Market Overview

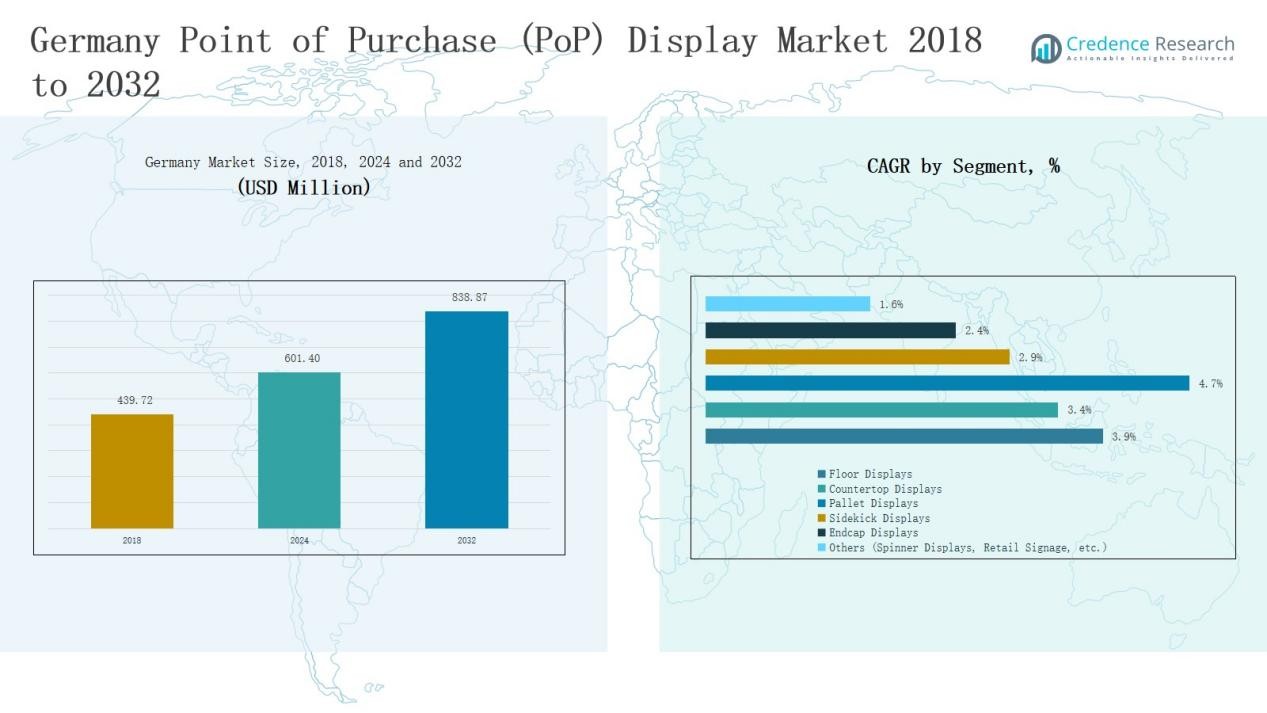

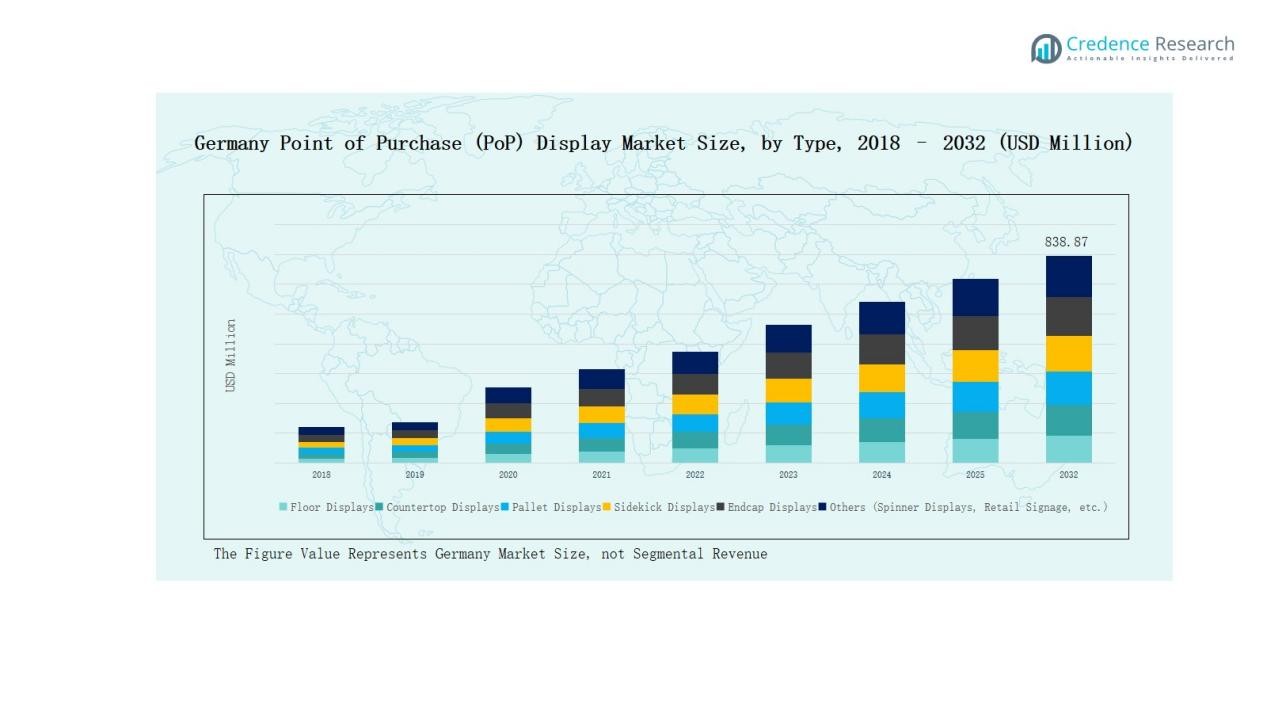

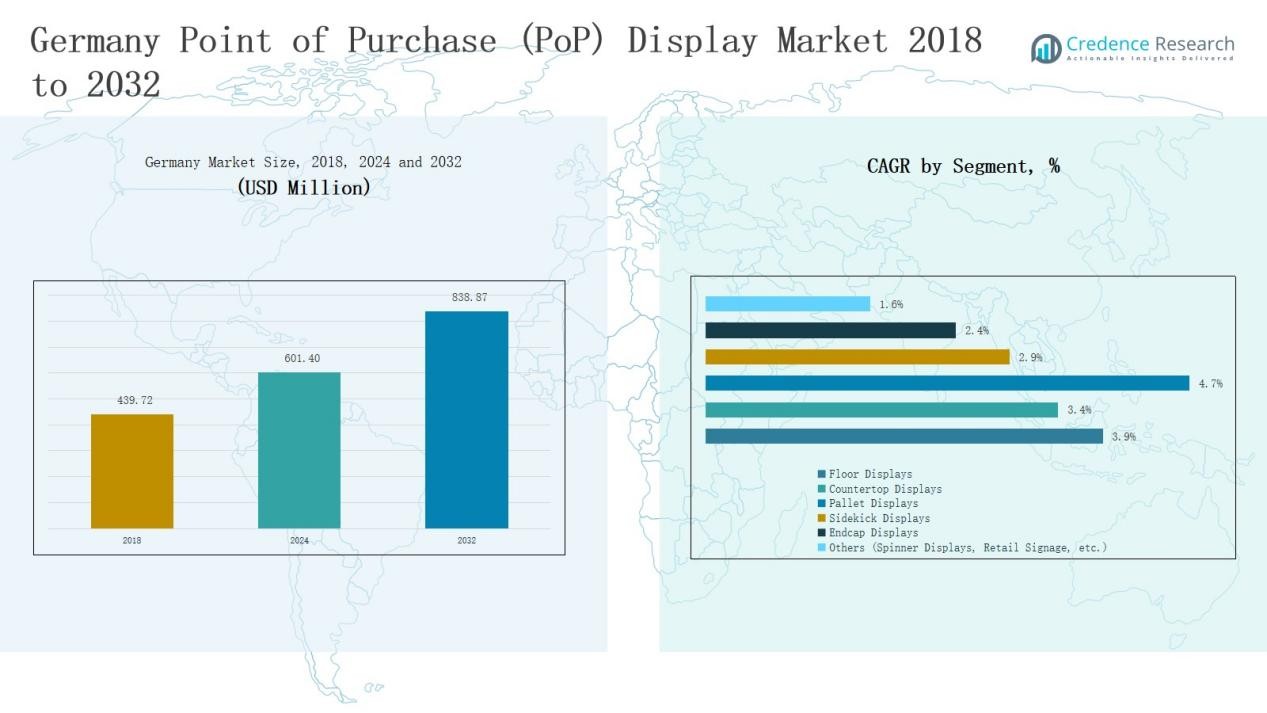

