Market Overview:

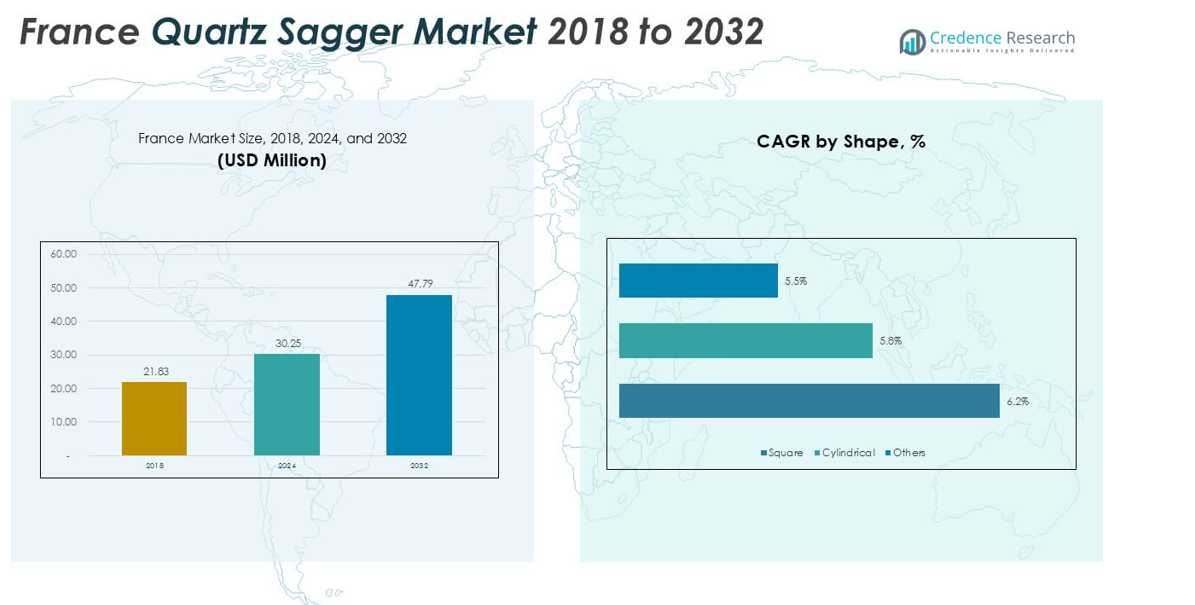

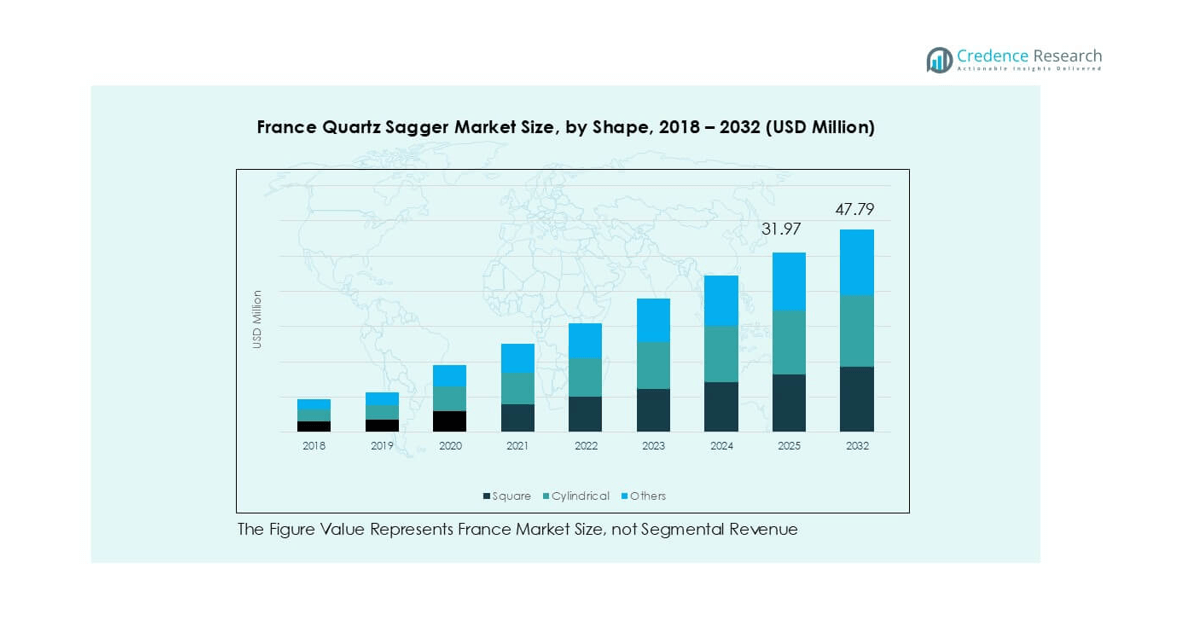

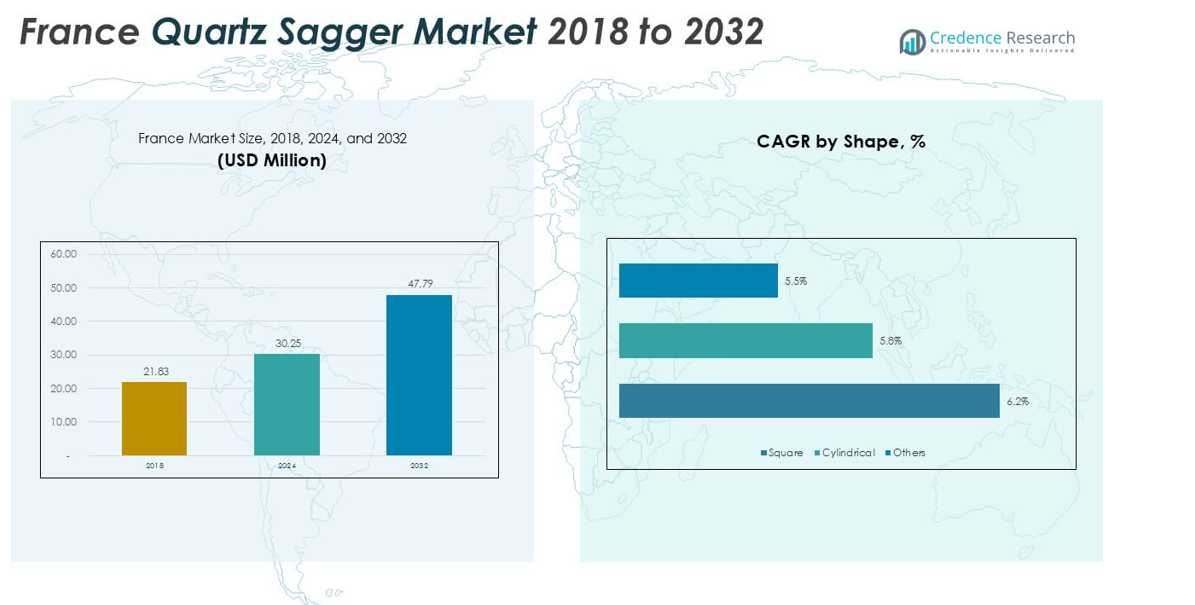

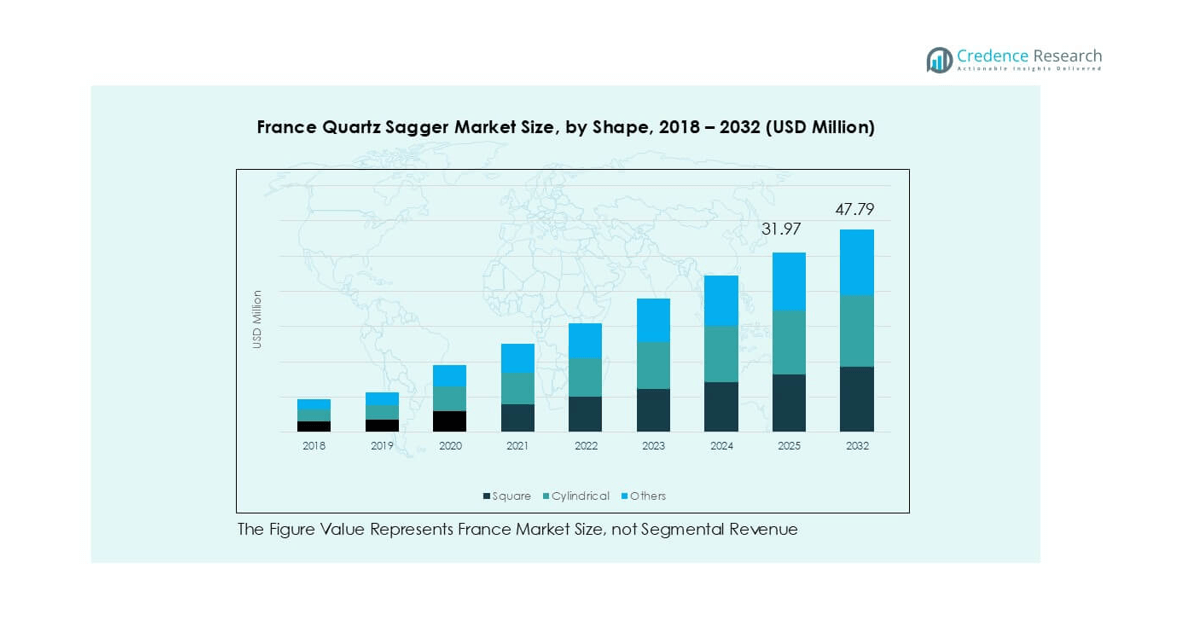

France Quartz Sagger market size was valued at USD 21.83 million in 2018, increasing to USD 30.25 million in 2024, and is anticipated to reach USD 47.79 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Quartz Sagger Market Size 2024 |

USD 30.25 million |

| France Quartz Sagger Market, CAGR |

5.9% |

| France Quartz Sagger Market Size 2032 |

USD 47.79 million |

The France quartz sagger market is led by key companies such as Saint-Gobain, NORITAKE CO., LIMITED, Morgan Advanced Materials plc, Zibo Gotrays Industry Co., Ltd., and Liling Zen Ceramic Co., Ltd. These players dominate through advanced production technologies, durable product lines, and strong ties with semiconductor and metallurgy manufacturers. Saint-Gobain holds a notable presence in high-performance refractories, while NORITAKE focuses on precision ceramic applications. Île-de-France leads regionally, accounting for over 35% of total market share, supported by dense industrial and R&D activities. Auvergne–Rhône-Alpes follows with around 25%, driven by strong metallurgical and glass-processing industries.

Market Insights

- The France quartz sagger market was valued at USD 30.25 million in 2024 and is projected to reach USD 47.79 million by 2032, expanding at a CAGR of 5.9% during 2025–2032.

- Rising demand from semiconductor and advanced ceramics industries drives market expansion, supported by technological upgrades in heat treatment and sintering systems.

- Key trends include the adoption of customized and precision-engineered saggers and a shift toward eco-efficient and recyclable materials in line with industrial decarbonization goals.

- The competitive landscape features major players like Saint-Gobain, NORITAKE, Morgan Advanced Materials, Zibo Gotrays, and Liling Zen Ceramic, focusing on product innovation and high-purity quartz sourcing.

