Market Overview

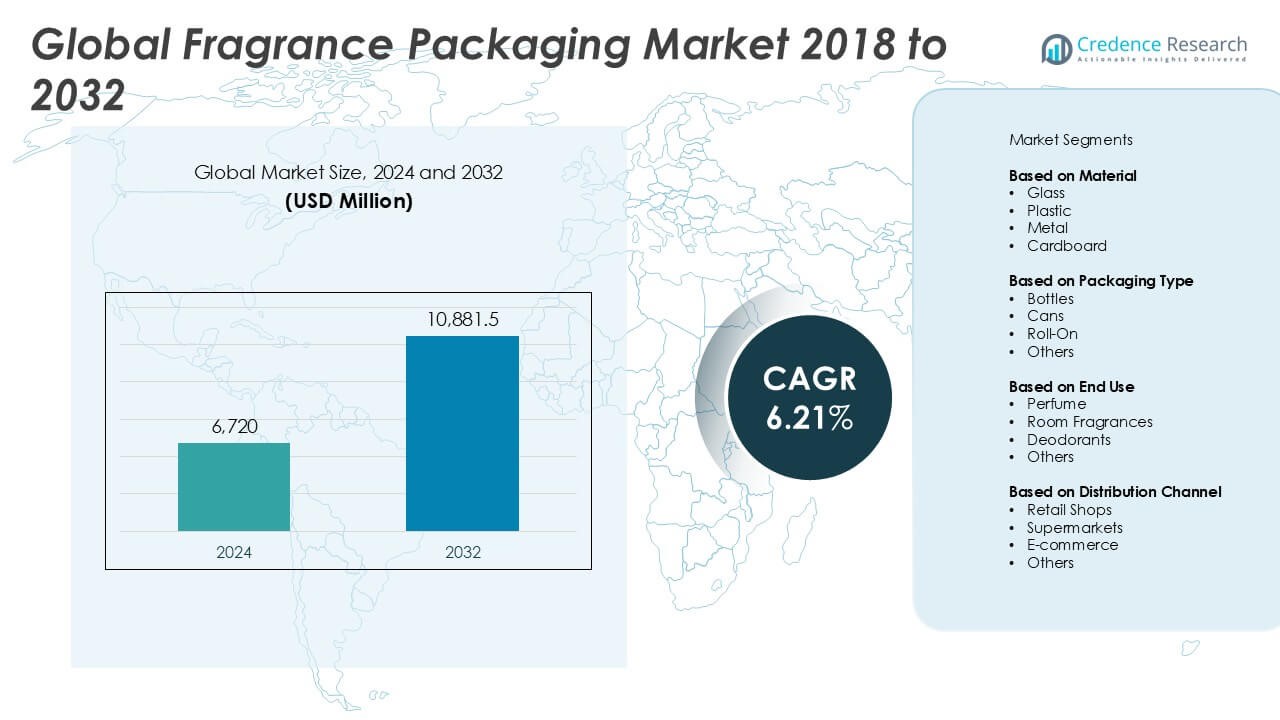

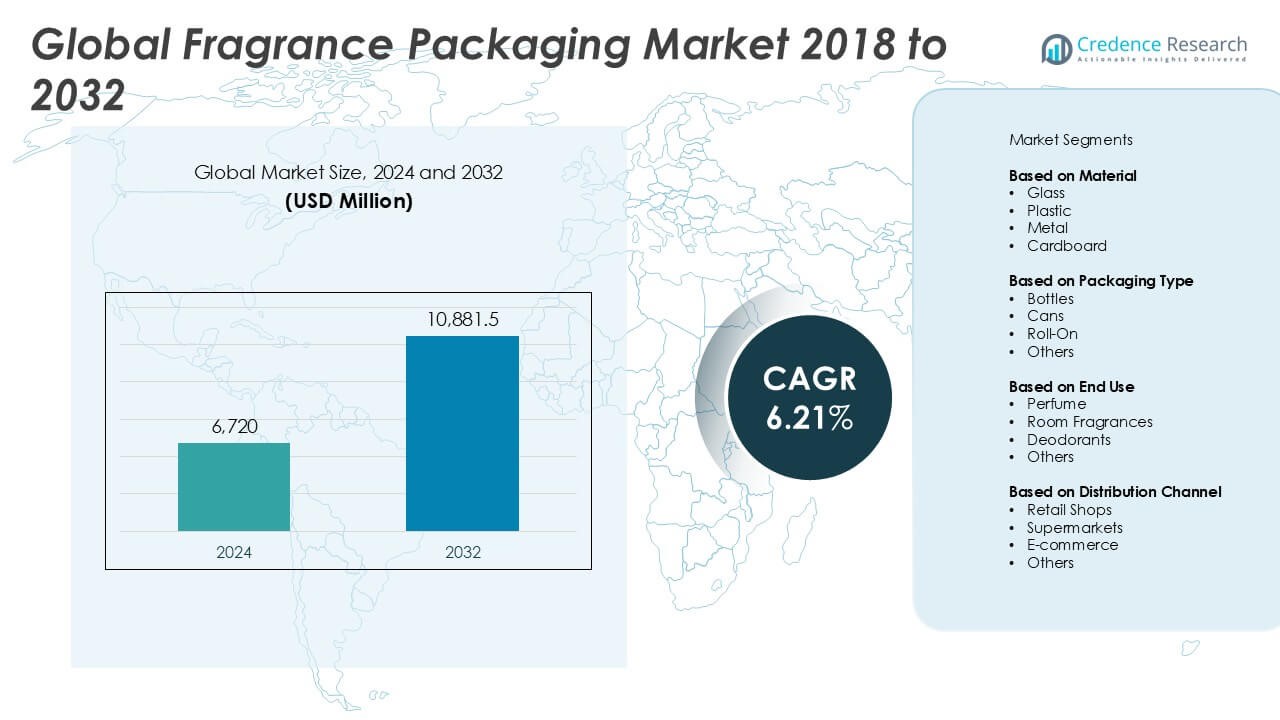

The Fragrance Packaging market size was valued at USD 6,720 million in 2024 and is anticipated to reach USD 10,881.5 million by 2032, at a CAGR of 6.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fragrance Packaging Market Size 2024 |

USD 6,720 Million |

| Fragrance Packaging Market, CAGR |

6.21% |

| Fragrance Packaging Market Size 2032 |

USD 10,881.5 Million |

Top players in the fragrance packaging market include Verescence France SASU, Saverglass SAS, Gerresheimer AG, Albéa S.A., and Piramal Glass Ltd., all of which maintain a strong global presence and focus on premium, sustainable, and customizable packaging solutions. These companies lead through continuous innovation in glass, metal, and eco-friendly materials to meet evolving consumer demands. Europe emerged as the dominant region in 2024, holding 34% of the global market share, driven by the concentration of luxury fragrance brands and strict sustainability regulations. North America followed with 28%, supported by strong retail infrastructure and demand for premium personal care products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The fragrance packaging market was valued at USD 6,720 million in 2024 and is projected to reach USD 10,881.5 million by 2032, growing at a CAGR of 6.21% during the forecast period.

- Growing demand for premium, personalized fragrances and increasing focus on sustainable and refillable packaging are major drivers propelling market growth across both developed and emerging economies.

- Key trends include the rising adoption of smart and interactive packaging, increased investments in eco-friendly materials, and growing consumer interest in refillable and reusable packaging formats.

