Market Overview

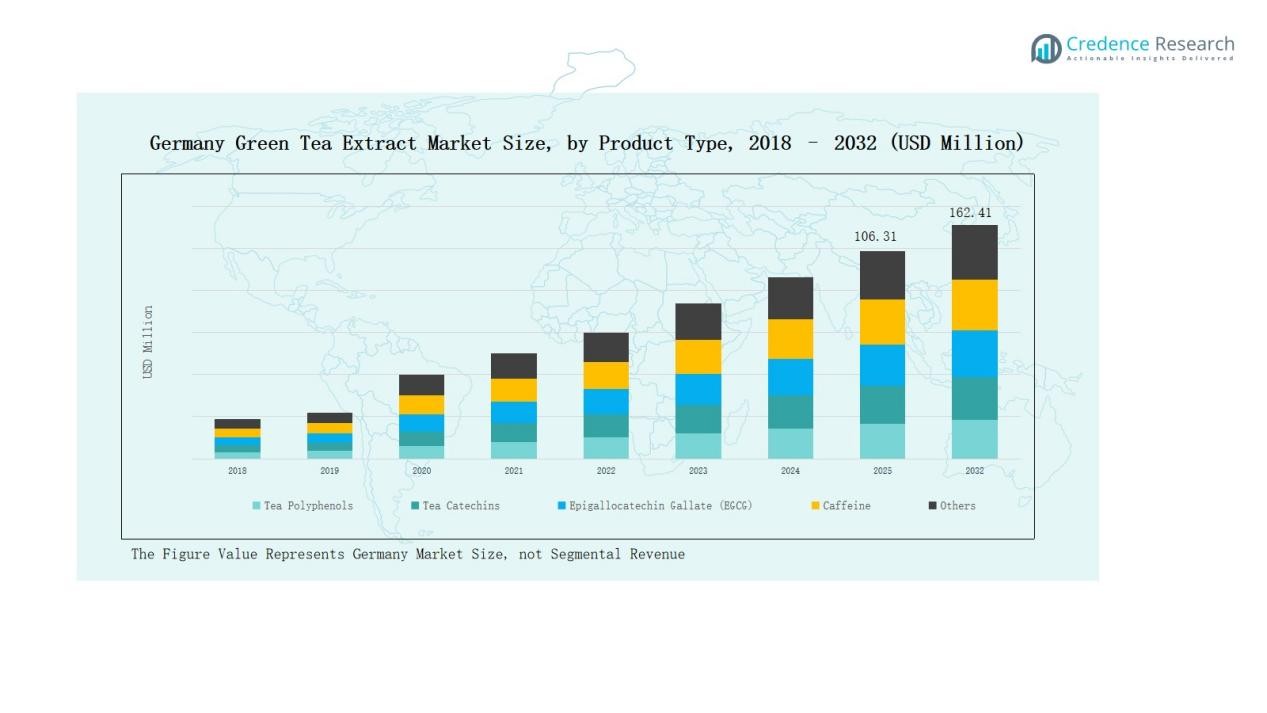

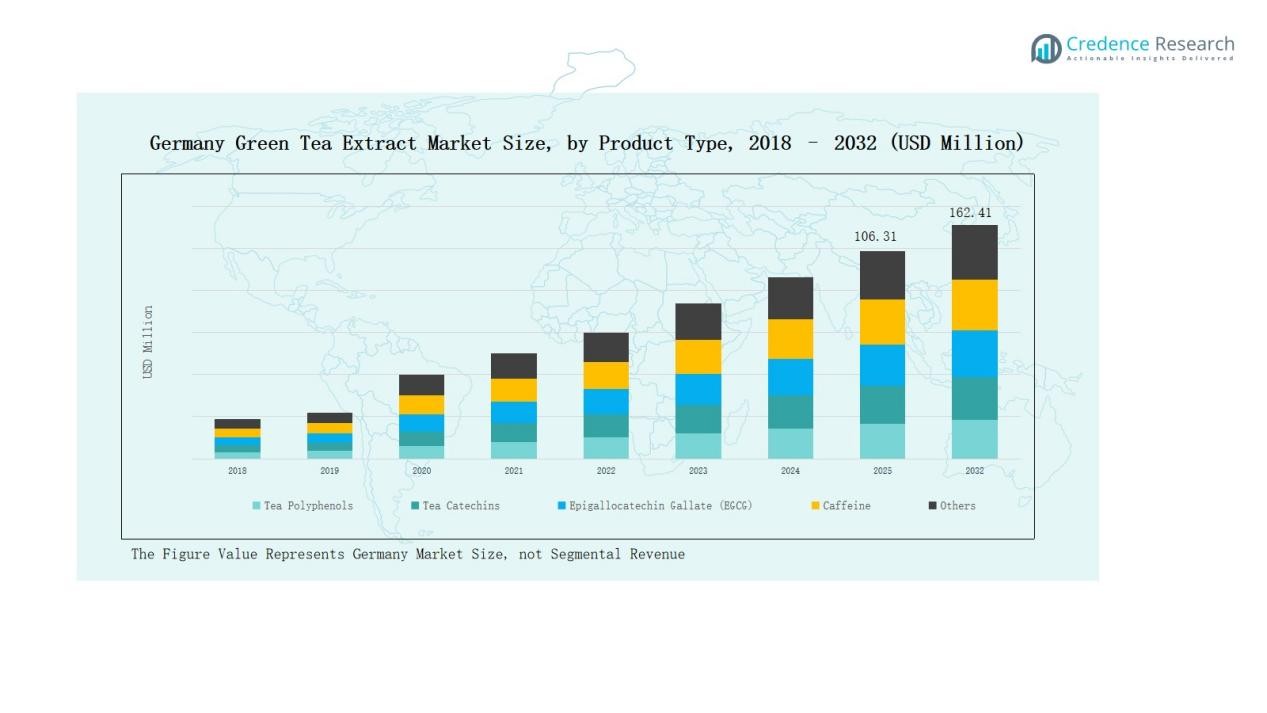

Germany Green Tea Extract Market size was valued at USD 65.44 million in 2018, reaching USD 96.66 million in 2024, and is anticipated to attain USD 162.41 million by 2032, at a CAGR of 6.24% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Green Tea Extract Market Size 2024 |

USD 96.66 Million |

| Germany Green Tea Extract Market, CAGR |

6.24% |

| Germany Green Tea Extract Market Size 2032 |

USD 162.41 Million |

The Germany Green Tea Extract Market is shaped by prominent players including MartinBauer Group, BASF SE, Symrise AG, Döhler Group, Bayer AG, Evonik Industries, Flavex Naturextrakte GmbH, Hopfenveredlung St. Johann GmbH, Sensient Technologies, and Dr. Willmar Schwabe GmbH & Co. KG. These companies strengthen market presence through advanced formulations, sustainable sourcing, and strategic partnerships across pharmaceuticals, nutraceuticals, and functional foods. Northern Germany leads the market with a 34% share in 2024, supported by strong consumer adoption of nutraceuticals, robust retail infrastructure, and increasing demand for premium, clean-label green tea extract products.

Market Insights

- The Germany Green Tea Extract Market reached USD 96.66 million in 2024 and is projected to attain USD 162.41 million by 2032 at 6.24% CAGR.

- Tea Catechins lead with 38% share in 2024, supported by strong demand in nutraceuticals and functional foods, while EGCG sees increasing pharmaceutical integration.

- Powder form dominates with 52% share in 2024, driven by stability, cost-efficiency, and strong use in supplements and fortified food applications.

- Pharmaceuticals hold 41% share in 2024, supported by clinical evidence and growing integration in treatments for cardiovascular, metabolic, and cognitive health conditions.

- Northern Germany leads with 34% share in 2024, supported by strong nutraceutical adoption, robust retail infrastructure, and growing demand for clean-label green tea products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Tea Catechins dominate the Germany Green Tea Extract Market with a 38% share in 2024, driven by their strong role in functional foods and nutraceuticals. Catechins are valued for antioxidant properties that support cardiovascular and metabolic health, aligning with consumer demand for natural wellness solutions. EGCG holds a significant position due to clinical adoption in pharmaceuticals and supplements. Tea Polyphenols contribute steadily through broad applications in skincare and dietary products, while caffeine-based extracts find niche use in energy formulations. The “Others” category covers minor bioactive compounds that enhance specialized formulations.