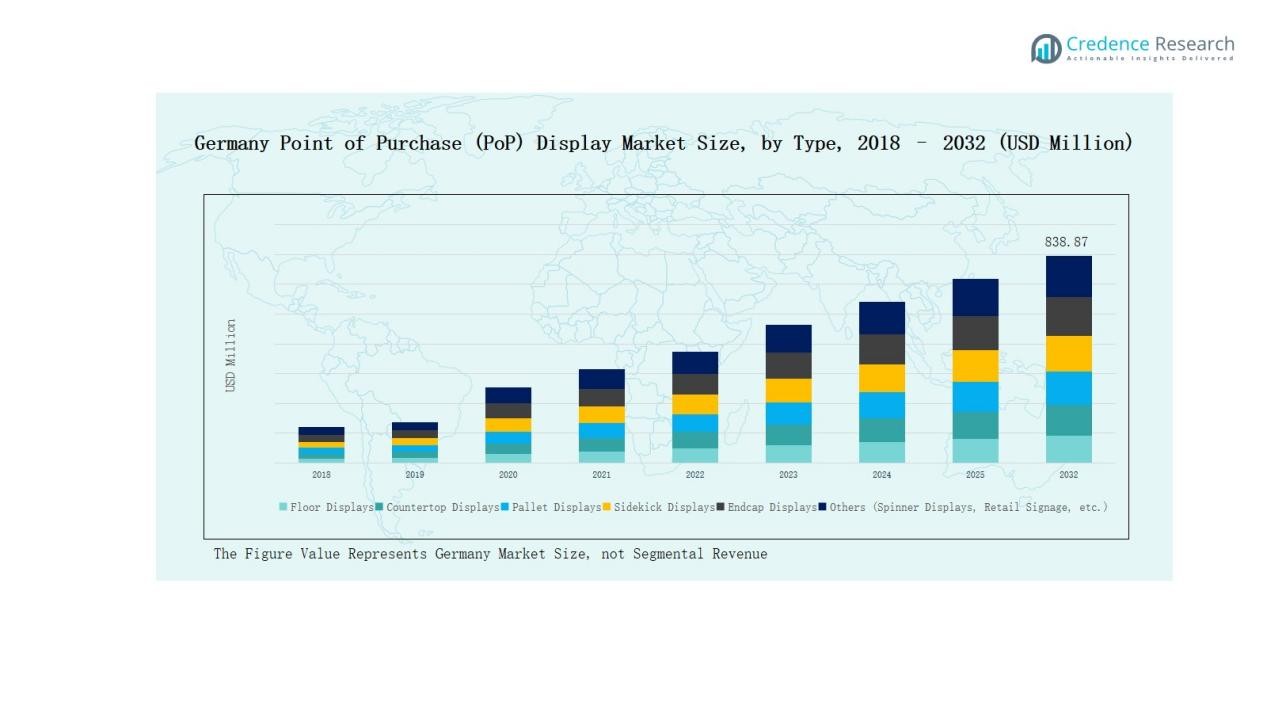

Germany Point of Purchase (PoP) Display Market size was valued at USD 439.72 million in 2018 to USD 601.40 million in 2024 and is anticipated to reach USD 838.87 million by 2032, at a CAGR of 3.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Point of Purchase (PoP) Display Market Size 2024 |