- The market is highly competitive with major players such as Verescence France SASU, Saverglass SAS, Gerresheimer AG, and Albéa S.A. dominating through innovation, global presence, and strategic partnerships.

- Europe led the market with 34% share in 2024, followed by North America at 28% and Asia Pacific at 22%; glass remained the dominant material segment with over 40% market share due to its premium appeal.

Market Segmentation Analysis:

By Material

The glass segment held the dominant share in the fragrance packaging market in 2024, accounting for over 40% of the total market revenue. Glass is widely preferred due to its premium appearance, excellent barrier properties, and recyclability. It enhances the aesthetic appeal of fragrances, making it the ideal choice for high-end perfumes. The segment continues to grow due to increasing consumer preference for sustainable and luxurious packaging. Although plastic and metal offer cost advantages and design flexibility, they lag behind in premium positioning, especially in the perfume segment, where brand image and presentation are crucial.

- For instance, Verescence produced 500 million glass bottles in 2023, with 98% of them being eco-designed and manufactured using 40% post-consumer recycled glass, reinforcing its leadership in sustainable luxury fragrance packaging.

By Packaging Type:

Bottles emerged as the leading packaging type in the fragrance packaging market, contributing more than 50% of the market share in 2024. Bottles, particularly glass bottles, are widely used for perfumes and deodorants due to their ability to maintain fragrance integrity and offer superior visual appeal. The demand is supported by innovations in bottle design, such as custom shapes, embellishments, and advanced dispensing mechanisms. Cans and roll-ons are also gaining traction, especially in the deodorant and room fragrance categories, owing to their convenience and portability, but they remain secondary to bottles in overall market contribution.