For instance, Taiyo GmbH expanded its Sunphenon range of green tea catechin extracts in Germany, highlighting EGCG-based solutions for dietary supplements and functional beverages.

By Form

Powder form leads the market with a 52% share in 2024, reflecting its wide integration in dietary supplements, capsules, and functional foods. The powdered format is cost-efficient, easy to transport, and offers higher stability, making it attractive for manufacturers. Liquid extracts account for growing demand in beverages, especially RTD teas and concentrated health drinks. Soft gels, while smaller in share, cater to consumers seeking convenience and precision dosage in nutraceuticals. Market adoption is influenced by innovation in formulation technologies that improve bioavailability and consumer experience.

For instance, Glanbia Nutritionals expanded its Solmiko whey protein powder portfolio, highlighting improved solubility for functional food use.

By Application

Pharmaceuticals dominate with a 41% share in 2024, supported by rising use of green tea extract in cardiovascular, metabolic, and cognitive health applications. Strong clinical evidence for EGCG and catechins has driven integration into prescription and over-the-counter products. Food & Beverages follow closely, with consumers adopting fortified snacks, confectionery, and teas for daily health benefits. RTD teas hold a rising share due to demand for convenience among younger demographics. Functional foods also expand with protein bars and fortified cereals, while “Others” contribute through cosmetics and personal care uses.

Key Growth Drivers

Key Growth Drivers

Rising Consumer Demand for Natural Health Products

The Germany Green Tea Extract Market benefits from increasing consumer preference for natural and plant-based health solutions. Growing awareness of antioxidants, polyphenols, and catechins strengthens adoption in supplements and functional foods. Consumers view green tea extract as a safe and effective alternative for supporting cardiovascular, metabolic, and cognitive health. This shift is reinforced by lifestyle changes that emphasize preventive healthcare. Retail channels highlight green tea extract-based products, enhancing accessibility and visibility. These factors collectively drive steady demand across multiple consumer groups and industry applications.

Expansion in Pharmaceutical Applications

Green tea extract is witnessing strong uptake in the pharmaceutical sector, supported by clinical studies on its therapeutic benefits. Epigallocatechin Gallate (EGCG) in particular has demonstrated potential in treating cardiovascular issues, diabetes, and neurodegenerative conditions. German pharmaceutical companies integrate standardized extracts into prescription and over-the-counter formulations. Increasing research collaborations with biotech firms accelerate product development pipelines. Regulatory approval of health claims further strengthens market confidence. The established German healthcare system provides a robust framework for expanding extract-based medicines, securing long-term growth momentum in this segment.

For instance, Schwabe Group in Germany reported the use of green tea extract in clinical trials for cognitive health formulations, highlighting its neuroprotective role documented in peer-reviewed studies.

Growing Popularity of Functional Foods and Beverages

The rising demand for fortified foods and beverages is a key driver for the market. German consumers increasingly seek products that combine nutrition and convenience, such as protein bars, energy drinks, and fortified teas. Green tea extract’s antioxidant properties align with consumer interest in immunity and wellness. Ready-to-drink teas infused with green tea extract are popular among younger demographics seeking on-the-go health solutions. Food manufacturers actively innovate with clean-label, organic, and EGCG-rich ingredients. This trend supports diversification of applications and sustains growth in food and beverage integration.

For instance, Fuze Tea uses sustainably sourced tea extracts and is available in Germany. It offers a green tea with citrus and mango chamomile varieties, but there is no widely published information about a version with 30% higher catechin levels.

Key Trends & Opportunities

Shift Toward Clean-Label and Organic Products

The market is experiencing a strong trend toward clean-label, organic, and sustainably sourced green tea extracts. German consumers increasingly prioritize transparency in sourcing, production, and labeling. Manufacturers respond by introducing eco-friendly extraction processes and organic-certified formulations. This shift creates opportunities for premium positioning in dietary supplements and beverages. Regulatory frameworks encouraging natural and organic products also support adoption. Companies that align with this sustainability-driven consumer preference can capture higher-value market segments and strengthen brand credibility in both domestic and export markets.

