Market Overview

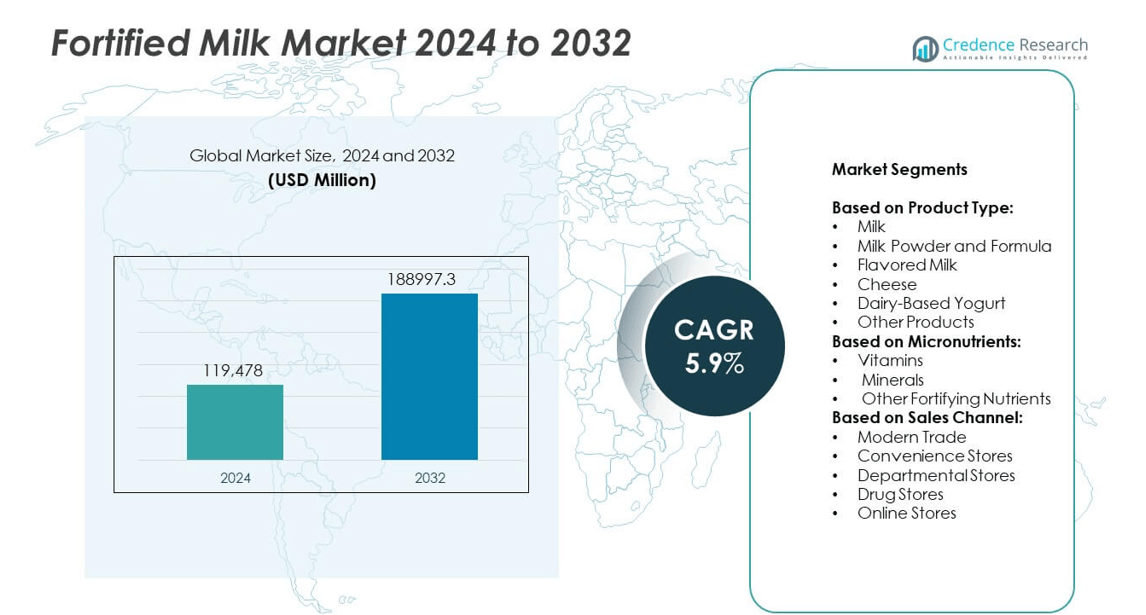

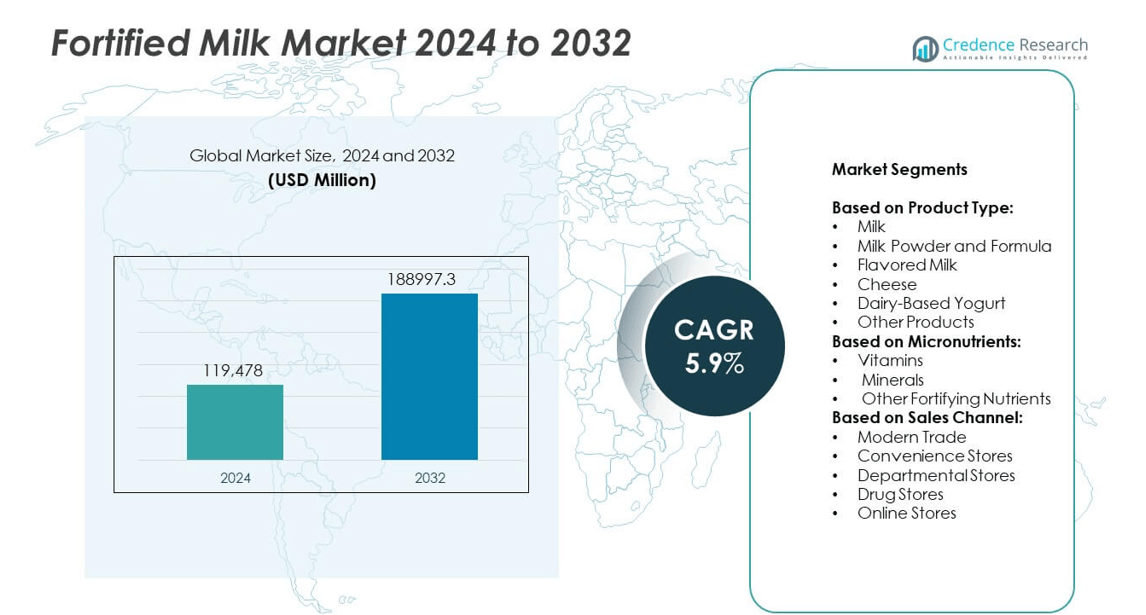

Fortified milk market size was valued at USD 119,478 million in 2024 and is expected to reach USD 188,997.3 million by 2032. The market is projected to grow at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fortified Milk Market Size 2024 |