- For instance, Gerresheimer AG operates over 30 production sites globally and has introduced over 150 custom bottle designs for fragrance brands in the last two years, integrating precise embossing and laser-engraving technologies.

By End Use:

The perfume segment dominated the end-use category, capturing approximately 55% of the global fragrance packaging market share in 2024. High consumer demand for luxury and personal care products has driven significant investments in attractive and functional perfume packaging. This segment benefits from increased spending on premium and designer fragrances, particularly in emerging economies. Room fragrances and deodorants are also key contributors, with growing urbanization and lifestyle changes encouraging their adoption. However, these segments primarily opt for more cost-effective packaging options, unlike perfumes, which prioritize visual and tactile appeal to enhance brand perception and customer experience.

Key Growth Drivers

Rising Demand for Premium and Personalized Fragrance Products

The increasing consumer inclination toward luxury and customized fragrances is significantly driving growth in the fragrance packaging market. Premium perfumes often require high-end, aesthetically appealing packaging, which boosts demand for glass and intricately designed bottles. Personalization trends—such as monogrammed bottles or limited-edition packaging—enhance customer engagement and brand loyalty, encouraging brands to invest more in innovative packaging. This is especially prominent in mature markets like Europe and North America, where consumers value exclusivity and visual identity, directly influencing the choice and design of packaging materials.

- For instance, Quadpack developed over 60 custom-packaged fragrance SKUs for niche brands in 2023, incorporating laser-personalized caps and limited-run decorative finishes tailored to brand narratives.

Growth of E-commerce and Direct-to-Consumer Channels

The expanding e-commerce ecosystem has amplified the demand for durable and visually appealing fragrance packaging. As more consumers purchase fragrances online, brands are prioritizing packaging that not only protects products during shipping but also delivers an engaging unboxing experience. This trend has prompted innovation in secondary packaging such as cardboard boxes and eco-friendly fillers. Furthermore, direct-to-consumer (DTC) channels enable greater control over branding, encouraging investment in packaging that reflects the product’s story and premium nature. The convenience of online platforms further supports consistent growth in fragrance sales and packaging demand.

- For instance, Albéa developed over 25 custom secondary packaging solutions in 2023 optimized for e-commerce shipping tests, including ISTA-6 Amazon-certified designs for luxury fragrance brands.

Sustainability Initiatives Driving Material Innovation

Growing environmental awareness among consumers and tightening regulations on single-use plastics are pushing fragrance brands to adopt sustainable packaging solutions. Companies are increasingly exploring biodegradable, recyclable, and refillable packaging formats to meet sustainability goals. This trend supports the use of eco-friendly materials such as recycled glass, cardboard, and bio-based plastics. Brands focusing on green packaging not only align with consumer values but also enhance their corporate image and comply with regulatory requirements. As a result, sustainability has become a central growth driver, spurring innovation and reshaping material selection in fragrance packaging.

Key Trends & Opportunities

Refillable and Reusable Packaging Solutions

The growing popularity of refillable fragrance bottles is emerging as a transformative trend in the market. Luxury brands are increasingly launching refill stations and modular packaging systems to promote sustainability and reduce environmental impact. Refillable packaging provides a long-term value proposition for consumers while helping brands reduce material waste and strengthen customer retention. This trend aligns with circular economy principles and offers manufacturers a key opportunity to innovate in design and functionality, especially in the premium and niche fragrance categories where sustainability adds to brand prestige.

- For instance, LVMH brand Guerlain installed over 200 fragrance refill fountains worldwide by the end of 2023, allowing consumers to reuse high-end glass bottles while reducing single-use packaging waste.

Integration of Smart and Interactive Packaging

Technological advancements are driving the integration of smart packaging elements such as QR codes, NFC tags, and AR-enabled labels into fragrance packaging. These features enhance consumer engagement by offering interactive product stories, usage instructions, or promotional content. Smart packaging also helps brands combat counterfeiting—a persistent challenge in the luxury fragrance segment—by enabling traceability and authentication. As digital-savvy consumers increasingly expect personalized and immersive experiences, smart packaging opens up opportunities for brands to differentiate themselves and build stronger connections with their audience.

- For instance, Paco Rabanne embedded NFC tags into 1 million units of its Phantom fragrance bottles in 2023, enabling users to access digital experiences and verify authenticity via smartphone interaction.

