Market Overview:

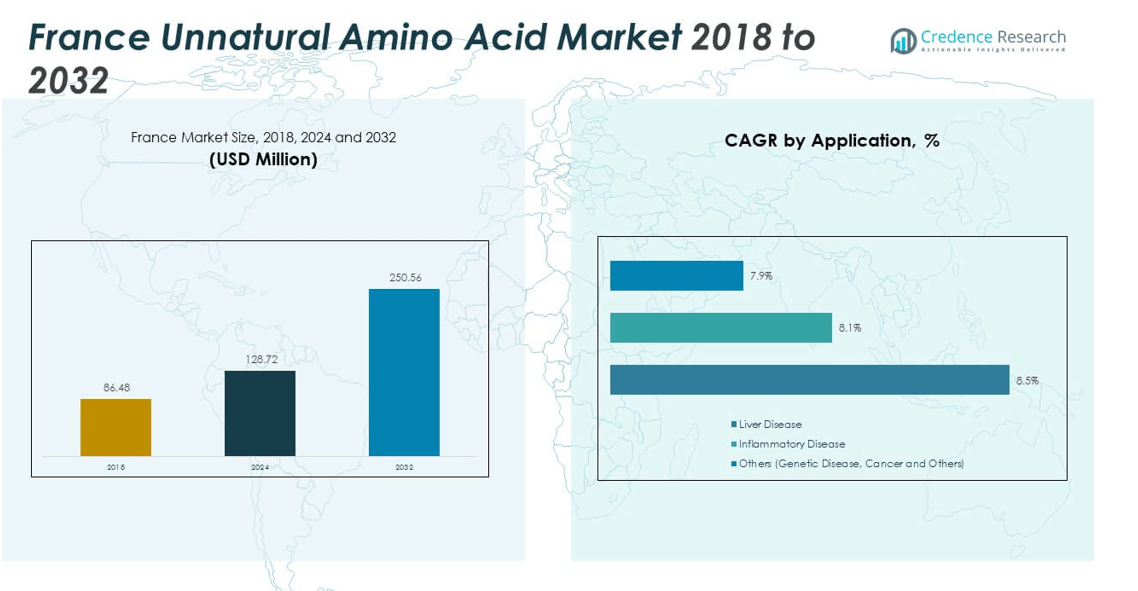

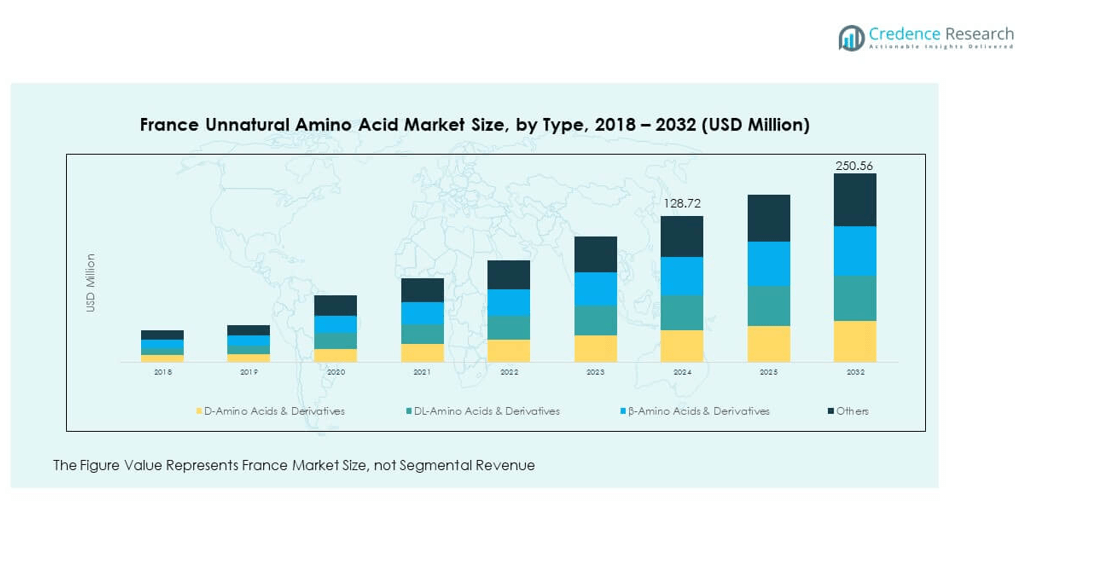

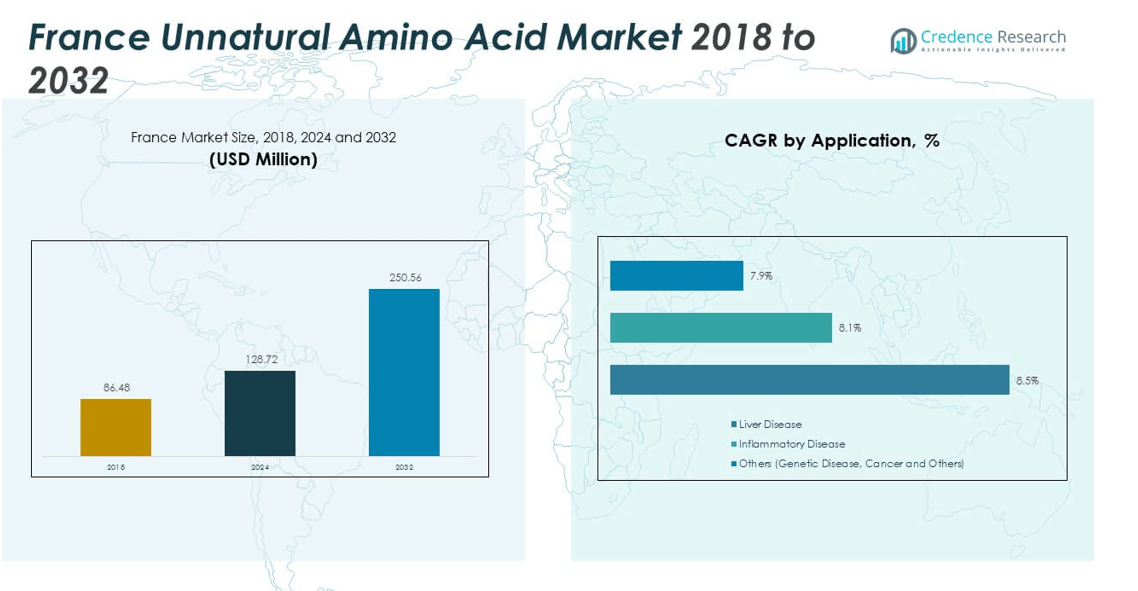

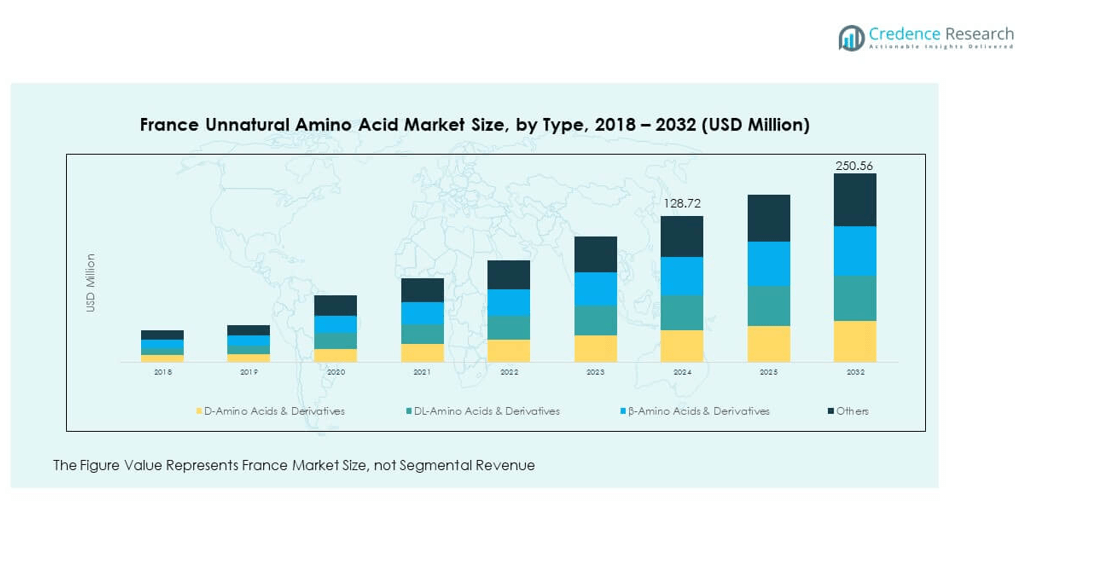

The France Unnatural Amino Acid Market size was valued at USD 86.48 million in 2018 to USD 128.72 million in 2024 and is anticipated to reach USD 250.56 million by 2032, at a CAGR of 8.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Unnatural Amino Acid Market Size 2024 |

USD 128.72 million |

| France Unnatural Amino Acid Market, CAGR |

8.68% |

| France Unnatural Amino Acid Market Size 2032 |

USD 250.56 million |

The market is expanding due to rising applications in pharmaceuticals, biotechnology, and protein engineering. Growing demand for targeted therapies and precision medicine fuels the adoption of unnatural amino acids in drug discovery. Researchers and companies increasingly utilize these compounds for enhanced protein stability, therapeutic efficacy, and innovative drug formulations. Supportive government initiatives and investments in life sciences research further strengthen market growth. Rising collaborations between academia and industry also create opportunities for advanced applications in enzyme design, biocatalysis, and therapeutic proteins.

