| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Pea Proteins Market Size 2024 |

USD 82.29 Million |

| France Pea Proteins Market, CAGR |

11.97% |

| France Pea Proteins Market Size 2032 |

USD 203.36 Million |

Market Overview:

The France Pea Proteins Market is projected to grow from USD 82.29 million in 2024 to an estimated USD 203.36 million by 2032, with a compound annual growth rate (CAGR) of 11.97% from 2024 to 2032.

Several factors are propelling the growth of the pea protein market in France. Foremost is the rising health awareness among consumers, who are seeking nutritious and sustainable protein sources. Pea protein, derived primarily from yellow peas, offers a high-quality amino acid profile and is hypoallergenic, making it suitable for individuals with dietary restrictions. The growing popularity of plant-based diets, driven by concerns over animal welfare and environmental sustainability, further fuels demand. Additionally, the sports nutrition segment is a significant contributor, accounting for 28% of the market, as athletes and fitness enthusiasts turn to pea protein for muscle recovery and strength development. Increasing innovation in food processing technologies has also enabled manufacturers to incorporate pea protein into a wider range of applications, including dairy alternatives, baked goods, and ready-to-eat meals.

Within France, the adoption of pea protein varies across regions, influenced by factors such as urbanization, lifestyle, and access to health food markets. Urban centers like Paris and Lyon exhibit higher consumption rates, driven by a concentration of health-conscious consumers and greater availability of plant-based products. In contrast, rural areas are gradually embracing pea protein, spurred by nationwide health campaigns and increasing availability in mainstream retail channels. The implementation of European Food Safety Authority (EFSA) regulations in France, aimed at ensuring the quality of nutritional supplements, is expected to encourage manufacturers to develop high-quality plant protein products, thereby supporting market growth. Furthermore, the growing number of organic and health-focused retail outlets across French regions is facilitating increased consumer access to innovative pea protein products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The France pea proteins market is projected to grow from USD 82.29 million in 2024 to USD 203.36 million by 2032, registering a strong CAGR of 11.97% during the forecast period.

- The global pea proteins market is projected to grow from USD 2,229.15 million in 2024 to USD 5,618.92 million by 2032, at a CAGR of 12.25%.

- Growing consumer preference for health-focused, allergen-free nutrition is a major driver, with pea protein gaining popularity due to its digestibility and suitability for gluten- and dairy-free diets.

- Environmental sustainability and ethical consumption trends are accelerating demand, as consumers increasingly seek low-impact, plant-based alternatives to animal-derived proteins.

- Pea protein’s functional versatility is driving its incorporation into dairy alternatives, snacks, supplements, and bakery products, supported by ongoing food processing innovations.

- The sports nutrition segment accounts for 28% of the market, reflecting the strong demand from fitness-conscious consumers for clean, plant-based protein sources for muscle recovery.

- Key restraints include high production costs and unfavorable taste or texture in some formulations, which may limit mass-market penetration unless resolved through product innovation.

- Regionally, urban centers such as Paris and Lyon lead in adoption, while rural regions show growing interest due to health campaigns and expanding access to plant-based retail products.

Market Drivers:

Rising Health Consciousness and Dietary Shifts

A significant driver of the France pea proteins market is the growing health consciousness among consumers, who are increasingly inclined toward balanced, high-nutrient diets. As awareness of the negative health impacts of excessive animal protein consumption rises, consumers are actively seeking plant-based alternatives that support overall well-being. For instance, Roquette, a leading French pea protein producer, highlights that pea protein’s hypoallergenic nature, balanced amino acid profile, and high digestibility make it a preferred alternative for individuals managing lactose intolerance, gluten sensitivity, or cholesterol issues. It aligns well with the nutritional requirements of individuals managing lactose intolerance, gluten sensitivity, or cholesterol issues. These factors, combined with France’s broader wellness culture, are driving substantial demand for clean-label and health-focused protein sources.

Environmental Sustainability and Ethical Consumption

Environmental and ethical concerns are also contributing significantly to the market’s growth. Consumers in France are increasingly aware of the environmental footprint associated with animal farming, including greenhouse gas emissions, deforestation, and water usage. In response, many are transitioning to more sustainable protein sources such as pea protein, which requires fewer resources to produce. Additionally, ethical considerations—such as animal welfare and sustainable agriculture—are influencing consumer choices, especially among younger demographics. The popularity of vegan, vegetarian, and flexitarian lifestyles is steadily increasing, and pea protein fits seamlessly into these dietary models, reinforcing its appeal as a climate-conscious and ethical food option.

