Market Overview

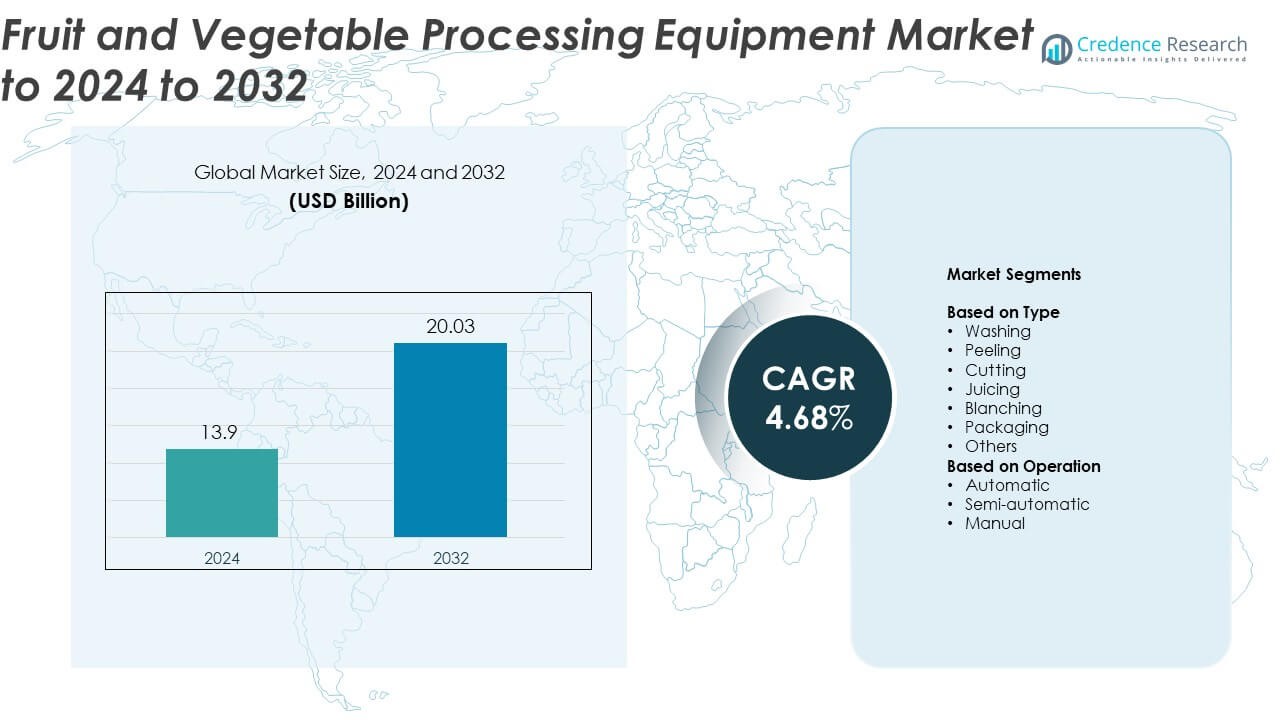

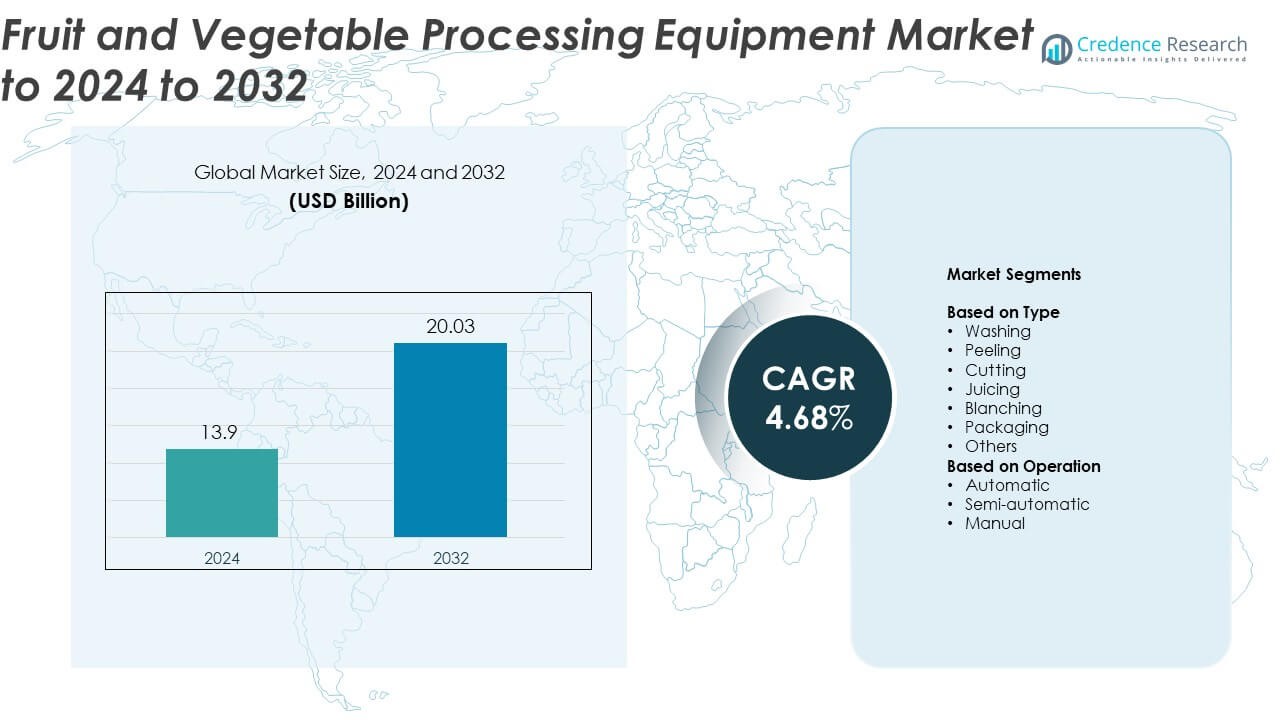

The Fruit and Vegetable Processing Equipment Market size was valued at USD 13.9 Billion in 2024 and is anticipated to reach USD 20.03 Billion by 2032, at a CAGR of 4.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fruit and Vegetable Processing Equipment Market Size 2024 |

USD 13.9 Billion |

| Fruit and Vegetable Processing Equipment Market, CAGR |

4.68% |

| Fruit and Vegetable Processing Equipment Market Size 2032 |

USD 20.03 Billion |

The Fruit and Vegetable Processing Equipment Market features strong participation from global leaders such as Marel, Bühler Group, JBT Corporation, Alfa Laval AB, and GEA Group, each contributing significantly through technological innovation and automation. These companies focus on integrating robotics, IoT-enabled systems, and hygienic designs to boost efficiency and meet global food safety standards. North America remains the leading region with a 36.8% share in 2024, supported by a well-established food manufacturing base and advanced automation infrastructure. Europe follows with a 29.2% share, driven by sustainable production practices and regulatory compliance, while Asia Pacific, holding 23.7%, is the fastest-growing region, supported by rising industrialization, food demand, and modernization of processing facilities across China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The fruit and vegetable processing equipment market was valued at USD 13.9 billion in 2024 and is expected to reach USD 20.03 billion by 2032, growing at a CAGR of 4.68%.

- Rising demand for convenience and packaged foods, coupled with automation adoption in large processing units, drives market growth across developed and emerging economies.

- Key trends include integration of IoT-based monitoring, hygienic stainless-steel designs, and sustainable manufacturing systems that enhance production efficiency and reduce waste.

