Market Overview

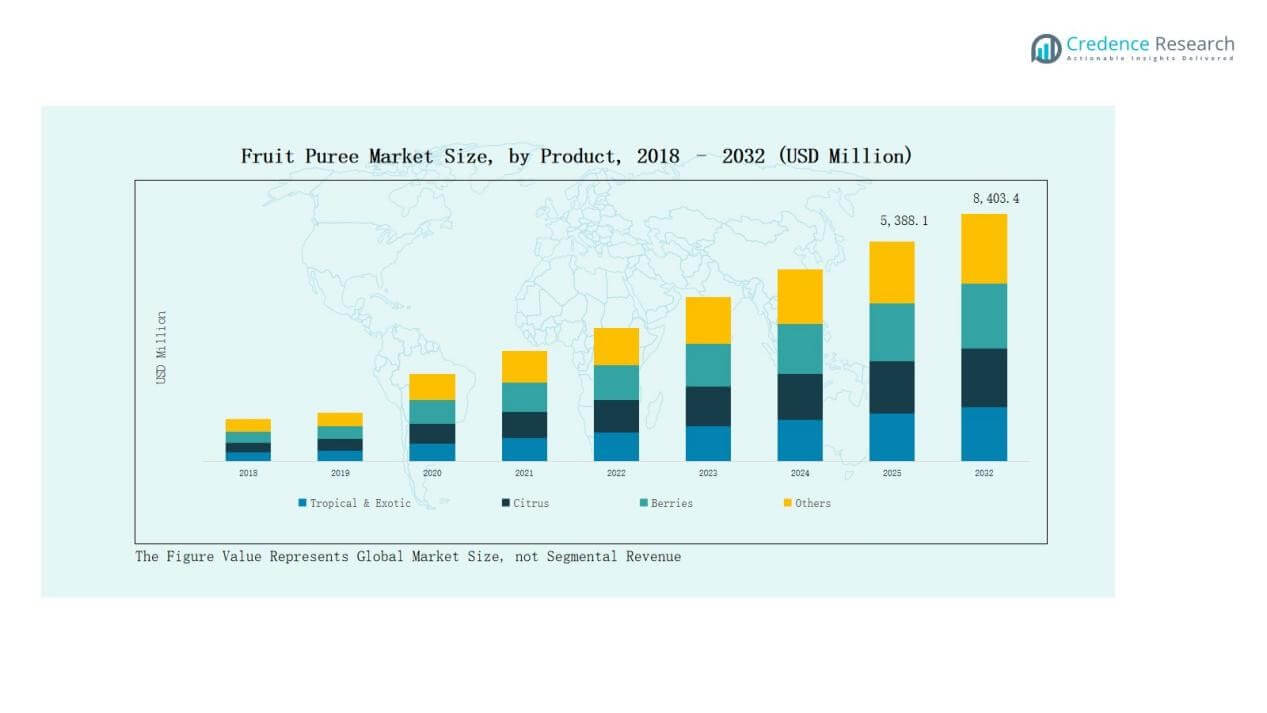

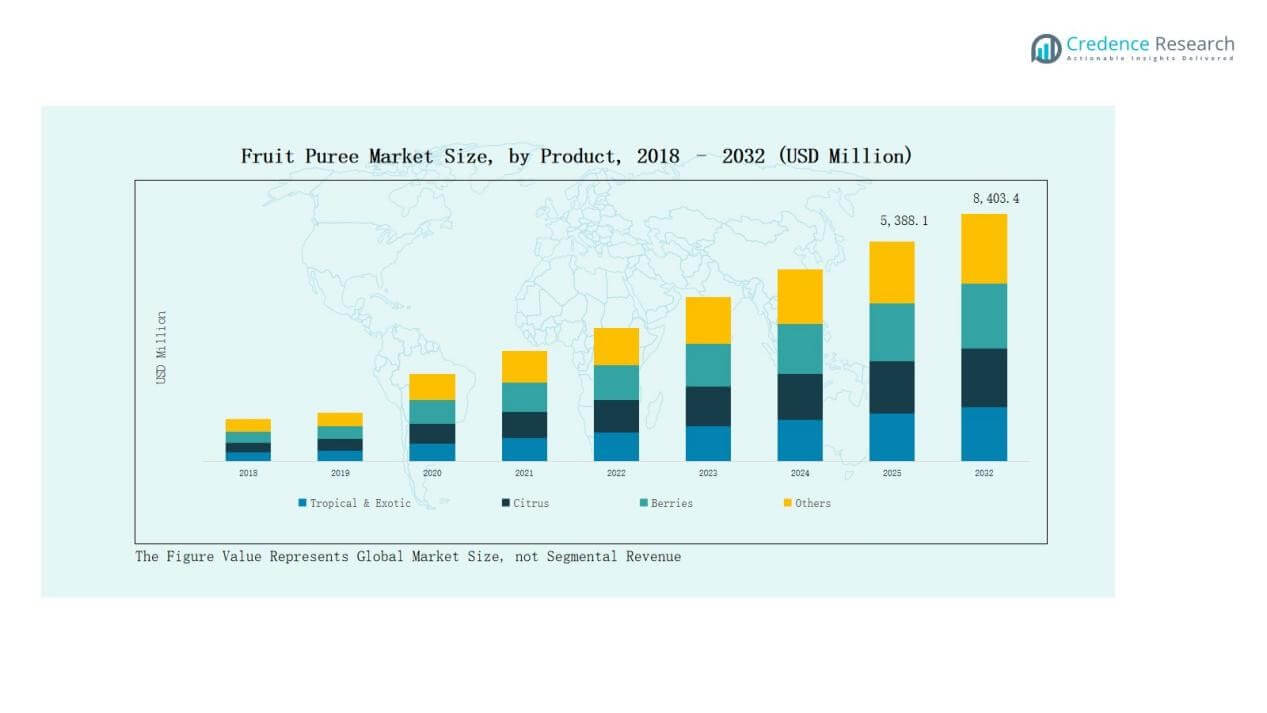

The Fruit Puree Market size was valued at USD 4,320.00 million in 2018, reaching USD 5,105.36 million in 2024, and is anticipated to reach USD 8,403.44 million by 2032, at a CAGR of 6.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fruit Puree Market Size 2024 |

USD 5,105.36 Million |

| Fruit Puree Market, CAGR |

6.56% |

| Fruit Puree Market Size 2032 |

USD 8,403.44 Million |

The Fruit Puree Market is shaped by a mix of multinational corporations and regional suppliers, with leading players including Fénix, Döhler GmbH, Kerr by Ingredion, AGRANA Beteiligungs-AG, Brothers International Food Holdings, CHINA KUNYU INDUSTRIAL, Grünewald International, Tree Top, Uren Food Group, The Perfect Purée of Napa Valley, and Oregon Fruit Products. These companies compete through broad product portfolios, global distribution networks, and continuous innovation in exotic, organic, and sustainable puree offerings. Asia Pacific emerged as the leading region in 2024, commanding a 37.9% market share, driven by strong demand for beverages and infant food, expanding urban populations, and rising investments in food processing and retail sectors.

Market Insights

Market Insights

- The Fruit Puree Market grew from USD 4,320.00 million in 2018 to USD 5,105.36 million in 2024, and is projected at USD 8,403.44 million by 2032.

- Asia Pacific led with 37.9% share in 2024, supported by urbanization, rising disposable incomes, and strong demand for beverages and infant food.

- The Tropical & Exotic segment held 42.6% share in 2024, driven by mango, banana, and guava purees widely used in beverages and baby food.

- The Beverages segment dominated with 46.3% share in 2024, reflecting rising consumption of smoothies, flavored water, and health-focused drinks using natural puree ingredients.

- Leading players include Fénix, Döhler GmbH, Kerr by Ingredion, AGRANA Beteiligungs-AG, Tree Top, Uren Food Group, The Perfect Purée of Napa Valley, and Oregon Fruit Products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product

The Tropical & Exotic segment accounted for the largest share of 42.6% in 2024, driven by rising demand for mango, banana, and guava purees in beverages and baby food. These fruits provide natural sweetness and vibrant color, making them popular in smoothies, juices, and packaged infant food. Citrus held a 25.4% share, supported by strong usage in concentrates and flavored drinks, while berries captured 20.8%, fueled by health-conscious consumers seeking antioxidant-rich options. The remaining 11.2% share belonged to other fruits such as apples and pears, which continue to support bakery and snack applications.