Expanding Applications in Food and Beverage Industry

Another major growth driver is the rising incorporation of pea protein in a wide range of food and beverage products. The functional versatility of pea protein makes it suitable for use in dairy alternatives, meat substitutes, nutritional supplements, baked goods, and protein bars. As French food manufacturers respond to consumer demand for plant-based innovation, they are launching new product lines that prominently feature pea protein. For instance, companies like Roquette and Eurial are participating, with the goal of delivering products with optimal nutritional and sensory qualities while improving sustainability across the supply chain. Advancements in food processing technologies have also improved the taste, texture, and solubility of pea protein, enhancing its acceptability and expanding its market applications. The growing interest in fortified and functional foods has further accelerated its adoption.

Growth of Sports Nutrition and Fitness Trends

The increasing penetration of fitness and active lifestyle trends is boosting demand for high-protein dietary supplements, further supporting the growth of the pea protein market. In France, the sports nutrition segment accounts for a notable share of pea protein consumption, as athletes and fitness enthusiasts turn to plant-based proteins for muscle recovery, strength building, and endurance. The shift toward natural and allergen-free supplements is reinforcing this demand, particularly among consumers looking to avoid whey or soy proteins due to allergies or dietary preferences. This trend is likely to sustain long-term growth in the French market as the fitness culture continues to expand.

Market Trends:

Shift Toward Organic and Clean-Label Products

One of the most notable trends in the France pea proteins market is the growing consumer preference for organic and clean-label food products. French consumers are increasingly scrutinizing ingredient labels, seeking transparency and simplicity in formulations. Pea protein, particularly when derived from organically grown yellow peas, aligns well with these expectations. Manufacturers are responding by offering certified organic pea protein products that are free from synthetic additives, preservatives, and genetically modified organisms (GMOs). For instance, in December 2022, Merit Functional Foods introduced its first USDA-Certified Organic Protein ingredient, Organic Peazazz C 850, made from organic peas grown on Canadian farms, offering exceptional solubility and texture enhancement with 85% protein content. This trend is particularly strong in premium product segments, where health-conscious buyers are willing to pay a premium for traceability and sustainability in food sourcing.

Innovation in Product Formulation and Functional Benefits

Continuous innovation in product development is reshaping the application landscape of pea proteins across France. Food and beverage companies are leveraging advancements in formulation technologies to improve the solubility, taste, and texture of pea protein, making it suitable for a broader range of applications such as plant-based cheeses, ready-to-drink beverages, and infant nutrition. Additionally, French brands are emphasizing functional benefits such as immunity enhancement, gut health support, and satiety in their marketing, integrating pea protein into multifunctional health products. These innovations are expanding consumer appeal beyond vegetarians and vegans to mainstream health-focused demographics.

Emergence of Local Processing and Sourcing Initiatives

Another key trend is the rise of domestic sourcing and local processing of pea protein, as France aims to reduce dependency on imported plant proteins. French agribusinesses and cooperatives are increasingly investing in local supply chains, from pulse farming to protein extraction, to meet growing demand and ensure product quality. For instance, the French government is also backing the €11.4 million, five-year AlinOVeg project, with €8.3 million in funding from France 2030, aimed at developing new plant-based products and solutions, optimizing the value of pea and fava bean crops, and supporting French farmers. This movement aligns with national sustainability objectives and has received policy support under the French Protein Plan, which promotes domestic legume cultivation. Localizing the supply chain not only supports rural economies but also allows manufacturers to market their products as locally produced and environmentally responsible, resonating with eco-conscious consumers.

Expansion of Retail and E-commerce Channels

Retail distribution patterns are also evolving rapidly in France, influencing the market dynamics of pea protein products. While health food stores and specialty retailers have traditionally dominated the distribution of plant-based proteins, mainstream supermarkets and hypermarkets are now expanding their plant-based offerings. At the same time, online sales are gaining momentum, driven by the convenience of digital shopping and a broader range of product choices. French consumers are increasingly turning to e-commerce platforms for accessing specialty nutrition products, including pea protein powders, bars, and fortified foods, contributing to wider market penetration and brand diversification.

Market Challenges Analysis:

High Production Costs and Price Sensitivity

One of the major restraints in the France pea proteins market is the relatively high cost of production compared to conventional animal and soy-based proteins. For instance, Roquette, a leading plant protein supplier with production sites in France and Canada, reported that pea prices increased by 120% in 2021 due to a 45% drop in Canadian pea production following an unprecedented drought, with additional crop damage in France from wet harvest conditions. The extraction and purification processes required to produce high-quality pea protein isolates involve advanced technologies and infrastructure, which increase operational costs. As a result, pea protein-based products often carry premium price tags, limiting their appeal to cost-sensitive consumers. This pricing challenge becomes particularly evident in mass-market food segments, where consumers may opt for more affordable protein sources, hindering widespread adoption across all income brackets.

Taste and Texture Limitations

Despite improvements in formulation, pea protein still faces ongoing challenges related to its inherent taste and texture. Many consumers report an earthy or bitter aftertaste, which can affect the sensory experience, particularly in beverages and dairy alternatives. Additionally, the gritty or chalky mouthfeel of some pea protein products can deter repeat purchases. These sensory drawbacks present a hurdle for manufacturers seeking to position their offerings as comparable to traditional dairy or meat-based products. Overcoming these limitations requires continuous investment in flavor-masking technologies and texture-enhancing formulations.

Regulatory and Allergen Labeling Challenges

Navigating regulatory requirements and food labeling standards also presents a challenge for pea protein manufacturers in France. While pea protein is generally considered hypoallergenic, it must still be labeled carefully to avoid confusion with other legumes that may cause allergic reactions. Compliance with European Food Safety Authority (EFSA) guidelines and evolving food safety standards adds complexity to product development and marketing. For small and mid-sized manufacturers, aligning with these regulatory demands without inflating production costs can be particularly challenging.

Market Opportunities:

The France pea proteins market presents substantial growth opportunities driven by increasing consumer alignment with plant-based nutrition and national sustainability goals. As dietary habits evolve and the population becomes more health-conscious, there is a growing demand for alternative protein sources that are both nutritionally robust and environmentally sustainable. Pea protein, with its clean-label positioning and allergen-free nature, fits this demand profile and stands to benefit from rising interest in flexitarian and vegan lifestyles. Moreover, government-backed initiatives under the French Protein Plan, which aim to reduce reliance on imported soy and animal proteins, are supporting the development of domestic pulse crops. This policy environment creates a favorable ecosystem for stakeholders across the pea protein value chain—from growers to manufacturers—who can capitalize on incentives, subsidies, and increased consumer awareness.

In addition to domestic demand, there are significant opportunities for French companies to scale pea protein exports across Europe, where similar shifts in dietary preferences are taking place. As France strengthens its local processing capacity, it can position itself as a regional hub for premium pea protein production. Furthermore, innovation in end-use applications—ranging from infant nutrition to senior health products—offers niche yet high-potential segments for expansion. Companies that invest in advanced processing technologies, flavor enhancement techniques, and strategic partnerships with food and beverage brands are likely to capture larger market share. With continued emphasis on clean, functional, and sustainable nutrition, the France pea proteins market offers an attractive landscape for long-term investment and innovation.

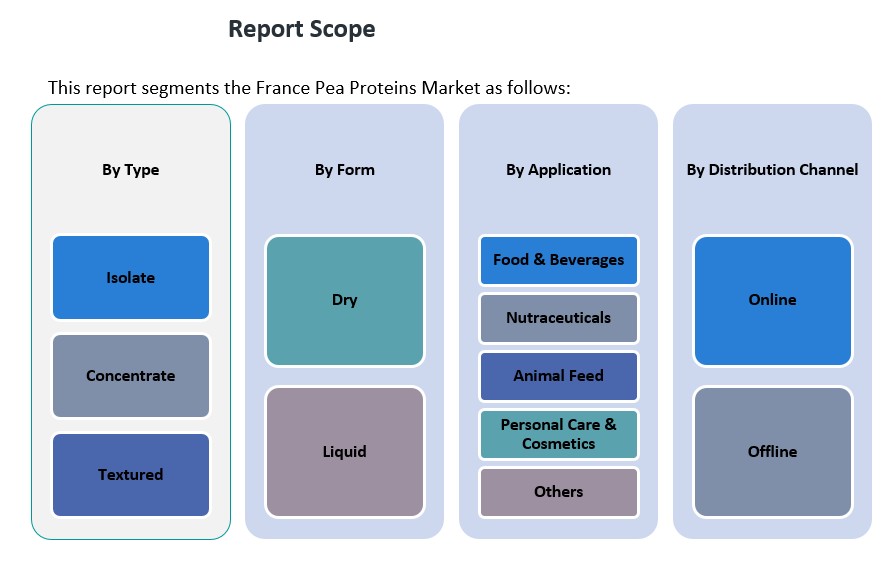

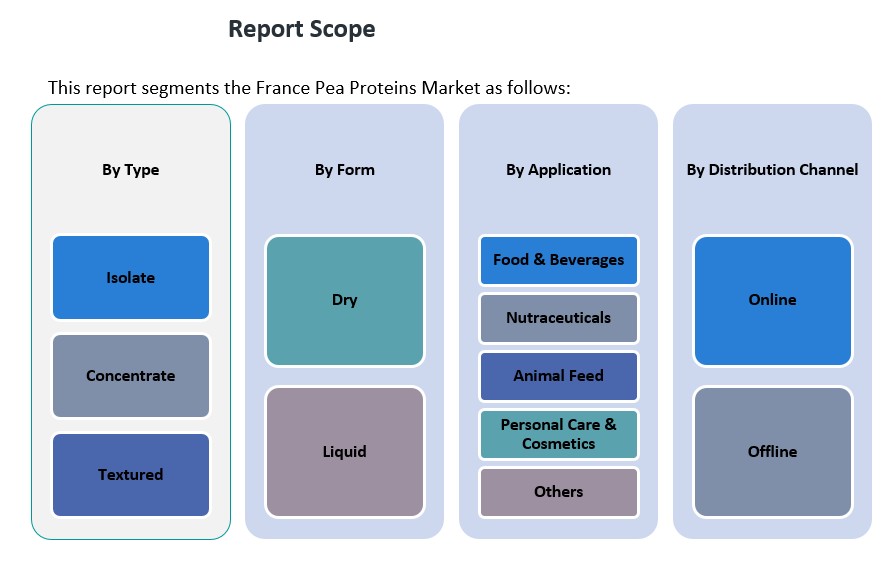

Market Segmentation Analysis:

The France pea proteins market is segmented

By type, application, form, and distribution channel, each reflecting evolving consumer preferences and industrial requirements. Among types, pea protein isolates dominate the market due to their high protein content and superior functionality in health and wellness products. Concentrates are gaining traction in mainstream food applications owing to their cost-effectiveness and balanced nutritional profile, while textured pea proteins are increasingly used in meat analogs and ready-to-cook meals for their fibrous structure and ability to mimic meat texture.

By application, the food and beverages segment accounts for the largest share, driven by growing demand for plant-based dairy alternatives, protein bars, and meal replacements. The nutraceuticals segment is also witnessing strong growth, fueled by rising consumer interest in preventive health and fitness-focused supplements. Animal feed is an emerging segment, supported by interest in sustainable livestock nutrition, while personal care and cosmetics are gradually incorporating pea protein due to its moisturizing and anti-aging properties. The ‘others’ category includes specialized industrial uses, such as biodegradable packaging and adhesives.

By form, dry pea proteins lead the market, preferred for their longer shelf life, ease of transport, and wide application in powdered and processed food products. Liquid pea proteins are used in niche beverage formulations, although their market share remains smaller.

By distribution channel, offline retail—comprising supermarkets, health stores, and pharmacies—continues to dominate. However, online sales are growing steadily as consumers seek convenience and variety, particularly for niche dietary supplements and specialty health products.

Segmentation:

By Type

- Isolate

- Concentrate

- Textured

By Application

- Food & Beverages

- Nutraceuticals

- Animal Feed

- Personal Care & Cosmetics

- Others

By Form

By Distribution Channel

Regional Analysis:

The France pea proteins market exhibits notable regional variations, reflecting differences in consumer preferences, urbanization, and access to health-focused retail channels. Urban centers such as Paris, Lyon, and Marseille lead in market share, collectively accounting for approximately 45% of national consumption. These cities benefit from a high concentration of health-conscious consumers, a proliferation of specialty health food stores, and a strong presence of fitness and wellness communities. The availability of diverse plant-based products in these metropolitan areas further drives the adoption of pea protein.

In the Île-de-France region, which encompasses Paris, the demand for pea protein is particularly robust, driven by a dense population and a significant number of consumers adhering to vegetarian, vegan, or flexitarian diets. The region’s advanced retail infrastructure and emphasis on sustainable food choices contribute to its leading position in the market.

The Auvergne-Rhône-Alpes region, with Lyon as a central hub, holds a substantial share of the market, estimated at around 15%. The region’s focus on health and wellness, combined with a growing elderly population seeking high-quality protein sources, supports the increased consumption of pea protein products.

In the southern regions of France, including Occitanie and Provence-Alpes-Côte d’Azur, the market share is approximately 20%. These areas are experiencing a gradual increase in pea protein adoption, influenced by rising health awareness and the expansion of plant-based product offerings in local markets.

The northern regions, such as Hauts-de-France and Grand Est, collectively contribute around 10% to the national market. While traditionally less focused on plant-based diets, these regions are witnessing growth in pea protein consumption due to increased availability in mainstream retail channels and government initiatives promoting sustainable agriculture.

The remaining 10% of the market is distributed across other regions, including Brittany and Nouvelle-Aquitaine, where the adoption of pea protein is emerging, supported by local health campaigns and the integration of plant-based options in regional cuisines.

Key Player Analysis:

- Roquette Frères

- Cosucra Groupe Warcoing

- Burcon NutraScience Corporation

- Emsland Group

- Shandong Jianyuan Group

- Naturz Organics

- Fenchem Biotek Ltd.

- Kerry Group

- Sotexpro

- Meelunie B.V.

Competitive Analysis:

The France pea proteins market features a moderately competitive landscape, characterized by the presence of both global suppliers and regional players striving to strengthen their market position. Leading companies such as Roquette Frères, Cosucra Groupe Warcoing, and Ingredion Incorporated dominate the market with well-established production facilities and extensive distribution networks. These firms focus on innovation, offering advanced pea protein isolates and textured forms tailored for diverse applications across food, nutraceutical, and personal care sectors. Strategic partnerships with food manufacturers and investments in sustainable sourcing practices further reinforce their market leadership. Meanwhile, smaller domestic companies are gaining traction by offering organic, clean-label alternatives that appeal to health-conscious and environmentally aware consumers. Continuous product development, coupled with expanding retail and e-commerce reach, enables these players to meet evolving consumer demands. As competition intensifies, differentiation through quality, sustainability, and application-specific functionality remains a critical factor for sustained growth in the French market.

Recent Developments:

- In February 2024, Roquette Frères advanced its presence in the France pea proteins market by launching four new multi-functional pea proteins under its NUTRALYS® range: NUTRALYS® Pea F853M (isolate), NUTRALYS® H85 (hydrolysate), NUTRALYS® T Pea 700FL (textured), and NUTRALYS® T Pea 700M (textured). These innovations are designed to improve taste, texture, and application flexibility for food manufacturers, especially in plant-based and high-protein nutritional products.

- In December 2024, Burcon NutraScience Corporation introduced its next-generation Peazazz®C pea protein, which boasts over 90% protein purity and low sodium content. This product, made from North American non-GMO field peas, is targeted at beverages, dairy alternatives, baked goods, and nutrition products, and reflects Burcon’s commitment to high-purity, clean-tasting plant proteins.

- In April 2024, Edonia, a French company specializing in plant-based ingredients, raised EUR 2 million to accelerate the production of ingredients derived from microalgae. This funding will enable Edonia to expedite its market entry across Europe and pursue strategic partnerships for international expansion, further contributing to innovation within the broader plant protein sector in France.

Market Concentration & Characteristics:

The France pea proteins market exhibits a moderately concentrated structure, with a few dominant players accounting for a significant share of overall revenue. Companies like Roquette Frères and Cosucra Groupe Warcoing lead the market, leveraging advanced processing capabilities and robust supply chains to maintain a competitive edge. The market is characterized by a strong emphasis on innovation, with a growing number of companies investing in improved formulations, organic certifications, and functional product offerings tailored to diverse consumer needs. Sustainability and clean-label positioning are key characteristics, as French consumers increasingly favor transparent and environmentally responsible brands. While large enterprises continue to expand their presence through strategic collaborations and R&D investments, emerging firms are entering the market with niche offerings such as allergen-free or locally sourced pea proteins. This balance between established leadership and growing new entrants fosters healthy competition and continuous advancement in product quality and application diversity within the French pea protein industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Form and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for pea protein is expected to rise with increasing consumer shift toward plant-based and flexitarian diets.

- Continued investment in R&D will enhance product taste, texture, and solubility, expanding usage across food categories.

- Government support for domestic legume cultivation will strengthen local supply chains and reduce reliance on imports.

- Expansion of clean-label and organic product lines will attract health-conscious and environmentally aware consumers.

- Growth in sports nutrition and functional food sectors will open new high-value application opportunities.

- E-commerce platforms will play a larger role in distribution, particularly for personalized nutrition and supplements.

- Rising awareness of pea protein’s hypoallergenic properties will drive its adoption in infant and senior nutrition.

- Technological advancements in protein extraction will improve cost-efficiency and scalability for manufacturers.

- Collaboration between manufacturers and foodservice brands will increase visibility and integration in mainstream diets.

- Regional market penetration will improve as awareness spreads beyond urban hubs into rural and semi-urban areas.