Market Overview:

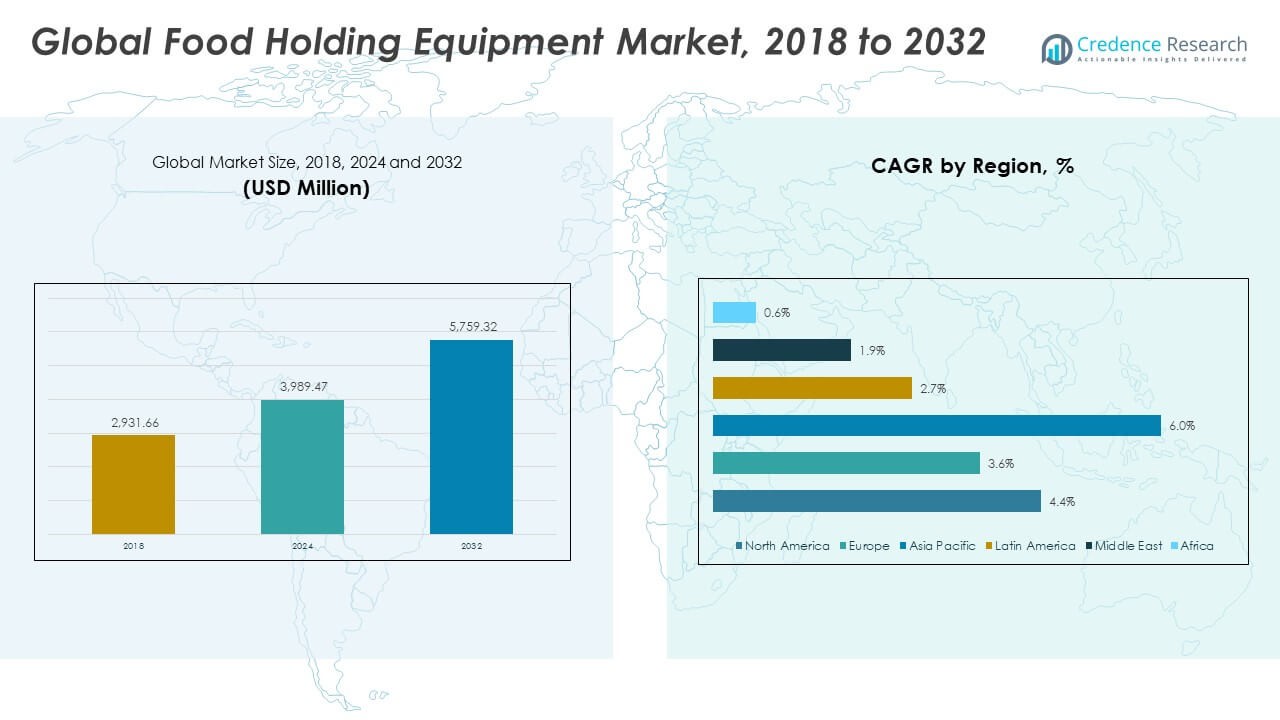

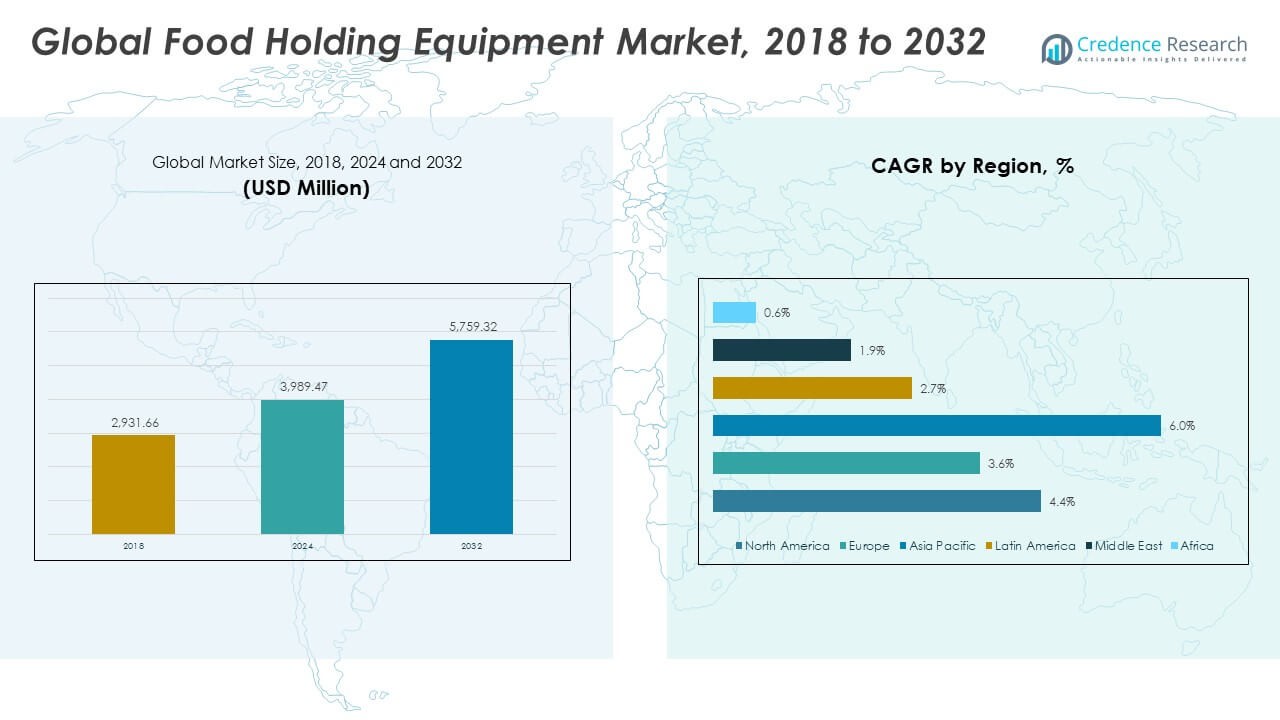

The Global Food Holding Equipment Market size was valued at USD 2,931.66 million in 2018, reached USD 3,989.47 million in 2024, and is anticipated to reach USD 5,759.32 million by 2032, at a CAGR of 4.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Holding Equipment Market Size 2024 |

USD 3,989.47 Million |

| Food Holding Equipment Market, CAGR |

4.37% |

| Food Holding Equipment Market Size 2032 |

USD 5,759.32 Million |

The market is primarily driven by increasing consumer demand for food safety and quality assurance in foodservice establishments. The growing popularity of quick-service restaurants (QSRs) and full-service restaurants necessitates the use of reliable food holding equipment to maintain the quality of food for extended periods. Additionally, technological advancements in temperature control, energy efficiency, and space-saving designs are further pushing the demand for these systems. The need to meet food safety regulations also contributes significantly to the market’s growth.

Geographically, North America leads the market due to a well-established foodservice industry, including a high concentration of QSRs and full-service restaurants. Europe follows closely, with countries like the UK, Germany, and France investing in advanced food holding solutions to meet food safety standards. The Asia Pacific region is emerging rapidly, driven by increasing urbanization, changing lifestyles, and a growing foodservice industry in countries like China, Japan, and India. Latin America and the Middle East also present expanding opportunities, particularly in tourism and hospitality.

Market Insights:

