Market Overview:

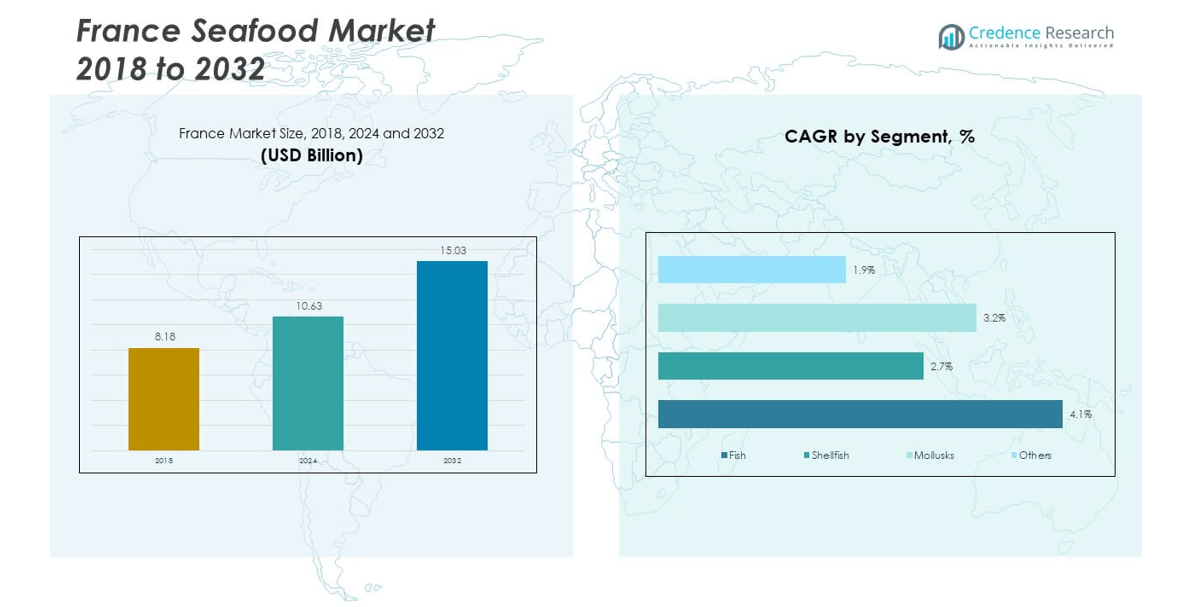

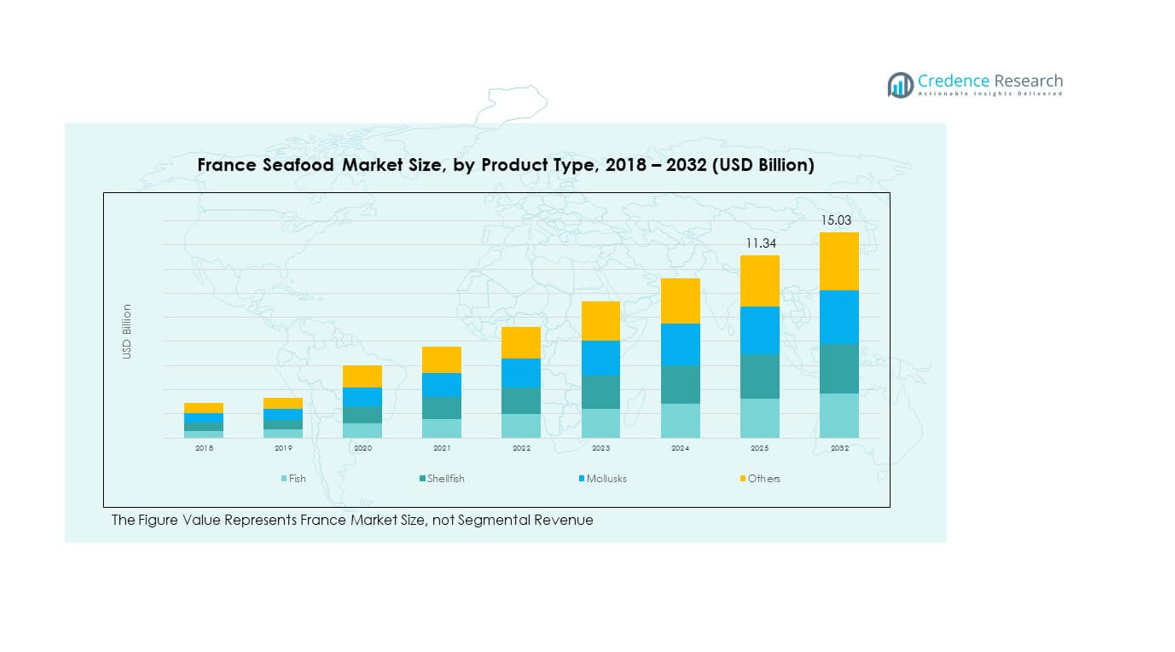

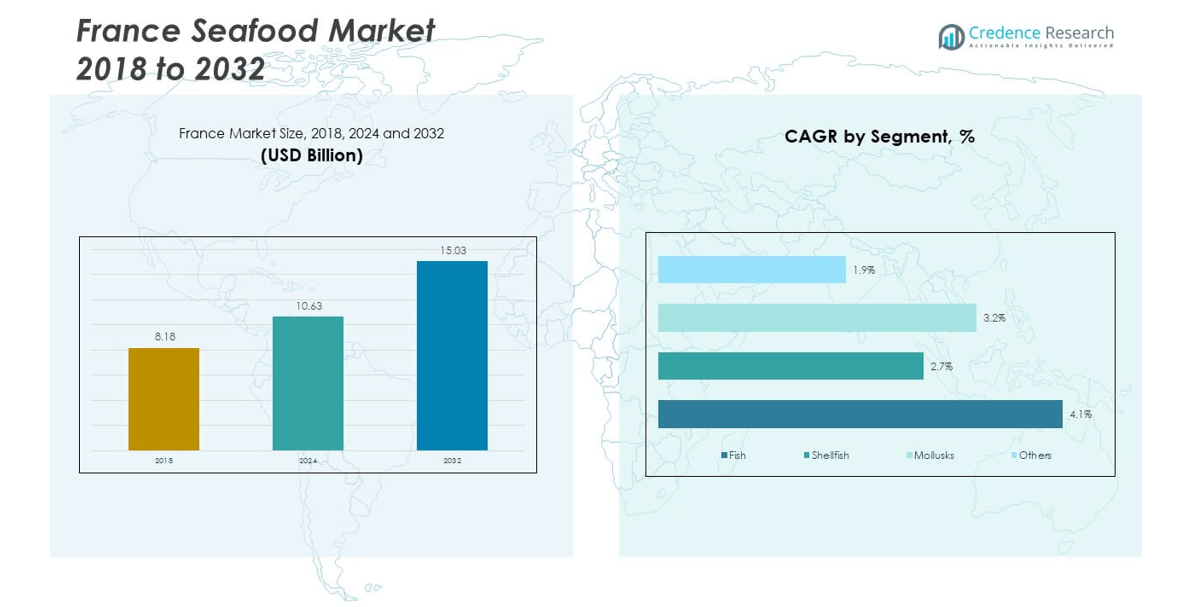

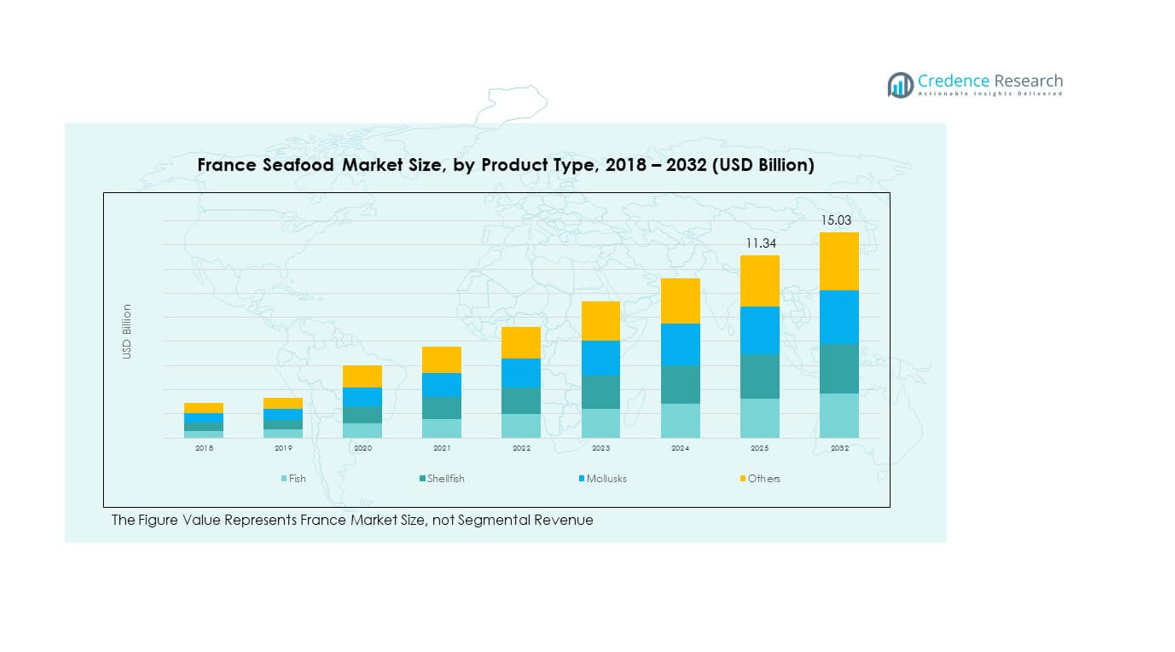

The France Seafood Market size was valued at USD 8.18 billion in 2018 to USD 10.63 billion in 2024 and is anticipated to reach USD 15.03 billion by 2032, at a CAGR of 4.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Seafood Market Size 2024 |

USD 10.63 billion |

| France Seafood Market, CAGR |

4.12% |

| France Seafood Market Size 2032 |

USD 15.03 billion |

The France Seafood Market grows through rising health awareness, strong culinary traditions, and supportive government policies. Consumers increasingly prefer seafood for its nutritional value, including omega-3 fatty acids and lean protein. Demand expands further as seafood remains a