Market Overview

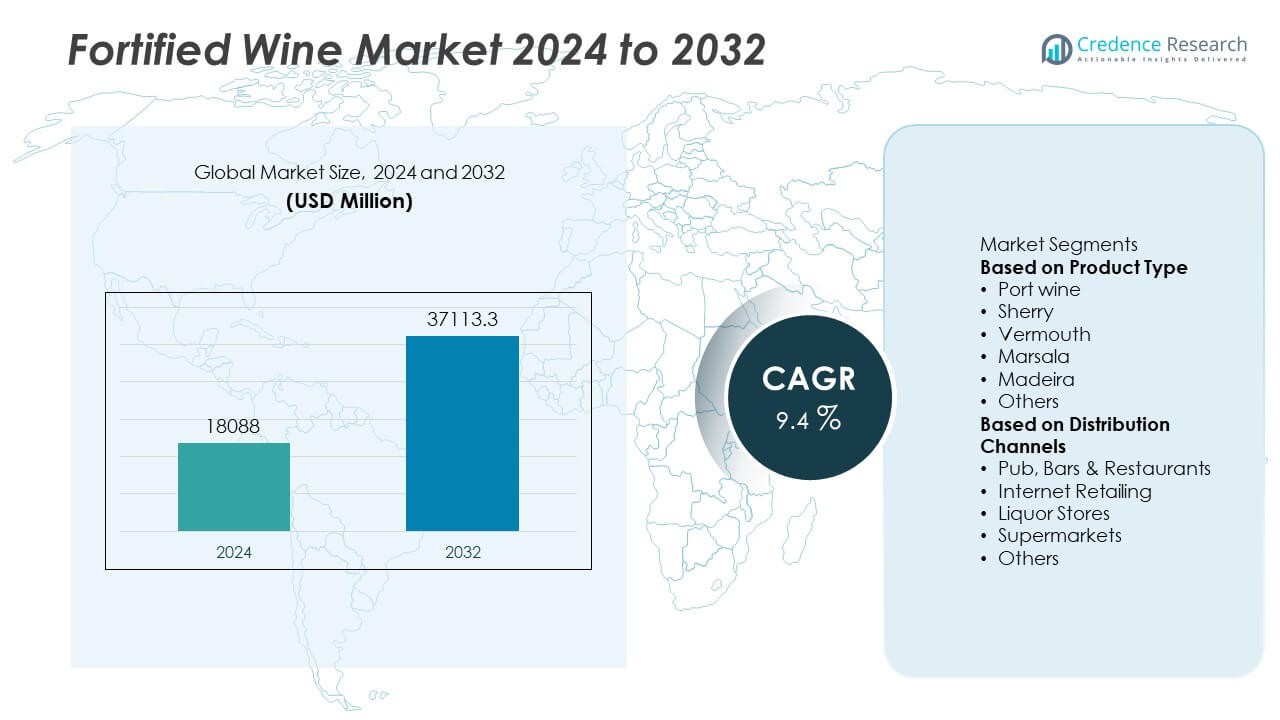

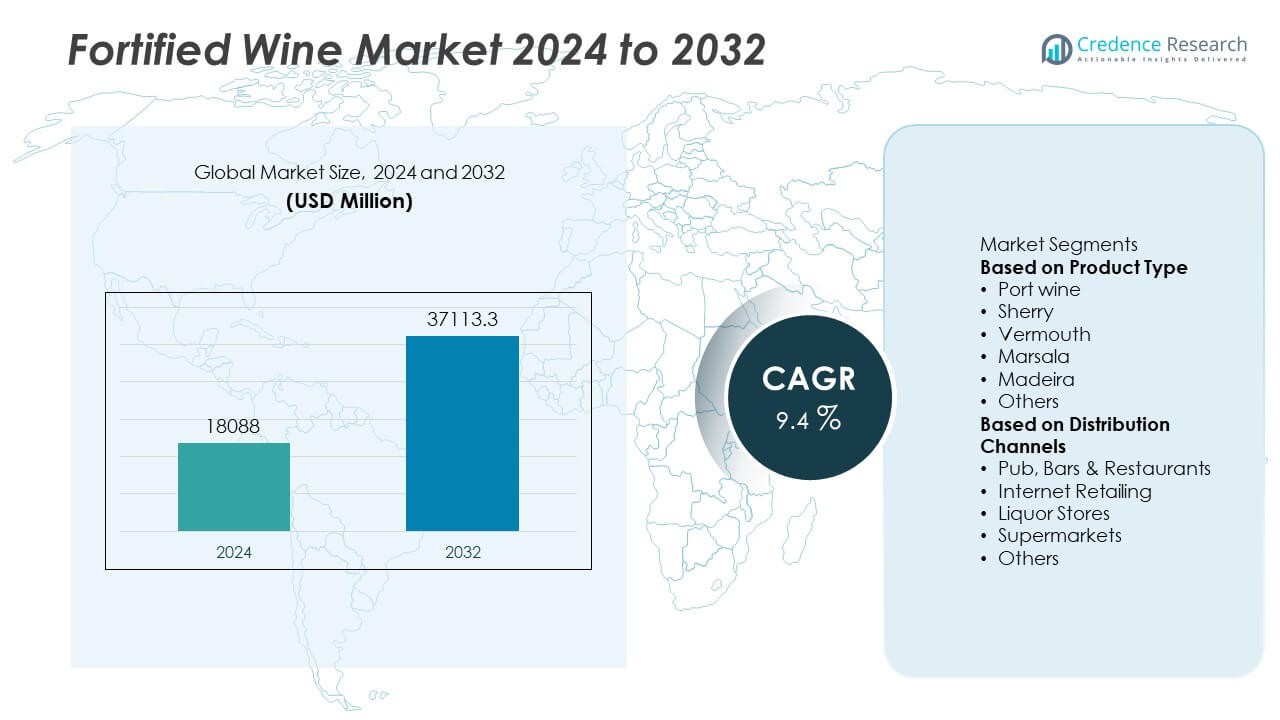

The global fortified wine market was valued at USD 18,088 million in 2024 and is projected to reach USD 37,113.3 million by 2032, growing at a CAGR of 9.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fortified Wine Market Size 2024 |

USD 18,088 Million |

| Fortified Wine Market, CAGR |

9.4% |

| Fortified Wine Market Size 2032 |

USD 37,113.3 Million |

The Fortified Wine Market grows with rising demand for premium and craft alcoholic beverages, driven by changing consumer preferences and interest in unique flavors. Expanding wine tourism and tasting experiences build awareness and encourage trial purchases.

Geographically, the Fortified Wine Market shows strong demand across Europe, North America, Asia-Pacific, Latin America, and the Middle East & Africa. Europe remains the leading hub, supported by a deep heritage in fortified wine production and high consumer preference for port, sherry, and vermouth. North America experiences steady growth with rising interest in premium wines and cocktail culture. Asia-Pacific emerges as a high-potential region driven by urbanization, rising incomes, and expanding wine tourism. Latin America and Africa see growing consumption in urban centers and hospitality sectors. Key players such as E. & J. Gallo Winery, Treasury Wine Estates, Constellation Brands, Inc., and Grupo Sogevinus Fine Wines focus on product innovation, portfolio expansion, and partnerships with hospitality and retail channels. Investments in e-commerce, vineyard modernization, and small-batch production strengthen their competitive positioning and improve global consumer reach across both traditional and emerging markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fortified Wine Market was valued at USD 18,088 million in 2024 and is projected to reach USD 37,113.3 million by 2032, growing at a CAGR of 9.4%.

