Market Overview

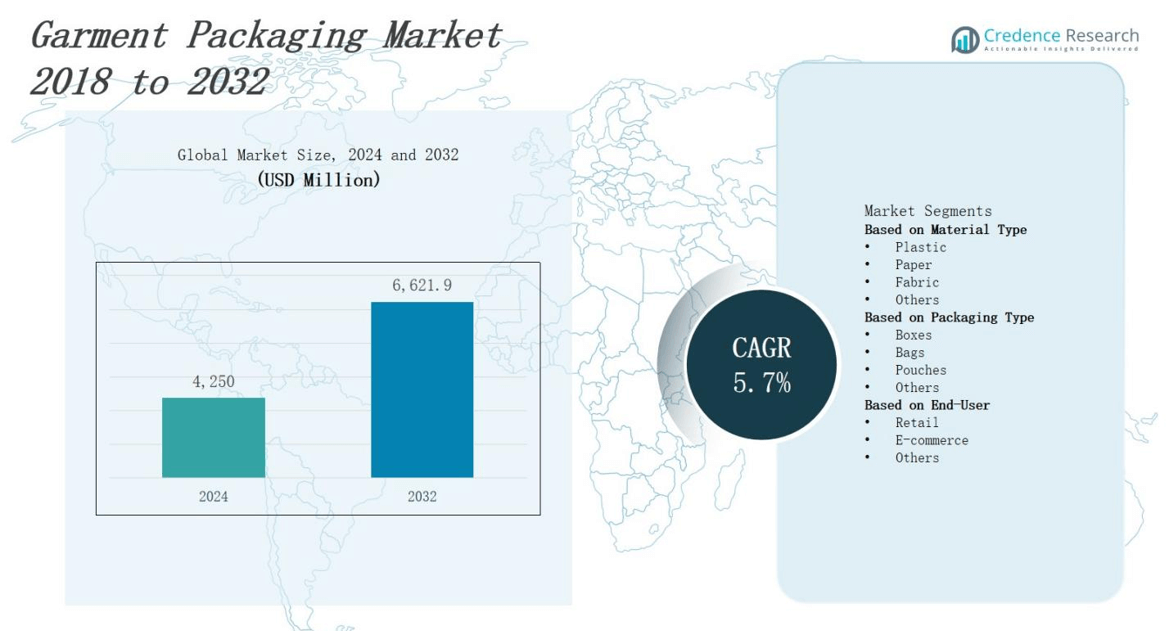

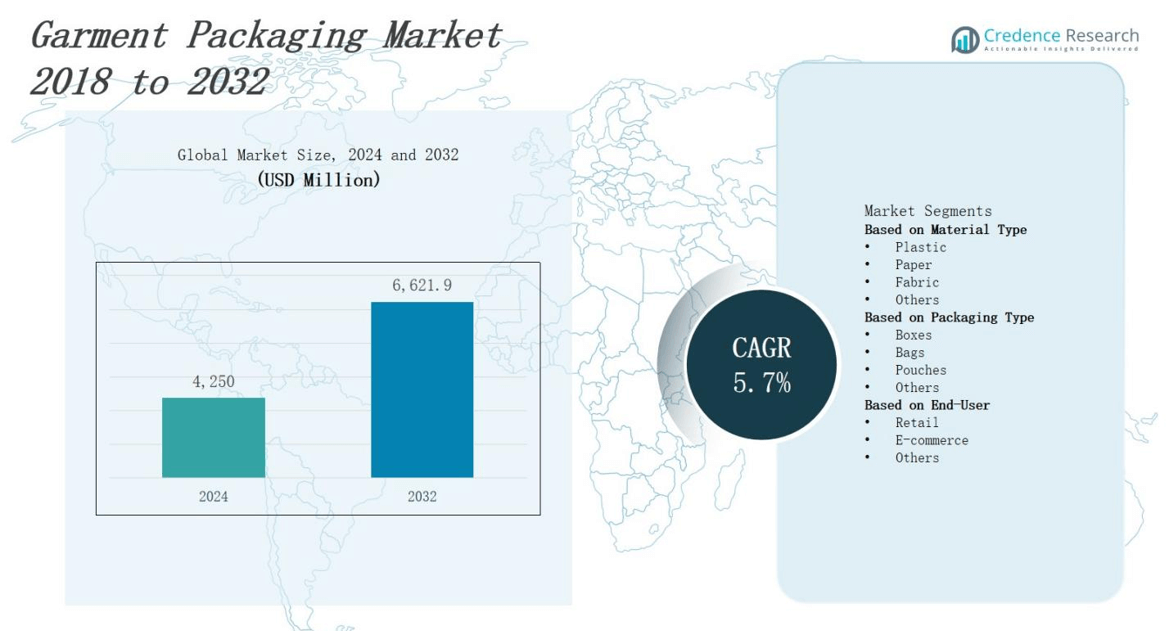

The garment packaging market is expected to expand from USD 4,250 million in 2024 to USD 6,621.9 million by 2032, growing at a CAGR of 5.7%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Garment Packaging Market Size 2024 |

USD 4,250 million |

| Garment Packaging Market, CAGR |

5.7% |

| Garment Packaging Market Size 2032 |

USD 6,621.9 million |

The garment packaging market benefits from rising e‑commerce sales, stringent sustainability regulations, and demand for brand differentiation. It responds to consumer expectations for eco‑friendly and reusable materials by adopting recyclable plastics, biodegradable films, and compostable fibers. Manufacturers invest in smart packaging technologies, including QR codes and RFID tags, to improve inventory visibility and customer engagement. Cost pressures drive optimization of supply chains through lightweight, durable designs that reduce shipping expenses. Market players pursue collaborations with textile brands and logistics providers to develop innovative, tamper‑evident solutions. Ongoing trends emphasize minimalistic design, customization, and integration of anti‑microbial coatings to meet hygiene standards.

The garment packaging market exhibits diverse regional strengths: North America drives innovation with scalable e‑commerce solutions; Europe champions sustainable materials under strict environmental mandates; Asia‑Pacific leads volume growth supported by manufacturing hubs and rising consumer demand; Latin America shows growing adoption of recyclable films; Middle East & Africa rely on protective packaging for textile exports. Key players such as Avery Dennison Corporation, Mondi Group, Smurfit Kappa Group, DS Smith Plc, International Paper Company, WestRock Company, Amcor Plc, Berry Global Inc., Sealed Air Corporation, Sonoco Products Company, Coveris Holdings S.A. and Huhtamaki Oyj advance material innovation.

Market Insights

- The garment packaging market is expected to expand from USD 4,250 million in 2024 to USD 6,621.9 million by 2032, growing at a CAGR of 5.7%.

