Market Overview:

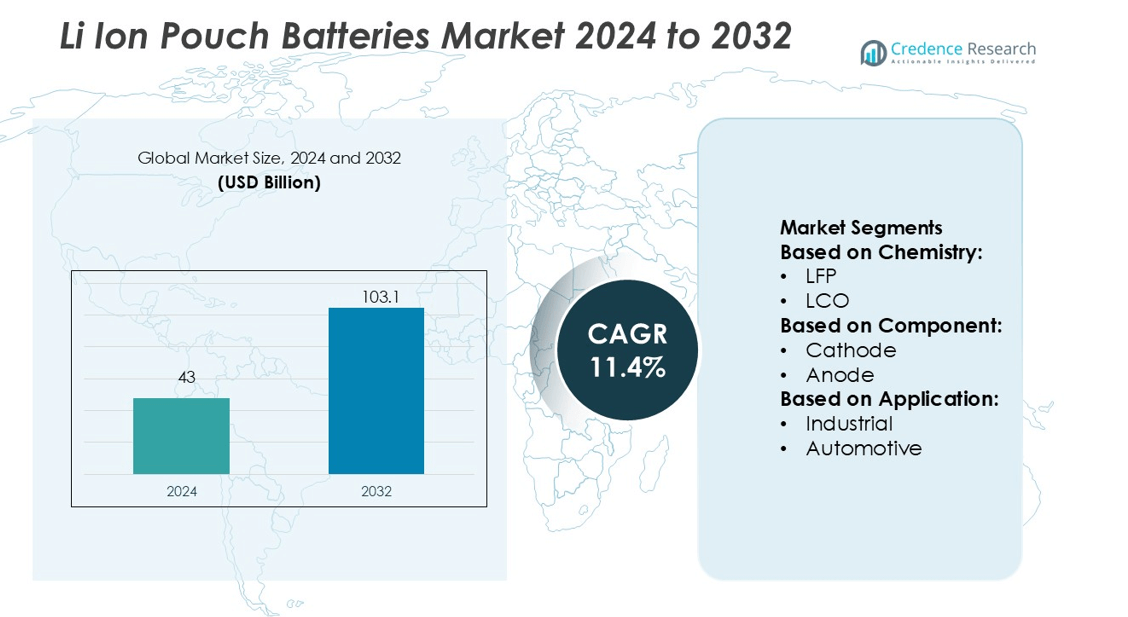

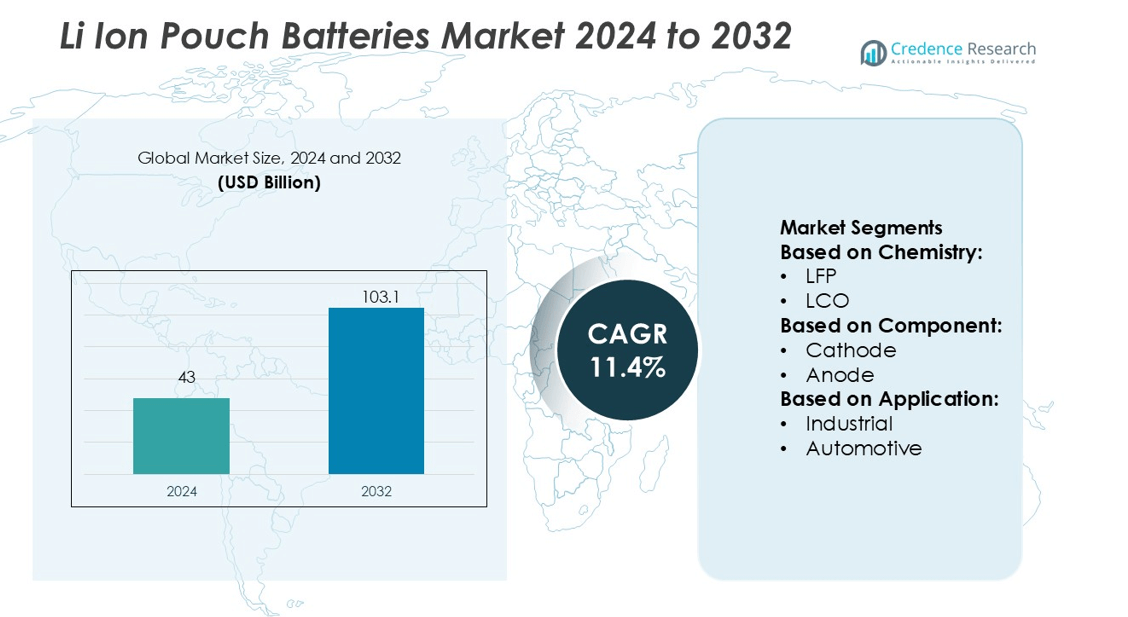

Li Ion Pouch Batteries Market size was valued USD 43 billion in 2024 and is anticipated to reach USD 103.1 billion by 2032, at a CAGR of 11.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Li Ion Pouch Batteries Market Size 2024 |