- Rising demand for premium and craft fortified wines drives market growth across global hospitality and retail sectors.

- Consumers show increasing interest in low-ABV options, organic products, and heritage-based fortified wines such as port and sherry.

- Leading players such as E. & J. Gallo Winery, Treasury Wine Estates, Constellation Brands, Inc., and Grupo Sogevinus Fine Wines invest in innovation, vineyard modernization, and e-commerce channels.

- High production costs, regulatory complexities, and competition from beer, spirits, and ready-to-drink cocktails challenge growth momentum.

- Europe remains the dominant producer and consumer base, while Asia-Pacific shows the fastest growth due to rising disposable incomes and growing wine tourism.

- Expanding distribution channels, digital campaigns, and virtual tasting events create new opportunities for direct-to-consumer engagement and global market penetration.

Market Drivers

Rising Popularity of Premium and Craft Alcoholic Beverages

Consumer demand for premium and artisanal drinks fuels strong growth in the Fortified Wine Market. Consumers seek unique flavors, heritage labels, and limited-edition products. It benefits from growing interest in sherry, port, and vermouth among younger demographics. Premiumization trends encourage wineries to experiment with high-quality blends and innovative aging processes. This shift supports higher profit margins for producers. Growing preference for sophisticated drinking experiences drives market expansion across restaurants, bars, and e-commerce platforms.

- For instance, Graham’s Port produced a “Six Grapes Vila Velha Special Edition” bottling limited to 12,000 bottles, drawn from grapes on a 145-hectare estate with 55 hectares under vine.

