Market Overview:

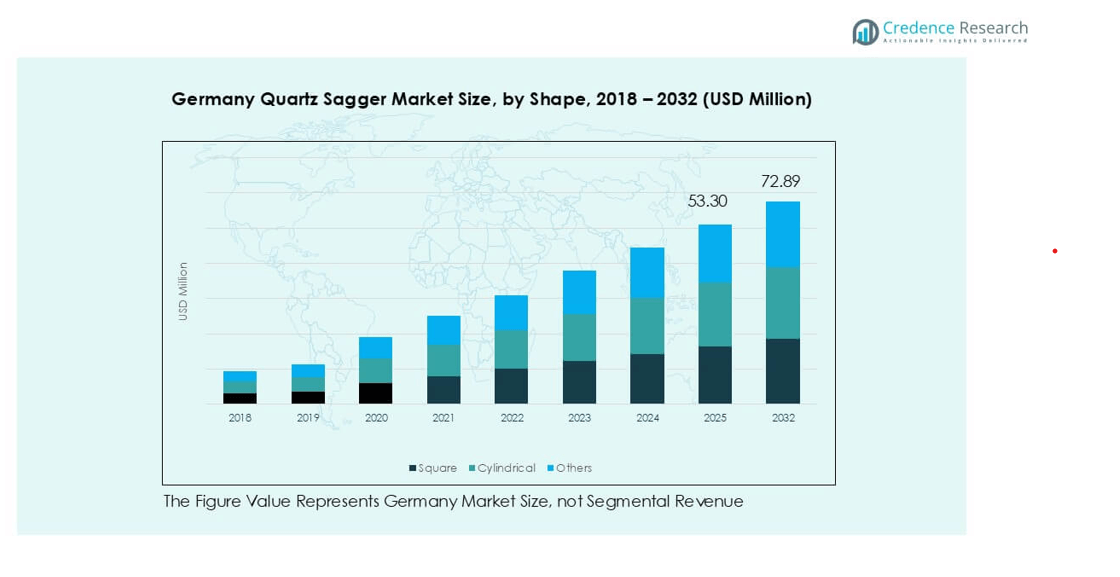

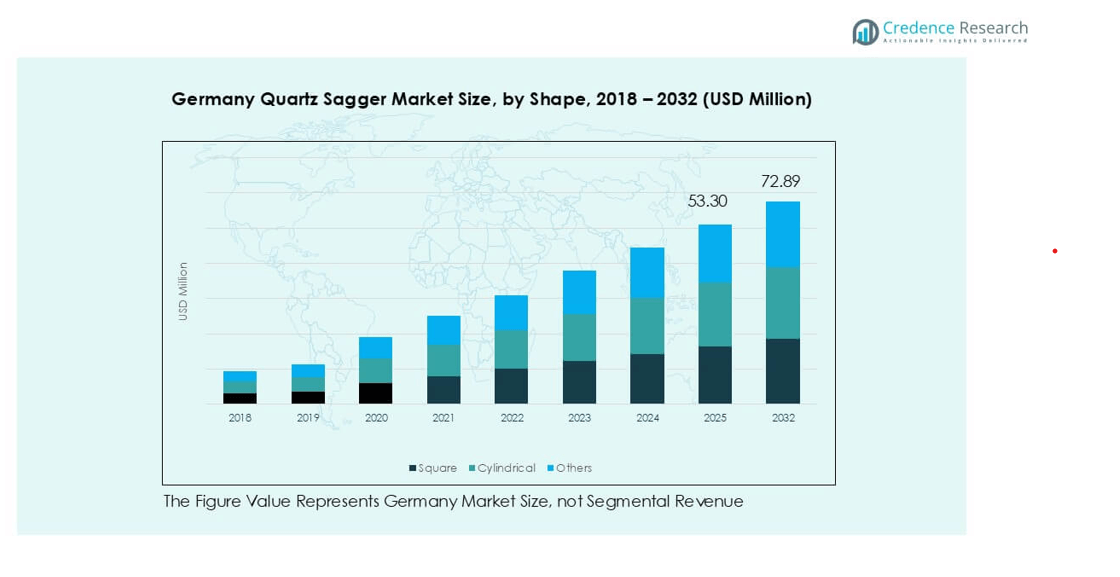

Germany quartz sagger market size was valued at USD 39.78 million in 2018, increasing to USD 51.08 million in 2024, and is anticipated to reach USD 72.89 million by 2032, growing at a CAGR of 4.45% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Quartz Sagger Market Size 2024 |

