Market Overview

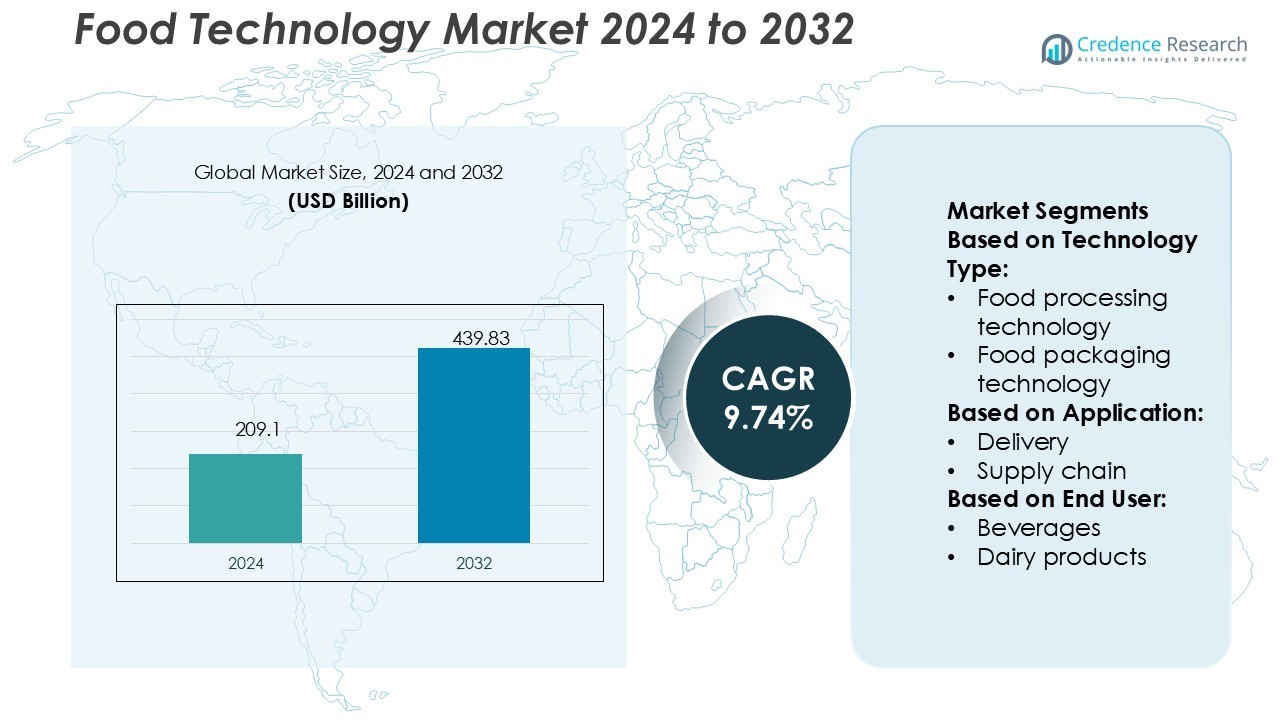

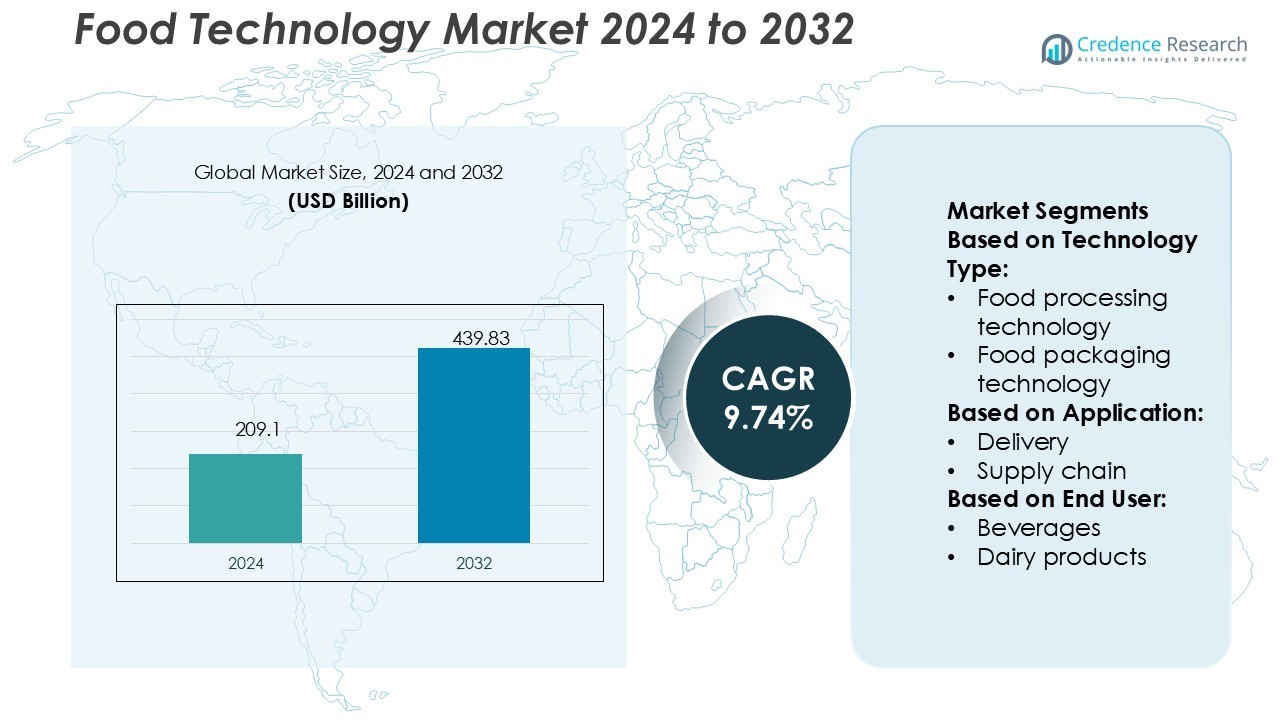

Food Technology Market size was valued USD 209.1 billion in 2024 and is anticipated to reach USD 439.83 billion by 2032, at a CAGR of 9.74% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Technology Market Size 2024 |

USD 209.1 Billion |

| Food Technology Market, CAGR |

9.74% |

| Food Technology Market Size 2032 |

USD 439.83 Billion |

The food technology market is highly competitive, with top players including Swiggy, CUBIQ FOODS, Carlisle Technology, Miso Robotics, Delivery Hero SE, TRAX IMAGE RECOGNITION, Flytrex Inc., HelloFresh SE, Nymble (Epifeast Inc.), and LUNCHBOX driving innovation across delivery, automation, safety, and packaging solutions. These companies focus on expanding digital platforms, advancing kitchen robotics, improving supply chain transparency, and promoting sustainable practices to meet evolving consumer demands. North America leads the global market with a 35% share, supported by advanced infrastructure, strong investment in automation, and high adoption of food safety and packaging technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food Technology Market size was valued at USD 209.1 billion in 2024 and is projected to reach USD 439.83 billion by 2032, growing at a CAGR of 9.74%.

- Rising demand for processed and convenience foods, along with increasing focus on food safety and sustainability, drives strong adoption of processing, packaging, and automation technologies.

- Key players such as Swiggy, CUBIQ FOODS, Miso Robotics, Delivery Hero SE, and HelloFresh SE shape competition by investing in digital platforms, robotics, smart packaging, and supply chain transparency.

- High implementation costs and complex regulatory compliance remain major restraints, limiting adoption among small and medium enterprises and creating gaps in technology penetration across emerging regions.

- North America dominates with a 35% market share, supported by advanced infrastructure and regulatory frameworks, while food processing technology leads by segment with 36% share, reinforcing its role as the most influential sub-segment globally.