For instance, SVZ International launched a range of frozen berry purees, including blueberry and blackberry, to cater to the growing demand for antioxidant-rich ingredients in smoothies and dairy drinks.

By Application

The Beverages segment dominated with a 46.3% share in 2024, reflecting strong consumption of smoothies, flavored water, and health drinks that incorporate fruit puree as a natural ingredient. Rising consumer preference for clean-label and nutrient-rich drinks drives consistent growth in this sub-segment. Infant food followed with a 28.5% share, supported by growing awareness of natural and safe food ingredients for babies. Bakery & snacks held 17.9%, with demand for fruit-filled pastries, bars, and desserts gaining traction, while the remaining 7.3% share belonged to other applications such as sauces and dairy products.

For instance, Coca-Cola India expanded its Minute Maid range with new offerings, including the Minute Maid Vita Punch mixed fruit drink, which is fortified with vitamin C to meet rising demand for nutrient-rich beverages.

Key Growth Drivers

Key Growth Drivers

Rising Demand for Natural and Healthy Ingredients

Consumers are shifting toward natural and clean-label products, driving the adoption of fruit purees as substitutes for artificial flavors and sweeteners. Fruit purees deliver authentic taste, natural sweetness, and nutritional benefits, making them highly preferred in beverages, infant food, and snacks. Health-conscious lifestyles, combined with increasing awareness of antioxidants, vitamins, and fiber content in fruit-based products, strengthen this trend. Manufacturers are leveraging this shift to develop innovative offerings that meet consumer expectations for healthier choices, directly fueling market expansion.

For instance, Döhler acquired SVZ to deliver premium, clean-label fruit and vegetable ingredients, including purees, for bakery and snack formulations

Growth of Infant and Baby Food Industry

The infant food industry significantly drives the fruit puree market due to rising awareness of safe and nutritious food for children. Parents increasingly prefer fruit puree-based products because of their digestibility and natural nutrient content. Packaged baby foods, containing apple, mango, and banana purees, are gaining strong traction worldwide. Rising disposable incomes and urbanization are accelerating this demand, particularly in emerging economies. Regulatory support for organic and natural food further boosts the integration of fruit purees in infant food products, strengthening long-term market prospects.

Expansion in Beverage Industry Applications

Fruit purees are becoming core ingredients in smoothies, juices, flavored water, and functional drinks, fueling consistent demand growth. The beverages segment dominates due to consumer preferences for natural and refreshing drink options, especially among younger demographics. Premium beverage brands are focusing on exotic fruit blends to differentiate offerings, expanding their product portfolios with tropical and antioxidant-rich fruits. Seasonal demand surges, along with rising investments in ready-to-drink and fortified beverages, continue to reinforce fruit puree utilization. This strong linkage with beverages sustains long-term market growth momentum.

For instance, in March 2024, PepsiCo expanded its Tropicana Essentials line in Europe with fruit puree-based juices fortified with vitamins and fiber to target functional beverage consumers.

Key Trends & Opportunities

Rising Popularity of Exotic and Functional Fruits

Consumers are increasingly drawn to exotic fruits such as mango, guava, passionfruit, and berries, which are perceived as premium and functional. These fruits provide vibrant colors, unique flavors, and health-boosting nutrients that appeal to both retail and foodservice sectors. The demand for exotic fruit purees in smoothies, yogurts, and gourmet applications creates new opportunities for suppliers to expand their portfolios. This trend is especially strong in developed markets, where consumers seek novelty and health benefits in their food and beverage purchases.