USD 51.08 million |

| Germany Quartz Sagger Market, CAGR |

4.45% |

| Germany Quartz Sagger Market Size 2032 |

USD 72.89 million |

The Germany quartz sagger market is led by prominent companies such as Saint-Gobain, NORITAKE CO., LIMITED, Morgan Advanced Materials plc, and Zibo Gotrays Industry Co., Ltd, supported by regional players like Liling Zen Ceramic Co., Ltd and Shandong Topower Pte Ltd. These firms dominate through advanced material engineering, customized sagger solutions, and integration with automated furnace systems. North Germany emerged as the leading region in 2024, capturing 30% of the national market share, driven by strong semiconductor and glass manufacturing activity. South Germany follows with 28%, supported by automotive and ceramics industries, while East Germany holds 22%, boosted by semiconductor clusters in Saxony.

Market Insights

- The Germany quartz sagger market was valued at USD 51.08 million in 2024 and is projected to reach USD 72.89 million by 2032, growing at a CAGR of 4.45%.

- Key growth is driven by rising semiconductor and advanced ceramics production, where quartz saggers ensure high-purity sintering and temperature stability.

- Market trends highlight growing demand for customized and high-purity sagger designs compatible with smart furnaces and automated manufacturing systems.

- Leading players such as Saint-Gobain, NORITAKE CO., LIMITED, and Morgan Advanced Materials plc dominate through product innovation, while regional suppliers like Zibo Gotrays Industry Co., Ltd expand cost-efficient offerings.

- North Germany leads with 30% share, followed by South Germany (28%), driven by electronics and automotive ceramics; by shape, square saggers hold over 45% share, and by end user, electronics and semiconductor industries account for about 50% of total demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Shape

The square segment dominated the Germany quartz sagger market in 2024, accounting for over 45% of total demand. Its dominance stems from high thermal stability, even heat distribution, and suitability for automated furnace systems. Square saggers are widely used in semiconductor sintering and precision ceramic firing due to their consistent dimensional control. The cylindrical type follows, mainly preferred in laboratory-scale and specialized metallurgy processes. Growing use of customized designs in advanced manufacturing supports further growth of square saggers across industrial applications.

- For instance, Kyocera Corporation developed precision square silicon carbide saggers and other advanced ceramic products for semiconductor sintering furnaces, which can operate at temperatures of over 1,400°C. These products are designed for the high-temperature processing stages of manufacturing and are made to high specifications, ensuring reliability for chip production.

By Application:

\The sintering powders segment held the largest share in 2024, representing around 40% of market volume. Its leadership is driven by rising adoption in lithium-ion battery components, ceramic substrates, and semiconductor materials that require controlled thermal processing. Sintering operations increasingly demand quartz saggers due to their low thermal expansion and chemical inertness. Firing ceramics remains another key application, supported by the expansion of technical ceramics in electronics and automotive parts. The trend toward miniaturized and high-purity materials continues to reinforce the dominance of sintering applications.

- For instance, QSIL GmbH supplies precision quartz saggers for electronic-grade ceramic firing lines, which are valued for their high thermal stability, purity, and shock resistance.

By End User:

The electronics and semiconductors industry led the market in 2024, capturing approximately 50% share. Strong demand from wafer fabrication, LED production, and chip packaging drives this leadership. Quartz saggers are essential for high-temperature annealing and diffusion processes, where dimensional accuracy and material purity are critical. Metallurgy industries follow closely, using quartz saggers for alloy heat treatment and controlled sintering. The ongoing growth of Germany’s semiconductor production capacity and advanced material manufacturing is expected to sustain high adoption among electronics end users through 2032.