Regionally, Europe represents a leading hub for unnatural amino acid research and commercialization, with France holding a significant role due to its strong pharmaceutical and biotech sector. Germany and the United Kingdom also lead the regional landscape, driven by advanced R&D infrastructures. Emerging markets in Eastern Europe are gaining attention as governments invest in healthcare innovation. France benefits from established academic institutions, skilled research talent, and collaborative biotech ecosystems, making it an attractive center for innovation in this evolving field

Market Insights:

- The France Unnatural Amino Acid Market was valued at USD 86.48 million in 2018, reached USD 128.72 million in 2024, and is projected to attain USD 250.56 million by 2032, growing at a CAGR of 8.68%.

- Northern France held the largest share at 38% in 2024, supported by strong pharmaceutical manufacturing; Central France followed with 34%, driven by Paris-based research institutions; Southern France accounted for 28%, benefiting from biotech clusters in Lyon and Toulouse.

- Northern France remains the fastest-growing subregion with its 38% share, boosted by international collaborations, skilled workforce, and proximity to European research hubs.

- By type, D-Amino Acids & Derivatives commanded 35% of the France Unnatural Amino Acid Market in 2024, owing to their extensive role in protein engineering and drug design.

- DL-Amino Acids & Derivatives followed with 28% market share, reflecting steady demand from biochemical research and metabolic studies across academic and pharmaceutical settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Pharmaceutical Research and Development Activities Fuel Market Growth

The France Unnatural Amino Acid Market benefits from the strong pharmaceutical research base in the country. Drug discovery programs adopt unnatural amino acids to improve protein stability and therapeutic performance. Pharmaceutical companies explore these compounds for targeted therapies and antibody-drug conjugates. It drives higher adoption across advanced treatment areas such as oncology and metabolic disorders. Regulatory agencies support innovation by encouraging clinical development in niche fields. Collaborations between universities and industry enhance knowledge transfer. France’s focus on biotechnology innovation further sustains research funding. This combination of factors strengthens the demand for unnatural amino acids in modern drug pipelines.