Key Challenges

High Cost of Premium and Sustainable Packaging Materials

While premium and eco-friendly materials enhance product appeal and brand image, they come at a significantly higher cost compared to conventional materials. This creates a barrier for small and mid-sized fragrance manufacturers looking to compete with established brands. The cost of glass, biodegradable plastics, and customized components adds to production expenses, often impacting profitability. Balancing quality, aesthetics, and sustainability while maintaining competitive pricing remains a key challenge, especially in price-sensitive markets where affordability is crucial to consumer purchase decisions.

Regulatory Pressures and Compliance Complexities

The fragrance packaging industry is subject to stringent regulations concerning safety, sustainability, and material usage, particularly in the European Union and North America. Compliance with packaging waste directives, labeling standards, and chemical restrictions increases the complexity and cost of production. Frequent updates to these regulations require constant monitoring and adaptation, posing operational challenges for manufacturers. For global brands, managing compliance across multiple regions further complicates packaging design and supply chain logistics, potentially slowing down innovation and market entry.

Supply Chain Disruptions and Raw Material Volatility

Global supply chain disruptions—driven by geopolitical tensions, logistics bottlenecks, and fluctuating raw material prices—pose significant challenges to fragrance packaging manufacturers. Delays in the availability of glass, plastics, and metal components can lead to production setbacks and increased lead times. Additionally, the volatility in raw material prices affects budget planning and can squeeze profit margins. These issues highlight the need for robust supply chain strategies and diversified sourcing to mitigate risks and ensure consistent delivery in a highly competitive market environment.

Regional Analysis

North America

North America accounted for approximately 28% of the global fragrance packaging market in 2024, driven by strong demand for premium personal care and luxury fragrance products. The United States leads the region with a robust retail and e-commerce infrastructure, encouraging continuous innovation in packaging aesthetics and functionality. Consumers increasingly favor sustainable and customized packaging, prompting manufacturers to invest in eco-friendly and refillable solutions. Additionally, high disposable income and brand-conscious behavior support the expansion of luxury brands, further boosting demand for high-end packaging materials such as glass and metal across both retail and direct-to-consumer channels.

Europe

Europe held the largest share in the fragrance packaging market in 2024, capturing around 34% of the global revenue. The region benefits from a strong heritage in perfumery, especially in France, Germany, and Italy, which house many global luxury fragrance brands. Stringent sustainability regulations have accelerated the adoption of recyclable and biodegradable packaging materials. Refillable packaging and minimalistic designs are gaining traction among environmentally conscious consumers. The presence of a well-established cosmetics industry, along with advanced packaging technologies and a strong focus on aesthetics and sustainability, continues to position Europe as a dominant force in the global market.

Asia Pacific

The Asia Pacific region captured approximately 22% of the global fragrance packaging market in 2024 and is expected to register the fastest growth during the forecast period. Rising urbanization, increasing disposable income, and growing interest in personal grooming in countries like China, India, Japan, and South Korea are fueling demand for both premium and mass-market fragrances. Regional manufacturers are investing in cost-effective yet visually appealing packaging to cater to a broad consumer base. Additionally, expanding e-commerce channels and influencer marketing are driving product visibility, encouraging the adoption of innovative and customizable packaging formats suited to diverse consumer preferences.

Latin America

Latin America contributed to around 8% of the global fragrance packaging market share in 2024, with Brazil and Mexico being the key contributors. The region demonstrates steady growth, supported by a strong cultural preference for fragrance usage across social and daily routines. Affordable and attractive packaging solutions are in demand, particularly for deodorants and body sprays. While the market remains largely price-sensitive, there is a growing trend toward premiumization, creating opportunities for glass and branded bottle packaging. Local brands are also adopting sustainable materials to align with rising environmental consciousness among urban consumers.

Middle East & Africa

The Middle East & Africa accounted for about 8% of the global fragrance packaging market in 2024, with the Middle East leading due to high per capita spending on luxury fragrances, particularly in the UAE and Saudi Arabia. Traditional scent preferences, such as oud and attar, continue to influence packaging styles, favoring ornate and premium bottle designs. The market is gradually witnessing a shift toward sustainable and refillable packaging, particularly among luxury and niche brands. In Africa, demand is growing for affordable, compact packaging, driven by expanding urban markets and increasing interest in personal grooming among younger consumers.