For instance, MartinBauer Group introduced a line of organic-certified green tea extracts in 2023, produced using water-based extraction that reduces solvent use by 40%, meeting EU organic standards and strengthening its premium nutraceutical portfolio.

R&D Innovation for Enhanced Bioavailability

An important opportunity lies in advancing extraction and formulation technologies to improve bioavailability. Traditional green tea extracts often face absorption limitations, reducing their effectiveness. German companies are investing in nanotechnology, encapsulation, and advanced delivery systems to enhance functional outcomes. These innovations attract pharmaceutical firms seeking more efficient active ingredients and food producers aiming for stable integration. By addressing efficacy concerns, R&D developments expand the scope of high-performance applications in both healthcare and consumer goods. This innovation-driven approach strengthens Germany’s role as a hub for advanced nutraceutical solutions.

For instance, Evonik launched its Eudratec SoluFlow technology, which boosts solubility of poorly water‑soluble bioactives by up to 10 times, enabling higher absorption efficiency in nutraceutical formulations.

Key Challenges

Regulatory Complexity and Compliance Costs

The market faces challenges due to stringent EU and German regulations on nutraceuticals and health supplements. Obtaining approvals for health claims linked to green tea extract requires extensive clinical evidence, which demands high investment. Smaller companies struggle to meet compliance standards, limiting their ability to compete with larger firms. Complex labeling and safety standards further increase production costs. While regulations ensure product safety, they also slow down the speed of innovation and market entry. This environment creates barriers for emerging players and restricts faster expansion.

Intense Competitive Landscape

The Germany Green Tea Extract Market is highly competitive, with global leaders and domestic firms vying for share. Multinational players leverage economies of scale, established distribution networks, and broad product portfolios to maintain dominance. Smaller local firms differentiate through specialized formulations or organic certifications but face pricing pressures. Continuous innovation in product design and marketing further intensifies rivalry. The presence of substitutes such as herbal extracts and functional ingredients adds to competition. This saturated environment challenges companies to balance differentiation, cost, and scalability effectively.

Price Sensitivity and Supply Chain Risks

Market growth is constrained by supply chain volatility and raw material price fluctuations. Dependence on imported tea leaves exposes companies to geopolitical uncertainties, currency changes, and climatic variations in producing countries. High production costs for premium organic extracts increase retail pricing, limiting adoption among price-sensitive consumers. German buyers often weigh cost against perceived benefits, creating hurdles for premium-positioned products. Supply disruptions also affect consistency in quality and availability. These challenges force manufacturers to explore alternative sourcing strategies and cost optimization measures to sustain competitiveness.

Regional Analysis

Northern Germany

Northern Germany accounts for 34% share in 2024, driven by strong adoption of nutraceuticals and functional beverages. The region has a well-established retail and distribution infrastructure that enhances product reach. Consumers in Hamburg and Bremen display high awareness of preventive healthcare, encouraging use of green tea extracts in dietary supplements. Pharmaceutical applications also gain traction through partnerships with local biotech firms. The Germany Green Tea Extract Market in this region benefits from premium positioning of organic and clean-label products. It maintains steady growth supported by increasing health-conscious lifestyles.

Western Germany

Western Germany holds a 27% share in 2024, supported by its concentration of leading food and beverage manufacturers. Cities like Cologne and Düsseldorf serve as hubs for product innovation, particularly in fortified foods and ready-to-drink teas. Demand is reinforced by younger demographics seeking convenience-oriented wellness products. The Germany Green Tea Extract Market in this region also benefits from proximity to neighboring European markets, boosting export opportunities. Strong research activity in pharmaceutical companies ensures greater integration of catechins and EGCG in medical formulations. It demonstrates solid long-term growth prospects.