USD 119,478 million |

| Fortified Milk Market, CAGR |

5.9% |

| Fortified Milk Market Size 2032 |

USD 188,997.3 million |

Fortified milk market growth is driven by rising health awareness, government-backed fortification programs, and increasing demand for nutrient-rich diets. Consumers prefer products enriched with vitamins and minerals to address deficiencies and support immunity. Technological advances enhance nutrient stability and product quality, encouraging wider adoption. Expanding retail networks and e-commerce platforms improve accessibility in urban and rural areas. Clean-label trends and flavored fortified options attract younger demographics. Continuous innovation and public health initiatives sustain market momentum and long-term demand.

North America leads the fortified milk market with strong government support and advanced dairy infrastructure. Europe follows with rising demand for clean-label and plant-based fortified options. Asia Pacific shows rapid growth driven by urbanization and large-scale nutrition programs in India and China. Latin America and Middle East & Africa present opportunities through school feeding schemes and public health campaigns. Key players include FrieslandCampina, Gujarat Cooperative Milk Marketing Federation Ltd., Nestle S.A., and Fonterra Co-operative Group, focusing on innovation and distribution expansion.

Market Insights

- Fortified milk market was valued at USD 119,478 million in 2024 and is projected to reach USD 188,997.3 million by 2032, growing at a CAGR of 5.9%.

- Rising health awareness and government fortification programs drive demand for nutrient-enriched milk products.

- Consumers show strong preference for clean-label, flavored, and plant-based fortified milk options, supporting innovation.

- Leading players focus on R&D, product diversification, and partnerships to expand market presence and reach.

- High production costs, supply chain challenges, and limited consumer awareness in rural areas restrain growth.

- North America remains a major market, while Asia Pacific shows fastest growth due to nutrition initiatives and urbanization.

- Online retail and subscription models boost accessibility, while rural distribution programs create opportunities for wider adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Consumer Awareness of Nutritional Deficiencies and Health Benefits

Fortified Milk market growth is fueled by rising awareness of micronutrient deficiencies. Governments and health agencies promote fortified foods to address malnutrition. Consumers seek products that support immune health and overall wellness. It helps bridge nutritional gaps by adding vitamins like A, D, and B-complex, along with minerals such as iron and calcium. Increasing campaigns highlighting the health benefits of fortified products encourage wider adoption. The shift toward preventive healthcare strengthens the demand for fortified dairy products.

- For instance, Danone Nutricia conducted a 20‑week randomized trial with young children (ages 1‑3), providing a young‑child formula with 1.2 mg iron per 100 mL and 1.7 µg vitamin D per 100 mL. That led to average increases of 6.6 µg/L in serum ferritin and 16.4 nmol/L in 25‑hydroxyvitamin D compared to non‑fortified cow milk.

Expanding Government Initiatives and Regulatory Support

National health programs drive large-scale fortification efforts, boosting market penetration. Regulatory bodies mandate or recommend milk fortification in several countries. It creates a strong framework for producers to comply and scale production. Government subsidies and partnerships with dairy cooperatives enhance fortified milk availability in rural regions. School nutrition schemes also integrate fortified milk into daily diets. These policies create a consistent demand and support steady market expansion.

- For instance, in India’s FSSAI program a dairy cooperative in Jharkhand scaled up fortification: starting at 13,000 litres/day of fortified milk, within one year expanded to 80,000 litres/day.

Technological Advancements and Product Innovation

Innovations in processing and formulation improve nutrient stability and taste. Manufacturers invest in technologies that maintain bioavailability of added vitamins and minerals. It enables the development of low-fat, lactose-free, and flavored fortified milk products to meet diverse preferences. Companies focus on improving shelf life while retaining nutritional value. Rising investment in R&D drives new product launches targeting different consumer groups. Continuous innovation ensures competitive advantage and attracts health-conscious buyers.

