% share of the global market in 2024, supported by strict nutritional guidelines and growing consumer preference for fortified products. Germany, France, and the UK drive demand for magnesium-enriched beverages and dietary supplements. Pharmaceutical-grade magnesium derivatives are widely used in antacids and laxatives across the region, strengthening the healthcare sector’s contribution. Regulatory compliance with EFSA standards ensures product safety and quality, boosting consumer confidence. Growing demand for vegan and non-GMO magnesium supplements in Western Europe provides opportunities for product innovation. Eastern Europe is witnessing gradual adoption driven by urbanization and rising disposable incomes.

Asia-Pacific

Asia-Pacific captured 25% share of the market in 2024, emerging as the fastest-growing region due to rising health awareness and expanding food processing industries. China leads demand with high production capacity for magnesium derivatives, while Japan and South Korea show strong adoption of dietary supplements. Government nutrition programs in India and Southeast Asia are driving food fortification initiatives. The pharmaceutical sector’s demand for magnesium-based antacids supports steady market growth. Rapid urbanization, changing dietary habits, and expansion of e-commerce platforms are creating new opportunities for magnesium derivative manufacturers across the region.

Latin America

Latin America represented 7% share of the market in 2024, with Brazil and Mexico as key contributors. Growing demand for fortified foods and supplements is driven by increasing prevalence of magnesium deficiency. The region’s pharmaceutical industry uses magnesium hydroxide in gastrointestinal care products, supporting steady consumption. Expanding middle-class populations and improving healthcare infrastructure are fueling supplement adoption. Local production capacity remains limited, leading to a reliance on imports. Opportunities exist for global players to strengthen distribution networks and introduce cost-effective magnesium formulations to meet rising consumer demand.

Middle East & Africa

Middle East & Africa held 5% share in 2024, with demand concentrated in Gulf countries and South Africa. Rising health awareness and government-led nutrition programs are encouraging adoption of fortified foods and beverages. The pharmaceutical industry’s growing use of magnesium-based antacids supports market expansion. Limited local manufacturing capacity results in higher import dependency, creating opportunities for international suppliers. Investments in healthcare infrastructure and retail channels are improving product availability. Growth potential is significant as consumer education and purchasing power continue to rise across developing markets within the region.

Market Segmentations:

By Grade

- Pharmaceutical Grade

- Industrial Grade

- Food Grade

By Type

- Magnesium Carbonate

- Magnesium Chloride

- Magnesium Citrate

- Magnesium Oxide

By Application

- Food Fortification

- Dietary Supplements

- Antacids and Laxatives

- Pharmaceutical Excipients

By Source

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the Food Grade Magnesium Derivative market is moderately consolidated, with key players including Dead Sea Magnesium, Showa Denko, SCM Chemicals, Martin Marietta Materials, Solikamsk Magnesium Works, Magnesita, Salton Energy, BASF, Lianyungang Dahua Magnesium Industry Co., Ltd, and Ube Industries leading the market. These companies focus on capacity expansion, product innovation, and strategic partnerships to strengthen their global presence. Many players invest in developing high-purity magnesium oxide and citrate to cater to dietary supplement and pharmaceutical applications. Vertical integration strategies help secure raw material supply and manage cost fluctuations. Several companies are targeting fast-growing regions like Asia-Pacific through joint ventures and localized production to reduce import dependency. Sustainability initiatives, including eco-friendly production methods and recycling of magnesium by-products, are gaining importance to meet regulatory requirements and consumer expectations. Continuous R&D investment supports the development of advanced magnesium formulations with improved bioavailability and application versatility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dead Sea Magnesium

- Showa Denko

- SCM Chemicals

- Martin Marietta Materials

- Solikamsk Magnesium Works

- Magnesita

- Salton Energy

- BASF

- Lianyungang Dahua Magnesium Industry Co., Ltd

- Ube Industries

Recent Developments

- In August 2025, Dead Sea Magnesium expanded its magnesium chloride food-grade product line, increasing annual production capacity to 45,000 metric tons through improved brine extraction and purification technologies.

- In May 2025, SCM Chemicals expanded its magnesium carbonate production line dedicated to food additive markets, increasing monthly output capacity by 20% to meet rising demand in the bakery and confectionery sectors.

- In 2023, Dead Sea Magnesium increased production capacity of its food grade magnesium chloride derived from Dead Sea brine to 45,000 metric tons annually, supporting growing demand from global food fortification and beverage manufacturers.

Report Coverage

The research report offers an in-depth analysis based on Grade, Type, Application, Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dietary supplements will continue to rise due to growing health awareness.

- Functional food fortification will expand as governments promote nutrition programs worldwide.

- Bioavailable forms like magnesium citrate and glycinate will gain stronger market share.

- Clean-label and plant-based magnesium derivatives will attract premium consumer segments.

- Pharmaceutical applications will grow with rising cases of gastrointestinal disorders and aging populations.

- Asia-Pacific will see the fastest growth with expanding food processing and supplement industries.

- Strategic collaborations and joint ventures will strengthen regional production and reduce import reliance.

- Sustainability initiatives and eco-friendly production will become key differentiators for manufacturers.

- Technological innovation will improve purity levels and enhance product absorption rates.

- Competitive intensity will increase as global players focus on emerging markets and capacity expansion.