Market Overviews

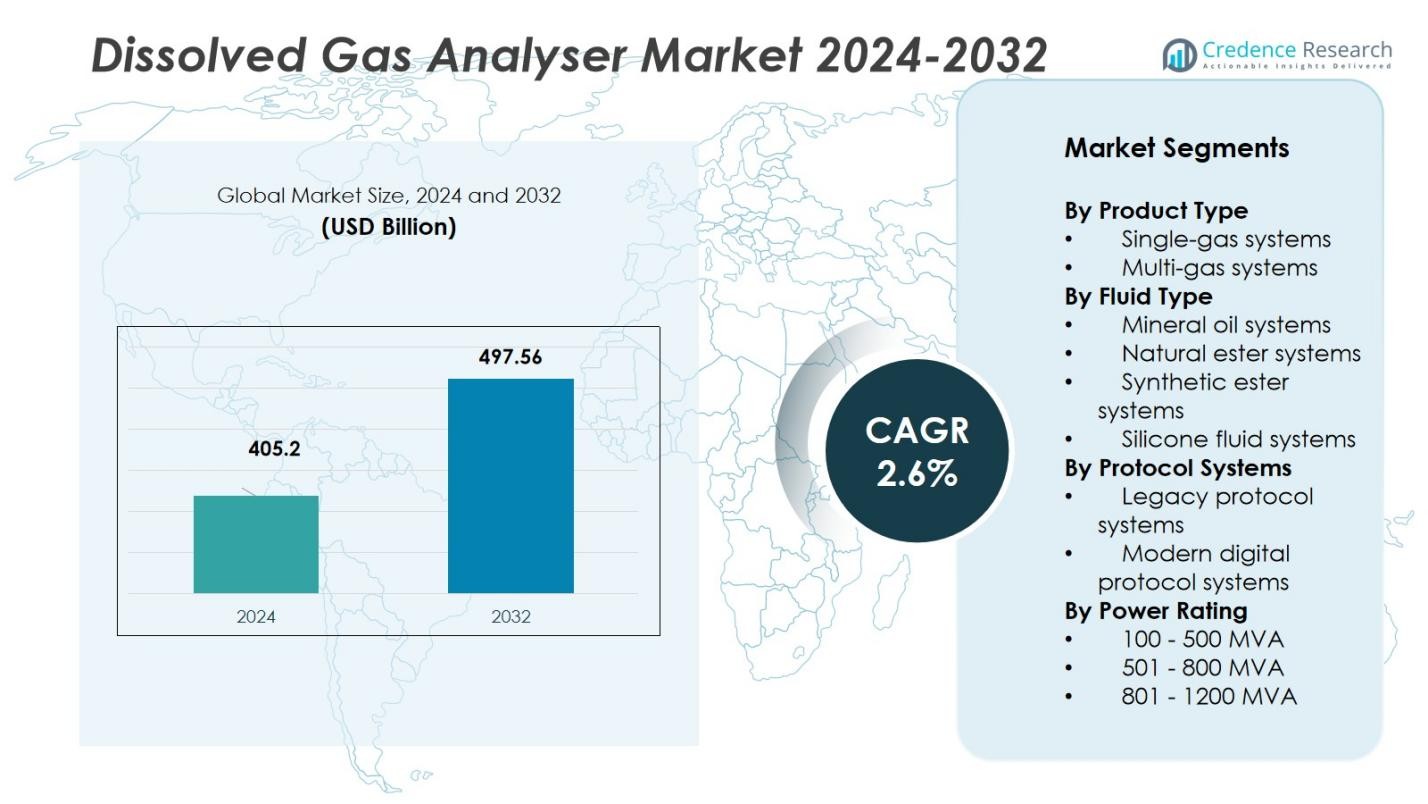

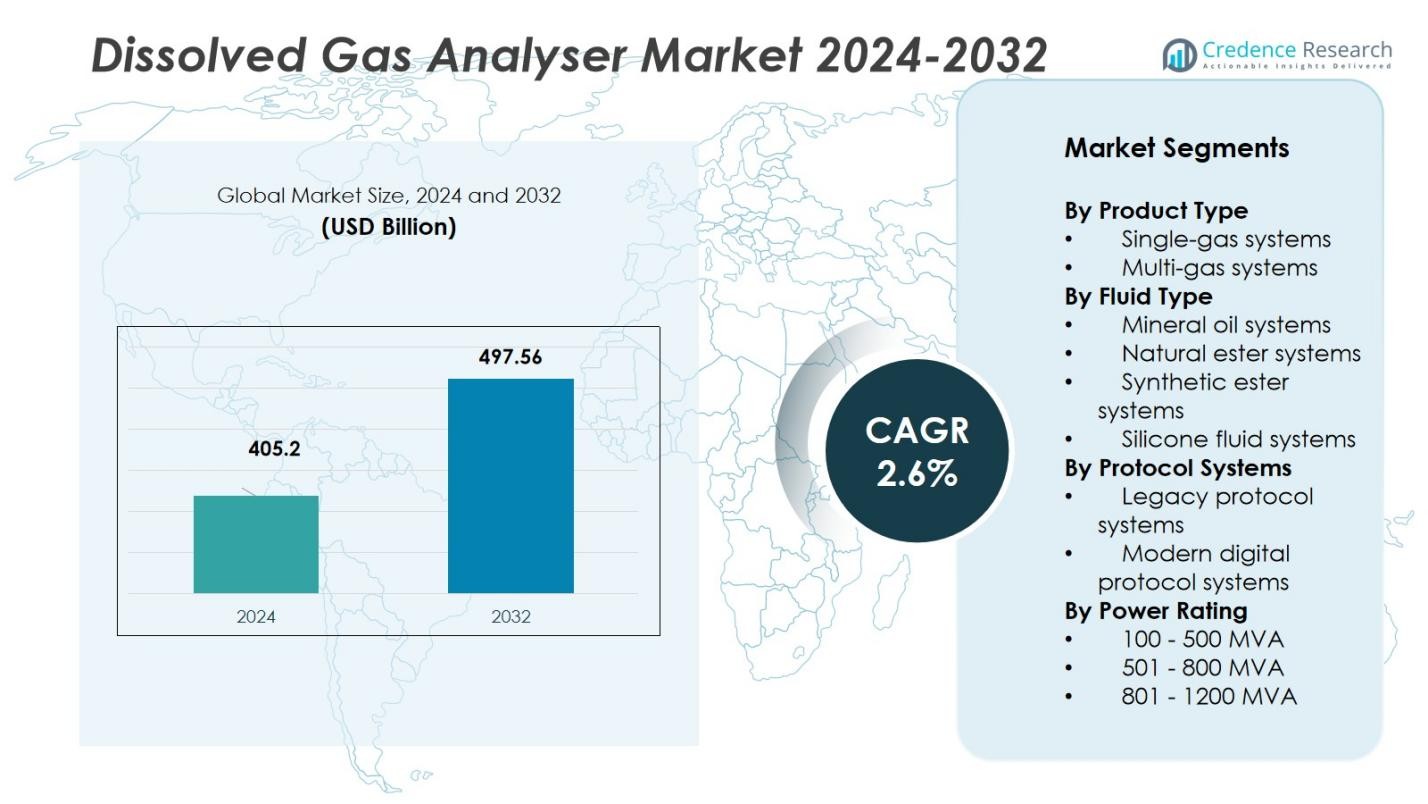

The Dissolved Gas Analyser Market size was valued at USD 405.2 billion in 2024 and is anticipated to reach USD 497.56 billion by 2032, growing at a CAGR of 2.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dissolved Gas Analyser Market Size 2024 |

USD 405.2 Billion |

| Dissolved Gas Analyser Market, CAGR |

2.6% |

| Dissolved Gas Analyser Market Size 2032 |

USD 497.56 Billion |

The Dissolved Gas Analyser Market is dominated by major players including ABB Ltd., GE Vernova Inc., Siemens AG, Hitachi Energy Ltd., and Qualitrol Company LLC, which together hold around 35% of the market share in 2024. These companies lead the market through continuous innovation, strategic partnerships, and global service offerings. Regionally, the Asia-Pacific region holds the largest share at approximately 34%, fueled by significant infrastructure development and increasing demand for transformer monitoring. North America follows with a 30% share, driven by grid modernization and regulatory compliance. Europe holds 25% of the market, supported by strict environmental regulations and ongoing infrastructure upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dissolved Gas Analyser Market was valued at USD 405.2 million in 2024 and is expected to reach USD 497.56 million by 2032, growing at a CAGR of 2.6% during the forecast period.