- For example, Montpellier-based Ciloa secured €6.5 million in July 2025 through the France 2030 “Biotherapies and Biomanufacturing” initiative (via the DIADEME project) to advance its APN-sEV (adiponectin-associated exosome) candidate up to Phase IIa in type 2 diabetes and obesity development.Using its proprietary EVENGI bioengineering platform, Ciloa has produced batches of APN-sEV that remain stable at 4 °C for several months, underscoring the technology’s robustness

Increasing Adoption in Biotechnological Applications Enhances Market Expansion

The biotechnology sector contributes significantly to the France Unnatural Amino Acid Market. Research organizations rely on these compounds for protein engineering and enzyme optimization. It enables production of proteins with improved catalytic efficiency and durability. Biotech firms integrate unnatural amino acids into tools for molecular labeling and structural studies. Growth in synthetic biology accelerates demand for specialized amino acid variants. Academic institutions in France partner with international labs to expand applications. Startups in the biotech field leverage these compounds for novel therapeutics. This creates a favorable environment for continuous expansion in research-focused industries.

- For example, in May 2025, OSE Immunotherapeutics launched the HexARN project, backed with €1.3 million from the France 2030 initiative, to advance mRNA nanodrugs for inflammatory and autoimmune disorders. Collaborating with Inside Therapeutics and the MiNT Laboratory at the University of Angers, the project focuses on optimizing RNA-lipid nanoparticle formulations and ensuring scalable, high-quality drug production.

Rising Demand for Precision Medicine Drives Market Adoption

The demand for precision medicine supports the expansion of the France Unnatural Amino Acid Market. Physicians and researchers focus on therapies tailored to genetic and molecular profiles. It increases reliance on amino acids that extend half-lives and improve bioavailability of drugs. Personalized drug models benefit from proteins designed with site-specific modifications. Research institutions explore new diagnostic tools enabled by amino acid incorporation. Patient-specific therapies create consistent demand for advanced materials. Pharmaceutical pipelines shift toward biologics requiring innovative amino acid chemistry. This dynamic strengthens adoption across diverse therapeutic fields in France.

Growing Government Support and Investments Strengthen Market Position

Government initiatives in France encourage growth within the France Unnatural Amino Acid Market. Funding for life sciences research supports universities and biotech firms. It provides infrastructure for large-scale studies and clinical trials. National programs promote healthcare innovation to align with EU-level priorities. Policies incentivize partnerships between research groups and industrial leaders. International collaborations open doors for joint development projects. Academic centers expand laboratory facilities to advance amino acid applications. Private investors also recognize the growth potential of the biotech sector. This alignment of public and private support consolidates the market’s position in Europe.

Market Trends

Expanding Applications in Enzyme Design and Industrial Biocatalysis

The France Unnatural Amino Acid Market experiences growth through applications in enzyme design. Research labs develop enzymes with enhanced thermal stability and resistance to degradation. It helps industrial processes in pharmaceuticals and specialty chemicals achieve higher yields. Enzyme-based biocatalysis benefits from unnatural amino acid incorporation. Companies adopt these methods to reduce energy costs and environmental impact. Academic studies showcase progress in modifying metabolic pathways. Startups develop solutions for more sustainable production methods. This trend pushes the market toward broader industrial relevance beyond drug development.

- For example, Codexis’ CodeEvolver® platform enhances enzyme performance for industrial and pharmaceutical use. In 2021, the company extended its partnership with Merck, supplying an engineered enzyme for sitagliptin (JANUVIA®) production that improved efficiency, yields, cost savings, and sustainability in large-scale manufacturing.

Increasing Use in Advanced Protein Labeling and Imaging Techniques

Advanced imaging technologies rely on specialized amino acids for improved accuracy. The France Unnatural Amino Acid Market gains traction through demand in structural biology. It provides tools for fluorescence labeling and molecular mapping. These compounds enhance understanding of protein dynamics at the molecular level. Universities and research centers use them for breakthrough discoveries in protein folding. Biotech firms integrate labeling technologies into commercial diagnostic platforms. Rising interest in live-cell imaging creates steady market demand. This trend strengthens the role of unnatural amino acids in advanced research.

