Market Overview

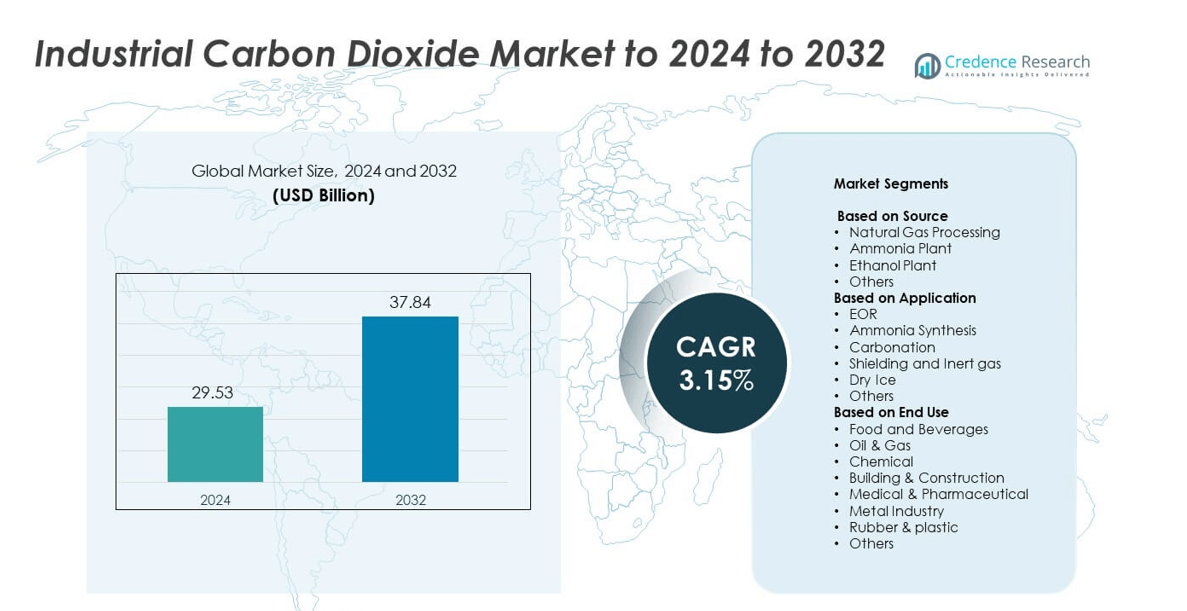

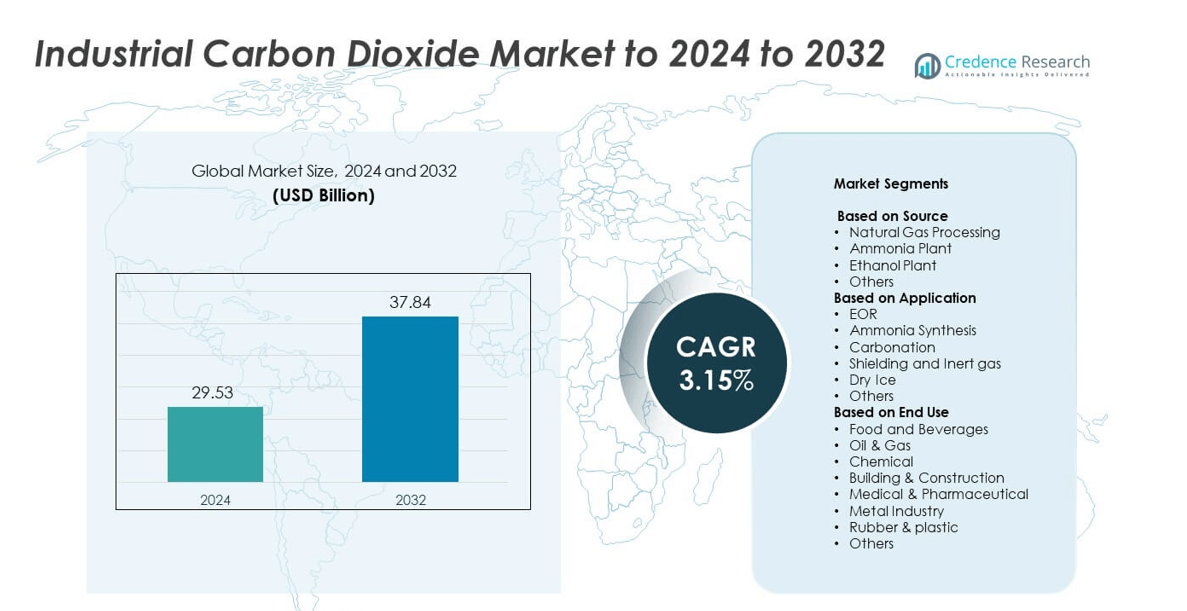

The Industrial Carbon Dioxide Market size was valued at USD 29.53 Billion in 2024 and is anticipated to reach USD 37.84 Billion by 2032, at a CAGR of 3.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Carbon Dioxide Market Size 2024 |

USD 29.53 Billion |

| Industrial Carbon Dioxide Market, CAGR |

3.15% |

| Industrial Carbon Dioxide Market Size 2032 |

USD 37.84 Billion |

The Industrial Carbon Dioxide Market is characterized by strong competition among major players such as Air Products and Chemicals Ltd., Linde Group, Taiyo Nippon Sanso Corporation, Iwatani Corporation, and Air Water Inc. These companies focus on expanding production capacities, adopting carbon capture technologies, and enhancing distribution networks to meet rising global demand. Strategic mergers, partnerships, and investments in sustainable CO₂ recovery systems strengthen their market presence. North America led the global market with a 36.4% share in 2024, driven by extensive EOR projects and strong demand from food and beverage industries, followed by Europe and Asia-Pacific with notable growth potential.

Market Insights

- The Industrial Carbon Dioxide Market was valued at USD 29.53 Billion in 2024 and is projected to reach USD 37.84 Billion by 2032, growing at a CAGR of 3.15%.

- Rising demand from the food and beverage industry for carbonation, freezing, and packaging applications drives market growth globally.

- Increasing adoption of carbon capture and utilization technologies and expansion of EOR projects are shaping sustainable CO₂ production trends.

- The market remains competitive, with key players focusing on technological advancements, purification efficiency, and expansion of distribution networks to strengthen regional presence.

- North America held a 36.4% share in 2024, leading the global market, while the ammonia plant segment accounted for 42.6% of total production; Asia-Pacific and Europe continue to show strong growth driven by industrial expansion and carbon-neutral initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

The ammonia plant segment dominated the industrial carbon dioxide market in 2024, accounting for a 42.6% share. Large-scale CO₂ recovery from ammonia production supports its leading position due to abundant byproduct availability. Increasing adoption of carbon capture and utilization (CCU) technologies in ammonia plants enhances CO₂ purification efficiency. Expanding fertilizer manufacturing in Asia-Pacific and Europe further fuels CO₂ output from ammonia units. Companies focus on integrating low-emission processes and advanced gas purification systems to meet tightening environmental standards and improve operational sustainability in CO₂ production.

- For instance, CF Industries’ Donaldsonville ammonia complex in the U.S. announced a project to capture about 2 million metric tons of CO₂ annually from its by-product stream during ammonia production.

By Application

The carbonation segment held the largest 34.8% share of the industrial carbon dioxide market in 2024. The segment’s growth is driven by rising demand from the food and beverage industry for carbonated drinks and packaged beverages. High consumption of soft drinks in North America and Asia-Pacific supports strong CO₂ utilization in carbonation processes. The growing preference for sparkling water and functional beverages also contributes to demand. Manufacturers invest in high-purity CO₂ recovery systems to ensure consistent quality and meet beverage-grade standards globally.

- For instance, CarbonQuest deployed a system in a food & beverage facility in Washington state that will capture ~22,000 metric tons of CO₂ over 15 years via on-site capture and reuse for carbonation and packaging.

By End Use

The food and beverages segment led the industrial carbon dioxide market in 2024 with a 39.2% share. Widespread CO₂ use in carbonation, freezing, and packaging applications drives this dominance. Rising demand for processed and frozen foods, along with beverage expansion, boosts CO₂ consumption. Food-grade CO₂ ensures extended shelf life and improved product safety. Growth in quick-service restaurants and beverage bottling facilities, especially across Asia-Pacific, supports continued market expansion. Companies enhance distribution networks and invest in high-capacity liquefaction plants to meet industry-specific purity requirements.

Key Growth Drivers

Rising Demand from the Food and Beverage Industry

The growing consumption of carbonated drinks, packaged beverages, and frozen foods drives industrial CO₂ demand. Beverage manufacturers use high-purity CO₂ for carbonation, preservation, and freezing applications. Expanding beverage bottling operations across Asia-Pacific and North America further strengthen demand. The increasing preference for sparkling water and ready-to-drink products also contributes to market growth, supported by technological advancements in CO₂ capture and purification systems ensuring consistency and food-grade safety standards.

- For instance, the CO₂ recovery specialist PCCS Pte Ltd states that CO₂ recovery systems for food & beverage enable reuse of captured CO₂ for carbonation and preservation rather than sourcing new CO₂.