key component of French cuisine, both in daily meals and festive occasions. Retail expansion, e-commerce growth, and improved supply chains enhance accessibility across urban and rural areas. Support for sustainable fishing and aquaculture also strengthens the long-term availability of high-quality seafood.

Northern France leads the France Seafood Market with strong fishing traditions and aquaculture activities. Coastal regions in Brittany and Normandy provide stable supply supported by well-established wholesale markets. Southern France shows robust demand fueled by Mediterranean seafood culture and tourism-driven consumption. Western France benefits from Atlantic coast resources, supporting both domestic demand and export potential. Central regions reflect growing reliance on processed and imported seafood through retail distribution. This regional diversity ensures balanced growth, with traditional coastal regions setting benchmarks while inland markets expand steadily.

Market Insights

- The France Seafood Market size was valued at USD 8.18 billion in 2018, USD 10.63 billion in 2024, and is anticipated to reach USD 15.03 billion by 2032, at a CAGR of 4.12% during the forecast period.

- Northern France holds 28% share, Western France holds 27%, and Southern France holds 25%, with dominance linked to strong coastal resources, aquaculture capacity, and tourism-driven demand.

- Central France, with a 20% share, shows the fastest growth, driven by retail expansion and rising consumption of processed seafood.

- Fish accounts for the largest segment in the France Seafood Market, representing over 40% of total share, supported by its wide consumption base.

