Market Overview

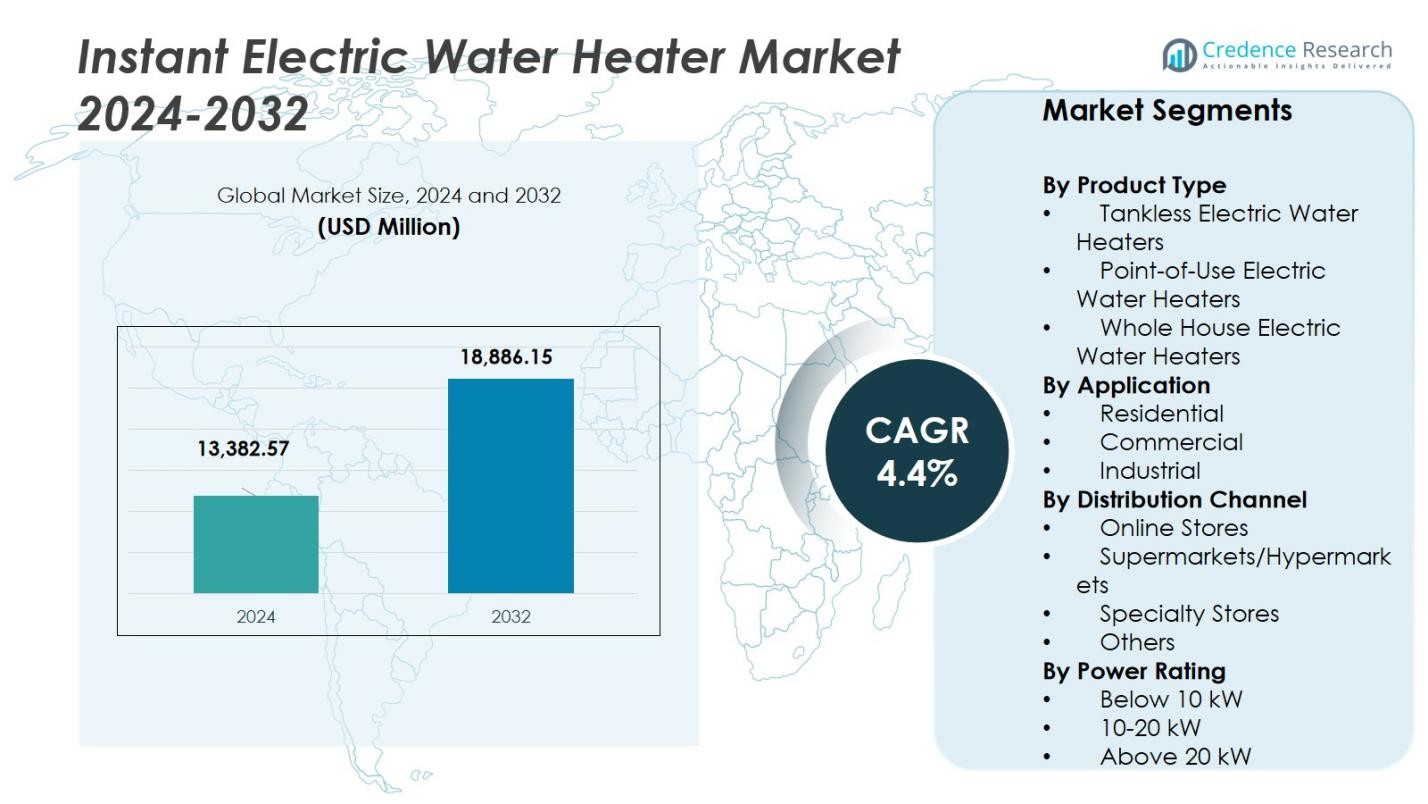

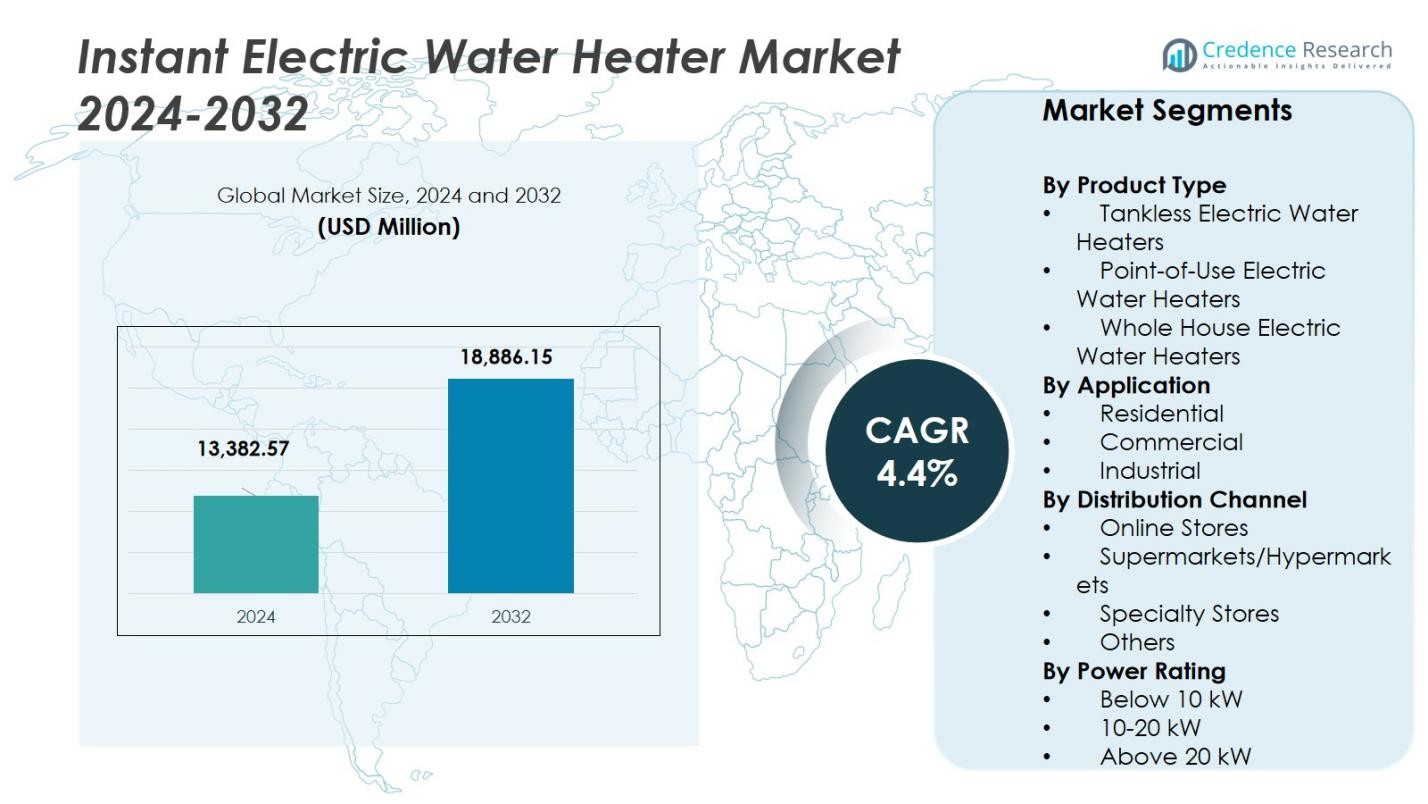

The Instant Electric Water Heater Market size was valued at USD 13,382.57 million in 2024 and is anticipated to reach USD 18,886.15 million by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Instant Electric Water Heater Market Size 2024 |

USD 13,382.57 Million |

| Instant Electric Water Heater Market, CAGR |

4.4% |

| Instant Electric Water Heater Market Size 2032 |

USD 18,886.15 Million |

The Instant Electric Water Heater Market features several prominent players, including A. O. Smith Corporation, Ariston Thermo Group, Rheem Manufacturing Company, Stiebel Eltron, Bosch Thermotechnology, Bradford White Corporation, EcoSmart Green Energy Products, Eemax Inc., Midea Group, and Haier Electronics Group Co., Ltd. These companies strengthen their market presence through product innovation, energy-efficient technologies, and expanded global distribution. Among all regions, Asia-Pacific leads the market with a 40% share, driven by rapid urbanisation, rising household appliance adoption, and strong demand for compact, on-demand water-heating solutions across both residential and commercial sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Instant Electric Water Heater Market reached USD 13,382.57 million in 2024 and is projected to hit USD 18,886.15 million by 2032, expanding at a CAGR of 4.4% during the forecast period.

