Market Overview:

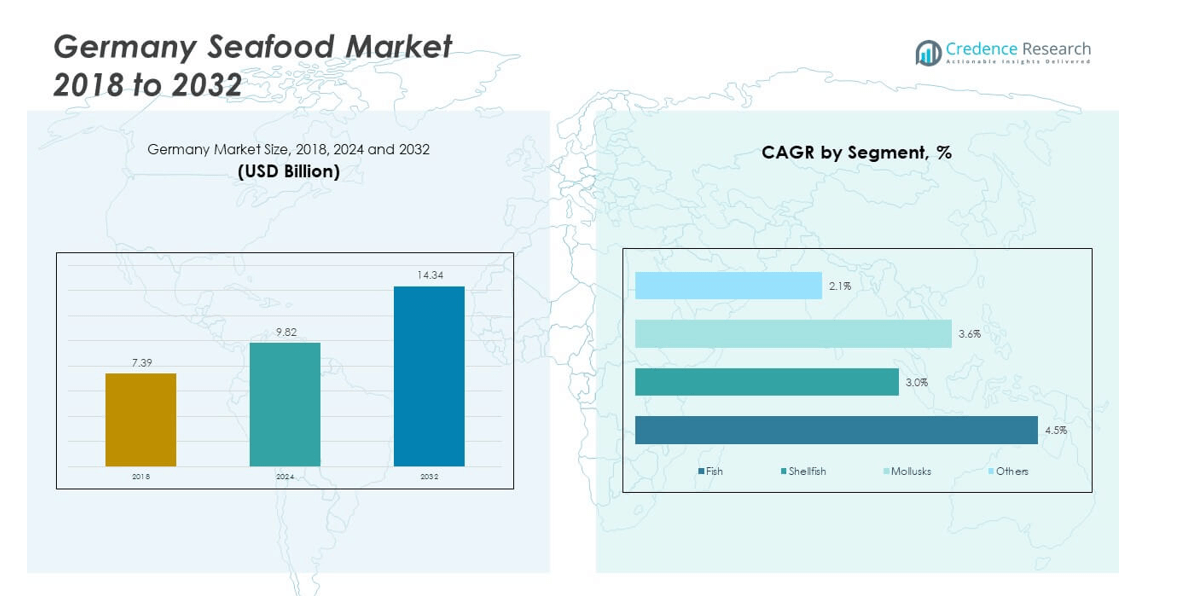

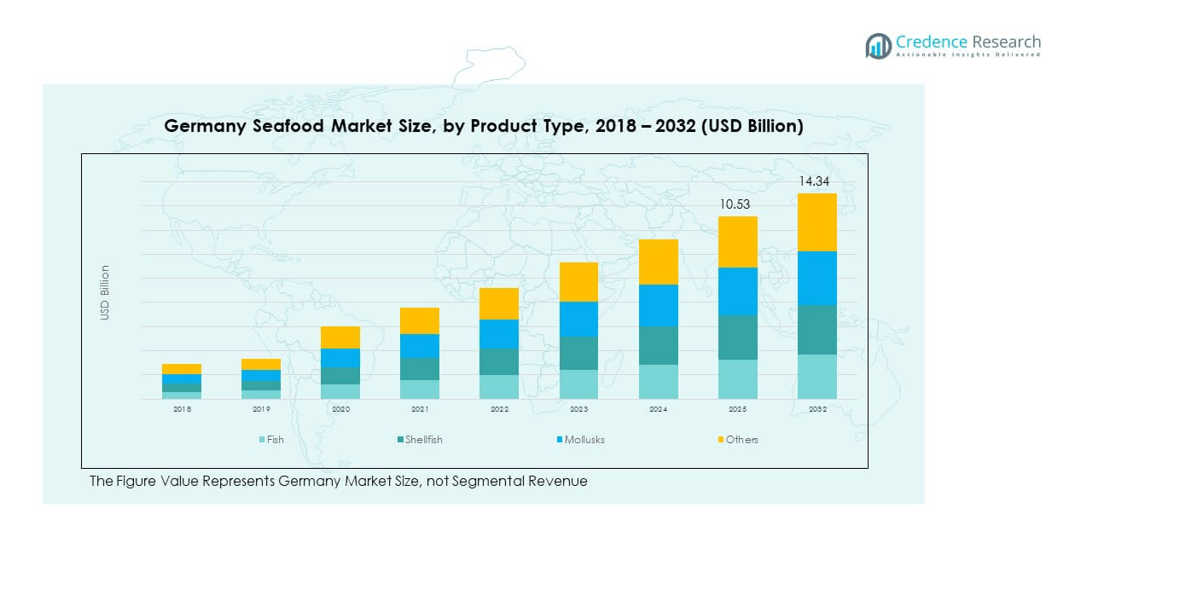

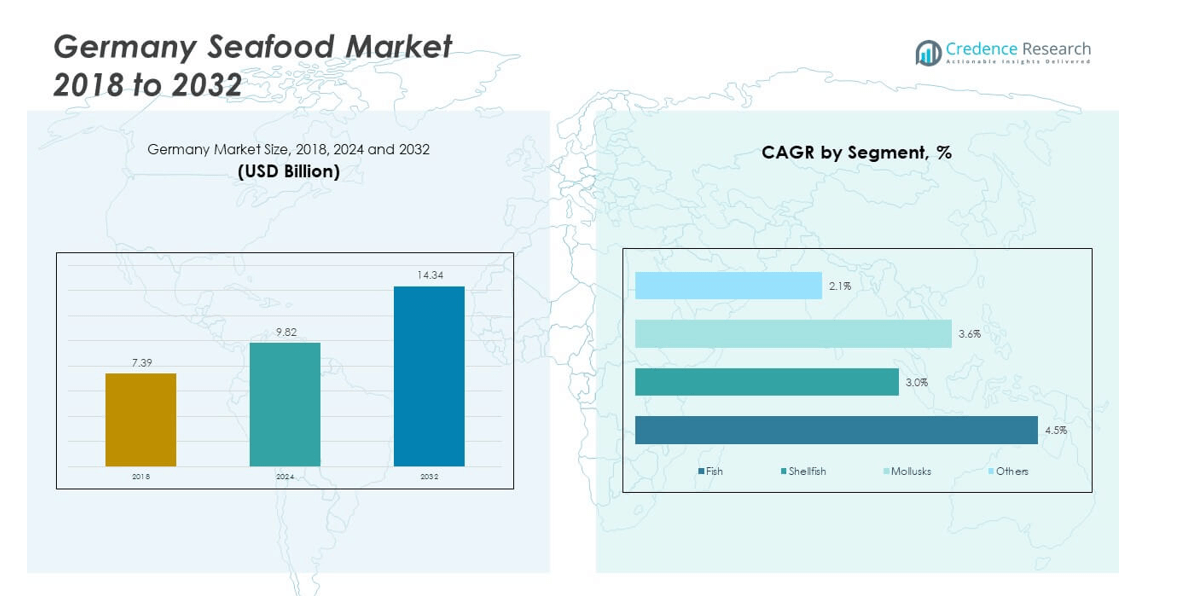

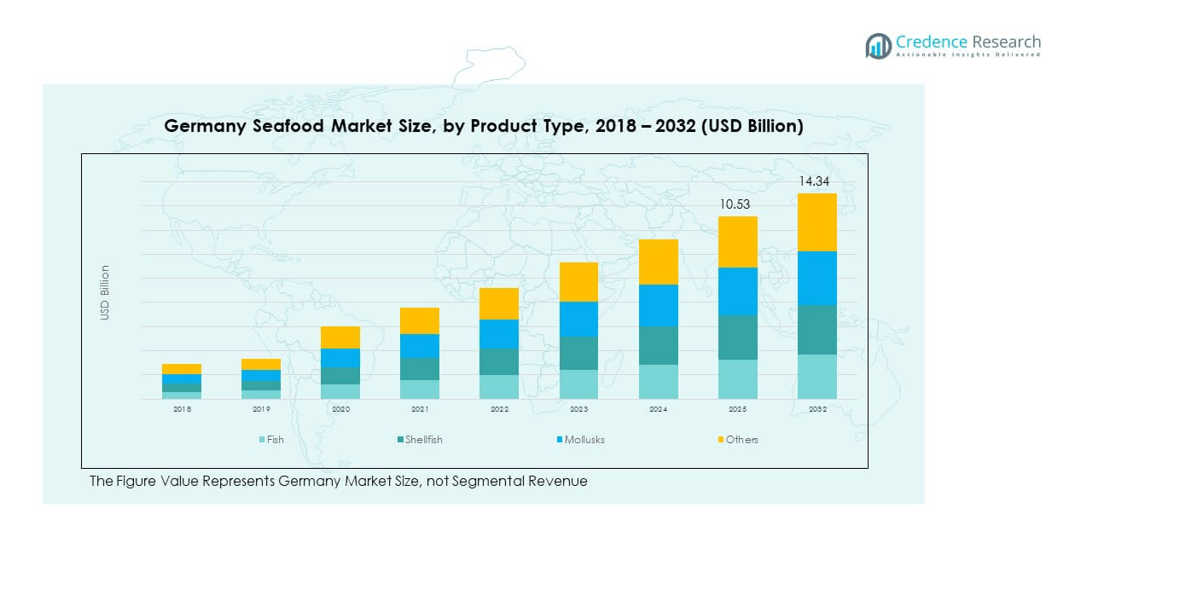

The Germany Seafood Market size was valued at USD 7.39 billion in 2018 to USD 9.82 billion in 2024 and is anticipated to reach USD 14.34 billion by 2032, at a CAGR of 4.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Seafood Market Size 2024 |

USD 9.82 billion |

| Germany Seafood Market, CAGR |

4.51% |

| Germany Seafood Market Size 2032 |

USD 14.34 billion |

The market grows steadily with rising consumer demand for healthier protein sources. Increasing awareness of the nutritional value of fish and shellfish supports higher household consumption. Busy lifestyles and urbanization push demand for frozen, processed, and ready-to-eat seafood. Foodservice operators expand seafood offerings to appeal to diverse preferences and international cuisines. Sustainability certifications and eco-friendly sourcing further drive brand loyalty and influence retail performance. Strong government support for aquaculture and logistics infrastructure also reinforces supply security and product availability.