Growing Urbanization and Rising Disposable Income

Urban population growth increases demand for convenient and healthy food options. Rising disposable incomes allow consumers to choose premium fortified milk products. It supports a shift from traditional unfortified milk to branded fortified options. Expansion of modern retail and online grocery platforms enhances product accessibility. Marketing campaigns targeting urban households promote daily consumption. Growing health awareness and lifestyle changes sustain long-term demand in this segment.

Market Trends

Rising Preference for Plant-Based and Specialty Fortified Options

Fortified Milk market sees growing interest in plant-based fortified alternatives. Consumers with lactose intolerance and vegan lifestyles drive demand for soy, almond, and oat milk options enriched with nutrients. It supports inclusive nutrition while appealing to health-conscious buyers. Producers focus on matching the nutrient profile of cow’s milk through advanced fortification. The trend encourages dairy and non-dairy brands to diversify their product portfolios. Expansion of specialty fortified milk segments strengthens market reach.

- For instance, Danone in Australia used synbiotic‑fortified toddler milk with 780 million CFU of Bifidobacterium breve M‑16V plus 1.3 mg iron and 1.2 µg vitamin D per 100 mL, yielding significantly higher serum iron absorption in toddlers versus unfortified milk.

Focus on Clean Label and Natural Fortification Ingredients

Consumers prefer clean label products with transparent ingredient lists and minimal additives. Fortified Milk market players adopt natural sources of vitamins and minerals to meet this demand. It builds trust and aligns with the global shift toward healthier, chemical-free diets. Brands highlight natural fortification on packaging to attract educated buyers. Adoption of bioavailable nutrient forms such as chelated minerals improves absorption rates. This trend promotes a premium positioning for fortified milk products.

- For instance, Mother Dairy in India has been supplying Vitamin A fortified toned milk since 1984; after FSSAI norms, they fortify toned, double toned, and skimmed milk to reach states like Delhi, Punjab, and Maharashtra, contributing “approximately 18 LLPD (lakh litres per day)” of fortified milk by the year 2016 to 2017.

Increasing Adoption of Digital Marketing and Personalized Nutrition

Brands leverage social media and digital platforms to educate consumers about health benefits. Fortified Milk market benefits from campaigns focused on daily nutrition requirements. It creates awareness among younger demographics and urban professionals. Personalized nutrition solutions use AI tools to recommend fortified milk based on individual needs. E-commerce channels allow subscription-based delivery models, improving customer retention. Growing digital engagement supports a direct-to-consumer distribution approach.

Expansion of Fortification Programs in Emerging Economies

Developing nations intensify efforts to combat malnutrition through fortified milk distribution. Public-private partnerships ensure affordable access in low-income communities. It drives large-scale demand and strengthens dairy supply chains. Governments collaborate with global organizations to fund fortification programs. Growth of local dairy cooperatives accelerates fortified milk production and distribution networks. Rising support in emerging regions creates a significant growth avenue for the market.

Market Challenges Analysis

High Production Costs and Supply Chain Constraints

Fortified Milk market faces challenges from high production costs linked to fortification ingredients and processing technology. Procuring quality vitamins and minerals increases manufacturing expenses for producers. It puts pressure on pricing strategies, especially in price-sensitive regions. Fluctuating raw milk supply and logistics disruptions impact consistent product availability. Small dairy players struggle to invest in fortification infrastructure, limiting market penetration. Ensuring cost efficiency while maintaining nutritional quality remains a major challenge.

Consumer Awareness Gaps and Taste Acceptance Issues

Limited consumer knowledge about the benefits of fortified milk affects demand growth. Some buyers associate fortified products with artificial additives, leading to hesitation. It forces brands to invest heavily in awareness campaigns and education programs. Taste and texture changes caused by fortification may deter repeat purchases. Overcoming misconceptions while balancing sensory quality is critical for market success. Building trust through transparency and consistent messaging helps address these barriers.

Market Opportunities

Rising Demand for Functional and Preventive Nutrition Solutions

Fortified Milk market holds strong opportunities due to rising demand for functional foods. Consumers actively seek products that support immunity, bone health, and cognitive development. It creates scope for developing fortified variants targeting children, pregnant women, and elderly groups. Producers can include probiotics, omega-3 fatty acids, and herbal extracts to create premium offerings. Growing interest in preventive healthcare drives households to adopt fortified milk in daily diets. Expanding health-focused product portfolios strengthens brand loyalty and market presence.