- Rising e‑commerce sales and demand for eco‑friendly, reusable materials drive adoption of recyclable plastics, biodegradable films and compostable fibers.

- Brands embed QR codes and RFID tags to enhance inventory visibility, boost engagement and authenticate garments.

- Lean manufacturing and lightweight, durable designs lower shipping costs and minimize supply‑chain waste.

- Volatile resin and specialty‑film prices erode margins, prompting buyers to seek alternative substrates and renegotiate contracts.

- Non‑harmonized environmental and safety regulations force multiple product lines, delay launches and inflate compliance costs.

- North America (30%), Europe (25%), Asia‑Pacific (35%), Latin America (5%) and Middle East & Africa (5%) exhibit diverse growth patterns led by scalable e‑commerce, sustainability mandates and protective packaging needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rapid e‑commerce expansion drives demand

The garment packaging market benefits from growing online retail channels and rising purchases. It supports brands by providing protective, lightweight packaging that lowers shipping costs and improves customer satisfaction. Retailers demand scalable production capabilities to handle seasonal sales peaks and promotions. Manufacturers adopt flexible packaging lines to reduce lead times and optimize output. Strategic partnerships with e‑tailers enhance distribution reach and strengthen supply chain resilience.

Stringent sustainability mandates reshape production

The garment packaging market responds to stricter environmental rules by adopting recycled materials and compostable polymers. It reduces plastic waste through lightweight film designs that maintain durability and barrier performance. Industry standards promote eco‑friendly certification programs. Suppliers invest in renewable energy to lower carbon footprints. Brands showcase sustainable credentials on packaging to attract eco‑conscious consumers. Collaboration with recycling networks ensures end‑of‑life recovery and full circularity.

- For instance, EcoPackables manufactures 100% compostable and biodegradable poly bags made from cornstarch and bio-based polymers, certified by TUV, ABA, and BPI, with the capacity to produce 35,000 units daily for sustainable apparel packaging.

