Market Overview

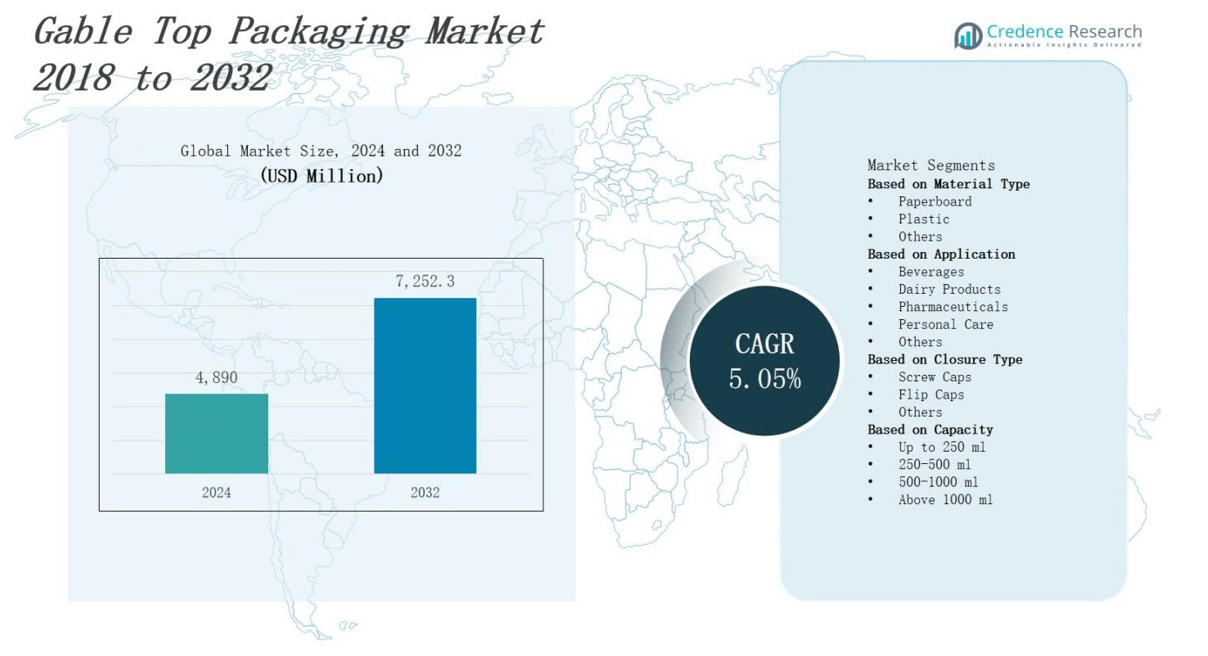

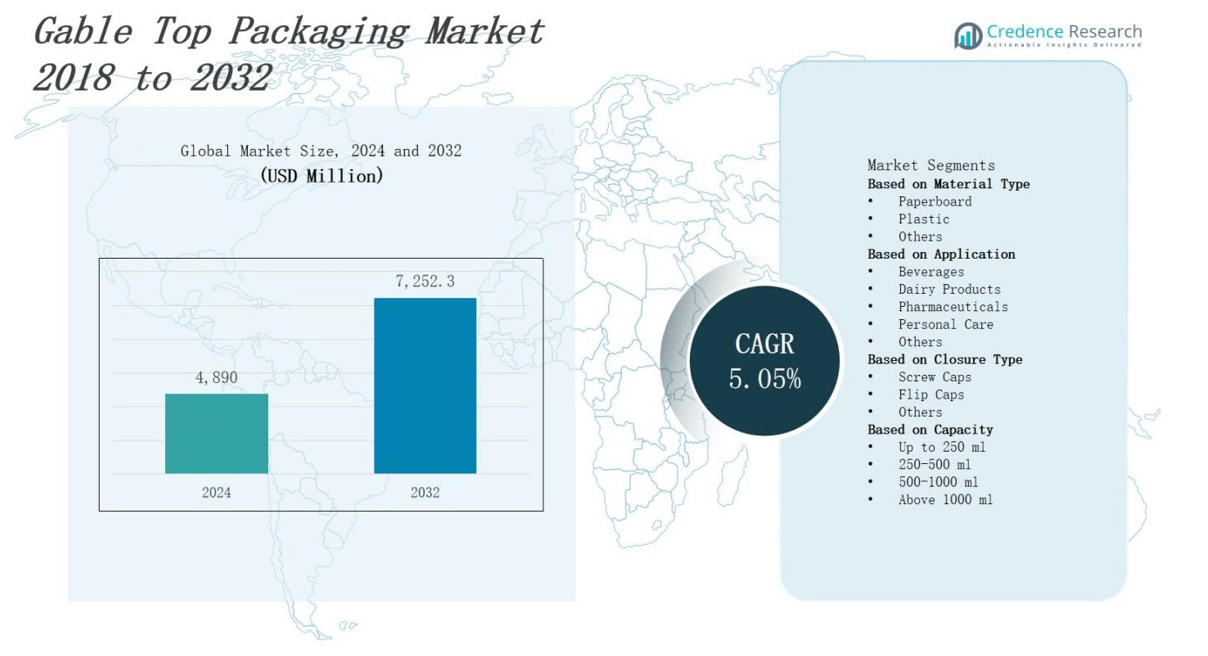

The gable top packaging market is projected to expand from USD 4,890 million in 2024 to USD 7,252.3 million by 2032, registering a CAGR of 5.05 %.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gable Top Packaging Market Size 2024 |

USD 4,890 million |

| Gable Top Packaging Market, CAGR |

5.05% |

| Gable Top Packaging Market Size 2032 |

USD 7,252.3 million |

The gable top packaging market grows as consumers and manufacturers demand sustainable, eco‑friendly, convenient, and cost‑effective solutions. Rising environmental regulations drive adoption of recyclable and biodegradable materials. Brands leverage gable top cartons to differentiate products through premium graphics and smart labels. Advances in aseptic processing and barrier coatings extend shelf life for dairy, juice, and liquid food applications. Growth in e‑commerce and single‑serve consumption fuels innovation in lightweight, tamper‑evident designs. Collaboration between packaging suppliers and food producers accelerates development of renewable polymers and functional inks. Manufacturers optimize production lines to reduce material waste, enhance operational efficiency and supply chain visibility.

North America holds a share driven by dairy and juice consumption. Europe leverages recycling and premium branding. Asia Pacific leads growth through local production. Latin America adopts shelf‑stable cartons for functional beverages. Middle East & Africa shows demand for fortified drinks. The gable top packaging market features firms like Tetra Pak International, Elopak AS, SIG Combibloc Group, Evergreen Packaging LLC, Nippon Paper Industries, Adam Pack S.A., International Paper Company, Parksons Packaging, Polyoak Packaging Group, Stora Enso Oyj, TidePak Aseptic Packaging Material Ltd and Nampak Ltd compete on innovation and sustainability.

Market Insights