Key Growth Drivers

Expansion of the Semiconductor Manufacturing Sector

Germany’s rapidly expanding semiconductor industry is a major growth driver for the quartz sagger market. The country’s focus on strengthening its domestic chip production, supported by the EU Chips Act and government funding, is increasing demand for high-purity thermal processing equipment. Quartz saggers are critical in wafer sintering, diffusion, and annealing processes due to their resistance to high temperatures and contamination. Companies such as Infineon Technologies and Bosch Semiconductor are expanding local fabs, which boosts quartz sagger consumption. As advanced chip production transitions to smaller nodes, precision and purity requirements intensify, strengthening market growth through 2032.

- For instance, Infineon Technologies began constructing a new 300-mm power semiconductor plant in Dresden in 2023, designed to process over 12 million wafers annually once operational in 2026

Rising Adoption in Advanced Ceramics Production

The surge in demand for advanced ceramics in electronics, automotive, and energy applications fuels the use of quartz saggers in Germany. These saggers provide stable performance during sintering and firing processes, ensuring uniform heating and preventing contamination. High-end ceramics used in sensors, capacitors, and electric vehicle components rely on quartz saggers for precision temperature control. Increased R&D in ceramic coatings and substrate materials further accelerates demand. With Germany being a hub for automotive technology and material innovation, the integration of ceramic components in EVs and industrial systems continues to drive quartz sagger adoption across manufacturing lines.

- For instance, CeramTec AG operates over 20 production lines in Germany for advanced ceramic components used in sensors and medical devices, requiring continuous use of high-temperature saggers.

Growing Focus on Energy Efficiency and High-Temperature Performance

Manufacturers in Germany are prioritizing energy-efficient thermal processing, which directly increases demand for high-performance quartz saggers. Their low thermal expansion and high insulation properties enable reduced energy loss during repeated heating cycles. Industries such as metallurgy, glass, and semiconductors rely on these saggers to optimize furnace performance and extend operational lifespan. The shift toward decarbonization in industrial processes also supports the use of quartz-based materials that minimize emissions and enhance process stability. As energy efficiency regulations tighten, quartz saggers with superior durability and lower maintenance costs are becoming integral to achieving sustainable production targets.

Key Trends & Opportunities

Increasing Automation and Smart Furnace Integration

A growing trend in Germany’s manufacturing sector is the integration of smart furnaces and automated handling systems that use precision quartz saggers. These systems enhance temperature uniformity, minimize human error, and improve throughput in semiconductor and ceramic production lines. The demand for digitally monitored sintering and firing processes aligns with Industry 4.0 initiatives. Manufacturers are developing saggers compatible with robotic loading and sensor-equipped furnaces, enabling real-time quality control. This automation-driven modernization opens opportunities for domestic producers to supply advanced saggers tailored to high-tech manufacturing environments.

- For instance, ECM Technologies does install automated furnace systems and has a German subsidiary. Its ECM Robotics division integrates robots for handling various loads, from fragile substrates to very heavy items.

Shift Toward Customized and High-Purity Sagger Designs

An emerging opportunity lies in the growing demand for customized quartz saggers designed for specific temperature profiles and material loads. German manufacturers are investing in advanced forming technologies and precision machining to meet client-specific requirements in semiconductors and specialty ceramics. The need for ultra-clean environments in chip fabrication and optical glass production drives demand for saggers with superior purity and minimal thermal deformation. Companies focusing on tailored product design, material innovation, and local supply capabilities stand to capture strong growth potential in this evolving niche market.

Key Challenges

High Manufacturing and Material Costs

The production of quartz saggers involves high-purity raw materials and precision forming processes, resulting in elevated manufacturing costs. Germany’s stringent quality standards and labor expenses further contribute to cost pressures. This limits the competitiveness of local producers against lower-cost suppliers from Asia. Moreover, quartz material sourcing is sensitive to global supply chain fluctuations, which can increase procurement costs. As industries demand larger volumes of custom-designed saggers, maintaining profitability while ensuring technical precision becomes challenging, especially for small and mid-sized manufacturers in the region.