Untapped Potential in Rural and Emerging Markets

Emerging economies offer significant room for fortified milk expansion. Rural regions face high micronutrient deficiency rates, creating urgent demand for fortified solutions. It enables companies to collaborate with governments and NGOs to ensure wide access. Investments in low-cost packaging and local distribution networks improve affordability. Rising incomes and urban migration in these markets boost consumption of branded dairy products. Strengthening partnerships with cooperatives and community programs helps accelerate adoption.

Market Segmentation Analysis:

By Product Type:

Fortified Milk market is led by fortified milk in liquid form due to its daily household use and easy availability. Milk powder and formula hold a major share in infant and maternal nutrition segments. It offers convenience, longer shelf life, and controlled nutrient composition. Flavored milk shows strong traction among children and teenagers, supported by rising preference for tasty yet healthy drinks. Cheese and dairy-based yogurt segments grow steadily with expanding urban consumption and demand for functional snacks. Other fortified dairy products, including butter and cream, target niche applications and premium consumers, supporting portfolio diversification.

- For instance, In a 2006 clinical trial led by Sunil Sazawal, children in North India received milk fortified daily with 9.6 mg iron, 7.8 mg zinc, 156 µg vitamin A, 40.2 mg vitamin C, and 7.5 mg vitamin E.

By Micronutrients:

Vitamins represent the largest share owing to mandatory fortification policies in many countries. Vitamin D and A are the most common, addressing bone health and vision deficiencies. It helps governments tackle public health issues linked to malnutrition. Mineral fortification, including calcium, iron, and zinc, is expanding in both liquid and powdered formats. This segment addresses anemia and skeletal health concerns, especially in developing economies. Other fortifying nutrients, including probiotics and omega-3 fatty acids, create value-added product lines targeting specific health outcomes.

- For instance, the same Nestlé Fortificada milk powder provides 3 mg iron and 270 mg calcium per serving.

By Sales Channel:

Modern trade outlets such as supermarkets and hypermarkets dominate due to high consumer footfall and wide product availability. Convenience stores play a vital role in semi-urban and rural areas where access to large retailers is limited. It supports quick purchases and impulse buying. Departmental stores and drug stores offer fortified products linked to health and wellness solutions, attracting targeted buyers. Online stores gain momentum with the growth of e-commerce and subscription models, offering doorstep delivery and a wide range of fortified options. This channel continues to grow rapidly, driven by digital campaigns and health-focused marketing.

Segments:

Based on Product Type:

- Milk

- Milk Powder and Formula

- Flavored Milk

- Cheese

- Dairy-Based Yogurt

- Other Products

Based on Micronutrients:

- Vitamins

- Minerals

- Other Fortifying Nutrients

Based on Sales Channel:

- Modern Trade

- Convenience Stores

- Departmental Stores

- Drug Stores

- Online Stores

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 32% of the global fortified milk market, driven by rising health-conscious consumers and strong regulatory support. The region benefits from mandatory vitamin D fortification programs that have been in place for decades, ensuring widespread adoption. It continues to see strong demand for low-fat and lactose-free fortified milk products, appealing to diverse dietary needs. The presence of major dairy brands and advanced distribution networks supports consistent product availability across urban and rural markets. E-commerce adoption is high, enabling subscription-based delivery of fortified milk and related products. It also benefits from robust R&D activities that lead to innovative fortified dairy offerings, including omega-3-enriched and probiotic variants. Increasing awareness about preventive healthcare and nutritional supplementation continues to strengthen growth in this region.

Europe

Europe holds 28% share of the fortified milk market, with strong demand led by countries such as Germany, France, and the United Kingdom. The region benefits from strict nutrition regulations and EU-wide food fortification policies promoting balanced diets. It witnesses steady adoption of plant-based fortified milk, particularly in Western Europe, where vegan and flexitarian trends are growing. The market also thrives on consumer preference for clean-label and organic fortified products. Manufacturers invest heavily in innovative flavors and packaging to attract younger demographics. It is supported by well-established retail networks, including supermarkets and specialty health stores, which ensure easy access to fortified milk products. Eastern Europe shows potential growth opportunities due to rising income levels and government programs addressing micronutrient deficiencies.

Asia Pacific

Asia Pacific represents 25% of the fortified milk market and is one of the fastest-growing regions. Rapid urbanization and a rising middle-class population drive demand for fortified dairy products. Governments in countries such as India and China run large-scale milk fortification programs to combat vitamin and mineral deficiencies. It helps improve public health and creates a steady demand base for fortified milk producers. Flavored fortified milk and milk powders are popular among children and working professionals seeking convenient nutrition. Local and international brands compete aggressively, launching affordable options to capture rural and semi-urban markets. Expanding modern retail infrastructure and digital grocery platforms accelerate product accessibility across the region.