Market Segmentation Analysis:

By Technology Type

Food processing technology holds the dominant share at 36%, driven by automation and efficiency improvements. Advanced machinery for sorting, freezing, and preservation enhances scalability and reduces waste across large-scale operations. Growing demand for ready-to-eat meals and frozen products further supports this leadership. Food packaging technology follows closely, benefitting from sustainable packaging innovations and extended shelf-life solutions. Food safety technology also records steady growth as regulatory compliance and consumer focus on traceability strengthen its adoption across industries.

- For instance, Crown introduced its Peelfit™ can technology, which eliminates the need for a metal ring-pull, making the can up to 16% lighter than conventional alternatives. The technology also reduces energy consumption compared to conventional foil seam closures.

By Application

Food science leads with 31% share, driven by innovations in ingredient research, nutritional enrichment, and biotechnology applications. The segment benefits from rising health awareness and the demand for functional foods fortified with proteins, probiotics, and vitamins. Kitchen and restaurant technology also grows strongly with digital ordering platforms, robotics, and IoT devices streamlining meal preparation. Delivery applications expand quickly due to the rise of food delivery platforms and contactless services. Supply chain technology continues to scale with blockchain, AI, and IoT-based systems enhancing transparency and logistics efficiency.

- For instance, Sealed Air CRYOVAC® 8490 Vertical Rotary Vacuum Chamber System runs up to 20 cycles per minute, supports product sizes up to 21-inch length and 12-inch width, and offers 100% process yield when used with CRYOVAC® Cook-In Barrier Bags.

By End User

The beverages segment dominates with 33% market share, supported by continuous demand for functional drinks, energy beverages, and low-calorie alternatives. Increasing investments in processing and packaging technologies enhance product diversity and distribution efficiency. Dairy products follow, driven by fortified milk, yogurt, and probiotic-rich offerings meeting nutritional demand. Bakery and meat & seafood segments also register robust growth due to rising consumer preference for convenience-driven and protein-rich foods. Grain & oil and fruits & vegetables segments benefit from advancements in preservation, processing, and global trade support.

Key Growth Drivers

Rising Demand for Processed and Convenience Foods

The growing demand for processed and convenience foods drives the expansion of the food technology market. Urban lifestyles and time constraints push consumers toward ready-to-eat meals, frozen products, and packaged snacks. Advanced processing technologies enhance efficiency, maintain product quality, and extend shelf life. Global food manufacturers continue investing in automated systems and innovative processing equipment to meet evolving consumer needs. This shift positions food processing technology as a central driver of growth, supported by increased adoption across both developed and emerging economies.

- For instance, Berry and Nestlé Purina’s 20 oz and 30 oz Friskies® Party Mix® treat canisters are now made with 100% mechanically recycled PET (excluding lid/label), eliminating more than 500 metric tons of virgin plastic annually.

Increasing Focus on Food Safety and Quality

Food safety has become a critical growth driver, fueled by stricter regulatory frameworks and heightened consumer awareness. Companies are adopting advanced safety technologies, including real-time pathogen detection, blockchain-based traceability, and automated quality control systems. These solutions minimize contamination risks, improve transparency, and build consumer trust in global supply chains. The demand for healthier and safer food products further amplifies the need for technology-driven safety practices. As governments enforce compliance standards worldwide, food safety technology continues to gain strong adoption across industries, supporting long-term market growth.

- For instance, Mondi & Saga Nutrition launched in a recyclable mono-material FlexiBag for dry pet food in sizes from 3 kg, with high barrier properties safeguarding against moisture, fat and odour.

Technological Advancements in Packaging and Distribution

Innovations in packaging and distribution play a crucial role in market growth, ensuring both efficiency and sustainability. Smart packaging, eco-friendly materials, and active packaging solutions extend shelf life and improve product tracking. At the same time, distribution technologies supported by AI, IoT, and blockchain optimize logistics, enhance transparency, and reduce waste. The rise of e-commerce and global trade strengthens the demand for advanced packaging and distribution systems. Together, these advancements drive efficiency, reduce costs, and improve customer satisfaction, positioning packaging and distribution technology as major growth accelerators.