Market Segmentations:

By Material

- Glass

- Plastic

- Metal

- Cardboard

By Packaging Type

- Bottles

- Cans

- Roll-On

- Others

By End Use

- Perfume

- Room Fragrances

- Deodorants

- Others

By Distribution Channel

- Retail Shops

- Supermarkets

- E-commerce

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The fragrance packaging market is characterized by intense competition, with key players focusing on innovation, sustainability, and premium design to differentiate themselves. Major companies such as Verescence France SASU, Saverglass SAS, Gerresheimer AG, and Albéa S.A. dominate the market with extensive product portfolios and strong global presence. These firms invest heavily in R&D to develop eco-friendly materials, refillable packaging solutions, and advanced decoration techniques to meet evolving consumer preferences. Emerging players and regional manufacturers are also gaining traction by offering cost-effective and customizable packaging options. Strategic collaborations, mergers, and acquisitions—such as EXAL Corporation’s integration into Trivium Packaging—are reshaping the competitive dynamics by enhancing manufacturing capabilities and global reach. Additionally, companies like Quadpack Ltd. and Piramal Glass Ltd. are expanding their footprints through partnerships and localized production strategies. As sustainability and personalization become critical to brand identity, the competitive landscape continues to evolve with a strong emphasis on innovation, design aesthetics, and material sustainability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Verescence France SASU

- Saverglass SAS

- Gerresheimer AG

- Albéa S.A.

- EXAL Corporation (Now part of Trivium Packaging)

- Quadpack Ltd.

- Piramal Glass Ltd.

- Coverpla S.A.

- Alcion Plasticos

- CCL Container, Inc.

- General Converting, Inc.

- IntraPac International Corporation

Recent Developments

- In December 2023, the global company Saverglass SAS, which specializes in the production, modification, and decoration of luxury glass bottles for the wine, cosmetics, perfume, food, and spirit markets, was fully acquired by Australian packaging maker Orora Limited.

- In November 2023, the luxury perfume filling, production, and high-end contract packaging company Anjac Health & Beauty (Anjac), Stephen, France, purchased Anjac Health & Beauty. This manufacturing group formulates, manufactures, and packages dietary supplements and cosmetics.

- In September 2023, Bormioli Luigi finalized its merger with glass maker Bormioli Rocco. The move is expected to capitalize on the two firms’ synergies, resulting in a more “agile and flexible” business strategy.

- In April 2023, Coverpla collaborated with the Asian fragrance company Daniche to design the Pirate Song cap, bottle, and pump.

- In February 2023, the global leader in luxury and owner of 75 recognizable brands, LVMH and Dow Beauty, a division of LVMH, have partnered to advance sustainable packaging across all of LVMH’s fragrance and cosmetic goods. Through this partnership, the cosmetics giant could incorporate circular and bio-based plastics into multiple product applications without sacrificing the packaging’s quality or functionality.

Market Concentration & Characteristics

The Fragrance Packaging Market exhibits a moderately concentrated structure, with a mix of global leaders and regional players competing across different segments. It features strong brand loyalty and high entry barriers due to design expertise, material sourcing, and compliance with stringent regulatory standards. Large players dominate premium and luxury segments by leveraging advanced manufacturing capabilities and extensive distribution networks. Regional manufacturers hold competitive ground in cost-sensitive categories by offering localized solutions. The market emphasizes aesthetics, sustainability, and innovation, making product differentiation a key competitive factor. Companies invest in research and development to meet consumer demand for eco-friendly, refillable, and customized packaging. It reflects a growing shift toward premiumization, supported by evolving consumer preferences and expanding direct-to-consumer channels. Regulatory compliance, especially in Europe and North America, shapes material selection and production methods. The market rewards suppliers who deliver packaging that combines visual appeal with functionality and environmental responsibility. Pricing pressure remains a challenge in mass-market segments.

Report Coverage

The research report offers an in-depth analysis based on Material, Packaging Type, End Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising demand for premium and luxury fragrance products.

- Sustainable and refillable packaging solutions will become standard across major product lines.

- Consumer preference for personalized and limited-edition designs will influence packaging innovation.

- E-commerce expansion will push brands to develop protective and visually appealing secondary packaging.

- Demand for recyclable and biodegradable materials will continue to increase due to environmental regulations.

- Smart packaging technologies like QR codes and NFC tags will enhance consumer engagement and brand protection.

- Glass packaging will retain its dominance due to its premium look and recyclability.

- Asia Pacific will emerge as the fastest-growing regional market due to rising urbanization and disposable income.

- Competitive pressure will drive investments in automation and design efficiency.

- Collaborations between fragrance manufacturers and packaging companies will intensify to accelerate product development.