- The gable top packaging market will expand from USD 4,890 million in 2024 to USD 7,252.3 million by 2032 at a CAGR of 5.05 %.

- The gable top packaging market faces rising environmental regulations and consumer demand for recyclable and biodegradable materials that drive sustainable material adoption.

- The gable top packaging market sees brands differentiate products through premium graphics, interactive smart labels and digital integrations such as QR codes and NFC tags.

- The gable top packaging market leverages advances in aseptic processing and high‑barrier coatings to extend shelf life of dairy, juice and liquid food products.

- The gable top packaging market supports manufacturers optimizing automated filling and carton‑erecting lines to cut labor costs and reduce material waste.

- The gable top packaging market experiences margin pressure from volatile paperboard and polymer prices while supply chain disruptions force higher inventory levels.

- The gable top packaging market confronts underdeveloped recycling infrastructure and complex barrier coatings that hinder circularity and require investment in recyclable alternatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Sustainable Material Adoption Accelerates Growth

The gable top packaging market gains momentum driven by stricter environmental regulations and consumer demand for eco‑friendly alternatives. Manufacturers invest in renewable polymers and recyclable paperboard to meet sustainability targets. It enables brands to highlight their commitment to circular economy principles. Advances in material science improve barrier performance while reducing carbon footprint. Partnerships between suppliers and recyclers support closed‑loop. Cost efficiencies emerge from waste reduction.

- For instance, Parksons Packaging delivers recyclable gable top cartons for liquid and dry goods, integrating partnerships with filling equipment makers to enhance circular economy principles and reduce waste in the supply chain.

