Market Overview

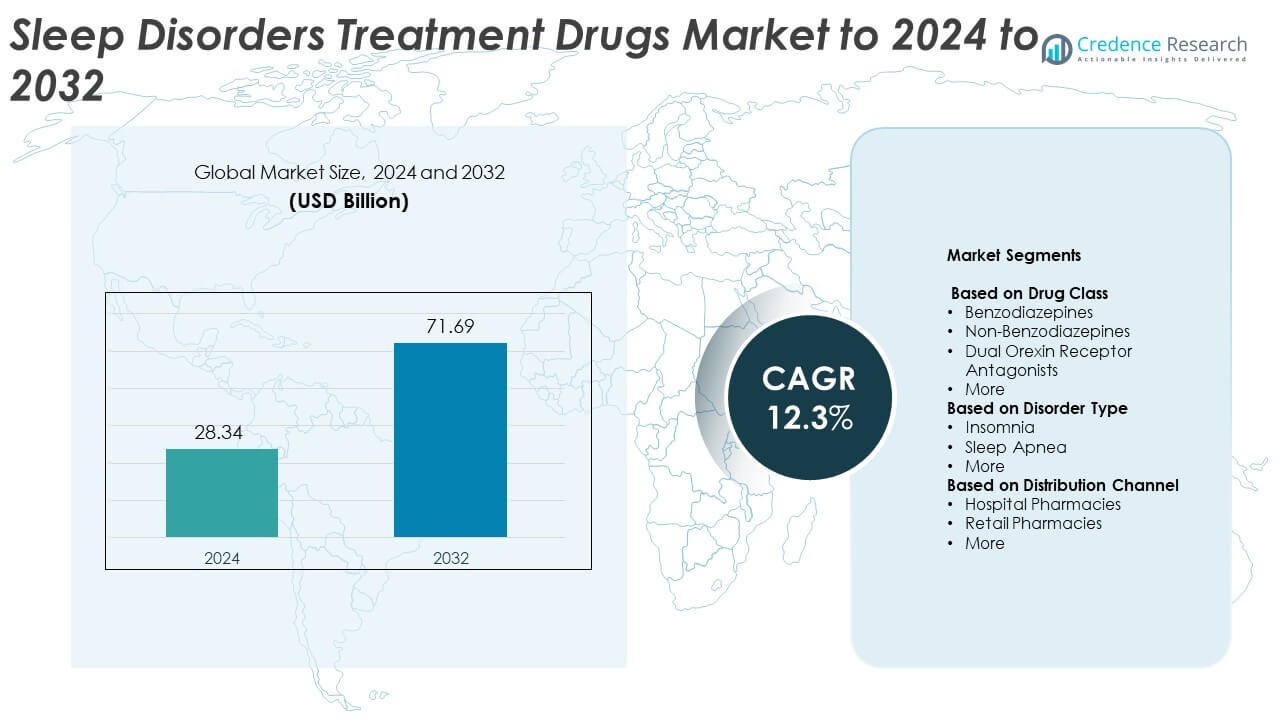

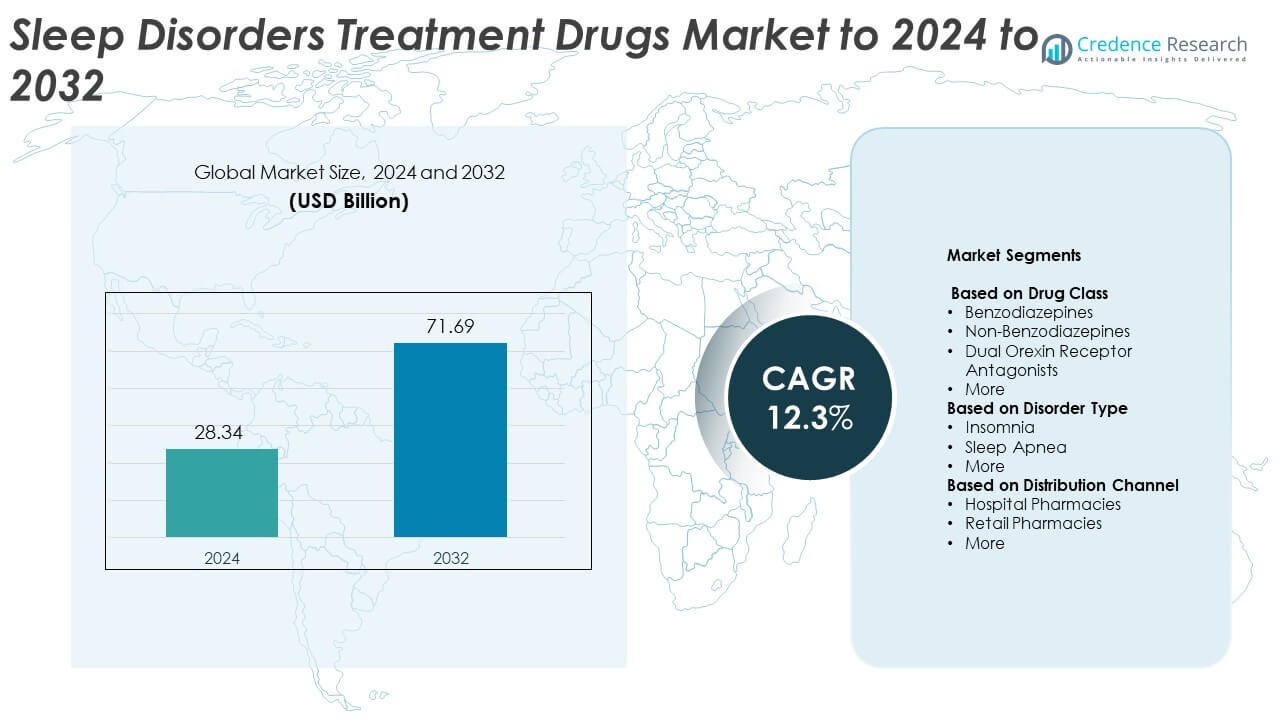

Sleep Disorders Treatment Drugs Market size was valued at USD 28.34 Billion in 2024 and is anticipated to reach USD 71.69 Billion by 2032, at a CAGR of 12.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sleep Disorders Treatment Drugs Market Size 2024 |

USD 28.34 Billion |

| Sleep Disorders Treatment Drugs Market, CAGR |

12.3% |

| Sleep Disorders Treatment Drugs Market Size 2032 |

USD 71.69 Billion |

The sleep disorders treatment drugs market is led by major pharmaceutical players such as Takeda, Merck, Eisai, Evotec, Eli Lilly, Astellas Pharma, Heptares Therapeutics (Sosei Group Corporation), Nxera Pharma, Ferring International Center, Athenex, Galenica, and Alexza Pharmaceuticals (Ferrer Therapeutics, Inc.). These companies focus on developing next-generation therapies targeting insomnia, sleep apnea, and narcolepsy, emphasizing safety, efficacy, and reduced dependency risks. North America dominated the market in 2024 with a 42.7% share, driven by advanced healthcare infrastructure and high diagnosis rates. Europe followed with 28.4%, while Asia Pacific emerged as the fastest-growing region due to increasing awareness and expanding access to modern sleep treatments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sleep Disorders Treatment Drugs Market was valued at USD 28.34 Billion in 2024 and is projected to reach USD 71.69 Billion by 2032, growing at a CAGR of 12.3%.

• Rising prevalence of insomnia and sleep apnea, coupled with growing awareness of sleep health, is driving strong demand for safer and more effective drug formulations.

• Increasing adoption of non-benzodiazepines and dual orexin receptor antagonists is shaping product innovation, supported by advancements in personalized and non-addictive therapies.

• The market remains moderately consolidated, with leading pharmaceutical firms investing in R&D and digital health collaborations to strengthen global reach and maintain competitive positioning.

• North America led the market with a 42.7% share in 2024, followed by Europe at 28.4%, while Asia Pacific showed the fastest growth; the non-benzodiazepines segment accounted for 41.6% of total revenue, reflecting high physician preference for safer, next-generation treatments.

Market Segmentation Analysis:

By Drug Class

The non-benzodiazepines segment dominated the sleep disorders treatment drugs market in 2024, accounting for 41.6% of the total share. Its leadership is driven by favorable safety profiles and lower dependency risks compared to benzodiazepines. Drugs such as zolpidem and eszopiclone are widely prescribed for chronic insomnia management. Advancements in dual orexin receptor antagonists like daridorexant and suvorexant are further reshaping the market landscape. Increased physician preference for next-generation therapies supporting improved sleep architecture without addiction potential continues to boost demand across developed markets.

- For instance, in 2023, the combined total of all zolpidem prescriptions in the U.S. was 11,424,127, covering 2,405,571 patients.

By Disorder Type

The insomnia segment held the largest share of 56.8% in 2024, reflecting the growing global prevalence of sleep deprivation and stress-related disorders. Rising diagnosis rates and expanding access to behavioral and pharmacological treatments fuel this dominance. Increasing prescription of non-benzodiazepine hypnotics and orexin receptor antagonists for long-term insomnia management strengthens the segment’s position. Additionally, greater awareness among healthcare providers regarding comorbidities linked to insomnia, such as anxiety and depression, has accelerated treatment adoption. Supportive healthcare programs and improved screening in clinical settings further contribute to market growth.

- For instance, the Philips Global Sleep Survey published in March 2019, which involved more than 13,000 adults across 13 countries, found that 37% of respondents reported experiencing insomnia.

By Distribution Channel

Hospital pharmacies led the market in 2024 with a 49.2% share, supported by the availability of prescription-based and controlled medications. Their dominance stems from the high volume of inpatients diagnosed with severe sleep disorders requiring specialist care. Hospitals serve as primary points for accurate diagnosis, patient monitoring, and administration of advanced therapeutic drugs. The presence of regulated distribution networks ensures drug safety and compliance with prescription guidelines. Additionally, rising hospitalization rates for sleep apnea and chronic insomnia continue to enhance pharmaceutical sales through hospital-based channels globally.

Key Growth Drivers

Rising Prevalence of Sleep Disorders

The global rise in sleep-related conditions such as insomnia, sleep apnea, and narcolepsy is a major market growth driver. Sedentary lifestyles, stress, and longer screen exposure have led to disrupted sleep patterns among adults and children. Increasing diagnostic rates and awareness campaigns by healthcare organizations are improving early detection. This has expanded the patient base seeking pharmaceutical interventions, boosting demand for sleep-inducing and maintenance drugs. The growing geriatric population, which is more prone to sleep disorders, further strengthens overall market expansion.

- For instance, a Google (Fitbit) study analyzed sleep data from 6,700+ users, linking sleep metrics with health outcomes.

Advancements in Drug Formulations and Novel Mechanisms

Continuous innovation in drug formulations and delivery systems is enhancing treatment efficiency and patient adherence. The emergence of dual orexin receptor antagonists, melatonin receptor agonists, and extended-release formulations is improving safety profiles and reducing side effects. Pharmaceutical companies are focusing on developing non-habit-forming, fast-acting therapies to meet clinical and regulatory standards. These technological advancements are reshaping prescription preferences and expanding product portfolios, offering long-term opportunities for both branded and generic drug manufacturers.

- For instance, Idorsia’s daridorexant Phase 3 reported TEAEs in 37.7% at 25/50 mg vs 34.0% on placebo.

Growing Awareness and Healthcare Infrastructure Expansion

Expanding healthcare access in emerging economies is facilitating better diagnosis and management of sleep disorders. Public health initiatives and sleep awareness campaigns are promoting consultation and therapy adoption. Improved infrastructure, such as specialized sleep centers and telemedicine platforms, is helping identify patients requiring pharmaceutical treatment. Insurance coverage for sleep disorder medications in several developed markets also increases affordability. Together, these factors are creating favorable conditions for sustained market growth and higher treatment penetration rates.

Key Trends & Opportunities

Shift Toward Non-Addictive and Targeted Therapies

Pharmaceutical research is shifting toward non-addictive, receptor-specific drugs that improve sleep quality without dependency risks. Growing physician preference for safer alternatives such as orexin receptor antagonists and melatonin-based therapies is driving innovation. This transition aligns with stricter regulatory policies on benzodiazepine use. Companies focusing on precision-based treatments and personalized dosing approaches have significant opportunities to strengthen their market position and cater to evolving patient safety needs.

- For instance, Eisai’s SUNRISE-1 randomized 1,006 adults; lemborexant arms were n=266 (5 mg) and n=269 (10 mg).

Integration of Digital Sleep Health Solutions

The integration of digital therapeutics, sleep-tracking wearables, and telehealth platforms is transforming disorder management. These technologies enable real-time monitoring, behavioral therapy support, and treatment compliance tracking. Pharmaceutical companies are collaborating with tech developers to pair drug therapies with data-driven care models. This hybrid approach enhances treatment outcomes and allows personalized medication adjustment, opening new revenue opportunities within the digital health ecosystem.

- For instance, Oura has sold 5.5 million+ rings, expanding sleep tracking across 150+ countries.

Key Challenges

Stringent Regulatory Requirements and Drug Approval Delays

The market faces delays due to complex regulatory frameworks governing the approval of sleep-related medications. Strict safety and dependency evaluations extend clinical trial timelines and increase R&D costs. Companies must meet evolving FDA and EMA standards concerning long-term efficacy and side effect control. These compliance challenges slow product launches and limit access to innovative therapies, restraining short-term market expansion.

High Dependence on Prescription and Risk of Misuse

Many sleep disorder drugs, particularly benzodiazepines, are subject to controlled prescriptions due to addiction risks. Dependence issues and withdrawal symptoms associated with prolonged use have raised clinical and ethical concerns. Regulatory authorities closely monitor distribution and prescribing patterns, affecting market growth potential. The growing emphasis on non-pharmacological therapies such as cognitive behavioral therapy is also shifting demand away from conventional drugs in several developed economies.

Regional Analysis

North America

North America dominated the sleep disorders treatment drugs market in 2024 with a 42.7% share. The region’s leadership is supported by high diagnosis rates, advanced healthcare infrastructure, and strong pharmaceutical R&D presence. Rising prevalence of insomnia and sleep apnea, along with the growing use of non-benzodiazepine and orexin antagonist therapies, drives demand. The United States accounts for the majority of regional revenue due to strong physician awareness and reimbursement coverage. Continuous product innovation and the availability of FDA-approved drugs further reinforce the region’s dominant market position.

Europe

Europe held a 28.4% market share in 2024, driven by increasing awareness of sleep-related health issues and expanded access to prescription treatments. Countries such as Germany, France, and the United Kingdom are major contributors due to supportive healthcare systems and research investments. Government-backed awareness campaigns addressing insomnia and sleep apnea have accelerated diagnosis rates. The region also benefits from rising use of non-addictive therapies and strict pharmacovigilance standards ensuring patient safety. Growing geriatric populations and adoption of advanced formulations continue to support steady market growth across Europe.

Asia Pacific

Asia Pacific accounted for 20.6% of the global market in 2024 and is projected to witness the fastest growth through 2032. Rising stress levels, increasing urbanization, and growing awareness of mental health are expanding the patient base. Japan, China, and India are key markets supported by improving healthcare infrastructure and a surge in sleep-related consultations. Expanding pharmaceutical distribution networks and rising affordability of prescription drugs are boosting adoption. Multinational firms are also increasing product availability through partnerships, further supporting regional expansion.

Latin America

Latin America represented 5.1% of the global market in 2024, supported by gradual improvements in healthcare systems and growing awareness of sleep disorders. Brazil and Mexico are the leading contributors due to a rising middle-class population and expanding access to specialist care. Increasing stress-related insomnia and the availability of over-the-counter sleep aids are stimulating demand. Although limited reimbursement and affordability issues persist, ongoing healthcare reforms and the entry of generic formulations are expected to strengthen the regional market outlook over the forecast period.

Middle East and Africa

The Middle East and Africa held a 3.2% market share in 2024, reflecting emerging awareness of sleep health and growing investments in healthcare infrastructure. Urbanization, lifestyle-related stress, and increasing prevalence of chronic disorders are contributing to higher diagnosis rates. The United Arab Emirates, Saudi Arabia, and South Africa are among the key markets showing early adoption of advanced treatment drugs. Limited specialist availability and regulatory restrictions on controlled substances remain challenges. However, expanding telehealth services and awareness programs are gradually improving access to effective sleep disorder therapies.

Market Segmentations:

By Drug Class

- Benzodiazepines

- Non-Benzodiazepines

- Dual Orexin Receptor Antagonists

- More

By Disorder Type

- Insomnia

- Sleep Apnea

- More

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- More

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players in the sleep disorders treatment drugs market include Takeda, Merck, Eisai, Evotec, Eli Lilly, Astellas Pharma, Heptares Therapeutics (Sosei Group Corporation), Nxera Pharma, Ferring International Center, Athenex, Galenica, and Alexza Pharmaceuticals (Ferrer Therapeutics, Inc.). The competitive landscape is marked by strong R&D activity, focusing on developing next-generation therapies with reduced side effects and lower dependency risks. Companies are investing heavily in dual orexin receptor antagonists and melatonin-based formulations to address unmet medical needs. Strategic collaborations, licensing deals, and technology partnerships are enabling portfolio expansion and faster regulatory approvals. Firms are also emphasizing clinical trials to improve long-term efficacy and safety outcomes. The growing preference for personalized and non-addictive treatments is driving innovation, while established players maintain dominance through diversified product lines, global distribution networks, and targeted marketing strategies that strengthen their presence across major regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Takeda

- Merck

- Eisai

- Evotec

- Eli Lilly

- Astellas Pharma

- Heptares Therapeutics (Sosei Group Corporation)

- Nxera Pharma

- Ferring International Center

- Athenex

- Galenica

- Alexza Pharmaceuticals (Ferrer Therapeutics, Inc.)

Recent Developments

- In 2025, Takeda published Phase 2b results for oveporexton (TAK-861) in The New England Journal of Medicine, showing significant improvements in wakefulness and cataplexy for patients with narcolepsy type 1

- In 2024, Eli Lilly and Company stated that the U.S. Food and Drug Administration had approved Zepbound® (tirzepatide) as the first prescription medication for adults diagnosed with moderate-to-severe obstructive sleep apnea (OSA) and obesity.

- In 2024, Nxera Pharma and Shionogi & Co., Ltd. launched QUVIVIQ™ (daridorexant) as a treatment for adult insomnia in Japan.

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Disorder Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising global prevalence of insomnia and sleep apnea will continue to drive strong drug demand.

- Non-benzodiazepine and orexin receptor antagonist drugs will see higher adoption due to safety advantages.

- Digital health integration will enhance treatment monitoring and patient adherence.

- Pharmaceutical innovation will focus on non-addictive, long-acting, and personalized sleep medications.

- Expanding healthcare infrastructure in Asia Pacific will create new growth opportunities.

- Increased mental health awareness will boost early diagnosis and therapy uptake.

- Strategic collaborations between pharma and digital health firms will reshape treatment models.

- Patent expirations will encourage competition from cost-effective generic formulations.

- Regulatory support for safe and innovative drugs will accelerate product approvals.

- Growing investment in clinical trials for novel sleep therapies will strengthen long-term market expansion.