Market Overview:

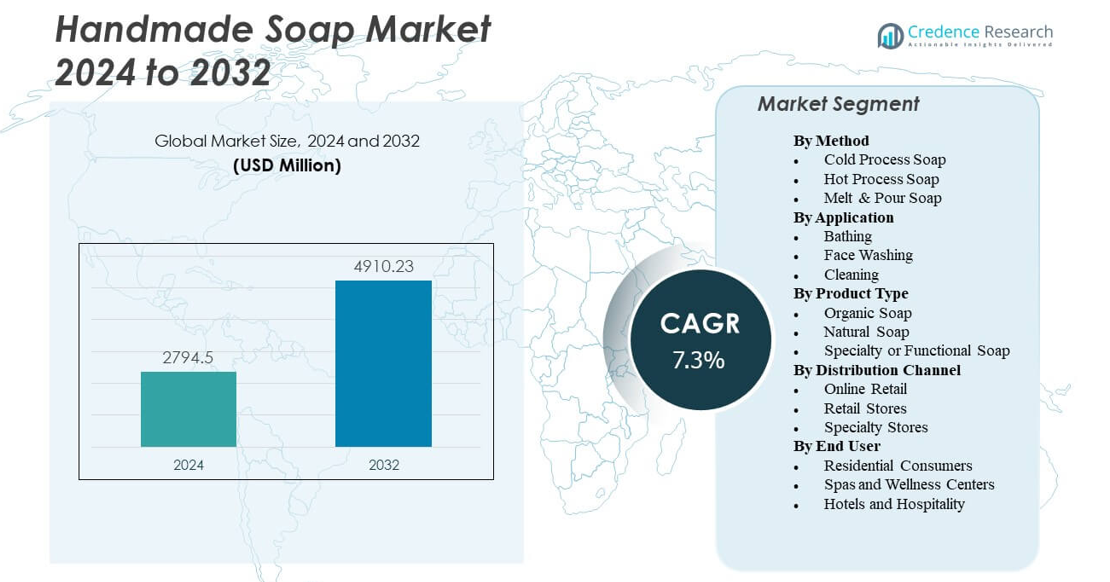

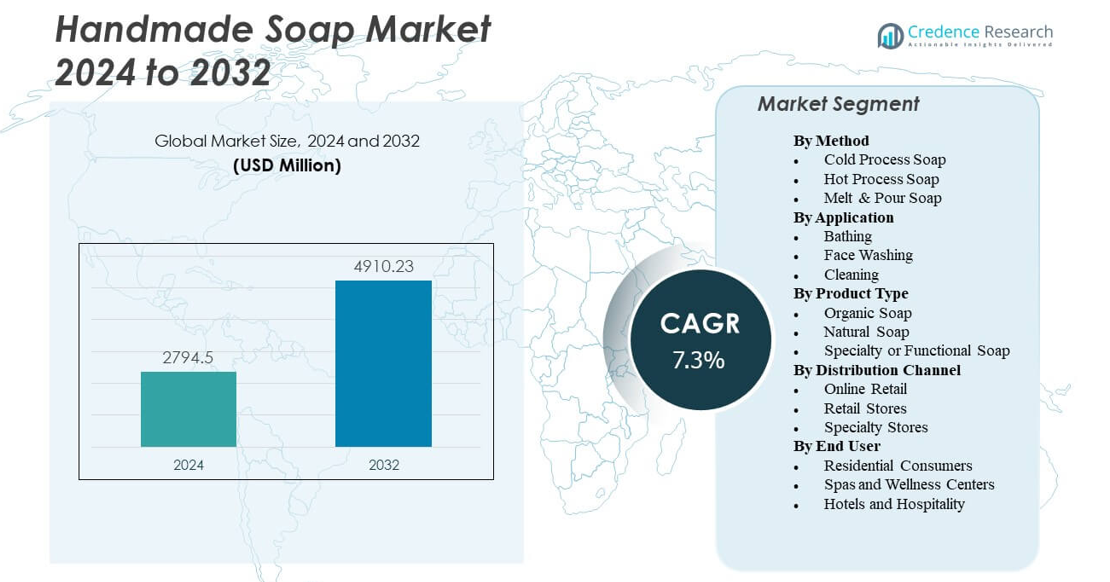

The Handmade soap market is projected to grow from USD 2,794.5 million in 2024 to an estimated USD 4,910.23 million by 2032, with a compound annual growth rate (CAGR) of 7.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Handmade Soap Market Size 2024 |