- Shellfish and mollusks together capture close to 35% share, driven by cultural significance, premium positioning, and high seasonal demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Health Awareness and Consumer Preference for Protein-Rich Diets

The growing emphasis on nutrition supports the demand for seafood in France. Consumers increasingly favor protein-rich foods with low fat, and seafood fits this need. It provides essential omega-3 fatty acids, vitamins, and minerals, making it a preferred choice. The France Seafood Market benefits from this shift as people look for healthier substitutes to red meat. Demand is also rising among younger populations, who prioritize balanced diets. Restaurants and retailers highlight seafood as a premium, health-driven option. Educational campaigns on nutrition continue to strengthen awareness. The combination of health benefits and lifestyle shifts pushes steady market growth.

- For instance, in June 2025, Labeyrie Fine Foods announced an investment of €120–140 million to boost production capacity across its 12 facilities. The plan aims to increase annual output by about 110 million additional units by 2028, strengthening its position in premium seafood and fine foods.

Strong Demand Driven By Cultural Significance And Culinary Integration

Seafood is deeply embedded in French cuisine and culture. Traditional dishes such as bouillabaisse, moules marinières, and oysters reinforce this demand. It is a central feature in both fine dining and casual meals. The France Seafood Market gains momentum from culinary tourism and local festivals centered around seafood. Seasonal demand peaks during holidays and regional celebrations, strengthening sales. Retail chains and specialty stores highlight regional seafood varieties, boosting awareness. Culinary schools also support professional training in seafood preparation, expanding appreciation. This cultural integration secures seafood as an everyday and festive staple.

Expanding Retail Networks and Rising Accessibility of Fresh and Processed Products

Retail expansion ensures that seafood reaches wider audiences in urban and rural areas. Supermarkets and hypermarkets showcase both fresh and frozen options, making it convenient for consumers. The France Seafood Market benefits from online grocery platforms offering home delivery. E-commerce allows buyers to access premium imported varieties with ease. Specialty seafood stores also create niche demand for gourmet and exotic products. Growth in supply chain logistics enables faster distribution and longer shelf life. Packaging innovations maintain freshness and hygiene, reassuring buyers. This expanded access drives higher sales across different demographics.

Government Support Through Sustainable Fishing Practices and Import Regulations

Government policies focus on protecting marine resources while supporting domestic fisheries. Regulations encourage sustainable fishing, ensuring long-term availability of key species. The France Seafood Market aligns with EU directives promoting certified sustainable practices. Imports are closely monitored to maintain quality and safety standards. Subsidies and support programs help small-scale fishermen remain competitive. Research funding for aquaculture also strengthens domestic supply. Traceability measures guarantee product authenticity, which increases consumer confidence. Together, these initiatives create a secure and sustainable growth path for the industry.

- For instance, MSC reported that sales of MSC-certified seafood in Southern Europe, including France, have doubled over the past five years. Retailers such as Carrefour are recognized partners in expanding the availability of certified seafood products in the French market.

Market Trends

Shift Toward Premiumization and Demand for High-Quality Seafood Varieties

Consumers in France increasingly prefer premium seafood such as lobster, scallops, and salmon. It is no longer only about volume but about superior quality and flavor. The France Seafood Market sees growing interest in organic and sustainably certified varieties. Chefs and restaurants promote premium offerings, creating aspirational demand. Consumers with higher disposable incomes prioritize specialty and imported seafood. Retailers respond by highlighting origin labeling and freshness guarantees. Subscription boxes focusing on premium seafood also expand. This trend reshapes the industry toward value-driven growth.

- For instance, in 2025 Labeyrie Fine Foods announced an investment of €120–140 million across its 12 facilities to expand capacity. The plan targets an increase from around 290 million units in 2024 to 400 million units by 2028, adding 110 million units in annual sales.

Integration of Technology and Online Platforms in Seafood Purchasing Behavior

E-commerce continues to transform how people access seafood. The France Seafood Market benefits from platforms that guarantee freshness through advanced cold-chain logistics. Consumers now order oysters, salmon, and shellfish online with next-day delivery. Retailers integrate digital tracking systems, ensuring full transparency from sea to plate. QR codes allow customers to verify origin, catch date, and sustainability certifications. Mobile apps promote recipes and pairings, improving consumer engagement. Social media campaigns highlight seafood nutrition and freshness. Technology not only improves convenience but also strengthens brand trust.