Expansion of Enhanced Oil Recovery (EOR) Activities

Rising global energy demand and efforts to maximize oil production are boosting CO₂ use in EOR processes. Injecting CO₂ into oil reservoirs increases crude extraction efficiency while reducing carbon emissions. Oil producers adopt captured industrial CO₂ as a cost-effective and sustainable recovery solution. Growing investments in CO₂ pipeline infrastructure and carbon capture projects in North America and the Middle East are expected to enhance supply reliability and support sustainable energy strategies.

- For instance, according to recent data from sources like the Global CCS Institute, global CO₂ capture capacity stood at approximately 57 million metric tons per year as of July 2025.

Increased Focus on Carbon Capture and Utilization (CCU)

Governments and industries emphasize CCU adoption to reduce greenhouse gas emissions. Captured CO₂ from ammonia, ethanol, and natural gas plants is increasingly used in industrial applications such as chemicals, fuels, and building materials. The integration of advanced capture technologies, including membrane and cryogenic systems, improves recovery efficiency. Policy incentives and partnerships for low-carbon solutions further accelerate the transition toward circular CO₂ utilization models, driving sustainable market expansion.

Key Trends & Opportunities

Shift Toward Sustainable CO₂ Production Methods

Industries are shifting toward low-carbon CO₂ generation through renewable and bio-based sources. Ethanol and biogas facilities are emerging as key contributors to sustainable CO₂ supply. Companies invest in carbon-neutral production and storage solutions to meet stricter emission regulations. The development of CO₂-based synthetic fuels and green methanol also presents long-term growth opportunities, aligning with global decarbonization goals and energy transition initiatives.

- For instance, the direct-air-capture company Climeworks AG opened its “Mammoth” plant in Iceland with a capacity to capture 36,000 metric tons of CO₂ per year using renewable geothermal energy.

Technological Advancements in CO₂ Capture and Storage

Continuous innovations in carbon capture, utilization, and storage (CCUS) technologies are transforming the industrial CO₂ landscape. Advanced cryogenic separation, adsorption, and membrane technologies enhance recovery rates and energy efficiency. Strategic collaborations between technology firms and energy producers accelerate deployment. These advancements reduce production costs and increase the scalability of CO₂ reuse across sectors, including chemicals, construction materials, and alternative fuels.

- For instance, EnLink, CF Industries, and ExxonMobil have collaborated on a project to capture and store CO₂ in Louisiana. The plan involves CF Industries capturing up to 2 million metric tons of CO₂ annually from its Donaldsonville facility.

Key Challenges

High Operational and Transportation Costs

The cost of CO₂ capture, purification, and liquefaction remains a major challenge for manufacturers. Transporting compressed CO₂ requires specialized pipelines and cryogenic tankers, increasing capital and operational expenses. Limited storage infrastructure in developing regions further complicates logistics. These cost pressures affect market competitiveness, especially for small-scale producers without integrated carbon capture systems or long-term supply contracts.

Stringent Environmental and Regulatory Standards

Tightening environmental policies and emission standards create compliance challenges for CO₂ producers. Regulatory frameworks require significant investment in monitoring systems and emission control technologies. Failure to meet carbon intensity targets may lead to penalties and production restrictions. Additionally, varying regional policies on carbon trading and utilization create uncertainty in international operations, impacting long-term investment and expansion decisions.

Regional Analysis

North America

North America dominated the industrial carbon dioxide market in 2024, accounting for a 36.4% share. The region’s leadership is driven by extensive CO₂ use in enhanced oil recovery operations and the strong presence of food and beverage manufacturers. The United States leads with advanced carbon capture infrastructure and large-scale EOR projects. Increasing investments in CO₂ pipeline networks and carbon utilization technologies further strengthen regional supply security. Supportive government policies promoting low-carbon industrial processes and the rapid expansion of sustainable fuel production continue to boost market growth across the region.

Europe

Europe held a 27.1% share of the industrial carbon dioxide market in 2024. The region benefits from a strong focus on carbon neutrality and circular economy initiatives. High CO₂ consumption in the food, beverage, and chemical industries sustains steady demand. European companies increasingly adopt carbon capture and utilization systems in ammonia and ethanol plants. Countries such as Germany, the UK, and France lead in CO₂ reuse projects for synthetic fuel and building material production. Stringent emission norms and funding for green technologies continue to drive sustainable CO₂ sourcing across industrial sectors.

Asia-Pacific

Asia-Pacific accounted for a 29.8% share of the industrial carbon dioxide market in 2024. Strong growth in food processing, beverage production, and chemical manufacturing fuels regional demand. China, India, and Japan remain major CO₂ producers due to large-scale ammonia and ethanol facilities. The expansion of carbonated beverage industries and increased adoption of CO₂-based refrigeration technologies support market growth. Governments are investing in carbon capture pilot projects to reduce industrial emissions. Rapid industrialization and increasing energy consumption strengthen Asia-Pacific’s position as a high-growth region for CO₂ utilization.

Latin America

Latin America represented a 4.2% share of the industrial carbon dioxide market in 2024. The market is primarily driven by CO₂ use in beverage carbonation, oil recovery, and medical applications. Brazil and Mexico dominate regional consumption, supported by their expanding food and beverage industries. The growth of ethanol production facilities also contributes to sustainable CO₂ generation. Investments in carbon capture technologies remain limited but are gradually increasing through public-private partnerships. Rising energy demand and growing environmental awareness are expected to support steady market development across the region.

Middle East & Africa

The Middle East & Africa accounted for a 2.5% share of the industrial carbon dioxide market in 2024. The demand is mainly supported by enhanced oil recovery operations and industrial gas applications. Gulf countries such as Saudi Arabia and the UAE lead in CO₂ utilization within the oil and gas sector. Growing infrastructure and construction activities further drive industrial CO₂ consumption. Limited capture and storage capacity currently restrains expansion, but regional governments are investing in carbon management technologies to diversify their energy economies and align with global sustainability goals.

Market Segmentations:

By Source

- Natural Gas Processing

- Ammonia Plant

- Ethanol Plant

- Others

By Application

- EOR

- Ammonia Synthesis

- Carbonation

- Shielding and Inert gas

- Dry Ice

- Others

By End Use

- Food and Beverages

- Oil & Gas

- Chemical

- Building & Construction

- Medical & Pharmaceutical

- Metal Industry

- Rubber & plastic

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The industrial carbon dioxide market is highly competitive, featuring key players such as Air Products and Chemicals Ltd., Taiyo Nippon Sanso Corporation, Abdullah Hashim Industrial & Equipment Co., Iwatani Corporation, Ellenbarrie Industrial Gases, Linde Group, Buzwair Industrial Gases, Matheson Tri Gas Inc., Gulf Crypo, SICGIL India Limited, Cosmo Engineering, Air Water Inc., Mohsin Haider LLC, Bristol Gases, Continental Carbonic Products, and Dubai Industrial Gases. Market participants focus on strategic collaborations, production capacity expansion, and technological advancements in carbon capture and purification. Companies invest in low-carbon solutions to align with emission targets and sustainability standards. Product quality, purity consistency, and efficient logistics remain key differentiators in maintaining competitive advantage. The ongoing shift toward renewable CO₂ sources and advanced liquefaction technologies is driving innovation across global markets, while regional expansion strategies and mergers continue to strengthen supply reliability and distribution networks in the evolving industrial carbon dioxide landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Air Products and Chemicals Ltd.

- Taiyo Nippon Sanso Corporation

- Abdullah Hashim Industrial & Equipment Co.

- Iwatani Corporation

- Ellenbarrie Industrial Gases

- Linde Group

- Buzwair Industrial Gases

- Matheson Tri Gas Inc.

- Gulf Crypo

- SICGIL India Limited

- Cosmo Engineering

- Air Water Inc.

- Mohsin Haider LLC

- Bristol Gases

- Continental Carbonic Products

- Dubai Industrial Gases

Recent Developments

- In 2025, Linde plc Announced a long-term agreement to supply industrial gases to a world-scale low-carbon ammonia facility in Louisiana.

- In 2023, Matheson Tri-Gas, Inc., signed an oxygen supply agreement with Direct Air Capture (DAC) company 1PointFive for its first plant in Texas, which is scheduled to start operations around mid-2025 and capture 500,000 tons of CO₂ annually.

- In 2023, Taiyo Nippon Sanso Corporation launched a 10 tons/day CO₂ recovery system using the PSA method to capture high-concentration CO₂.

Report Coverage

The research report offers an in-depth analysis based on Source, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing integration of carbon capture and utilization technologies will enhance sustainable CO₂ production.

- Rising beverage and food processing demand will continue to drive consumption globally.

- Expanding enhanced oil recovery projects will strengthen industrial CO₂ applications in the energy sector.

- Increasing investment in CO₂ pipeline infrastructure will improve supply efficiency and storage capacity.

- Advancements in cryogenic and membrane separation systems will boost CO₂ recovery efficiency.

- Government policies supporting carbon neutrality will accelerate industrial adoption of low-emission processes.

- Emerging CO₂-to-fuel and CO₂-to-chemical projects will open new commercial opportunities.

- Growing construction and medical industries will expand downstream application areas.

- Regional collaborations will promote large-scale CO₂ recycling and export initiatives.

- The shift toward renewable and bio-based CO₂ sources will shape the long-term market trajectory.