- Île-de-France leads regionally with 35% market share, followed by Auvergne–Rhône-Alpes at 25%, driven by strong industrial and R&D ecosystems supporting electronics, metallurgy, and glass manufacturing sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Shape

The cylindrical segment dominated the France quartz sagger market in 2024, accounting for over 45% of the total share. Cylindrical saggers are widely used for uniform heat distribution and structural stability during high-temperature processes, making them ideal for semiconductor and ceramic firing operations. Their geometry minimizes cracking and thermal stress, extending service life in continuous furnaces. Demand is reinforced by precision manufacturing in electronics and metallurgy sectors that require consistent sintering results. Square and other custom-shaped saggers serve niche uses in laboratory and specialty material processing.

- For instance, STMicroelectronics operates its Crolles 300-mm wafer fab with over 500 high-temperature process chambers, each relying on cylindrical quartz carriers for diffusion and oxidation stages.

By Application

The sintering powders segment held the largest share, exceeding 40% in 2024, driven by its extensive use in electronic components and advanced ceramics. Quartz saggers provide exceptional thermal shock resistance and chemical inertness, essential for maintaining purity in sintering environments. France’s growing semiconductor fabrication and technical ceramics industries continue to rely on these saggers to ensure high-quality powder compaction. The firing ceramics and heat-treating metals segments are also expanding, supported by innovations in high-temperature materials and precision furnaces for metallurgical applications.

- For instance, Imerys operates advanced ceramics facilities globally, utilizing different methods to create its products. In France, the company produces high-purity quartz and has a plant in La Bathie that produces up to 40,000 metric tons of fused alumina annually through an electrofusion process

By End User

The electronics and semiconductors industry emerged as the leading end user in 2024, capturing over 50% of market share. The dominance stems from rising adoption in wafer processing, dielectric sintering, and high-purity component manufacturing. Quartz saggers are preferred for their low contamination and stability under extreme thermal cycles critical in semiconductor fabrication. France’s expanding microelectronics ecosystem, supported by initiatives such as the European Chips Act, drives continued demand. Metallurgy and glass industries follow, utilizing quartz saggers for consistent thermal treatment and material integrity in specialized production lines.

Key Growth Drivers

Rising Demand from Semiconductor Manufacturing

The rapid expansion of France’s semiconductor sector is a major driver for the quartz sagger market. Quartz saggers play a vital role in wafer fabrication, dielectric sintering, and substrate processing, where high thermal stability and purity are crucial. As companies such as STMicroelectronics and Soitec scale their production capacities under the EU Chips Act, the need for high-performance thermal processing materials continues to rise. These saggers ensure contamination-free environments and durability at extreme temperatures, supporting consistent yields in advanced chip manufacturing. The country’s investment in domestic semiconductor facilities further accelerates adoption, especially in precision sintering applications.

- For instance, in 2022, STMicroelectronics and GlobalFoundries announced a plan for a new, jointly-operated 300mm wafer manufacturing facility in Crolles, France, adjacent to an existing ST site. The project, which was to be backed by French government funds under the EU Chips Act, targeted a full-build annual capacity of 620,000 wafers.

Growth in Advanced Ceramics and Metallurgical Applications

France’s expanding ceramics and metallurgy industries are fueling quartz sagger demand for sintering powders, refractory components, and metal heat treatment. Quartz’s ability to maintain dimensional stability and resist chemical corrosion makes it ideal for firing and sintering high-performance materials. The increasing production of advanced technical ceramics for aerospace, defense, and electronics sectors is driving steady adoption. Similarly, metallurgical firms rely on quartz saggers to ensure temperature uniformity in alloy formation. As sustainability targets push for longer-lasting and recyclable refractory components, French manufacturers increasingly favor quartz over traditional alumina or mullite materials.

- For instance, Safran Ceramics operates advanced sintering lines for silicon carbide (SiC) composites used in aircraft engines, with furnaces exceeding 1,800°C, relying on specialized refractory saggers made from materials like high-purity alumina or silicon carbide for dimensional accuracy.