Rise of Ready-To-Cook and Processed Seafood Options for Busy Consumers

French consumers increasingly look for convenience without compromising quality. The France Seafood Market responds with marinated fish, pre-cut fillets, and frozen seafood meals. Ready-to-cook packs reduce preparation time for urban households. Retail chains expand their frozen seafood sections to meet this demand. Innovative packaging ensures longer shelf life and consistent taste. These products appeal strongly to working professionals and young families. Food service providers also adopt semi-processed seafood for efficient operations. The convenience-driven trend reshapes product portfolios across suppliers and retailers.

Sustainability Becoming a Central Influence on Consumer Purchase Decisions

Sustainability influences purchasing choices more strongly than before. Consumers prefer certified eco-labels and traceable seafood. The France Seafood Market integrates sustainability as a core business strategy. Retailers highlight Marine Stewardship Council (MSC) or Aquaculture Stewardship Council (ASC) certifications. Restaurants promote menus featuring locally sourced, sustainable seafood. Younger consumers show higher sensitivity toward ecological impact. Media coverage of overfishing reinforces demand for sustainable options. This trend ensures ethical alignment between suppliers and end-users.

- For instance, Auchan implemented TE-FOOD’s blockchain-based FoodChain traceability system in France, following earlier trials in Vietnam. The system allows consumers to scan QR codes on products to access origin and supplier information, strengthening transparency in its supply chain.

Market Challenges Analysis

Fluctuating Supply Due To Climate Change And Overfishing Concerns

Climate change significantly impacts fish populations and supply stability. Rising sea temperatures affect breeding and migration patterns. The France Seafood Market experiences pressure as certain species become scarce. Overfishing worsens the problem, creating long-term sustainability concerns. Import dependency increases during periods of domestic shortage, driving higher costs. Supply volatility challenges restaurants and retailers relying on consistent stock. Aquaculture partially balances the gap, but it faces its own environmental constraints. Managing these risks becomes critical for long-term market resilience.

High Price Volatility and Rising Competition Across Global Imports

Seafood prices fluctuate due to fuel costs, logistics, and supply shortages. The France Seafood Market often faces unpredictability in raw material sourcing. Imported varieties compete strongly with domestic catches, raising competition. Premium seafood items such as tuna and lobster experience frequent price swings. Consumer affordability challenges market stability when costs escalate. Restaurants and retail outlets struggle to maintain margins during such volatility. Exchange rate variations add further uncertainty to import costs. Balancing affordability and premium demand remains a key challenge.

Market Opportunities

Expansion of Aquaculture and Domestic Production Capabilities to Reduce Import Dependency

Aquaculture represents a major growth opportunity in France. It reduces reliance on imports and improves supply consistency. The France Seafood Market benefits from innovation in sustainable fish farming. Government and private investors support aquaculture infrastructure expansion. Domestic seafood farming ensures better traceability and quality. Eco-friendly aquaculture practices also align with consumer expectations. It provides resilience against fluctuating international prices. This creates new opportunities across production and supply networks.

Rising Export Potential for Premium Seafood Varieties Across Global Markets

France holds strong opportunities in seafood exports. High-quality oysters, mussels, and scallops are globally recognized. The France Seafood Market positions itself as a premium supplier to international buyers. Demand from Asia and North America supports long-term export expansion. Certification and branding enhance the appeal of French seafood abroad. Logistics improvements enable faster delivery of fresh products overseas. Export growth creates jobs and strengthens local economies. It helps France build a competitive edge in global seafood trade.