- The competitive landscape is shaped by leading global players focusing on modular equipment development, digitalization, and strategic acquisitions to expand service networks and maintain technological leadership.

- North America leads with a 36.8% share, followed by Europe at 29.2% and Asia Pacific at 23.7%, while the cutting equipment segment dominates with about 29.4% share due to its high demand in ready-to-eat and frozen food processing.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

The cutting segment dominates the fruit and vegetable processing equipment market with approximately 29.4% share in 2024. Its leadership stems from the growing use of precision cutting machines that ensure uniformity and speed in bulk food preparation. These systems help minimize waste and preserve nutritional quality, catering to large-scale processing in frozen and ready-to-eat food industries. Increasing investments in automation and hygienic designs, especially for high-capacity slicers and dicers, are reinforcing this segment’s dominance in modern food manufacturing facilities.

- For instance, KRONEN’s KUJ HC-220 cutter processes up to 8,000 kg/hour of vegetables and fruit.

By Operation

The automatic operation segment holds the largest share of around 52.6% in 2024. The strong adoption is driven by rising demand for efficiency, labor cost reduction, and consistent product output in large processing units. Automatic systems enable real-time monitoring, reduce manual intervention, and ensure compliance with food safety standards. Growing integration of smart controls and IoT-based technologies in processing lines further enhances operational precision, making this segment the preferred choice for commercial-scale processors.

- For instance, Ishida multihead weighers reach up to 210 weighments per minute with 0.5–1.0 g accuracy.