Southern Germany

Southern Germany captures a 22% share in 2024, supported by a strong pharmaceutical and biotechnology cluster in Munich and Stuttgart. The region emphasizes advanced formulations, including encapsulated extracts that enhance bioavailability. Food manufacturers in Bavaria integrate green tea extracts into confectionery and functional foods. The Germany Green Tea Extract Market here reflects growing consumer demand for natural and herbal products in premium categories. Its healthcare sector further drives usage of extracts for therapeutic purposes. It continues to expand with innovation and supportive regulatory environments.

Eastern Germany

Eastern Germany contributes 17% share in 2024, showing steady adoption of green tea extract across food, beverage, and wellness sectors. Retail penetration is growing in cities like Leipzig and Dresden, though at a slower pace compared to other regions. The Germany Green Tea Extract Market in this region benefits from government initiatives promoting healthier dietary habits. Pharmaceutical usage is emerging, with smaller firms experimenting in specialized applications. Functional beverages remain the fastest-growing segment. It shows strong potential as awareness and infrastructure continue to improve across this part of the country.

Market Segmentations:

Market Segmentations:

By Product Type

- Tea Polyphenols

- Tea Catechins

- Epigallocatechin Gallate (EGCG)

- Caffeine

- Others

By Form

By Application

- Pharmaceuticals

- Food & Beverages

- Ready-to-Drink (RTD) Teas

- Functional Foods

- Others

By Region

- Northern Germany

- Western Germany

- Southern Germany

- Eastern Germany

Competitive Landscape

The Germany Green Tea Extract Market is characterized by strong competition among multinational corporations and domestic players, each leveraging distinct strengths to secure market presence. Leading companies such as MartinBauer Group, BASF SE, Symrise AG, and Döhler Group dominate with broad product portfolios, established supply chains, and strong global networks. These players focus on R&D to develop high-purity extracts and advanced formulations with enhanced bioavailability, catering to pharmaceutical and nutraceutical demand. Domestic firms like Flavex Naturextrakte GmbH and Hopfenveredlung St. Johann GmbH emphasize organic certifications and sustainable sourcing, targeting the growing clean-label segment. Pharmaceutical firms such as Dr. Willmar Schwabe GmbH & Co. KG and Bayer AG integrate green tea extract into clinical applications, reinforcing market credibility. Intense rivalry encourages continuous innovation, partnerships, and acquisitions, while price sensitivity and strict EU regulations shape strategic approaches. Overall, the competitive environment balances global leadership with local specialization, driving both innovation and market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- MartinBauer Group

- Flavex Naturextrakte GmbH

- Hopfenveredlung St. Johann GmbH

- Symrise AG

- Evonik Industries

- Sensient Technologies

- BASF SE

- Willmar Schwabe GmbH & Co. KG

- Döhler Group

- Bayer AG

Recent Developments

- In October 2024, PLT Health Solutions launched Cellflo6, a patented green tea extract designed to support energy and wellness, featured in products like 7-Select Fusion Energy at retail outlets, which could impact the European market including Germany.

- In August 2024, Firmenich signed a partnership agreement to market Finlay’s tea and coffee extracts portfolio across Europe, which includes Germany, enhancing the availability of high-quality natural tea extracts in the region.

- In March 2025, Schwabe Group increased its stake in Braineffect, enhancing its portfolio in natural and science-based dietary supplements and functional foods.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for green tea extract will expand with rising consumer focus on preventive health.

- Pharmaceutical adoption will strengthen as clinical studies validate therapeutic benefits of EGCG and catechins.

- Functional foods and beverages will see higher integration of extracts for daily wellness.

- Ready-to-drink teas infused with green tea extract will attract younger demographics.

- Clean-label and organic-certified products will gain preference among health-conscious consumers.

- Innovation in encapsulation and delivery systems will improve bioavailability and effectiveness.

- Strategic collaborations between pharmaceutical and nutraceutical firms will accelerate product development.

- Supply chain resilience and sustainable sourcing will become a competitive differentiator.

- Local players will expand market share through specialized formulations and targeted niches.

- Regulatory clarity will encourage investment in advanced extract-based health solutions.

Key Growth Drivers

Key Growth Drivers

Market Segmentations:

Market Segmentations: