Market Overview:

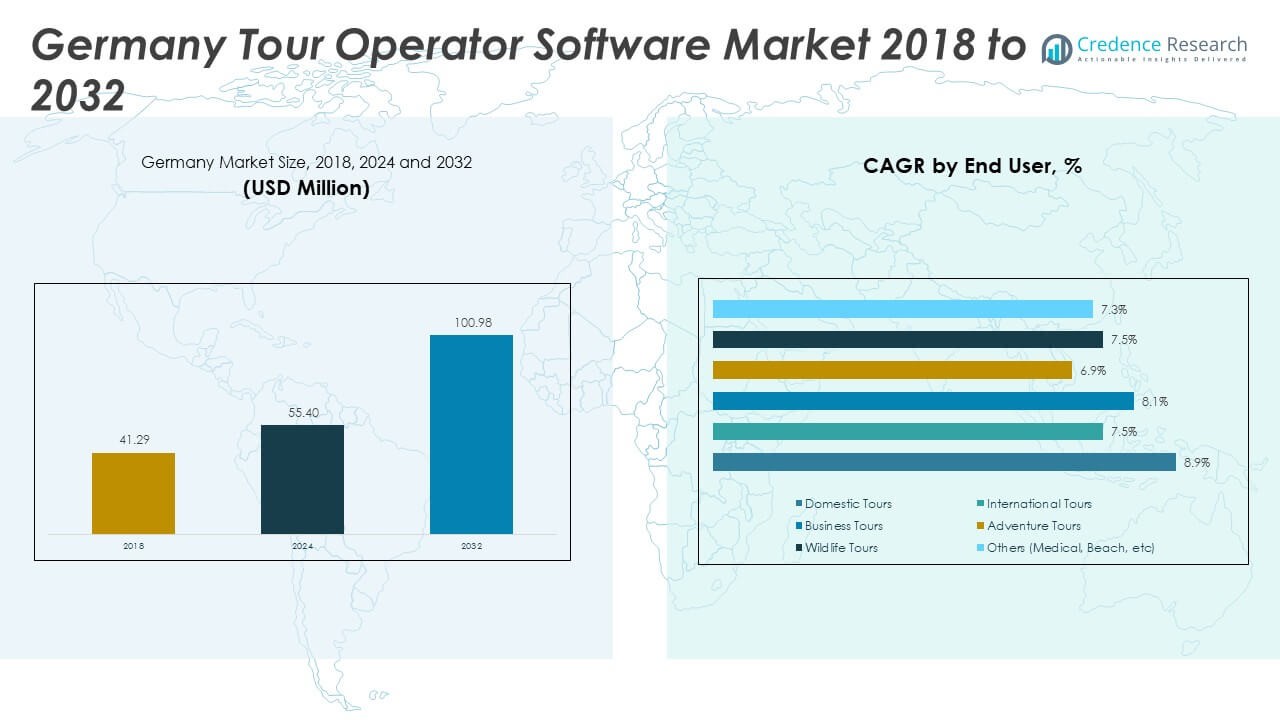

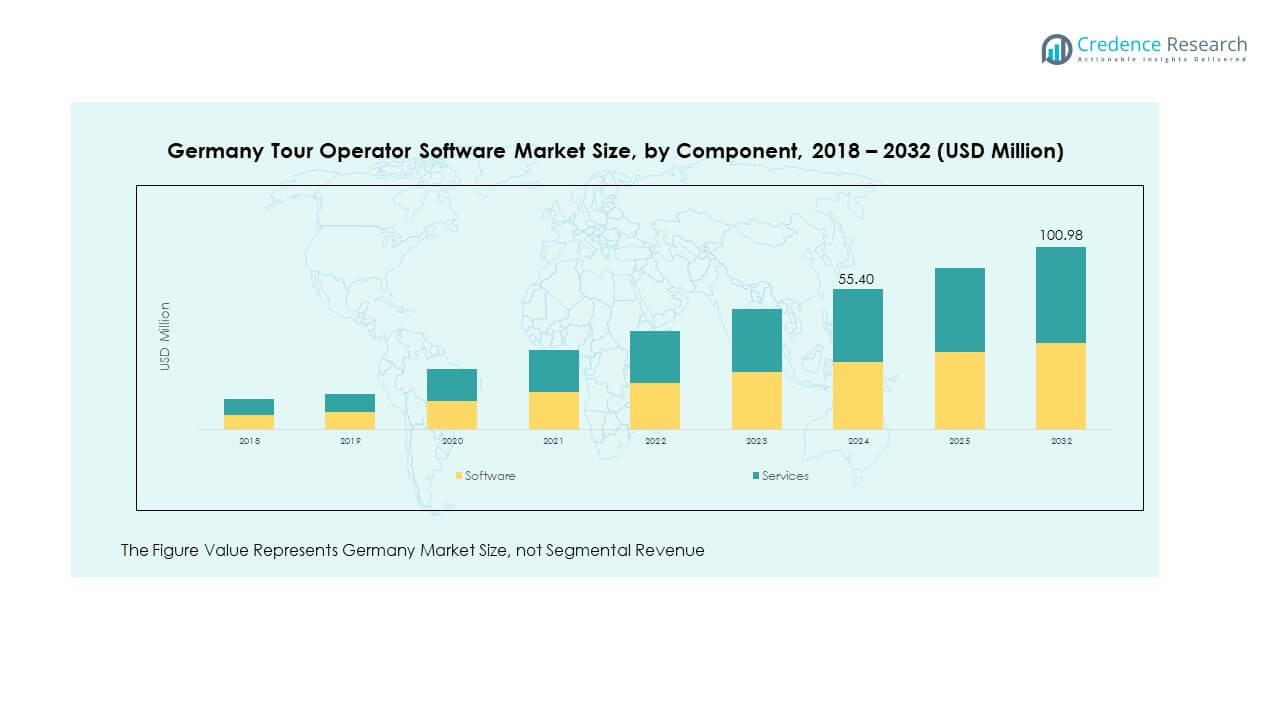

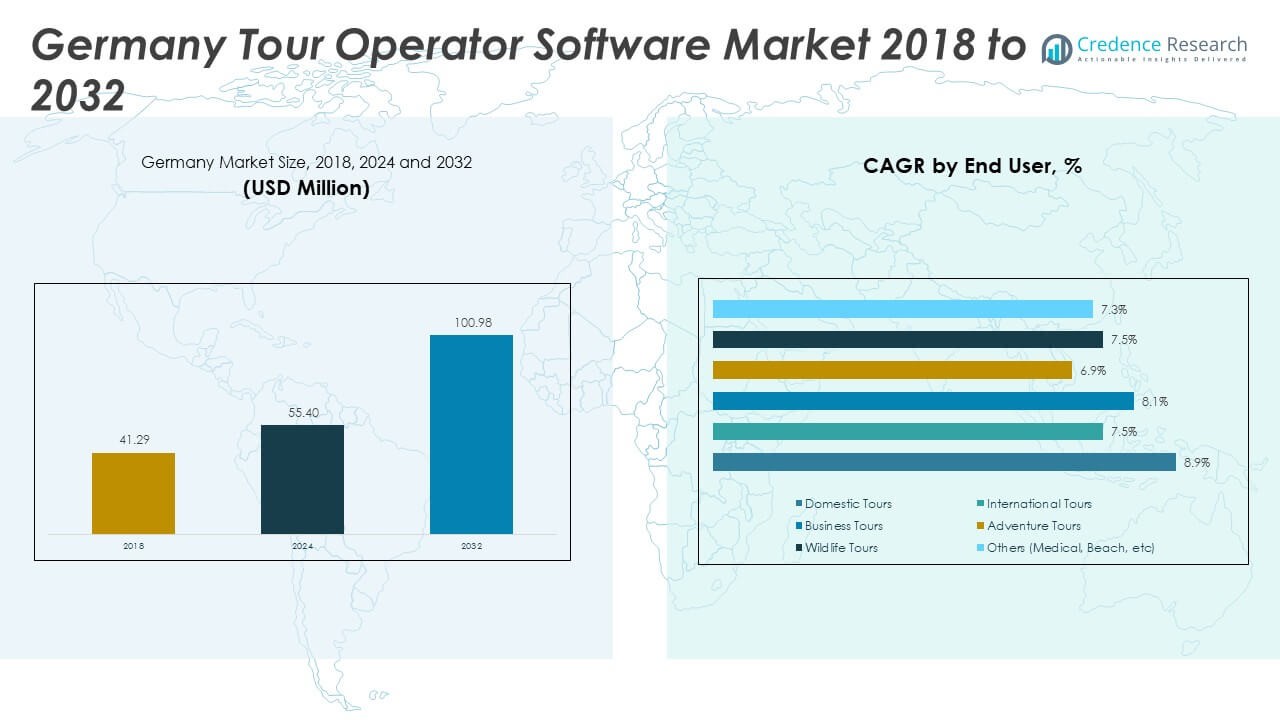

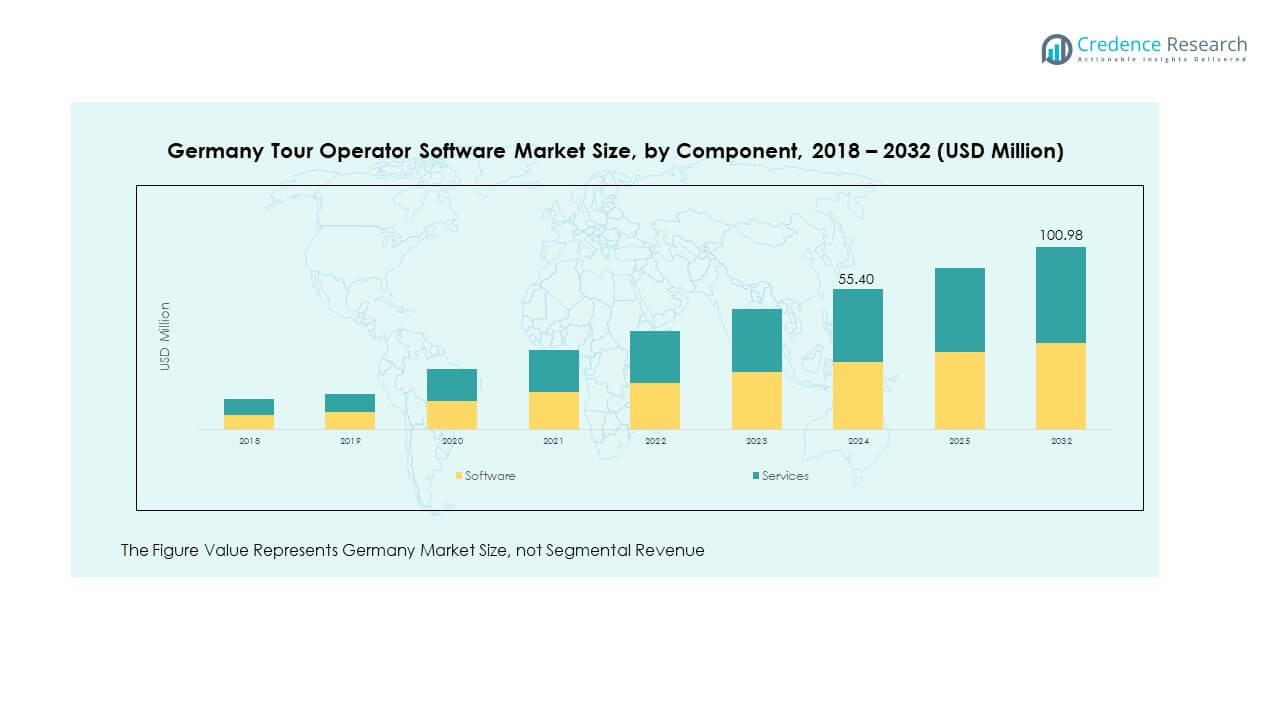

The Germany Tour Operator Software Market size was valued at USD 41.29 million in 2018 to USD 55.40 million in 2024 and is anticipated to reach USD 100.98 million by 2032, at a CAGR of 7.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Tour Operator Software Market Size 2024 |

USD 55.40Million |

| Germany Tour Operator Software Market, CAGR |

7.79% |

| Germany Tour Operator Software Market Size 2032 |

USD 100.98 Million |

Growth in the Germany Tour Operator Software Market is driven by digital transformation, customer-centric innovation, and a rising preference for automated travel booking processes. Tour operators are actively embracing cloud-based solutions to streamline workflows, integrate payment gateways, and deliver personalized experiences. The growth in domestic and international travel, coupled with higher expectations for transparency and convenience, is fueling demand. Service providers are focusing on advanced tools with mobile-first features, enabling greater accessibility for travelers.

Regionally, Germany holds a strong position in Europe’s travel technology ecosystem. It benefits from a mature tourism industry, robust digital infrastructure, and the presence of leading vendors. Northern and Western Germany have emerged as key adopters due to their concentration of large travel agencies and international airports. Eastern Germany is gradually expanding with government support for digitalization initiatives. Emerging players in secondary cities are also gaining momentum by offering niche solutions tailored to local tourism demands.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany Tour Operator Software Market was USD 41.29 million in 2018, grew to USD 55.40 million in 2024, and is projected to reach USD 100.98 million by 2032, registering a CAGR of 7.79%.

- Europe accounted for 36% of the market share in 2024, followed by North America at 28% and Asia Pacific at 24%, driven by strong travel infrastructure, high digital adoption, and large operator networks.

- Asia Pacific is the fastest-growing region with 24% share, supported by expanding tourism, rising mobile usage, and government investments in digital travel solutions.

- In 2024, software accounted for around 61% of the market, reflecting strong adoption of booking, payment, and automation platforms.

- Services held 39% share in 2024, supported by rising demand for integration, customization, and technical support among operators.

Market Drivers:

Rising Digital Transformation Across the Travel Industry:

The Germany Tour Operator Software Market is strongly influenced by ongoing digitalization across the tourism sector. Travel businesses are shifting from traditional methods toward automated solutions that improve efficiency and customer satisfaction. Operators increasingly prefer cloud-based and AI-powered platforms to streamline bookings, optimize resources, and enhance reporting. It has improved service quality, reduced operational costs, and enabled personalized marketing. Adoption of automation has helped smaller operators compete with global players. The integration of secure payment gateways further accelerates adoption rates. Continuous government support for digital tourism initiatives strengthens this trend.

- For instance, studies in Germany show increasing cloud computing adoption among businesses, with SaaS being a particularly large segment in the German cloud market. Government programs like the “Digital Jetzt” initiative offer grants for a broad range of small and medium-sized enterprises (SMEs) to invest in digital technologies, including new software.

Increasing Demand for Personalized Travel Experiences:

Personalization has emerged as a central driver of the Germany Tour Operator Software Market. Travelers expect tailored itineraries, flexible options, and real-time updates. Tour operators rely on software solutions that analyze customer data and deliver customized offerings. This shift has boosted loyalty, engagement, and higher revenue streams. It has enabled operators to diversify packages, offer dynamic pricing, and provide multilingual support. Companies are also integrating AI-based chatbots to enhance pre- and post-travel communication. Customer-centricity has become a key differentiator for operators. Growing competition is pushing vendors to refine personalization strategies further.

- For instance, personalization has emerged as a central driver of the Germany Tour Operator Software Market, with artificial intelligence (AI) and predictive analytics enabling more customized experiences. AI-powered itinerary customization, dynamic recommendations, and multilingual content are transforming traveler engagement, boosting customer retention and satisfaction.

Expansion of Online Booking Platforms and Mobile Adoption:

The rapid penetration of smartphones has fueled the demand for mobile-ready solutions in the Germany Tour Operator Software Market. Tourists prefer seamless mobile apps for booking, payment, and itinerary management. Operators adopt responsive platforms with real-time availability updates, making travel planning simpler. Mobile-first design has become a standard expectation across the industry. It improves user convenience and drives higher conversion rates for operators. With younger demographics prioritizing instant bookings, mobile adoption is expanding at an accelerated pace. Secure mobile payment systems also enhance trust among customers. This trend continues to reshape distribution strategies.

Integration of Cloud-Based and AI-Enabled Platforms:

The growing adoption of cloud-based systems is redefining operational models for operators in the Germany Tour Operator Software Market. Cloud solutions reduce hardware costs, improve scalability, and provide access from anywhere. It enables collaboration between agencies, vendors, and travelers. AI integration further enhances itinerary planning, predictive analytics, and customer support. Operators are adopting intelligent platforms for fraud detection and dynamic pricing. Cloud-driven flexibility also supports quick system upgrades and seamless integrations with global distribution systems. The scalability of these solutions is attractive to both large enterprises and SMEs. Together, these technologies are establishing new industry benchmarks.

Market Trends:

Growth of Eco-Friendly and Sustainable Tourism Software Solutions:

The Germany Tour Operator Software Market is witnessing a trend toward eco-friendly and sustainable travel management. Operators are incorporating modules that allow carbon tracking, eco-certification, and green travel packages. Tourists increasingly favor operators who highlight sustainability in their services. Software vendors are building solutions that measure environmental impact and encourage responsible choices. This integration supports Germany’s broader sustainability goals. It has created new demand for features that balance profitability with environmental stewardship. Corporate clients are particularly responsive to sustainability-driven offerings. This trend continues to reshape competitive strategies across the sector.

- For instance, environmental policies for software vendors to embed real-time carbon emission calculators into their platforms, aligning with wider sustainability goals. Tourists increasingly favor operators who highlight sustainability in their services.

Increasing Integration with Virtual and Augmented Reality Experiences:

Virtual and augmented reality tools are becoming popular within the Germany Tour Operator Software Market. Operators use VR tours and AR-based guides to enrich travel experiences before and during trips. This technology allows customers to preview destinations, enhancing booking confidence. It has also become a strong marketing tool for tour providers. Vendors integrating immersive technologies are gaining a competitive edge. Younger travelers show a high preference for such interactive experiences. Integration of AR/VR is also proving valuable for cultural and heritage tourism. Its adoption signals a shift toward highly engaging, tech-driven travel planning.

- For instance, Vendors integrating immersive technologies are gaining a competitive edge. Younger travellers show a high preference for such interactive experiences. Integration of AR/VR is also proving valuable for cultural and heritage tourism. Its adoption signals a shift toward highly engaging, tech-driven travel planning.

Rise of Multi-Channel Distribution and Omni-Channel Engagement:

The Germany Tour Operator Software Market is aligning with omni-channel strategies to maximize reach. Operators use multiple digital channels, from social media to online travel agencies, for customer acquisition. Integrated platforms allow consistent communication and engagement across these channels. It ensures brand visibility and customer loyalty. The ability to capture customers across varied touchpoints has increased sales conversion. Software vendors are refining CRM integrations to support this approach. Operators also benefit from data-driven insights on customer behavior across platforms. This trend has improved transparency and responsiveness in travel bookings.

Adoption of Subscription-Based and SaaS Pricing Models:

Subscription-based models are gaining popularity in the Germany Tour Operator Software Market. Operators prefer predictable costs and flexibility offered by SaaS solutions. It reduces upfront investment and ensures continuous access to updates. Vendors are expanding tiered subscription plans to target different business sizes. This trend improves affordability for SMEs and startups. Large operators also find value in enterprise-level customizations. Vendors gain long-term customer retention through recurring revenue models. The shift toward SaaS has made software more accessible and scalable, boosting overall adoption.

Market Challenges Analysis:

Data Security Concerns and Rising Cyber Threats:

The Germany Tour Operator Software Market faces challenges linked to data protection and cyber threats. Operators store large volumes of sensitive customer data, including payment details and personal information. Growing risks of hacking and phishing attacks make security critical. It has forced vendors to adopt strict compliance measures such as GDPR. Small operators struggle with the cost of implementing advanced security systems. Customer trust depends heavily on robust cybersecurity. Breaches can cause reputational damage and financial losses. Maintaining secure, scalable systems remains a top challenge for vendors. Continuous investment in cybersecurity tools is essential.

High Competition and Cost Pressures on Small Operators:

Intense competition within the Germany Tour Operator Software Market creates pressure on pricing and margins. Large vendors with global reach dominate through advanced product portfolios and strong partnerships. Smaller firms struggle to match these offerings due to limited resources. It results in cost pressures and slower adoption for SMEs. Customers demand comprehensive features at affordable rates, raising expectations. Vendors must continuously innovate to remain competitive. Balancing affordability with quality becomes difficult for smaller operators. The competitive landscape is expected to intensify further, demanding strategic differentiation.

Market Opportunities:

Expansion into Niche and Specialized Tourism Segments:

The Germany Tour Operator Software Market holds opportunities in niche tourism segments such as adventure, cultural, and eco-tourism. Operators focusing on specialized packages are adopting software to manage unique itineraries. It supports customized pricing models and targeted promotions. Niche markets offer smaller players a chance to compete with large agencies. Software tailored for niche needs can improve efficiency and profitability. Growing demand for experiential travel makes this opportunity significant. Vendors that align solutions with niche preferences will capture untapped growth. These trends strengthen innovation in service delivery.

Growing Role of Artificial Intelligence and Predictive Analytics:

Artificial intelligence offers strong opportunities in the Germany Tour Operator Software Market. Predictive analytics helps operators forecast demand, optimize pricing, and improve customer engagement. AI tools also enable smart recommendations for travelers. It reduces manual intervention and improves accuracy. Vendors offering AI-powered platforms gain a strong competitive edge. Operators benefit from better decision-making and resource allocation. These opportunities allow the market to expand into advanced, value-added solutions. AI integration will likely remain a priority for future developments.

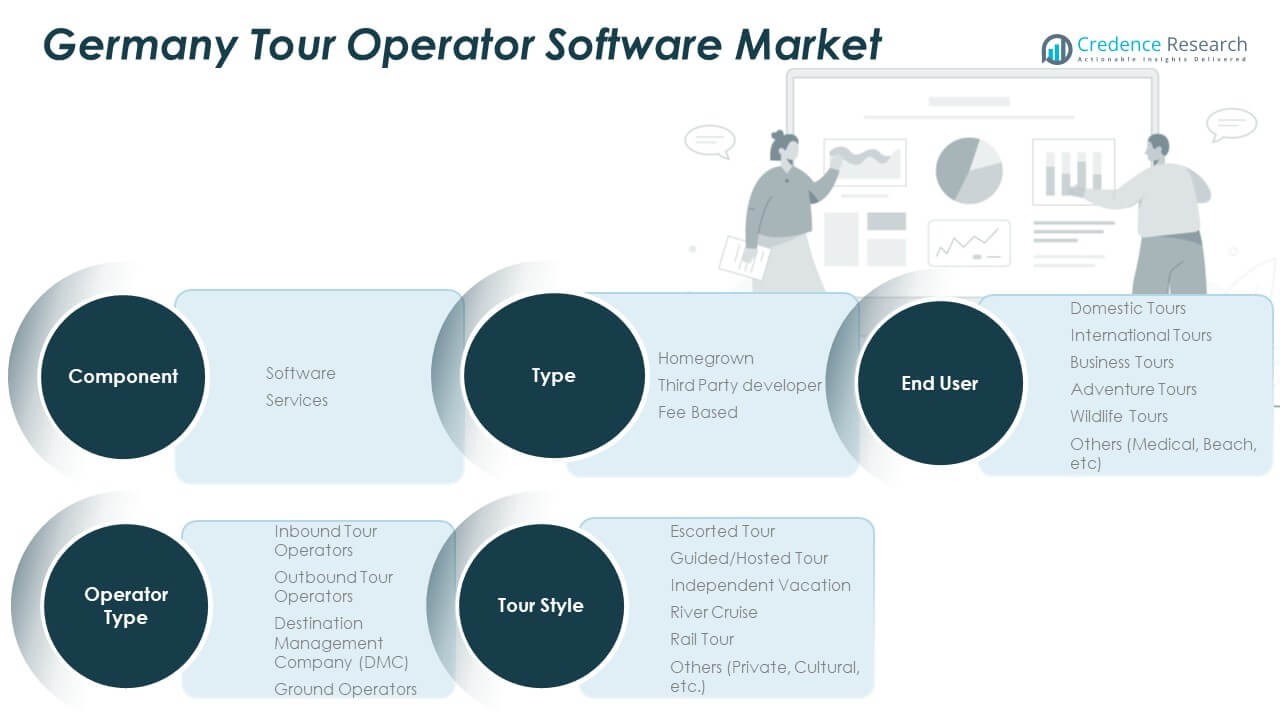

Market Segmentation Analysis:

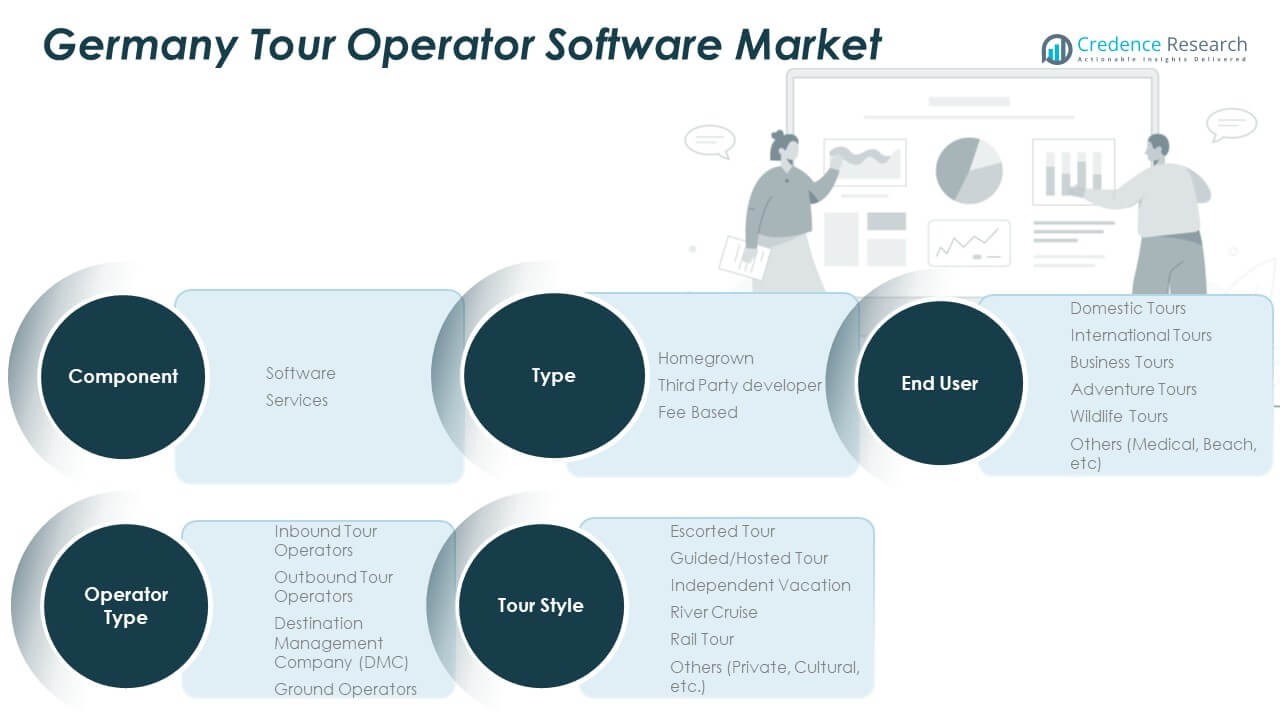

By Type

The Germany Tour Operator Software Market is segmented into homegrown, third party developer, and fee-based models. Homegrown platforms cater to operators seeking customized control and flexibility. Third party developer solutions provide scalability and faster deployment, attracting mid to large operators. Fee-based models remain popular for predictable costs and easy upgrades, supporting small and medium enterprises. It highlights a balanced demand across categories with emphasis on cost efficiency and adaptability.

- For instance, Third-party developer solutions provide scalability and faster deployment, attracting mid to large operators. Fee-based models remain popular for predictable costs and easy upgrades, supporting small and medium enterprises. It highlights a balanced demand across categories with emphasis on cost efficiency and adaptability.

By Component

The market divides into software and services, each playing a key role in adoption. Software ensures automation of booking, payments, and reporting functions, driving efficiency for operators. Services support integration, training, and ongoing customization, ensuring smooth performance. It has strengthened overall adoption as operators increasingly value seamless workflows and technical support.

- For instance, service-based add-ons—including integration assistance and system training—account for a growing percentage of total enterprise software spending, reflecting an increased demand for technical support and bespoke workflow customization. This shift is part of a broader trend where businesses are increasing investments in cloud-based solutions and IT services to improve operational efficiency and gain a competitive edge.

By Operator Type

Key operator types include inbound operators, outbound operators, destination management companies (DMCs), and ground operators. Inbound and outbound operators dominate usage, supported by high tourist flows and complex itinerary needs. DMCs and ground operators also rely on platforms for vendor coordination and local logistics. It reflects broad market penetration across the ecosystem.

By Tour Style and End User

Tour styles include escorted, guided/hosted, independent vacations, river cruises, rail tours, and others such as private and cultural packages. End users span domestic tours, international tours, business travel, adventure travel, wildlife tourism, and other categories. It shows strong adoption across both leisure and business segments, driven by rising demand for specialized and flexible travel packages.

Segmentation:

By Type

- Homegrown

- Third Party Developer

- Fee Based

By Component

By Operator Type

- Inbound Tour Operators

- Outbound Tour Operators

- Destination Management Company (DMC)

- Ground Operators

By Tour Style

- Escorted Tour

- Guided/Hosted Tour

- Independent Vacation

- River Cruise

- Rail Tour

- Others (Private, Cultural, etc.)

By End User

- Domestic Tours

- International Tours

- Business Tours

- Adventure Tours

- Wildlife Tours

- Others

Regional Analysis:

Northern Germany

Northern Germany accounted for 24% of the Germany Tour Operator Software Market in 2024. The presence of major airports in Hamburg and Bremen, along with strong inbound tourism flows, supports adoption. It benefits from growing demand for multi-channel booking platforms and cloud-based solutions. Maritime tourism and cultural attractions further enhance the region’s position. Larger agencies lead adoption, while smaller operators increasingly turn to fee-based systems. Government-backed digital transformation initiatives continue to support expansion. Northern Germany is expected to maintain steady growth through a mix of inbound and domestic travel demand.

Western Germany

Western Germany held the 32% share of the Germany Tour Operator Software Market in 2024, making it the largest regional contributor. Frankfurt’s international hub and corporate concentration drive demand for advanced digital platforms. It emphasizes strong adoption of AI-enabled booking tools and CRM integration for outbound operators. Partnerships with airlines and hotels further improve service efficiency. The region’s mature infrastructure and innovation-driven ecosystem create a strong foundation for continued dominance. Western Germany remains the anchor of market expansion due to its high outbound travel volume and competitive vendor presence.

Eastern and Southern Germany

Eastern and Southern Germany together represented 28% of the Germany Tour Operator Software Market in 2024. Berlin’s role as a cultural hub and Munich’s position in international tourism enhance demand for modern booking platforms. It reflects strong adoption by smaller operators leveraging fee-based solutions to access advanced digital tools. Growth is also fueled by domestic tourism, event tourism, and adventure packages. Government support for smart tourism projects strengthens digital adoption across both regions. With expanding infrastructure and rising middle-class demand, Eastern and Southern Germany are expected to record steady growth, contributing more to overall market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BEWOTEC (DaVinci & flexStore)

- TourRadar

- Regiondo

- Anixe (Resfinity)

- Rezdy

- Amadeus Germany GmbH

- DCS Dialog-Computer-Software GmbH

- HitchHiker GmbH

- INTOBIS GmbH & Co. KG

- TourOne Systems GmbH

Competitive Analysis:

The Germany Tour Operator Software Market features a competitive landscape marked by both global and domestic players. Companies compete on innovation, pricing flexibility, and comprehensive service offerings. Larger vendors dominate through strong product portfolios, cloud-based solutions, and strategic partnerships with operators. Small and mid-sized firms focus on niche markets, customization, and affordability to retain competitiveness. It reflects a market where customer experience, data integration, and automation are key differentiators. Vendors continue to expand through product development and regional partnerships, strengthening their positions in an evolving digital travel ecosystem.

Recent Developments:

- In September 2024, BEWOTEC unveiled significant developments for its DaVinci and flexStore product lines. The firm announced the launch of “DaVinci New Technology,” a cloud-based software-as-a-service application designed to blur the lines between classic and dynamic production for tour operators.

- In June 2025, TourRadar formed a high-profile partnership with HolidayPirates to expand its reach in the U.S. market. The partnership integrates over 50,000 multi-day adventure tours into TravelPirates.com, enabling American travelers to book tours as part of their holiday packages seamlessly.

- Regiondo has made strategic moves in 2023 and beyond, most notably joining forces with Checkfront and Rezdy to reshape the global tours and activities technology (restech) landscape.

- Amadeus continued a strong run of strategic partnerships and product advancements in 2025. Notably, in May 2025, Amadeus partnered with Google to leverage cloud-based operations and boost AI innovation for travel applications, thereby enhancing its technological capabilities for clients in the German travel market. Furthermore, Amadeus extended partnerships with airlines like Jeju Air and launched “Offers and Orders,” a next-generation airline retailing initiative, in June 2025, designed to transform traditional ticketing and booking workflows.

Report Coverage:

The research report offers an in-depth analysis based on type, component, operator type, tour style, and end user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Cloud-based adoption will expand across operators of all sizes.

- Personalization and AI-driven tools will gain greater prominence.

- Mobile-first booking platforms will continue to dominate traveler preferences.

- Integration of AR/VR will reshape marketing and booking experiences.

- Sustainability-driven features will influence software adoption.

- SMEs will leverage fee-based solutions to compete effectively.

- Data security will remain a critical priority for operators.

- Partnerships between software vendors and airlines will intensify.

- Demand for omni-channel engagement tools will increase.

- Niche tourism operators will adopt specialized platforms for growth.