For instance, Döhler Group launched a range of tropical fruit purees including mango and guava, highlighting their

Growth of Organic and Sustainable Production

Sustainability and organic farming are reshaping the fruit puree industry, presenting opportunities for manufacturers to differentiate. Organic fruit purees are gaining popularity in infant food and beverages, as parents and health-focused consumers prioritize pesticide-free and environmentally responsible products. Brands promoting traceability, eco-friendly packaging, and sustainable sourcing are attracting premium buyers. Partnerships with farmers and investments in sustainable supply chains further support this shift. The opportunity to position fruit purees as both healthy and environmentally friendly enhances market potential and consumer trust globally.

For instance, Hain Celestial’s Earth’s Best Organic expanded its organic baby food line in the U.S., using BPA-free packaging and purees made from USDA-certified organic fruits.

Key Challenges

Seasonal Supply Fluctuations

The fruit puree industry is heavily dependent on agricultural cycles, leading to supply chain volatility. Seasonal variations, climate change impacts, and unpredictable harvests affect the availability and pricing of raw fruits. These fluctuations often disrupt production consistency, raising costs for manufacturers and distributors. The lack of year-round supply of certain exotic fruits can limit their use in large-scale food and beverage operations. Companies must invest in cold storage, preservation technologies, and diversified sourcing to minimize risks from seasonal supply dependency.

High Production and Processing Costs

Processing fruits into purees involves significant investment in advanced equipment, storage facilities, and quality control systems. Rising costs of raw fruits, transportation, and energy inputs further inflate production expenses. Manufacturers aiming to maintain natural flavors and nutrients often face higher costs compared to artificial substitutes. These elevated costs can constrain margins, especially for small and mid-sized producers. Balancing affordability with premium quality remains a core challenge, requiring continuous innovation and efficiency improvements across the value chain to sustain competitiveness.

Intense Market Competition and Substitutes

The fruit puree market faces stiff competition from alternative ingredients such as concentrates, artificial flavors, and synthetic additives that offer lower production costs. Large multinational players with diverse portfolios intensify competition, making it difficult for smaller firms to capture significant market share. Price-sensitive consumers in emerging markets may also opt for cheaper substitutes, limiting the penetration of purees. Companies need to differentiate through branding, product innovation, and sustainability positioning to mitigate the competitive threat and maintain a strong presence in this crowded market.

Regional Analysis

North America

The North America Fruit Puree Market was valued at USD 1,144.80 million in 2018, reaching USD 1,330.43 million in 2024, and is projected to hit USD 2,185.75 million by 2032, registering a CAGR of 6.6%. The region accounted for 26.1% share in 2024, supported by strong demand for infant food and premium beverage applications. The U.S. leads growth through advanced food processing industries and rising adoption of natural fruit ingredients in packaged goods. Increased consumer preference for health-focused and clean-label products further strengthens regional market expansion.

Europe

The Europe Fruit Puree Market stood at USD 1,073.52 million in 2018, increased to USD 1,216.47 million in 2024, and is forecast to reach USD 1,884.49 million by 2032, with a CAGR of 5.8%. Europe contributed 23.8% of the global share in 2024, led by strong demand in bakery, snacks, and beverage industries. Countries like the UK, France, and Germany emphasize organic and sustainable sourcing, driving steady adoption. The rising popularity of fruit-based infant food and premium bakery products supports long-term growth across the region.

Asia Pacific

The Asia Pacific Fruit Puree Market was valued at USD 1,589.76 million in 2018, reached USD 1,934.15 million in 2024, and is projected to expand to USD 3,405.92 million by 2032, achieving a CAGR of 7.4%. Holding the largest 37.9% share in 2024, the region dominates due to rapid urbanization, rising disposable incomes, and growing demand for packaged beverages and infant food. China and India drive major consumption, while Japan and Southeast Asia focus on premium fruit puree applications. Expanding investments in food processing and retail strengthen Asia Pacific’s leadership.

Latin America

The Latin America Fruit Puree Market was valued at USD 268.27 million in 2018, increased to USD 313.93 million in 2024, and is forecast to reach USD 478.74 million by 2032, at a CAGR of 5.6%. The region captured 6.2% share in 2024, led by Brazil and Argentina’s demand for tropical and exotic fruits in beverages and snacks. Growing urban populations and shifting dietary preferences are driving adoption of natural fruit-based products. Expansion in the regional foodservice industry further enhances demand for fruit puree in smoothies, desserts, and bakery applications.