USD 601.40 Million |

| Germany Point of Purchase (PoP) Display Market, CAGR |

3.95% |

| Germany Point of Purchase (PoP) Display Market Size 2032 |

USD 838.87 Million |

The Germany Point of Purchase (PoP) Display Market is shaped by leading players such as POP Solutions Group, MHK Displays GmbH, Smurfit Kappa Group, DS Smith Plc, STI Group, Koehler Paper Group, Model Group, Panther Display, Kohlschein GmbH, and Thimm Group. These companies strengthen their positions through innovation, sustainability, and strong partnerships with FMCG, cosmetics, and electronics retailers. While global leaders focus on scalable, eco-friendly solutions, regional specialists emphasize customization and rapid service to support local retailers. In 2024, the South region led the market with 28% share, supported by dense retail infrastructure, strong FMCG activity, and high consumer spending, making it the most significant contributor to national revenue.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insight

- The Germany Point of Purchase (PoP) Display Market grew from USD 439.72 million in 2018 to USD 601.40 million in 2024 and will reach USD 838.87 million by 2032.

- Floor displays dominated with 34% share in 2024, driven by supermarkets and large retail chains boosting impulse purchases and product visibility.

- The food & beverage segment led applications with 42% share in 2024, supported by FMCG promotions, packaged snacks, and strong demand for ready-to-drink products.

- Temporary PoP displays held 58% share in 2024, reflecting their cost-effectiveness and flexibility for seasonal promotions across diverse retail formats.

- The South region led with 28% share in 2024, followed by the West at 32%, highlighting strong FMCG activity, high spending, and robust retail infrastructure.

Market Segment Insights

By Type

Floor displays held the largest share of the Germany Point of Purchase (PoP) Display Market, accounting for around 34% of total revenue in 2024. Their dominance stems from strong adoption in supermarkets and large retail chains, where they effectively capture consumer attention and drive impulse purchases. Pallet and endcap displays follow, supported by their ability to promote bulk packaging and seasonal campaigns. Countertop and sidekick displays contribute to brand visibility in convenience stores, while niche categories such as spinner displays and retail signage add incremental value for specialty retail formats.

- For instance, in June 2024, DS Smith supplied floor display solutions for German supermarket chains, optimizing recyclable cardboard displays to improve product visibility for fast-moving consumer goods.

By Application

The food & beverage segment dominated the Germany Point of Purchase (PoP) Display Market, securing over 42% share in 2024. Strong demand for ready-to-drink products, packaged snacks, and promotional campaigns by FMCG giants reinforced growth in this segment. Cosmetics and personal care followed with notable traction, leveraging premium countertop and endcap displays to enhance brand appeal. Pharmaceuticals gained momentum due to rising OTC product visibility, while electronics and automotive applications used durable POP displays for feature-driven promotions. Niche categories, including sports, recreation, and wine & spirits, offered steady contributions, especially in premium retail outlets.

- For instance, Coca-Cola Germany launched limited-edition PoP displays across EDEKA outlets to promote its FIFA Euro 2024 tie-in beverages, driving retail engagement.

By Style

Temporary PoP displays led the Germany Point of Purchase (PoP) Display Market with a 58% revenue share in 2024, driven by their cost-effectiveness and flexibility for seasonal and promotional campaigns. Retailers widely prefer corrugated and lightweight formats for short-term events, enabling rapid deployment across diverse stores. Permanent PoP displays accounted for the remaining share, favored in luxury, electronics, and automotive retail due to their durability, high-quality materials, and long-term branding impact. The balance between temporary and permanent styles reflects Germany’s mix of promotional-driven FMCG retail and premium-focused specialty markets.