- Key drivers include increasing demand for transformer health monitoring, rising adoption of smart grid technologies, and the shift towards eco-friendly ester-based fluids.

- Market trends show a growing integration of IoT and AI technologies, allowing for predictive maintenance and real-time monitoring of transformer performance.

- The competitive landscape is dominated by companies like ABB Ltd., GE Vernova Inc., and Siemens AG, with innovation and service networks driving competition.

- Regionally, Asia-Pacific leads the market with a 34% share, followed by North America at 30% and Europe at 25%, with growth fueled by grid modernization and infrastructure upgrades.

Market Segmentation Analysis:

By Product Type:

In the Dissolved Gas Analyser Market, the product types are segmented into single-gas systems and multi-gas systems. Multi-gas systems dominate this segment, holding 65% of the market share due to their ability to analyze multiple gases simultaneously, offering greater efficiency and comprehensive diagnostics. These systems are particularly favored in industrial applications where early detection of faults is critical for system reliability and maintenance. The demand for multi-gas systems is driven by their advanced capabilities in improving the safety and performance of power equipment, contributing to their strong market presence.

- For instance, GE’s Hydran M2-X multi-gas analyser, widely adopted by global utilities, supports online continuous monitoring and early warning of transformer faults, thereby reducing unplanned outages and maintenance costs.

By Fluid Type:

The fluid types in the Dissolved Gas Analyser Market include mineral oil systems, natural ester systems, synthetic ester systems, and silicone fluid systems. Mineral oil systems hold the largest market share at around 55%, primarily due to their long-standing use and reliability in power transformers. These systems are cost-effective and widely adopted across various industries, contributing to their dominant position. The growing shift toward more eco-friendly options like natural ester and synthetic ester systems is gradually increasing their market share, driven by the rising demand for sustainable and biodegradable fluid solutions.

- For instance, silicone-based samplers developed for dissolved gas measurement have demonstrated the capability to detect accurate gas levels such as nitrous oxide and carbon dioxide at ppm levels, facilitating early fault diagnosis in transformers using silicone fluids.

By Protocol Systems:

The Dissolved Gas Analyser Market is segmented by protocol systems into legacy protocol systems and modern digital protocol systems. Modern digital protocol systems dominate this segment, accounting for 70% of the market share as they offer real-time data transmission, higher accuracy, and advanced diagnostic capabilities. The increasing adoption of smart grid technologies and automated monitoring systems is driving the demand for modern digital protocol systems. These systems’ ability to integrate with digital infrastructure and enhance predictive maintenance processes is key to their market dominance.

Key Growth Drivers

Increasing Demand for Transformer Monitoring

The growing need for efficient and reliable monitoring of electrical transformers is a key driver for the Dissolved Gas Analyser (DGA) market. As power grids and transformers age, the importance of continuous monitoring to detect potential faults and avoid costly breakdowns becomes critical. DGA systems provide real-time analysis of dissolved gases, helping utilities identify transformer health and prevent failures. This proactive approach to maintenance is becoming increasingly vital, driving the demand for advanced DGA systems in both established and emerging markets.

- For instance, Hitachi Energy’s CoreSense™ DGA units are installed on utility transformers rated up to 500 kV, allowing users to continuously monitor gases such as hydrogen and acetylene with detection thresholds as low as 1 ppm, which significantly improves maintenance precision.

Rising Adoption of Smart Grid Technologies

The adoption of smart grid technologies is significantly contributing to the growth of the Dissolved Gas Analyser market. These advanced grids rely on real-time data and remote monitoring to enhance power distribution efficiency and reliability. DGAs play a crucial role in smart grid systems by offering continuous, accurate monitoring of transformer health and performance. The integration of DGA systems with smart grids ensures predictive maintenance and optimization, thereby reducing operational risks and improving system uptime, further propelling the market’s expansion.

- For instance, ABB’s online DGA monitors can provide continuous data integration, enabling utilities to detect faults early and remotely diagnose transformer conditions, with analyzers supporting multi-gas analysis and digital substation compatibility.

Shift Towards Sustainable Solutions

As industries increasingly focus on sustainability, there is a rising demand for eco-friendly alternatives in transformer monitoring. Natural ester and synthetic ester fluid systems in DGA technologies are gaining popularity due to their biodegradable nature and reduced environmental impact. This shift towards greener solutions is being driven by stricter environmental regulations and growing consumer preference for sustainable products. As businesses and governments emphasize eco-friendly operations, the DGA market is experiencing a positive impact, especially in regions with stringent environmental standards.

Key Trends & Opportunities

Integration with IoT and AI Technologies

The integration of IoT (Internet of Things) and AI (Artificial Intelligence) with Dissolved Gas Analyser systems is one of the key trends shaping the market. These technologies enable the collection and analysis of large datasets, providing actionable insights for transformer health management. AI-powered DGAs offer predictive maintenance capabilities, reducing the risk of unexpected failures. The opportunity to integrate DGA systems with cloud-based platforms also enhances remote monitoring and data accessibility, allowing for more efficient decision-making and optimized performance, which is driving market growth.

- For instance, ABB Ltd. introduced the Sensi analyzer, which can detect and assess up to three impurities including H2S, H2O, and CO2 in natural gas streams instantly, significantly enhancing pipeline monitoring and reducing operational disruptions.

Expanding Market in Emerging Economies

Emerging economies, particularly in Asia-Pacific, are witnessing rapid growth in industrialization and infrastructure development, presenting significant opportunities for the Dissolved Gas Analyser market. As these regions modernize their power grids and invest in new energy infrastructure, the demand for advanced monitoring systems like DGAs is rising. Additionally, the growing adoption of renewable energy sources, such as solar and wind power, is further driving the need for efficient transformer management, creating a substantial growth opportunity for DGA systems in these developing markets.

- For instance, GE Vernova reports a worldwide installed base of more than 13,000 DGA units across its transformer monitoring portfolio, highlighting how utilities are investing in advanced monitoring systems.

Key Challenges

High Initial Cost of Installation

The initial installation cost of Dissolved Gas Analyser systems remains a significant barrier to market growth. For many utilities and industries, the upfront investment required for implementing advanced monitoring systems can be prohibitive. Although these systems offer long-term cost savings through preventive maintenance and extended equipment life, the high capital expenditure may deter smaller players or those with limited budgets from adopting DGA technologies. Overcoming this financial challenge is critical to accelerating widespread adoption, especially in cost-sensitive markets.

Lack of Skilled Workforce

The adoption and effective utilization of Dissolved Gas Analyser systems require a skilled workforce capable of interpreting the data generated by these sophisticated monitoring tools. However, there is a shortage of trained professionals with expertise in DGA technology and data analysis. This gap in skilled labor is hindering the market’s growth, as many organizations struggle to properly install, operate, and maintain these systems. Bridging this skills gap through specialized training programs and certifications is crucial to unlocking the full potential of the DGA market.

Regional Analysis

North America

The North America region commands around 30% market share in the dissolved gas analyser market. Its strong position stems from extensive grid modernisation, a high volume of aging transformers, and rigorous regulatory demands for asset monitoring. Key utilities invest heavily in online and multi‑gas systems to pre‑empt failures and avoid costly downtime. Innovation hubs and established vendors facilitate rapid adoption of digital protocol DGA systems. Growth is also supported by large‑scale deployment in the oil & gas sector and favorable maintenance budgets that sustain replacement cycles and sensor upgrades.

Europe

In Europe the market holds about 25% market share, driven by robust regulatory frameworks and an emphasis on energy efficiency and infrastructure resilience. Many utilities there upgrade ageing transformer fleets and transition toward ester‑based fluids, which increases demand for DGA monitoring. The presence of major vendors, a widespread customer base and established maintenance regimes helps adoption. Germany, the U.K., France and Benelux markets are particularly active in specifying multi‑gas systems and modern digital protocols that support predictive maintenance across networks with high reliability expectations.

Asia‑Pacific

The Asia‑Pacific region leads with 34% market share, powered by rapid industrialisation, grid expansion and growing electricity demand in China, India, and Southeast Asia. The surge in transformer installations and the prevalence of mineral oil‑filled equipment create strong demand for dissolved gas analysers. Manufacturers benefit from escalated spending on power generation and distribution systems. The region also registers higher growth rates as newer networks integrate online DGA systems coupled with IoT analytics, enabling utilities to leap‑frog older monitoring paradigms.