Key Growth Drivers

Rising Demand for Processed Food Products

The growing preference for ready-to-eat, packaged, and convenience foods is a major driver of the fruit and vegetable processing equipment market. Urbanization, rising disposable incomes, and changing dietary habits have increased the consumption of processed food items globally. Manufacturers are investing in advanced equipment to meet higher production volumes while ensuring quality and safety. This demand is further supported by the expansion of organized retail and online grocery platforms, which are boosting the need for efficient and hygienic processing systems.

- For instance, Lyco’s Iceberg cooler handles up to 30,000 lb/hour, precooling produce in seconds for high-throughput lines.

Technological Advancements in Processing Equipment

Continuous innovations in automation, robotics, and control systems are transforming the processing landscape. Advanced machines with integrated sensors and real-time data analytics enable precision, higher throughput, and reduced product loss. These technologies improve energy efficiency and enhance product quality by maintaining texture, flavor, and nutrition. The integration of IoT and AI allows remote monitoring and predictive maintenance, which minimizes downtime and ensures seamless production across large-scale processing units.

- For instance, Key Technology’s VERYX sorters for leafy greens sort up to 8.2 metric tons per hour.

Stringent Food Safety and Hygiene Regulations

Increasing regulatory emphasis on food safety and hygiene standards is fueling equipment upgrades and modernization. Governments and food safety authorities are enforcing strict compliance with sanitation and traceability standards in food processing. This has prompted manufacturers to adopt stainless-steel machinery and automated cleaning systems that reduce contamination risks. Rising consumer awareness regarding food quality is further driving investments in equipment that ensures consistency, hygiene, and adherence to global certification norms such as HACCP and ISO.

Key Trends & Opportunities

Adoption of Automation and Smart Technologies

Automation and smart technologies are becoming integral to modern fruit and vegetable processing plants. Automated systems reduce dependency on manual labor, increase operational efficiency, and support 24/7 production. The adoption of IoT-enabled machinery and digital monitoring tools provides insights into performance optimization, waste reduction, and energy savings. These advancements create opportunities for companies to achieve higher precision, traceability, and quality control while meeting the growing demand for processed products.

- For instance, JBT Proseal’s GT4e tray sealer delivers up to 84 MAP packs per minute with a 7-impression tool.

Rising Popularity of Sustainable Processing Solutions

Sustainability is emerging as a critical focus area across the food industry. Manufacturers are investing in energy-efficient machines, water-saving washers, and recyclable packaging systems. Equipment designed for minimal waste generation and easy cleaning helps reduce the environmental footprint of processing plants. Growing consumer demand for sustainably processed food products and stricter environmental policies encourage equipment makers to develop eco-friendly and resource-efficient solutions that support circular economy initiatives.

- For instance, TOMRA notes peeling losses can reach 30% with mechanical peelers, and 20% with low-tech steam, highlighting waste-reduction potential from advanced systems.

Key Challenges

High Capital Investment and Maintenance Costs

The initial cost of advanced processing equipment and its maintenance poses a major barrier for small and medium enterprises. High-end automated systems require significant investment in installation, skilled labor, and regular upkeep. Maintenance and component replacement can further escalate operational expenses, particularly for multi-stage processing lines. These cost challenges often limit technology adoption among smaller processors, slowing down modernization across developing economies.

Lack of Skilled Workforce and Technical Expertise

The growing reliance on advanced and automated processing systems has increased the need for trained professionals. However, many processing plants face a shortage of skilled operators capable of handling sophisticated machinery and digital control systems. Insufficient technical training programs and limited access to qualified personnel can lead to inefficiencies, downtime, and suboptimal utilization of high-tech equipment. Bridging this skills gap is essential for achieving consistent production quality and improving overall industry productivity.

Regional Analysis

North America

North America holds the largest share of approximately 36.8% in the fruit and vegetable processing equipment market in 2024. The dominance is driven by the strong presence of large-scale food manufacturers and advanced automation infrastructure in the United States and Canada. High consumer demand for packaged and ready-to-eat foods, coupled with stringent food safety regulations, supports equipment modernization. Technological innovations such as smart control systems and robotics have enhanced processing efficiency, while investments in sustainable and hygienic machinery continue to strengthen the regional market’s leadership position.

Europe

Europe accounts for nearly 29.2% of the global fruit and vegetable processing equipment market in 2024. The region benefits from a mature food processing industry and strict compliance with hygiene and sustainability standards. Countries such as Germany, France, and the Netherlands are investing heavily in automation and energy-efficient equipment. Growing demand for organic and minimally processed foods has encouraged manufacturers to adopt advanced washing, peeling, and cutting systems. The region’s focus on reducing food waste and maintaining product traceability continues to drive steady technological adoption.