Market Segmentation Analysis

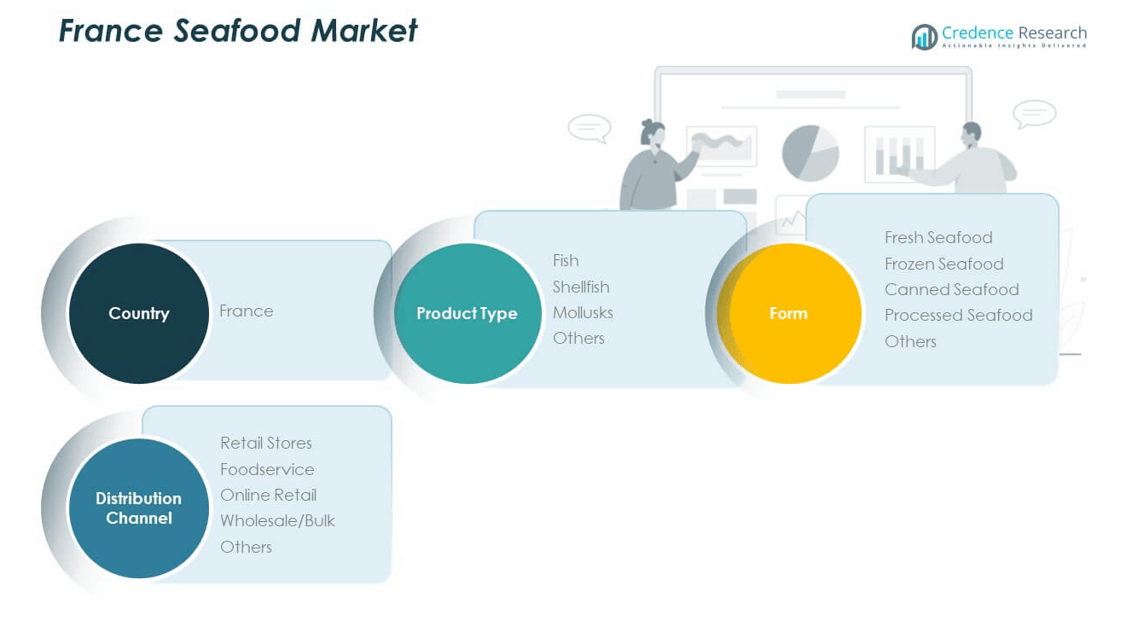

By Product Type

The France Seafood Market covers fish, shellfish, mollusks, and other seafood categories. Fish dominates consumption due to its variety and nutritional value. Shellfish and mollusks hold strong demand in regional cuisines and festive occasions. It shows stable growth with oysters, mussels, and shrimp maintaining premium appeal. Other seafood varieties cater to niche buyers and expand product diversity. Restaurants and gourmet outlets strengthen demand for these specialized products. Consumer preference for locally sourced options supports all categories. Product variety ensures balanced growth across the segment.

- For instance, Parcs Saint Kerber won the Best Retail Product award at the 2024 Seafood Excellence Global Awards in Barcelona for its Oysters Trio Saint Kerber. It features three oyster varieties (European flat oyster, Tsarkaya Pacific oyster, and Bay of Mont Saint Michel oyster), packed in a traditional wooden box lined with seaweed

By Form

Fresh seafood leads the market due to its strong cultural preference and premium positioning. Frozen seafood follows, supported by longer shelf life and availability across regions. The France Seafood Market benefits from canned seafood, which ensures convenience and affordability. Processed seafood meets urban consumer demand for ready-to-cook solutions. It appeals to households seeking quick meal preparation without compromising nutrition. Other forms, including marinated and packaged seafood, attract younger consumers. Packaging innovations help maintain product quality and safety. Form segmentation highlights the balance between tradition and convenience.

By Distribution Channel

Retail stores remain dominant as they ensure accessibility across urban and rural markets. Foodservice holds strong share with restaurants, hotels, and catering driving large-scale consumption. Online retail records rising traction, supported by digital platforms and home delivery models. It builds consumer trust through traceability and freshness guarantees. Wholesale and bulk distribution serve institutional buyers and exporters. Other channels include specialty seafood stores offering premium imports. Market players optimize logistics to support each channel effectively. Diverse distribution ensures steady seafood availability across consumer categories.

- For instance, Algolesko won the Best HORECA Product award at the 2024 Seafood Excellence Global Awards (Seafood Expo Global) for its Wakame Pickles. Its seaweed is sustainably harvested on 350 hectares in a Natura 2000 protected area

Segmentation

By Product Type

- Fish

- Shellfish

- Mollusks

- Others

By Form

- Fresh Seafood

- Frozen Seafood

- Canned Seafood

- Processed Seafood

- Others

By Distribution Channel

- Retail Stores

- Foodservice

- Online Retail

- Wholesale/Bulk

- Others

Regional Analysis

Northern France

Northern France accounts for 28% share of the France Seafood Market, supported by strong fishing traditions and coastal resources. Regions such as Brittany and Normandy serve as key supply hubs, especially for shellfish and mollusks. It benefits from local aquaculture and well-established wholesale markets. Retail and foodservice outlets highlight regional specialties, driving cultural and tourism-based demand. Exports of oysters and mussels further enhance market importance in this subregion. The northern coastline maintains a strong influence over national seafood supply and consumption.

Southern France

Southern France holds 25% share, driven by Mediterranean seafood varieties and high tourism. It is a key destination for premium seafood such as tuna, sea bass, and shellfish. Culinary culture in Provence and coastal cities integrates seafood into both daily meals and fine dining. Strong demand from the hospitality industry supports continuous growth. Fishing ports and local markets create high availability of fresh products. This subregion benefits from cross-border trade and imports through Mediterranean ports.

Central and Western France

Central and Western France represent 20% and 27% shares respectively, together holding significant influence. Central France shows moderate consumption levels supported by retail networks and processed seafood demand. It relies more on imports and distribution from coastal regions. Western France, led by regions along the Atlantic coast, sustains robust supply through both fishing and aquaculture. It records steady demand for fish and shellfish in retail and foodservice channels. The France Seafood Market strengthens its position through balanced growth across these subregions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Krustanord

- L’Argonaute

- La Crustas

- Les Huitres Courdavault Alain

- Les Mascareignes Seafood

- Setalg

- Worldistri

- All Seafood Company

- France Naissain

- Boulogne Sur Mer Group

Competitive Analysis

The France Seafood Market features strong competition among domestic and international players. Leading companies focus on expanding aquaculture capacity, sustainable fishing, and premium product offerings. It highlights strategies such as advanced cold-chain logistics, traceability systems, and eco-certifications to build consumer trust. Retailers and processors invest in frozen, canned, and ready-to-cook seafood to meet evolving demand. Global exporters compete with local fisheries by supplying exotic and high-value varieties. Partnerships between producers, distributors, and retailers strengthen supply chain efficiency. The market continues to evolve through innovation, sustainability, and strategic expansion, ensuring competitive positioning across all segments.

Recent Developments

- In July 2025, Varlaks, a premium salmon producer under the Norwegian Seafood umbrella, entered a strategic partnership with Carrefour to debut its Arctic-raised salmon at major French retail test stores, emphasizing a joint commitment to quality, freshness, and bringing a new approach to seafood for French consumers.

- In early August 2025, Cite Marine, a French subsidiary of Nissui Corporation, acquired a new processing facility located in Pontivy, France. This acquisition is expected to expand Cite Marine’s seafood processing capacity and strengthen its market position within the French seafood sector.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The France Seafood Market will strengthen through health-driven demand for protein-rich diets.

- Expansion of aquaculture will reduce reliance on imports and improve supply stability.

- Premium seafood varieties will gain wider adoption in restaurants and retail outlets.

- Online retail platforms will expand, improving access to fresh and frozen seafood.

- Processed and ready-to-cook seafood will grow as urban lifestyles demand convenience.

- Sustainability and eco-label certifications will influence consumer purchase decisions more strongly.

- Export opportunities for oysters, mussels, and scallops will drive international positioning.

- Cold-chain logistics and traceability technology will ensure freshness and quality assurance.

- Regional festivals and tourism will continue to promote cultural demand for seafood.

- Strategic partnerships between producers, distributors, and retailers will optimize market efficiency.