- The Global Food Holding Equipment Market size was valued at USD 2,931.66 million in 2018, USD 3,989.47 million in 2024, and is projected to reach USD 5,759.32 million by 2032, at a CAGR of 4.37% during the forecast period.

- North America holds the largest market share, approximately 34%, driven by the high concentration of quick-service restaurants and a well-developed hospitality industry.

- Europe, with a market share of 28%, is the second-largest, fueled by strict food safety regulations and demand for energy-efficient solutions in the restaurant and hotel sectors.

- The Asia Pacific region, with a 22% market share, is the fastest-growing, driven by urbanization, changing consumer preferences, and a booming foodservice industry in countries like China and India.

- Holding cabinets make up the largest segment by revenue, followed by proofing cabinets and refrigerators & chillers, with holding cabinets consistently leading in product demand across all regions.

Market Drivers:

Increasing Demand for Food Safety and Quality Standards

The Global Food Holding Equipment Market is experiencing growth due to the rising importance of food safety and quality standards across food service industries. Food holding equipment plays a key role in maintaining food temperature and ensuring it stays safe for consumption. These systems help maintain optimal conditions for food storage, which is crucial to prevent contamination and preserve quality. The implementation of stringent regulations regarding food safety further drives the demand for reliable and efficient holding equipment.

- For instance, E-Control Systems offers the IntelliCheck™ system, an IoT-based wireless temperature monitoring solution that helps foodservice businesses comply with HACCP requirements. The system automates temperature data logging and integrates with E-Control Systems’ FusionLive™ software to streamline food safety management.

Rising Popularity of Quick Service Restaurants (QSRs)

The rise of quick-service restaurants (QSRs) contributes significantly to the growth of the Global Food Holding Equipment Market. With an increasing number of customers opting for fast food, these establishments rely on advanced food holding equipment to store and serve food efficiently. The demand for equipment that can handle large quantities of food while maintaining quality is high, as QSRs aim to reduce wait times while ensuring food freshness and taste.

Growing Urbanization and Changing Lifestyles

Urbanization and changing lifestyles are key factors influencing the market’s growth. With more people moving into urban areas, the demand for food services in restaurants, hotels, and catering businesses rises. This urban shift drives the need for efficient food holding equipment that can accommodate larger volumes of food. Additionally, more people are opting for dining out, further boosting the demand for equipment that ensures food remains at the desired temperature for longer periods.

- For instance, Ali Group S.R.L. is one of the world’s largest foodservice equipment manufacturers, with a portfolio of over 110 brands and a global presence in more than 150 countries. The company offers advanced food holding solutions, including temperature-controlled equipment designed for energy efficiency and precise management.

Technological Advancements in Food Holding Equipment

Technological advancements are playing a pivotal role in the expansion of the Global Food Holding Equipment Market. Innovations in heating, cooling, and smart temperature management systems help improve energy efficiency and reduce operational costs for food service businesses. Equipment with digital interfaces, remote monitoring, and automatic temperature regulation is gaining traction. These innovations enhance operational efficiency, ensuring that food is held at safe temperatures while minimizing waste and energy consumption.

Market Trends:

Smart and IoT-Enabled Food Holding Equipment

A notable trend in the Global Food Holding Equipment Market is the integration of smart technologies, such as the Internet of Things (IoT), in food holding equipment. These systems allow real-time monitoring and temperature adjustments through smartphones or computers. By leveraging data analytics, food service businesses can optimize food holding times, ensuring energy efficiency while maintaining food quality. The increasing adoption of IoT-enabled equipment aligns with the growing trend of automation and digitalization in the foodservice industry.

- For instance, Middleby Corporation’s Open Kitchen IoT solution enables real-time wireless temperature monitoring, predictive analytics, and remote recipe distribution across commercial kitchens. This platform connects various foodservice equipment brands, enhancing operational efficiency and food safety in the hospitality industry.

Focus on Energy-Efficient Equipment

Energy efficiency is becoming a critical trend in the food service industry, directly influencing the demand for food holding equipment. As businesses seek ways to lower their energy costs and reduce their carbon footprint, equipment manufacturers are focusing on developing more energy-efficient models. The use of advanced insulation materials, energy-saving heating systems, and smart temperature control features are becoming common in food holding solutions. The trend towards sustainability and eco-friendliness is expected to continue, driving innovation in the sector.

Customization and Modular Food Holding Solutions

Customization and modular solutions are gaining traction within the Global Food Holding Equipment Market. As foodservice operations become more diverse, the demand for equipment that can be tailored to specific needs grows. Modular food holding systems allow businesses to configure their equipment according to space requirements, menu items, and storage capacity. Customization options enable better food storage management, improving efficiency and ensuring food stays fresh until serving.

- For instance, Henny Penny offers SmartHold humidified holding cabinets, which feature automatic humidity control and modular countertop units. These systems are designed to help maintain food quality and extend holding times in commercial kitchens.

Growing Popularity of Delivery and Takeout Services

The increasing trend of food delivery and takeout services is having a significant impact on the food holding equipment market. With the rise of delivery platforms, restaurants and foodservice providers are investing in solutions that keep food fresh during transportation. Food holding equipment that is portable, lightweight, and capable of maintaining temperature during delivery is in high demand. This trend reflects changing consumer behaviors and the industry’s shift towards convenience-based services.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs

One of the major challenges faced by the Global Food Holding Equipment Market is the high initial investment and maintenance costs associated with purchasing and maintaining advanced food holding systems. Many businesses, especially small and medium-sized enterprises, may find it difficult to afford these technologies, limiting market penetration. The cost of regular maintenance and potential repairs can also add to the overall expenses, which could deter some food service businesses from upgrading their equipment.

Competition from Traditional Food Holding Methods

Traditional food holding methods, such as basic heating lamps and manual food storage techniques, continue to pose competition to more advanced systems in the market. These traditional methods are often less expensive and simpler to implement, making them attractive options for smaller foodservice businesses that are trying to keep costs down. Despite the growing awareness of the benefits of modern food holding equipment, the lower upfront cost of traditional methods can slow the adoption of newer technologies.

Market Opportunities:

Expansion of Foodservice Chains in Emerging Markets

The Global Food Holding Equipment Market stands to benefit from the expansion of foodservice chains in emerging markets, particularly in regions like Asia-Pacific, Latin America, and Africa. With a growing middle class and changing consumer preferences, these regions offer vast opportunities for foodservice businesses to expand. As more restaurants, cafes, and food delivery services enter these markets, there will be an increased demand for reliable food holding equipment to ensure the quality and safety of food served.

Technological Innovations for Sustainability

The shift towards sustainability presents significant opportunities in the Global Food Holding Equipment Market. Manufacturers are investing in technologies that not only improve energy efficiency but also reduce environmental impact. Innovations such as energy-efficient food holding units, the use of recyclable materials, and systems that minimize food waste are becoming more popular. This trend aligns with the growing emphasis on corporate social responsibility and environmental sustainability within the foodservice industry.

Market Segmentation Analysis:

The Global Food Holding Equipment Market is segmented into product types and end-users, both of which play a significant role in its growth.

By product type, the market includes holding cabinets, proofing cabinets, and refrigerators & chillers. Holding cabinets are widely used in foodservice establishments to maintain food at the optimal temperature. Proofing cabinets are essential for bakeries, allowing dough to rise in a controlled environment. Refrigerators and chillers are crucial for preserving food at safe temperatures across various foodservice operations.

- For instance, Alto-Shaam’s heated holding cabinets with Halo Heat® technology use a unique low-density thermal cable to maintain precise food temperatures without fans or added humidity these cabinets support up to three full-sized pans, reduce food waste, and cost less than $2 per day to operate, as used by venues like Thunder Road Café, serving more than 3,500 customers each week.

By end-user, the market serves quick-service restaurants (QSRs), full-service restaurants, hotels, airports, and others. QSRs, which require efficient systems for fast service, heavily rely on food holding equipment to maintain food quality. Full-service restaurants also use these systems for large menu offerings, ensuring that food is kept fresh. Hotels demand large-scale food holding solutions to cater to multiple dining options, including buffets and room service. Airports, with a high volume of travelers, require specialized equipment to ensure food is stored at the right temperature for longer periods. The “others” segment includes catering services, food trucks, and cafeterias, each with unique needs for food holding equipment.

- For instance, Hatco’s Flav-R-Shield® Full-Service Pass-Over Sneeze Guard models, used by Marriott International, use 0.25-inch thick tempered glass and flush NSF-rated stainless steel flanges to maintain food safety and visibility for up to four bays in buffet stations.

Segmentation:

By Product Type

- Holding Cabinets

- Proofing Cabinets

- Refrigerators & Chillers

By End-User

- Quick Service Restaurants

- Full-Service Restaurants

- Hotels

- Airports

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Food Holding Equipment Market size was valued at USD 1,297.13 million in 2018, reached USD 1,747.07 million in 2024, and is anticipated to reach USD 2,529.04 million by 2032, at a CAGR of 4.4% during the forecast period. The market is driven by the region’s strong foodservice industry, particularly in quick-service restaurants (QSRs) and full-service restaurants. High consumer demand for quality food served at the right temperature leads to the adoption of advanced holding equipment. The U.S. remains the dominant market, supported by a growing trend towards energy-efficient and IoT-enabled food holding systems. Canada and Mexico also show significant demand growth due to their expanding hospitality and travel sectors. North America’s robust regulatory environment ensures a high level of compliance with food safety standards, further boosting market demand. The region’s market share stands at approximately 34% in the global food holding equipment sector.

Europe

The Europe Global Food Holding Equipment Market size was valued at USD 845.33 million in 2018, reached USD 1,109.54 million in 2024, and is anticipated to reach USD 1,509.62 million by 2032, at a CAGR of 3.6% during the forecast period. The European market is driven by a high demand for food safety and energy-efficient equipment across both large hotels and independent foodservice outlets. The growing preference for sustainable practices and innovations in food holding technologies aligns with Europe’s environmental regulations. Germany, the U.K., and France are leading contributors to the market due to their large hospitality and food service industries. Europe’s market share is estimated to be 28% of the global total.

Asia Pacific

The Asia Pacific Global Food Holding Equipment Market size was valued at USD 549.23 million in 2018, reached USD 811.78 million in 2024, and is anticipated to reach USD 1,331.10 million by 2032, at a CAGR of 6.0% during the forecast period. The rapid urbanization and the expanding foodservice sector in countries like China, India, and Japan are fueling growth in this region. Increasing disposable incomes and the growing demand for Western-style fast food and restaurants are driving the need for advanced food holding systems. The rise of food delivery services is also contributing to market expansion. Asia Pacific holds a 22% market share globally.