Emerging Role in Next-Generation Therapeutic Proteins

Therapeutic protein design evolves rapidly with incorporation of unnatural amino acids. The France Unnatural Amino Acid Market benefits from this innovation. It enables development of long-lasting drugs with fewer side effects. Biopharma firms invest in production of site-specific conjugates. Enhanced drug delivery methods improve patient outcomes across chronic diseases. This trend fuels collaboration between global biotech players and local French firms. Research on novel monoclonal antibodies incorporates amino acid modifications. Growth in therapeutic innovation drives wider recognition of market potential.

- For example, Sanofi’s THOR-707 (now SAR-444245 or Pegenzileukin) is an engineered IL-2 variant created through site-specific incorporation of a non-canonical amino acid. This design extends half-life and reduces IL-2Rα binding, helping expand CD8⁺ T cells and NK cells while limiting regulatory T cell activity. Preclinical studies showed improved stability and immune activation, and Phase 1 data confirmed increases in CD8⁺ T and NK cells with minimal Treg expansion, supporting its potential in advanced cancer treatment.

Rising Academic and Industrial Collaborations in Synthetic Biology

The field of synthetic biology provides new opportunities for market expansion. The France Unnatural Amino Acid Market gains from collaborations between academic groups and industry. It supports projects focused on metabolic pathway engineering and bio-manufacturing. Companies invest in synthetic platforms to produce rare biomolecules. Research institutions explore expanded genetic code systems. It advances integration of novel amino acids into living cells. This trend increases the scope of application in healthcare and agriculture. France’s strong academic research base drives cross-border partnerships. These collaborations set the foundation for the next phase of market development.

Market Challenges Analysis

High Production Costs and Limited Commercial Scale Restrict Growth

The France Unnatural Amino Acid Market faces cost challenges linked to production. It requires complex synthesis methods that increase manufacturing expenses. Commercial scalability remains limited due to these financial constraints. Small companies often struggle to balance R&D investment with production feasibility. Pharmaceutical firms hesitate to commit without clear economic benefits. Limited cost-effectiveness restricts broader adoption across industries. The challenge of achieving affordability persists despite technological progress. This situation hinders the market from reaching full commercial maturity in France.

Regulatory Complexity and Intellectual Property Barriers Create Obstacles

Strict regulatory pathways slow expansion of the France Unnatural Amino Acid Market. It involves extensive testing and approval requirements that extend timelines. Intellectual property disputes further complicate commercialization. Patent restrictions limit accessibility for smaller innovators. Companies face hurdles in protecting unique synthesis techniques. Regulatory agencies emphasize safety, making clinical validation resource-intensive. Uncertainty around IP ownership discourages some investors. These combined challenges reduce pace of product launches and applications. The market continues to face pressure from compliance and legal complexities.

Market Opportunities

Expansion of Applications in Diagnostic and Therapeutic Fields

The France Unnatural Amino Acid Market shows potential in diagnostics and therapeutics. It supports development of advanced biomarkers and imaging probes. Pharmaceutical companies invest in targeted therapies that depend on amino acid modifications. Growing demand for personalized healthcare strengthens the relevance of these compounds. It improves detection of diseases at earlier stages. Opportunities also emerge in immune therapy applications. Academic research focuses on expanding diagnostic platforms. This opens avenues for new commercial ventures in the French biotech landscape.

Rising Industrial and Academic Collaborations Accelerate Innovation

Collaborations between universities and industry drive new market opportunities. The France Unnatural Amino Acid Market gains from increased joint research programs. It enables scaling of laboratory findings into commercial solutions. International partnerships strengthen innovation ecosystems in France. Companies benefit from access to advanced facilities and skilled talent. Research projects expand into sustainable bio-manufacturing and agricultural solutions. It allows for wider industrial adoption in non-medical areas. These collaborations create long-term opportunities for market expansion and diversification.

Market Segmentation Analysis:

By type, the France Unnatural Amino Acid Market demonstrates strong momentum across type-based segments. D-Amino acids and derivatives dominate due to their role in protein engineering and drug discovery. DL-Amino acids hold steady demand in biochemical research and metabolic studies. β-Amino acids gain interest for their structural stability and potential in therapeutic design. Other categories, including rare variants, contribute by supporting niche applications in diagnostics and advanced therapies. It reflects the market’s ability to cater to both mainstream pharmaceutical needs and specialized research fields.