Innovative branding and technology elevate products

Brands in the garment packaging market differentiate offerings through advanced design features and interactive elements. It embeds QR codes and NFC tags to enable authentication and traceability. Package structures showcase brand aesthetics and ensure garment protection. Designers apply custom printing and tactile finishes for visual impact. Manufacturers deploy automated inspection to maintain quality. Partnerships with technology firms drive smart packaging adoption that engages consumers.

- For instance, Qliktag uses NFC tags embedded in garments that generate dynamic secure codes on each scan, allowing customers to authenticate the product and prevent counterfeiting effectively. This technology links to a secure database ensuring that every item is genuine.

Streamlined operations reduce costs and waste

The garment packaging market embraces lean manufacturing and JIT inventory to minimize storage needs. It selects lightweight, durable materials that cut freight expenses. Suppliers upgrade modular production lines for flexible output and faster changeovers. Analytics tools guide demand forecasting and inventory optimization. Brands partner with logistics providers to improve route efficiency. Continuous process refinement boosts throughput and reduces waste across the supply chain globally.

Market Trends

Rise of Sustainable Materials and Designs

The garment packaging market embraces renewable resources and recycled fibers to meet environmental targets. It shifts toward paperboard cartons, compostable films and biodegradable textiles that preserve garment quality. Brands highlight sustainability credentials on labels and sleeves to attract eco‑conscious customers. Suppliers collaborate with material innovators to refine coatings and adhesives that maintain strength. Packaging lines integrate quality checks to prevent defects. Consumers support brands that commit to circular economy principles.

- For instance, Keap, a candle subscription company, uses mushroom packaging made from mycelium, offering a lightweight yet durable alternative to traditional plastics that safely protects products while being fully compostable.

Acceleration of Smart Tracking and Authentication

The garment packaging market integrates QR codes, RFID tags and NFC chips to enable product tracking and fraud prevention. It connects packaging to digital platforms that provide consumers with origin and care information. Brands leverage interactive features to boost engagement and loyalty. Suppliers invest in scanning systems and serialization methods to ensure accuracy. Packaging developers employ printing to embed secure markers. Stakeholders prioritize traceability to uphold brand integrity and safety.

- For instance, Checkpoint Systems reports that RFID inlays embedded at the source allow tracking of each garment with up to 99% inventory accuracy, reducing manual counts and preventing theft.

Customization and Minimalist Visual Appeal

The garment packaging market shifts toward personalized designs that reflect brand identity and consumer taste. It offers modular kits, adjustable inserts and bespoke labels that match garment dimensions and style. Brands deploy clean layouts and limited color palettes to emphasize product features. Suppliers use precision die‑cuts and window panels to showcase textures. Packaging engineers apply lightweight structures that reduce material use. Collaboration with graphic artists drives innovative aesthetic solutions globally.

Shift Toward Protective and Anti‑Microbial Features

The garment packaging market preserves fabric quality, hygiene and safety through barrier films and anti‑microbial coatings. It employs moisture‑resistant pouches and odor‑neutralizing layers that extend shelf life. Brands highlight protective performance on packaging surfaces to reassure customers. Suppliers adopt ultrasonic sealing and foam liners to cushion garments. Packaging developers conduct durability tests to verify strength. Partnerships with chemical firms further accelerate development of functional treatments that inhibit microbial growth globally.

Market Challenges Analysis

Volatile Raw Material Price Fluctuations Impact Profitability

The garment packaging market faces unpredictable raw material costs that erode margins and complicate budgeting. It depends on petroleum‑based resins and specialty films whose prices oscillate with energy markets. Suppliers struggle to maintain consistent pricing in long‑term contracts. Buyers react by seeking alternative substrates and renegotiating terms. Cost pressure limits investment in new equipment and technology upgrades. Companies endure higher working capital requirements when reserves shrink.

Complex Regulatory Landscape Hinders Innovation Efforts

The garment packaging market must comply with varied environmental and safety standards across multiple regions. It requires certification for compostable and recycled packaging under stringent government guidelines. Non‑harmonized rules force manufacturers to produce multiple product lines for different markets. Compliance efforts delay product launches and inflate administrative overhead. Small producers face disproportionate costs to secure approvals. Industry participants risk fines and product recalls when requirements shift suddenly.

Market Opportunities

Expansion in Direct‑to‑Consumer and Niche Retail Channels

The garment packaging market benefits from growth of D2C brands and niche retailers. It provides flexible, small‑run solutions that align with brand storytelling and limited‑edition releases. Brands leverage custom kits and subscription services to boost consumer loyalty and reduce returns. Suppliers partner with online platforms to integrate packaging procurement into order fulfillment workflows. Demand for unboxing experiences drives investment in premium textures and interactive elements. Regional e‑commerce growth in Asia‑Pacific and Latin America offers new revenue streams. Collaborative ventures with boutique designers accelerate penetration in underserved segments.

Adoption of Circular Economy and Sustainable Innovation

The garment packaging market stands to gain from circular business models that reclaim and reuse materials. It extends lifecycle of packaging through deposit‑return schemes and refillable containers. Technology providers deliver material‑tracking platforms that optimize recovery rates and reduce landfill waste. Brands invest in biodegradable coatings and compostable lamination to satisfy eco‑conscious consumers. Suppliers develop closed‑loop manufacturing processes that lower resource consumption and waste. Cross‑industry alliances with recycling firms and textile producers foster integrated supply chains. Regulatory incentives in Europe and North America encourage sustainable innovation.

Market Segmentation Analysis:

By Material Type

The garment packaging market segments packaging by material type to align product protection with sustainability goals. It emphasizes plastic for moisture resistance and cost efficiency in bulk shipments. Paper appeals to eco‑focused brands seeking recyclability and premium finishes. Fabric solutions support reusable and breathable packaging for high‑end apparel. Other materials, including compostable biopolymers and hybrid films, address emerging environmental standards. Suppliers optimize material blends to balance strength, weight and eco‑credentials.

- For instance, Adidas uses polyethylene (PE) plastic polybags for moisture resistance and cost efficiency in bulk shipments, enabling slimmer and lightweight packaging suitable for shipping large volumes.

By Packaging Type

The garment packaging market divides packaging into boxes, bags, pouches and other formats to suit diverse distribution needs. It offers rigid boxes for structured protection and premium presentation. Bags, including tote and garment covers, provide cost‑effective storage and transit solutions. Pouches deliver lightweight, flexible containment for online orders and sample kits. Other formats, such as clamshells and hang tags with integrated sleeves, support specialty applications. Manufacturers calibrate format choice to streamline handling and meet brand aesthetics.

- For instance, Gucci uses glossy rigid boxes with large logos to provide premium protection and reinforce brand identity for their clothing items.

By End‑User

The garment packaging market caters to retail, e‑commerce and other end‑user channels to optimize customer experience and supply chain efficiency. It supplies retail outlets with display‑ready packaging that enhances in‑store appeal. E‑commerce solutions focus on lightweight, tear‑resistant designs that reduce shipping damage. Other end‑users—including wholesalers, rental services and textile manufacturers—require bulk packaging and protective liners. Suppliers tailor packaging dimensions and features to match order volumes and channel requirements, ensuring consistent performance across segments.

Segments:

Based on Material Type

- Plastic

- Paper

- Fabric

- Others

Based on Packaging Type

- Boxes

- Bags

- Pouches

- Others

Based on End-User

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America leads the garment packaging market with a 30% share driven by robust e‑commerce and retail infrastructure. It supports high‑volume operations through scalable production and rapid delivery networks. Brands invest in premium packaging to enhance unboxing experiences and reinforce brand loyalty. Regulatory frameworks reinforce sustainable material use and waste reduction targets. Suppliers develop lightweight films and compostable options that comply with federal and state standards. Collaborative ventures with logistics providers streamline order fulfillment.

Europe

Europe holds a 25% share of the garment packaging market supported by strong sustainability mandates and circular economy initiatives. It adopts recycled paperboard and bio‑based polymers to meet stringent environmental regulations. Packaging producers secure certifications under EU ecolabel schemes to validate eco‑credentials. Brands leverage minimalist designs and smart labels to engage informed consumers. Suppliers upgrade facilities with energy‑efficient machinery that reduces carbon footprints. Cross‑border trade agreements enhance material sourcing and distribution efficiency.