USD 2,794.5 million |

| Handmade Soap Market, CAGR |

7.3% |

| Handmade Soap Market Size 2032 |

USD 4,910.23 million |

Growing consumer awareness toward natural and chemical-free skincare drives market expansion. Customers increasingly prefer products made from essential oils, herbs, and plant-based ingredients that promote skin health and environmental sustainability. Small-scale producers and artisanal brands benefit from this shift by offering eco-friendly, cruelty-free soaps. Rising disposable incomes and demand for premium personal care enhance the growth prospects of the handmade soap market.

Regionally, North America leads the market due to strong demand for organic and ethically sourced skincare products. Europe follows closely, supported by sustainable consumption trends and high awareness of ingredient transparency. Asia-Pacific emerges as a fast-growing region, driven by expanding urbanization, lifestyle changes, and increasing online retail access. Latin America and the Middle East & Africa show growing adoption, supported by natural beauty trends and expanding artisan-based production.

Market Insights:

- The Handmade soap market is projected to grow from USD 2,794.5 million in 2024 to USD 4,910.23 million by 2032, registering a CAGR of 7.3% during the forecast period.

- Growing consumer inclination toward natural, chemical-free, and eco-friendly personal care products drives steady market demand.

- Rising disposable incomes and preference for premium organic skincare encourage the adoption of handmade soaps across global markets.

- High production costs and limited scalability among small producers restrain wider market penetration.

- North America holds the largest share, supported by strong awareness of sustainable and cruelty-free products.

- Asia-Pacific shows the fastest growth, driven by expanding urbanization and increased online retail presence.

- Artisanal brands and small enterprises focusing on customization and ethical sourcing gain a competitive edge in the handmade soap industry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Consumer Preference for Natural and Organic Personal Care Products

The handmade soap market gains strength from the shift toward natural personal care items. Consumers prefer soaps crafted with essential oils, herbs, and botanical extracts that are free from harsh chemicals. Demand rises among health-conscious users who value sustainable and skin-friendly options. Retailers promote these soaps as premium wellness products, attracting environmentally aware buyers. The global movement toward cleaner ingredients reinforces brand differentiation in the sector. Manufacturers focus on plant-based raw materials to maintain transparency. Eco-friendly packaging complements the appeal of handcrafted items. The handmade soap market benefits from strong alignment with global sustainability goals.

Rising Awareness of Skin Sensitivity and Chemical Reactions

Growing reports of allergic reactions from synthetic soaps drive awareness about safer alternatives. Dermatologists recommend handmade options for individuals with sensitive skin, boosting credibility. Consumers recognize that artisanal soaps often include glycerin, which helps retain skin moisture. Specialty stores highlight hypoallergenic properties to attract niche users. This increased understanding builds long-term brand loyalty among wellness enthusiasts. Producers invest in natural preservation techniques to ensure product safety. Marketing emphasizes gentle cleansing and nourishing effects to appeal to varied demographics. The handmade soap market expands due to its positive skin compatibility profile.

- For example, Chagrin Valley Soap & Salve manufactures handmade cold-process soaps using USDA-certified organic ingredients and is certified cruelty-free by the Leaping Bunny program. Its “Milk & Honey Baby Soap” is verified as USDA organic, unscented, and formulated for sensitive skin, with full ingredient transparency available on the company’s official website.

Expanding E-Commerce Platforms and Direct-to-Consumer Strategies

The rise of e-commerce supports wider distribution for artisanal soap brands. Small producers use digital platforms to showcase ingredient quality and craftsmanship. Social media channels such as Instagram and TikTok amplify product visibility and storytelling. Direct-to-consumer sales models strengthen engagement through customisation and subscription options. Online marketplaces simplify international expansion for local artisans. Consumers value transparent sourcing and limited-batch authenticity displayed online. Digital analytics allow companies to monitor preferences and adjust offerings quickly. The handmade soap market grows steadily with stronger online retail access.