- For example, Genepep, a Montpellier-based biotech company, has synthesized over 21,000 custom peptides, including D- and DL-amino acid derivatives, for both French and international R&D clients in drug discovery . Additionally, recent French-European research developed a dual-enzyme hybrid nanoflower system that achieved over 99% conversion of biobased levulinic acid to (S)-4-aminopentanoic acid, a β-amino acid, on a preparative scale, providing stable building blocks for new therapeutic peptide scaffolds.

By application, the market shows robust demand from liver disease treatments, where amino acid modifications improve drug delivery and efficacy. Inflammatory diseases represent another significant segment, supported by rising research in autoimmune conditions and chronic disorders. Other applications, including genetic disease and cancer, create promising opportunities through innovative drug development pipelines. It highlights the critical role of unnatural amino acids in addressing complex healthcare challenges across multiple therapeutic areas.

By end-use segmentation underscores the pharmaceutical industry as the leading consumer. Companies adopt these compounds for precision medicine, biologics, and therapeutic protein development. Biotechnological companies, research laboratories, and academic institutes form the secondary segment, driving innovation through continuous R&D activities. It reinforces the importance of collaborative ecosystems in shaping advancements. The France Unnatural Amino Acid Market benefits from this balanced demand between commercial and research-focused applications, creating a foundation for sustained long-term growth.

- For instance, Paris-based Coave Therapeutics is developing gene therapies using its proprietary ALIGATER™ platform, which chemically conjugates ligands to AAV capsids to optimize vector targeting for liver and central nervous system (CNS) delivery. Meanwhile, Genepep, a Montpellier-based biotech company, provides custom peptides and unnatural amino acid analogues to French pharmaceutical and academic partners, supporting drug discovery, structure–function studies, and biologics engineering.

Segmentation:

By Type

- D-Amino Acids & Derivatives

- DL-Amino Acids & Derivatives

- β-Amino Acids & Derivatives

- Others

By Application

- Liver Disease

- Inflammatory Disease

- Others (Genetic Disease, Cancer, and Others)

By End-use

- Pharmaceutical

- Others (Biotechnological Companies, Research Laboratories, and Academic Institutes)

Regional Analysis:

Northern France accounts for 38% of the France Unnatural Amino Acid Market share, driven by its strong pharmaceutical manufacturing base and established research clusters. The region hosts several leading pharmaceutical and biotech companies that actively invest in drug discovery and therapeutic innovation. It benefits from proximity to Belgium and Germany, facilitating cross-border collaborations and trade. Universities and academic institutions in Lille and surrounding cities support research partnerships with industry. A skilled workforce and access to advanced infrastructure further reinforce the region’s market strength. The concentration of innovation and industrial capability positions Northern France as a key growth hub.

Central France holds 34% of the market share, supported by the presence of large research laboratories and biotechnology-focused organizations. Paris functions as a critical innovation center, driving clinical research and hosting numerous academic institutions. It benefits from a strong healthcare system and the headquarters of multinational companies, which fosters advanced R&D. The presence of government-funded initiatives supports local biotech startups and promotes clinical advancements. It also creates an ecosystem where collaborative research thrives, particularly in therapeutic protein design. The combination of commercial influence and research capacity ensures steady market expansion in Central France.

Southern France contributes 28% of the market share, with Marseille, Lyon, and Toulouse emerging as important hubs for biotechnology and life sciences. The region is known for its growing biotech clusters and strong connections with Mediterranean trade routes. It attracts investments in synthetic biology and biomanufacturing, supporting wider applications of unnatural amino acids. It also benefits from collaborations with international research centers, boosting competitiveness. Universities in Lyon and Toulouse strengthen research capacity and supply skilled professionals. This distribution of expertise ensures that Southern France plays a significant role in shaping the future trajectory of the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AstraZeneca

- GlaxoSmithKline

- Almac Group

- Bachem

- Pepceuticals Ltd

- Sygnature Discovery

- Domainex Ltd

- NovaBiotics Ltd

- Cyclacel Pharmaceuticals (France base)