- Growing demand for energy-efficient and space-saving water heating systems drives adoption, with tankless electric water heaters leading the product segment at a 65% share.

- Smart connectivity, app-controlled features, and IoT integration are shaping market trends as consumers prioritise convenience and energy optimisation.

- Key players like A. O. Smith, Ariston Thermo Group, Rheem, and Bosch enhance market presence through product innovation and global expansion while competing on efficiency, pricing, and technology.

- Asia-Pacific dominates regional performance with a 40% market share, supported by rapid urbanisation and rising residential installations, followed by Europe at 25% and North America at 20%, reflecting strong adoption across advanced economies.

Market Segmentation Analysis:

By Product Type

In the product-type segment of the instant electric water heater market, the tankless electric water heaters sub-segment is dominant, accounting for 65% of the total market share. This leadership stems from their on-demand heating capability, compact footprint and lower energy consumption compared with traditional storage units. Their suitability for retrofit applications and growing consumer preference for energy-efficient solutions are key drivers. Meanwhile, point-of-use and whole-house variants grow steadily as urban housing and smart appliances proliferate.

- For instance, models like the Stiebel Eltron Tempra provide instantaneous hot water while reducing standby energy losses, making them highly suitable for retrofit applications and appealing to energy-conscious consumers.

By Application

Within application, the residential segment commands the largest share of around 47% of the market, driven by rising urbanisation, smaller family units, and increased infrastructure investment in new homes. Home-owners prioritise space-saving, instant hot water systems and lower utility bills, favouring instant electric water heaters over traditional storage ones. Commercial and industrial deployments also contribute to growth, but residential installations remain the main driver of volume and value.

- For instance, in urban apartments and compact homes, units like the Bosch Tronic 3000 are favored for their small footprint and energy efficiency.

By Distribution Channel

In terms of distribution, the supermarkets/hypermarkets channel holds the largest portion of share, thanks to broad consumer reach, convenient purchasing, and the bundling of multiple appliance brands under one roof. While online stores are recording the fastest growth due to digital adoption and home delivery convenience, the mass-retail format remains the dominant route to market. Specialty stores and other channels add niche value but account for smaller shares.

Major Growth Drivers

Rising Demand for Energy-Efficient Water Heating Solutions

The instant electric water heater market benefits from increasing global emphasis on energy efficiency and cost-effective heating technologies. Consumers and businesses seek appliances that reduce electricity consumption and carbon emissions, prompting rapid adoption of tankless and point-of-use systems. Government regulations promoting efficient household appliances further accelerate uptake. Manufacturers respond with advanced heating elements, precise temperature controls, and improved insulation technologies. As energy prices rise and sustainability awareness strengthens, energy-efficient instant electric water heaters continue to experience robust, long-term demand.

- For instance, manufacturers like AO Smith and Rheem have introduced models featuring advanced heating elements, precise temperature controls, and enhanced insulation technologies to maximize energy savings.

Urbanisation and Growth of Compact Living Spaces

Rapid urbanisation, especially in emerging economies, drives strong demand for compact and space-saving water heating systems. Instant electric water heaters align well with modern residential layouts, micro-apartments, and urban housing developments where storage space is limited. Their wall-mounted design, quick installation, and on-demand heating capability appeal to urban households seeking convenience and efficiency. Rising construction of multifamily units and renovation of older residential infrastructure also support market expansion. As cities continue to densify, compact water heating solutions gain further traction across residential and commercial environments.

- For instance, Intellihot’s commercial tankless water heaters have been adopted in high-rise apartment buildings with hundreds of units to meet urban demand efficiently.

Expansion of Commercial Applications Across Service Industries

The commercial sector increasingly adopts instant electric water heaters to support hotels, restaurants, hospitals, and institutional facilities requiring continuous hot water availability. These sectors value the technology’s rapid heating, reliability, and lower operational costs compared with traditional boilers. Growth in tourism, foodservice establishments, and healthcare infrastructure boosts demand for high-capacity, durable systems. Additionally, regulatory requirements for sanitation and hygiene amplify commercial adoption. As service industries scale globally, instant electric water heaters become integral to operational efficiency and compliance with safety standards.