Sustainability and Ethical Sourcing as Core Consumer Motivators

Eco-conscious customers demand transparency in sourcing and production ethics. Handmade soap brands respond with fair-trade ingredients and biodegradable materials. Companies invest in zero-waste packaging to reduce their environmental footprint. Local supply chains shorten transport emissions while supporting regional economies. Ethical labeling strengthens trust and brand loyalty among conscious buyers. Initiatives such as carbon-neutral certification enhance credibility. Marketing stories highlight artisans’ role in sustainable livelihoods. The handmade soap market aligns with ethical consumption trends influencing personal care industries.

- For example, Ethique operates on a 100% plastic-free, home-compostable packaging model documented on its official website and by third-party sustainability analyses, with a 60% reduction in operational carbon emissions between 2018 and 2020 (from over 7,000 tons to just over 2,000 tons) as independently verified by EKOS, an external emissions auditing agency.

Market Trends

Customization and Personalization of Formulations and Packaging

Personalized handmade soaps become popular among consumers seeking unique experiences. Brands allow buyers to choose fragrance combinations, essential oils, and exfoliants. Custom packaging options enhance gifting appeal and brand recognition. Digital tools enable virtual product design before purchase. Boutique manufacturers use small-batch methods to tailor output to regional preferences. Corporate gifting programs increasingly include eco-friendly handmade soaps. Retailers integrate interactive displays where customers select ingredients on-site. The handmade soap market evolves toward bespoke production to satisfy individual needs.

Increasing Adoption of Sustainable and Minimalist Lifestyle Choices

Global lifestyle trends favor minimalism and sustainability in consumer behavior. Handmade soaps fit these values by offering multifunctional use and simple ingredients. Zero-waste stores promote refillable soap bars to limit plastic waste. Natural formulations attract users reducing chemical exposure in daily routines. Subscription models for sustainable products boost recurring sales. Younger generations link handmade soap usage with eco-responsibility. Urban households integrate sustainable bathing products into conscious living habits. The handmade soap market benefits from alignment with minimalist and green lifestyles.

- For instance, The Body Shop confirmed in its 2024 sustainability report that an average of 25% recycled PET plastic is used across its global product packaging, with select haircare bottles and tubs made from 100% recycled plastic. The company aims to achieve 75% post-consumer recycled plastic content by 2025, aligning with its long-term circular packaging and environmental responsibility goals.

Expansion of Artisanal and Boutique Retail Formats

Artisan stores and boutique outlets drive visibility for handcrafted soaps. Consumers appreciate in-store demonstrations and scent sampling experiences. Local fairs and farmer markets offer direct connections between makers and buyers. Tourism destinations feature handmade soaps as cultural souvenirs. Luxury spas and hotels adopt artisanal brands to elevate guest experiences. Co-branding between retailers and local artisans increases reach. Fragrance innovation helps maintain novelty in limited-edition collections. The handmade soap market sees stronger differentiation through artisanal retail expansion.

- For instance, Lush Fresh Handmade Cosmetics operates more than 900 retail shops across nearly 50 countries as of 2024, all offering demonstrations and in-store customization for handmade soaps and bath products

Integration of Innovative Natural Ingredients and Botanical Blends

Producers experiment with exotic herbs, activated charcoal, clays, and fruit extracts. These ingredients enhance cleansing performance while supporting skin health. Scientific studies validate the benefits of plant-based antioxidants and essential oils. Brands market transparency by listing active natural compounds on labels. Seasonal ingredient variations encourage repeat purchases. Partnerships with organic farms ensure quality control. Growing consumer curiosity drives exploration of unique regional botanicals. The handmade soap market thrives on innovation rooted in natural science.

Market Challenges Analysis

High Production Costs and Limited Scalability in Manufacturing

Handmade soap producers face challenges from high material and labor costs. Natural ingredients and manual processes restrict economies of scale. Maintaining consistent quality across batches demands skilled craftsmanship and testing. Small manufacturers often struggle to meet rising global demand. Limited automation slows output and increases delivery timelines. Sourcing certified organic raw materials adds expense and complexity. Retail competition with mass-produced soaps puts pressure on pricing strategies. The handmade soap market must balance craftsmanship with operational efficiency to stay competitive.