USD 43 billion |

| Li Ion Pouch Batteries Market, CAGR |

11.4% |

| Li Ion Pouch Batteries Market Size 2032 |

USD 103.1 billion |

The Li-ion pouch batteries market is shaped by leading players such as LG Energy Solution, Panasonic Corporation, Samsung SDI Co. Ltd., CATL, BYD Company Ltd., SK On Co. Ltd., Amara Raja Energy & Mobility Limited, Exide Industries Limited, and Tata Chemicals Limited. These companies emphasize advanced material innovation, energy density enhancement, and large-scale manufacturing to meet growing demand from automotive and energy storage sectors. Strategic collaborations with electric vehicle manufacturers and renewable energy developers strengthen their market footprint globally. Asia-Pacific dominates the global Li-ion pouch batteries market with a 38.3% share in 2024, driven by extensive production capacities, government incentives, and strong technological expertise in countries like China, Japan, and South Korea.

Market Insights

- The Li-ion pouch batteries market was valued at USD 43 billion in 2024 and is projected to reach USD 103.1 billion by 2032, growing at a CAGR of 11.4% during the forecast period.

- Increasing demand for electric vehicles and energy storage systems is a key driver, as pouch batteries offer high energy density, flexibility, and lightweight performance suited for modern mobility solutions.

- A major trend includes the shift toward solid-state and cobalt-free chemistries, enabling safer and higher-capacity battery designs, supported by large-scale R&D investments.

- The competitive landscape is dominated by leading players such as LG Energy Solution, Panasonic, Samsung SDI, CATL, BYD, and SK On, focusing on material innovation and capacity expansion to gain global advantage.

- Asia-Pacific leads the market with a 38.3% share in 2024, supported by strong manufacturing infrastructure, while the automotive segment accounts for the largest application share, driven by EV production growth.\

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Chemistry

The NMC (Nickel Manganese Cobalt) chemistry segment dominates the Li-ion pouch batteries market with a 42.6% share in 2024, driven by its high energy density, long cycle life, and thermal stability. NMC batteries are widely used in electric vehicles and consumer electronics for efficient power delivery. Continuous advancements in cathode formulations, such as higher nickel content ratios, enhance energy capacity and reduce cobalt dependency. The rising demand for cost-efficient and sustainable chemistries further strengthens NMC’s position, supported by its adaptability to various voltage ranges and applications across automotive and energy storage sectors.

- For instance, HBL Engineering Ltd. completed a pilot plant for Li‑ion cell production in 2021 that met the specifications of Naval Science and Technological Laboratory (NSTL) for defence‑grade NMC cells, achieving 2,000 full charge‑discharge cycles at 80% depth of discharge and achieving a cell energy density of 240 Wh/kg in the prototype batch.

By Component

The cathode segment leads the market with a 33.8% share in 2024, as it directly influences energy output, battery life, and thermal performance. Cathode materials like NMC and LFP are gaining traction due to improved structural stability and high specific capacity. Ongoing innovations in coating technology and nanostructured materials enhance energy density while reducing material degradation. Major manufacturers focus on high-purity active materials to improve ion conductivity and efficiency, driving their adoption across electric vehicles and grid applications. The demand for safer, high-performance cathodes continues to accelerate in high-power energy storage solutions.

- For instance, BYD India Private Limited’s parent, BYD Co. Ltd., launched its “Blade Battery” featuring an LFP (Lithium Iron Phosphate) cathode design that achieved space‑utilisation improvements of over 50% compared with conventional block LFP modules.

By Application

The automotive segment dominates the market with a 47.1% share in 2024, propelled by the expanding electric vehicle industry and supportive government initiatives promoting clean mobility. Li-ion pouch batteries are favored for their lightweight design, flexible form factor, and high discharge rates, enabling improved vehicle range and performance. Major automakers are integrating pouch batteries for fast-charging capabilities and higher energy density. Advancements in cell manufacturing and battery management systems enhance safety and lifecycle efficiency. Increasing production of electric cars, buses, and two-wheelers positions the automotive sector as the prime growth driver for this market.

Key Growth Drivers

Rising Electric Vehicle Adoption

The rapid expansion of electric vehicle (EV) production is a major driver of the Li-ion pouch batteries market. Pouch cells offer high energy density, lightweight construction, and design flexibility ideal for EV applications. Automakers prefer pouch batteries for compact packaging and improved thermal management. Government incentives, emission regulations, and advancements in fast-charging infrastructure further boost demand. Major EV manufacturers are increasingly integrating pouch battery technology to enhance range, performance, and reliability while reducing overall vehicle weight and manufacturing costs.

- For instance, Luminous Power Technologies launched its “Helios” lithium‑ion battery system which supports a charging rate stated as “3× faster charging” compared to traditional batteries, and offers system capacities of 12.8 V/100 Ah, 25.6 V/100 Ah, 51.2 V/100 Ah and 51.2 V/314 Ah.

Increasing Demand for Consumer Electronics

The growing consumption of smartphones, laptops, wearables, and portable devices continues to drive pouch battery demand. These batteries provide high power output and longer operating times within slim, flexible designs. Manufacturers are focusing on high-capacity cells to support energy-intensive devices. The integration of next-generation materials and solid-state electrolytes further enhances performance and safety. With the surge in 5G-enabled gadgets and connected devices, pouch batteries remain essential in maintaining longer usage and supporting the compact form factors demanded by modern electronics.

- For instance, Tata Chemicals’ battery recycling plant at Palghar recovers lithium, cobalt, nickel and manganese from spent Li‑ion cells with a purity level exceeding 99 % for each metal.

Expanding Renewable Energy Storage Solutions

The rising deployment of renewable energy systems such as solar and wind farms is boosting demand for high-capacity energy storage. Li-ion pouch batteries play a critical role in storing excess power and stabilizing grid operations. Their scalability, efficiency, and long cycle life make them ideal for both residential and industrial energy storage systems. Governments and utilities are investing heavily in battery-based storage projects to balance fluctuating energy supply. This shift toward decentralized power generation strengthens the adoption of pouch batteries in large-scale grid applications.

Key Trends & Opportunities

Transition Toward Solid-State and Silicon-Based Designs

Manufacturers are increasingly investing in solid-state battery research and silicon-anode innovations to improve energy density and safety. These technologies minimize risks associated with liquid electrolytes and increase thermal stability. Silicon-based anodes can offer up to 30% higher capacity compared to traditional graphite materials. Companies are accelerating pilot production and partnerships to commercialize advanced pouch formats. This trend presents opportunities for higher-capacity cells in both automotive and industrial storage applications, reshaping the competitive landscape toward next-generation energy solutions.

- For instance, Samsung SDI’s global operations introduced a “Material & Electrode Technology for LFP+ Platform” which blended LFP with high‑nickel materials and achieved a measured improvement in energy density of ~10% compared with conventional LFP cells.

Sustainable and Recyclable Material Development

Growing environmental concerns are pushing manufacturers to adopt eco-friendly materials and recycling technologies. The recovery of lithium, nickel, and cobalt from used pouch batteries supports a circular economy and reduces raw material dependency. Companies are developing closed-loop supply chains and using low-carbon manufacturing methods to meet global sustainability standards. Government regulations promoting green production further strengthen this shift. These advancements not only reduce environmental impact but also lower production costs, improving long-term profitability across the Li-ion pouch battery industry.

- For instance, ARE&M has announced a lithium‑ion cell pilot plant targeting an initial capacity of 2 GWh per annum, with readiness planned by end of FY 2025‑26.

Key Challenges

High Manufacturing and Raw Material Costs

The market faces challenges from fluctuating prices of lithium, nickel, and cobalt, which increase overall production costs. Complex manufacturing processes and advanced equipment requirements further elevate capital expenditure. Smaller producers find it difficult to maintain profitability amid rising input costs. The dependency on limited raw material suppliers, especially from specific regions, adds supply chain risk. To address this, manufacturers are investing in material optimization and recycling technologies, though cost competitiveness remains a significant barrier to mass-scale expansion.

Safety and Thermal Management Issues

Li-ion pouch batteries are prone to overheating and mechanical swelling under high load or poor ventilation. Incidents of thermal runaway have raised safety concerns, especially in electric vehicles and energy storage systems. Ensuring consistent safety standards requires advanced battery management systems and durable separator materials. Companies are integrating thermal-resistant coatings, multi-layer foils, and intelligent monitoring systems to prevent failures. Despite these efforts, maintaining stability under extreme operating conditions continues to challenge manufacturers and limits adoption in sensitive applications.

Regional Analysis

North America

North America holds a 27.8% share of the Li-ion pouch batteries market in 2024, driven by rising adoption of electric vehicles and energy storage systems. The U.S. leads regional demand due to strong EV infrastructure, government incentives, and the presence of major automotive OEMs. Leading companies are investing in localized battery manufacturing to reduce import dependency and strengthen domestic supply chains. The region’s robust consumer electronics market and growing renewable energy projects further support market expansion. Ongoing advancements in battery recycling and energy efficiency enhance long-term growth prospects across North America.