Middle East & Africa

The Middle East & Africa region accounts for 6% market share, with growth supported by rising investment in oil & gas infrastructure and power grid development in Gulf Cooperation Council (GCC) countries. However, adoption of advanced DGA systems lags due to budget constraints and fewer large‑scale utilities compared to other regions. Key drivers include demand for transformer health monitoring in harsh environmental conditions and increasing awareness of reliability in remote installations. Opportunities exist for portable and modular DGA units well‑suited to this region’s unique operational settings.

Latin America

In Latin America the market share stands at about 5%, underpinned by expanding electrification and ageing transmission assets needing condition monitoring. Utilities in Brazil, Argentina and Chile increasingly adopt DGA systems as part of grid reinforcement efforts. Despite slower budget availability and longer procurement cycles, there’s growing interest in cost‑effective online and portable analysers to reduce unplanned outages. Opportunities remain for local service partnerships and rental‑based models to accelerate uptake across emerging power networks.

Market Segmentations:

By Product Type

- Single-gas systems

- Multi-gas systems

By Fluid Type

- Mineral oil systems

- Natural ester systems

- Synthetic ester systems

- Silicone fluid systems

By Protocol Systems

- Legacy protocol systems

- Modern digital protocol systems

By Power Rating

- 100 – 500 MVA

- 501 – 800 MVA

- 801 – 1200 MVA

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the dissolved gas analyser market is anchored by key players such as ABB Ltd., GE Vernova Inc., Siemens AG, Hitachi Energy Ltd, Qualitrol Company LLC, Doble Engineering Company, Vaisala Oyj, MTE Meter Test Equipment AG, Weidmann Electrical Technology AG and Advanced Energy Industries Inc.. Many of these companies concentrate on product innovation, global expansion and strategic partnerships to stay competitive. The market remains moderately concentrated, with the top players together holding roughly 35 % of the market in 2024. They differentiate through advanced features like multi‑gas analysis, real‑time monitoring and AI‑enabled diagnostics. Meanwhile, smaller niche players focus on portable units or regional service offerings to capture market share. As utilities and industrial users prioritise condition‑based maintenance and grid reliability, competition intensifies around service ecosystem, accuracy and integration capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ABB Ltd.

- GE Vernova Inc.

- Siemens AG

- Hitachi Energy Ltd.

- Qualitrol Company LLC

- Doble Engineering Company

- Vaisala Oyj

- MTE Meter Test Equipment AG

- Weidmann Electrical Technology AG

- Advanced Energy Industries Inc.

Recent Developments

- In January 2025, SICK and Endress+Hauser launched a strategic partnership in process automation. As part of this, approximately 800 sales and service employees from SICK transferred to Endress+Hauser across 42 countries.

- In March 2024, ABB Ltd. introduced the GasSense 3000, a portable dissolved gas analyser designed for on-site transformer-oil diagnostics and field testing. The device enhances reliability in predictive maintenance by offering multi-gas detection with rapid analysis capability.

- In January 2024, Siemens AG unveiled its IoT-enabled Sitrax DGA system, integrating real-time monitoring and advanced multi-gas detection for power transformers. This innovation supports digital grid modernization and efficient transformer condition assessment.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Fluid Type, Protocol System, Power Rating and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly support online and remote‑connected analysers to meet demand for continuous monitoring.

- Integrating AI and machine learning will enable predictive insights from dissolved gas data, enhancing maintenance strategies.

- Demand from renewable energy infrastructure and upgraded transformer networks will fuel growth of advanced analysers.

- Growth in emerging economies will drive adoption of cost‑effective and portable analysers for decentralized grid systems.

- The shift toward ester‑based and silicone fluid systems will open new monitoring requirements and boost analyser sales.

- Vendors will focus on modular and scalable systems to serve both large utilities and smaller industrial users.

- Regulatory pressure around transformer safety and environmental compliance will increase investments in dissolved gas analysis.

- The emergence of service‑based models (monitoring as a service) will create recurring revenue streams and ease adoption.

- Consolidation through strategic partnerships and acquisitions will reshape competitive dynamics and expand global reach.

- Rising raw‑material and component costs may drive innovation in lower‑cost, high‑accuracy analysers to maintain margin.