Regulatory Compliance and Shorter Shelf Life of Natural Ingredients

Strict regulations governing cosmetic products affect artisanal producers. Handmade soaps often require testing to meet regional safety standards. Compliance with labeling laws and ingredient disclosure adds administrative burden. Lack of preservatives leads to shorter shelf life and higher wastage. Small brands face difficulty managing logistics for fresh inventory. Climate variations influence ingredient stability during storage and transport. Retailers prefer standardized packaging, limiting creativity for small producers. The handmade soap market faces persistent challenges ensuring long-term stability and compliance.

Market Opportunities

Rising Global Demand for Organic and Vegan Personal Care Products

Consumers increasingly adopt vegan and cruelty-free lifestyles, boosting demand for handmade soaps. Brands integrating organic certification gain advantage in premium markets. Global retailers expand sections dedicated to plant-based personal care items. Awareness campaigns by influencers highlight environmental and ethical values. Export opportunities rise for artisanal producers targeting eco-conscious customers abroad. Technological advancements in cold-process methods improve product quality. Certification programs strengthen credibility for small-scale producers. The handmade soap market holds strong growth potential within the vegan and organic care niche.

Emerging Market Penetration Through Tourism, Gifting, and Local Branding

Tourism-rich countries provide new sales channels through souvenir and wellness markets. Artisans collaborate with hotels and spas to design signature product lines. Local governments support craft clusters promoting handmade goods internationally. Seasonal festivals and fairs enhance brand visibility among travelers. Creative packaging linked to regional culture attracts gift buyers. Collaborations with boutique stores expand presence in high-income urban zones. Export partnerships foster cultural exchange and economic inclusion. The handmade soap market finds expanding opportunities through tourism-driven retail and cultural branding.

Market Segmentation Analysis:

By Method

The handmade soap market by method includes cold process, hot process, and melt & pour techniques. Cold process soap holds a major share due to its long-lasting properties and retention of natural glycerin. Hot process soap appeals to artisans who prioritize faster curing and rustic aesthetics. Melt & pour variants attract hobbyists and small businesses for their ease of customization. Producers leverage each method to create differentiated offerings. Innovation in natural colorants and essential oils enhances product diversity. Cold process remains favored for high-quality organic blends, supporting premium positioning in the handmade soap market.

By Application

The bathing segment dominates due to widespread daily use and preference for gentle cleansing formulas. Consumers appreciate soaps made from natural oils that suit varied skin types. Face washing products gain traction through targeted formulations for sensitive or acne-prone skin. Cleaning soaps find use in niche areas such as stain removal or pet hygiene. Companies design distinct lines to address each application segment. Enhanced fragrance combinations improve sensory appeal. Custom blends for specific skin conditions foster brand loyalty. Demand across applications keeps product innovation active within artisanal production lines.

- For instance, ITC’s Savlon Glycerin Soap demonstrates innovation in the bath soap category, featuring packaging verified by third-party auditors to contain 70% post-consumer recycled material. The launch reflects ITC’s strategy to align product development with evolving environmental standards and consumer demand for sustainable, skin-friendly formulations.

By Product Type

Organic soap leads the segment driven by rising awareness of chemical-free living. Natural soap follows with strong acceptance among consumers seeking affordable sustainable options. Specialty or functional soaps address specific skin needs like exfoliation, hydration, or aromatherapy. These variants attract wellness-oriented customers valuing performance and natural care. Brands focus on transparent labeling to gain consumer confidence. Certification and ingredient traceability add credibility in competitive markets. Functional soaps with herbal infusions enhance differentiation. This product segmentation supports continuous innovation in handmade soap design.

- For instance, Vermont Soap holds a valid USDA Organic Certification issued by Vermont Organic Farmers (VOF) for 2024–2025, covering the majority of its soap and skincare products.

By Distribution Channel

Online retail expands quickly, offering global reach to small artisans. E-commerce platforms enable personalized marketing and subscription-based models. Retail stores maintain strong visibility through local brands and boutique displays. Specialty stores attract loyal customers with curated collections and gift-ready packaging. Omnichannel strategies combine online and offline presence for higher consumer engagement. Social media sales integrate storytelling and visual branding to boost conversions. Brick-and-mortar outlets continue to serve impulse buyers. The handmade soap market thrives on a balanced mix of digital and physical distribution.