Europe

Europe accounts for a 25.6% share of the Li-ion pouch batteries market in 2024, supported by strict emission norms and rapid electrification initiatives. Germany, France, and the U.K. are key contributors, with strong demand from the EV and industrial sectors. The European Battery Alliance and green energy policies encourage local cell production and innovation in sustainable materials. Growing investment in solid-state and cobalt-free chemistries strengthens the region’s competitive advantage. The expansion of gigafactories and strategic partnerships among automakers and energy firms ensure Europe’s leadership in high-performance, eco-friendly battery solutions.

Asia-Pacific

Asia-Pacific dominates the global Li-ion pouch batteries market with a 38.3% share in 2024, led by China, Japan, and South Korea. The region benefits from large-scale production capabilities, strong raw material availability, and advanced R&D in cell technology. China’s EV boom and South Korea’s leadership in NMC and NCA chemistries reinforce market dominance. Japan focuses on safety and high-capacity pouch batteries for consumer electronics and hybrid vehicles. The rapid development of renewable energy storage projects across India and Southeast Asia further accelerates adoption, making Asia-Pacific the key growth engine globally.

Latin America

Latin America holds a 4.5% share of the Li-ion pouch batteries market in 2024, with Brazil and Mexico leading regional demand. Expanding automotive manufacturing, growing consumer electronics penetration, and rising renewable energy investments drive market growth. Governments are encouraging battery-based storage to stabilize energy grids and support EV adoption. Multinational manufacturers are exploring partnerships and production facilities to meet emerging demand. Though the market remains at an early stage, increasing urbanization and policy support for clean energy are expected to strengthen the region’s position in the global pouch battery landscape.

Middle East & Africa

The Middle East & Africa region accounts for a 3.8% share of the Li-ion pouch batteries market in 2024, primarily driven by renewable energy projects and industrial electrification. The UAE and Saudi Arabia are investing heavily in solar and storage systems to reduce carbon footprints. South Africa’s growing demand for energy backup in commercial and residential sectors supports market adoption. Strategic initiatives promoting EV infrastructure and energy diversification further expand opportunities. Despite infrastructure challenges, government incentives and foreign investments are expected to accelerate pouch battery deployment across the region.

Market Segmentations:

By Chemistry:

By Component:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Li-ion pouch batteries market is highly competitive, featuring key players such as Panasonic Life Solutions India Private Limited, Exide Industries Limited, HBL Power Systems Limited, BYD India Private Limited, Luminous Power Technologies Pvt. Ltd., Tata Chemicals Limited, Okaya Power Private Limited, Samsung SDI India Private Limited, Loom Solar Pvt. Ltd., and Amara Raja Energy & Mobility Limited. The Li-ion pouch batteries market is characterized by strong competition driven by rapid technological advancements and expanding manufacturing capacities. Companies are focusing on improving energy density, thermal stability, and safety features through advanced cathode materials and innovative cell designs. The growing adoption of electric vehicles, renewable energy storage, and portable electronics continues to push manufacturers toward high-performance, lightweight, and flexible battery solutions. Strategic partnerships, capacity expansions, and investment in localized production are becoming central to maintaining market competitiveness. The industry also emphasizes sustainable practices, including battery recycling, raw material recovery, and eco-friendly manufacturing to reduce environmental impact.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Vivo launched the V50 Elite edition with a snapdragon processor, a 6000 mAh battery, and bundled earbuds in India. The brand provides 3 years of OS updates and 4 years of security support.

- In October 2024, Exide Technologies launched its new Solition Material Handling battery, a lithium iron phosphate (LFP) battery designed to provide enhanced safety, reliability, and a lower total cost of ownership for material handling fleets like forklifts and automated guided vehicles.

- In April 2024, Hyundai Motor Company and Kia Corporation announced a partnership with Exide Industries to localize electric vehicle (EV) battery production in India. This collaboration aims to strengthen the supply chain for EV batteries in the country and reduce reliance on imports.

- In March 2024, Panasonic announced joint venture with Indian Oil Corporation Ltd (IOCL) to develop cylindrical lithium-ion batteries. The product is majorly used in consumer electronics, EVs, and power tools.

Report Coverage

The research report offers an in-depth analysis based on Chemistry, Component, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for lightweight and flexible energy storage solutions will drive pouch battery adoption across EVs and consumer electronics.

- Manufacturers will invest in high-nickel and cobalt-free chemistries to enhance energy density and reduce material costs.

- Solid-state and silicon-anode pouch batteries will gain traction due to improved safety and higher performance.

- Global EV expansion will continue to be the strongest growth catalyst for pouch battery production.

- Recycling technologies will advance, improving lithium, nickel, and cobalt recovery efficiency.

- Automation and AI-driven manufacturing will optimize production yield and quality control.

- Strategic collaborations between automakers and cell manufacturers will expand regional supply chains.

- Government incentives and carbon-neutral policies will accelerate investments in gigafactories.

- Innovations in battery management systems will extend cycle life and thermal stability.

- The market will experience steady growth through diversification into grid and renewable energy storage systems.