Competition from Alternative Refractory Materials

The increasing availability of cost-effective refractory materials such as alumina and silicon carbide poses a significant challenge to quartz sagger adoption. These alternatives offer good thermal resistance at lower prices, appealing to industries less sensitive to contamination or dimensional precision. While quartz provides superior purity and stability, not all applications require such performance levels. The substitution risk is particularly high in metallurgy and non-critical ceramic processing. To retain market share, quartz sagger manufacturers must emphasize product differentiation, highlighting long-term efficiency, recyclability, and lower lifecycle costs over cheaper alternatives.

Regional Analysis

North Germany

North Germany accounted for around 30% of the quartz sagger market in 2024, driven by strong industrial infrastructure and semiconductor activity. The region hosts advanced manufacturing hubs in Hamburg and Lower Saxony, focusing on precision ceramics and electronics processing. Expansion of wafer fabrication and cleanroom technologies has increased demand for high-purity saggers. Additionally, ongoing investments in renewable energy and glass production enhance the need for durable thermal containment equipment. Supportive industrial policies and proximity to major ports facilitate efficient material imports and exports, sustaining North Germany’s leadership in quartz sagger utilization.

South Germany

South Germany captured approximately 28% of the market share in 2024, supported by a strong base of automotive, ceramic, and semiconductor manufacturers. Bavaria and Baden-Württemberg lead production, hosting several advanced material and electronics firms. The growing use of quartz saggers in sintering EV components and precision ceramics for automotive applications fuels regional demand. Continuous R&D in high-performance materials and close collaboration between industry and research institutes strengthen innovation. Rising adoption of Industry 4.0 technologies across manufacturing lines further supports quartz sagger integration in automated thermal processing systems.

East Germany

East Germany held around 22% of the quartz sagger market in 2024, led by the expansion of electronics and photovoltaic manufacturing. Saxony, known as “Silicon Saxony,” serves as a major semiconductor hub, with fabs operated by Infineon and GlobalFoundries driving consistent sagger demand. The region’s advanced infrastructure and access to skilled labor support continuous industrial growth. Additionally, investments in glass and optical materials production contribute to quartz sagger usage in high-temperature applications. Government-backed programs promoting high-tech manufacturing and innovation continue to strengthen East Germany’s position in the national market.

West Germany

West Germany represented roughly 20% of the market share in 2024, supported by metallurgy, glass, and specialty ceramics industries concentrated in North Rhine-Westphalia and Hesse. The region’s established heavy industrial base relies on quartz saggers for heat treatment, alloy processing, and precision firing. Growing modernization of furnace operations and the shift toward eco-efficient production methods encourage adoption of high-durability saggers. Although competition from other regions remains strong, ongoing investments in energy-efficient manufacturing and circular material reuse are expected to enhance West Germany’s role in the national quartz sagger market by 2032.