By End User

Residential consumers remain the largest end-user group due to growing demand for natural skincare. Spas and wellness centers adopt handmade soaps for premium treatments and customer experience enhancement. Hotels and hospitality establishments include artisanal soaps as part of sustainable guest amenities. Institutional adoption highlights the growing recognition of handmade quality in service industries. Custom labeling for business clients strengthens brand identity. Producers target bulk orders with eco-conscious formulations and minimal packaging. Collaboration with hospitality partners expands global exposure. The handmade soap market benefits from multi-sector acceptance and repeat usage across end users.

Segmentation:

By Method

- Cold Process Soap

- Hot Process Soap

- Melt & Pour Soap

By Application

- Bathing

- Face Washing

- Cleaning

By Product Type

- Organic Soap

- Natural Soap

- Specialty or Functional Soap

By Distribution Channel

- Online Retail

- Retail Stores

- Specialty Stores

By End User

- Residential Consumers

- Spas and Wellness Centers

- Hotels and Hospitality

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America region commands the largest share in the handmade soap market, accounting for about 40.2 % of global revenue in 2024. Strong consumer preference for organic and sustainable personal-care items drives this dominance. The U.S. leads activity by sourcing natural ingredients and adopting innovative retail models. It records high per-capita spending on premium artisanal soaps and supports market expansion through digital commerce.

In Europe, the market share stands near 34 %, driven by stringent sustainability regulations and high awareness of cruelty-free products. Consumers in Germany, the UK and France emphasise transparency and ethical sourcing, boosting demand for handcrafted soap. The region supports small-scale producers and regional artisanal brands, which strengthens local ecosystems.

The Asia-Pacific and Latin America regions are emerging players with rising shares estimated around 26 % combined. Rapid urbanisation, growing disposable incomes and increasing skin-care awareness fuel growth in India, China and Brazil. Local producers leverage botanical ingredients and cultural heritage to capture niche segments. The handmade soap market in these regions expands through both domestic artisanal brands and international e-commerce penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Lush Fresh Handmade Cosmetics

- Bronner’s

- Burt’s Bees

- Rocky Mountain Soap Company

- Chagrin Valley Soap & Salve Company

- Aspen Kay Naturals

- Soap Box Soaps

- Olive & Clay

- The Soap Kitchen

- Wild Hill Botanicals

- Squatch

- Zum Bar

- Patcha Soap Co.

- Poleview Group

Competitive Analysis:

Key players in the handmade soap market include brands like Lush, Dr. Bronner’s and Burt’s Bees. These companies emphasise natural ingredients, ethical sourcing and brand storytelling to differentiate themselves in a crowded market. They invest in sustainable packaging and global distribution channels to secure market visibility. Smaller artisanal brands compete by offering customised blends and local-craft appeal. Strategic alliances, limited-edition product launches and regional expansion help maintain competitiveness. Quality control and ingredient transparency shape buying decisions and brand loyalty. The handmade soap market rewards innovation, strong brand identity and agile responses to consumer trends.

Recent Developments:

- In June 2025, Dr. Bronner’s executed a notable business transition by selling their Magic Chocolate line to Magic Chocolate Inc., marking a strategic move to focus on their core business of soapmaking. The transition will allow Magic Chocolate Inc. to drive new product innovation and expand regenerative organic practices in chocolate production.

- In January 2025, RM Soap Market launched its new Body Bar concept, allowing customers to design handcrafted soaps using premium ingredients, unique colors, and bespoke fragrances, crafted live in-store. This product launch emphasizes customization and experiential retail, helping RM Soap Market attract discerning clients seeking personalized, artisanal self-care products.

Report Coverage:

The research report offers an in-depth analysis based on Method, Application, Product Type, Distribution Channel and End User It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for handmade soap will continue to rise due to global awareness of clean-label personal care.

- Eco-friendly packaging and sustainable sourcing will define long-term brand differentiation.

- Premium organic blends will dominate luxury retail and boutique store shelves.

- E-commerce channels will expand faster, improving accessibility for small artisans.

- Vegan and cruelty-free product certifications will enhance consumer confidence and market trust.

- Asia-Pacific will emerge as the fastest-growing region due to rising urbanisation and wellness culture.

- Innovation in natural ingredients such as herbal infusions and botanical extracts will intensify competition.

- Collaborations with spas, hotels, and wellness centers will strengthen institutional demand.

- Personalised soap designs and fragrance customization will boost brand loyalty.

- Technological improvements in cold-process production will enhance product consistency and shelf life.