Latin America

The Latin America Global Food Holding Equipment Market size was valued at USD 130.33 million in 2018, reached USD 175.01 million in 2024, and is anticipated to reach USD 221.78 million by 2032, at a CAGR of 2.7% during the forecast period. The region’s growth is driven by the expanding tourism and hospitality sectors, particularly in Brazil and Mexico. The growing demand for quality food storage solutions in quick-service restaurants and hotels is pushing the adoption of advanced food holding equipment. Market growth is also influenced by the need for compliance with international food safety regulations. Latin America’s market share is around 6%.

Middle East

The Middle East Global Food Holding Equipment Market size was valued at USD 73.98 million in 2018, reached USD 91.07 million in 2024, and is anticipated to reach USD 108.43 million by 2032, at a CAGR of 1.9% during the forecast period. The region’s foodservice industry, particularly in the UAE and Saudi Arabia, is experiencing growth due to an influx of tourists and increasing local demand for high-quality dining experiences. However, the region’s growth is relatively slow compared to other regions due to a focus on traditional food holding methods. The Middle East holds a market share of about 4%.

Africa

The Africa Global Food Holding Equipment Market size was valued at USD 35.66 million in 2018, reached USD 54.99 million in 2024, and is anticipated to reach USD 59.35 million by 2032, at a CAGR of 0.6% during the forecast period. The market’s growth is driven by the expanding hotel and restaurant industry in South Africa and Egypt, where rising disposable incomes and urbanization are spurring demand for efficient food storage and holding solutions. The market remains underdeveloped in many parts of the continent, limiting growth potential. Africa’s market share is approximately 2%.

Key Player Analysis:

- AB Electrolux

- Ali Group Srl a Socio Unico

- Dover Corporation

- Duke Manufacturing

- Haier Group Corporation

- Smeg S.p.A.

- The Middleby Corporation

- Meiko Maschinenbau GmbH & Co. KG

- Hoshizaki Electric Co. Ltd.

- Fujimak Corporation

Competitive Analysis:

The Global Food Holding Equipment Market is characterized by a competitive landscape comprising both established multinational corporations and regional players. Key global companies such as Dover Corporation, Welbilt Inc., and Ali Group S.r.l. lead the market, offering a wide range of products including holding cabinets, proofing cabinets, and refrigerators. These companies leverage their extensive distribution networks, strong brand recognition, and continuous innovation to maintain market dominance. They focus on enhancing product features like energy efficiency, smart temperature control, and modular designs to meet the evolving needs of the foodservice industry. Regional players also play a significant role, particularly in emerging markets, by offering cost-effective solutions tailored to local preferences and regulatory requirements. The market is witnessing increased consolidation through mergers and acquisitions, as companies seek to expand their product portfolios and geographical reach. Strategic partnerships and collaborations are also common, enabling companies to co-develop new technologies and enter new markets. Overall, the competitive dynamics of the market are driven by technological advancements, regulatory compliance, and the growing demand for efficient and sustainable food holding solutions.

Recent Developments:

- In October 2025, Dover Corporation launched the “NextGen Thermal Platform,” a line of advanced temperature control food holding solutions for commercial kitchens. The platform leverages IoT-enabled sensors for precise temperature maintenance and caters to growing demand among restaurant chains for smarter, connected food holding equipment.

Report Coverage:

The research report offers an in-depth analysis based on Product Type and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is expected to witness continued growth, driven by the increasing demand for food safety and quality standards in the foodservice industry.

- Technological innovations, such as IoT-enabled food holding equipment, will play a pivotal role in enhancing operational efficiency and energy savings.

- The shift towards energy-efficient and sustainable equipment solutions will accelerate as businesses look to reduce costs and minimize their environmental impact.

- The growing prevalence of food delivery services and the increasing demand for convenience foods will boost the need for reliable food holding solutions.

- Emerging markets, especially in Asia Pacific and Latin America, will see significant growth due to expanding foodservice sectors and rising consumer incomes.

- Companies are likely to focus on modular, customizable equipment to meet the diverse needs of the foodservice industry.

- As regulatory standards become stricter, businesses will invest in advanced food holding systems to comply with food safety guidelines.

- The rise of quick-service restaurants (QSRs) and full-service restaurants will continue to drive the demand for efficient food holding equipment.

- The trend toward automation and integration of artificial intelligence in foodservice operations will increase, leading to more intelligent food holding systems.

- Competitive dynamics will intensify as companies focus on mergers, acquisitions, and strategic partnerships to expand their global presence and product offerings.