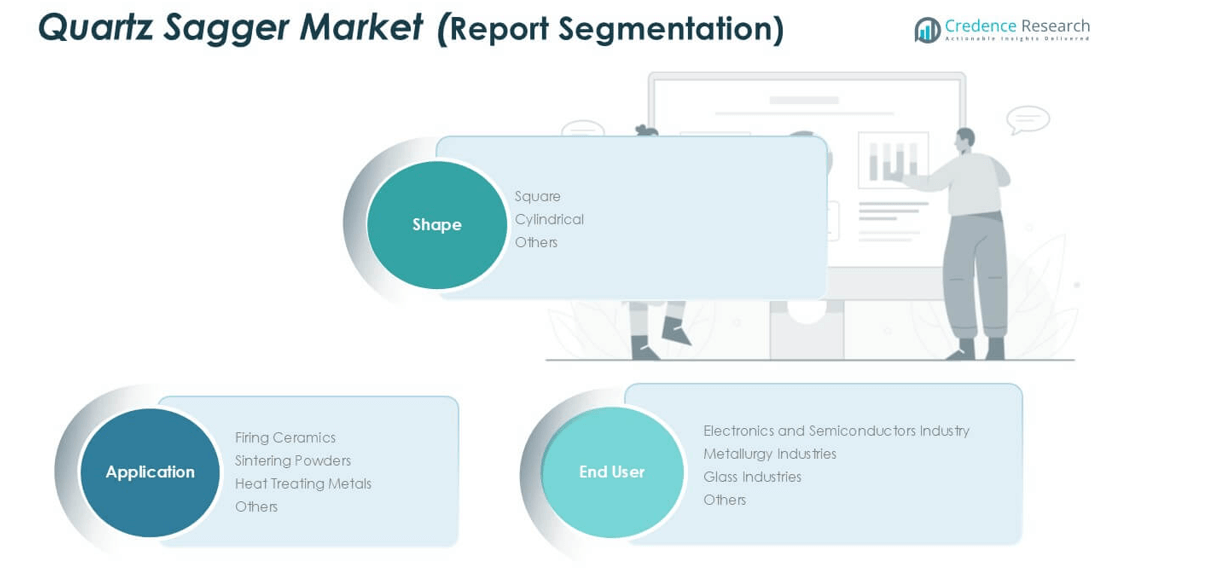

Market Segmentations:

By Shape

- Square

- Cylindrical

- Others

By Application

- Firing Ceramics

- Sintering Powders

- Heat Treating Metals

- Others

By End User

- Electronics and Semiconductors Industry

- Metallurgy Industries

- Glass Industries

- Others

By Geography

- North Germany

- South Germany

- East Germany

- West Germany

Competitive Landscape

The competitive landscape of the Germany quartz sagger market is moderately consolidated, featuring both global and regional manufacturers competing through innovation, material quality, and customization. Leading players such as Saint-Gobain, NORITAKE CO., LIMITED, and Morgan Advanced Materials plc maintain dominance by offering high-purity, thermally stable quartz saggers tailored for semiconductor, ceramics, and metallurgy applications. Domestic firms like Zibo Gotrays Industry Co., Ltd and Liling Zen Ceramic Co., Ltd focus on cost-effective production and rapid delivery, catering to mid-tier industries. Strategic collaborations, capacity expansions, and digitalized manufacturing are key growth tactics. Recent developments emphasize energy-efficient and contamination-free sagger designs compatible with automated furnace systems. With rising semiconductor and advanced material demand, competition increasingly centers on precision engineering, product lifespan, and technological adaptability to high-temperature, low-emission industrial environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zibo Gotrays Industry Co., Ltd

- Saint-Gobain

- NORITAKE CO., LIMITED

- Morgan Advanced Materials plc

- Liling Zen Ceramic Co., Ltd.

- Shandong Topower Pte Ltd.

- Magma Group

- Other Key Players

Recent Developments

- In 2023, Sumitomo Refractories announces the development of a sustainable, recyclable quartz sagger.

- In 2022, RHI Magnesita invests in a new manufacturing facility for advanced quartz saggers in China.

Report Coverage

The research report offers an in-depth analysis based on Shape, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for quartz saggers will rise with Germany’s expanding semiconductor fabrication capacity.

- Increased adoption of advanced ceramics in EV and electronics production will support market growth.

- Energy-efficient and eco-friendly sagger manufacturing will gain stronger industry focus.

- Automation and smart furnace integration will enhance process reliability and drive sagger upgrades.

- Custom-designed saggers tailored for specific temperature and purity needs will see higher demand.

- Local suppliers will benefit from reshoring trends and shorter supply chains within Europe.

- Continuous innovation in high-purity quartz materials will improve durability and thermal performance.

- Collaboration between material scientists and industrial furnace manufacturers will accelerate product development.

- Rising replacement demand in metallurgy and glass industries will sustain steady sales.

- The market will remain moderately consolidated, with key players expanding through partnerships and capacity investments.