Asia-Pacific, Latin America & Middle East & Africa

Asia‑Pacific commands a 35% share of the garment packaging market driven by expanding manufacturing hubs and rising consumer spending. It deploys flexible packaging solutions that accommodate diverse garment styles and seasonal collections. Latin America accounts for 5% share as market entrants introduce sustainable films and low‑cost pouches. Middle East & Africa contribute 5% through investment in protective packaging for textile exports. Regional players form alliances with technology firms to integrate QR codes and traceability systems. Suppliers tailor outputs to local regulatory requirements and consumer preferences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huhtamaki Oyj

- Berry Global Inc.

- Smurfit Kappa Group

- International Paper Company

- Sonoco Products Company

- DS Smith Plc

- Sealed Air Corporation

- Coveris Holdings S.A.

- WestRock Company

- Amcor Plc

- Mondi Group

- Avery Dennison Corporation

Competitive Analysis

Key players in the garment packaging market compete by advancing eco‑friendly materials and smart technologies. It drives differentiation through renewable film and compostable fiber solutions. Avery Dennison Corporation leverages RFID and QR code integration to deliver traceability. Mondi Group invests in bio‑based coatings to reduce carbon footprints. Smurfit Kappa Group tailors corrugated boxes for brand visibility and structural protection. Amcor Plc focuses on lightweight laminates that cut shipping costs and waste. Berry Global Inc. secures high‑volume contracts through scalable production and consistent quality. Sealed Air Corporation integrates cushioning and anti‑microbial treatments to preserve fabric integrity. WestRock Company exploits digital printing to enhance customization at scale. Coveris Holdings S.A. emphasizes protective barrier films for moisture control. Sonoco Products Company expands service portfolios with design‑to‑delivery support. International Paper Company and Huhtamaki Oyj deploy circular economy pilots that reclaim materials at end‑of‑life. Competitive pressure encourages rapid product development and strategic partnerships across regions.

Recent Developments

- In November 2024, Amcor announced its acquisition of Berry Global for $8.4 billion. This deal significantly enhances Amcor’s position in both flexible and rigid plastic packaging, relevant to apparel and other consumer goods packaging sectors.

- In December 2024, TOPPAN Holdings acquired Sonoco Products Company’s thermoformed and flexibles packaging business for $1.8 billion. Sonoco is known for various specialty packaging, which can include garment packaging formats.

- On April 30, 2025: Avery Dennison enhanced its Optica™ portfolio for the apparel industry by launching optimized Materials Traceability in partnership with TrusTrace and a new Work‑in‑Progress Tracking solution with GPRO.

- On 12 June 2025: Mondi launched its re/cycle PaperPlus Bag Advanced, a high‑barrier, sustainable paper bag that protects humidity‑sensitive garments while reducing plastic use by 60% .

Market Concentration & Characteristics

The garment packaging market exhibits moderate concentration, with the top ten global suppliers commanding roughly 60% of total revenue while numerous regional and niche players serve local demands. It features strategic alliances among major firms that secure long‑term contracts with leading apparel brands and e‑commerce platforms. High entry barriers—driven by capital‑intensive production lines, quality certification requirements and technology integration—limit new competitors. Suppliers differentiate through proprietary materials, advanced printing techniques and smart‑label capabilities. Price competition remains intense for standard film and paper products, prompting cost optimization. Innovation cycles accelerate adoption of sustainable and functional solutions, reinforcing the dominant position of established players. Regulatory pressures and fluctuating raw material costs influence capacity utilization and investment decisions. Robust distribution networks and service portfolios further define competitive advantage across regions.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Packaging Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Brands will expand use of biodegradable and compostable materials to meet sustainability goals.

- Packaging suppliers will integrate real-time tracking features to enhance supply‑chain transparency.

- Companies will adopt modular production systems to accelerate customization and reduce lead times.

- Stakeholders will develop closed‑loop recycling programs to reclaim and reuse packaging materials.

- Digital printing technologies will enable on‑demand graphics and variable data personalization.

- Manufacturers will implement automated quality‑inspection systems to maintain consistent performance.

- Partnerships between packaging firms and textile brands will drive co‑development of tamper‑evident solutions.

- Regional players will tailor offerings to local regulatory standards and consumer preferences.

- Innovative coatings will deliver anti‑microbial and moisture‑barrier properties for enhanced protection.

- Data analytics will guide demand forecasting and inventory optimization across distribution networks.