Premium Branding and Customization Drive Adoption

The gable top packaging market benefits from consumer preference for differentiated shelf presence and tailored designs. Brands collaborate with printers and label companies to create high-resolution graphics. It enables engagement through QR codes and sensors. Elevated brand experiences justify premium pricing and enhance customer loyalty. Industry players adopt flexible die‑cutting and embossing techniques. Manufacturers refine supply chains to ensure timely, efficient delivery, maintain quality standards.

- For instance, Nova Packaging designed luxury product cases with embossed logos and suede-lined compartments to combine elegance with protection, reinforcing authenticity and premium appeal.

Enhanced Shelf Life Extends Application Scope

The gable top packaging market leverages advanced barrier coatings and aseptic processing to extend product shelf life. Enhanced oxygen and moisture resistance protect dairy, juice and liquid food products. It reduces spoilage risk and supply chain disruptions. Manufacturers integrate high‑barrier films without compromising recyclability. Industry standards ensure food safety compliance and consistent quality. Long shelf life enables expansion into emerging markets and remote regions.

Operational Efficiencies Lower Production Costs

The gable top packaging market experiences cost reductions through optimized manufacturing workflows and automation adoption. Robotic filling and carton erecting lines deliver precise, high‑speed performance and reliability. It cuts labor expenses and minimizes downtime. Suppliers implement maintenance to avoid equipment failures. Lean inventory management reduces material carrying costs shrinkage. Process improvement enhances throughput lowers energy consumption. Collaborative planning with food producers streamlines fulfillment reduces expenses.

Market Trends

Digital Integration and Smart Label Adoption

Brands deploy QR codes, RFID tags and NFC chips to offer product information and traceability on gable top packaging market. It enhances transparency and consumer trust. Data gates allow real-time tracking across supply chains. Companies integrate digital platforms to deliver interactive experiences. Printers adopt UV ink and variable data printing technologies. Suppliers collaborate on platform development. Consumers engage through mobile applications to verify authenticity and sourcing details.

- For instance, Parksons Packaging in India offers end-to-end gable top carton solutions incorporating smart packaging technologies like RFID for tracking liquid and dry products.

Bio‑based Coatings and Minimalist Designs Rise

Manufacturers explore renewable polymers and eco‑friendly coatings to reduce environmental footprint across gable top packaging market. It maintains barrier performance while meeting regulatory demands. Designers simplify graphics and eliminate excess layers to lower material usage. Producers test compostable liners and water‑based adhesives. Collaborations help certify materials under global standards. Brands highlight minimalism to appeal eco‑conscious consumers. Regulatory bodies update guidelines to encourage sustainable packaging formats.

- For instance, Gable Top Pak uses renewable paperboard from responsibly managed forests combined with multi-layer polyethylene and aluminum foil coatings to extend shelf life and cut carbon emissions by reducing fossil fuel-based materials by 80% in dairy packaging.

Customization and Short‑Run Production Expand

Food producers demand unique carton shapes and sizes to differentiate products within gable top packaging market. It drives investments in modular equipment that switch between runs quickly. Suppliers offer digital proofing and low‑volume printing services to accommodate seasonal promotions. Designers propose variable cutlines and folding patterns to support limited editions. Manufacturers reduce lead times and inventory risks. Retailers request on‑demand production near distribution centers. Partnerships optimize logistics networks and reduce delays.

Emerging Markets and Functional Packaging Growth

Companies penetrate developing economies by adapting carton designs to local tastes in gable top packaging market. It supports fruit juices and dairy brands targeting rural populations. Producers add functional features such as reclosable seals and portion control. Suppliers design introductory SKUs priced for affordability. Government programs promote fortified beverages in shelf‑stable containers. Joint ventures enable technology transfer and local production. Demand for nutrient‑enriched liquids elevates market potential.

Market Challenges Analysis

Volatile Input Costs and Supply Chain Disruptions

The gable top packaging market experiences significant margin pressure due to fluctuations in paperboard and polymer prices. It struggles to maintain cost stability when raw material rates shift unexpectedly. Suppliers face extended lead times and logistical bottlenecks that disrupt production schedules. It forces manufacturers to carry higher inventory levels to avoid stockouts. Regulatory updates on wood sourcing and packaging materials increase compliance requirements and costs. Smaller producers confront challenges securing flexible contracts that mitigate price spikes.