Technological Advancements in High-Temperature Processing Equipment

Ongoing technological advancements in furnaces and sintering systems are boosting the efficiency of quartz sagger usage. Modern kilns now operate at higher temperatures and require materials capable of withstanding rapid thermal cycling without deformation. This trend favors quartz saggers with enhanced mechanical strength and reduced impurity levels. French manufacturers are integrating advanced design features, such as precision-shaped saggers and automated handling compatibility, to reduce operational downtime. Furthermore, the move toward digital monitoring of heat treatment processes promotes the use of standardized, high-performance saggers that maintain structural integrity during repeated cycles, reinforcing overall process reliability and energy efficiency.

Key Trends & Opportunities

Shift Toward Customized and Precision-Engineered Saggers

A major trend is the growing shift toward customized quartz saggers designed for specific industrial applications. French manufacturers are increasingly producing precision-engineered saggers tailored to unique furnace configurations and material specifications. This customization ensures optimal heat transfer, reduced contamination risk, and longer operational life. Demand for customized saggers is rising especially among semiconductor and ceramic component producers that operate under strict quality control parameters. The ongoing adoption of computer-aided design and 3D forming technologies further allows manufacturers to produce consistent, high-tolerance saggers, offering a strong competitive advantage in France’s precision manufacturing landscape.

- For instance, Saint-Gobain’s Performance Ceramics & Refractories business manufactures high-purity silicon carbide saggers, such as its PowerCeram™ line, for thermal processing applications, including the production of electronic

Growing Adoption of Sustainable and Recyclable Refractory Materials

The increasing focus on sustainability in France’s industrial production offers new opportunities for quartz sagger manufacturers. Companies are seeking eco-efficient materials with extended service life and reduced energy consumption during sintering. Quartz saggers, known for reusability and recyclability, align well with these goals. Furthermore, regulatory initiatives promoting clean manufacturing practices, such as France’s Industrial Decarbonization Plan, are pushing industries toward low-waste and long-lasting thermal equipment. This creates growth potential for suppliers providing environmentally responsible quartz saggers designed for reduced degradation and enhanced lifecycle performance in high-temperature environments.

Key Challenges

High Production and Material Costs

One of the major challenges for the France quartz sagger market is the high cost of raw materials and manufacturing. Producing high-purity quartz components requires specialized processing techniques and tight quality control, which significantly raise production expenses. Additionally, fluctuations in silica sand supply and energy prices further impact cost stability. Small and mid-sized producers often struggle to compete with low-cost imports from Asian manufacturers that benefit from economies of scale. To maintain competitiveness, French manufacturers are investing in automated fabrication and efficient forming methods, though cost optimization remains an ongoing constraint.

Limited Awareness and Substitution by Alternative Materials

Another challenge lies in the limited awareness of quartz sagger advantages among small-scale end users and the increasing competition from substitute materials. Alternatives like alumina and silicon carbide saggers offer comparable heat resistance at lower upfront costs, attracting cost-sensitive buyers. Many traditional industries also lack the technical understanding of quartz’s long-term benefits, such as purity retention and minimal contamination. This situation limits large-scale replacement opportunities. Expanding customer education, promoting case-based performance data, and developing hybrid sagger compositions could help overcome this restraint and reinforce quartz’s position in France’s high-temperature processing market.

Regional Analysis

Northern France

Northern France held the largest share of about 32% in the France quartz sagger market in 2024. The region’s strong industrial base in metallurgy, ceramics, and glass manufacturing fuels consistent demand for high-purity quartz saggers. Major cities such as Lille and Rouen host several refractory and metal-processing facilities that rely on advanced saggers for heat treatment and sintering operations. Supportive regional policies promoting industrial modernization and energy-efficient furnace systems further strengthen adoption. The presence of established suppliers and easy access to European logistics routes enhances the region’s competitiveness and production capacity.

Eastern France

Eastern France accounted for around 27% of the market share in 2024, supported by its thriving metallurgical and specialty ceramics sectors. Industrial hubs across Alsace and Lorraine have long histories of material innovation, which now extend into high-performance quartz sagger production. The region benefits from close proximity to Germany and Switzerland, enabling cross-border trade and technology collaboration in advanced manufacturing. Growing adoption in powder sintering and high-temperature alloy treatment continues to boost demand. Eastern France’s industrial clusters also focus on sustainable production processes, reinforcing long-term growth prospects for quartz saggers.