Regional analysis shows Northern Germany dominating due to its proximity to key ports and processing hubs. Western Germany follows with demand supported by urban centers and multicultural food trends. Southern Germany demonstrates growth potential in premium categories linked to higher income levels and evolving retail formats. Eastern Germany shows emerging adoption supported by retail expansion and aquaculture projects. Each subregion contributes uniquely, strengthening the overall structure of the market. Together these dynamics highlight the geographic diversity shaping future growth of the Germany Seafood Market.

Market Insights

- The Germany Seafood Market size was USD 7.39 billion in 2018, grew to USD 9.82 billion in 2024, and is projected to reach USD 14.34 billion by 2032, reflecting a CAGR of 4.51%.

- Northern Germany held the largest share at 38% in 2024, driven by strong port infrastructure and seafood processing hubs, while Western Germany followed with 27% supported by urban centers and diverse consumer demand.

- Southern Germany captured 20% share in 2024, supported by premium product demand, while Eastern Germany accounted for 15% and is the fastest-growing subregion due to retail expansion and aquaculture projects.

- By product type, fish accounted for the largest portion of the market, representing nearly 55% of overall share in 2024, supported by strong consumer preference and wide availability in retail and foodservice.

- Shellfish and mollusks collectively represented close to 30% share, with others contributing the remaining portion, highlighting growing demand for premium and exotic seafood categories in Germany.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Health Awareness Among Consumers Driving Higher Seafood Consumption

The growing focus on healthier diets supports rising seafood consumption across Germany. Consumers increasingly prioritize high-protein and low-fat diets to improve long-term health outcomes. The presence of omega-3 fatty acids in fish attracts strong interest from health-focused segments. Rising cases of lifestyle-related diseases encourage households to substitute red meat with seafood. Retail chains highlight nutritional labeling to promote fish and shellfish as premium dietary choices. The Germany Seafood Market benefits from this change, as it aligns with consumer priorities. Foodservice operators also expand seafood menus to target wellness-driven demand. It creates a cycle of stronger consumer interest and steady retail performance.

- For instance, Deutsche See processes an average of 11,000 tons of salmon annually, which accounts for 35% of its total seafood production, making salmon the main product in its German portfolio. The company supplies its fish and seafood to retail, foodservice, restaurants, and fish shops nationwide.

Expansion Of Convenience-Oriented Packaged Seafood Supporting Market Growth

Busy lifestyles and urban migration increase reliance on ready-to-cook seafood items. Packaged fish fillets, frozen shrimp, and canned tuna record higher demand in supermarkets. Households prefer these options for time-saving benefits and reliable quality standards. Retail chains introduce innovative packaging solutions to extend product shelf life. Digital platforms also promote subscription-based seafood delivery services to urban customers. The Germany Seafood Market grows under these conditions by matching convenience needs with innovation. It benefits from investments in cold chain logistics and wider distribution systems. Growing preference for meal kits further accelerates adoption in younger demographics.

- For example, BLG Logistics Group has major cold storage and logistics operations in Bremerhaven, a hub for Europe’s seafood trade. The company manages refrigerated warehousing and distribution,

Rising Consumer Interest In Premium And Sustainable Seafood Varieties

Consumers show strong preference for premium categories such as salmon, tuna, and shellfish. Sustainability labels and certifications influence purchasing behavior, especially among younger buyers. Ethical sourcing and eco-friendly fishing methods drive loyalty toward branded seafood lines. Retailers prioritize partnerships with certified suppliers to build credibility in the marketplace. The Germany Seafood Market thrives on this awareness, reinforcing transparency and brand trust. It reflects a shift toward environmentally responsible consumption patterns. It also highlights the increasing role of eco-consciousness in shaping purchase intent. Consumer willingness to pay more for traceable seafood reinforces premium market segments.

Government Initiatives And Strong Supply Chain Infrastructure Supporting Expansion

Government campaigns promote fish consumption as part of balanced diets nationwide. Public authorities also support research on sustainable aquaculture and responsible fishing practices. Cold chain infrastructure strengthens delivery efficiency from ports to retail shelves. Investments in logistics improve the availability of fresh seafood across urban regions. The Germany Seafood Market gains from this ecosystem, ensuring product quality and safety. Trade policies facilitate import flows from major seafood-exporting nations. These measures safeguard supply security while expanding consumer choice. It creates a resilient system that supports market growth even during supply disruptions.

Market Trends

Growing Integration Of E-Commerce Platforms Expanding Seafood Distribution

E-commerce channels transform how consumers purchase seafood across Germany. Online platforms provide direct access to fresh and frozen products from domestic and global suppliers. Digital tools allow buyers to trace product origin and quality in real time. Subscription models for seafood baskets gain popularity in urban centers. Food delivery applications integrate seafood offerings into broader meal solutions. The Germany Seafood Market benefits from these models by improving accessibility and reach. It allows brands to engage customers with convenience-focused strategies. It also creates competitive advantages in attracting digital-native consumers.

Rising Popularity Of Exotic And International Seafood Varieties Among Consumers

Global travel and cultural exchange encourage higher demand for exotic seafood products. Sushi-grade fish, octopus, and specialty shellfish gain visibility in German markets. International cuisines influence restaurant menus and retail assortments. Importers diversify supply chains to include seafood from Asia and South America. The Germany Seafood Market adapts by expanding variety to satisfy evolving tastes. It aligns with changing consumer interest in diverse dining experiences. Retail promotions highlight new species to stimulate trial purchases. Growing appetite for exotic products strengthens premium and specialty seafood segments.

- For instance, Rungis Express GmbH offers around 10,000 premium food products from over 80 countries, including fish and seafood. The company supplies these to gastronomy, hotels, catering, and retail clients across Germany.

Expansion Of Aquaculture Practices To Meet Rising Domestic Demand

Aquaculture gains prominence as a solution for meeting seafood demand. Domestic fish farming facilities increase production of salmon, trout, and carp. Controlled environments ensure consistent supply and higher quality standards. Innovations in feed and water management reduce environmental impact. The Germany Seafood Market integrates aquaculture outputs to complement imports. It enhances supply stability and reduces dependence on external markets. Sustainable practices further align with consumer expectations for eco-friendly sourcing. It positions aquaculture as a long-term driver for local seafood availability.

- For instance, AquaPri operates fully recirculated farms in Denmark, where water is cleaned and reused at nearly 100%. Its zander facility in Gamst, Vejen is a modern recirculating aquaculture site, showcasing efficient and sustainable fish farming practices.

Adoption Of Cold Chain And Smart Packaging Technologies Enhancing Quality

Technological improvements strengthen seafood preservation throughout the supply chain. Cold chain systems ensure freshness from catch to consumer. Smart packaging solutions provide indicators for product freshness and safety. Retailers adopt QR codes to offer traceability and transparency. The Germany Seafood Market benefits from these innovations, building consumer trust. It also supports compliance with strict food safety standards in Germany. Technology investments reduce spoilage and enhance shelf life. It creates long-term advantages for retailers and suppliers focused on quality assurance.

Market Challenges Analysis

Sustainability Concerns And Environmental Pressures Limiting Supply Growth

Overfishing, climate change, and habitat loss present serious challenges to seafood availability. Environmental organizations highlight risks tied to unsustainable fishing practices. Regulatory frameworks impose restrictions on catch limits and fishing zones. These policies safeguard marine ecosystems but reduce supply flexibility for operators. The Germany Seafood Market navigates this by balancing sustainability with consumer demand. It requires stakeholders to adopt eco-friendly sourcing strategies and transparency measures. Supply shortages also influence prices, reducing accessibility for some households. It forces companies to adjust sourcing while meeting stricter compliance requirements.

Rising Competition From Alternative Proteins And Supply Chain Disruptions

Plant-based seafood alternatives gain traction as substitutes for traditional fish and shellfish. Their appeal lies in health claims, sustainability narratives, and cost competitiveness. This trend creates direct competition across retail and foodservice outlets. Global supply chain disruptions, including port delays and higher freight costs, affect seafood imports. The Germany Seafood Market experiences volatility under these pressures. It must adapt to fluctuating input costs and reduced availability of specific species. Dependence on imports further amplifies these risks. It challenges the stability of long-term growth strategies.

Market Opportunities

Innovation In Sustainable Aquaculture And Premium Seafood Products

Aquaculture innovation opens pathways for sustainable growth in seafood supply. Controlled fish farms support production consistency while reducing ecological footprint. Premium product development, such as organic salmon and antibiotic-free shrimp, creates added value. The Germany Seafood Market benefits by catering to both sustainability and premium demand. It positions local producers as reliable suppliers with environmentally safe practices. Consumers are willing to support such efforts with higher spending. It strengthens both domestic aquaculture and specialized premium categories.

Expansion Of Digital Retail And International Trade Partnerships

Digital retail platforms expand customer access to fresh and frozen seafood. Online subscription models allow consistent consumption across urban households. Trade partnerships with leading exporters strengthen product variety in domestic markets. The Germany Seafood Market gains resilience by diversifying global sourcing networks. It improves accessibility and variety while ensuring competitive pricing. Strategic cooperation with e-commerce players supports wider distribution. It unlocks opportunities for seafood brands to capture larger market shares.

Market Segmentation Analysis

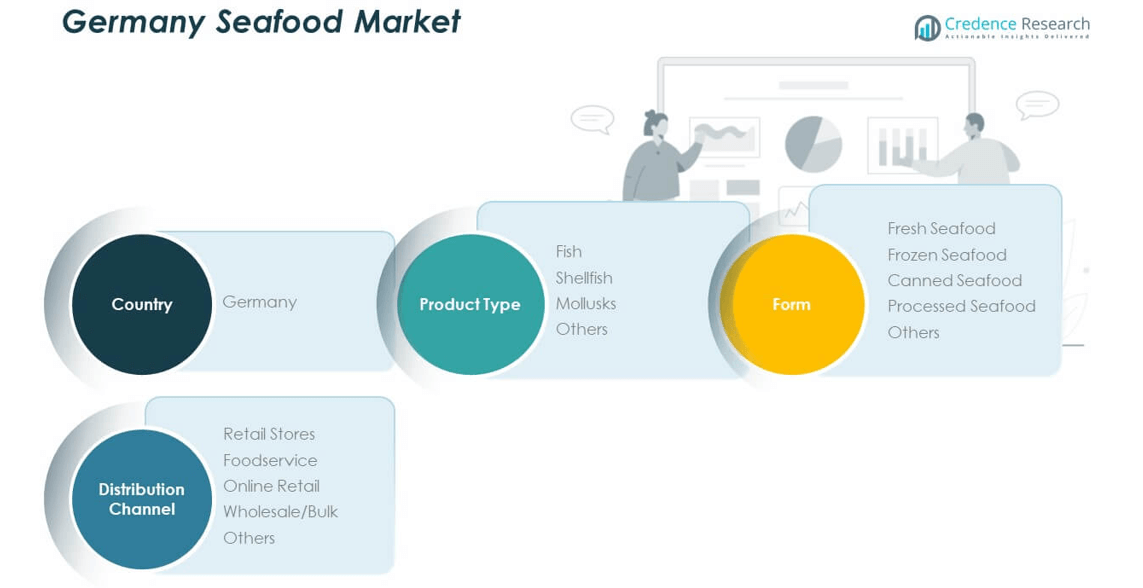

By product type, fish dominates the Germany Seafood Market due to its strong presence in retail and foodservice. Salmon, trout, and cod remain the most consumed varieties, reflecting consumer preference for high-protein diets. Shellfish, including shrimp and crab, gain traction in premium categories, while mollusks such as mussels and oysters support regional consumption. Others, including exotic seafood, register gradual adoption through specialty channels. It reflects a market structure shaped by both traditional and emerging product choices.

- For instance, Germany’s Fish Information Center (FIZ) reported that in 2023 salmon was the most consumed fish in the country, surpassing Alaska pollock, tuna, and herring to become Germany’s leading seafood choice.

By form, fresh seafood leads demand, supported by advanced cold chain logistics and consumer trust in quality. Frozen seafood records steady growth, driven by busy lifestyles and convenience. Canned seafood, led by tuna and mackerel, maintains relevance in cost-sensitive households and value retail chains. Processed seafood benefits from innovation in ready-to-eat meals and packaged assortments. Others, including dried and specialty preserved items, serve niche demand. It highlights the balance between freshness and convenience shaping consumer preferences.

- For instance, Nomad Foods Ltd. (Iglo brand) reported in its 2022 Annual Report that frozen fish products such as fish fingers, coated fish, and natural fish represented its largest revenue category. The company also confirmed that 9% of its sourced fish and seafood came from certified sustainable or responsibly farmed sources.

By distribution channel, retail stores remain dominant due to strong supermarket networks and nationwide accessibility. Foodservice contributes significantly through restaurants and catering services offering diverse seafood menus. Online retail grows rapidly with e-commerce adoption and subscription models targeting urban consumers. Wholesale and bulk channels serve institutional demand and food manufacturers. Others, including specialty seafood outlets, add depth to distribution. It positions the Germany Seafood Market as a multi-channel environment where both traditional and modern platforms ensure broad availability.

Segmentation

By Product Type

- Fish

- Shellfish

- Mollusks

- Others

By Form

- Fresh Seafood

- Frozen Seafood

- Canned Seafood

- Processed Seafood

- Others

By Distribution Channel

- Retail Stores

- Foodservice

- Online Retail

- Wholesale/Bulk

- Others

Regional Analysis

Northern Germany Dominating With Strong Seafood Infrastructure

Northern Germany holds the largest share of the Germany Seafood Market at 38%. The region benefits from access to the North Sea and Baltic Sea, supporting both fishing activities and seafood imports. Ports in Hamburg and Bremerhaven act as major distribution hubs for domestic and international trade. Strong logistics infrastructure ensures rapid supply to retailers and foodservice providers. Local demand for fresh fish and shellfish is high, supported by consumer preference for traditional seafood cuisine. It remains the core region for imports, exports, and processing facilities, sustaining its dominant role in the national market.

Western Germany Emerging With Rising Urban Demand

Western Germany accounts for 27% of the Germany Seafood Market. Large urban centers such as Cologne, Frankfurt, and Düsseldorf drive seafood consumption through retail and foodservice channels. A growing multicultural population boosts demand for diverse seafood products, including exotic and imported varieties. Strong retail networks and wholesale markets in this subregion expand accessibility. Foodservice operators increasingly integrate seafood into premium menus, supporting higher sales. It reflects an evolving market structure where urban demand and diverse consumer profiles stimulate long-term growth.

Southern And Eastern Germany Showing Steady Growth Potential

Southern and Eastern Germany together represent 35% of the Germany Seafood Market, with Southern Germany holding 20% and Eastern Germany 15%. Southern Germany shows strong demand in Munich and Stuttgart, fueled by higher disposable incomes and premium food culture. Eastern Germany is expanding due to rising investments in aquaculture and modern retail outlets. Both regions rely on seafood imports routed through Northern ports, yet distribution networks are improving. Growing health awareness and retail promotions strengthen adoption across these areas. It indicates potential for higher market penetration supported by logistics upgrades and consumer-driven trends.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Deutsche See GmbH

- Frosta AG

- Nordsee GmbH

- Seafresh GmbH

- Evers GmbH

- Fishery & Seafood GmbH

- Sandor Seafood GmbH

- Rügenfisch

- Gossner Foods GmbH

- Clear Sea GmbH

Competitive Analysis

The Germany Seafood Market features a competitive landscape shaped by established domestic companies and specialized suppliers. Leading players such as Deutsche See GmbH, Frosta AG, and Nordsee GmbH hold significant positions through strong brand recognition and nationwide distribution. These firms emphasize sustainability certifications, product freshness, and premium assortments to retain consumer trust. Mid-sized firms including Rügenfisch and Seafresh GmbH focus on processed and canned seafood to serve value-oriented segments. It maintains competitiveness by balancing premium offerings with cost-effective solutions. Strategic partnerships, acquisitions, and new product launches further strengthen positioning. With demand rising across retail, foodservice, and online channels, the market continues to attract investments in innovation and supply chain optimization.

Recent Developments

- In July 2025, VAN HEES GmbH, a German spice and food ingredient specialist, announced a strategic partnership with BLUU Seafood, Europe’s leading food biotech focused on cultivated fish, to develop innovative hybrid food products combining plant-based ingredients with fish cells grown in bioreactors.

- In March 2025, Deutsche See GmbH introduced three new frozen seafood products to expand its retail offering in Germany, focusing on practical, portioned packaging that caters to both quality-conscious consumers and innovative retail needs.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Consumer preference for healthy diets will continue to support higher seafood demand nationwide.

- Premium categories such as salmon, tuna, and shellfish will gain further traction in retail and foodservice.

- E-commerce platforms will strengthen market reach, expanding seafood accessibility across urban households.

- Aquaculture will play a growing role in meeting demand while ensuring sustainable domestic supply.

- Smart packaging and cold chain investments will enhance freshness, safety, and product traceability.

- Foodservice channels will expand seafood offerings to attract wellness-driven and multicultural consumers.

- Imports will diversify from Asian and South American countries to balance supply risks.

- Sustainability certifications will increasingly shape purchase decisions, reinforcing eco-conscious consumer loyalty.

- Regional markets in Southern and Eastern Germany will record stronger penetration with retail expansion.

- Strategic mergers, product innovation, and international partnerships will sharpen competitiveness and market stability.