Recycling Infrastructure Gaps and Design Constraints

The gable top packaging market depends on effective recycling systems that remain underdeveloped in many regions. It fails to achieve circularity goals in areas with limited waste collection and sorting facilities. Complex barrier coatings hinder material recovery and recycling quality. It compels companies to invest in research and development for recyclable alternatives. Inconsistent recycling protocols increase sorting errors and contamination rates. Consumers hold brands accountable for end‑of‑life packaging performance and may penalize unsustainable designs. Manufacturers must balance barrier performance and environmental impact to avoid reputational risks.

Market Opportunities

Expansion into Plant‑Based and Functional Beverages

The gable top packaging market can tap growth by serving plant‑based and nutrient‑enriched drink segments. It enables dairy alternative brands to use shelf‑stable cartons for almond, soy and oat beverages. Nutrient fortification offers high‑value applications in protein shakes and vitamin‑fortified juices. It strengthens brand appeal among health‑conscious consumers. Emerging demand for low‑sugar, high‑fiber formulations creates new SKU opportunities. It supports shelf life extension without preservatives. Companies that align with wellness trends secure premium pricing and market share.

Partnerships for Sustainable Material Innovation and Local Production

The gable top packaging market gains potential through alliances between material scientists and carton producers to develop bio‑based coatings and liners. It reduces reliance on fossil‑fuel plastics and boosts recyclability. Local production partnerships in emerging regions cut transportation costs and improve responsiveness. It permits adaptation of design and size to regional consumer preferences. Investment in modular manufacturing lines accelerates small‑batch runs. It supports rapid market testing for new flavors and packaging styles. Collaborative R&D accelerates regulatory approval for novel eco‑friendly materials.

Market Segmentation Analysis:

By Material Type

The gable top packaging market divides into three material categories: paperboard, plastic, and others. Paperboard leads volume and revenue due to its renewability and printing versatility. It supports barrier coatings that protect liquids and maintain structural integrity. Plastic serves high‑barrier applications requiring moisture resistance and allows transparent windows. It also offers lightweight options for transport efficiency. Others, including composite laminates and bio‑based films, gain traction in niche segments seeking sustainable alternatives and specialized performance.

- For instance, Tetra Pak’s paperboard cartons use specialized barrier coatings that enable long shelf-life for milk and juice, ensuring product safety and structural integrity during transport.

By Application

The gable top packaging market segments by beverages, dairy products, pharmaceuticals, personal care, and others. Beverages represent the largest share due to rising juice and functional drink consumption. It sustains growth through convenience and shelf stability. Dairy products follow closely, with aseptic cartons used for milk and plant‑based alternatives. Pharmaceuticals use sterile cartons for liquid formulations and nutritional supplements. Personal care adopts cartons for lotions and hand sanitizers. Others include chemical and niche liquid products requiring secure, lightweight packaging.

- For instance, Danone uses aseptic gable top cartons for its plant-based milks, enhancing freshness and portability.

By Closure Type

The gable top packaging market classifies closures into screw caps, flip caps, and others. Screw caps dominate thanks to tight seals and consumer familiarity. It enables repeat use and secure shipping. Flip caps gain momentum in single‑serve segments and improve user convenience. It also helps reduce litter by preventing spills. Others, such as spouts and push‑pull closures, serve specialized applications in nutritional shakes and industrial liquids. Custom closure designs enhance brand identity and functionality.

Segments:

Based on Material Type

- Paperboard

- Plastic

- Others

Based on Application

- Beverages

- Dairy Products

- Pharmaceuticals

- Personal Care

- Others

Based on Closure Type

- Screw Caps

- Flip Caps

- Others

Based on Capacity

- Up to 250 ml

- 250-500 ml

- 500-1000 ml

- Above 1000 ml

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 30% share of the gable top packaging market. It benefits from robust dairy and juice industries in the United States and Canada. Companies invest in high‑barrier cartons to protect aseptic products. Manufacturers streamline distribution networks to serve urban and rural areas. It faces regulatory scrutiny on sustainable sourcing and waste management. It drives innovation through digital print and smart label integration. It competes with Europe, which accounts for 25% share, and Asia Pacific at 35%, while Latin America and Middle East & Africa hold 7% and 3% shares respectively.

Europe

Europe accounts for 25% share of the gable top packaging market. It leverages advanced recycling infrastructure to support paperboard cartons. Brands use premium graphics and interactive labels to engage consumers. It maintains high compliance standards on material sourcing and waste. Manufacturers adopt barrier films to extend shelf life of juices and liquid dairy. It benefits from trade agreements that facilitate cross‑border supply. North America, Asia Pacific, Latin America and Middle East & Africa represent 30%, 35%, 7% and 3% shares respectively.

Asia Pacific

Asia Pacific leads with 35% share of the gable top packaging market. It hosts growing demand in China, India and Southeast Asia for juice and plant‑based milk. Manufacturers expand local facilities to reduce costs and improve responsiveness. It adopts bio‑based coatings to meet evolving environmental regulations. Brands launch functional beverage SKUs in shelf‑stable cartons. It works with local suppliers to secure renewable paperboard sources. Europe, North America, Latin America and Middle East & Africa share 25%, 30%, 7% and 3% of the market respectively.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Parksons Packaging Ltd.

- SIG Combibloc Group AG

- Nippon Paper Industries Co., Ltd.

- International Paper Company

- Evergreen Packaging LLC

- TidePak Aseptic Packaging Material Co., Ltd.

- Elopak AS

- Stora Enso Oyj

- Polyoak Packaging Group (Pty) Ltd.

- Adam Pack S.A.

- Nampak Ltd.

- Tetra Pak International S.A.

Competitive Analysis

Leading players such as Tetra Pak International, Elopak, SIG Combibloc, Evergreen Packaging and Nippon Paper compete on innovation, capacity, partnerships and regional presence. The gable top packaging market demonstrates high entry barriers due to capital intensity and strict safety standards. It thrives on R&D investment to develop sustainable materials and aseptic processing technologies. Major suppliers leverage global manufacturing networks to optimize costs and reduce lead times. It faces pressure from emerging local producers in Asia Pacific and price‑sensitive retailers. Companies differentiate through digital printing, smart label integration and customization services. It encounters consolidation through acquisitions and joint ventures that expand product portfolios. Competitive advantage depends on agile supply chains, strong distribution channels and compliance with environmental regulations. It prioritizes collaboration with material scientists and food producers to deliver barrier performance and eco‑friendly credentials. It invests in automation to increase throughput and maintain consistent quality across multiple formats.

Recent Developments

- On June 3, 2025 – Elopak introduces first-ever D‑PAK™ cartons incorporating 10% post‑consumer circular polyethylene and 90% bio‑circular polymers in collaboration with Orkla Home and Personal Care and Dow.

- In April 2024, Evergreen Packaging launched a recyclable gable top carton featuring improved barrier performance without compromising recyclability.

- In March 2024, Tetra Pak introduced a new plant‑based gable top carton to enhance sustainability and reduce reliance on fossil‑based materials.

- On January 31, 2025 – International Paper and DS Smith completed a combination to form a global leader in sustainable packaging solutions.

Market Concentration & Characteristics

Market concentration in the gable top packaging market remains high, with a handful of global leaders—Tetra Pak, Elopak and SIG Combibloc—commanding the largest production capacities and distribution networks. It operates under significant entry barriers due to capital‑intensive aseptic processing equipment and strict food‑safety regulations. Major suppliers invest heavily in research and development to introduce eco‑friendly materials and advanced barrier technologies that extend product shelf life. It benefits from economies of scale, which enable price competitiveness and rapid rollout of new carton designs. Regional players compete on niche customizations and local service agility. It relies on strong partnerships with food and beverage manufacturers to secure long‑term contracts and optimize supply chains. Market characteristics include ongoing automation of filling and carton‑erecting lines, integration of smart labels for traceability and growing focus on closed‑loop recycling initiatives. It drives steady innovation while maintaining consistent quality across diverse formats.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, Clouser Type, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will adopt advanced bio‑based materials to enhance recyclability and meet regulatory standards.

- Brands will integrate NFC and QR technologies to provide real‑time product information and traceability.

- Suppliers will expand modular production lines to support short‑run customization and seasonal promotions.

- Companies will develop barrier coatings that balance shelf life extension with recyclability.

- Producers will invest in automation to increase throughput and reduce labor costs.

- Collaborations between material scientists and carton makers will accelerate approval of novel eco‑friendly liners.

- Regional partnerships will enable local sourcing of renewable paperboard and reduce transportation emissions.

- Packaging designers will simplify graphic layers to minimize material usage and lower production complexity.

- Industry consortia will standardize recycling protocols to improve material recovery rates.

- Food and beverage manufacturers will launch fortified and functional beverages in gable top cartons to capture health‑focused consumers.