Western France

Western France represented about 22% of the France quartz sagger market in 2024, driven by its expanding glass and advanced materials industries. Key cities such as Nantes and Rennes are fostering new production units for ceramics and heat-resistant materials. The region’s focus on eco-friendly manufacturing and technological upgrades in furnace design has accelerated the use of quartz saggers for consistent, high-purity thermal processing. Western France also benefits from strong academic collaboration with materials science institutes, promoting R&D initiatives. Investments in industrial automation and digital monitoring systems further contribute to market expansion across local manufacturing units.

Southern France

Southern France captured nearly 19% of the total market share in 2024, propelled by the region’s robust aerospace, semiconductor, and materials research ecosystem. Cities such as Toulouse and Marseille are major innovation centers for high-temperature processing applications, where quartz saggers are essential. The region’s glass and electronics industries increasingly adopt saggers to maintain quality and reduce production defects under extreme thermal conditions. Southern France’s focus on clean manufacturing and its proximity to Mediterranean export ports support both domestic supply and international trade. Continued investments in advanced furnace technologies ensure a stable growth trajectory.

Market Segmentations:

By Shape

- Square

- Cylindrical

- Others

By Application

- Firing Ceramics

- Sintering Powders

- Heat Treating Metals

- Others

By End User

- Electronics and Semiconductors Industry

- Metallurgy Industries

- Glass Industries

- Others

By Geography

- Northern France

- Eastern France

- Western France

- Southern France

Competitive Landscape

The France quartz sagger market features a moderately consolidated competitive landscape, with global and regional players focusing on product innovation, purity enhancement, and furnace compatibility. Leading companies such as Saint-Gobain, NORITAKE CO., LIMITED, and Morgan Advanced Materials plc dominate through advanced ceramic engineering and extensive distribution networks. Domestic firms like Zibo Gotrays Industry Co., Ltd. and Liling Zen Ceramic Co., Ltd. cater to specialized applications across ceramics and semiconductor industries, emphasizing cost efficiency and product customization. Emerging players such as Shandong Topower Pte Ltd. and Magma Group are expanding through technical collaborations and sustainable manufacturing initiatives. Competition centers on high-purity quartz sourcing, dimensional precision, and extended thermal life cycles. Increasing investments in automation and localized production are shaping the strategic direction, while partnerships with semiconductor and advanced material manufacturers strengthen long-term market positioning in France’s growing high-temperature processing ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zibo Gotrays Industry Co., Ltd

- Saint-Gobain

- NORITAKE CO., LIMITED

- Morgan Advanced Materials plc

- Liling Zen Ceramic Co., Ltd.

- Shandong Topower Pte Ltd.

- Magma Group

- Other Key Players

Recent Developments

- In 2023, Sumitomo Refractories announces the development of a sustainable, recyclable quartz sagger.

- In 2022, RHI Magnesita invests in a new manufacturing facility for advanced quartz saggers in China.

Report Coverage

The research report offers an in-depth analysis based on Shape, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The France quartz sagger market is expected to grow steadily through 2032 with strong industrial adoption.

- Rising investments in semiconductor and electronics manufacturing will drive sustained product demand.

- Technological advancements in high-temperature sintering and kiln design will improve performance efficiency.

- Companies will focus on developing lightweight and long-lasting saggers for industrial optimization.

- Increased automation in production lines will enhance quality consistency and reduce process losses.

- Adoption of recyclable and eco-efficient materials will align with national sustainability goals.

- Imports of high-purity quartz materials may increase to meet precision standards.

- Domestic manufacturers will expand collaboration with furnace and ceramic component producers.

- Île-de-France and Auvergne–Rhône-Alpes will remain key production and consumption hubs.

- Continuous R&D investments will ensure France’s leadership in advanced refractory and thermal solutions.