Key Trends & Opportunities

Integration of Smart and Connected Technologies

A major trend shaping the market is the adoption of IoT-enabled features such as remote monitoring, mobile-app control, self-diagnostics, and energy-use analytics. These smart capabilities enhance user convenience, improve maintenance efficiency, and optimise electricity consumption. Manufacturers increasingly develop connected models that integrate with home automation platforms. This shift opens new opportunities for differentiation, subscription-based service models, and predictive maintenance ecosystems. As consumers embrace smart home technologies, connected instant electric water heaters provide strong potential for premium-segment growth.

- For instance, Bosch’s Smart Water Heater allows users to control temperature settings and monitor energy consumption remotely via a smartphone app, enhancing convenience and energy efficiency.

Rising E-Commerce Penetration and Direct-to-Consumer Sales

Online retail growth presents a significant opportunity for manufacturers to expand reach and reduce distribution costs. E-commerce platforms enable transparent pricing, easy product comparison, and targeted marketing campaigns, accelerating consumer adoption of instant electric water heaters. Direct-to-consumer models allow brands to offer custom installation support, extended warranties, and bundled services. As digital purchasing gains momentum across urban and semi-urban regions, companies leveraging robust online sales strategies and logistics networks stand to capture substantial incremental market share.

- For example, brands like A.O. Smith and Rheem leverage e-commerce platforms such as Amazon and Home Depot to provide transparent pricing, easy product comparisons, and targeted digital marketing campaigns that accelerate consumer adoption.

Key Challenges

High Upfront Costs and Installation Constraints

Despite long-term energy savings, instant electric water heaters typically require higher upfront investment than conventional storage units. Installation may also demand electrical upgrades, particularly in older buildings with limited wiring capacity. These additional costs can deter price-sensitive consumers and slow penetration in developing markets. Commercial properties may require multiple units to achieve adequate flow rates, further increasing capital expenditure. Overcoming these barriers requires improved cost-efficiency, consumer education, and targeted financing solutions.

Fluctuating Energy Prices and Grid Reliability Issues

Since instant electric water heaters depend entirely on electrical power, fluctuations in energy prices directly impact their operating costs. In regions with unstable electricity supply, frequent outages reduce system reliability and limit adoption. High peak-hour tariffs may also discourage usage, pushing consumers toward gas-based or hybrid alternatives. Utilities and policymakers play a critical role in addressing grid capacity, pricing structures, and renewable integration. Until these issues stabilise, market growth faces constraints in both emerging and energy-constrained regions.

Regional Analysis

North America

North America holds a 20% market share in the instant electric water heater market, supported by high adoption of energy-efficient home appliances, strong purchasing power, and widespread penetration of smart home technologies. Consumers prioritise convenience, rapid heating, and reduced energy consumption, which reinforces demand for tankless and point-of-use systems. Regulatory emphasis on lowering residential energy use further supports product uptake. Growth remains steady across both replacement and new installations, particularly in urban households and commercial buildings. Manufacturers leverage advanced features and digital integration to strengthen their presence in a mature yet innovation-driven market.

Europe

Europe accounts for a 25% market share, driven by stringent energy-efficiency regulations, rising electricity costs, and increasing preference for compact heating solutions in modern residential settings. Countries in Western and Northern Europe lead adoption due to high environmental awareness and strong policy support for low-carbon technologies. Renovation of older housing stock and growth in multi-unit dwellings also boost demand for instant systems. Commercial applications expand as hospitality and healthcare facilities seek reliable, space-saving water-heating solutions. Despite market maturity, opportunities remain in smart connected units and premium-efficiency models aligned with EU sustainability objectives.

Asia-Pacific

Asia-Pacific dominates the global market with a 40% market share, fuelled by rapid urbanisation, expanding middle-class populations, and rising construction of compact residential units. Growing electrification, improving living standards, and heightened demand for on-demand hot water systems support widespread adoption in China, India, Japan, and Southeast Asia. Price-sensitive consumers increasingly favour efficient, low-maintenance tankless models. Government initiatives promoting energy-efficient appliances and strong e-commerce penetration further accelerate growth. As infrastructure modernises and household appliance spending rises, Asia-Pacific remains the fastest-growing region with significant long-term potential for both residential and commercial applications.

