Market Overview

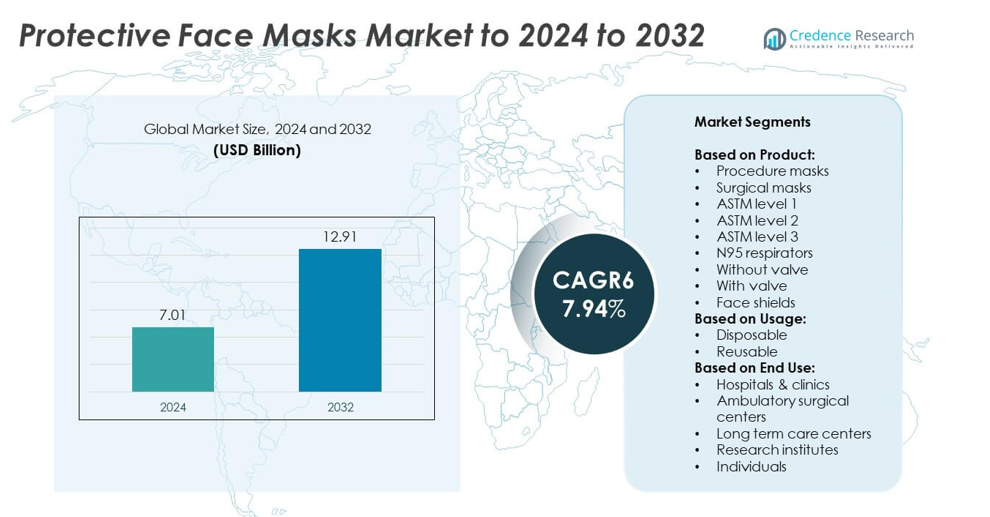

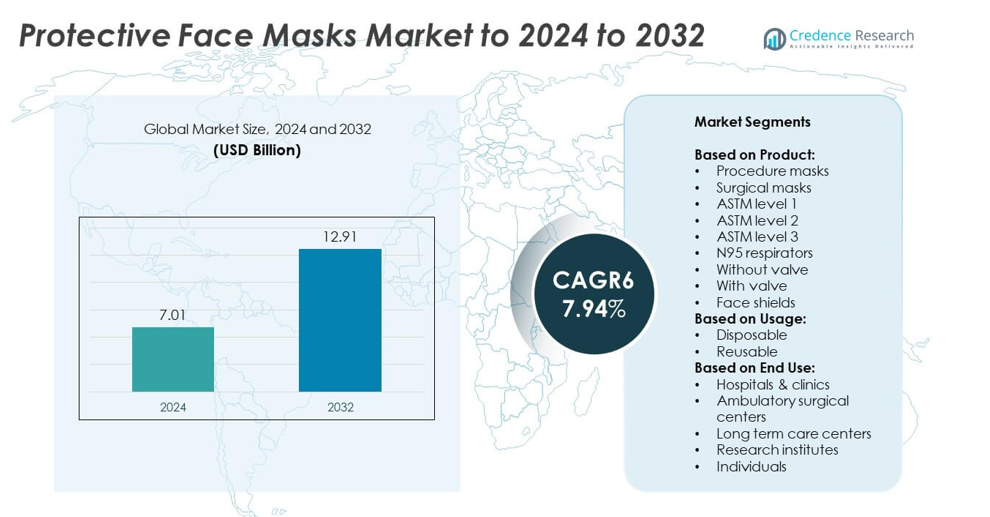

The Protective face masks market size was valued at USD 7.01 billion in 2024 and is anticipated to reach USD 12.91 billion by 2032, at a CAGR of 7.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Protective face masks market Size 2024 |

USD 7.01 billion |

| Protective face masks market, CAGR |

7.94% |

| Protective face masks market Size 2032 |

USD 12.91 billion |

The protective face masks market is shaped by major players including 3M, Honeywell, Kimberly-Clark Corporation, Cardinal Health, and Thermo Fisher Scientific, alongside other regional and specialized manufacturers. These companies focus on product innovation, compliance with safety standards, and expanding production capacity to meet fluctuating global demand. Strategic partnerships with healthcare providers and government bodies further strengthen their presence. Regionally, Asia Pacific dominated the market with a 34% share in 2024, supported by large-scale production, rising healthcare spending, and widespread individual use. North America followed with 32%, driven by advanced healthcare infrastructure and strong regulatory enforcement. Europe captured 27%, benefiting from sustainable product innovation and robust infection control measures, while Latin America and the Middle East & Africa together held smaller but steadily growing shares.

Market Insights

- The protective face masks market was valued at USD 7.01 billion in 2024 and is projected to reach USD 12.91 billion by 2032, growing at a CAGR of 7.94%.

- Rising demand from hospitals and clinics, along with pandemic preparedness and occupational safety regulations, are fueling steady market growth.

- A strong shift toward reusable, eco-friendly, and technologically advanced masks is shaping future product innovation and creating premium opportunities.

- The market is highly competitive, with global and regional players focusing on partnerships, capacity expansion, and sustainable product development to strengthen presence.

- Asia Pacific led with 34% share in 2024, followed by North America at 32% and Europe at 27%, while Latin America held 4% and the Middle East & Africa 3%; surgical masks dominated by product segment due to wide healthcare adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The protective face masks market by product is led by surgical masks, which accounted for the largest share in 2024 due to their widespread adoption in hospitals and clinics for infection control. N95 respirators also hold a significant portion, particularly in high-risk medical settings, driven by stringent safety standards. ASTM level 2 and 3 masks are gaining traction as regulatory bodies emphasize enhanced filtration and splash resistance. Face shields continue to serve as supplementary protection. Rising awareness of occupational safety and pandemic preparedness further supports product diversification and adoption.

- For instance, by the end of 2020, 3M had reached a U.S. monthly production rate of 95 million N95 respirators, an increase from 50 million units per month in June 2020. Globally, 3M produced a total of 2 billion respirators in 2020, achieving a global annual production rate of 2.5 billion units by the end of the year.

By Usage

Disposable masks dominated the usage segment with the highest market share in 2024, supported by their widespread application across hospitals, clinics, and community use. Single-use masks are preferred for infection control as they minimize contamination risks and align with regulatory hygiene standards. Reusable masks, while growing, remain a smaller portion, often used by individuals for environmental and cost reasons. Increasing demand from healthcare systems for disposable masks is fueled by consistent procurement contracts, government stockpiling initiatives, and their practicality in high-turnover environments.

- For instance, based on figures reported by Owens & Minor in a press release dated February 24, 2021, which covered their full-year 2020 performance, the company delivered more than 12 billion units of PPE to customers in the United States during 2020.

By End Use

Hospitals and clinics represented the dominant end-use segment in 2024, capturing the largest share due to continuous demand for high-quality protective masks across medical staff and patients. Their reliance on procedure masks, surgical masks, and N95 respirators drives steady procurement. Ambulatory surgical centers and long-term care centers also contribute, though at lower volumes. Individuals are an emerging user group, influenced by heightened health awareness and air pollution concerns. The dominance of hospitals and clinics is sustained by regulatory mandates, rising surgical procedures, and global emphasis on infection prevention.

Key Growth Drivers

Rising Healthcare Demand

The growing number of hospital admissions, surgical procedures, and infection prevention protocols continues to drive demand for protective face masks. Hospitals and clinics remain the largest end users, requiring steady supply of surgical masks, N95 respirators, and ASTM-certified products. Stringent safety regulations and increasing healthcare expenditure strengthen this segment further. The need to reduce healthcare-associated infections has pushed medical institutions to invest in high-quality protective masks, making rising healthcare demand the primary growth driver for the global protective face masks market.

- For instance, Moldex was actively expanding its production capabilities in response to the COVID-19 pandemic. A 2020 news release highlighted its plans to spend over $25 million to add N95 mask production at a new site in Lebanon, Tennessee.

Pandemic Preparedness and Public Awareness

Ongoing concerns around pandemic preparedness and recurring infectious disease outbreaks significantly boost mask adoption. Governments and organizations have increased stockpiling initiatives to ensure preparedness for future emergencies. Public awareness of respiratory health, influenced by past pandemics, continues to shape consumer behavior, with individuals adopting masks beyond medical needs. This heightened awareness drives demand for disposable masks and N95 respirators among communities. The combination of government readiness and individual awareness forms a crucial driver shaping long-term market stability and expansion.

- For instance, in early 2021, Medicom announced that its new Montreal manufacturing plant, established during the COVID-19 pandemic, had reached a capacity of producing about 4.8 million SafeMask Architect Pro N95-type respirator masks per month.

Workplace and Environmental Safety Regulations

Protective masks are increasingly required across industrial settings due to stricter occupational health regulations. Construction, manufacturing, and chemical industries use masks to safeguard workers from dust, fumes, and harmful particles. Environmental challenges like rising air pollution levels further accelerate mask adoption among individuals. Regulatory enforcement of workplace safety standards ensures consistent procurement of protective gear. This regulatory push, combined with growing pollution-related health concerns, positions occupational and environmental safety regulations as a key growth driver in boosting market penetration globally.

Key Trends & Opportunities

Shift Toward Reusable and Eco-Friendly Masks

Sustainability is a rising trend in the protective face masks market, with demand growing for reusable and eco-friendly alternatives. Consumers and institutions are seeking masks made from biodegradable materials to reduce environmental waste linked to disposable products. This shift presents opportunities for manufacturers to innovate with washable fabrics, antimicrobial coatings, and recyclable components. Eco-conscious purchasing patterns are likely to influence long-term market growth. The push for sustainable healthcare products creates strong opportunities for companies to differentiate in an increasingly competitive market landscape.

- For instance, Cambridge Mask Co. states the PRO mask is usable for up to 340 hours; BASIC lasts 90 hours.

Integration of Technology in Protective Masks

Smart and innovative face masks are emerging as a key opportunity for manufacturers. Integration of sensors, air purification systems, and filtration indicators enhances safety and comfort, addressing user concerns about prolonged wear. Technology-driven masks are gaining attention among high-risk workers and urban populations exposed to pollution. This trend also creates new revenue streams through premium product categories. As consumer preferences shift toward comfort and advanced protection, technological integration is becoming a central opportunity for market players aiming to capture niche but growing demand.

- For instance, Tech add-ons create premium categories. Hubble Connected (MaskFone) lists earbuds with up to 12 hours battery life integrated into the mask; filters are replaceable.

Key Challenges

Price Sensitivity and Market Saturation

The protective face masks market faces price sensitivity, especially in developing regions where cost plays a critical role in adoption. With the influx of numerous manufacturers during pandemic years, market saturation has led to intense competition and declining profit margins. Low-cost, counterfeit products also flood local markets, undermining the growth of premium, certified masks. This price pressure challenges established players to balance affordability with quality standards, making it a significant obstacle for long-term market sustainability and profitability.

Fluctuating Demand Post-Pandemic

One of the major challenges is demand instability following pandemic peaks. As infection rates decline, individual usage of masks often reduces, creating fluctuations in consumption patterns. This unpredictability makes it difficult for manufacturers to forecast demand accurately and maintain production levels. Overcapacity issues also arise when stockpiling slows down, leaving suppliers with unsold inventories. Balancing production with cyclical demand remains a core challenge for the industry, particularly as reliance on pandemic-driven spikes decreases and the market adjusts toward long-term stability.

Regional Analysis

North America

North America accounted for 32% of the protective face masks market share in 2024, driven by strong healthcare infrastructure, high adoption of surgical and N95 masks, and stringent occupational safety regulations. Hospitals and clinics remain the largest consumers, supported by steady procurement from government and private healthcare providers. Rising public awareness about respiratory health and the presence of leading mask manufacturers further strengthen market penetration. The region’s demand is also fueled by recurring influenza seasons and preparedness for infectious outbreaks, ensuring consistent consumption. The United States leads regional growth, followed by Canada with notable demand from healthcare and industrial sectors.

Europe

Europe captured 27% of the market share in 2024, supported by strict medical device regulations and high reliance on surgical and procedure masks across healthcare facilities. Countries such as Germany, France, and the United Kingdom drive adoption due to strong infection control protocols and large hospital networks. The region also emphasizes sustainable solutions, pushing demand for eco-friendly and reusable masks. Pandemic preparedness programs and a strong pharmaceutical and healthcare ecosystem ensure steady procurement of protective masks. Industrial adoption, especially in chemical and manufacturing sectors, further adds to regional growth, making Europe a significant and mature market.

Asia Pacific

Asia Pacific dominated with the highest share of 34% in 2024, driven by its large population base, rising healthcare spending, and growing industrial safety needs. China, India, and Japan remain the largest contributors, supported by extensive mask production facilities and government-led distribution initiatives. Strong demand is observed in hospitals, clinics, and individual use, particularly in densely populated cities. Air pollution concerns further accelerate adoption among individuals beyond medical settings. The presence of cost-efficient manufacturing hubs enhances supply chain resilience, allowing the region to remain the global leader in protective face mask production and consumption throughout the forecast period.

Latin America

Latin America held a 4% market share in 2024, with demand primarily concentrated in Brazil and Mexico. The region’s market is shaped by rising investments in healthcare infrastructure and increasing public health awareness. Hospitals and clinics represent the largest consumers, while individuals adopt masks due to pollution and infectious disease concerns. Limited local production capacity creates dependency on imports, particularly from North America and Asia Pacific. Government initiatives to strengthen healthcare supply chains and pandemic preparedness have supported recent demand. Despite a smaller share, the region shows steady growth potential with expanding healthcare access.

Middle East and Africa

The Middle East and Africa accounted for 3% of the market share in 2024, representing the smallest regional contribution but offering long-term opportunities. Growth is supported by expanding healthcare infrastructure in Gulf countries and increasing infection control practices in hospitals. South Africa and the UAE are key markets, with rising individual adoption due to pollution and respiratory health concerns. However, the region faces challenges such as limited local manufacturing and heavy reliance on imports. Government-led healthcare investments and pandemic preparedness programs are expected to gradually improve adoption rates, supporting moderate but steady market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product:

- Procedure masks

- Surgical masks

- ASTM level 1

- ASTM level 2

- ASTM level 3

- N95 respirators

- Without valve

- With valve

- Face shields

By Usage:

By End Use:

- Hospitals & clinics

- Ambulatory surgical centers

- Long term care centers

- Research institutes

- Individuals

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The protective face masks market is shaped by leading players such as Medibase, Cardinal Health, Dentsply Sirona, Kimberly-Clark Corporation, Crosstex, Moldex, Thermo Fisher Scientific, Prestige Ameritech, Coltene, GVS S.p.A, Honeywell, BSN Medical, Hygeco International Products, Henry Schein, 3M, Akzenta GmbH & Co. KG., Ahlstrom-Munksjo, and DACH Schutzbekleidung GmbH & Co. KG. These companies focus on strengthening their market presence through product innovation, manufacturing expansion, and compliance with stringent safety standards. Strategic partnerships with healthcare providers, distributors, and government agencies play a critical role in sustaining growth. Emphasis is placed on developing sustainable and eco-friendly products, as well as premium solutions such as respirators and technologically advanced masks. Many players are investing in scaling production capabilities and diversifying distribution networks to address fluctuating demand. The competitive environment remains intense, with companies balancing affordability, quality, and innovation to capture market share in both developed and emerging regions.

Key Player Analysis

- Medibase

- Cardinal Health

- Dentsply Sirona

- Kimberly-Clark Corporation

- Crosstex

- Moldex

- Thermo Fisher Scientific

- Prestige Ameritech

- Coltene

- GVS S.p.A

- Honeywell

- BSN Medical

- Hygeco International Products

- Henry Schein

- 3M

- Akzenta GmbH & Co. KG.

- Ahlstrom-Munksjo

- DACH Schutzbekleidung GmbH & Co. KG

Recent Developments

- In 2024, Singletto partnered with Prestige Ameritech to launch ProGear Level 3 Surgical Masks with Oxafence Active Protection, a new type of mask designed to inactivate viruses on contact by incorporating a photodynamic antiviral technology.

- In 2024, 3M Announced an expansion of its respirator production capacity in Europe to meet increasing regional demand driven by evolving workplace safety regulations.

- In 2022, Honeywell International Inc. Launched a new N95 respirator is designed for healthcare professionals with smaller facial features. The new filtered, reusable half mask respirator allows healthcare

Report Coverage

The research report offers an in-depth analysis based on Product, Usage, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The protective face masks market will continue to grow with steady healthcare demand.

- Hospitals and clinics will remain the largest end users of protective masks.

- N95 respirators and surgical masks will dominate high-risk medical and industrial settings.

- Demand for reusable and eco-friendly masks will increase with sustainability awareness.

- Smart masks with advanced filtration and sensors will create premium market opportunities.

- Asia Pacific will retain its lead due to large population and strong production base.

- North America and Europe will grow steadily with strict healthcare regulations.

- Public health awareness and pandemic preparedness will sustain long-term demand.

- Competition will intensify as more players focus on low-cost and innovative products.

- Regulatory enforcement and occupational safety standards will further shape market expansion.