Latin America

Latin America accounts for 9% share of the fortified milk market, supported by government-backed nutrition initiatives and school meal programs. Countries such as Brazil and Mexico are leading consumers, focusing on addressing public health issues like anemia and vitamin deficiencies. It benefits from partnerships between dairy cooperatives and public health authorities, improving fortified milk distribution in rural areas. Growing demand for flavored fortified milk also drives sales, particularly among children and teenagers. Urbanization increases exposure to premium dairy brands, encouraging higher adoption rates. E-commerce and small retail outlets provide wider access to fortified milk products. Rising health awareness campaigns continue to promote regular consumption across demographics.

Middle East and Africa

Middle East and Africa hold 6% market share, with growth driven by nutritional deficiency reduction initiatives. GCC countries adopt fortified milk as part of national food security and health improvement programs. It gains momentum in Africa where international organizations support micronutrient fortification to tackle malnutrition. Increasing investments in local dairy production enhance affordability and availability. Flavored and long-life fortified milk products perform well due to hot climate conditions and storage needs. Urban consumers show higher acceptance of fortified dairy options, while rural penetration remains a challenge. Continued focus on infrastructure development and awareness campaigns supports gradual but steady market expansion in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FrieslandCampina

- Gujarat Cooperative Milk Marketing Federation Ltd.

- The Kraft Heinz Company

- SanCor Cooperatives United Limited

- Guangming Dairy Co., Ltd.

- Arla Foods Ltd

- Dean Foods

- Nestle S.A.

- Fonterra Co-operative Group

- China Modern Dairy Holdings Ltd.

Competitive Analysis

The leading players in the fortified milk market include FrieslandCampina, Gujarat Cooperative Milk Marketing Federation Ltd., The Kraft Heinz Company, SanCor Cooperatives United Limited, Guangming Dairy Co., Ltd., Arla Foods Ltd, Dean Foods, Nestle S.A., Fonterra Co-operative Group, and China Modern Dairy Holdings Ltd. These companies focus on product innovation, fortification technology, and portfolio expansion to capture a larger consumer base. They invest heavily in research to develop milk products enriched with vitamins, minerals, and functional ingredients. Strong distribution networks, including modern retail and e-commerce, help these players maintain consistent market presence. Competitive strategies center on introducing flavored and specialty fortified milk to attract children and health-conscious consumers. Global players expand in emerging markets through partnerships with cooperatives and local distributors. It helps increase availability and affordability, particularly in rural and semi-urban regions. Companies also emphasize clean-label claims, natural fortification sources, and sustainable packaging to align with consumer preferences. Marketing campaigns highlight health benefits, building trust and encouraging regular consumption. Competitive intensity remains high, driving continuous innovation and price optimization to maintain market share.

Recent Developments

- In 2025, GCMMF continues its massive expansion, with reports detailing its strong revenue growth and focus on boosting milk consumption through pricing strategies.

- In 2023, FrieslandCampina launched “Step Up Nutrition,” a child-nutrition portfolio for kids aged 3 and above, focusing on growth, immunity, cognition, mental health and gut health.

- In June 2022, Fonterra’s ingredients brand, NZMP, launched its “Pro-Optima WPC 567” for the U.S. market, which is a Grade A whey protein concentrate designed to enable protein-fortified cultured products, particularly yogurt

Report Coverage

The research report offers an in-depth analysis based on Product Type, Micronutrients, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth driven by rising health awareness and fortified food adoption.

- Government fortification mandates will expand, increasing demand in both developed and developing nations.

- Plant-based fortified milk will gain popularity among lactose-intolerant and vegan consumers.

- Digital platforms will boost online sales and subscription-based delivery of fortified milk.

- Innovation in flavors and packaging will attract younger and urban consumers.

- Fortified milk powder and formula will see higher demand in infant and maternal nutrition segments.

- Investments in R&D will lead to products enriched with probiotics and functional nutrients.

- Rural distribution programs will expand access to fortified milk in low-income regions.

- Marketing campaigns will focus on preventive health and micronutrient benefits.

- Partnerships between dairy cooperatives and governments will strengthen supply chain efficiency.