Latin America

Latin America holds an 8% market share, supported by gradual improvement in household infrastructure, growing awareness of energy-efficient appliances, and increasing urban population concentrations. Adoption strengthens in countries such as Brazil, Mexico, and Colombia, where consumers seek affordable and space-saving water-heating solutions. Expansion of the hospitality and service sectors contributes to rising commercial demand. However, market growth is moderated by inconsistent electricity supply in some areas and price sensitivity among lower-income households. As economic stability improves and grid reliability strengthens, the region presents opportunities for mid-range and entry-level instant electric water heater models.

Middle East & Africa

The Middle East & Africa region represents a 7% market share, driven by growing residential development, expansion of commercial facilities, and increasing adoption of modern home appliances. Hot water demand continues to rise in urban centres across Gulf countries and parts of Africa, where construction activities and population growth remain strong. Instant electric water heaters appeal due to their compact design and suitability for diverse building types. Nonetheless, market expansion faces challenges from varied electricity pricing structures and uneven grid reliability. Continued infrastructure development and rising consumer awareness are expected to support gradual growth across the region.

Market Segmentations:

By Product Type

- Tankless Electric Water Heaters

- Point-of-Use Electric Water Heaters

- Whole House Electric Water Heaters

By Application

- Residential

- Commercial

- Industrial

By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

By Power Rating

- Below 10 kW

- 10-20 kW

- Above 20 kW

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the instant electric water heater market is shaped by key players such as A. O. Smith Corporation, Ariston Thermo Group, Rheem Manufacturing Company, Stiebel Eltron, Bosch Thermotechnology, Bradford White Corporation, EcoSmart Green Energy Products, Eemax Inc., Midea Group, and Haier Electronics Group Co., Ltd. These companies compete through continuous innovation, expanding product portfolios, and strengthening distribution networks across global and regional markets. Manufacturers prioritise energy-efficient designs, compact configurations, and smart connectivity features to align with evolving consumer preferences. Strategic initiatives such as mergers, acquisitions, and partnerships enhance market reach and technological capabilities. Additionally, investments in R&D support advancements in rapid-heating elements, durability, and safety systems. As online retail channels expand and demand increases across residential and commercial sectors, leading brands focus on pricing strategies, customer service, and warranty programs to maintain competitiveness. Overall, the market remains moderately consolidated with innovation-driven rivalry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2024, A.O. Smith launched the Elegance Neo Series in India, offering electric water heaters in both vertical and horizontal configurations. These models are rated with a BEE 5-star efficiency and are available in capacities of 10 and 15 litres, with prices starting at INR 9,800. Additionally, they are backed by warranties of up to seven years.

- In December 2024, Surya Roshni unveiled the Qube+ series of electric water heaters, which are also rated with 5-star efficiency by the Bureau of Energy Efficiency. These models offer excellent energy efficiency and performance, along with complimentary standard installation and home service options, making them ideal for a wide range of residential and commercial applications.

- In August 2024, Symphony Limited made its debut in the smart water geyser sector with three innovative series: Spa, Sauna, and Soul. These new electric water heaters feature AI-enabled controllers, advanced water filtration systems, voice notifications, customizable timer options, and enhanced safety mechanisms.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel, Power Rating and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand as consumers prioritise energy-efficient and space-saving water heating solutions.

- Smart and connected instant water heaters will gain traction with increasing adoption of IoT-enabled home appliances.

- Residential demand will rise due to growing urbanisation and construction of compact living spaces.

- Commercial adoption will strengthen as hotels, restaurants, and healthcare facilities seek reliable on-demand hot water systems.

- Manufacturers will focus on enhancing product durability, safety features, and rapid-heating technologies.

- E-commerce will play a larger role in product distribution, supported by price transparency and home delivery services.

- Emerging markets will present strong growth opportunities as electrification and infrastructure development improve.

- Sustainability regulations will encourage innovation in low-energy and eco-friendly product designs.

- Competitive intensity will increase as global and regional players expand their portfolios with advanced models.

- Consumer preference for long-term cost savings will drive accelerated replacement of traditional storage heaters.