Key Growth Drivers

Rising Retail Modernization

Germany’s expanding network of supermarkets, hypermarkets, and convenience stores fuels demand for advanced PoP displays. Retail modernization initiatives encourage brands to adopt eye-catching floor and pallet displays that improve visibility and consumer engagement. Increasing competition among FMCG companies drives promotional activities, pushing retailers to invest in differentiated display solutions. This modernization enhances the shopping experience, boosts impulse purchases, and sustains steady growth for the PoP display market across the country.

Strong FMCG and Food & Beverage Demand

The food and beverage sector, accounting for the largest application share, anchors growth in Germany’s PoP display market. Frequent promotional campaigns, product launches, and seasonal marketing drive consistent adoption of temporary displays. Global and domestic FMCG companies leverage PoP formats to influence consumer decisions at checkout points. Rising consumption of packaged foods, beverages, and convenience items further strengthens demand, making food & beverage a major growth driver for the market.

Shift Toward Sustainable Materials

Sustainability has become a decisive factor for German retailers and brands, driving demand for eco-friendly PoP displays. Corrugated board, recyclable plastics, and responsibly sourced wood are increasingly preferred to reduce environmental impact. Regulatory pressures and consumer expectations around green practices encourage manufacturers to redesign displays with lower carbon footprints. This shift supports innovation in biodegradable and reusable materials, enabling retailers to align with sustainability goals while maintaining display effectiveness and brand appeal.

- For instance, DS Smith introduced a new line of 100% recyclable corrugated PoP displays in Germany, designed to cut carbon emissions by up to 30% compared to conventional plastic displays.

Key Trends & Opportunities

Digital Integration in Displays

The integration of digital features, including LED lighting, QR codes, and interactive screens, is gaining momentum in Germany’s PoP display market. Retailers are exploring these technologies to provide immersive product experiences and capture customer data. Digital elements help brands stand out in competitive retail environments, particularly in electronics and cosmetics. The adoption of such interactive solutions represents a significant opportunity for manufacturers, allowing them to deliver smarter, consumer-driven display formats that enhance engagement.

- For instance, Samsung Electronics Germany deployed interactive digital screens at MediaMarkt stores, allowing consumers to test product features virtually and compare devices on-screen before purchase.

Expansion in Premium Retail Sectors

Germany’s premium cosmetics, personal care, and electronics segments are creating new opportunities for high-quality, permanent PoP displays. Brands increasingly favor durable wood, glass, and metal structures that align with luxury retail standards. These displays not only support long-term brand visibility but also improve store aesthetics, reinforcing premium positioning. As consumer spending on luxury products rises, opportunities for innovative, permanent display solutions are set to expand, offering manufacturers profitable avenues beyond mass retail channels.

- For instance, Kling GmbH, a German display specialist, delivered custom high-gloss wooden and acrylic PoP displays for luxury cosmetics brands, emphasizing brand individuality and sustainable materials made in Germany.

Key Challenges

High Cost of Permanent Displays

Permanent PoP displays require significant investment due to expensive materials such as glass, metal, or wood. For retailers, especially small and mid-sized stores, the high upfront cost limits adoption. Brands may hesitate to allocate large budgets for long-term installations in competitive markets with frequent product turnover. Balancing durability with cost-efficiency remains a critical challenge for manufacturers and retailers seeking to expand premium PoP display usage in Germany.

Intense Market Competition

The Germany PoP display market is highly competitive, with global leaders and regional specialists vying for contracts. Continuous price pressure and the need for customization put strain on manufacturers’ profit margins. Companies must differentiate through innovation, design quality, and sustainability to remain competitive. Intense rivalry often leads to shorter product life cycles and faster design refresh requirements, creating operational challenges for both large-scale suppliers and smaller domestic players.

Regulatory and Environmental Pressures

Germany’s strict regulations on sustainability and packaging waste impose challenges on PoP display producers. Compliance requires constant investment in eco-friendly materials and processes, raising production costs. Retailers and brands face scrutiny from both regulators and consumers over environmental impact, which limits flexibility in material choices. Manufacturers must adapt quickly to evolving environmental standards while balancing cost, durability, and performance, making regulatory compliance a persistent challenge in the market.

Regional Analysis

North

The North region accounted for 22% share of the Germany Point of Purchase (PoP) Display Market in 2024. Strong retail presence in Hamburg and Bremen supports consistent adoption of floor and pallet displays. Food and beverage promotions drive significant demand, while increasing preference for sustainable corrugated board enhances market traction. The region’s well-established logistics networks encourage rapid rollout of temporary displays across supermarkets. Premium cosmetics and electronics retailers also invest in permanent PoP solutions. It remains a vital hub for display manufacturers seeking volume-driven opportunities.

South

The South region commanded 28% share of the market in 2024, driven by the dense retail infrastructure in Bavaria and Baden-Württemberg. Major FMCG and automotive companies leverage pallet and endcap displays for product visibility. High consumer spending power sustains adoption of permanent displays in electronics and personal care outlets. The region’s strong manufacturing base encourages innovation in eco-friendly materials. Seasonal promotional campaigns across large hypermarkets further boost temporary PoP demand. It continues to serve as the largest contributor to overall market revenue in Germany.

East

The East region captured 18% share of the Germany Point of Purchase (PoP) Display Market in 2024. Rising retail development in cities such as Leipzig and Dresden expands opportunities for countertop and sidekick displays. Supermarket expansion and growth of convenience chains fuel steady demand for temporary formats. Electronics and pharmaceutical sectors are emerging as strong adopters in urban clusters. Increasing awareness of sustainable practices is driving use of corrugated and recyclable materials. It reflects steady but growing adoption across diverse retail applications.

West

The West region held 32% share of the market in 2024, making it the second-largest after the South. Strong FMCG concentration in North Rhine-Westphalia and Hesse boosts high-volume display adoption. Supermarkets and discount chains actively deploy pallet and floor displays to promote packaged foods and beverages. Premium retail in Düsseldorf and Frankfurt accelerates demand for durable permanent formats. The presence of major display manufacturers ensures steady supply and design innovation. It stands out for its balanced contribution from both temporary and permanent display styles.

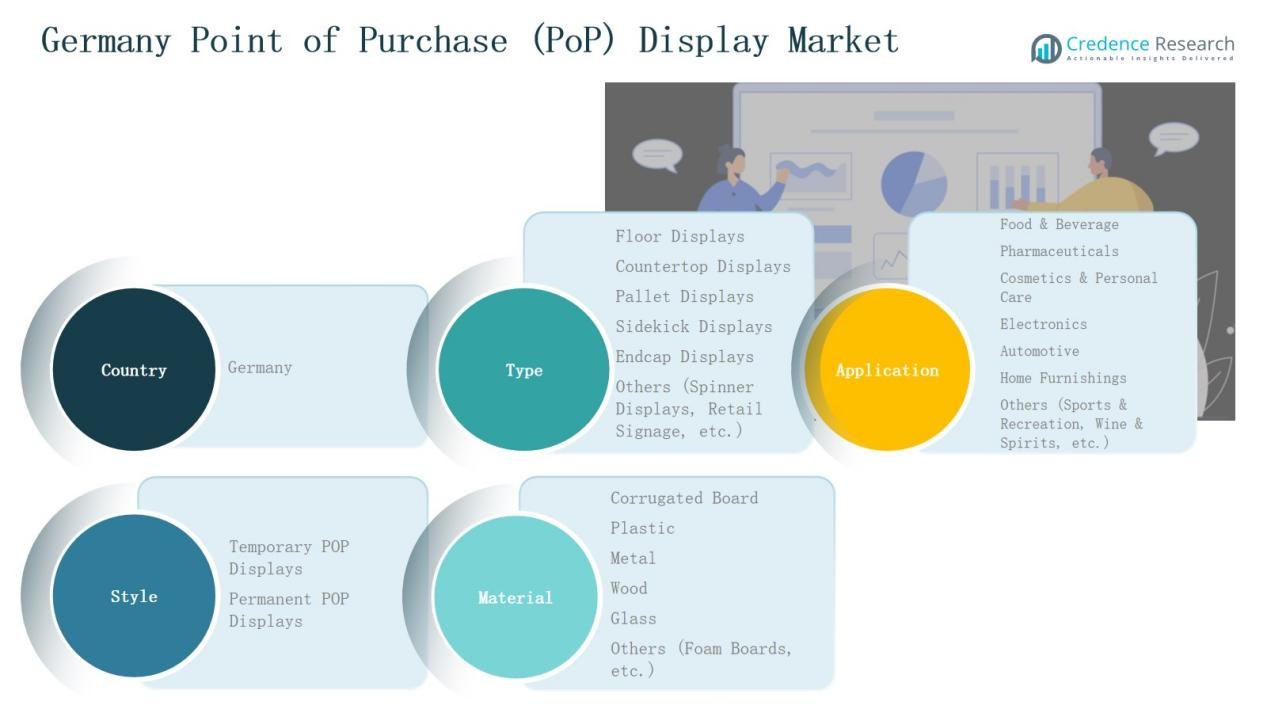

Market Segmentations:

By Type

- Floor Displays

- Countertop Displays

- Pallet Displays

- Sidekick Displays

- Endcap Displays

- Others (Spinner Displays, Retail Signage, etc.)

By Application

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Electronics

- Automotive

- Home Furnishings

- Others (Sports & Recreation, Wine & Spirits, etc.)

By Style

- Temporary PoP Displays

- Permanent PoP Displays

By Material

- Corrugated Board

- Plastic

- Metal

- Wood

- Glass

- Others (Foam Boards, etc.)

By Region

Competitive Landscape

The Germany Point of Purchase (PoP) Display Market features a mix of global leaders and regional specialists competing for market share through design innovation, sustainability, and customer-focused solutions. Companies such as Smurfit Kappa Group, DS Smith Plc, and STI Group maintain strong positions by offering wide product portfolios, scalable production, and eco-friendly display options. Regional players like MHK Displays GmbH, Panther Display, and Kohlschein GmbH emphasize customization and flexible solutions to serve mid-sized retailers and niche markets. Intense competition drives continuous advancements in corrugated board and recyclable plastic displays to align with Germany’s strict sustainability regulations. Partnerships with FMCG brands, cosmetic companies, and premium electronics retailers play a vital role in strengthening visibility. Price sensitivity remains a challenge, pushing firms to balance cost efficiency with quality. Overall, the market is characterized by high rivalry, frequent product innovation, and strong emphasis on environmental compliance as a key differentiator.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- POP Solutions Group

- MHK Displays GmbH

- Smurfit Kappa Group

- DS Smith Plc

- STI Group

- Koehler Paper Group

- Model Group

- Panther Display

- Kohlschein GmbH

- Thimm Group

Recent Developments

- In October 2024, POP Solutions Group acquired a majority stake in MHK Displays GmbH, strengthening its presence in the Germany Point of Purchase (PoP) Display Market.

- In June 2023, DS Smith introduced a new range of eco-friendly POP displays made from 100% recycled content designed for recyclability.

- In July 2023, Menasha Packaging Company partnered with a top consumer electronics brand to develop interactive floor displays for a new product launch.

Report Coverage

The research report offers an in-depth analysis based on Type, Application. Style, Material and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Retailers will increase adoption of eco-friendly corrugated and recyclable plastic displays.

- Demand for digital and interactive PoP displays will expand across electronics and cosmetics.

- Food and beverage promotions will remain the largest driver of temporary display usage.

- Permanent displays will gain traction in premium retail sectors such as luxury and automotive.

- Regional manufacturers will strengthen competitiveness through customization and quick turnaround services.

- Partnerships between FMCG companies and display providers will drive innovation in design.

- Regulatory focus on sustainability will accelerate investment in biodegradable display materials.

- Discount and convenience store formats will continue to expand demand for countertop displays.

- Increasing use of data-driven retail strategies will shape display placement and design decisions.

- The market will see rising competition between multinational suppliers and domestic specialists.