Increasing Wine Tourism and Tasting Experiences

Growth in wine tourism boosts fortified wine awareness and adoption. The Fortified Wine Market gains exposure through tasting sessions and vineyard tours that showcase product diversity. Visitors engage directly with producers, which builds brand loyalty. It drives word-of-mouth promotion and enhances consumer education about fortified wine styles. Events and festivals promote sherry, Madeira, and Marsala to global audiences. Rising tourism in Europe, Australia, and South America strengthens direct-to-consumer sales channels.

- For instance, at the Decanter World Wine Awards (DWWA) 2025, four Best in Show medals were awarded to fortified wines, with Sherry producers from Spain receiving two of them. Spain also earned a total of five Best in Show, 16 Platinum, and 84 Gold medals.

Expanding Presence in Global Food and Beverage Industry

Fortified wines gain popularity as ingredients in cocktails, sauces, and gourmet recipes. The Fortified Wine Market benefits from partnerships with bars, restaurants, and culinary schools. Growth of mixology culture drives demand for vermouth and sherry in crafted cocktails. It encourages producers to market fortified wines as versatile and food-friendly. Rising number of specialty wine bars and tasting lounges expands product reach. Strong demand from hospitality and catering sectors sustains consistent sales.

Rising Influence of Online Retail and Digital Marketing

E-commerce platforms expand availability of fortified wines worldwide. The Fortified Wine Market uses online channels to target diverse consumer groups. Digital marketing campaigns highlight product origin, heritage, and tasting notes to attract buyers. It improves accessibility for consumers in regions with limited specialty wine stores. Virtual tasting events and subscription models enhance customer engagement. Direct-to-consumer strategies help brands maintain control over pricing and brand positioning.

Market Trends

Shift Toward Low-ABV and Health-Conscious Options

Producers introduce low-alcohol and lower-sugar fortified wines to meet health-focused consumer demand. The Fortified Wine Market adapts to growing interest in moderation and balanced lifestyles. It allows consumers to enjoy complex flavors with reduced alcohol intake. Brands experiment with lighter styles of vermouth and port to attract younger audiences. Wellness trends push innovation in organic and vegan fortified wine offerings. This shift creates a new niche within premium product portfolios and drives higher engagement.

- For instance, McGuigan and PepperJack have released mid-strength wine variants at 7% ABV that target moderation-seeking drinkers. Wellness trends are pushing innovation in organic and vegan wine offerings, although these are typically not fortified wines. This shift into lower-alcohol, organic, and vegan products creates new niches within premium product portfolios and drives higher consumer engagement.

Growth of Ready-to-Drink and Single-Serve Formats

Convenience drives demand for smaller packaging and ready-to-drink fortified wine cocktails. The Fortified Wine Market benefits from consumers seeking portable options for events and casual occasions. It encourages brands to launch cans, small bottles, and pre-mixed variants. This trend attracts millennial and Gen Z buyers who value flexibility and portion control. On-the-go consumption supports sales through retail, travel, and online channels. Packaging innovation improves accessibility and expands market reach.

- For instance, Vino Fandango is a UK-based online wine merchant that offers a range of small-format options, such as half-bottles (375ml) and other single-serve sizes, including both still and fortified wines from various producers.

Revival of Heritage and Regional Varietals

Consumers rediscover traditional fortified wine varieties linked to specific regions. The Fortified Wine Market experiences renewed interest in sherry from Spain, port from Portugal, and Marsala from Italy. It supports tourism and educates consumers about cultural heritage. Producers highlight origin stories, terroir, and artisanal production methods to differentiate offerings. Limited-edition releases and specialty cask aging attract collectors and enthusiasts. Regional authenticity strengthens brand loyalty and commands premium pricing.

Integration of Digital and Experiential Marketing

Wineries adopt digital tools and immersive experiences to engage customers. The Fortified Wine Market uses virtual tastings, influencer collaborations, and interactive content to reach wider audiences. It helps brands create storytelling around heritage and production processes. Social media platforms amplify campaigns targeting niche wine communities. E-commerce integration allows seamless purchase after online engagement. Digital-first strategies increase visibility and drive direct-to-consumer growth.

Market Challenges Analysis

High Production Costs and Regulatory Complexities

Fortified wine production requires significant investment in aging, storage, and quality control. The Fortified Wine Market faces cost pressures from premium ingredients and specialized barrels. Compliance with alcohol regulations and varying tax structures across countries increases complexity. It challenges small and mid-sized producers to maintain competitive pricing. Longer production cycles limit flexibility to respond to sudden demand changes. Fluctuations in grape supply due to climate impact further raise operational risks.

Changing Consumer Preferences and Competition from Other Beverages

Shifting preferences toward low-calorie drinks and craft spirits create competitive pressure. The Fortified Wine Market competes with beer, hard seltzers, and ready-to-drink cocktails for younger consumers. It must continually refresh branding to stay relevant among modern drinkers. Lack of awareness about fortified wine categories in some regions slows adoption. Marketing costs rise as producers invest in consumer education and promotional campaigns. Evolving trends demand continuous product innovation to retain market share.

Market Opportunities

Expansion into Emerging Markets and Untapped Consumer Segments

Rising disposable incomes and growing urban populations create strong demand for premium beverages. The Fortified Wine Market can grow by targeting new consumers in Asia-Pacific, Latin America, and Africa. Governments easing alcohol trade regulations open new distribution opportunities. It allows producers to introduce fortified wines to markets with low current penetration. Wine education programs and tasting events increase awareness and build appreciation for fortified varieties. Expanding into airports, hotels, and luxury retail outlets supports visibility among affluent buyers.

Innovation in Product Formats and Experiential Marketing

Producers explore small-batch, limited-edition, and flavored fortified wines to attract younger consumers. The Fortified Wine Market benefits from rising interest in mixology and cocktail culture. It encourages wineries to collaborate with bars and restaurants for signature cocktail menus. Digital engagement through virtual tastings and influencer campaigns boosts consumer interaction. Sustainable packaging and organic certifications appeal to eco-conscious buyers. New product formats and storytelling experiences create fresh revenue streams and strengthen brand loyalty.

Market Segmentation Analysis:

By Product Type

The Fortified Wine Market is segmented into port, sherry, vermouth, Madeira, and other fortified wines. Port wine leads demand due to its global popularity and strong presence in premium hospitality sectors. Sherry and Madeira experience renewed interest from consumers seeking heritage products and complex flavor profiles. It benefits from the trend toward pairing fortified wines with gourmet cuisine and desserts. Vermouth shows strong growth supported by the rising cocktail culture and demand for aperitifs. Producers launch innovative variants with unique botanicals and flavor infusions to attract younger audiences. Limited-edition releases and cask-aged expressions create a niche segment for collectors and enthusiasts worldwide.

- For instance, Symington Family Estates launched a 50-Year-Old Tawny Port under its Graham’s brand in 2024 as a limited release. Separately, González Byass ages a wide range of sherries, including its flagship Tío Pepe, through multiple solera systems that contain tens of thousands of barrels and contribute to a global wine and spirits operation.

By Distribution Channels

Distribution channels include supermarkets and hypermarkets, specialty stores, on-trade channels such as bars and restaurants, and online platforms. Supermarkets and hypermarkets dominate due to their ability to offer a wide selection and convenient purchasing options. The Fortified Wine Market leverages specialty wine stores and tasting lounges to target premium buyers. On-trade sales remain critical, with restaurants and bars showcasing fortified wines in curated menus and mixology programs. It gains from the rapid expansion of e-commerce, allowing direct-to-consumer deliveries and subscription-based services. Online platforms educate customers through virtual tasting events and product recommendations, driving higher engagement. Strong channel diversification ensures wider reach and consistent sales across urban and semi-urban regions.

- For instance, Majestic Wine operates over 200 physical stores nationwide, with new locations having opened in 2024 and 2025 as part of an active expansion strategy. In 2024, it opened new stores in places such as East Dulwich and Brentwood and acquired the Vagabond wine bar chain.

Segments:

Based on Product Type

- Port wine

- Sherry

- Vermouth

- Marsala

- Madeira

- Others

Based on Distribution Channels

- Pub, Bars & Restaurants

- Internet Retailing

- Liquor Stores

- Supermarkets

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds nearly 28% share of the Fortified Wine Market. The region benefits from a strong culture of premium wine consumption and high disposable income levels. It shows strong demand for port, sherry, and vermouth in both retail and on-trade channels. Growth is supported by the popularity of cocktail culture and the integration of fortified wines into mixology programs. Wineries in the U.S. focus on small-batch production and exclusive releases to cater to premium buyers. Rising online wine sales expand consumer access and improve distribution efficiency. The presence of established brands and emerging craft producers strengthens competition and drives innovation.

Europe

Europe accounts for about 38% share of the Fortified Wine Market, making it the largest regional market. The region has a deep historical connection with fortified wines, including sherry from Spain, port from Portugal, and vermouth from Italy. It benefits from strong domestic consumption and tourism-driven sales. Consumers in France, Germany, and the U.K. increasingly demand premium and organic fortified wine offerings. Export opportunities for European producers remain strong, supported by global recognition of regional appellations. Innovation in packaging and growing use of e-commerce platforms further boost accessibility. Continued investment in vineyard modernization and quality certifications reinforces Europe’s leading position.

Asia-Pacific

Asia-Pacific represents nearly 20% share of the Fortified Wine Market and shows the fastest growth rate. Rising disposable incomes and urbanization increase demand for premium alcoholic beverages. It benefits from growing awareness of fortified wines through wine education programs, events, and tastings. China, Japan, and Australia lead consumption, with India and Southeast Asia emerging as high-potential markets. Expansion of luxury hotels, bars, and fine dining establishments accelerates adoption. E-commerce platforms play a major role in reaching younger consumers seeking convenience and variety. Partnerships between global producers and regional distributors strengthen market penetration and brand presence.

Latin America

Latin America holds close to 8% share of the Fortified Wine Market. Brazil, Argentina, and Chile are key markets with strong wine-making traditions. It sees rising consumption of fortified wines in urban centers where premium products gain popularity. Local producers experiment with fortified variants to cater to changing tastes. Growing tourism in wine-producing regions creates opportunities for direct-to-consumer sales. Online retail channels expand access to international brands, supporting higher adoption. Government initiatives to promote local wine exports also contribute to market development.

Middle East & Africa

Middle East & Africa represent nearly 6% share of the Fortified Wine Market. Growth is concentrated in countries with liberalized alcohol policies and expanding hospitality sectors. It benefits from demand in luxury hotels, resorts, and duty-free retail outlets. Rising expatriate population and tourism boost consumption of premium fortified wines. Online sales channels and specialty stores make products more accessible in key markets like UAE and South Africa. Increasing focus on premium dining experiences supports steady growth. Producers explore opportunities in untapped regions with rising urban populations and shifting cultural acceptance of wine consumption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Liberty Wines Limited

- Grupo Sogevinus Fine Wines

- Treasury Wine Estates

- & J. Gallo Winery

- Pedro Domecq Sherry

- Precept Wine, LLC

- The Wine Group

- Constellation Brands, Inc.

- Trinchero Family Estates

- Deutsch Family Wine & Spirits

Competitive Analysis

Competitive landscape of the Fortified Wine Market features leading players such as E. & J. Gallo Winery, Treasury Wine Estates, Constellation Brands, Inc., Grupo Sogevinus Fine Wines, The Wine Group, Trinchero Family Estates, Deutsch Family Wine & Spirits, Liberty Wines Limited, Pedro Domecq Sherry, and Precept Wine, LLC. These companies focus on expanding product portfolios with premium and heritage-based fortified wines to meet rising global demand. They invest in vineyard modernization, sustainable production practices, and advanced aging techniques to maintain quality and consistency. Strategic collaborations with restaurants, bars, and retail chains enhance visibility and strengthen distribution networks. Leading producers leverage e-commerce platforms and subscription models to reach younger and tech-savvy consumers. Marketing efforts highlight tradition, origin, and craftsmanship to appeal to enthusiasts and collectors. Intense competition drives innovation in low-ABV, organic, and flavored fortified wine offerings, allowing brands to capture new market segments and maintain global relevance.

Recent Developments

- In August 2025, WSET released the full list of wines used in its Diploma tasting exams, including nine fortified wines in the D5 unit.

- In June 2025, Treasury Wine Estates opened a new facility in Barossa Valley for ‘low and no’ alcohol wine production.

- In May 2025, Grupo Sogevinus declared four 2022 Vintage Ports, Kopke Quinta de São Luiz 2022, Burmester Quinta do Arnozelo 2022, Calem 2022, Barros 2022.

- In April 2024, the Sogevinus Group declared four 2022 Vintage Ports: Kopke Quinta de São Luiz 2022, Burmester Quinta do Arnozelo 2022, Calem 2022 and Barros 2022.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channels and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Fortified Wine Market will grow with rising demand for premium and craft wine varieties.

- Low-ABV and organic fortified wine options will attract health-conscious consumers.

- Digital marketing and virtual tasting events will strengthen direct-to-consumer engagement.

- Expansion of e-commerce platforms will boost sales in urban and emerging markets.

- Wine tourism and experiential events will increase awareness and brand loyalty.

- Collaborations with bars and restaurants will enhance on-trade consumption of fortified wines.

- Limited-edition and small-batch releases will appeal to collectors and enthusiasts.

- Producers will invest in sustainable practices and eco-friendly packaging solutions.

- Asia-Pacific will emerge as a major growth hub driven by rising incomes and urbanization.

- Continuous product innovation and flavor experimentation will keep fortified wine relevant for younger audiences.