Competitive Analysis:

The France Unnatural Amino Acid Market features a competitive landscape shaped by global pharmaceutical leaders and specialized biotechnology firms. Companies such as AstraZeneca, GlaxoSmithKline, and Almac Group focus on expanding drug discovery pipelines with advanced amino acid technologies. It reflects the growing importance of strategic investments in protein engineering and targeted therapies. Firms like Bachem and Pepceuticals Ltd strengthen their presence through contract manufacturing and custom synthesis solutions, supporting the needs of research institutes and pharmaceutical companies. Domestic players, including Cyclacel Pharmaceuticals, contribute to innovation with localized research and development capabilities. Emerging biotech firms and startups leverage collaborations with universities and research laboratories to enhance product innovation. It also benefits from strategic alliances, mergers, and acquisitions that expand portfolios and geographic presence. Companies pursue regulatory approvals and clinical trials to strengthen competitive advantage and secure market share. The presence of established global leaders alongside agile local firms creates a balanced environment where both large-scale commercialization and niche innovation thrive. This structure ensures that competition remains dynamic, driving continuous technological progress and expanding applications across the French biotechnology and pharmaceutical sectors.

Recent Developments:

- In May 2025, Almac Group, through its Almac Discovery division, entered a global licensing agreement with Formosa Pharmaceuticals for the development and commercialization of ALM-401, a next-generation, engineered bispecific antibody-drug conjugate (ADC); while not explicitly stated as an unnatural amino acid product, this indicates ongoing protein and peptide innovation relevant to the French market.

- In September 2025, Enlaza Therapeutics entered a collaboration with Vertex Pharmaceuticals, centered on its War-Lock platform that incorporates non-natural amino acids to create covalent-acting protein drugs. The partnership aims to develop immune therapies for autoimmune diseases and improve treatment conditioning for sickle cell disease and thalassemia, with USD 45 million upfront and up to USD 2 billion in potential milestones.

- In July 2025, AstraZeneca announced a $50 billion investment to expand its US-based manufacturing and R&D capabilities by 2030. This expansion includes establishing a Virginia facility dedicated to cutting-edge drug substances such as peptides and small molecules—crucial for advancing APIs and biopharmaceutical manufacturing, indirectly supporting innovations in unnatural amino acids.

- In June 2025, Argenx partnered with Unnatural Products, agreeing on a collaboration worth up to USD 1.5 billion to develop oral macrocyclic peptides targeting inflammatory and immunological diseases. The deal aims to deliver once-daily oral alternatives to current infused antibody treatments, leveraging the advantages of macrocyclic peptides such as stability without cold storage and resistance to protease degradation.

- In March 2024, Pearl Bio revealed a collaboration with Merck that could total up to $1 billion in option and milestone payments. This alliance aims to develop engineered biologics containing non-standard amino acids, targeting next-generation therapeutics. The technology could eventually impact the French market through the introduction of innovative drugs utilizing synthetic amino acids.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and End-Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The France Unnatural Amino Acid Market will expand with increasing adoption in pharmaceutical drug pipelines targeting complex diseases.

- Biotechnology firms will continue integrating amino acid derivatives into protein engineering for therapeutic and diagnostic innovations.

- Growth will be supported by rising demand for precision medicine and patient-specific treatments requiring amino acid modifications.

- Academic and industrial collaborations will intensify, strengthening the translation of research findings into commercial applications.

- Expansion in synthetic biology and bio-manufacturing will create opportunities for industrial-scale utilization of unnatural amino acids.

- Regulatory support and EU-backed healthcare innovation programs will encourage investments and accelerate clinical development timelines.

- The pharmaceutical industry will remain the dominant end-user, while research institutes and laboratories will sustain steady growth.

- Advances in drug delivery and antibody-drug conjugates will expand the scope of amino acid applications in targeted therapies.

- Regional clusters in Northern and Central France will maintain leadership through strong R&D capacity and industrial presence.

- The competitive landscape will evolve through mergers, strategic alliances, and new product development, reinforcing long-term growth.