Asia Pacific

Asia Pacific represents around 23.7% of the market share in 2024, emerging as the fastest-growing regional segment. Rapid industrialization, expanding food manufacturing capacity, and rising urbanization in China, India, and Japan are driving equipment demand. The growing middle-class population and changing dietary habits are increasing consumption of processed fruits and vegetables. Governments across the region are supporting food industry modernization through incentives and infrastructure development. Continuous adoption of automated and semi-automatic systems to improve efficiency and reduce manual dependency further strengthens regional growth.

Latin America

Latin America holds nearly 6.5% of the market share in 2024, supported by rising food exports and agricultural modernization. Brazil, Mexico, and Argentina are key contributors, with growing investments in processing facilities to enhance export competitiveness. The region’s abundant fruit and vegetable production base is encouraging the establishment of value-added processing plants. Adoption of packaging and juicing equipment is increasing due to the expanding beverage and frozen food sectors. However, slower technological adoption and limited access to capital constrain the overall pace of growth.

Middle East and Africa

The Middle East and Africa region accounts for about 3.8% of the fruit and vegetable processing equipment market in 2024. Growth is supported by increasing demand for packaged foods, improved cold chain infrastructure, and government-led food diversification programs. The United Arab Emirates, South Africa, and Saudi Arabia are leading adopters of advanced processing technologies. Rising urban populations and food security initiatives are promoting investments in processing machinery. Despite infrastructure limitations and high equipment costs, the market is gaining momentum with growing imports of modern automation systems.

Market Segmentations:

By Type

- Washing

- Peeling

- Cutting

- Juicing

- Blanching

- Packaging

- Others

By Operation

- Automatic

- Semi-automatic

- Manual

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Marel, Bertuzzi Food Processing S.r.l., Heat and Control, Inc., FENCO Food Machinery S.r.l., Krones AG, Navatta Group Food Processing S.r.l., JBT Corporation, Bühler Group, Alfa Laval AB, Bucher Industries AG, Lyco Manufacturing, Inc., Mepaco, Sormac B.V., GEA Group, and Key Technology, Inc. are the key players in the fruit and vegetable processing equipment market. The competition is characterized by continuous innovation, automation integration, and energy-efficient processing solutions aimed at enhancing product quality and throughput. Companies are focusing on modular designs and IoT-enabled systems that support predictive maintenance and real-time production analytics. Strategic partnerships and regional expansions are frequent, allowing firms to strengthen distribution and after-sales services. Manufacturers are increasingly investing in hygienic engineering and stainless-steel fabrication to meet stringent food safety standards. The competitive environment is driven by technological advancement, customization capabilities, and sustainable machinery solutions catering to evolving global food processing needs.

Key Player Analysis

- Marel

- Bertuzzi Food Processing S.r.l.

- Heat and Control, Inc.

- FENCO Food Machinery S.r.l.

- Krones AG

- Navatta Group Food Processing S.r.l.

- JBT Corporation

- Bühler Group

- Alfa Laval AB

- Bucher Industries AG

- Lyco Manufacturing, Inc.

- Mepaco

- Sormac B.V.

- GEA Group

- Key Technology, Inc.

Recent Developments

- In 2025, FENCO continues to innovate with unique technologies for processing all types of fruit, including tropical varieties, to deliver a broad range of finished products.

- In 2025, Key Technology, Inc. Introduced a new fully integrated nut processing line in collaboration with PPM Technologies, offering grading, sorting, oil roasting, seasoning, and packaging.

- In 2025, GEA introduced its new OptiSlicer 7000 and OptiScanner 5000 at IFFA to improve its automated line concept.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Operation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing demand for ready-to-eat and convenience foods.

- Automation and digital monitoring will become standard features in new processing lines.

- Manufacturers will focus on energy-efficient and water-saving equipment to meet sustainability goals.

- Smart technologies like IoT and AI will enhance operational control and predictive maintenance.

- Emerging economies in Asia Pacific will witness the fastest adoption of modern processing systems.

- Equipment customization will rise to handle diverse fruit and vegetable varieties efficiently.

- Stringent food safety regulations will continue driving equipment upgrades and compliance investments.

- Integration of robotics will improve speed, precision, and hygiene in large-scale production plants.

- Demand for hygienic design and easy-clean machinery will grow across all processing stages.

- Collaborations between technology firms and food processors will accelerate innovation in processing solutions.

Market Segmentation Analysis:

Market Segmentation Analysis: