Market Overview:

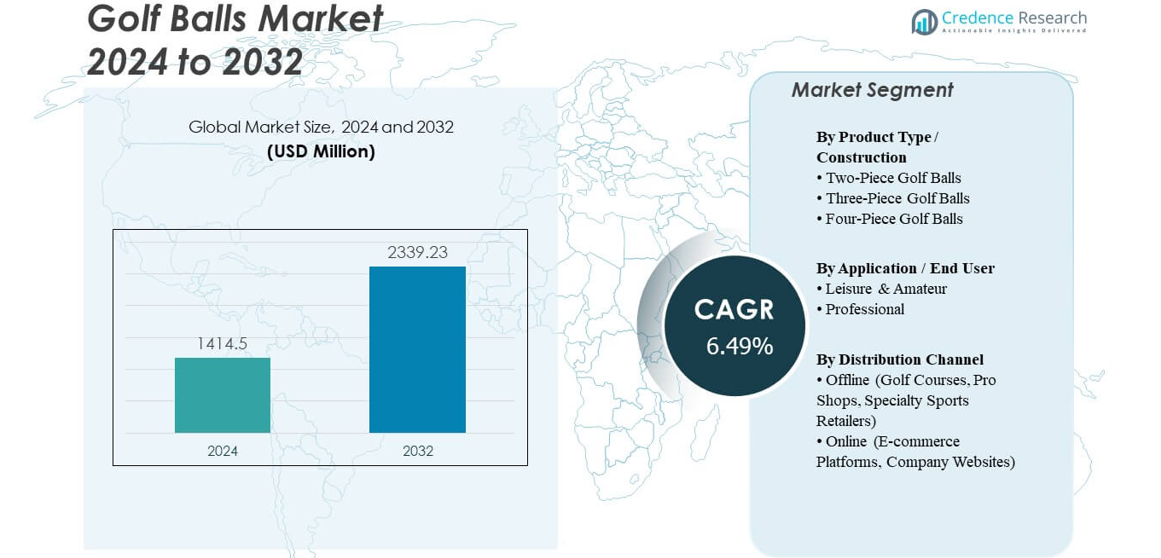

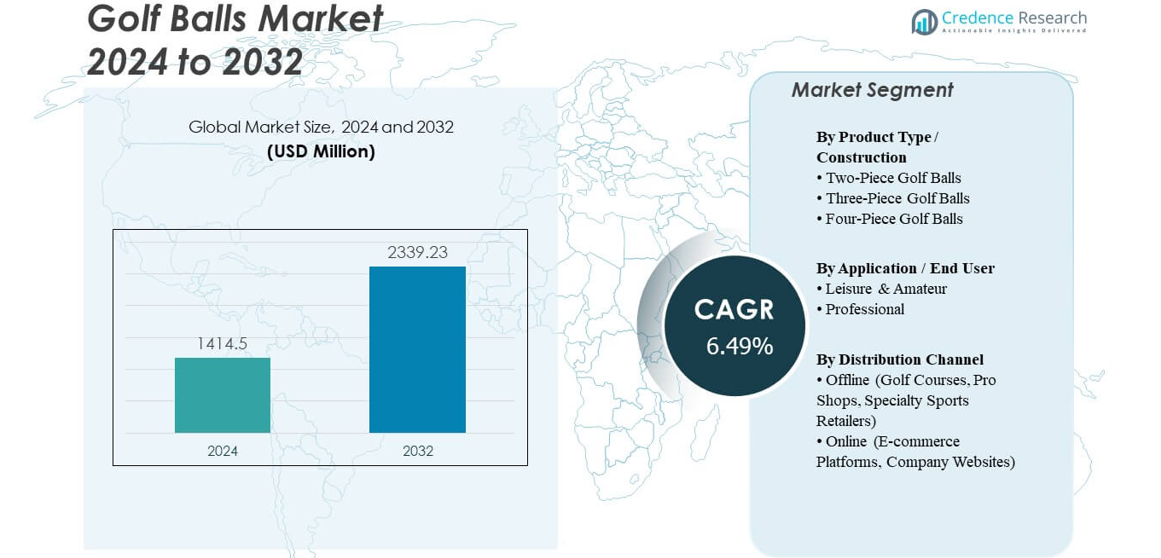

The Golf Balls Market is projected to grow from USD 1,414.5 million in 2024 to an estimated USD 2,339.23 million by 2032, with a compound annual growth rate (CAGR) of 6.49% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Golf Balls Market Size 2024 |

USD 1,414.5 million |

| Golf Balls Market, CAGR |

6.49% |

| Golf Balls Market Size 2032 |

USD 2,339.23 million |

Market drivers remain strong due to growing interest in golf among new and returning players. Manufacturers develop multi-layer designs that improve control, distance and durability, supporting strong adoption across skill levels. Indoor simulator centers boost off-season usage and raise repeat demand from younger golfers seeking year-round practice. Golf tourism expands in key regions and supports bulk purchases across resorts and academies. Custom printing and personalization trends also help brands gain traction among corporate buyers. Professional tournaments elevate product visibility and strengthen consumer trust in premium models.

Regional dynamics show clear leadership in North America due to a large golfer base, strong retail access and frequent tournament activity. Europe follows with established clubs and rising participation among recreational players. Asia Pacific emerges quickly as countries such as Japan, South Korea and China expand courses and training infrastructure. The Middle East gains momentum due to resort-driven demand, while Latin America grows at a steady pace with improving player engagement. Each region contributes to broad global expansion through varied adoption patterns and rising golf culture visibility.

Market Insights:

- The Golf Balls Market is projected to grow from USD 1,414.5 million in 2024 to USD 2,339.23 million by 2032, supported by a steady 6.49% CAGR.

- Rising participation in golf and strong interest from new players drive consistent demand across all product categories.

- Innovation in multi-layer construction strengthens performance gains, leading to higher adoption among skilled and intermediate golfers.

- Growing use of indoor simulators supports frequent purchases by younger users seeking year-round training experiences.

- Sustainability efforts encourage manufacturers to explore eco-friendly materials, creating new growth avenues.

- North America leads the market due to strong golfing culture, wide retail reach and active tournament activity.

- Asia Pacific emerges fast as expanding courses, training academies and rising middle-class participation lift long-term consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Participation in Recreational and Professional Golf

Growing interest in golf strengthens demand within the Golf Balls Market across global regions. Participation increases among young players who seek structured coaching. Corporate events encourage many first-time users to engage with the sport. Public courses offer easier access for new golfers. Tourism destinations promote golf packages that attract international visitors. Professional tournaments create high visibility for premium ball technologies. Brands invest in product education to help beginners choose the right design. It supports repeat purchases across seasonal cycles. New memberships rise across golf academies worldwide. Expanding grassroots programs nurture long-term player engagement.

Advancements in Ball Aerodynamics and Material Science

New engineering standards encourage strong product upgrades across all price points. Multi-layer construction enhances flight stability and spin control. Manufacturers refine core chemistry to improve energy transfer. Cover materials offer better durability under long use. Players notice visible gains in feel and distance. High-precision molding supports consistent performance in tour-grade balls. Companies highlight testing data to guide user decisions. The Golf Balls Market gains higher traction as innovation reshapes competitive positioning. Research teams explore new polymers to improve resilience. Brands test advanced dimple patterns to boost aerodynamic lift.

- For instance, Bridgestone’s TOUR B golf balls feature REACTIV iQ cover technology designed to increase ball speed on long shots while boosting spin on shorter approach shots. Bridgestone’s technical materials highlight how this adaptive cover responds differently based on impact force, supporting stronger all-round performance for skilled players.

Growth of Indoor Golf and Simulation Facilities

Indoor simulators attract players who practice during off-season periods. High-tech practice centers open in major cities and support amateur skill growth. Simulators require frequent ball replacement due to heavy wear. Training academies rely on bulk purchases of durable models. Entertainment chains add golf simulators to expand customer engagement. Young consumers explore golf through digital and virtual experiences. Reliable ball performance enhances the realism of simulator play. It helps convert casual users into regular buyers. Simulator leagues gain popularity in urban regions. New venues integrate coaching tools that increase ball usage.

- For instance, MyGolfSpy’s Ball Lab evaluation of Callaway’s Chrome Soft X LS highlighted strong consistency in construction and performance, noting reliable quality control across tested samples. The model is engineered with a high-speed core and durable cover, supporting stable performance for players who prefer a lower-spin tour-level ball design.

Expansion of Golf Tourism and Resort Development

Resort chains integrate world-class golf courses into hospitality offerings. International travelers seek premium destinations with coaching options. Golf tourism expands in Southeast Asia, Europe and the Middle East. Luxury resorts purchase balls in large volumes to serve visitors. Dedicated golf events increase visitor spending. Retail outlets inside resorts promote branded balls. Course operators collaborate with manufacturers for on-site custom printing. The Golf Balls Market benefits from strong demand driven by global tourism flows. Resorts upgrade practice facilities to attract high-value tourists. New travel packages include coaching sessions that increase ball rotation.

Market Trends

Rapid Shift Toward Eco-Friendly and Biodegradable Designs

Sustainability gains momentum across consumer segments. Biodegradable balls draw interest from environmentally aware players. Course operators test recyclable options to reduce waste. Material developers explore plant-based polymers for covers. Many brands introduce packaging with lower environmental impact. New regulations encourage greener manufacturing practices. Product lines highlight eco-credentials to improve brand perception. The Golf Balls Market observes steady migration toward sustainable choices. Retailers promote green products to eco-driven consumers. New R&D programs prioritize lower-impact production techniques.

- For instance, Topgolf Callaway Brands reported that its Carlsbad, California headquarters reached 60% renewable energy consumption in 2023. The company also reduced single-use plastics in club shipments while expanding the use of recyclable and recycled packaging materials across its operations.

Higher Demand for Custom-Printed and Personalized Golf Balls

Personalization climbs due to demand from corporate buyers and event organizers. Custom logos help brands create strong identity during tournaments. Retailers promote on-demand printing for small batches. Players order designs that reflect personal style preferences. Tournament gifts often feature unique branding. Premium packaging supports the gifting trend. Manufacturers expand digital printing lines for faster output. It fuels new demand streams linked to lifestyle and branding needs. Resorts use custom prints for event merchandising. Rising gifting culture strengthens repeat purchases.

Growing Influence of Data-Driven Ball Fitting Services

Ball fitting gains traction among players who want tailored performance. Digital tools help assess swing speed, spin rate and launch angle. Retail chains use sensors to guide buyer selection. Fitting studios attract both amateurs and professionals. Manufacturers publish performance data charts to support fitting sessions. Players experience measurable improvements after ball matching. Coaches promote fitting to accelerate learning. The Golf Balls Market responds with performance-focused segmentation. More players seek personalized fitting during equipment upgrades. Retail stores install advanced launch monitors to support the trend.

Rising Integration of Smart Technology in Training Ecosystems

Training ecosystems adopt sensors that track ball movement with high accuracy. Smart ranges use radar-based systems to monitor player progress. Connected devices sync content with mobile apps. Players get instant feedback on distance and trajectory. Coaches use digital data to refine training plans. Ball design adapts to withstand repeated high-speed tracking. Advanced launch monitors demand consistent ball characteristics. It creates new synergy between ball engineering and sports technology. Virtual coaching tools increase usage across digital practice modes. High-tech training centers raise expectations for ball consistency.

- For instance, Continental’s BAL.ON Smart Kit uses in-shoe pressure-sensing insoles paired with smart pods and a mobile app to provide real-time feedback on weight shift and balance during a golf swing. The system captures detailed stability and pressure data to support improved swing mechanics. It helps golfers and coaches refine technique through immediate, data-driven insights.

Market Challenges Analysis

High Price Sensitivity and Strong Competition Across Product Tiers

Price sensitivity limits rapid premium adoption among beginners. Low-cost balls attract first-time buyers who prefer basic options. Competition intensifies as new brands enter retail channels. Counterfeit products pose risks for market stability. Many players struggle to differentiate between similar models. Retail promotions dilute brand loyalty at entry segments. Manufacturers must balance innovation with affordability. The Golf Balls Market faces pressure to justify value through performance gains.

Environmental Impact and Difficulties in Large-Scale Recycling

Lost balls accumulate across forests, water bodies and course boundaries. Recycling remains complex due to multi-layer construction. Most facilities lack equipment to process composite materials. Course operators struggle to manage lost ball retrieval. Environmental groups raise concerns over long-term waste. Brands invest in green materials but face adoption hurdles. Regulations may tighten and raise compliance costs. It pushes manufacturers toward more sustainable solutions with scalable impact.

Market Opportunities

Growing Scope for Sustainable and Biodegradable Ball Development

Eco-friendly innovation creates strong commercial openings for global brands. Courses seek balls that reduce long-term environmental burden. Biodegradable cores gain traction among premium customers. Research improves durability without compromising flight stability. Brands market green credentials to differentiate products. New materials open pathways for patentable technologies. Retail chains promote sustainable lines to conscious players. The Golf Balls Market gains momentum through responsible manufacturing.

Rising Demand From Emerging Golfing Nations and Youth Segments

Developing regions invest in new training academies and public courses. Youth programs expand to make golf accessible for students. Social media exposure inspires young players to test the sport. Demand grows for mid-range balls tailored to skill building. Local retailers expand product availability across urban centers. Golf influencers create strong visibility for global brands. New tournaments support rising participation. It strengthens future sales pipelines across emerging markets.

Market Segmentation Analysis:

By Product Type / Construction

Two-piece, three-piece and four-piece golf balls shape performance preferences across skill levels. Two-piece balls attract beginners who seek durability and long-distance support. Three-piece balls meet the needs of intermediate players who want softer feel and enhanced control. Four-piece balls appeal to professionals who require advanced spin management on complex shots. Manufacturers refine core and cover technologies to strengthen product identity in each tier. Retailers position these formats to guide players through their improvement journey. The Golf Balls Market gains depth from this clear performance-based segmentation. It benefits from steady upgrades as players progress.

- For instance, the 2023 Titleist Pro V1 and Pro V1x feature High Gradient Core Technology designed to lower long-game spin compared with earlier generations, supporting more consistent distance off the tee and improved overall flight stability.

By Application / End User

Leisure and amateur players form the largest demand base due to high participation and frequent ball replacement. Casual golfers prefer balls that offer durability and predictable flight for daily practice. Professional players choose high-performance constructions that support faster swing speeds and shot precision. Brands focus on custom fitting programs to help each group select the right model. Training academies influence buying decisions through performance testing. Tournaments support visibility for tour-grade balls used by elite players. The Golf Balls Market expands through balanced growth across both user groups. It gains stability from consistent amateur engagement.

- For instance, the Srixon Soft Feel features a soft FastLayer Core that becomes firmer toward the outside to support better ball speed while maintaining a smooth feel. Its durable ionomer cover enhances longevity for amateur golfers and helps deliver consistent performance across varied playing conditions.

By Distribution Channel

Offline channels such as golf courses, pro shops and specialty retailers lead sales due to personalized guidance and on-site fitting. These outlets allow buyers to compare feel, spin and control before purchase. Online platforms grow fast due to broad availability and strong brand visibility. E-commerce supports bulk purchasing and custom printing services for events and corporate orders. Digital promotions help brands reach new players who research products online. Hybrid buying behavior strengthens cross-channel demand patterns. The Golf Balls Market benefits from wide accessibility across physical and digital networks. It gains momentum from rising brand engagement across both channels.

Segmentation:

By Product Type / Construction

- Two-Piece Golf Balls

- Three-Piece Golf Balls

- Four-Piece Golf Balls

By Application / End User

- Leisure & Amateur

- Professional

By Distribution Channel

- Offline (Golf Courses, Pro Shops, Specialty Sports Retailers)

- Online (E-commerce Platforms, Company Websites)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the leading position with an estimated 38% share driven by a large base of active golfers and strong retail penetration. The region benefits from mature golf culture, advanced training facilities and high adoption of premium multi-layer balls. Brands launch new models frequently to serve both amateur and professional segments. Courses maintain strong consumption levels due to tournaments and seasonal play. The Golf Balls Market gains sustained momentum from this region because it supports high-volume and high-value sales. It strengthens its position through partnerships with tour players.

Europe accounts for nearly 27% share, supported by established golf destinations across the UK, Germany, France and Scandinavia. Players show strong interest in tour-performance and eco-friendly designs. Clubs across Europe maintain steady ball replacement cycles due to frequent events. Retailers promote advanced fitting services to guide player selection. It drives stable long-term growth through a balanced mix of leisure and competitive players. The Golf Balls Market builds visibility in this region through strong tourism-driven demand.

Asia Pacific records an expanding footprint with around 24% share, driven by rising participation in Japan, South Korea, China and Australia. Growing middle-class spending supports rapid adoption of mid-range and advanced balls. New courses open across major cities to serve young and emerging golfers. Regional brands expand distribution networks to capture rising demand. It gains strong momentum as training academies increase ball consumption. The Golf Balls Market sees accelerated growth due to rising interest in golf as a lifestyle and sport.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Titleist (Acushnet Holdings Corp.)

- Callaway Golf Company

- TaylorMade Golf Company

- Bridgestone Golf (Bridgestone Sports Co., Ltd.)

- Srixon (Sumitomo Rubber Industries, Ltd.)

- Mizuno Corporation

- Wilson Sporting Goods Co.

- Volvik

- Dixon Golf

- OnCore Golf Technology

- Snell Sports

Competitive Analysis:

The Golf Balls Market features strong competition driven by global brands that focus on technology, performance and player endorsements. Leading companies invest in multi-layer construction research to strengthen distance, control and spin characteristics. Product differentiation remains a core strategy, with firms highlighting aerodynamic patterns and advanced cover materials. Partnerships with tour professionals help companies build credibility and influence purchasing trends. Retail presence across pro shops, courses and online channels supports wide availability for all skill groups. Companies emphasize brand identity through custom printing, sustainable product lines and fitting tools. It helps manufacturers target different consumer segments while maintaining strong premium positioning. Competitive pressure increases as emerging brands offer value-driven alternatives supported by digital marketing and direct-to-consumer sales.

Recent Developments:

- In November 2025, Topgolf Callaway Brands announced the sale of a 60% stake in its Topgolf entertainment business to private equity, with plans to refocus resources on core golf equipment, notably its ball technologies.

- In April 2025, TaylorMade announced a new licensing agreement with the NFL, unveiling SpeedSoft Ink, TP5, and TP5x MySymbol NFL golf balls timed with the NFL Draft. TaylorMade has also strategically broadened its manufacturing control by acquiring Korean golf ball manufacturer Nassau Golf.

- In February 2025, TaylorMade revamped its Tour Response line with a new Speed Wrapped Core Technology that significantly enhances ball speed, soft feel, and distance. The core uses a material long tested in their TP5 and TP5x balls, providing a softer sound and superior performance at a 70 compression rating.

- In January 2025, Srixon unveiled its latest Z-STAR golf ball series, including three new models: Z-STAR, Z-STAR DIAMOND, and Z-STAR XV. The series integrates innovative features like the Fastlayer DG Core 2.0 and Spin Skin+ technology, aiming for improved distance, spin rates, and sustainability with eco-friendly materials.

- In October 2024, Titleist unveiled the latest iterations of its flagship golf balls, the Pro V1 and Pro V1x, continuing its legacy of premium performance innovation in the golf balls market.

- In July 2024, Titleist launched specialized Pro V1 RCT and Pro V1x RCT balls in partnership with Trackman, targeting enhanced precision and data collection for indoor golf simulations.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market

Future Outlook:

- Growth will strengthen due to rising participation across leisure and competitive segments.

- Premium multilayer balls will gain traction as players seek higher control and consistency.

- Eco-friendly materials will see wider adoption driven by sustainability initiatives.

- Simulation facilities will lift practice-based demand through frequent ball replacement cycles.

- Personalization will expand as gifting and event branding grow across regions.

- Digital fitting tools will shape buying decisions with data-backed performance insights.

- Retail networks will widen reach through hybrid online and offline strategies.

- Resort-based golf tourism will support bulk purchases during peak travel seasons.

- Emerging markets will accelerate growth as training centers develop in major cities.

- Technology-driven coaching platforms will raise interest in performance-focused ball designs.