Key Trends & Opportunities

Shift Toward Sustainable and Smart Packaging

Sustainability is a defining trend in the food technology market, with smart packaging solutions gaining strong momentum. Biodegradable films, compostable containers, and recyclable materials address environmental concerns while meeting consumer expectations for eco-friendly products. Smart packaging with sensors and indicators further enables freshness tracking and food safety. Companies adopting these solutions improve brand perception and regulatory compliance. Growing global awareness of plastic pollution and sustainability creates significant opportunities for innovation in this area, making it one of the most attractive growth segments in food technology.

- For instance, Sonoco has deployed a 6-color digital press for direct-to-sheet displays, enhancing its print capability for point-of-purchase displays and other promotional packaging. This investment enables high-impact graphics and faster speed-to-market for customers.

Digitalization of Food Service and Supply Chain

The integration of digital technologies in food service and supply chain management opens new opportunities for efficiency and growth. Robotics, AI-driven inventory systems, and IoT-enabled kitchen equipment streamline operations in restaurants and foodservice outlets. Blockchain and cloud-based platforms improve transparency, ensuring traceability from farm to table. This digital transformation enhances food safety, reduces waste, and meets consumer demand for fast and accurate services. With e-commerce and delivery platforms expanding globally, digitalization creates significant opportunities for stakeholders to capture new revenue streams and strengthen operational resilience.

- For instance, Mondi’s thermoformable barrier films include products with up to 18 layers of film structure, engineered for pasteurisation, sterilisation, retort, and microwave applications.

Key Challenges

High Implementation and Maintenance Costs

The adoption of advanced food technologies faces a significant barrier in the form of high costs. Setting up automated processing systems, smart packaging lines, and digital supply chain solutions requires substantial investment. Small and medium-sized enterprises often struggle with these expenses, limiting widespread adoption. Ongoing maintenance and system upgrades further add to the financial burden. While large corporations can absorb these costs, smaller players face challenges in scaling operations, creating a gap in technology adoption between market leaders and smaller regional businesses.

Regulatory Compliance and Standardization Issues

Regulatory compliance remains a major challenge for companies operating in the food technology market. Countries have varying food safety standards, labeling requirements, and environmental regulations, making international operations complex. Compliance with these diverse frameworks increases costs and slows down market entry. Lack of standardization in digital systems and traceability tools also creates interoperability challenges. Companies must continuously adapt to evolving rules and certifications, which strains resources and increases operational risks. Addressing these issues is essential for smoother adoption and global expansion of food technology solutions.

Regional Analysis

North America

North America leads the food technology market with a 35% share, supported by strong adoption of advanced processing, packaging, and distribution systems. The region benefits from robust infrastructure, high consumer spending on processed foods, and established regulatory frameworks ensuring food safety. Demand for convenience foods, functional beverages, and clean-label products further drives technology integration. Investments in automation, AI, and IoT within the food supply chain enhance efficiency and traceability. The presence of major multinational food manufacturers and continuous innovation in sustainable packaging strengthens North America’s leadership in the global food technology landscape.

Europe

Europe holds a 28% market share, driven by strict regulatory policies on food safety, labeling, and sustainability. Countries such as Germany, France, and the UK lead adoption of smart packaging, biotechnology in food science, and eco-friendly solutions. The region’s focus on reducing carbon footprints and food waste accelerates the use of digital supply chain tools and recyclable packaging materials. High consumer demand for organic, plant-based, and fortified products supports ongoing innovation in food processing and preparation technologies. Europe’s strong emphasis on compliance and sustainable practices positions it as a leading contributor to market growth.

Asia Pacific

Asia Pacific accounts for 25% of the market, emerging as the fastest-growing region due to rapid urbanization, rising incomes, and growing demand for convenience foods. China, India, and Japan play pivotal roles in advancing food processing, packaging, and delivery technologies. Expanding e-commerce platforms and food delivery services further accelerate technology adoption across the region. Increasing health awareness fuels investments in functional foods and safety technologies. Government initiatives promoting food innovation and infrastructure modernization support regional expansion. The region’s large consumer base and evolving preferences make Asia Pacific a significant growth engine for the food technology market.

Latin America

Latin America captures a 7% share of the food technology market, supported by growing adoption of modern food processing and packaging systems. Brazil and Mexico dominate regional development, driven by rising demand for packaged foods, beverages, and dairy products. Investments in sustainable packaging, cold chain logistics, and safety technologies are increasing as consumer expectations shift toward higher quality and safer food products. While regulatory frameworks are less stringent compared to North America and Europe, multinational players are expanding operations to tap into the region’s evolving markets. Growth opportunities remain strong in food delivery and digital restaurant technologies.

Middle East & Africa

The Middle East & Africa region holds a 5% market share, with adoption fueled by expanding retail networks and rising demand for packaged and processed foods. Countries like the UAE and Saudi Arabia lead investments in food distribution and safety technologies to support growing urban populations. Africa sees gradual adoption of food processing and packaging innovations, supported by international collaborations and government-backed modernization initiatives. Rising health awareness and demand for longer shelf-life products encourage investments in packaging and preservation technologies. Though smaller in scale, the region offers untapped potential, especially in supply chain and food safety solutions.

Market Segmentations:

By Technology Type:

- Food processing technology

- Food packaging technology

By Application:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The food technology market include Swiggy, CUBIQ FOODS, Carlisle Technology, Miso Robotics, Delivery Hero SE, TRAX IMAGE RECOGNITION, Flytrex Inc., HelloFresh SE, Nymble (Epifeast Inc.), and LUNCHBOX. The food technology market is defined by rapid innovation, strategic collaborations, and digital transformation across the value chain. Companies are focusing on automation, smart packaging, and advanced distribution systems to enhance efficiency and meet consumer demand for convenience, safety, and sustainability. Emerging technologies such as AI-driven analytics, IoT-enabled supply chain solutions, and robotics in food preparation are reshaping operations globally. Sustainability also remains a core priority, with significant investment in eco-friendly packaging and plant-based product development. This dynamic environment fosters intense competition, pushing both established players and startups to differentiate through technological advancements and customer-centric solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, ULMA Packaging launched the new series of TFX, transforming machines tailored for food packaging, these machines are designs to overcome the challenges in the food industries which also helps in enhancing production efficiency, helps in digitalization and also promotes sustainability.

- In July 2024, Cama Group, a key producer of robotics and automation has launched a new top-loading packaging machine which is capable of increasing production rate and also help reduce machinery footprint.

- In July 2024, Cama Group launched a new top-loading packaging machine, which enhances productivity and reduces machinery footprint in the multipack market. The main motive behind launching this was to handle multiple food items in the food industry.

- In May 2024, Velteko announced the launch of the new vertical packaging machine, which helps in maintaining high standards in hygiene and sanitation, especially in the food industry in the packaging of frozen food, meat, sauces and fishes which require contamination free environment for safety and clean packaging.

Report Coverage

The research report offers an in-depth analysis based on Technology Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider adoption of AI and robotics in food preparation.

- Automation will continue to streamline large-scale food processing and packaging.

- Smart packaging will expand with sensors for freshness and safety tracking.

- Plant-based and alternative proteins will gain more investment and product innovation.

- Blockchain will enhance supply chain transparency and improve food traceability.

- E-commerce and delivery platforms will drive growth in digital food services.

- Food safety technologies will advance with real-time monitoring and detection systems.

- Sustainable packaging solutions will dominate as regulations and consumer demand increase.

- Personalized nutrition and meal solutions will rise with data-driven platforms.

- Emerging markets will accelerate adoption of modern food technologies and logistics.