Middle East

The Middle East Fruit Puree Market stood at USD 164.16 million in 2018, reached USD 181.72 million in 2024, and is anticipated to rise to USD 269.80 million by 2032, growing at a CAGR of 5.2%. With a 3.6% share in 2024, the market is driven by increasing use of fruit purees in beverages, confectionery, and infant food. GCC countries account for the majority of consumption, supported by higher purchasing power and preference for imported fruit-based products. Expanding modern retail and café culture contributes to steady growth across the region.

Africa

The Africa Fruit Puree Market was valued at USD 79.49 million in 2018, rose to USD 128.68 million in 2024, and is expected to reach USD 178.73 million by 2032, registering the slowest CAGR of 3.8%. Africa accounted for 2.5% share in 2024, with South Africa and Egypt being the largest contributors. The market is gradually expanding as awareness of packaged fruit-based food and beverages increases. Limited processing capacity and distribution challenges remain barriers, but rising urban populations and dietary shifts are expected to create modest opportunities in the long term.

Market Segmentations:

Market Segmentations:

By Product

- Tropical & Exotic

- Citrus

- Berries

- Others

By Application

- Beverages

- Bakery & Snacks

- Infant Food

- Others

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Fruit Puree Market is moderately fragmented, with competition shaped by both multinational corporations and regional suppliers. Key players such as Fénix, Döhler GmbH, Kerr by Ingredion, AGRANA Beteiligungs-AG, Brothers International Food Holdings, CHINA KUNYU INDUSTRIAL, Grünewald International, Tree Top, Uren Food Group, The Perfect Purée of Napa Valley, and Oregon Fruit Products dominate through diverse product portfolios and global distribution networks. Companies focus on innovation in exotic and organic fruit purees, strategic acquisitions, and partnerships with food and beverage manufacturers to strengthen market presence. Pricing competitiveness, quality consistency, and adherence to food safety standards remain critical differentiators. Emerging players in Asia Pacific and Latin America are leveraging regional fruit availability to expand cost-effective supply chains. With rising consumer preference for clean-label and natural products, sustainability and traceability have become central strategies for leading firms, driving investments in eco-friendly sourcing, processing efficiency, and premium positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Fénix

- Döhler GmbH

- Kerr by Ingredion

- AGRANA Beteiligungs-AG

- Brothers International Food Holdings, LLC.

- CHINA KUNYU INDUSTRIAL CO., LIMITED

- Grünewald International

- Tree Top

- Uren Food Group Limited

- The Perfect Purée of Napa Valley

- Oregon Fruit Products

Recent Developments

- In February 2025, The Perfect Purée of Napa Valley launched two new purees: Camu and Soursop, highlighting their high antioxidant and fiber content, aimed at diverse food and beverage applications.

- In November 2024, Oregon Fruit Products introduced a new Sicilian lemon puree as a limited release product for seasonal brewing applications.

- In January 2025, The Perfect Puree of Napa Valley introduced the Tastecraft Pure freeze-dried fruit line in partnership with Döhler, enhancing innovation in fruit ingredients.

- In April 2025, Döhler North America acquired Premier Juices. This acquisition strengthened Döhler’s natural fruit-based product offerings and supply chain in North America.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fruit purees will rise as consumers prefer natural and clean-label products.

- Beverages will remain the leading application due to growing popularity of smoothies and juices.

- Infant food consumption will expand with increasing focus on safe and nutritious ingredients.

- Exotic and tropical fruits will gain more traction in premium and functional food products.

- Organic and sustainably sourced fruit purees will attract health-conscious and eco-aware buyers.

- Asia Pacific will continue to lead growth, supported by urbanization and rising disposable incomes.

- Europe and North America will focus on premium, organic, and traceable puree offerings.

- Innovation in packaging and preservation technologies will improve shelf life and distribution efficiency.

- Strategic partnerships between puree producers and food companies will enhance product portfolios.

- Competition will intensify as regional suppliers expand capacity and challenge multinational players.

Market Insights

Market Insights Key Growth Drivers

Key Growth Drivers Market Segmentations:

Market Segmentations: